DIpil Das

The US

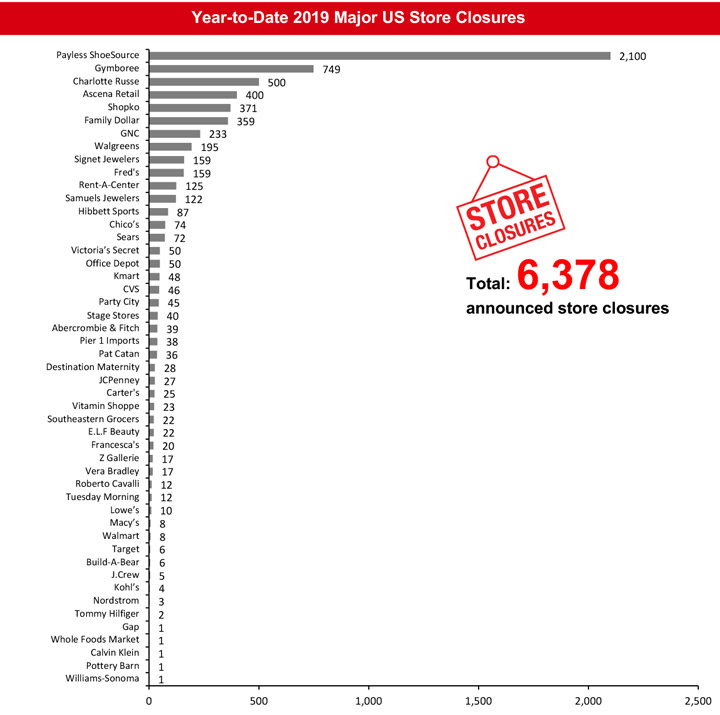

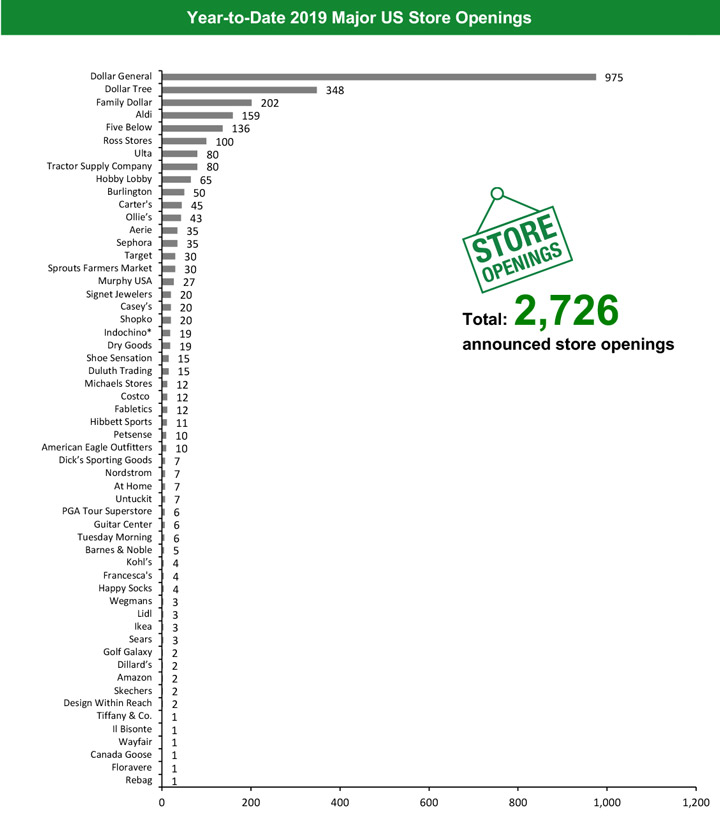

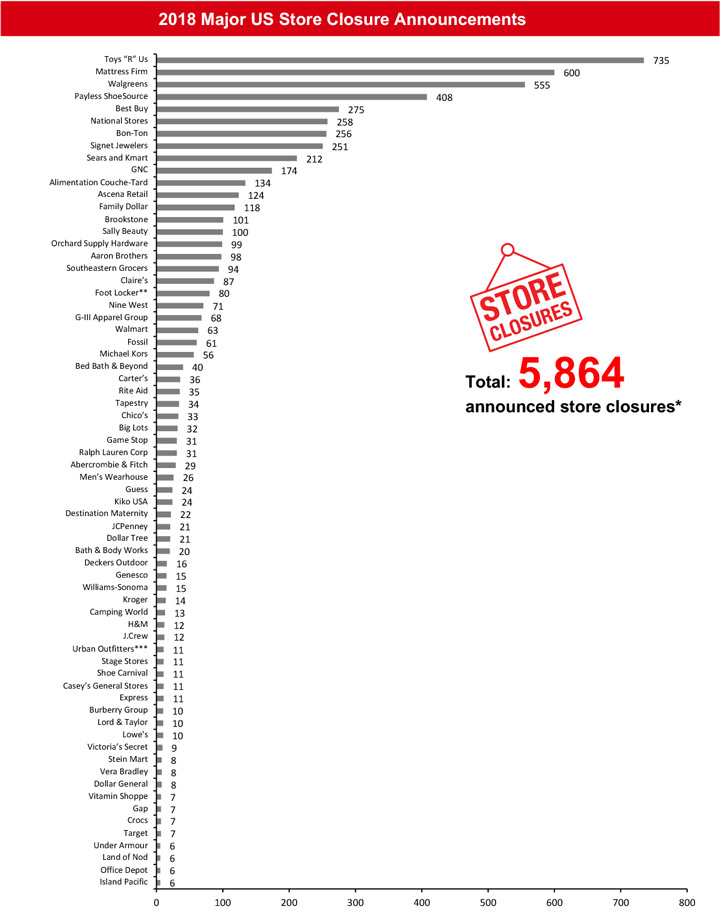

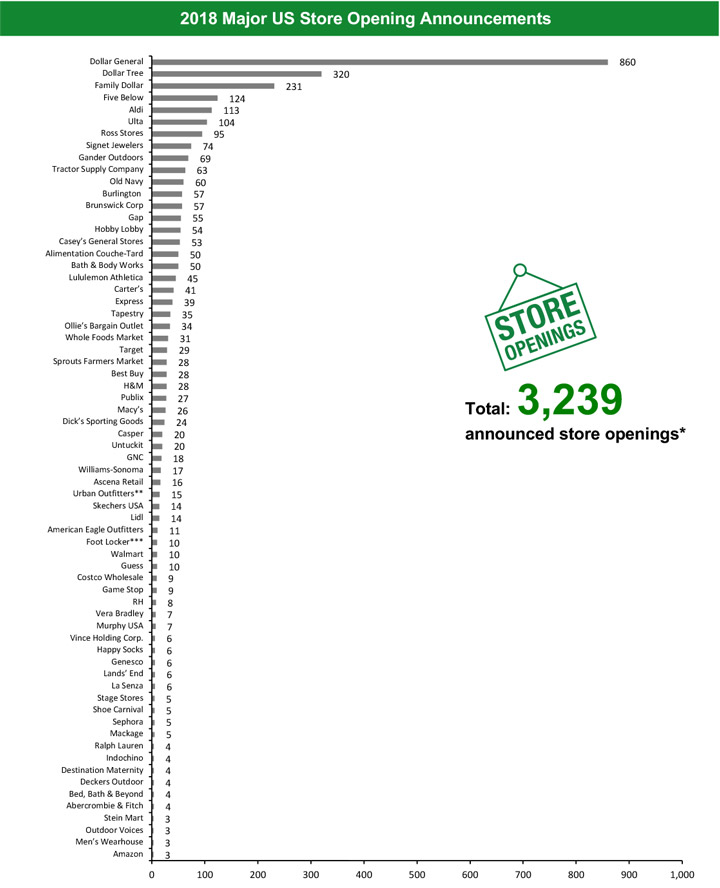

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 6,378 stores and open 2,726. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Party City to Close 45 Stores Party supplies retailer Party City has announced it will close 45 stores before the end of this year; this is higher than usual 10-15 stores that are shut each year as a part of Party City’s store optimization program. The retailer’s sales fell short of the consensus estimate in its first quarter, ended March 31, 2019, primarily due to the shortage of helium that affected sales of in-demand latex and metallic balloons, according to the company. Party City operated 870 stores as of March 31, 2019. The company has not yet provided any information around the location of stores that will shutter. Coresight Research Insight: Although the global helium shortage may have affected sales, the real driver for closures is the company’s optimization of store count. Regarding its helium supply, the company signed an agreement with a new supplier on March 31 that secures about 15% of its annual requirements from alternative sources. While Party City typically closes 10-15 stores per year, these store closures are the result of its annual review process, and management determined that sales could largely be transferred to other stores. Guitar Center Opens its First Hawaii Store Musical instruments retailer Guitar Center opened its first store outside the continental US in Hawaii in Pearl City on May 10, spanning 30,000 square feet, as a part of its planned store openings in 2019. The company aims to open six stores in 2019, with the Hawaii store being the third opening this year. It currently operates 290 stores in the US, which will increase to 293 stores by the year-end if the store openings follow the schedule. The openings also include the company’s first Alaska store which is set to open later this year. Coresight Research Insight: Guitar Center appears to be on a roll, having transformed its stores to create a community and in-store experiences. The company has transformed its stores to create a more open concept in which customers can touch and play the instruments, rather than serving as a meeting place for hard rockers, and customers have responded positively. The company is adding experiences such as live sound, recording equipment and music lessons and in Hawaii, is fine-tuning its new store to resonate with the local audience by adding an emphasis on Hawaiian music. Rebag Announces Plans to Open 30 New Stores Luxury handbag reseller Rebag has announced it plans to open 30 new stores in the US in the “medium-term,” after it raised $25 million in its Series C funding round led by private equity company Novator, with participation from General Catalyst and FJ labs. Rebag recently opened its sixth store in Westfield Santa Anita Mall in Arcadia, California. This is the company’s third store in California with stores in Los Angeles and Beverly Hills. We have included only one opening in the chart below as Rebag did not provide a timeline for its planned store openings. Coresight Research Insight: Rebag is riding the wave in the buoyant luxury segment, particularly the resale market. The company has opened six stores to date, including three in California and three in Manhattan, and its most recent store in Arcadia features a “Rebag Bar,” where customers can sell or exchange a bag for at least 70% of the original price. Rebag is pursuing a differentiated business model, in which it buys bags directly from the seller, paying in a couple of days for online transactions and under an hour for in-store transactions. Tuesday Morning to Shut 23 Stores While Opening 11 Off-price retailer Tuesday Morning announced it will close 23 stores, while opening 11 stores in its fiscal year 2019 ending June 30, 2019. The retailer expects its net debt balance for 2019 to be at or below the levels it recorded in the previous year. In its third quarter 2019 earnings call, Tuesday Morning’s management kept the capital expenditure forecast unchanged at previous guidance in the range of $12-15 million. We have calendarized our figures for Tuesday Morning in the charts below. Coresight Research Insight: Tuesday Morning is bucking the strong discount category and reported a 5.3% negative comp in its most recent quarter. The company blamed the decline on a pullback in promotional activity, the shift of the timing of the Easter holiday (which it said hurt comps by 350 basis points), and the weather. After two years focusing on its supply chain, the company recently changed merchandising leadership, hired an external consultant and is directing its focus on merchandising. Rent-A-Center Shuts 28 Stores Out of Planned 125 Closures in 2019 Rent-to-own furniture and home appliances retailer Rent-A-Center has announced that it has shut 28 stores in the US in its first quarter ended March 31, 2019. The company mentioned in its fourth quarter 2018 earnings call that it will shut around 125 stores in the year 2019. Coresight Research Insight: Rent-A-Center management has been focused on legal matters, which were settled on April 28 and for which it expects to receive $60 million after tax. The company is in the midst of a cost-reduction program that aims to save $140 million annually, which includes store closures. At the same time, the company is focusing on improving the customer experience through higher staffing levels. Rent-A-Center also expects store refranchising to stabilize the store footprint and improve store performance in certain markets.Non-Store-Closure News

Bed Bath & Beyond CEO Resigns Bed Bath & Beyond CEO Steven Temares has resigned with immediate effect. Temares will be replaced by former Family Dollar CFO Mary Winston on an interim basis. Temares’ resignation is believed to be a result of pressure from groups of activist investors, and a shareholder group that is seeking to overturn the entire board of Bed Bath & Beyond. The investors demand improved inventory and a shift in the company culture through training and by implementing innovative technology. [caption id="attachment_88269" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and Walgreens.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers, Tuesday Morning and Walgreens. Source: Company reports/Coresight Research [/caption] [caption id="attachment_88272" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. *Indochino openings refer to North America openings total, excluding one opening announced for the Greater Toronto Area.

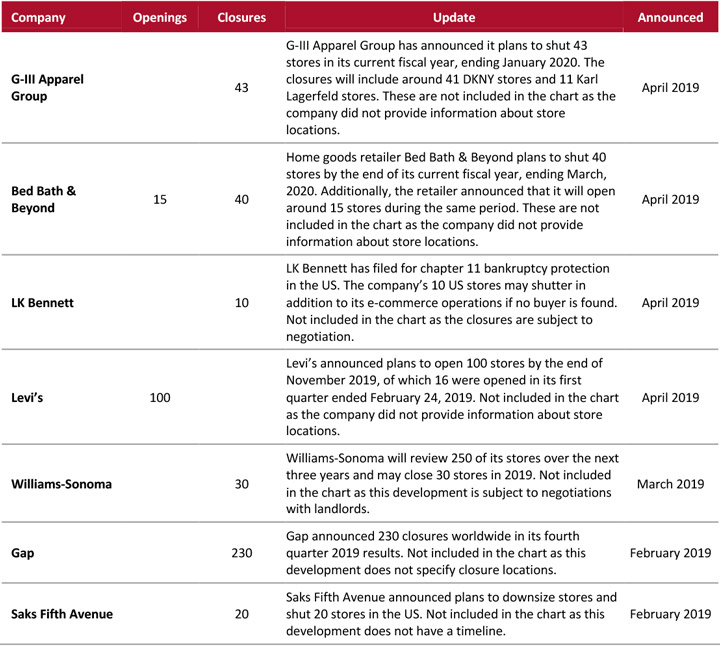

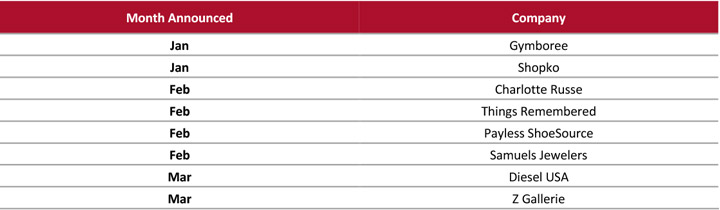

Source: Company reports/Coresight Research [/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures that we have not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_88273" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88274" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88274" align="aligncenter" width="720"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners Source: Company reports/Coresight Research [/caption] [caption id="attachment_88275" align="aligncenter" width="720"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_88276" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_88277" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_88277" align="aligncenter" width="720"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 **Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research [/caption]

The UK

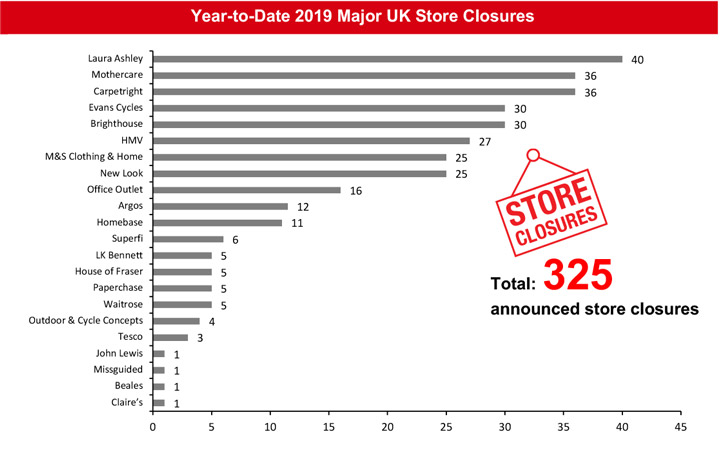

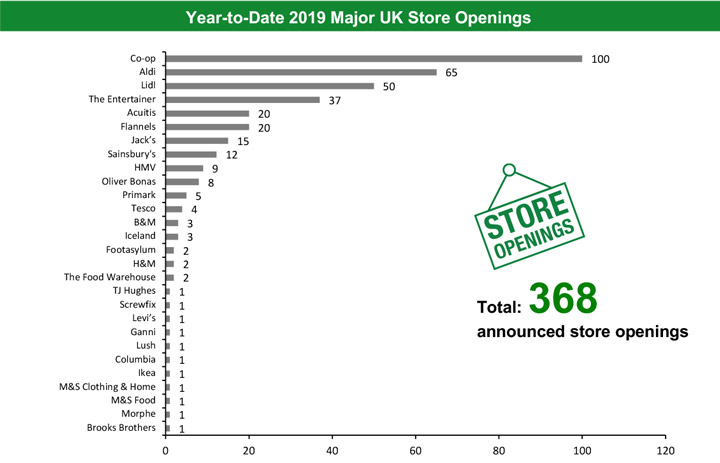

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 325 store closures and 368 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Outdoor & Cycle Concepts Announces Four Closures Under Approved CVA Outdoor & Cycle Concepts, which owns Snow+Rock, Cycle Surgery, Runners Need, and Cotswold Outdoor, has announced it will close four stores over the next three months as a part of its restructuring plan under its approved Company Voluntary Arrangement (CVA). The stores set for closure include Cotswold Outdoor stores in Ipswich and Peterborough, Cycle Surgery in Highbury and a Snow+Rock store located in Bridgend. The company applied for a CVA in April 2019 with the aim of reducing rents and closing stores. The CVA was approved by more than 97% of its unsecured creditors on May 14. [caption id="attachment_88278" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look. Source: Company reports/Coresight Research [/caption] [caption id="attachment_88279" align="aligncenter" width="720"]

Source: Company reports/Coresight Research [/caption]

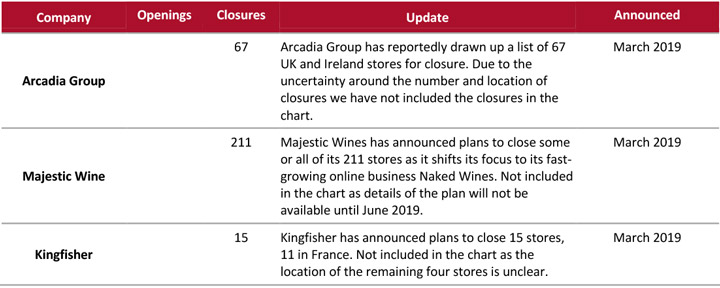

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_88280" align="aligncenter" width="720"]

Source: Company reports/Coresight Research [/caption]

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_88280" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

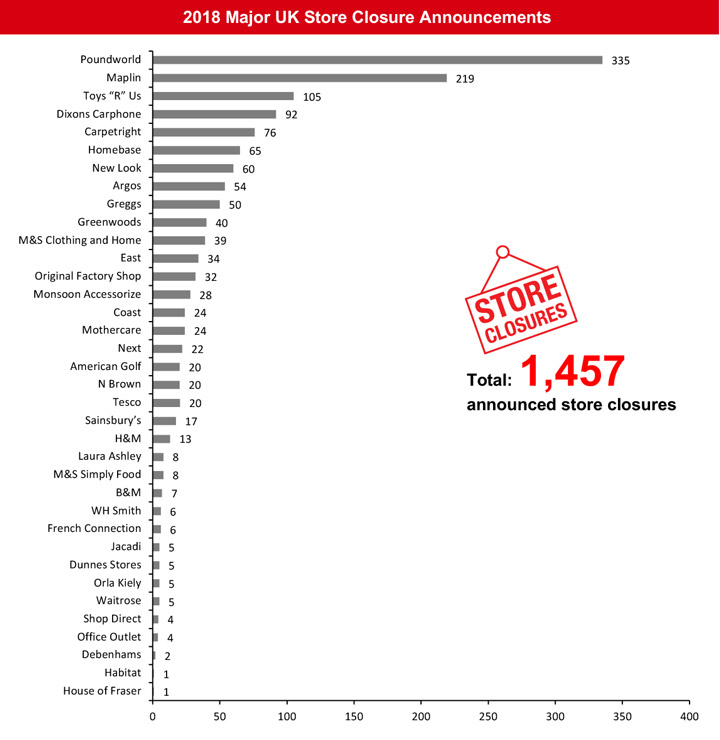

[caption id="attachment_88287" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88287" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

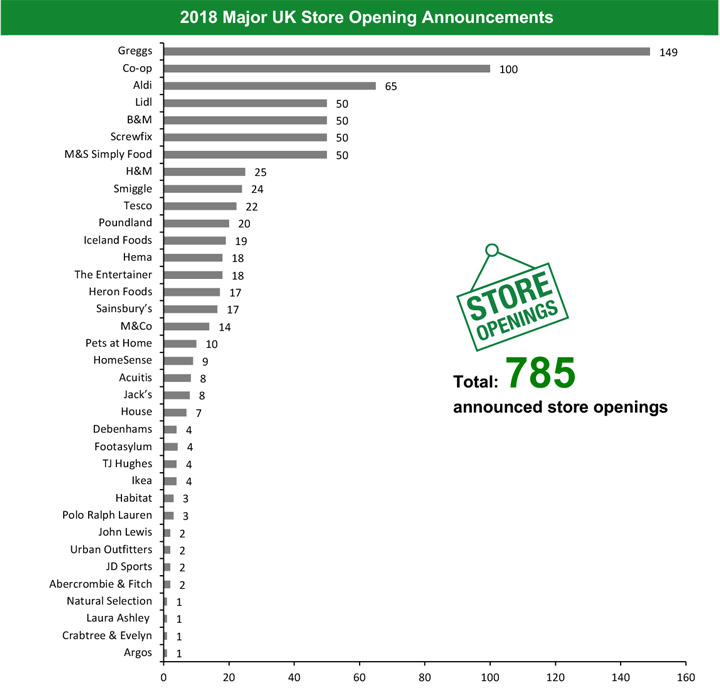

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research [/caption] [caption id="attachment_88288" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.