Nitheesh NH

The US

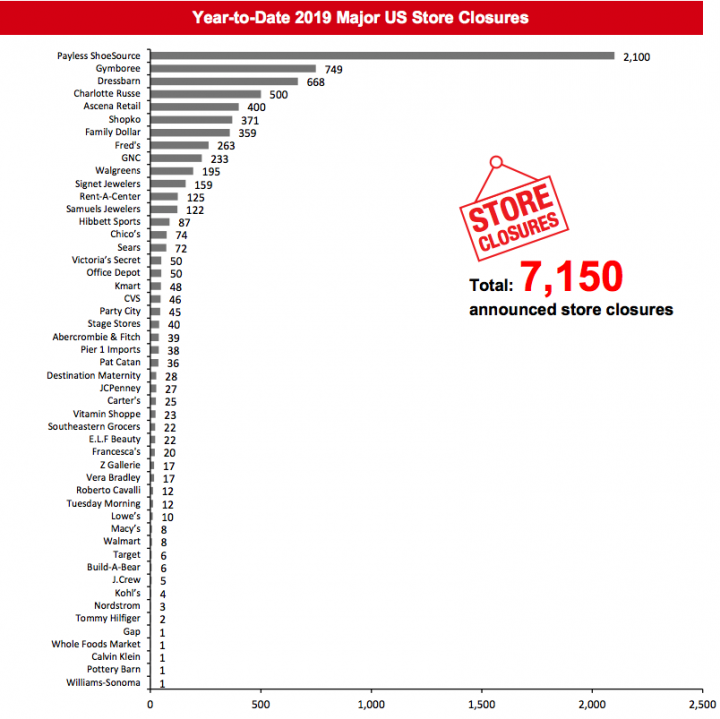

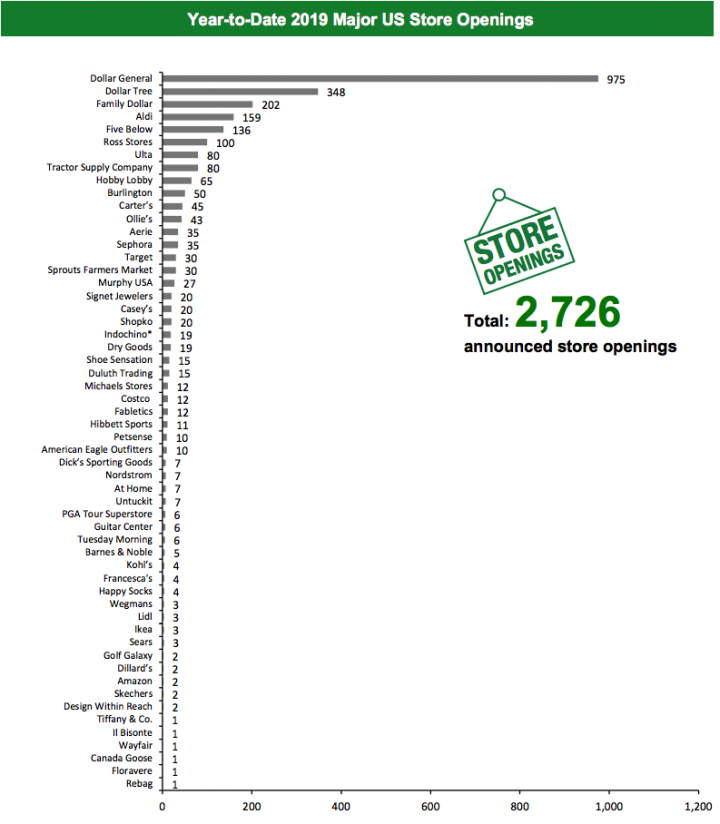

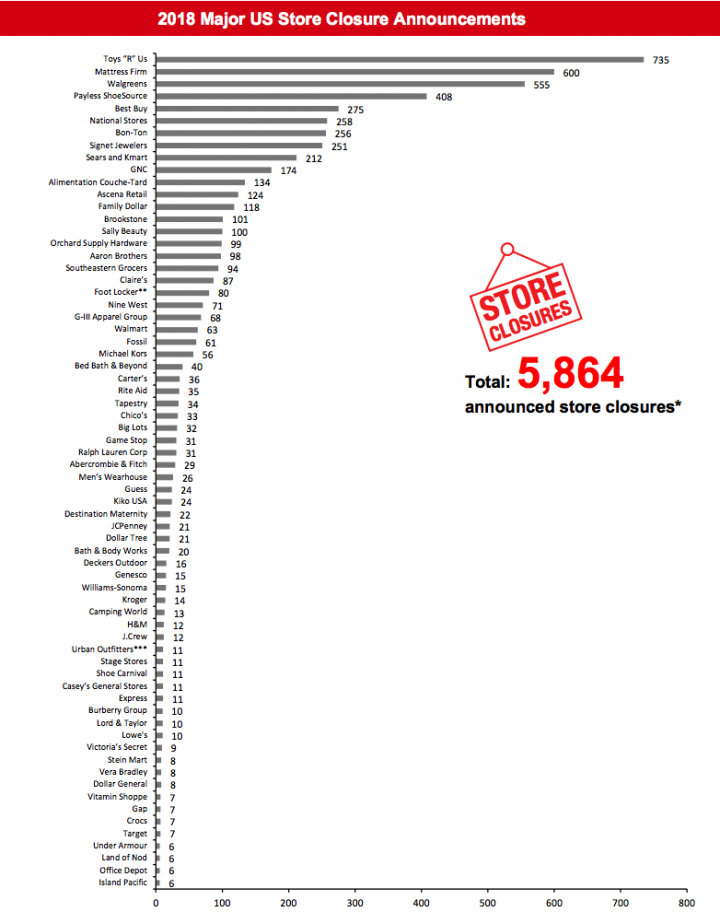

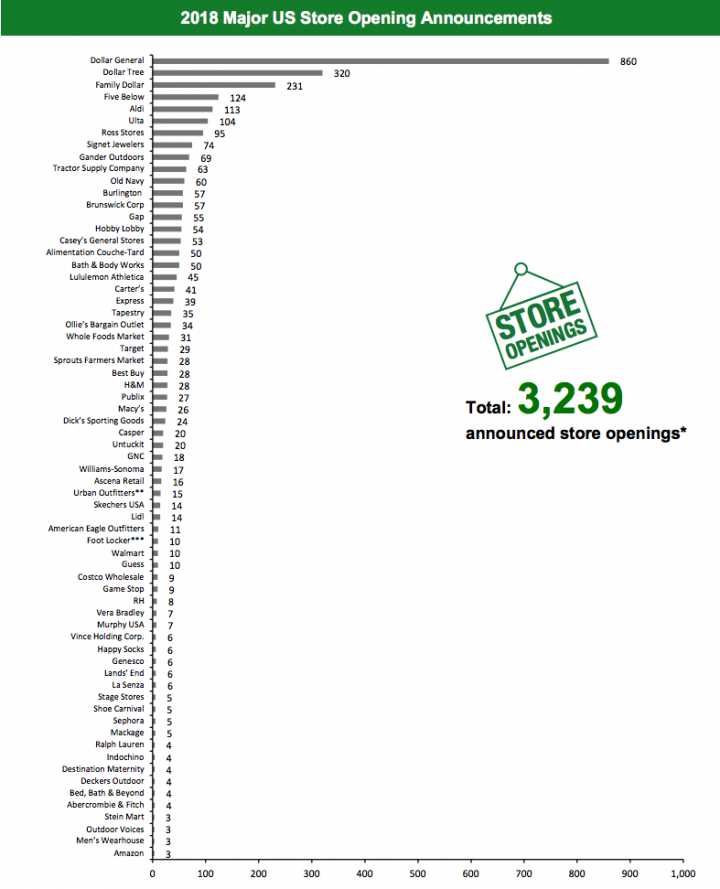

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 7,150 stores and open 2,726. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Dressbarn to Wind Down Business, Will Close 668 Stores Ascena Retail Group announced it will shut its womenswear chain Dressbarn amid falling profits, closing 668 stores in the US. Dressbarn CFO Steven Taylor said, “The Dressbarn chain has not been operating at an acceptable level of profitability in today’s retail environment.” This step will allow Ascena to focus on more profitable brands such as Ann Taylor and Lou & Grey. Coresight Research Insight: Ascena Retail Group has been making major changes as part of its Change for Growth program, which aims to save $300 million in run-rate by July 2019, with its CEO stepping down on May 1 and the company announcing the sale of Maurices on May 6. Dressbarn reported negative 1% comps in the most recent quarter, and management mentioned that the business was operating at an unacceptable level of profitability. Management is taking decisive action to achieve its cost-saving goals. Fred’s to Shut an Additional 104 Stores Pharmacy retailer store Fred’s has announced it will close 104 underperforming stores by June 30, 2019, as it optimizes its store portfolio. The 104 store closures are in addition to the previously announced 159 stores the company said will shut before the end of May. The additional closures will leave Fred’s with around 294 stores. Fred’s has retained its partnership with asset disposition service and advisory providers Malfitano Advisors and SB360 Capital Partners to manage its second set of closures. Coresight Research Insight: Fred’s most recent quarter was unprofitable and comps were negative. To cut costs, the company is optimizing its store footprint, cost structure and operating model, and examining various sale processes for non-core assets, including certain real estate and its remaining pharmacy script portfolio. The company’s annual 10-K expressed substantial doubt regarding its ability to remain a going concern, and in April, the company hired PJ Solomon to evaluate strategic alternatives. [caption id="attachment_88933" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and Walgreens

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and WalgreensSource: Company reports/Coresight Research[/caption] [caption id="attachment_88934" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco*Indochino openings refer to North America openings total, excluding one opening announced for the Greater Toronto Area.

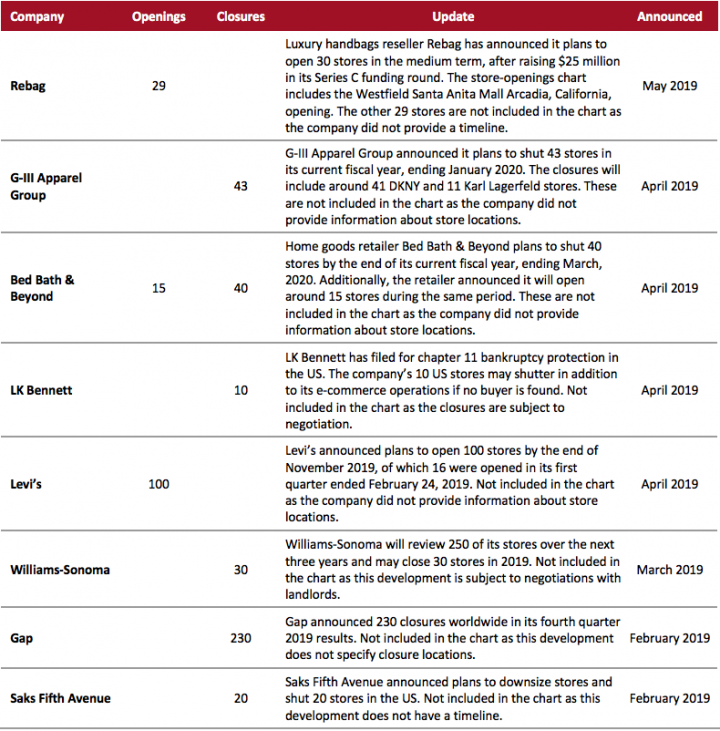

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures that we have not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_88935" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88936" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88936" align="aligncenter" width="720"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research[/caption] [caption id="attachment_88937" align="aligncenter" width="720"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_88938" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

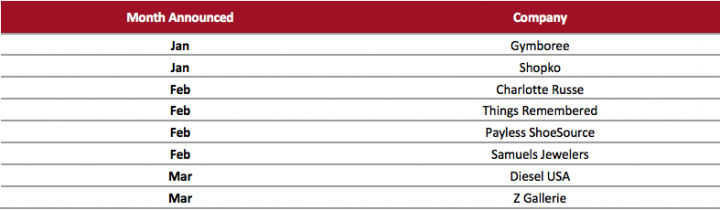

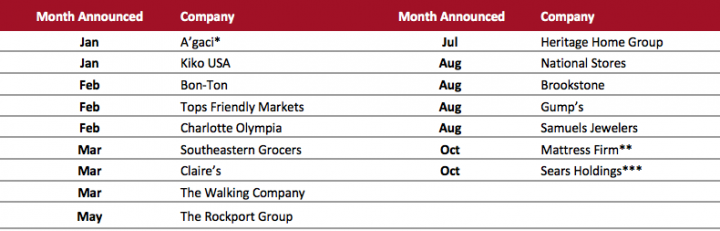

2018 Major US Retail Bankruptcies

[caption id="attachment_88939" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_88939" align="aligncenter" width="720"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

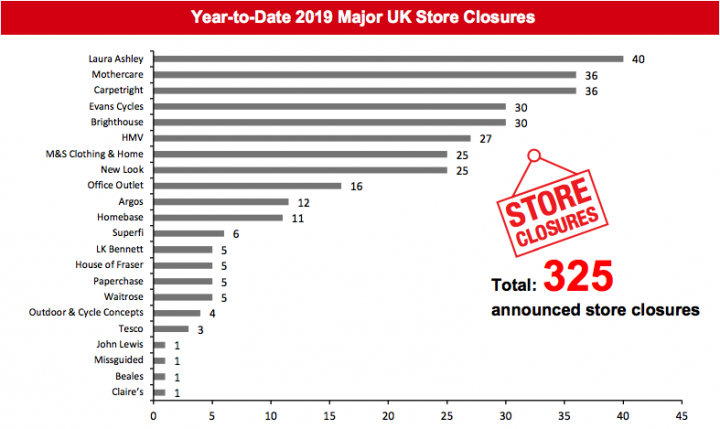

The UK

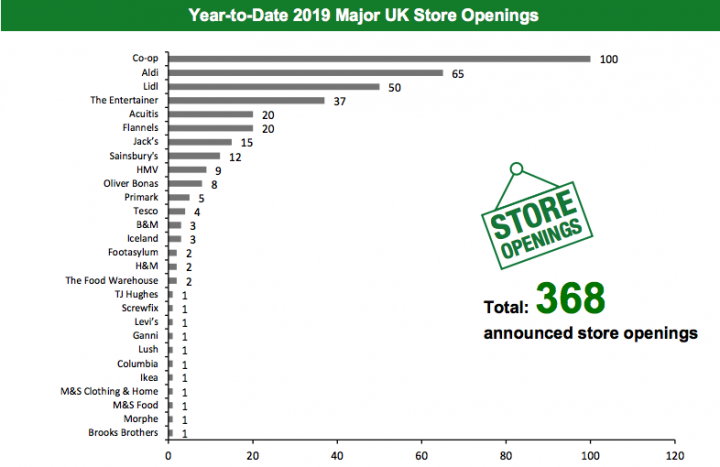

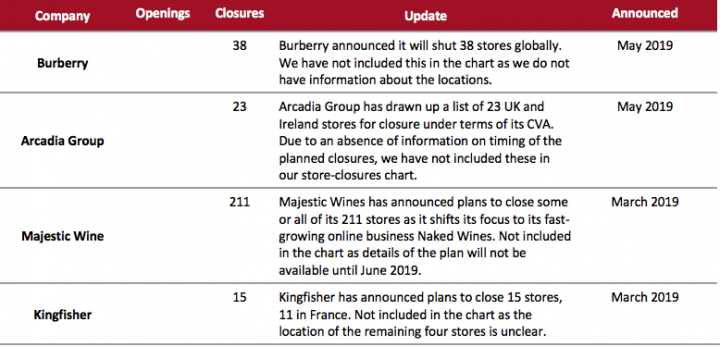

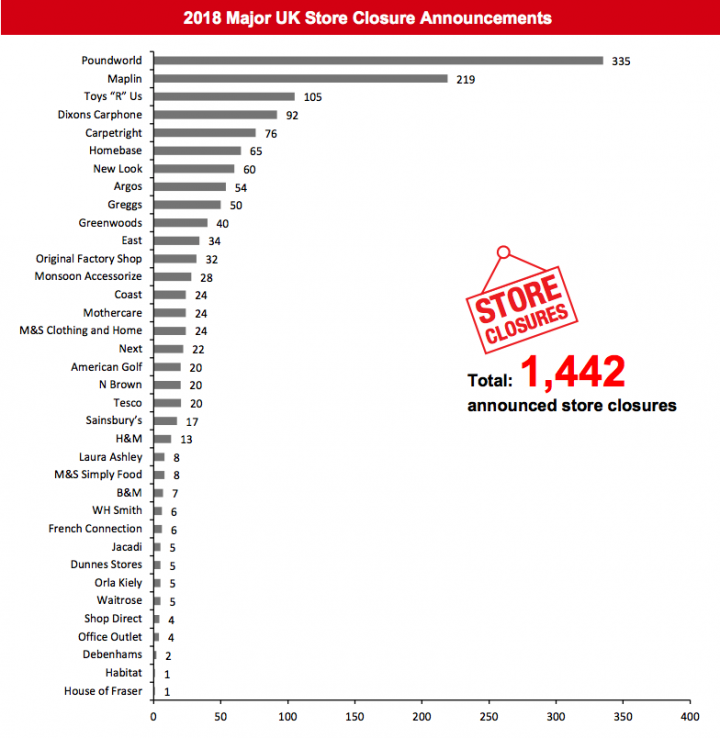

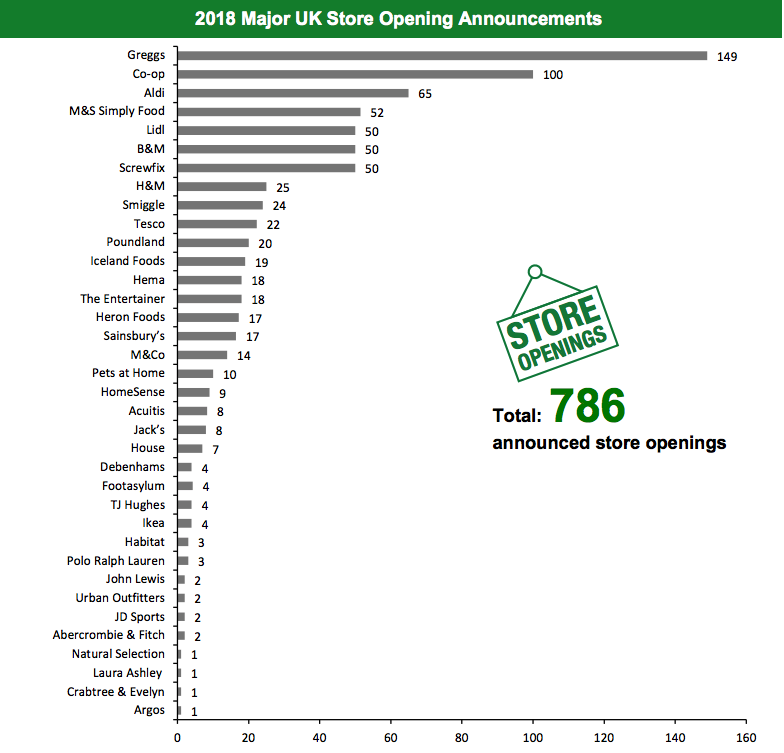

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 325 store closures and 368 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Burberry Announces Plans to Shut 38 Stores British luxury goods retailer Burberry announced it plans to shutter 38 stores globally in non-strategic locations as a part of its store optimization plan. Burberry expects to close these stores by the end of its fiscal year ending March 2020. We have not included the closures in the chart below because the company did not provide information about the location of store closures. Arcadia Group Confirms Plan to Shut 23 Stores Arcadia Group has confirmed the closure of 23 stores in the UK and Ireland under its proposed Company Voluntary Arrangement (CVA). The closures will put around 520 jobs at risk. Additionally, the restructuring plan involves rent reduction for 194 stores. Arcadia Group comprises eight brands that are: Burton Menswear, Dorothy Perkins, Evans, Miss Selfridge, Topshop, Topman and Wallis in addition to its multibrand outlet Outfit. Lady Tina Green, who is the main shareholder of Arcadia and wife of Arcadia Group Chairman Philip Green, has offered a £50 million ($63.8 million) cash investment to improve stores and revamp online sales infrastructure. The timing of the closures is unconfirmed, so these are not included in our 2019 store-closures chart. Coresight Research Insight: Arcadia’s estate is overspaced and underinvested, and some of its brands have looked tired for a number of years. The group is seeing comparable sales fall rapidly: According to The Sunday Times, comps fell 7.5% in the year ended August 2018. 23 closures represent just 4% of Arcadia’s approximately 570 stores in the UK and Ireland, and we think further closures will be prove necessary. [caption id="attachment_88940" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New LookSource: Company reports/Coresight Research[/caption] [caption id="attachment_88941" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88942" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88942" align="aligncenter" width="720"] 2019 Major UK Uncharted Openings and Closures[/caption]

[caption id="attachment_88943" align="aligncenter" width="720"]

2019 Major UK Uncharted Openings and Closures[/caption]

[caption id="attachment_88943" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_88944" align="aligncenter" width="784"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.