Nitheesh NH

The US

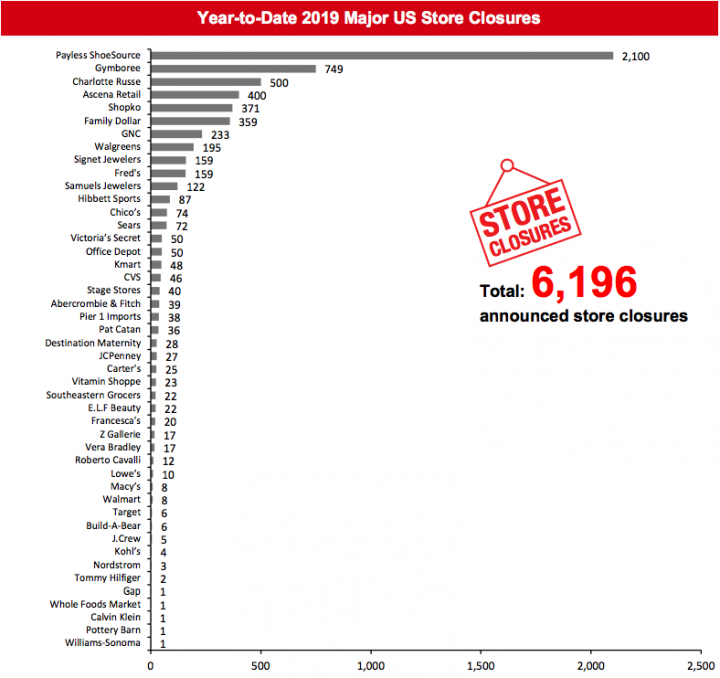

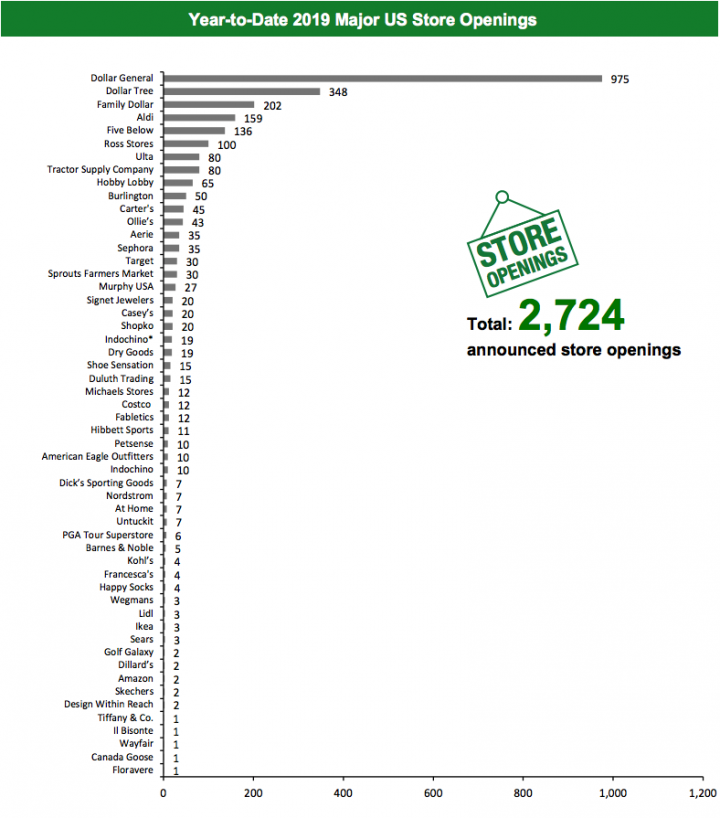

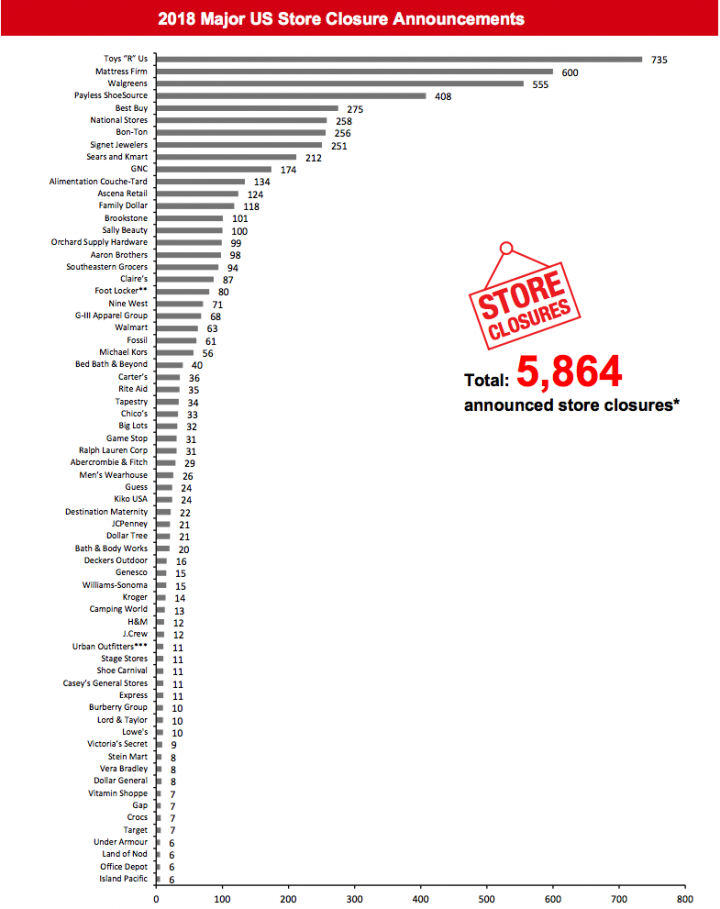

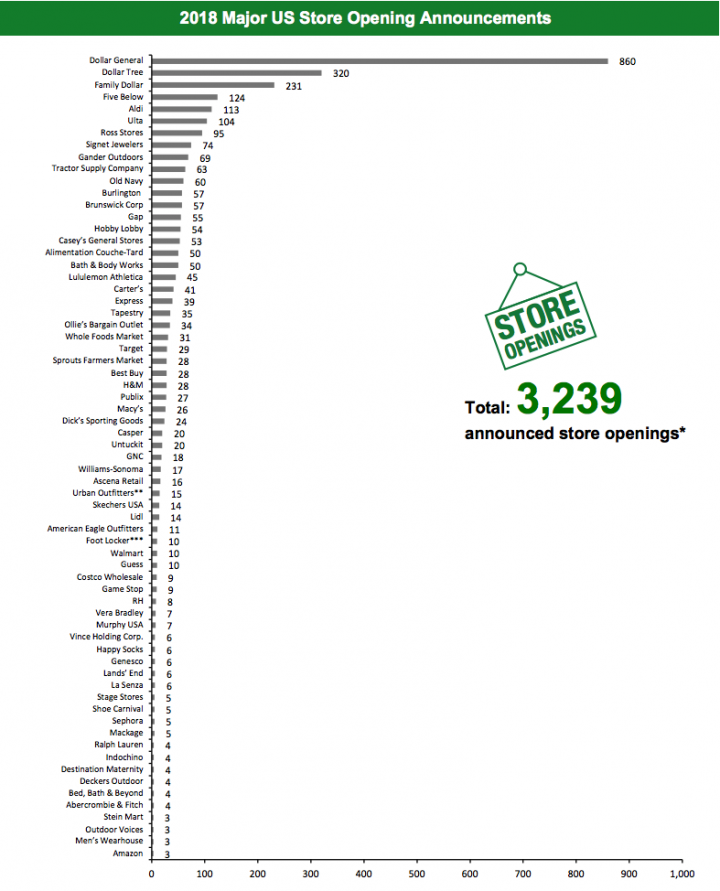

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 6,196 stores and open 2,724. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

CVS to Close 46 Stores Drugstore retailer CVS has announced it will close 46 underperforming stores in its second quarter, ending June 30, 2019, as it optimizes its store portfolio. Out of the 46 stores, those that have already shut include eight stores in Texas, seven in Illinois, four each in California and Florida, three each in Alabama and Minnesota, two each in New York and Hawaii and one store each in New Mexico, Missouri, Michigan, Delaware, Arizona and Washington, DC. The remaining seven stores will shut before June 30. Coresight Research Insight: CVS’s closure of underperforming stores will allow it to redirect resources and roll out store redesigns concentrated on beauty, health and wellness to more locations. CVS introduced shops-in-shops, called BeautyIRL, in October 2018 that feature expanded beauty departments and offer quick beauty services. In February this year, CVS launched HealthHUB stores which offer various healthcare services via digital tools and health kiosks and feature community spaces, called Wellness Rooms, for classes and seminars on health and nutrition. Francesca’s to Shut At Least 20 Stores, Open Four Womenswear apparel retailer Francesca’s has announced it will close 20 stores and open four in 2019. Additionally, the company announced that it will put a hold on its planned store remodels until it stabilizes financially. In its fourth quarter ended February 2, 2019, the company reported net sales of $119.3 million, down 14% year over year. It currently operates 727 stores in the US. Coresight Research Insight: The 20 boutiques targeted for closure are negative contribution margin boutiques that are at the kick-out period or lease end. Management believes the closures will reduce fixed boutique costs and anticipates they can recapture some of the sales in remaining boutiques and thus better leverage the go-forward four-wall cost. Happy Socks to Open 3-5 Stores in 2019 Socks and innerwear manufacturer and retailer Happy Socks opened its second Los Angeles store on May 1, spanning 1,500 square feet. Happy Socks has also opened its first ever creative hub “The Rabbit Hole,” which will be dedicated exclusively to developing new products in the Silver Lake neighbourhood of Los Angeles. The creative hub will also serve as the brand’s marketing headquarters. Happy Socks co-founder and Creative Director Viktor Tell said, “The Rabbit Hole is just like the one in Alice in Wonderland, something is falling down the rabbit hole and you do not know what will come out of it. It is the place where magic happens.” Currently, the company operates five stores in the US and expects to open another 3–5 stores in 2019 in New York and Los Angeles. Coresight Research Insight: Founded in 2008, Happy Socks is available in 90 countries and more than 10,000 fashion apparel boutiques, as well as online and its owns stores. With digital advertising costs rapidly increasing and marketing spend becoming less effective, consumer brands (both digitally native and more traditional wholesale brands) are increasingly opening physical stores to market and establish consumer relationships.Non-Store-Closure News

Ascena Retail Group Announces CEO’s and COO’s Departure Ascena Retail Group has announced that its current CEO David Jaffe has retired as CEO and chairman. Jaffe will be succeeded by Gary Muto, who is currently president and CEO of Ascena Brands. Ascena also announced the departure of COO and president Brian Lynch. Additionally, on May 6 the group completed the sale of women’s clothing chain Maurices, which is a part of Ascena’s “value” brand division, to London-based private-equity firm OpCapita. The transaction is valued at around $300 million. [caption id="attachment_87089" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers and Walgreens.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers and Walgreens.Source: Company reports/Coresight Research[/caption] [caption id="attachment_87093" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco.*Indochino openings refer to North America openings total, excluding one opening announced for the Greater Toronto Area.

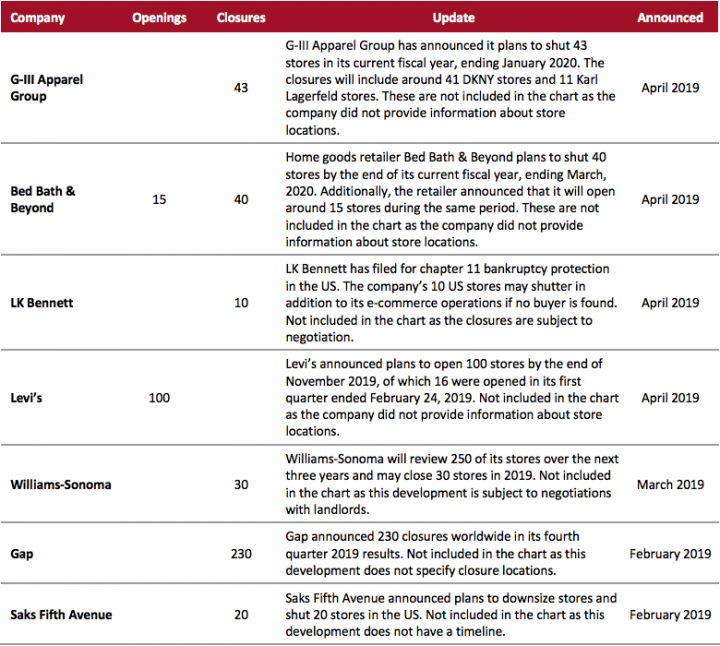

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures that we have not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_87094" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_87095" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_87095" align="aligncenter" width="720"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. ***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research [/caption] [caption id="attachment_87096" align="aligncenter" width="720"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

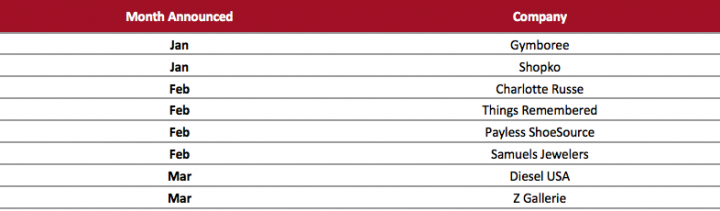

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_87097" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

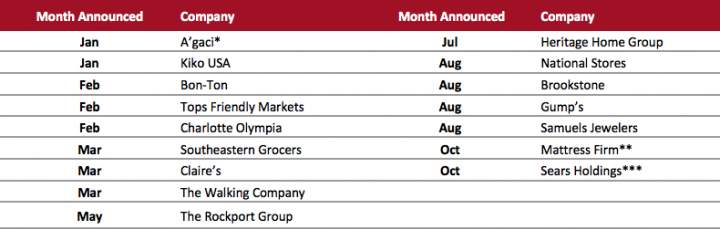

2018 Major US Retail Bankruptcies

[caption id="attachment_87098" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_87098" align="aligncenter" width="720"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

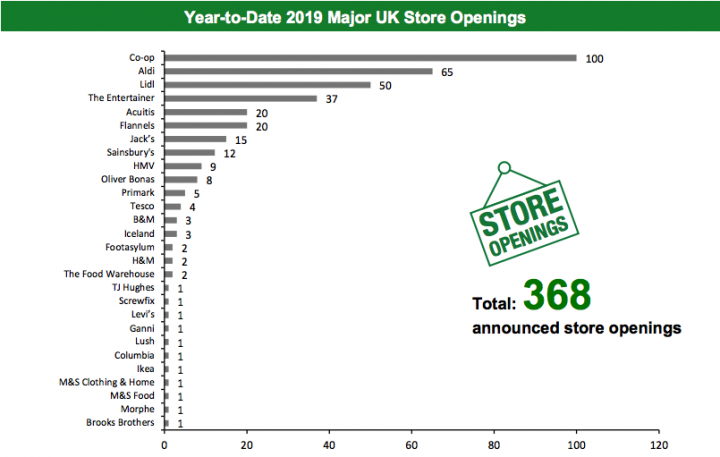

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 321 store closures and 368 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

We recorded no major opening or closure announcements in the past week. [caption id="attachment_87099" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look.Source: Company reports/Coresight Research[/caption] [caption id="attachment_87100" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

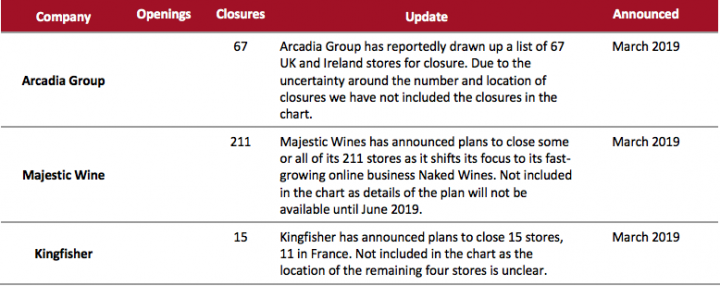

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_87101" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_87101" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

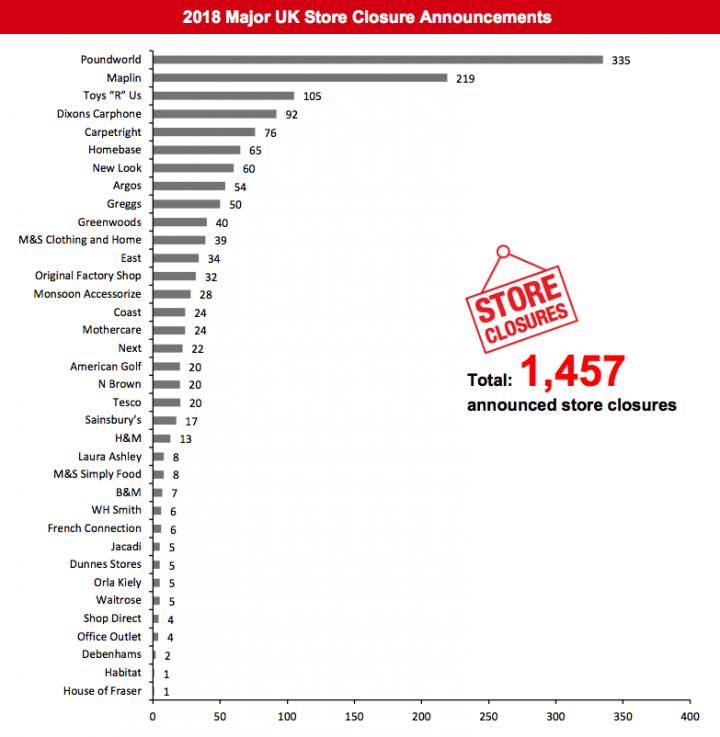

[caption id="attachment_87102" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_87102" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

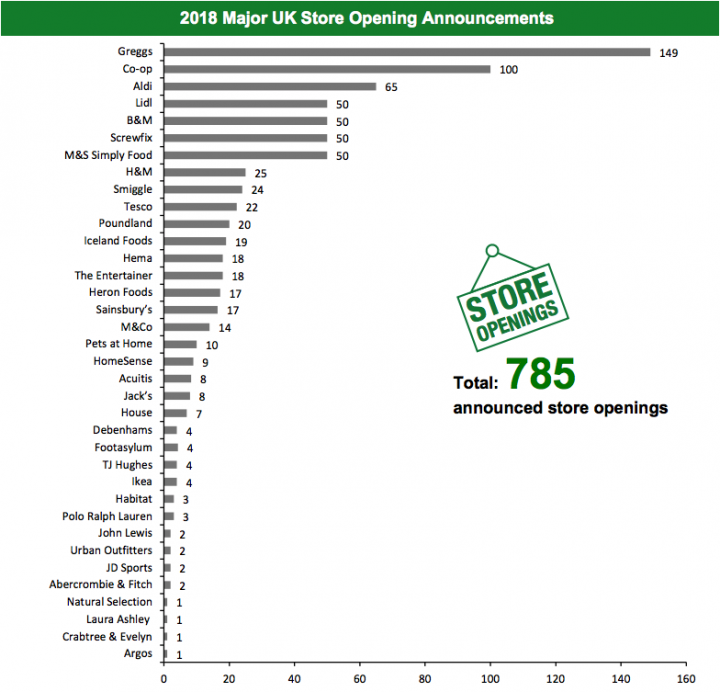

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_87103" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.