Nitheesh NH

The US

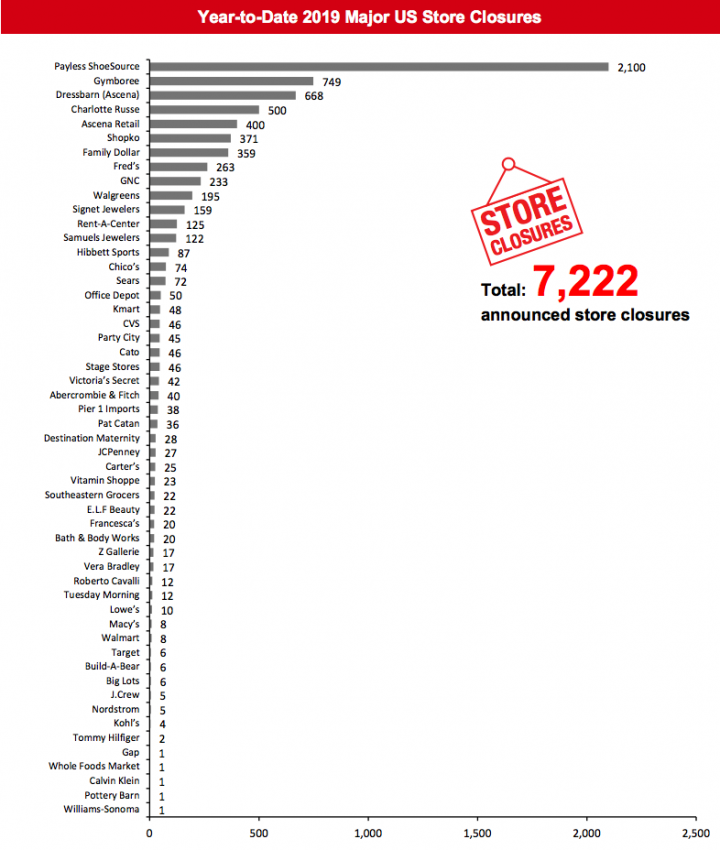

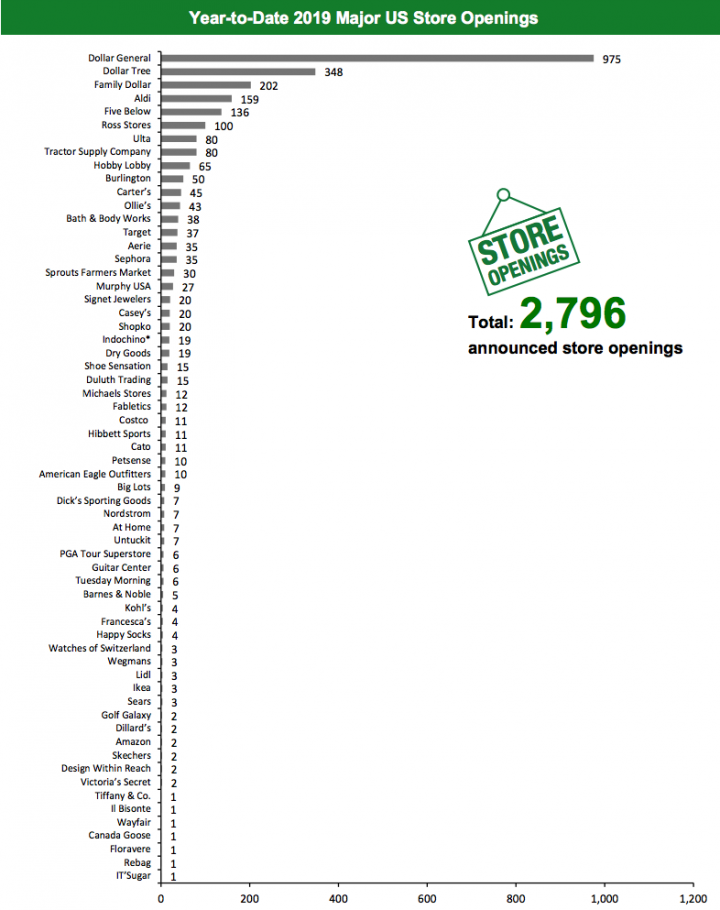

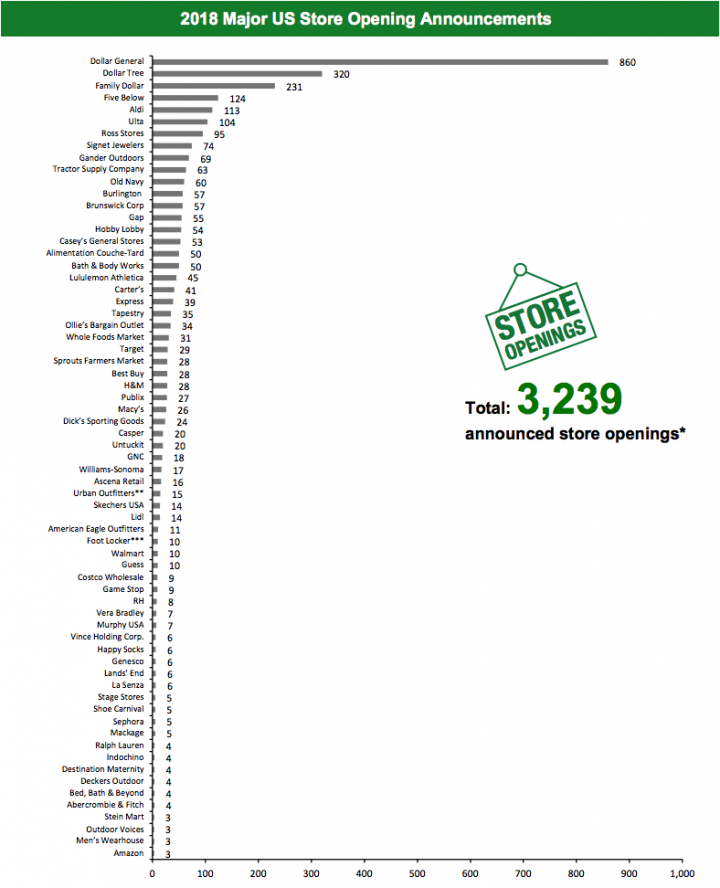

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 7,222 stores and open 2,796. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Our data represent closures and openings by calendar year.What Is Happening This Week in the US

Abercrombie & Fitch to Close Three Flagship Stores Apparel retailer Abercrombie & Fitch has announced plans to shutter the Hollister flagship store located in Manhattan’s SoHo district. The company also announced plans to shutter its namesake flagship stores in Fukuoka, Japan and Milan, Italy. The closures are scheduled for this year except for the Fukuoka flagship store, which is expected to close in 2020. Coresight Research Insight: Return on investment (ROI) for flagship locations has been nebulous at best and has deteriorated for most brands over the past few years. Hollister joins the ranks of Calvin Klein, Diesel, Ralph Lauren, and Tommy Hilfiger in shuttering expensive flagship locations as they adapt to the way their customers (and potential customers) discover and shop today. IT’Sugar Opens Flagship Store in Las Vegas Specialty candy retailer IT’Sugar opened a flagship store in Las Vegas, on May 30, its fourth store in Las Vegas. The store spans 6,000 square feet and its entrance showcases a 40-foot replica of a gum-ball vending machine. IT’Sugar founder and CEO Jeff Rubin said, “For many years it has been our vision to open an IT’Sugar flagship store on the Las Vegas strip and we couldn’t be more excited to see our vision become a reality.” Coresight Research Insight: Las Vegas attracts tourists from around the world, and as such is a good location to create brand awareness with larger-than-life store formats. Watches of Switzerland Mulls US Expansion The Watches of Switzerland Group plans to expand its footprint in the US. It opened one Watches of Switzerland store in the Hudson Yards neighborhood in New York earlier this year and plans to open one store each in New Jersey and Boston later this year. The group enjoyed a better-than-expected performance on the London Stock Exchange on its first day of trading following its IPO. The shares went up for sale on May 30, 2019, with each share priced at 270 pence ($3.41), valuing the company at £650 million ($821.6 million).Non-Store-Closure News

CVS Announces Plans to Expand HealthHub Concept to 1,500 Stores Drugstore retailer CVS has announced plans to expand its HealthHub concept to 1,500 stores by the end of 2021. Its new concept stores were introduced in February at three pharmacy locations in Houston. The new stores allocate 20% of store space to health services. The stores also offer product and service combinations to manage chronic conditions such as diabetes and sleep apnea. The company plans to open new format stores in Houston, Atlanta, Philadelphia, Southern New Jersey and Tampa this year. Coresight Research Insight: CVS has launched several initiatives in the health and wellness space in the past, including its Project Health program (launched in 2006) and the more-recent HealthHubs. While these initiatives and wellness programs will help CVS tap into the pulse of consumers seeking a new in-store shopping experience, regular screenings and chronic condition management can also draw customers in and keep them coming back for ongoing management of chronic conditions. FTD Companies Files for Bankruptcy FTD has filed for chapter 11 bankruptcy protection after it failed to find a buyer for its entire business, and so instead will sell off its business in pieces. FTD is a floral wire service, retailer and wholesaler founded as Florists' Telegraph Delivery in 1910, to help customers send flowers remotely using florists in the FTD network. The company will sell its restructured North America and Latin America business to an affiliate of Nexus Capital Management for $95 million, and that also includes its online flower delivery business ProFlowers. In addition, it will sell its flower delivery business Interflora in the UK to a subsidiary of The Wonderful Co. for $59.5 million, according to a court declaration by FTD CEO Scott Levin. [caption id="attachment_90017" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Ascena Retail, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and Walgreens.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Ascena Retail, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and Walgreens.Source: Company reports/Coresight Research[/caption] [caption id="attachment_90018" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco*Indochino openings refer to North America openings total, excluding one opening announced for the Greater Toronto Area.

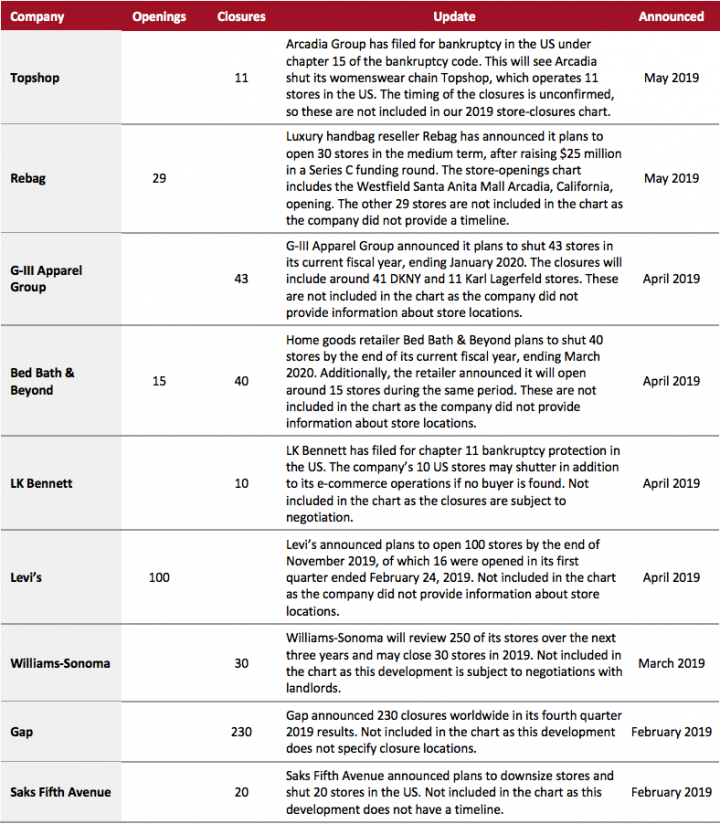

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures that we have not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_90019" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

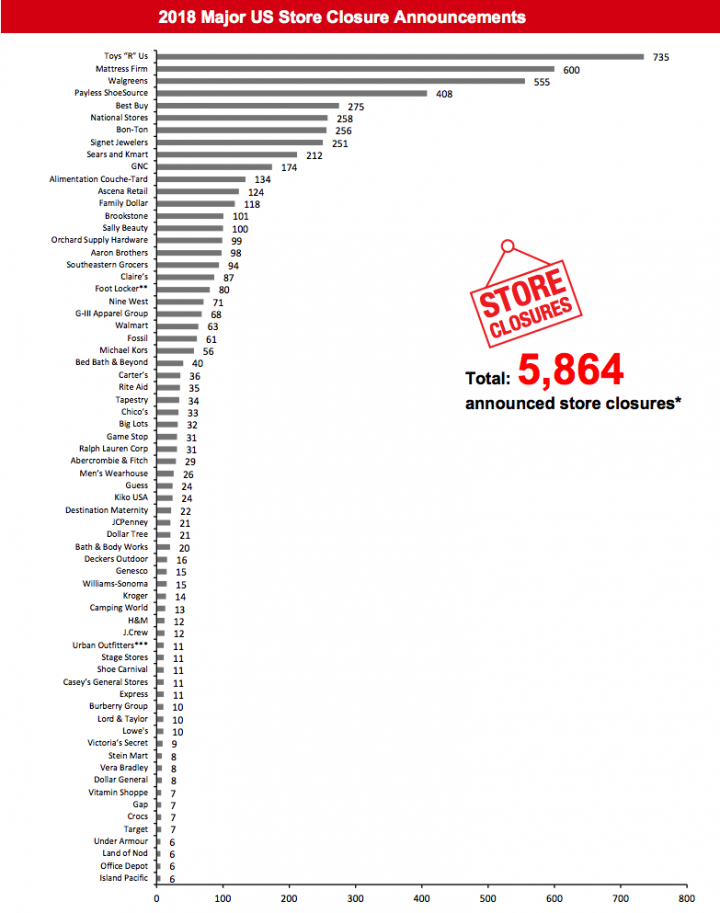

[caption id="attachment_90020" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_90020" align="aligncenter" width="720"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research[/caption] [caption id="attachment_90021" align="aligncenter" width="720"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners

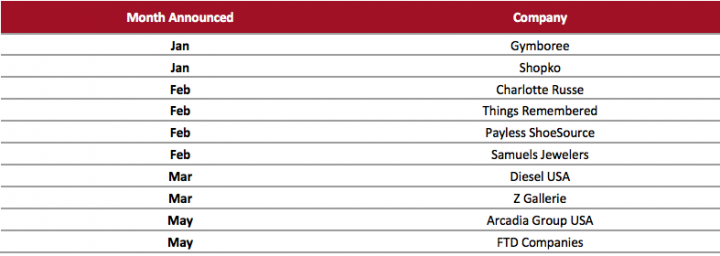

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_90022" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

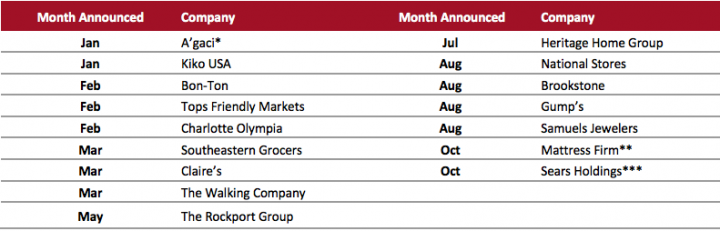

2018 Major US Retail Bankruptcies

[caption id="attachment_90023" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_90023" align="aligncenter" width="720"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

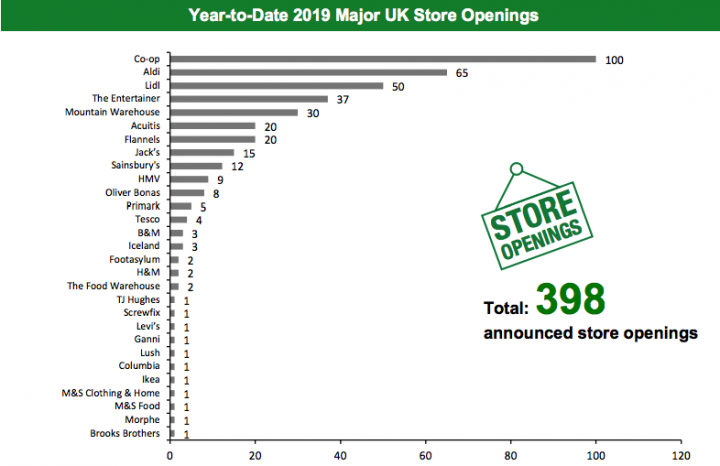

The UK

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 325 store closures and 398 store openings. Our data represent closures and openings by calendar year.What Is Happening This Week in the UK

Mountain Warehouse Announces Expansion Plans Amid Growing Profits Outdoor clothing and equipment retailer Mountain Warehouse has announced plans to open 50 new stores in 2019. The new openings will include around 20 stores in the UK. The remaining 30 stores are expected to open in Europe, North America and New Zealand. The company also announced plans to open 10 new stores in its gift chain Neon Sheep, focusing on areas outside London such as Leeds and St Albans. Mountain Warehouse recorded a 14% increase in pre-tax profits of £23.7 million ($30.8 million) for the 12 months ended February 24, 2019. [caption id="attachment_90024" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New LookSource: Company reports/Coresight Research[/caption] [caption id="attachment_90025" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

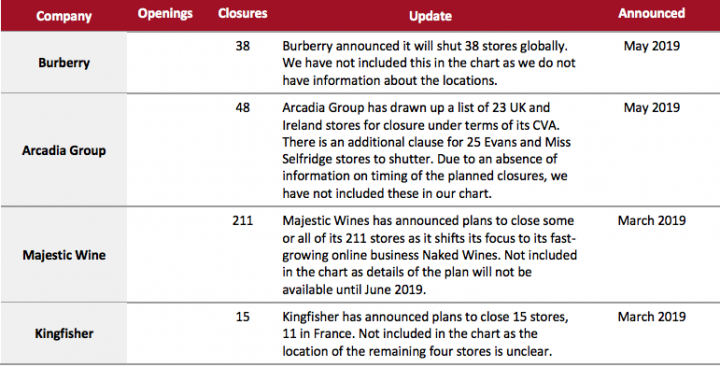

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_90026" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_90026" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

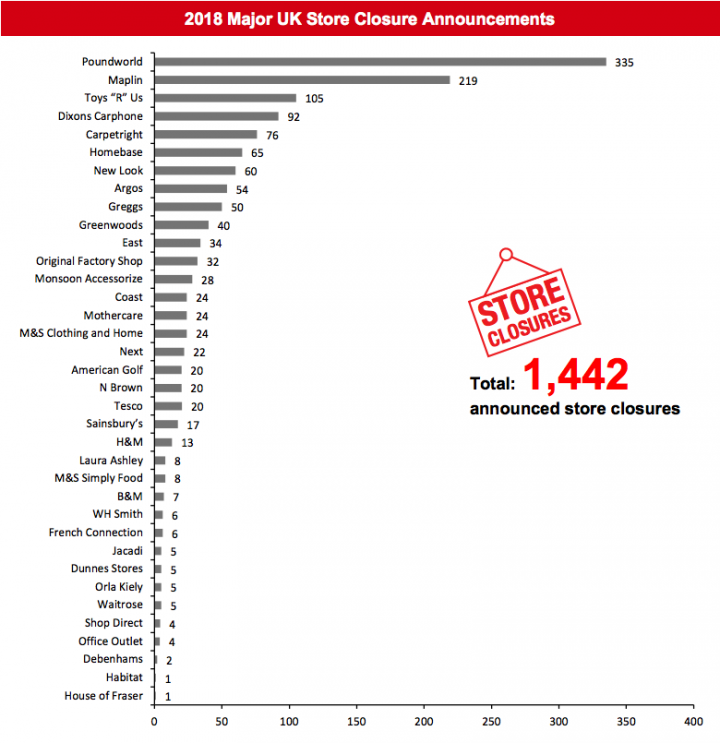

[caption id="attachment_90027" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_90027" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

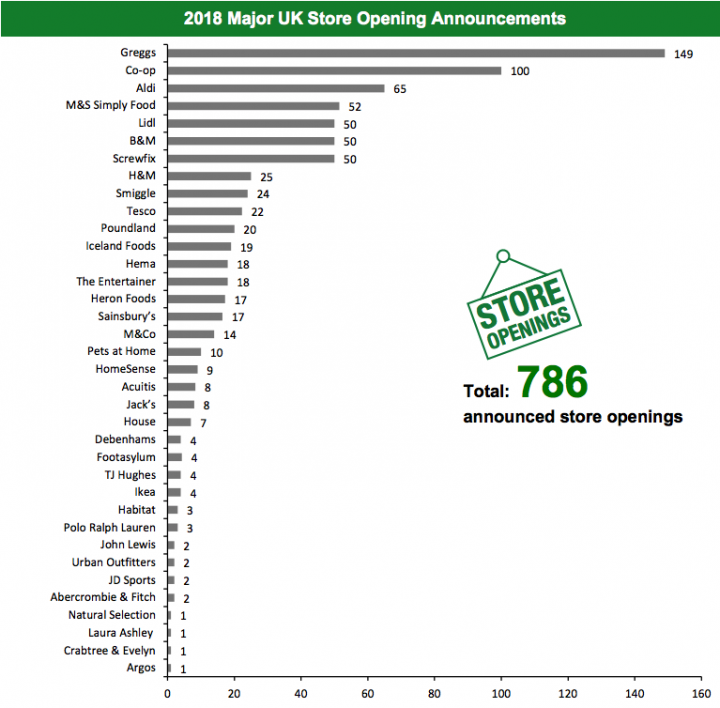

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_90028" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.