Nitheesh NH

Coresight Research tracks news about store closures, openings and bankruptcies. Our Weekly US and UK Store Openings and Closures Tracker focuses on department stores and specialty retail stores, including, but not limited to, those selling softlines, hardlines, consumer electronics, groceries and furniture.

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82073" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82073" align="aligncenter" width="800"] Total includes retailers that have announced multi-year store opening plans which have been included based on an estimate for each year, which includes Aldi’s five-year plan for store openings through 2022

Total includes retailers that have announced multi-year store opening plans which have been included based on an estimate for each year, which includes Aldi’s five-year plan for store openings through 2022

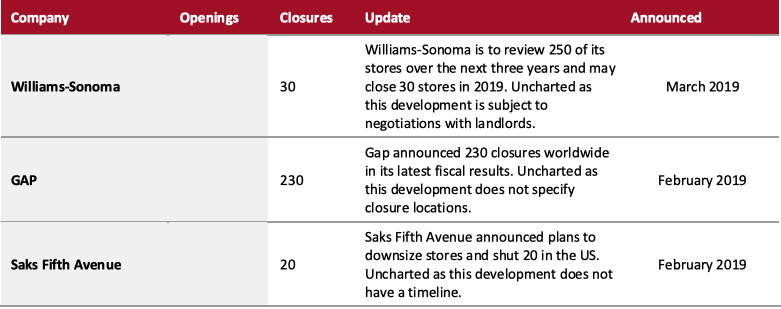

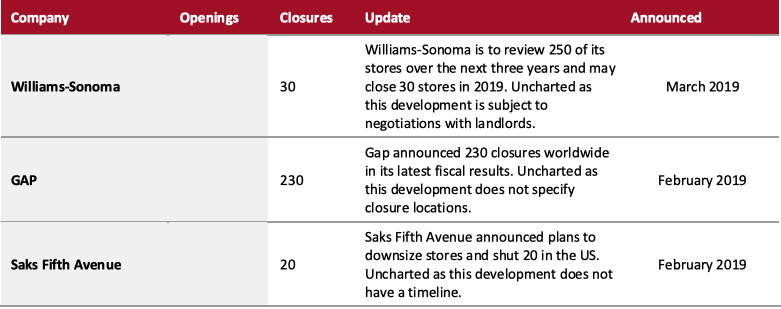

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings/Closures The data below are announced closures that we have not allocated to our current-year total, due to a lack of detail on the timing or location of closures. [caption id="attachment_82074" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82076" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

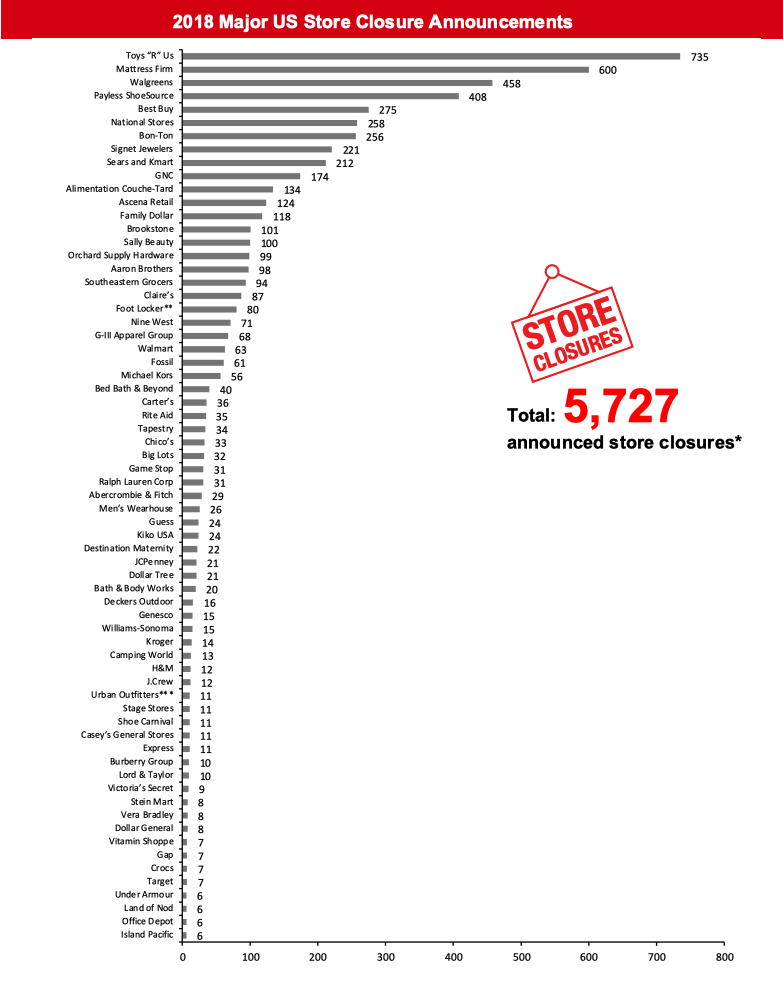

[caption id="attachment_82076" align="aligncenter" width="800"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research[/caption] [caption id="attachment_82078" align="aligncenter" width="800"] *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

** Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

*** Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research[/caption] 2019 Major US Store Bankruptcies [caption id="attachment_82080" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

2018 Major US Store Bankruptcies

[caption id="attachment_82082" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

2018 Major US Store Bankruptcies

[caption id="attachment_82082" align="aligncenter" width="800"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018

Source: Company reports/Coresight Research[/caption] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers including Debenhams, Homebase, Laura Ashley and New Look.

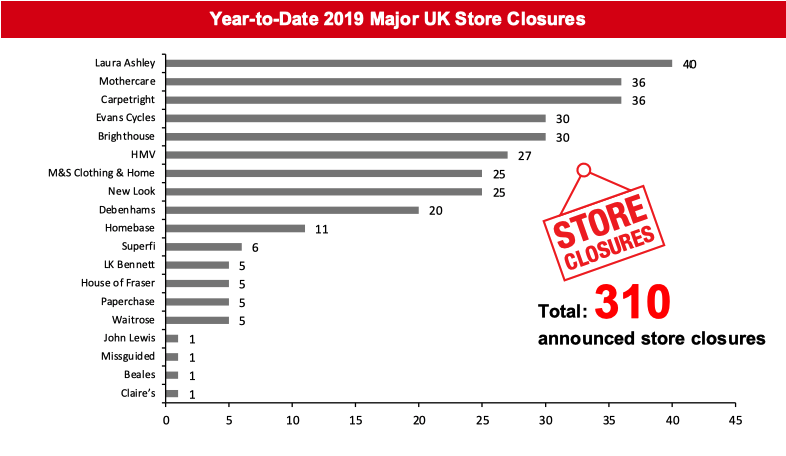

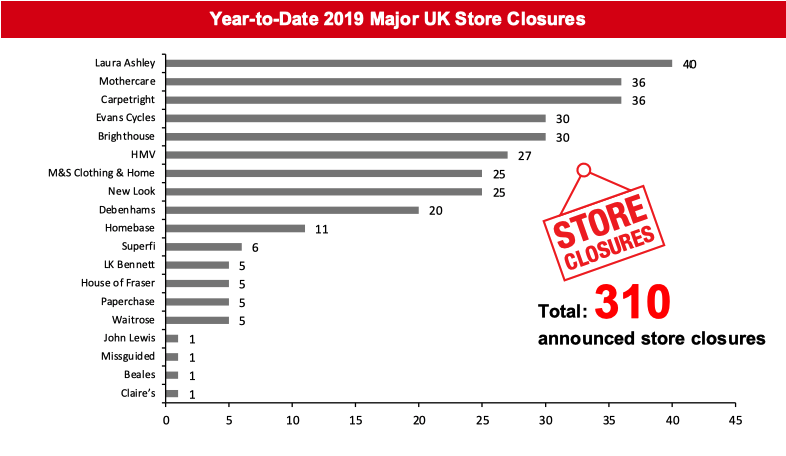

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers including Debenhams, Homebase, Laura Ashley and New Look.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_82089" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

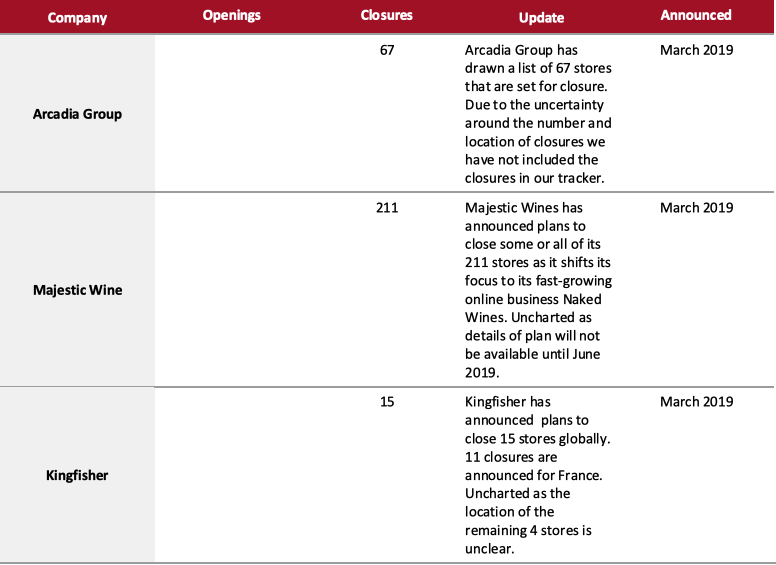

2019 Major UK Uncharted Openings/Closures

[caption id="attachment_82092" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

2019 Major UK Uncharted Openings/Closures

[caption id="attachment_82092" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82095" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82095" align="aligncenter" width="800"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Source: Company reports/Coresight Research[/caption] [caption id="attachment_82098" align="aligncenter" width="800"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.

The US

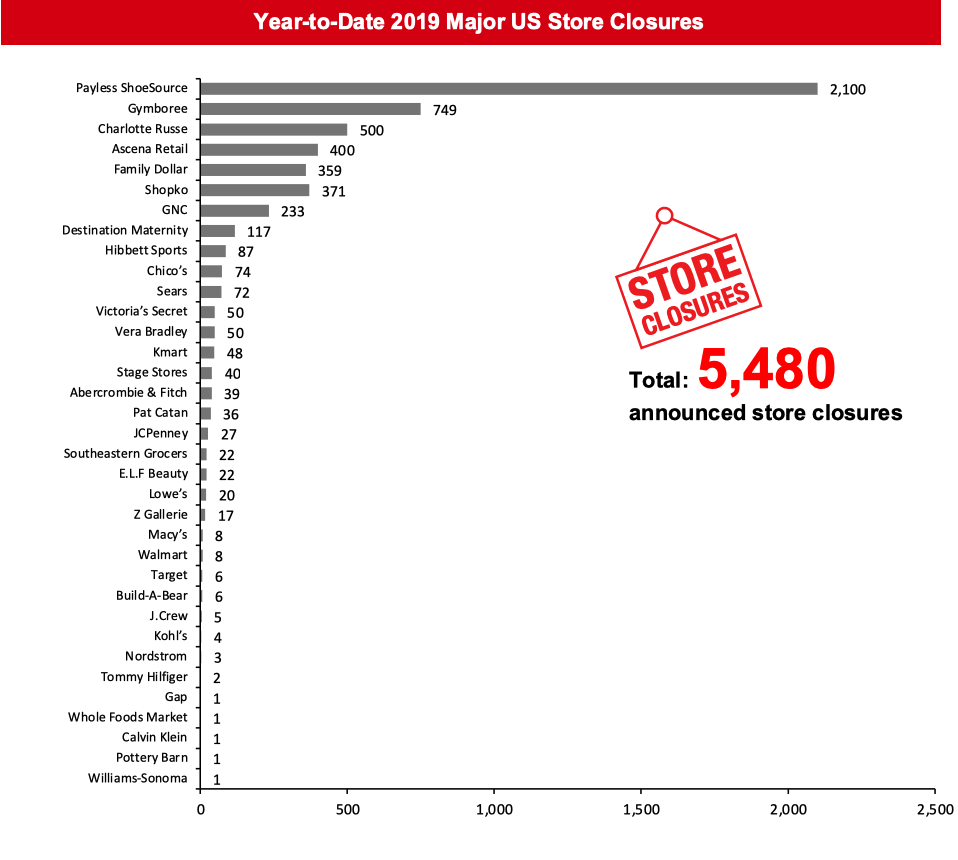

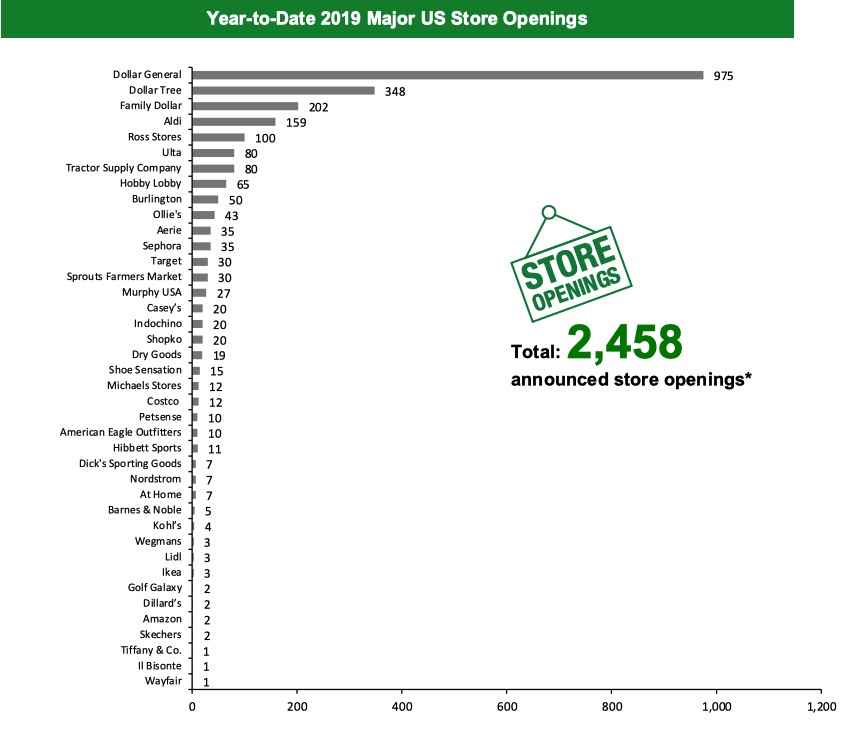

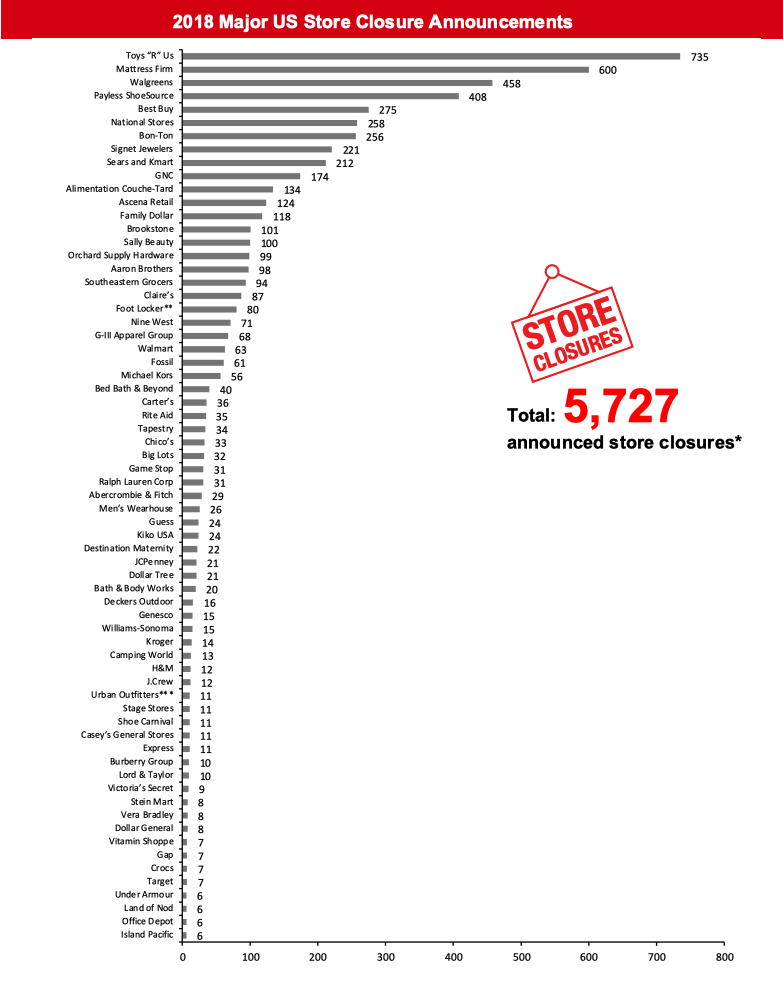

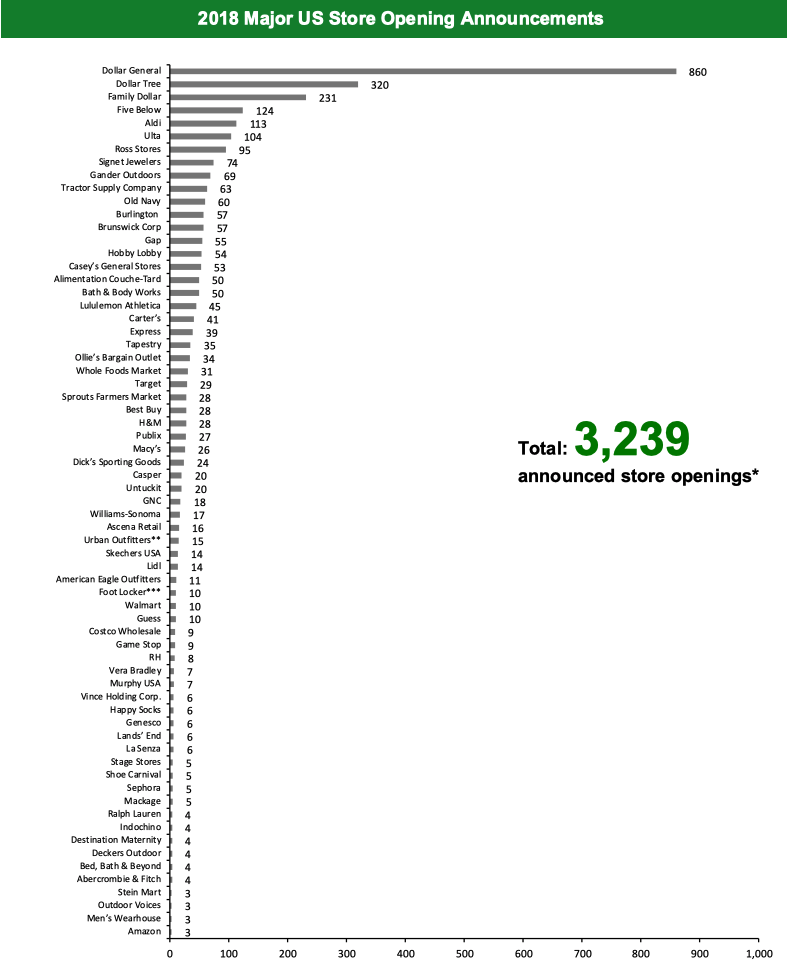

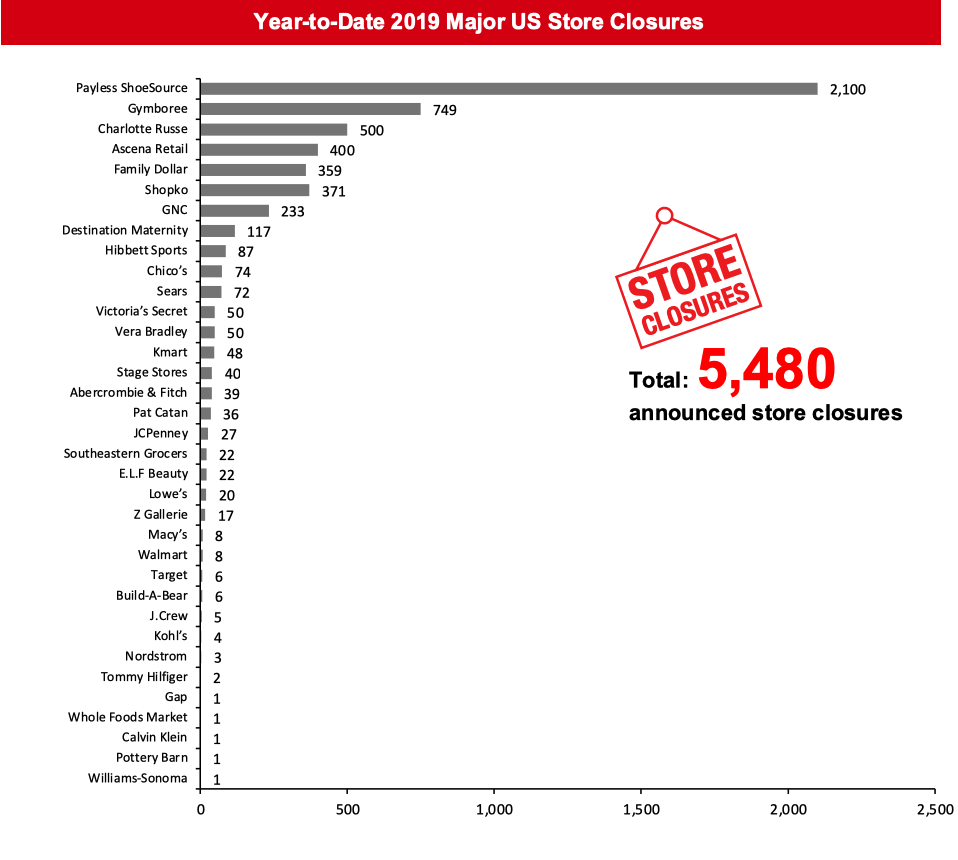

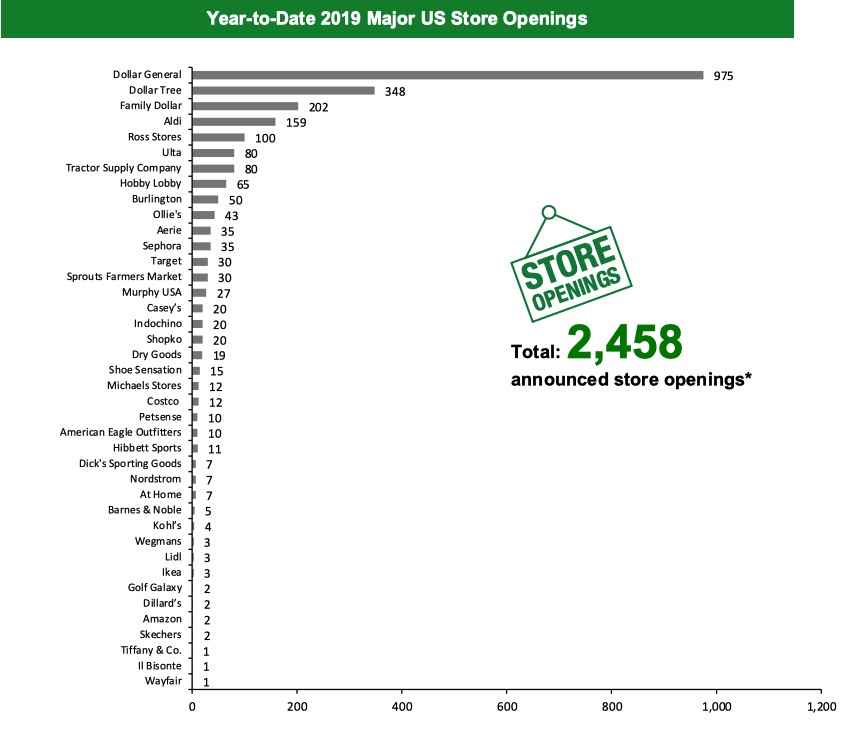

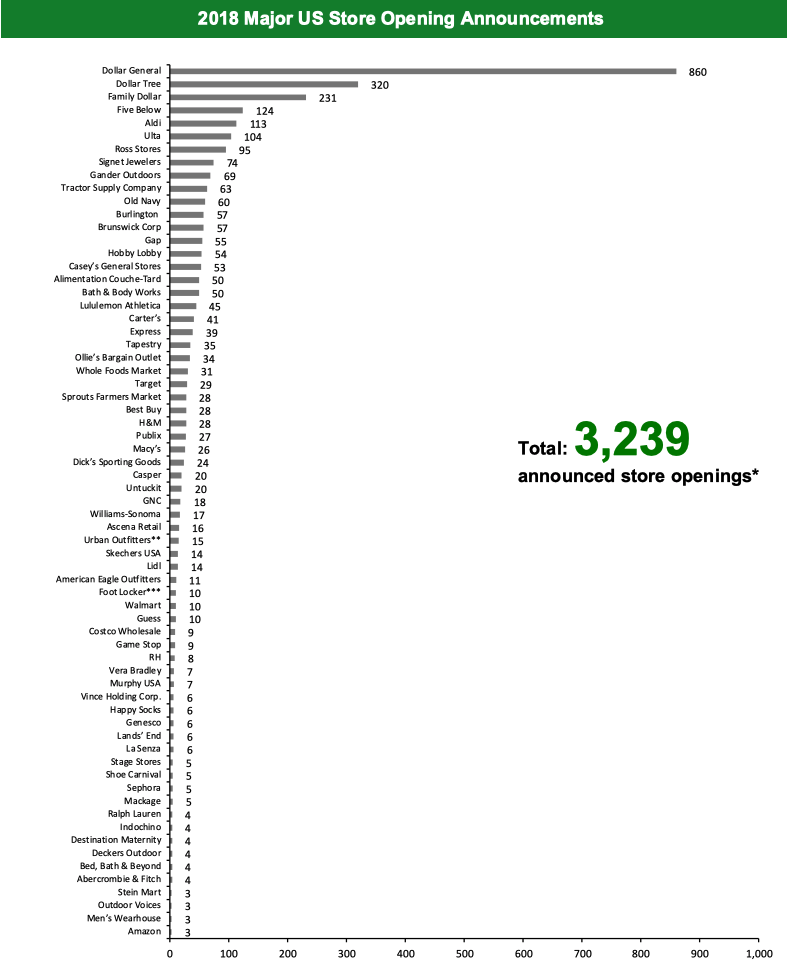

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 5,480 stores and open 2,458. This compares to 5,727 closures and 3,239 openings for the full year 2018. Our data represent closures and openings by calendar year.What Is Happening This Week in the US

Hibbett Sports to Close 95 Stores while Opening 10-15 Hibbett and City Gear Stores Athletic inspired fashion goods retailer Hibbett Sports has announced plans to close 95 stores during its fiscal 2020. Additionally, the company announced it will open 10-15 Hibbett and City Gear stores during the same period. Hibbett successfully acquired fashion chain City Gear in October 2018. The closure news followed the retailer’s strong online results for the fourth quarter, ended February 2, 2019, in which online sales surged 60% year over year to comprise 10.6% of total sales. This move is expected to strengthen the productivity of existing stores and to position City Gear stores to drive sales for the fashion consumers. Tommy Hilfiger Shuts Fifth Avenue Store and Set to Close Miami Store Tommy Hilfiger has shut its global flagship store located at 681 Fifth Avenue in New York City. The decision to shut the 22,000-square-foot store aligns with the company’s vision to extend its digital reach in North America. The company also plans to close its Miami store at Collins Avenue on April 28, 2019. Coresight Research Insight: Fifth Avenue retail real estate is in a state of flux as both long and short term tenants are leaving and the remaining retailers are a mix of high-end jewelry stores, value players, global brands (luxury and athletic) and mall-based retailers. Retail executives are wise to question the value of a Fifth Avenue location as consumers steadily migrate online to shop. At Home Opens Its First Ever California Store Home decor chain At Home has opened its first store in California, in Foothill Ranch, and will open four additional stores in San Diego and Los Angeles. The retailer also announced plans in December to open seven new stores in the fourth quarter ended January 2019. Tiffany & Co Has Opened its First Washington, DC Store Luxury jewelry retailer Tiffany & Co has opened its first store in Washington, DC, located at the CityCenterDC shopping complex at 960 New York Avenue. Tiffany & Co CEO Alessandro Bogliolo stated this was the company’s most important opening of the year in North America. Ollie’s Bargain Outlet to Open 42-44 New Stores in the US, of Which 12 Already Opened General retailer Ollie’s has announced plans to open 42-44 stores in the US in 2019. The retailer has opened 12 stores so far in 2019. The year will mark Ollie’s entry into two new states, Oklahoma and Massachusetts. The company aims to expand the store base to around 950 stores, three times its current store fleet. The company did not provide a timeline for this expansion. Walmart to Shut Eight Neighborhood Market Stores Walmart has announced it will shut eight of its neighborhood market stores. These stores are around one-fifth the size of Walmart’s supercenters, at around 38,000 square feet. The neighborhood market stores primarily sell groceries, including fresh produce, meat, bakery, and also include pharmacies. The store employees will have the option to move to other locations. Williams-Sonoma May Shut 30 Stores in 2019 Home furnishings and cookware retailer Williams-Sonoma may shut 30 underperforming stores in 2019. In its fourth quarter results, the company stated that it will have around 250 store leases come up for renewal over the next three years, and the company plans to retain only the ones that are performing well. This could mean shutting 30 stores in 2019. Williams-Sonoma CFO Julie Whalen stated this as an “aggressive” stance versus landlords as this is one of the largest closures the company has announced until now. These closures are not included in the charts below as they are tentative. Coresight Research Insight: Retail executives are rethinking real estate strategies and opting for shorter leases, pop-ups, shop-in-shops as well as selective store closures as the industry evolves. With more than 50% of total company sales now online, this is a prudent move. Non-Store-Closure News Ascena to Sell Majority Stake in Maurices Ascena Retail Group is set to sell its majority stake in women’s clothing chain Maurices to London-based private-equity firm OpCapita for around $300 million. Maurices is a part of Ascena’s “value” brand division and has 943 stores. The sale is a part of Ascena’s portfolio review to drive operating margin expansion by streamlining its operations. The transaction is subject to customary closing conditions and is set to be completed by early summer this year. Coresight Research Insight: Ascena Retail owns Ann Taylor, Ann Taylor Loft, Lane Bryant, Dressbarn and Catherines, as well as Maurices. Its plan to sell the majority ownership of Maurices will, overall, improve Ascena’s balance sheet while reducing its real estate exposure 21% (in terms of number of stores). [caption id="attachment_82071" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82073" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82073" align="aligncenter" width="800"] Total includes retailers that have announced multi-year store opening plans which have been included based on an estimate for each year, which includes Aldi’s five-year plan for store openings through 2022

Total includes retailers that have announced multi-year store opening plans which have been included based on an estimate for each year, which includes Aldi’s five-year plan for store openings through 2022 Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings/Closures The data below are announced closures that we have not allocated to our current-year total, due to a lack of detail on the timing or location of closures. [caption id="attachment_82074" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82076" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82076" align="aligncenter" width="800"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

Source: Company reports/Coresight Research[/caption] [caption id="attachment_82078" align="aligncenter" width="800"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above ** Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners

*** Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research[/caption] 2019 Major US Store Bankruptcies [caption id="attachment_82080" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

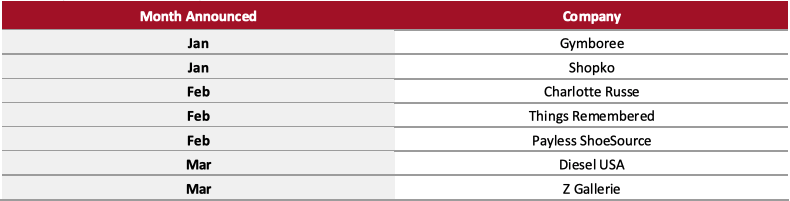

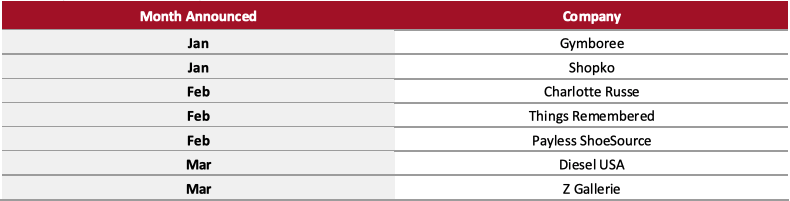

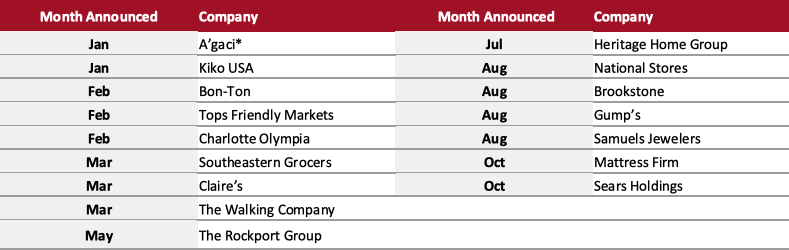

2018 Major US Store Bankruptcies

[caption id="attachment_82082" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

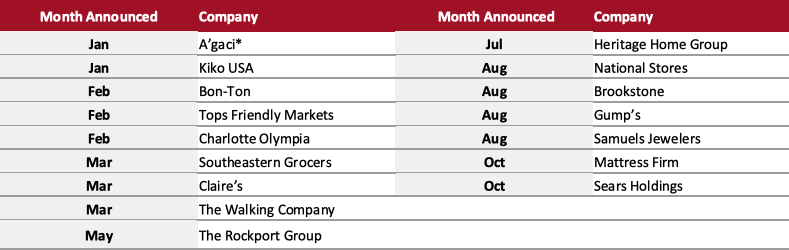

2018 Major US Store Bankruptcies

[caption id="attachment_82082" align="aligncenter" width="800"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 Source: Company reports/Coresight Research[/caption]

The UK

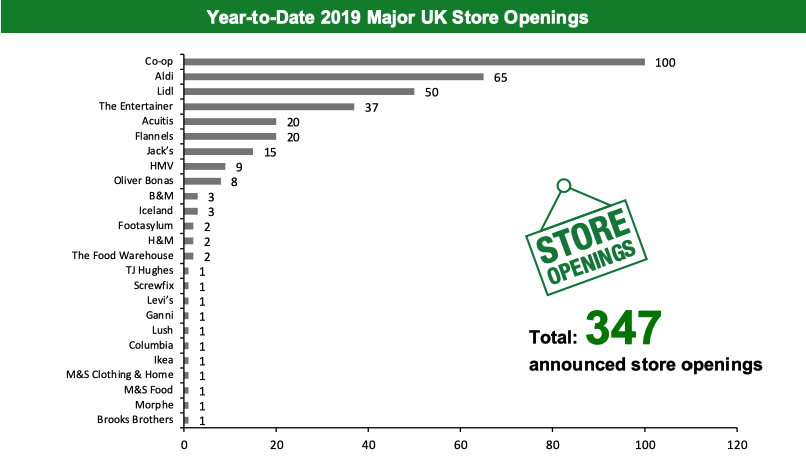

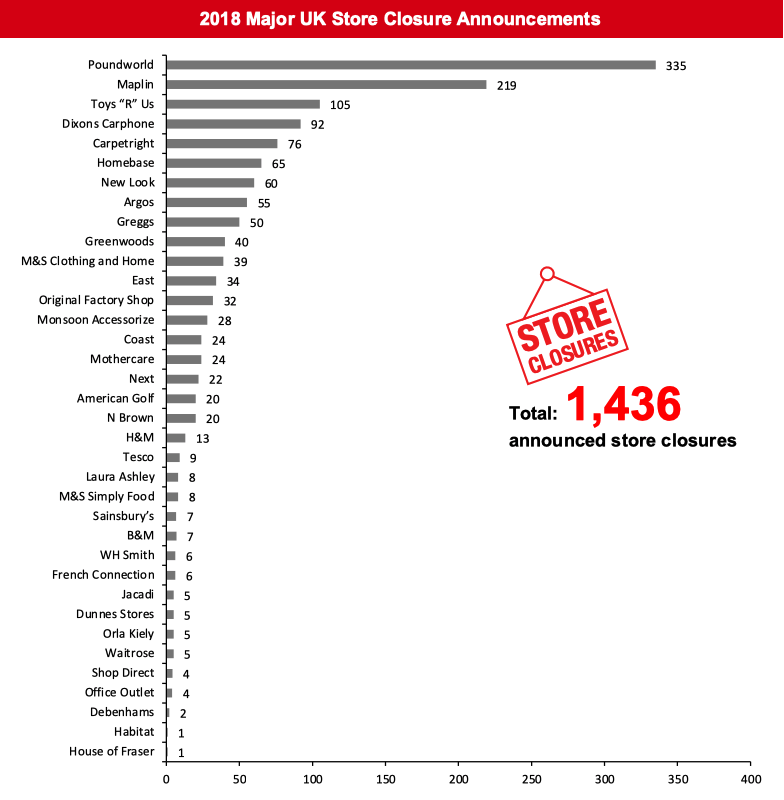

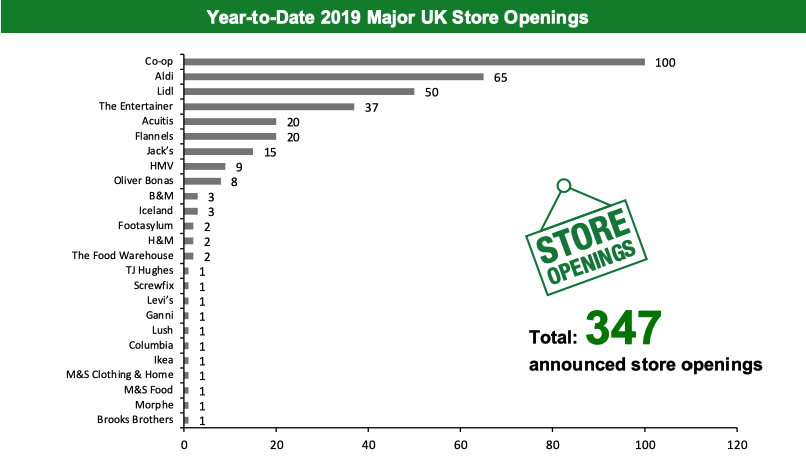

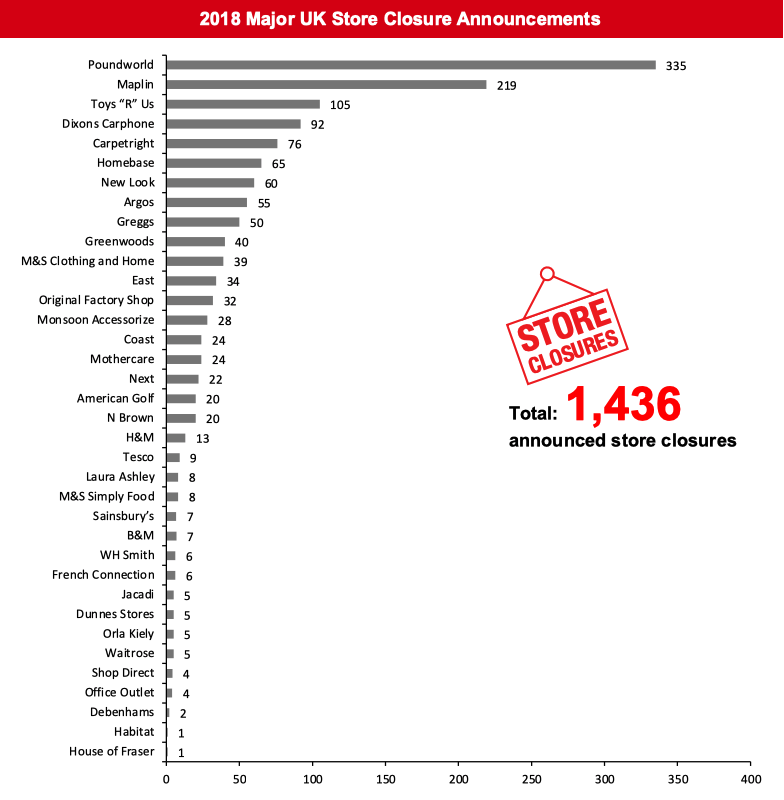

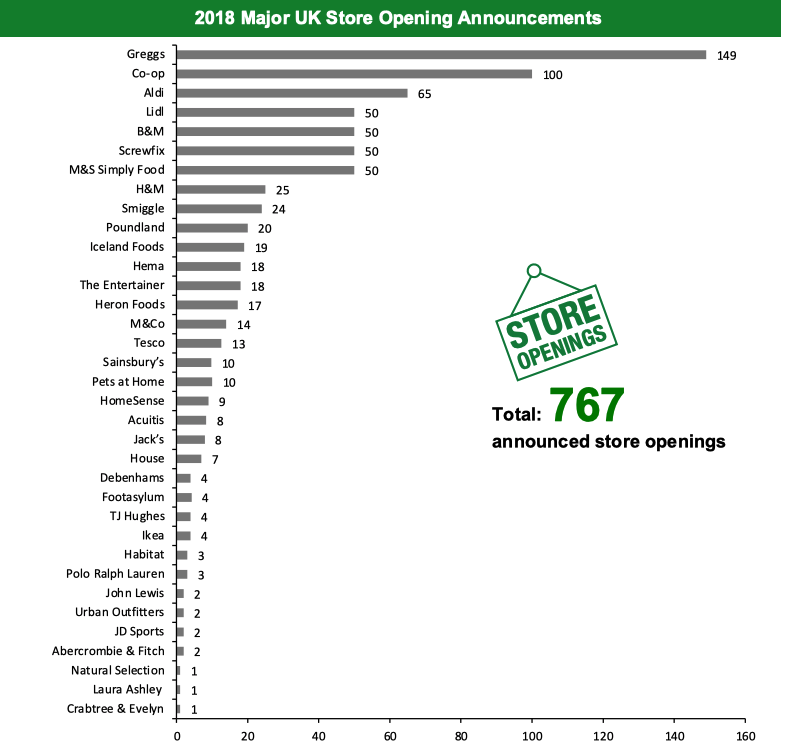

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 310 store closures and 347 store openings. Our data represent closures and openings by calendar year.What Is Happening This Week in the UK

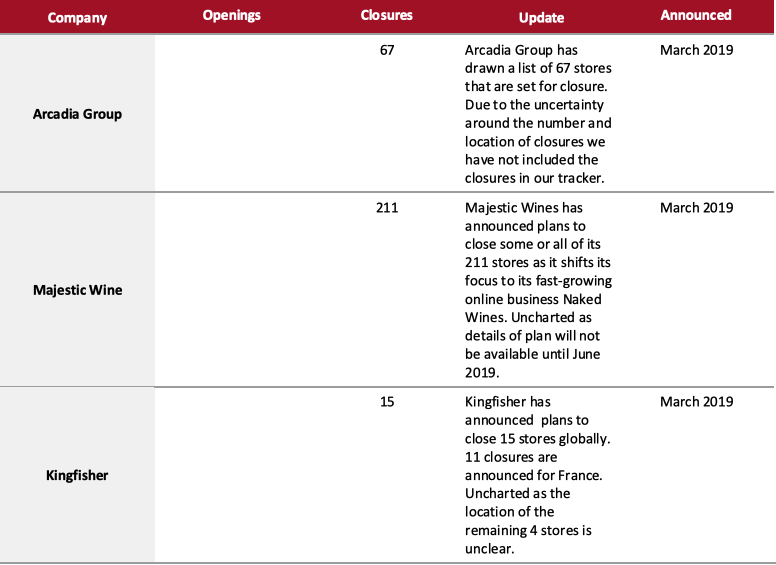

Flannels to Open 60 Stores by 2021 Luxury fashion chain Flannels stated its plans to open around 60 new stores over the next three years. The expansion will take the store count of the retailer above 100. Coresight Research Insight: 60 store openings is ambitious for a high-end, multibrand retailer that will see a natural cap on shopper numbers due to its positioning — and at a time when multibrand department-store rivals, such as House of Fraser (which, like Flannels, is owned by Sports Direct), are closing stores. Arcadia Group Draws a List of 67 Stores for Closure Arcadia Group has drawn a list of 67 stores that are set for closure. The closures will save the group £11 million in rent annually. The group is working closely with accounting firm Deloitte to come up with a restructuring scheme which may surface as early as April. The listed stores are spread across Arcadia Group’s portfolio of brands including Burton, Dorothy Perkins, Evans, Miss Selfridge, Topshop and Wallis. Due to the uncertainty around the number and location of closures, we have not included the closures in our tracker. Majestic Wine May Close Stores as Focus Shifts to Online Business Specialist retailer Majestic Wines has announced plans to close some or all of its 211 stores as it shifts its focus its fast-growing online business Naked Wines, which it bought for £70 million ($91 million) in 2015. The company will provide further details on its plan in June 2019. Due to the uncertainty around the number of closures we have not included the closures in our tracker. Non-Store-Closure News Pretty Green May Appoint Administrators Fashion brand Pretty Green, owned by musician Liam Gallagher, may appoint administrators. The label had filed a notice of intention to appoint Moorfields Advisors to handle the insolvency process, according to Sky News. The brand has a seven-day window to secure fresh investment. [caption id="attachment_82086" align="aligncenter" width="800"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers including Debenhams, Homebase, Laura Ashley and New Look.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers including Debenhams, Homebase, Laura Ashley and New Look.Source: Company reports/Coresight Research[/caption] [caption id="attachment_82089" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

2019 Major UK Uncharted Openings/Closures

[caption id="attachment_82092" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

2019 Major UK Uncharted Openings/Closures

[caption id="attachment_82092" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82095" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_82095" align="aligncenter" width="800"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research[/caption] [caption id="attachment_82098" align="aligncenter" width="800"]

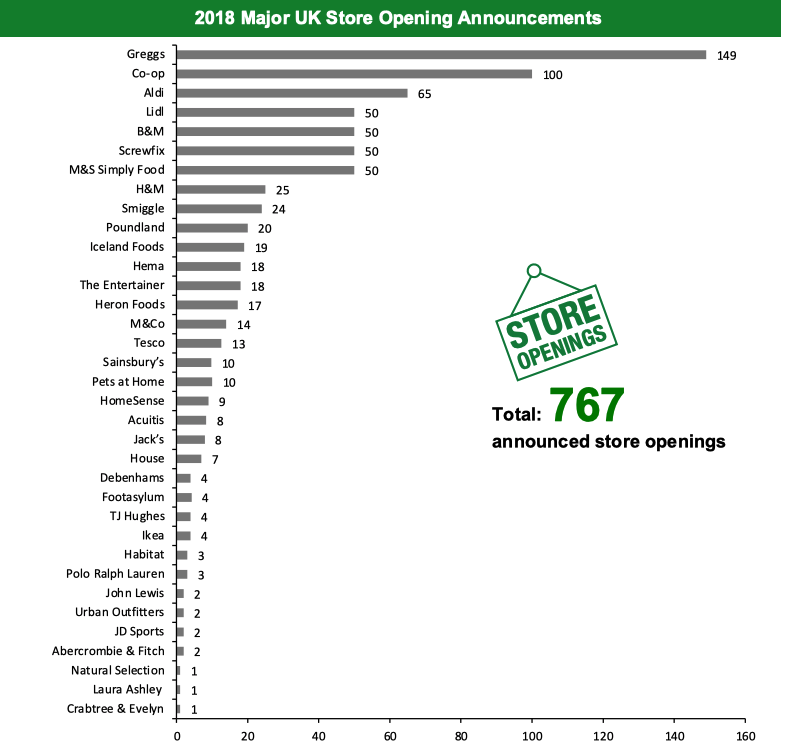

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.