DIpil Das

The US

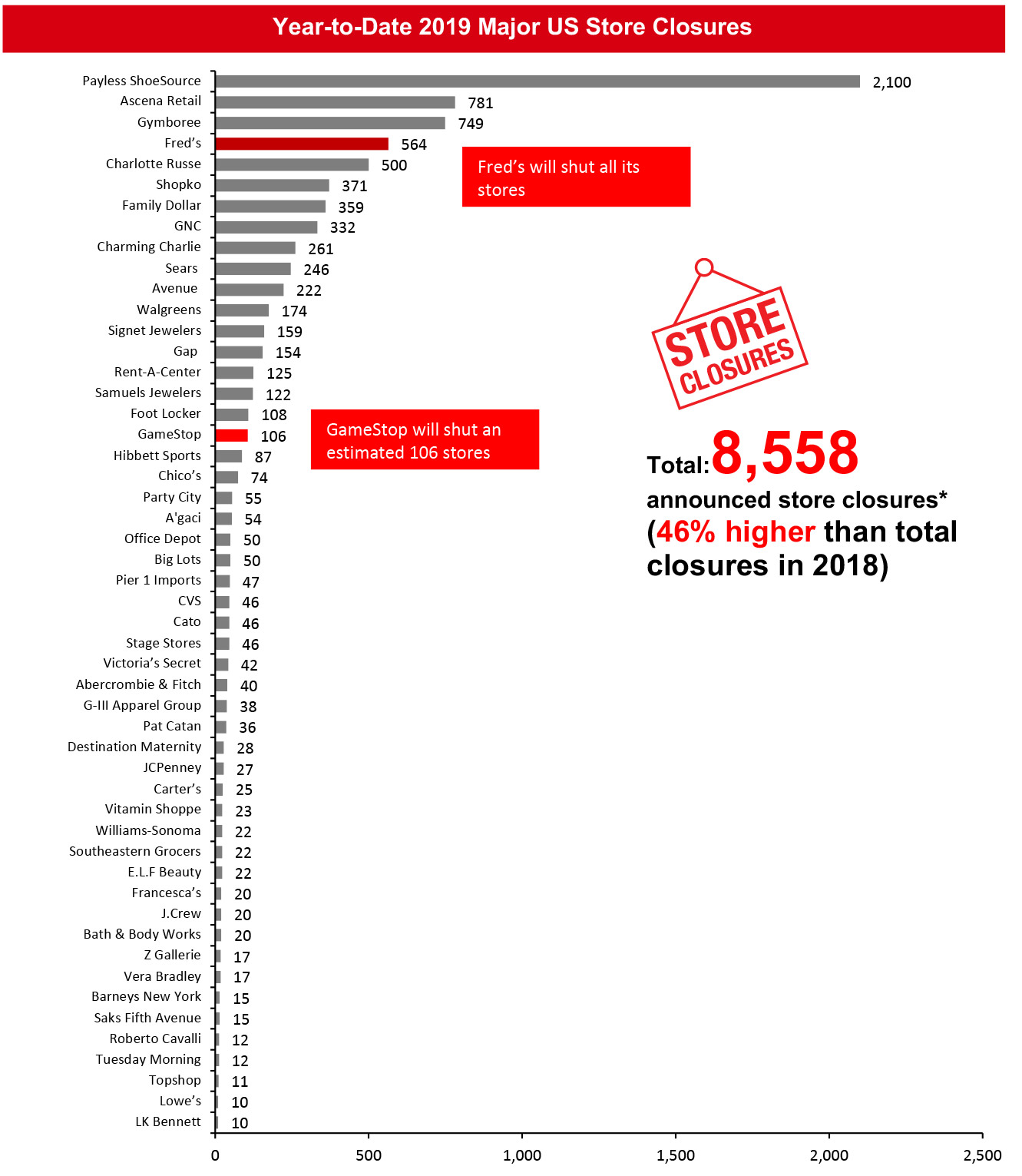

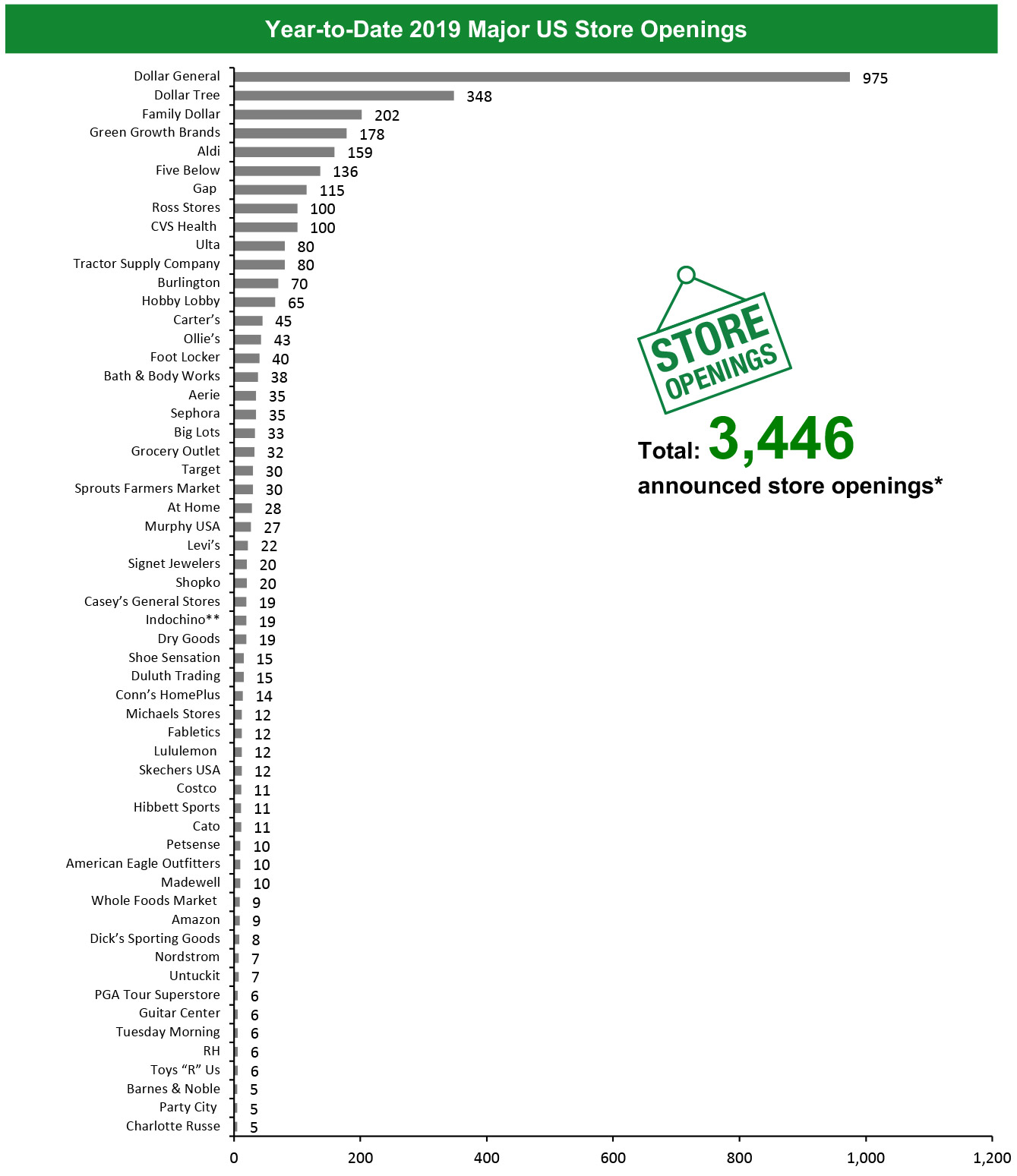

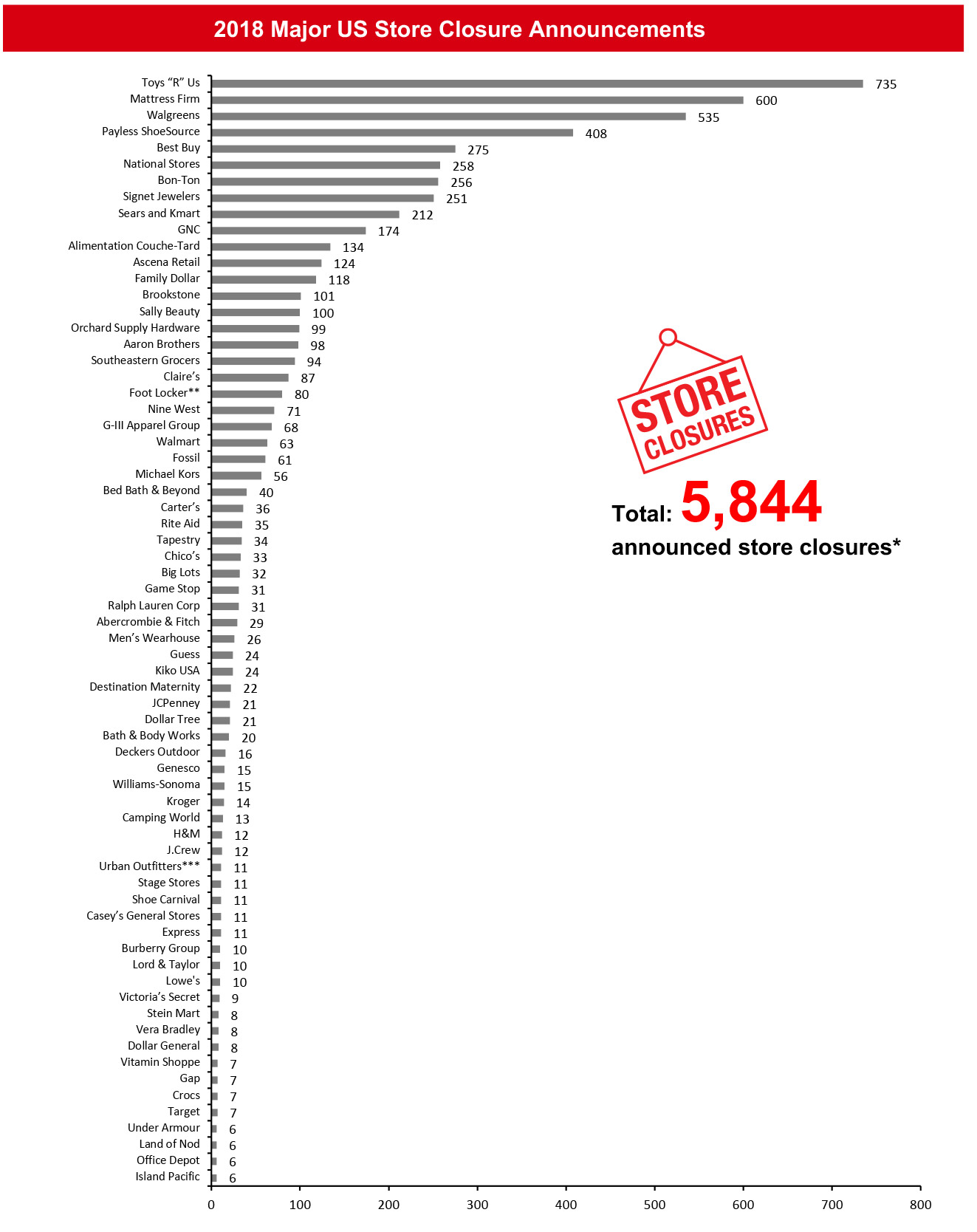

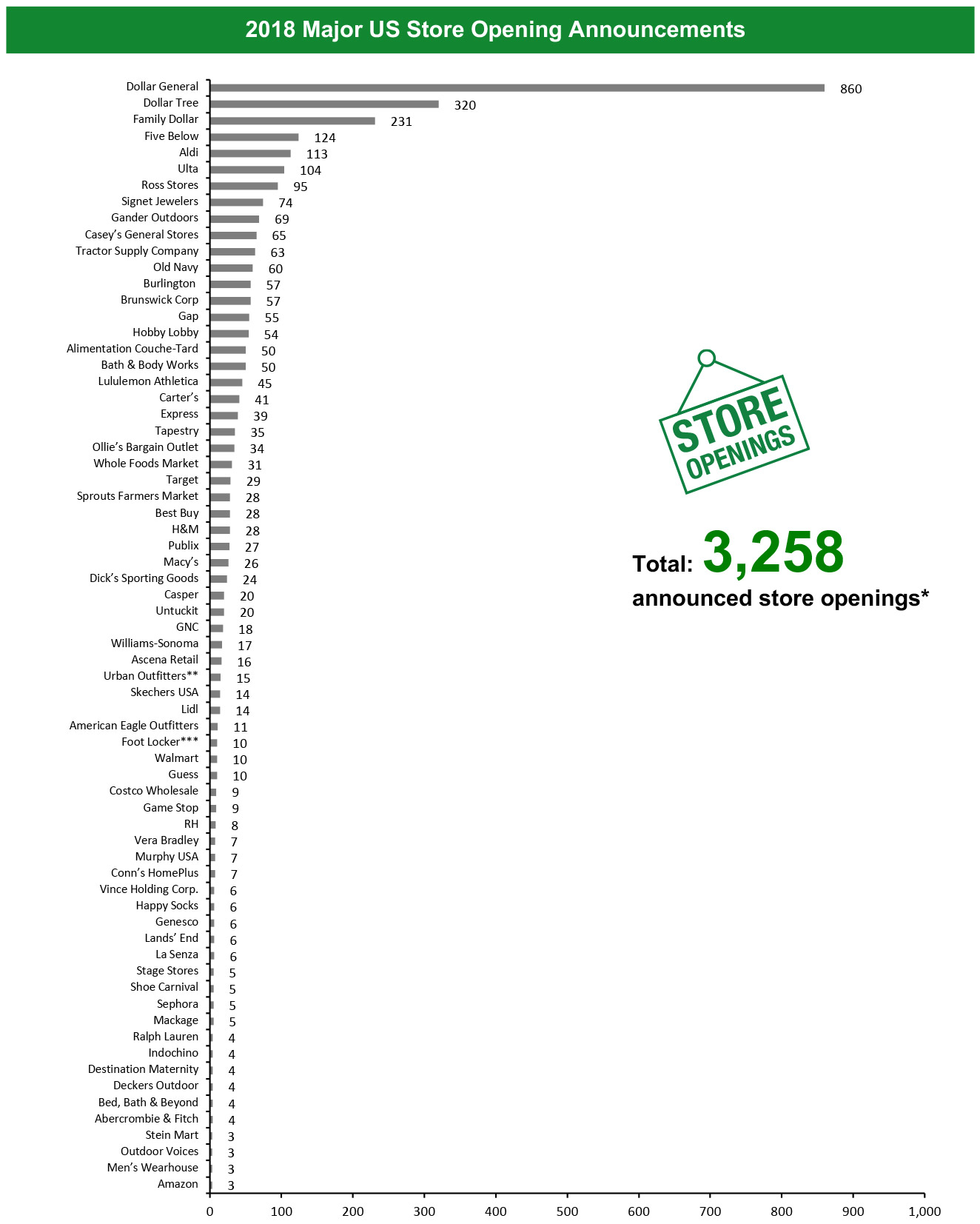

2019 Major US Store Closures and OpeningsYear to date in 2019, US retailers have announced they will close 8,558 stores and open 3,446. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.

What Is Happening This Week in the US

Fred’s Files for Chapter 11 Bankruptcy; Plans to Close All Stores

Discount retailer Fred’s announced on September 9, 2019 that it filed for Chapter 11 bankruptcy protection and plans to shut all its stores. The retailer has begun liquidation sales, and expects to close all stores within 60 days of the date of the announcement. In July, Fred’s announced it would close 129 underperforming stores. As of May 4, 2019, the company operated 545 stores in 15 states in the US, including 169 stores with full-service pharmacies.

Coresight Research Insight: In June 2017, Fred’s plans to buy 865 Rite Aid stores ended when Walgreens received regulatory approval for its roughly $7 billion acquisition of all of Rite Aid. The unsuccessful bid to acquire Rite Aid stores ended the company’s effort to transform itself by expanding its pharmacy business. Had the deal gone through, Fred’s would have become the third-largest drug-store chain in the US.

GameStop to Shutter Up to 200 Stores

Video game retailer GameStop has announced it will close between 180 to 200 underperforming stores globally by the end of its fiscal year as it looks to improve profitability by downsizing its store footprint. The retailer currently operates over 5,700 stores in 14 countries.

Lululemon to Open an Experiential Store

Athletic wear retailer Lululemon plans to open its second full-experiential store in the Mall of America in the Minneapolis area in November this year. According to previously announced plans, the company expects to open 15 to 20 stores in North America this year.

Coresight Research Insight: Building off of the success of its “store-as-a-community-experience,” Lululemon continues to open experiential stores which combine retail, fitness classes, cafés and brand ambassadors – all under one roof.

Nordstrom Expands its Local Stores to New York

Luxury department store chain Nordstrom has opened a Nordstrom Local store in Manhattan and plans to open another on September 27, 2019. These service stores are inventory-free and offer services such as online order pick-up, returns, alterations, consultations, repairs and gift wrapping.

Coresight Research Insight: Nordstrom is opening smaller format, local stores which offer consumers convenience and quick service. The company reported on its last earnings call that Nordstrom Local stores account for 30% of order pickups and that it sees higher engagement at Nordstrom Local, with customers spending 2.5 times more.Tractor Supply Company Opens Store in Ohio

Home improvement retailer Tractor Supply Company has opened its 1,800th store and its 93rd in Ohio, located in Berkshire Township. The company previously announced plans to open 80 Tractor Supply stores in 2019.

Non-Store-Closure News

L Brands Testing Smaller Format Store Called Victoria's Secret Beauty and Lingerie

L Brands announced at its Investor Day on September 10, 2019 that it is testing a smaller format store internationally that combines both beauty and lingerie. The company has tested the concept internationally in nine smaller format stores ranging from approximately 1,300 to 1,700 square feet. Management said initial results have been positive.

Coresight Research Insight: As the company has accelerated store closures, closing 55 stores, up from 10 to 30 stores in 2015-2018, this smaller format may provide several advantages for the retailer. First, it will allow Victoria’s Secret to showcase 80% of its beauty collection and over half of its lingerie collection, according to the company. Optimizing the smaller format carries lower capex cost, lowering opening cost and is easier to manage. Target to Roll Out Target Circle, a Free Loyalty Program Target announced it will roll out Target Circle, a new loyalty program that offers 1% back on purchases, early access to sales throughout the year, personalized deals and the opportunity to vote on Target’s local charitable initiatives. Target tested this program for 18 months to an overwhelmingly positive result: Target Circle’s two million new members spending more than those not enrolled in the program. Coresight Research Insight: Rolling out this program in advance of the holiday shopping season is a plus and likely to drive store traffic and increased spending at Target. Moreover, allowing Target Circle members to vote to direct Target’s nonprofit giving increases customer engagement and loyalty, supporting increased customer lifetime value. [caption id="attachment_96292" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than 10 store openings and are not included in the chart.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than 10 store openings and are not included in the chart. Source: Company reports/Coresight Research [/caption] [caption id="attachment_96293" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the Greater Toronto Area.

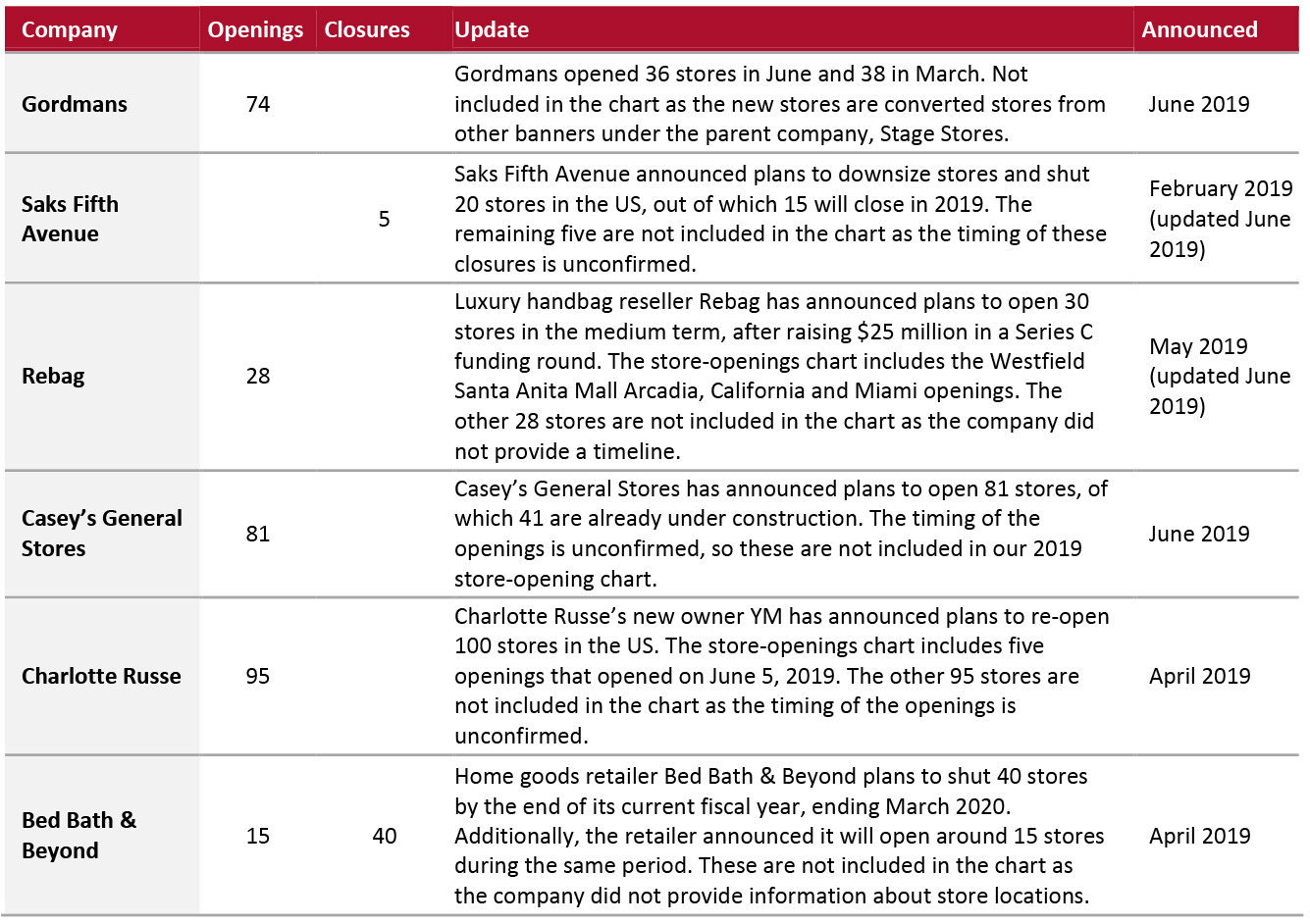

Source: Company reports/Coresight Research [/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals as the companies did not provide detail on timing or location. [caption id="attachment_96294" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_96295" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_96295" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. ***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_96296" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above. **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_96297" align="aligncenter" width="700"]

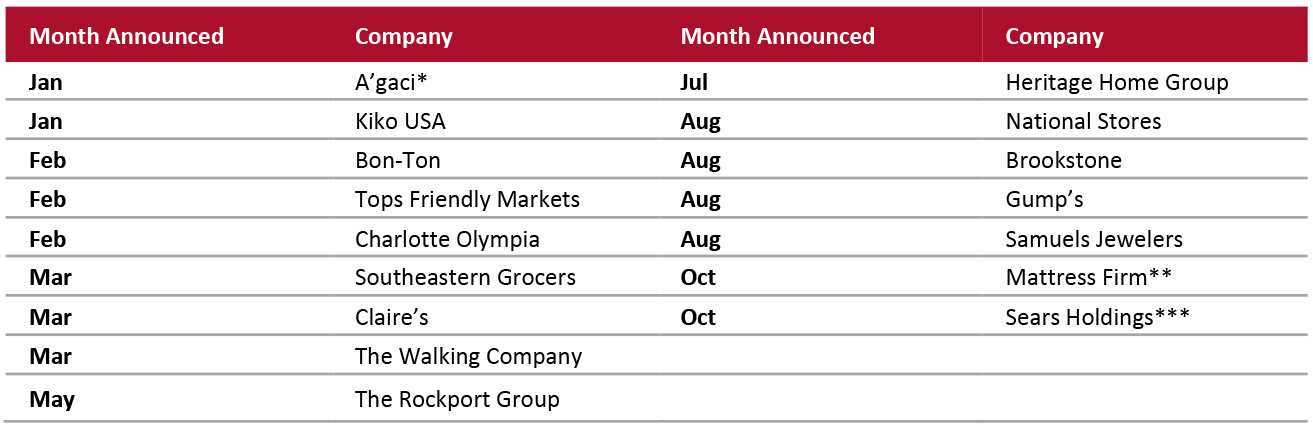

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research [/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_96298" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 **Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research [/caption]

The UK

2019 Major UK Store Closures and Openings

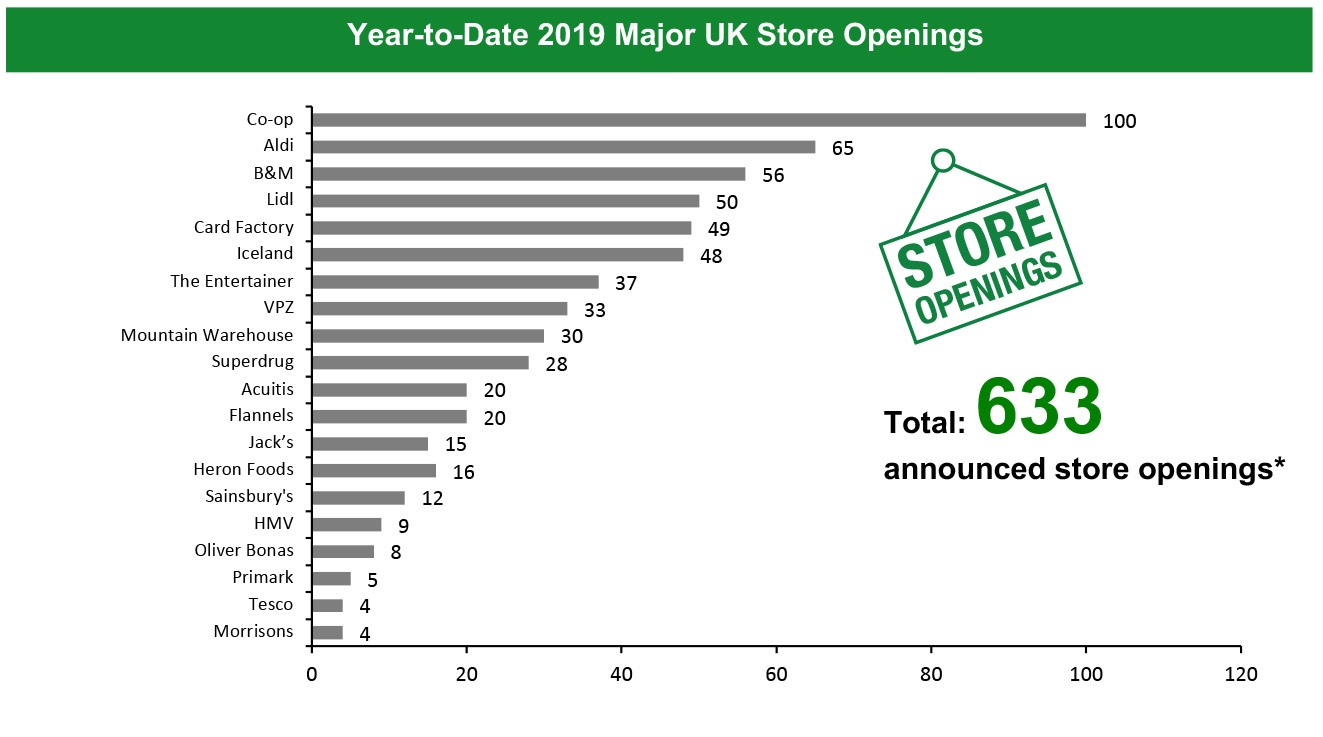

Year to date in the UK, major retailers have announced 431 store closures and 633 store openings. Our data represents closures and openings by calendar year.

What Is Happening This Week in the UK

No major retailers in the UK reported closures or openings this week.

Non-Store-Closure News

Unibail-Rodamco-Westfield Appoints Scott Parsons as MD for UK and Italy Real estate company Unibail-Rodamco-Westfield has appointed Scott Parsons as the Regional Managing Director for UK and Italy, effective November 13, 2019. Parsons will be responsible for the company’s asset portfolio and development projects including Westfield London and Westfield Stratford City. He most recently served as MD, Retail Portfolio at Land Securities Group. [caption id="attachment_96299" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_96300" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

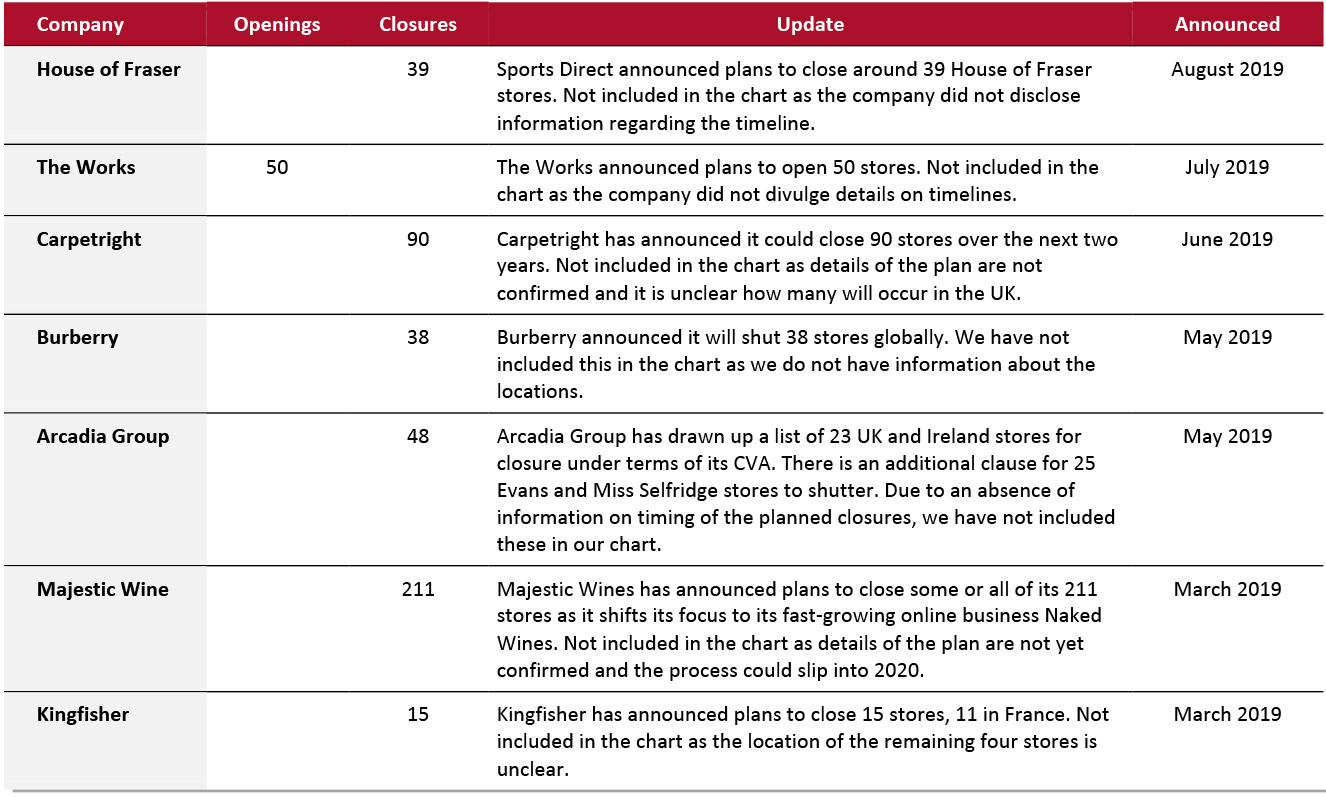

Source: Company reports/Coresight Research [/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_96301" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_96302" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

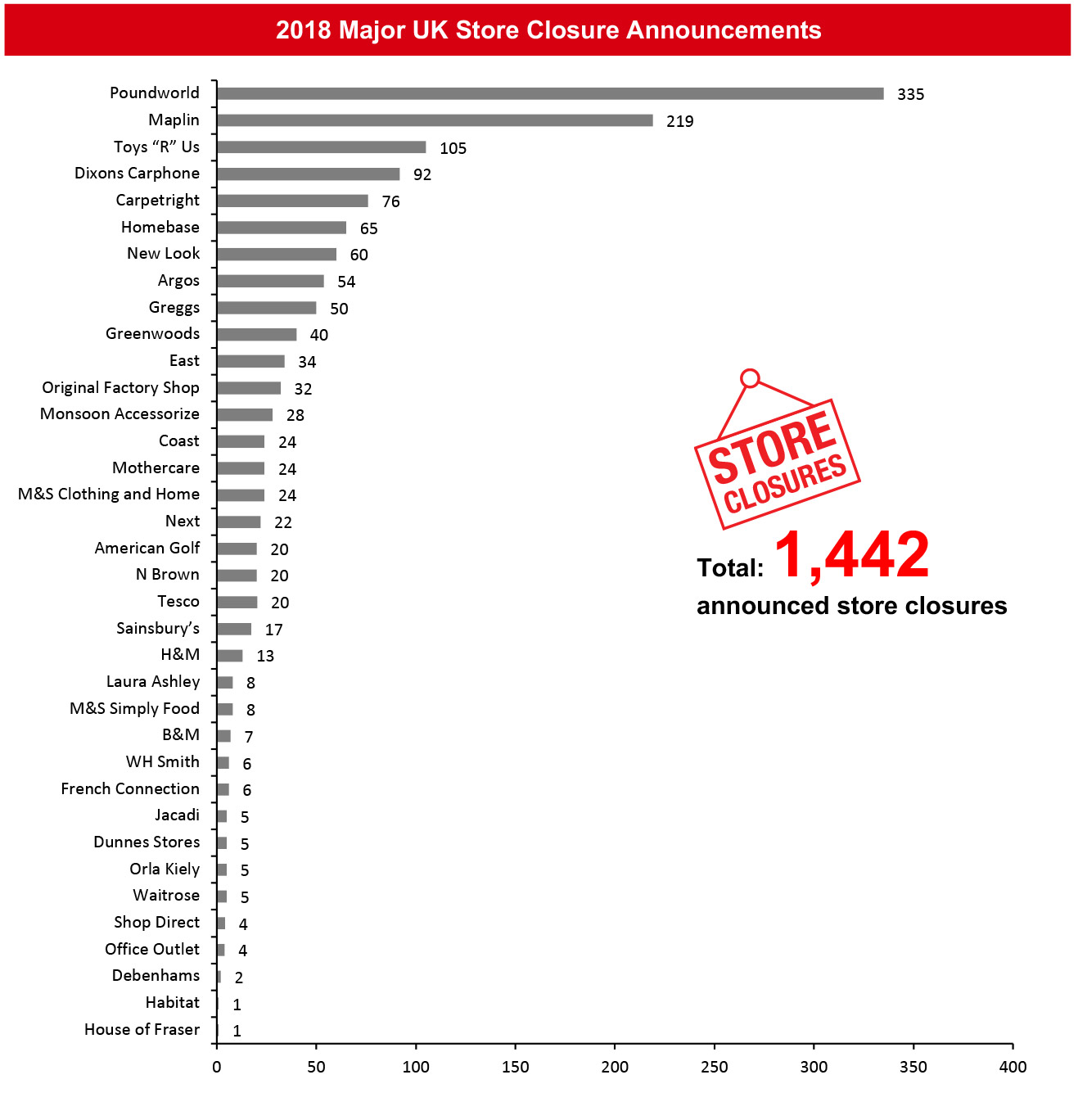

[caption id="attachment_96302" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research [/caption] [caption id="attachment_96303" align="aligncenter" width="700"]

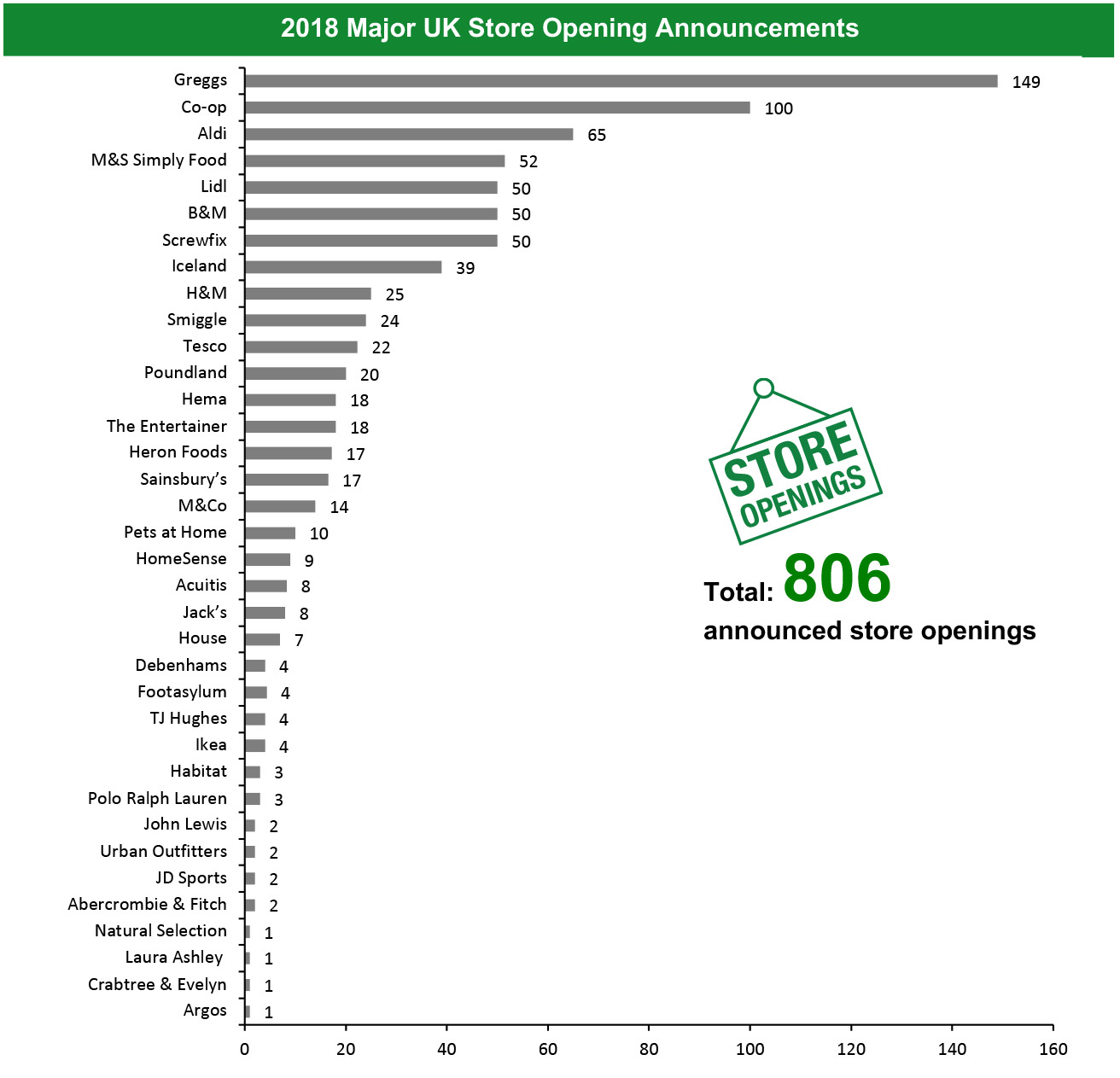

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption]

Notes

Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.