Nitheesh NH

The US

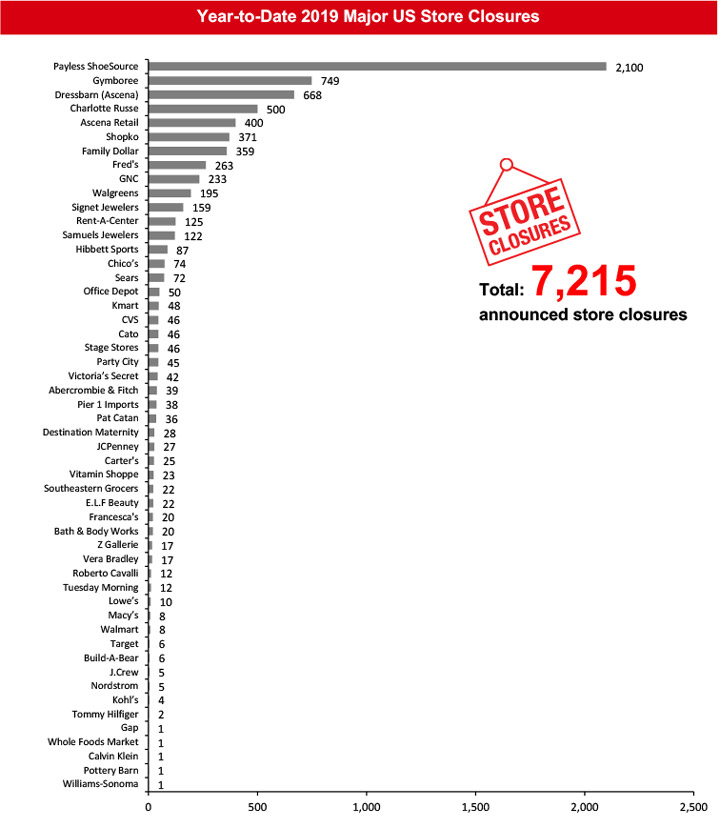

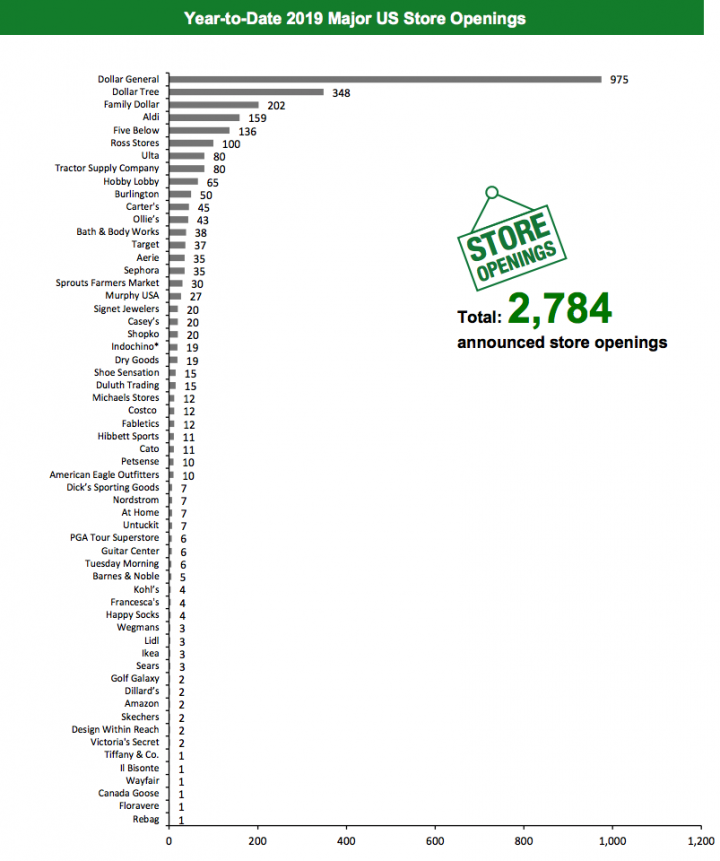

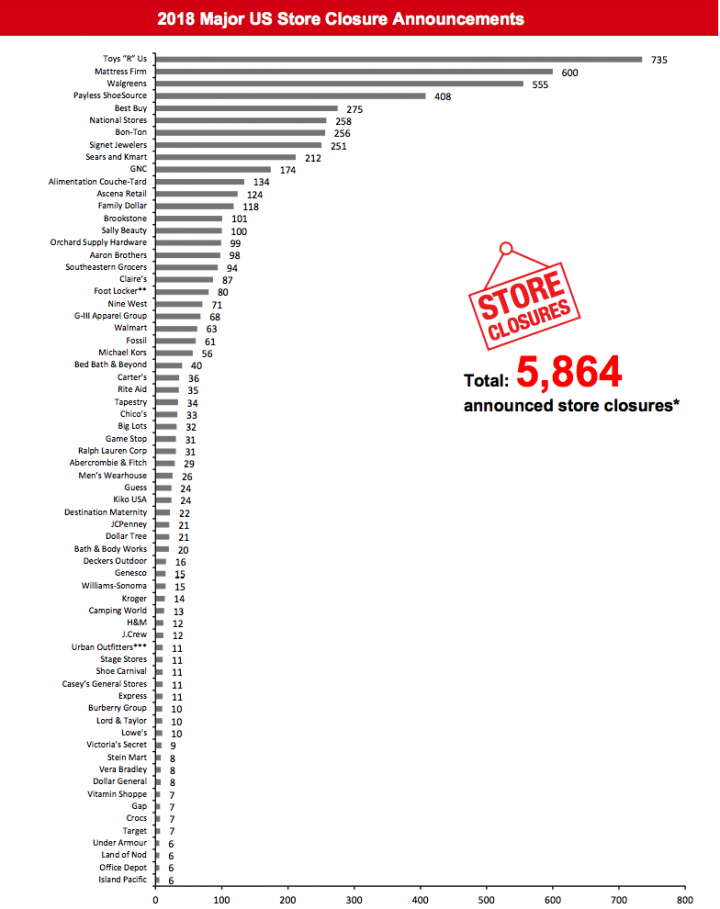

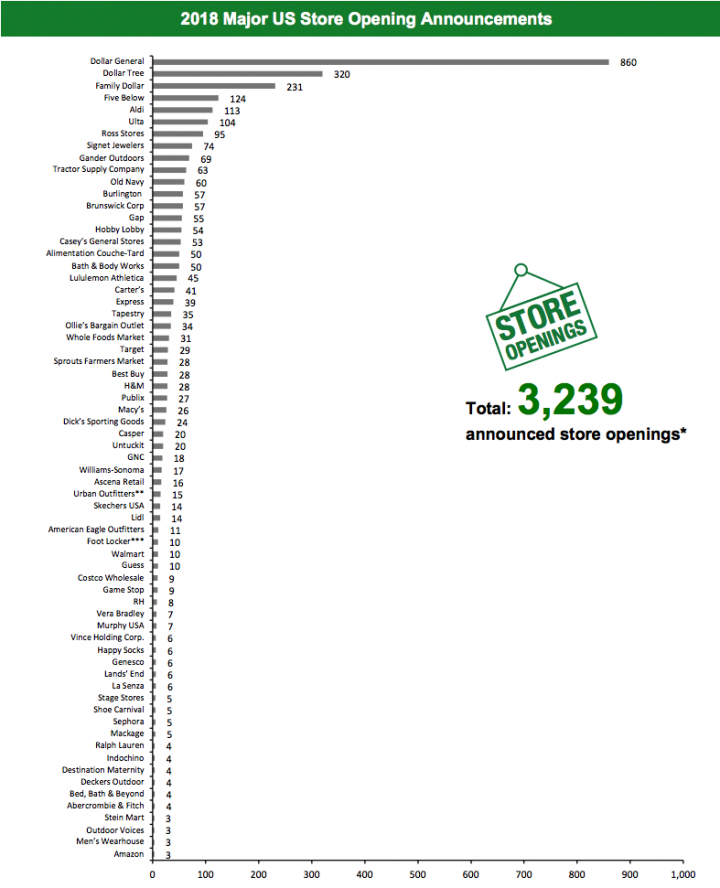

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 7,215 stores and open 2,784. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Cato to Shut 50 Stores While Opening 12 Stores Value fashion retailer Cato has announced it plans to close 50 underperforming stores in its fiscal year 2019, ending January 31, 2020. The company plans to open 12 stores over the same period. The store closures are in the context of Cato’s “ongoing practice to strengthen operations,” according to the company. The company operated 1,302 stores in 31 US states at the end of the first quarter, ended May 4, 2019. The company closed nine stores during its first quarter, which were part of the planned 50 closures throughout the year. We have calendarized our figure for Cato in the 2019 store-closure chart. Coresight Research Insight: Cato, a discount retailer focused on women’s fashion apparel, cited the high cost of leasing space as a challenge when the company closed physical stores in 2018. The retailer was founded in 1946, and its fashion offerings have become less differentiated as more value competitors have entered the space. Stage Stores to Close 40-60 Stores Department store chain Stage Stores has announced plans to shutter 40-60 department stores in fiscal 2019, ending February 3, 2020. Additionally, the retailer aims to convert around 70-80 department stores to Gordmans off-price stores over the same period. During the first quarter ended April 30, 2019, the retailer shut six department stores. We have calendarized our charted figure for Stage Stores in the 2019 store-closure chart. Coresight Research Insight: Consolidation and contraction have impacted the US department store sector since 2000, with industry sales down approximately 40% during the period. Mid-tiered retail venues are vulnerable to market share contraction and Stage Stores’ plan to convert 70-80 department stores to the Gordmans off-price venue is in keeping with the Weinswig Hourglass theory, whereby a whittling of mid-priced retailers is accompanied by a swelling of luxury and value retailers, reflecting consumers’ tendency to trade up or down the product/pricing spectrum, forgoing mid-priced alternatives in favor of value or luxury. Topshop to Shut all its US Stores Arcadia Group USA has filed for chapter 15 bankruptcy, the filing received provisional approval and the final hearing is scheduled for June 14. Arcadia shut its womenswear chain Topshop amid “challenging retail headwinds.” Topshop currently operates 11 stores in New York, Las Vegas, Chicago, Atlanta, Los Angeles and Houston. The company listed its assets at $53 million and debts at $179 million. The timing of the closures is unconfirmed, so these are not included in our 2019 store-closures chart. Coresight Research Insight The closing of Topshop’s 11 US stores reflects difficulties Arcadia is having in the UK as well, where separate insolvency documents were filed. Topshop’s target consumer seeks fast fashion at value prices and this sector is highly competitive and promotional. The brand suffered last year when Beyoncé pulled her Ivy Park athleisure line from Topshop in the fall of 2018. [caption id="attachment_89573" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and Walgreens

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and WalgreensSource: Company reports/Coresight Research[/caption] [caption id="attachment_89483" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco*Indochino openings refer to North America openings total, excluding one opening announced for the Greater Toronto Area.

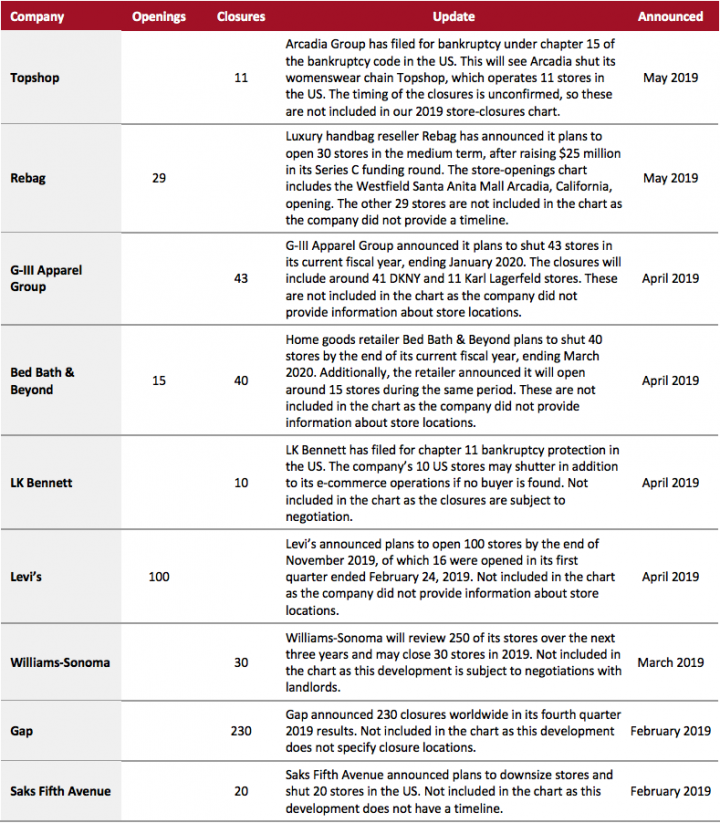

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures that we have not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_89484" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_89486" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_89486" align="aligncenter" width="720"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners ***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research[/caption] [caption id="attachment_89487" align="aligncenter" width="720"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_89488" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

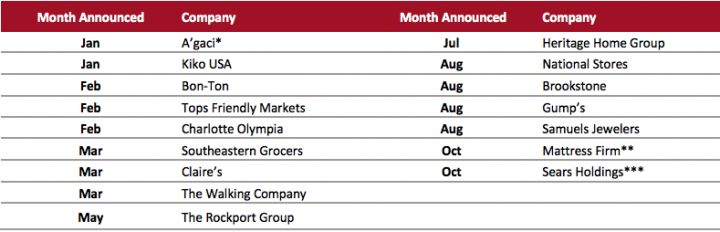

2018 Major US Retail Bankruptcies

[caption id="attachment_89489" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_89489" align="aligncenter" width="720"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

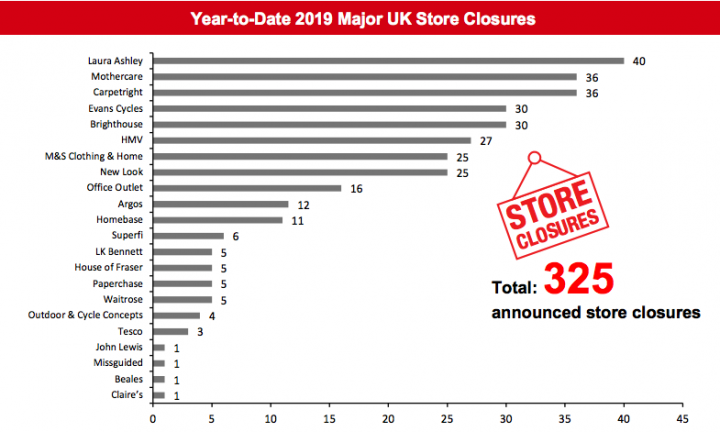

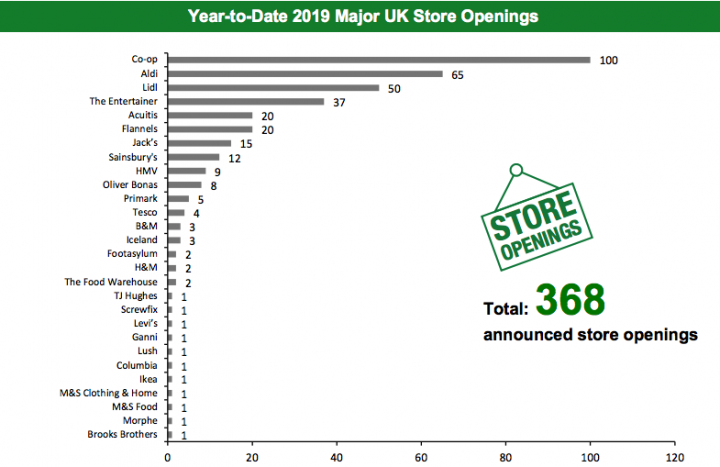

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 325 store closures and 368 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Arcadia Group to Shutter 25 Additional Stores Arcadia Group plans to shutter 25 stores in addition to the 23 closures that were previously announced after opting for a Company Voluntary Arrangement (CVA). The 25 stores belong to plus-size clothing chain Evans and women’s wear banner Miss Selfridge. Additionally, Miss Selfridge’s flagship store on Oxford Street in London is set to close in July and was included in the first 23 stores earmarked for closure. Coresight Research Insight: Last week, we noted that the original 23 closures represent just 4% of Arcadia’s approximately 570 stores in the UK and Ireland, and we said that further closures would likely prove necessary. So, we are not surprised to see a further tranche of closures. As we also said last week, Arcadia’s estate is overspaced and underinvested, and some of its brands have looked tired for a number of years. Boots May Close 200 Stores Pharmacy retailer Boots is reviewing 200 stores for closure over the next two years, according to sources close to the company. Boots’ parent company Walgreen Boots Alliance (WBA) said in April it was undertaking a review of Boots stores with a focus on underperforming stores while leveraging consolidation opportunities, largely in towns that have more than one Boots store. WBA has refused to comment on the news, so these closures are not included in our 2019 store closure chart. Coresight Research Insight: While Boots may look like it has too many stores, proximity is essential for pharmacy and adjacent wellness shopping missions. We point to a second space problem: Boots has too many very large stores which, in previous years, deployed some of their space to sell media products (which Boots no longer sells) or photo labs (now defunct, at least in their traditional format). Our channel checks suggest some Boots stores struggle to fill this space productively. We think Boots needs to downsize or relocate some of its older, larger stores.Non-Store-Closure News

Select Launches Company Voluntary Arrangement (CVA) Womenswear retailer Select has launched a CVA to be carried out by administrators from advisory firm Quantuma. Select entered administration earlier this month. In its current state, the CVA does not propose any store closures or redundancies. However, the advisors indicated there could be some closures even if the CVA proposals are approved. A meeting between Select’s creditors and landlords is scheduled for June 11, 2019. [caption id="attachment_89490" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New LookSource: Company reports/Coresight Research[/caption] [caption id="attachment_89491" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

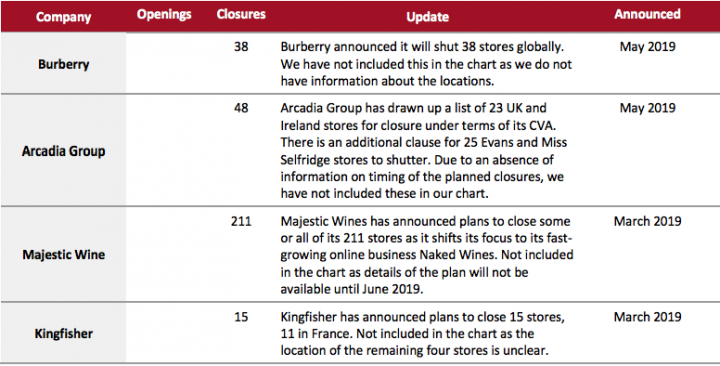

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_89492" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_89492" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

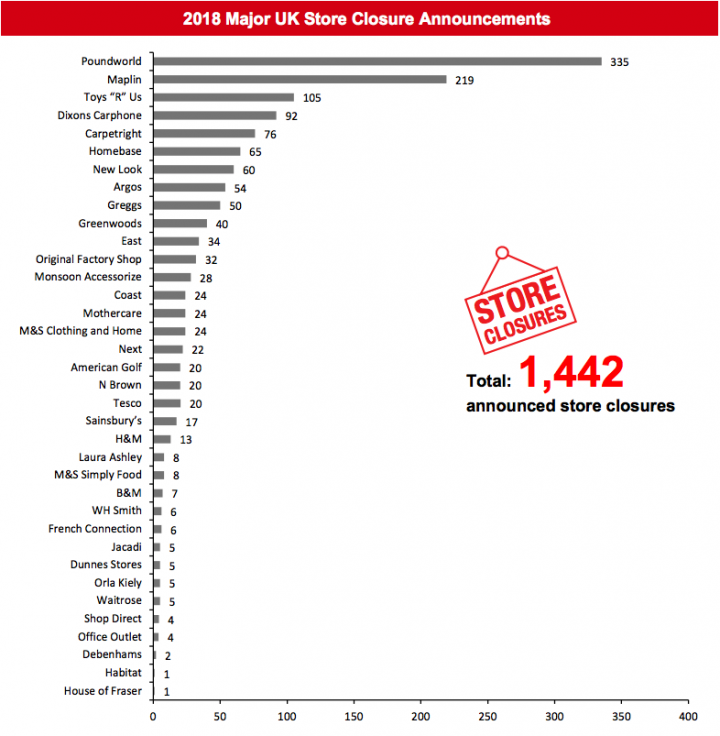

[caption id="attachment_89493" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_89493" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

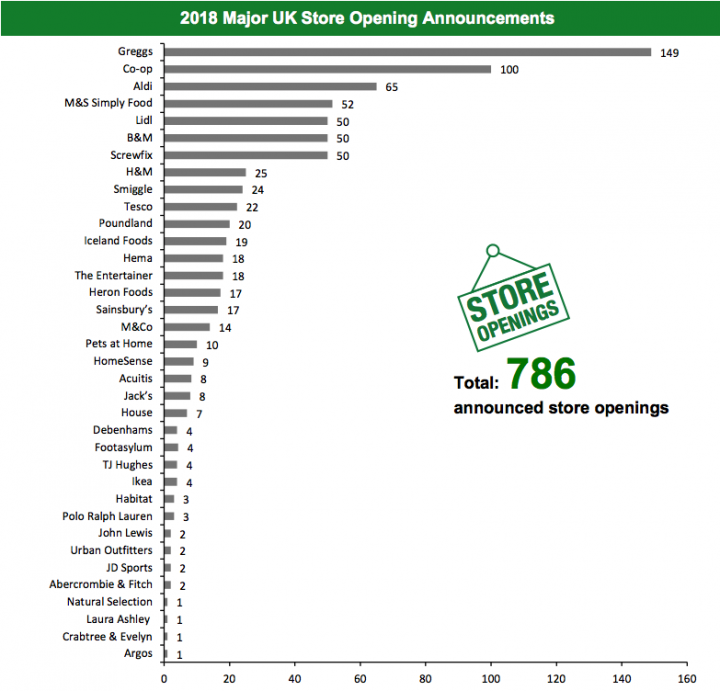

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_89495" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.