albert Chan

The US

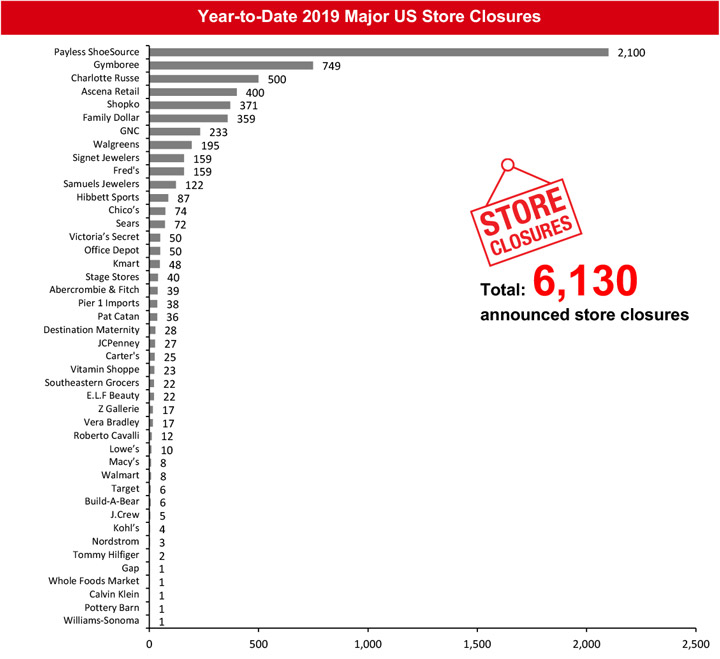

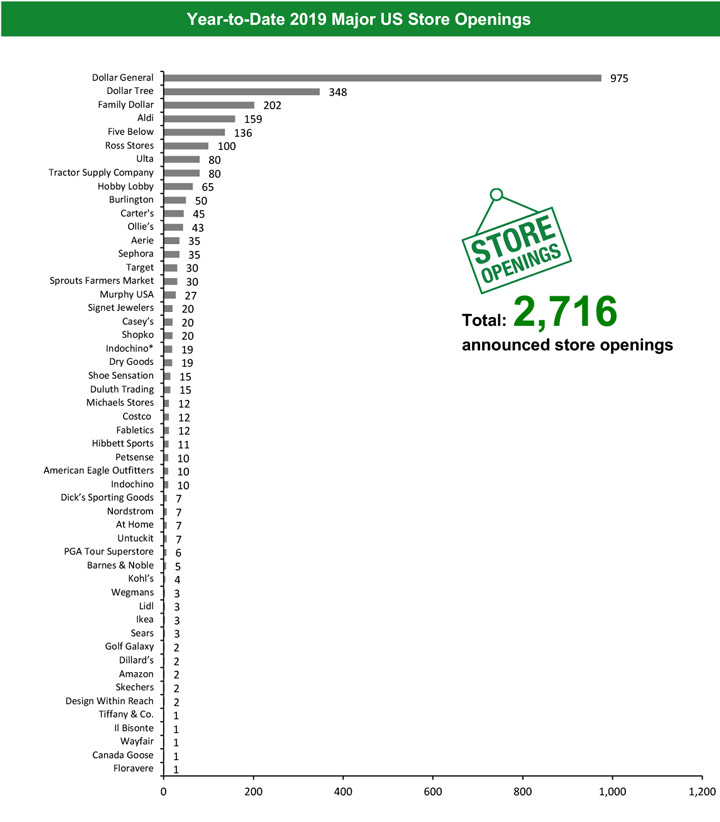

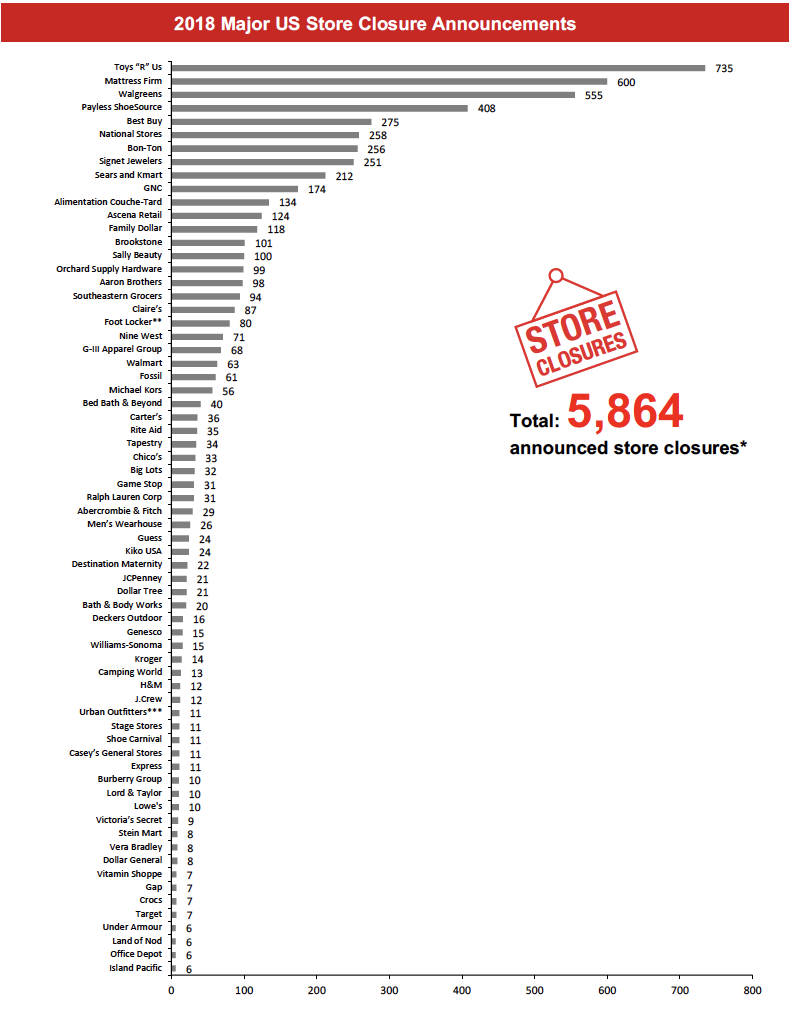

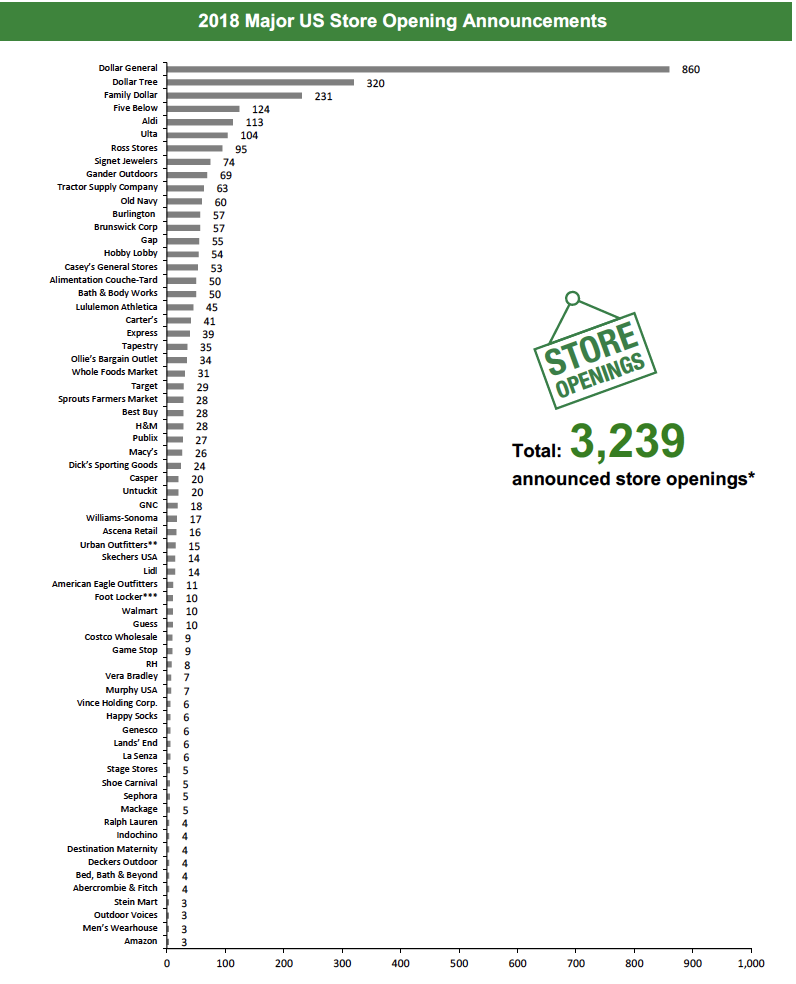

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 6,130 stores and open 2,716. Coresight Research estimates announced US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures exceeded the total we recorded for the full year in 2018. We recorded 5,864 closures and 3,239 openings for the full year 2018. Our data represent closures and openings by calendar year. What Is Happening This Week in the US Tractor Supply to Open 80 Tractor Supply and 10-15 Petsense Stores in 2019 Home improvement and agricultural equipment retailer Tractor Supply has announced plans to open 80 Tractor Supply stores in 2019, in addition to 10-15 Petsense stores during the same period. In its first quarter, ended March 2019, Tractor Supply opened 10 Tractor Supply stores and one Petsense store. The retailer sees potential for more than 2,500 Tractor Supply stores over time but did not provide a timeline. Carter’s Plans to Open 45 Stores While Closing 25 Stores Children’s apparel company Carter’s has announced it will open 45 stores in 2019. Additionally, the company plans to shutter 25 stores over the same period. The company opened four new stores and closed 14 stores in the first quarter, part of its planned openings and closures for the full year. Carter’s operated 834 stores at the end of its first quarter, ended March 31. Coresight Research Insight: This is part of Carter’s multiyear real estate strategy to open cobranded stores located closer to families with young children in tandem with closing more remote stores in declining outlet centers, which has enabled Carter to gain market share despite the closure of some of its legacy wholesale customers. Fabletics to Open 12 Stores in 2019 Activewear brand Fabletics plans to open 12 stores in 2019, taking its total store count to 39. Moreover, the company will open a pop-up store in Manhattan, New York that will serve as a testing ground for future New York expansion. The new stores will be in: Austin, Texas; Jacksonville, Florida; Pleasanton, California; Garden City, New York; and, King of Prussia, Pennsylvania. Fabletics offers shoppers interactive features such as “OmniSuite” and “OmniShop” with the help of data-driven robots that allow customers to request a different size or color, check stock and receive styling tips without leaving the changing room. Coresight Research Insight: Fabletics is on a path to 75 to 100 doors. For Co-CEO Adam Goldenberg, digitally native Fabletics is not opening new stores for customer acquisition, but rather as an additional place to service its 1.2 million VIP customers, who spend about 2.5 to 3 times more when they shop multiple channels. Fabletics is opening stores where they have a high membership concentration. Floravere Opens its First Permanent Location Luxury bridalwear company Floravere has opened its first store in the Tribeca neighborhood of Manhattan. Customers can make an appointment with a stylist on the brand website or through the messaging service on Instagram. The store houses three private bridal suites which have a dressing room and a separate seating area for the bride’s friends and family. The suites are personalized based on the data gathered through a digital questionnaire that customers fill out before making an appointment. Coresight Research Insight: This digitally native brand has used hotel suites in select US cities as well as customers’ homes to sell bridal gowns. A dedicated store is the next step in the evolution. The US bridal industry is in the midst of disruption and opportunity with David’s Bridal (the largest US bridal retailer) having entered and emerged from Chapter 11 bankruptcy earlier this year, along with the 2017 Chapter 7 bankruptcy filing of Alfred Angelo. Non-Store-Closure News Chico’s CEO Resigns Amid Falling Sales Chico’s CEO Shelly Broader has resigned from position of CEO and President, and is no longer a member of the board. Chico’s has appointed former President and CEO of Hudson’s Bay Company Bonnie Brooks, who currently serves as a board member, as interim CEO, effective immediately. In fiscal year 2018, Chico’s same-store sales slid 4.9% while net sales declined to $2.1 billion from $2.3 billion. Home Depot Names New CFO Home-improvement retailer Home Depot has announced that its CFO and Executive VP of Corporate Services Carol Tomé will retire on August 31, 2019. Richard McPhail, who currently serves as Senior VP of Finance Control and Administration, will be promoted to CFO following Tomé’s retirement. [caption id="attachment_86569" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers and Walgreens.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Abercrombie & Fitch, Chico’s, Hibbett Sports, Signet Jewelers and Walgreens.Source: Company reports/Coresight Research[/caption] [caption id="attachment_86570" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco.*Indochino openings refer to North America openings total, excluding one opening announced for the Greater Toronto Area.

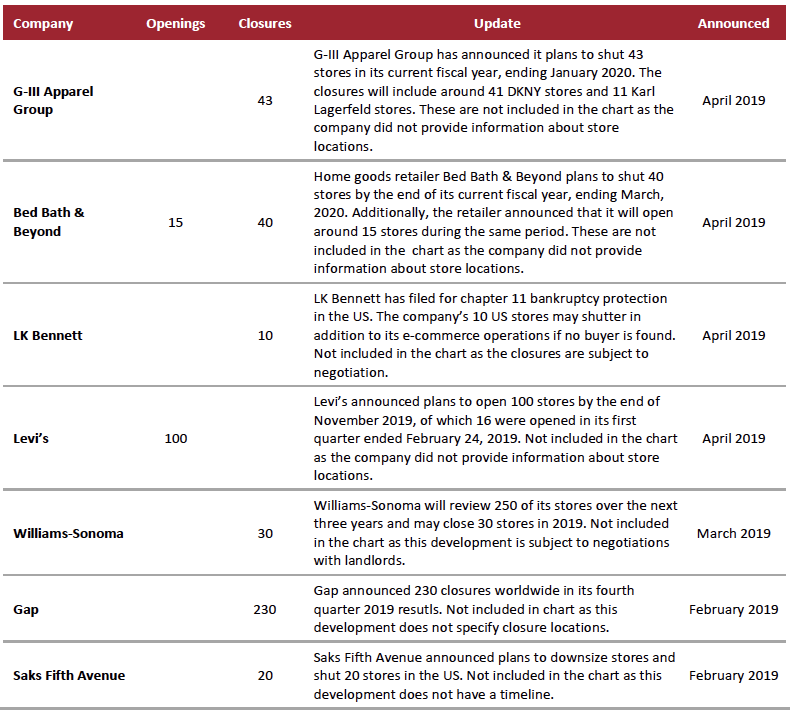

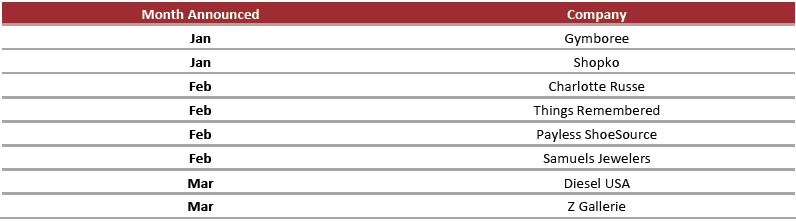

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures that we have not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_86171" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86172" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86172" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research[/caption] [caption id="attachment_86173" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_86174" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_86175" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_86175" align="aligncenter" width="700"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

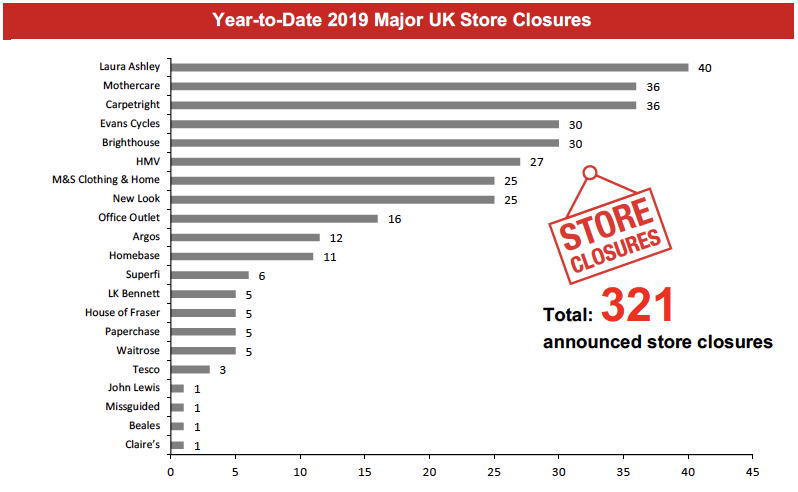

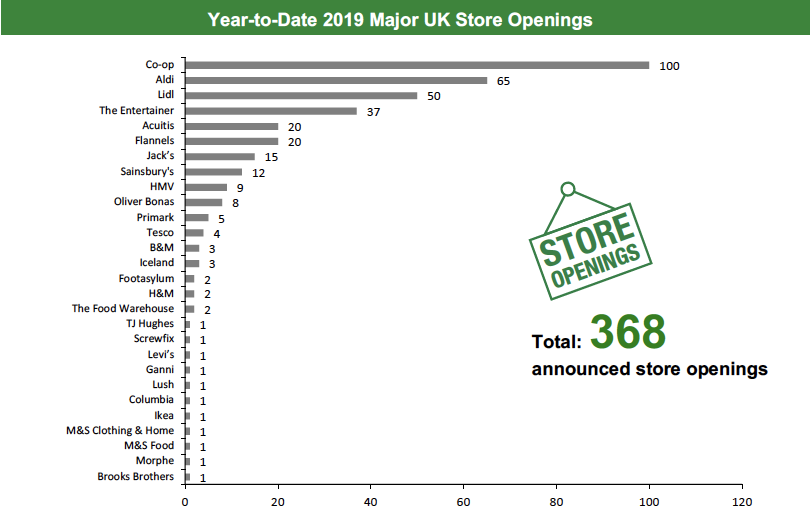

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 321 store closures and 368 store openings. Our data represent closures and openings by calendar year. What Is Happening This Week in the UK Debenham’s Earmarks 22 Stores for Closure in 2020 Department store chain Debenhams has provided details around its store portfolio optimization under its newly launched Company Voluntary Arrangement (CVA). Previously, Debenhams announced a store optimization plan in October 2018 that included 50 closures over the next 3-5 years. The new CVA proposes a closure of up to 22 stores in 2020 in the following locations: Altrincham, Ashford, Birmingham Fort, Canterbury, Chatham, Eastbourne, Folkestone, Great Yarmouth, Guildford, Kirkcaldy, Orpington, Slough, Southport, Southsea, Staines, Stockton, Walton, Wandsworth, Welwyn Garden City, Wimbledon, Witney and Wolverhampton. All of Debenham’s 166 stores are proposed to remain open during 2019, including the Christmas trading period. For this reason, we have removed our previously charted estimates of 2019 closures for Debenhams. [caption id="attachment_86176" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Homebase, Laura Ashley and New Look.Source: Company reports/Coresight Research[/caption] [caption id="attachment_86177" align="aligncenter" width="700"]

Source: Company reports/Coresight[/caption]

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_86178" align="aligncenter" width="700"]

Source: Company reports/Coresight[/caption]

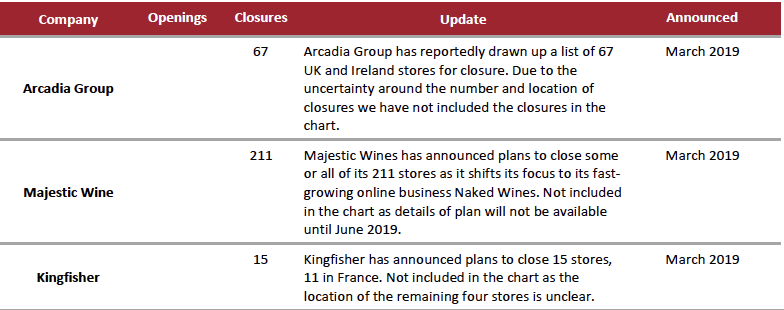

2019 Major UK Uncharted Openings and Closures

[caption id="attachment_86178" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86179" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

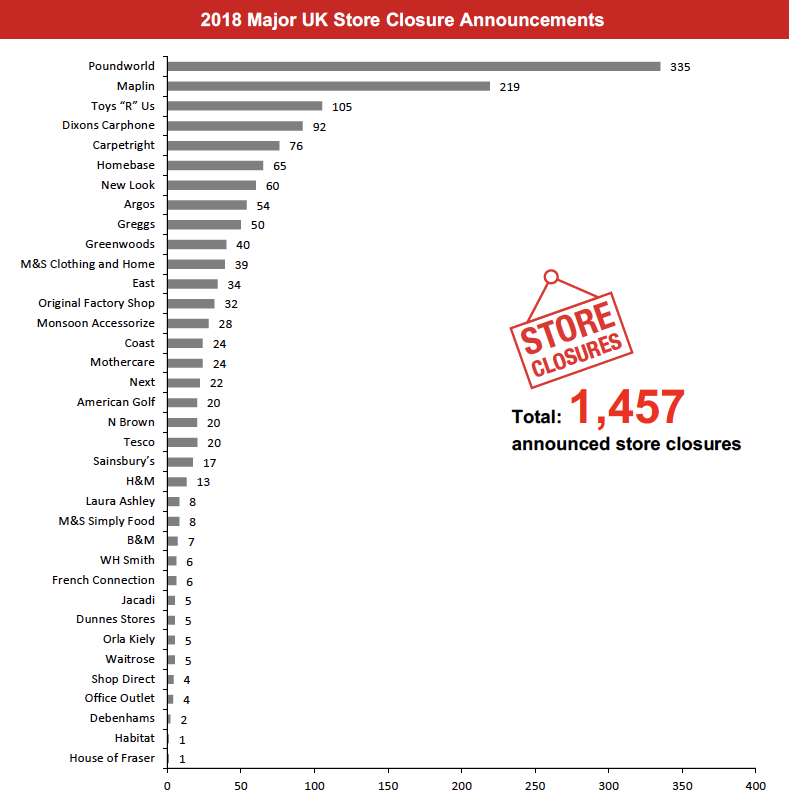

[caption id="attachment_86179" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_86180" align="aligncenter" width="700"]

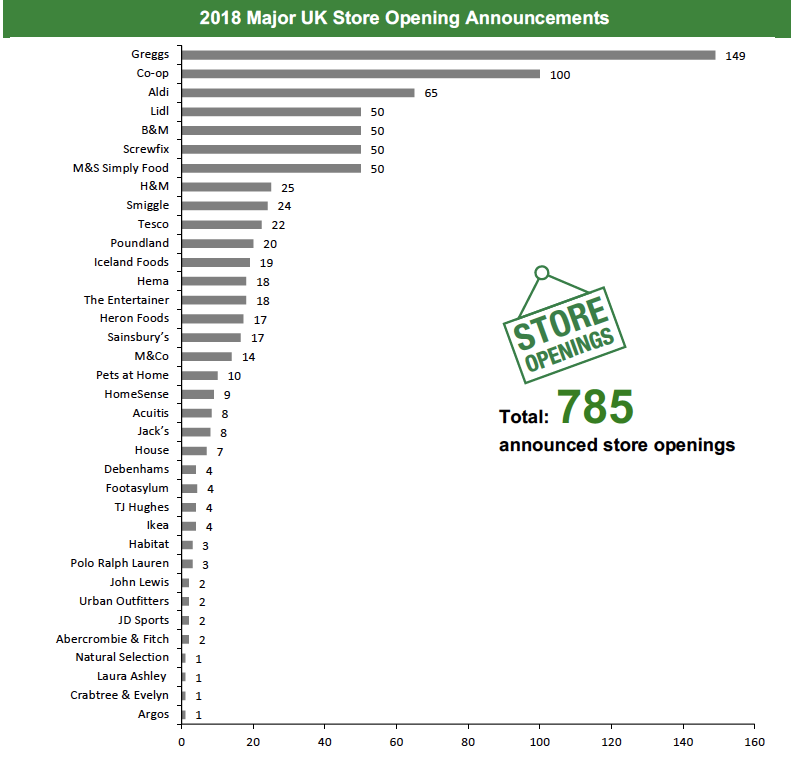

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.