Web Developers

FGRT has a dedicated team tracking news about store closures and openings, bankruptcies and management changes. Our Weekly Store Openings and Closures Tracker focuses on department stores and specialty retail, including, but not limited to, softlines, hardlines, consumer electronics, grocery and furniture.

This week, we look back at 2017, as well as wrap up news from the first week of the year.

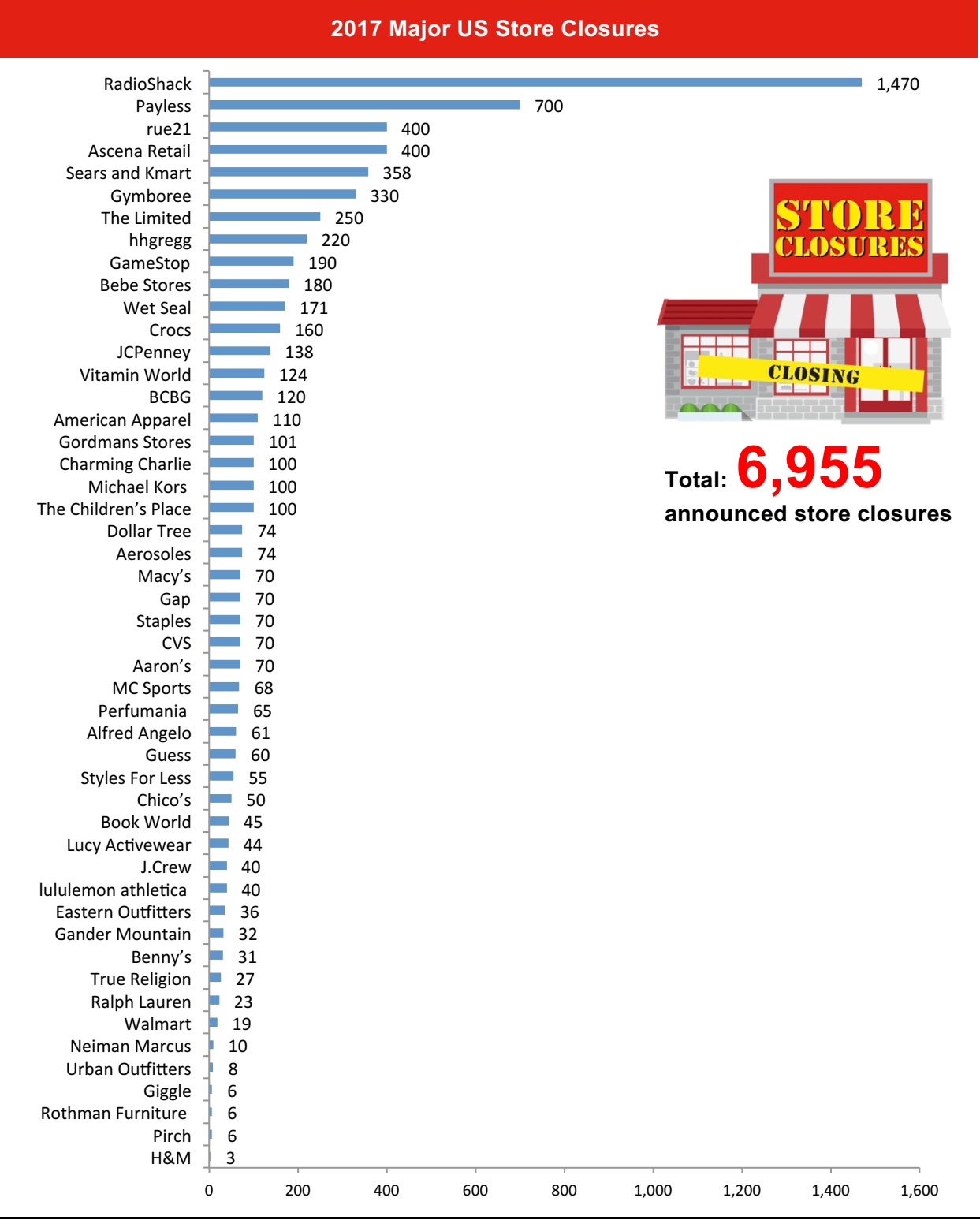

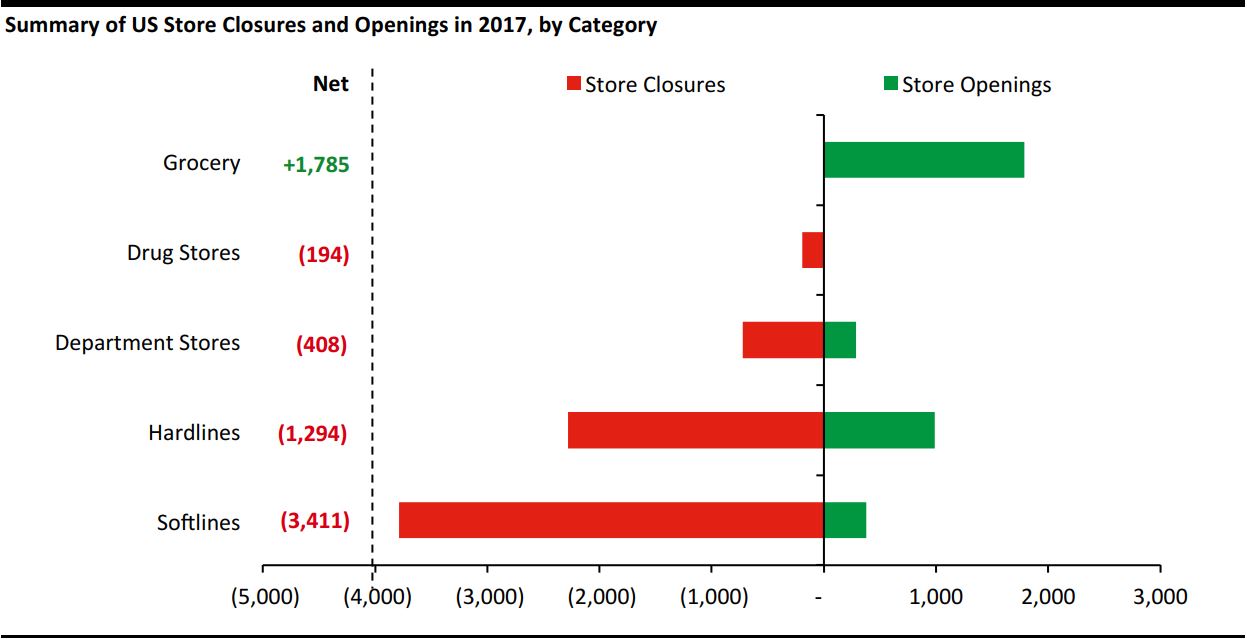

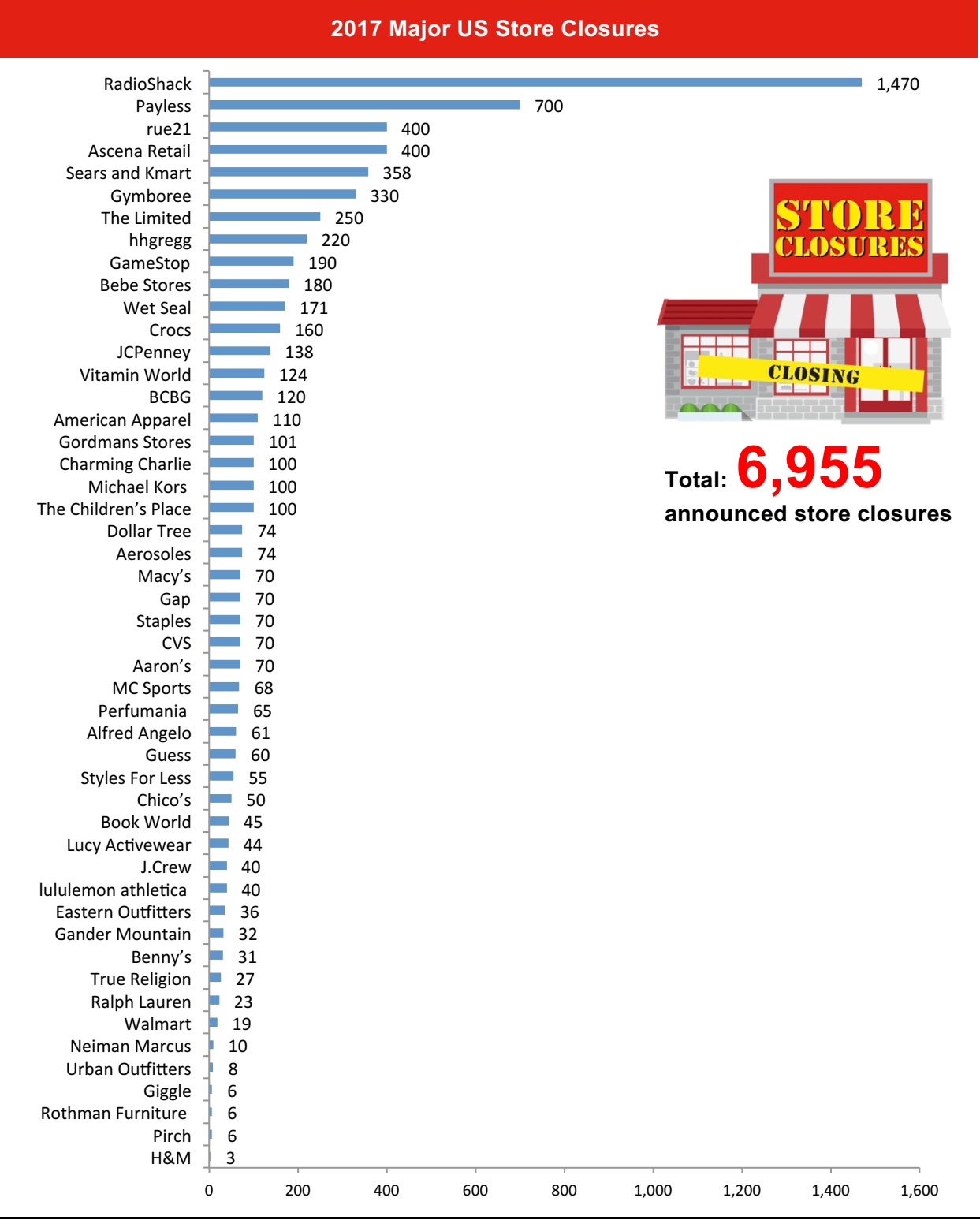

We group US retailers into five main categories: softlines, hardlines, department stores, drug stores and grocery (including dollar stores). Closures were almost entirely confined to nonfood retailers in the apparel, toys and electronics categories.

As shown in the chart above, softline retailers such as clothing specialist stores were impacted the most: major names such as Payless, rue21, Ascena Retail and Gymboree emerged from Chapter 11 bankruptcy proceedings with fewer stores. Several of these retailers blamed the store closures on the continue demergence of online stores and fierce competition from off-price retailers.

Unsurprisingly, department stores were also impacted, suffering from declining foot traffic, a more promotional environment and heightened competition from e-commerce. Sears, Kmart, JCPenney and Macy’s felt the greatest pressure, announcing a combined total of 566 closures. Management of a number of these retailers stated that they are looking at how to better integrate the online and offline segments and enhance operational efficiency through digitalization.

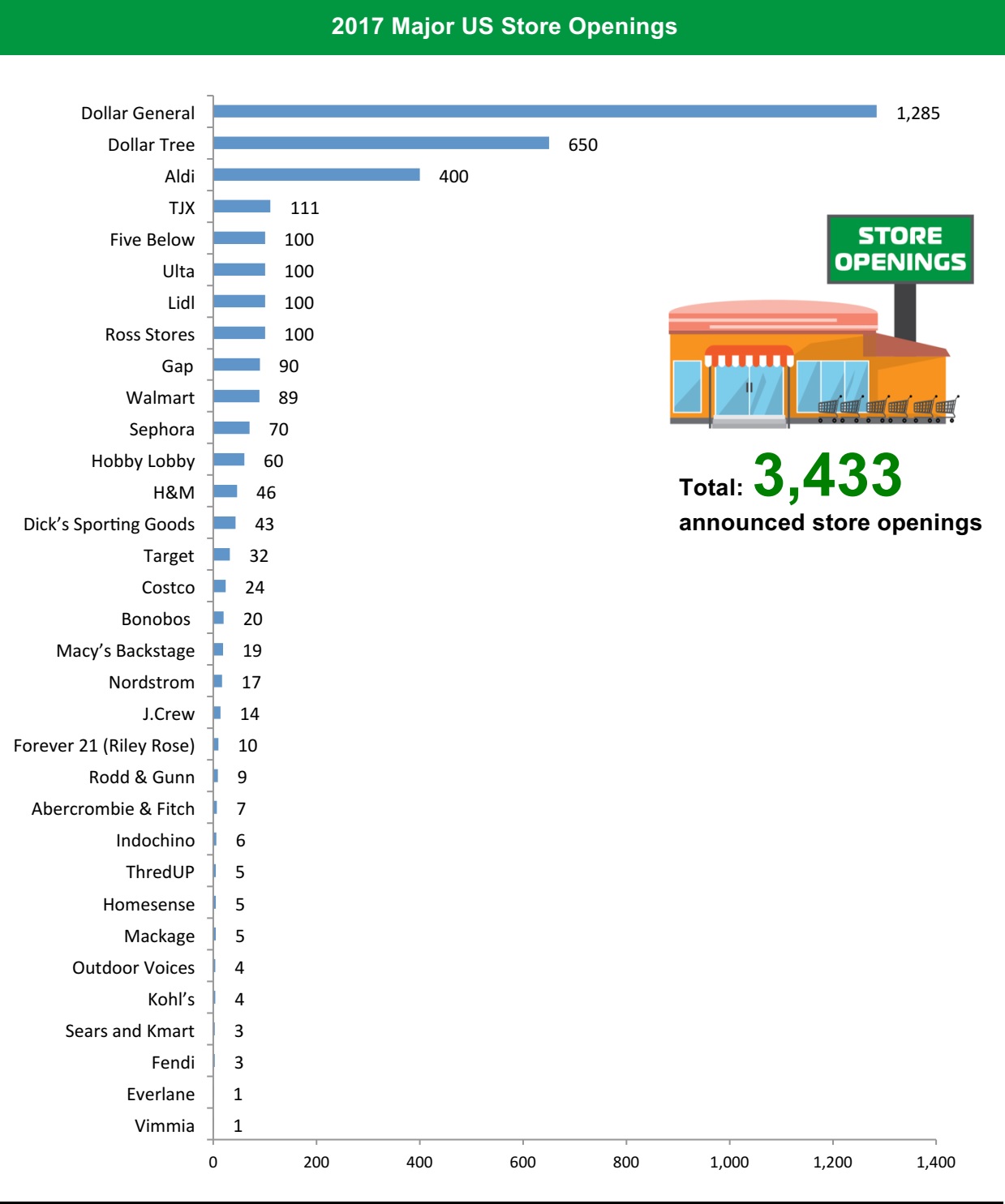

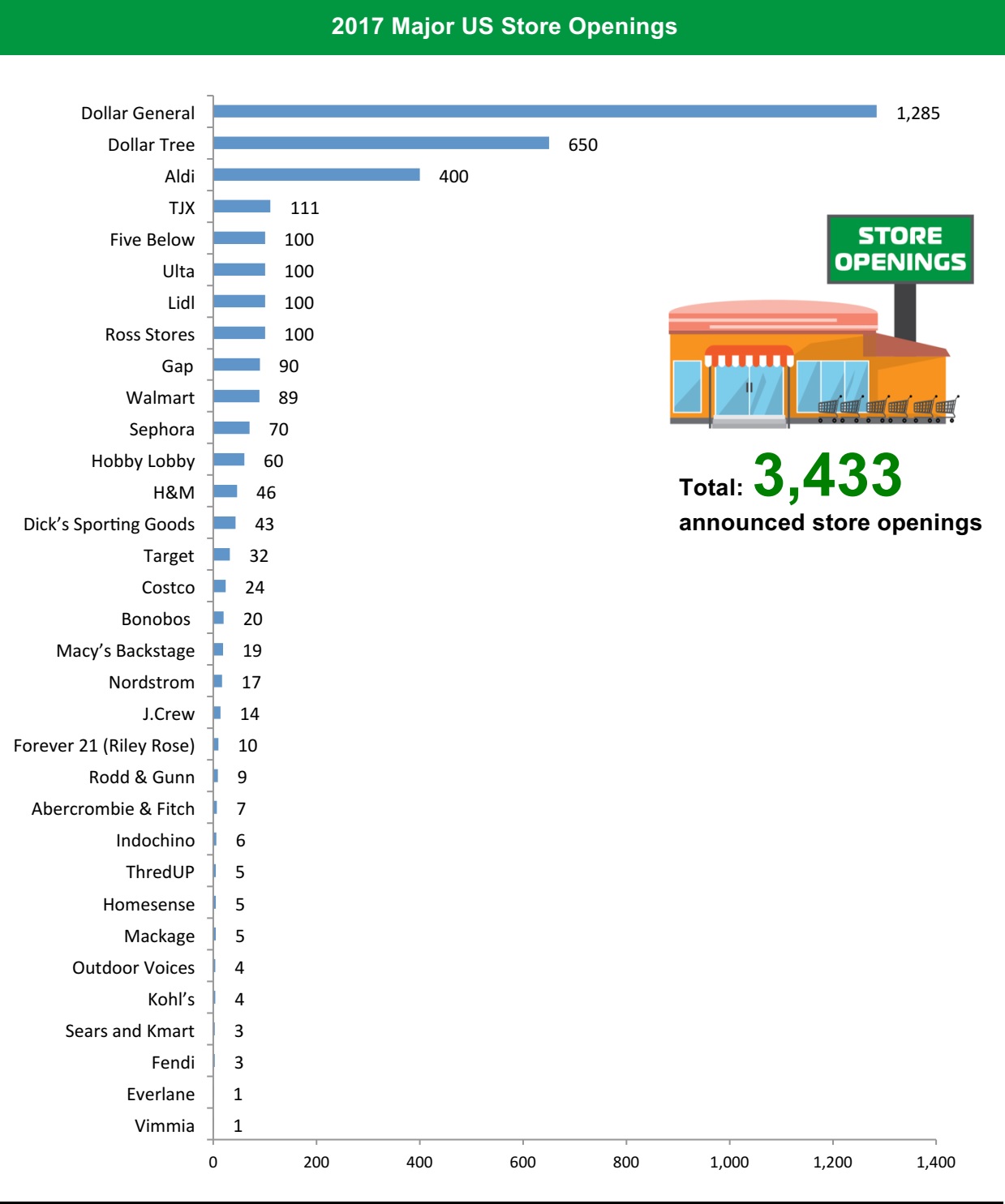

Grocery, however, was the bright spot of 2017. Competition from e-commerce in food retailing remains negligible and discount formats are growing fast. Value retailers such as Dollar General, Aldi and Lidl led the charge to open stores. Dollar General CEO Todd Vasos commented that his company is being very aggressive in delivering price to the consumer, and will continue to redesign stores to highlight the breadth of on-trend products at compelling prices.

2017 Wrap-Up of US Store Openings and Closures

2017 was a landmark year for US retail. Store closures during the year increased 229% from a year ago, with major US retailers closing some 6,955 stores, the highest recorded rate of closures—exceeding even the annual store closure count during the global economic downturn. At the same time,major US retailers announced 3,433 store openings for the year, up 50% compared to 2016. Below, we review the trends for 2017 by category. Grocery includes dollar stores.

Source: FGRT

Grocery includes dollar stores.

Source: FGRT

We group US retailers into five main categories: softlines, hardlines, department stores, drug stores and grocery (including dollar stores). Closures were almost entirely confined to nonfood retailers in the apparel, toys and electronics categories.

As shown in the chart above, softline retailers such as clothing specialist stores were impacted the most: major names such as Payless, rue21, Ascena Retail and Gymboree emerged from Chapter 11 bankruptcy proceedings with fewer stores. Several of these retailers blamed the store closures on the continue demergence of online stores and fierce competition from off-price retailers.

Unsurprisingly, department stores were also impacted, suffering from declining foot traffic, a more promotional environment and heightened competition from e-commerce. Sears, Kmart, JCPenney and Macy’s felt the greatest pressure, announcing a combined total of 566 closures. Management of a number of these retailers stated that they are looking at how to better integrate the online and offline segments and enhance operational efficiency through digitalization.

Grocery, however, was the bright spot of 2017. Competition from e-commerce in food retailing remains negligible and discount formats are growing fast. Value retailers such as Dollar General, Aldi and Lidl led the charge to open stores. Dollar General CEO Todd Vasos commented that his company is being very aggressive in delivering price to the consumer, and will continue to redesign stores to highlight the breadth of on-trend products at compelling prices.

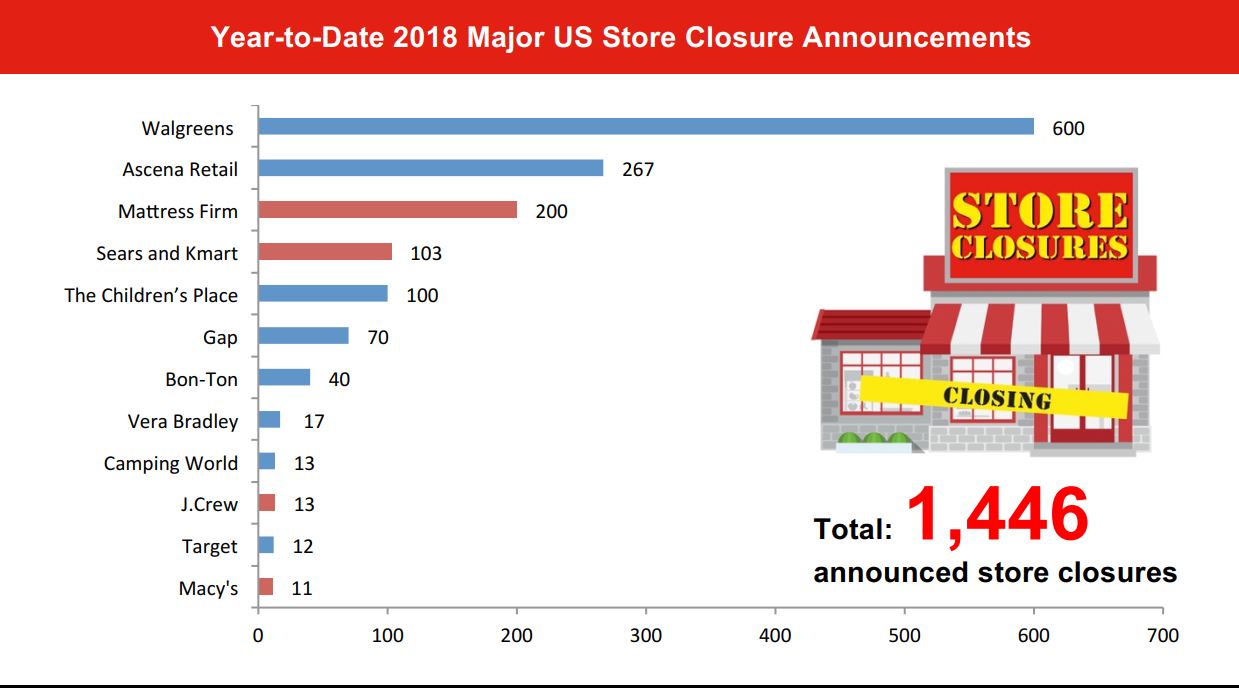

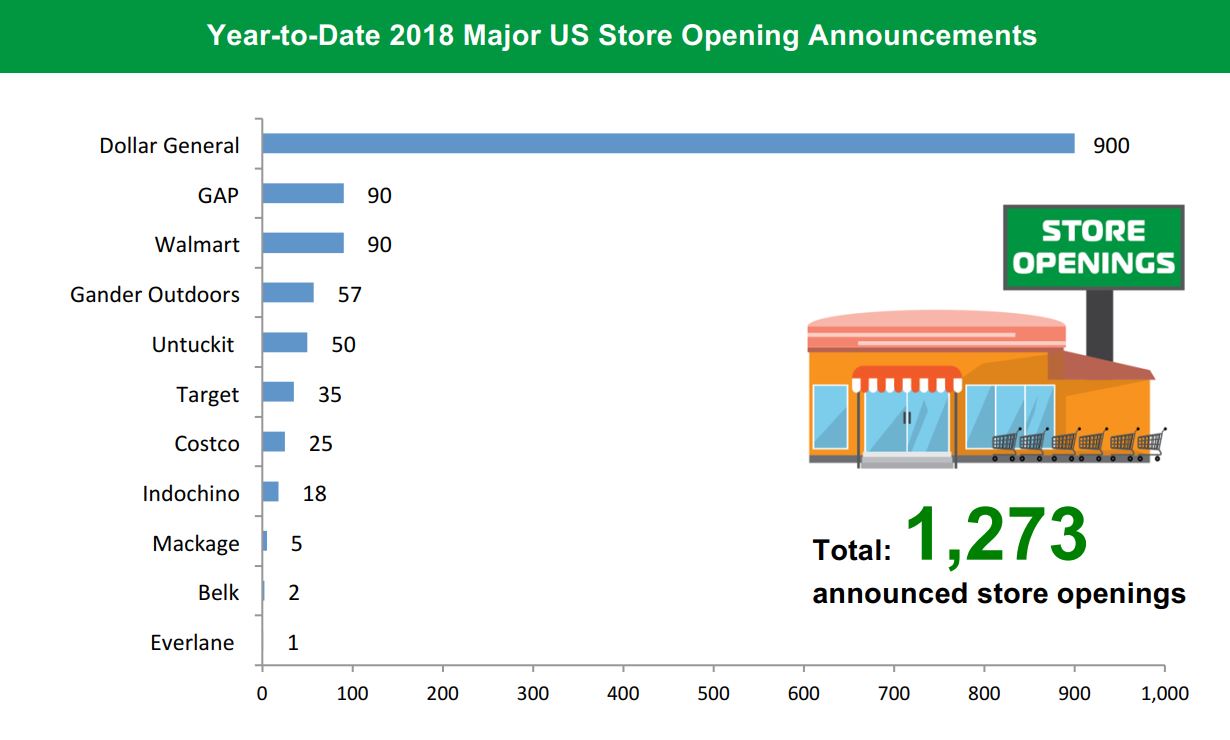

2018 Major US Store Openings and Closures

What Is Happening this Week in the US?

Mattress Firm to Close 200 Stores

Mattress Firm plans to close 200 stores as part of an ongoing restructuring effort. Management commented that the closures are designed to optimize the fleet of stores as part of the company’s strategy to close underperforming and/or duplicative locations following a series of acquisitions of other mattress companies.Macy’s to Close 11 Stores in Early 2018

Macy’s announced the closure of 11 stores.With these closures, the company will have completed 81 of the approximately 100 planned store closures announced in August 2016.These closures are part of a multi-year effort by the company to ensure the optimal mix of brick-and-mortar stores and digital footprint.Sears to Shutter over 100 More Stores

This week, Sears announced it would be closing at least another 100 stores, including 64 Kmart stores and 39 Sears stores, between March and April this year.Camping World to Acquire Erehwon Mountain Outfitter and Close 13 Stores

Camping World announced plans to purchase Erehwon Mountain Outfitter, a specialty retailer of outdoor gear and apparel. The company scrapped its original plan to preserve 70 Grander Mountain stores with a recent decision to keep just 57 open nationwide.Non-Store-Closure News

Rent-A-Center CEO Resigns

Rent-A-Center CEO Mark Speese has stepped down. Mitchell E. Fadel, the company’s former President and CEO and a current member of its Board of Directors, has been appointed as CEO, effective immediately. FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. The Children’s Place will close 300 stores by 2020. Ascena will close between 268 and 667 stores by July 2019, depending on negotiations with landlords. Gap will close 200 stores by 2020. VeraBradley will close 50 stores by 2021.

Source: Company reports/FGRT

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. The Children’s Place will close 300 stores by 2020. Ascena will close between 268 and 667 stores by July 2019, depending on negotiations with landlords. Gap will close 200 stores by 2020. VeraBradley will close 50 stores by 2021.

Source: Company reports/FGRT

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Mackage plans to operate 25 stores across North Americain the next five years. Gap will open 270 stores by 2020. Costco has opened 26 stores net for the fiscal year ended September 2017, and plans to open 25 stores net for fiscal year 2018.

Source: Company reports/FGRT

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Mackage plans to operate 25 stores across North Americain the next five years. Gap will open 270 stores by 2020. Costco has opened 26 stores net for the fiscal year ended September 2017, and plans to open 25 stores net for fiscal year 2018.

Source: Company reports/FGRT

2017 Major US Store Openings and Closures

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. 2017 annual number has been updated due to new data on Macy’s closures. Source: Company reports/FGRT

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Source: Company reports/FGRT

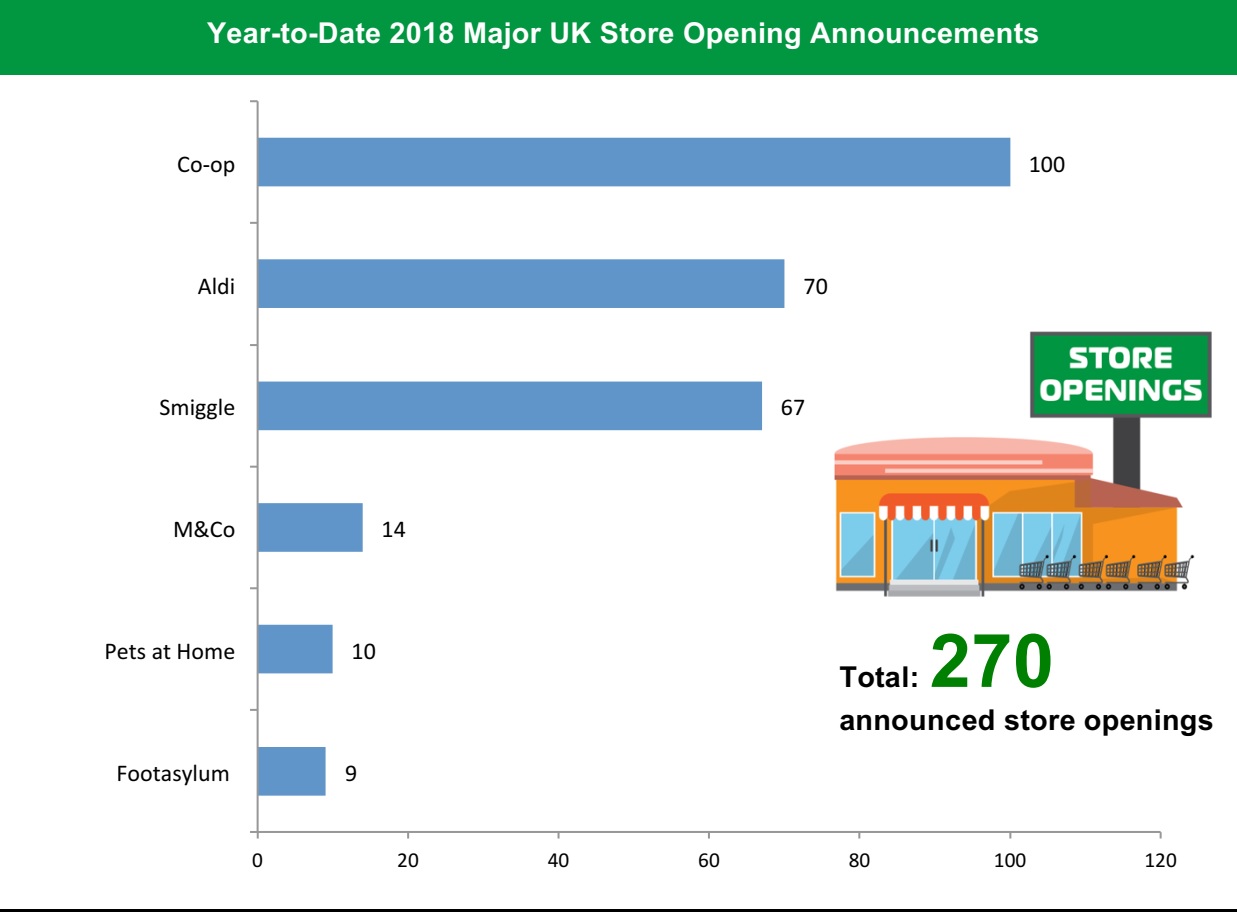

2018 Major UK Store Openings and Closures

Co-op to Open 100 New Food Stores

Co-op has confirmed plans to open 100 new food stores in 2018. FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers.

Source: Company reports/FGRT

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers.

Source: Company reports/FGRT

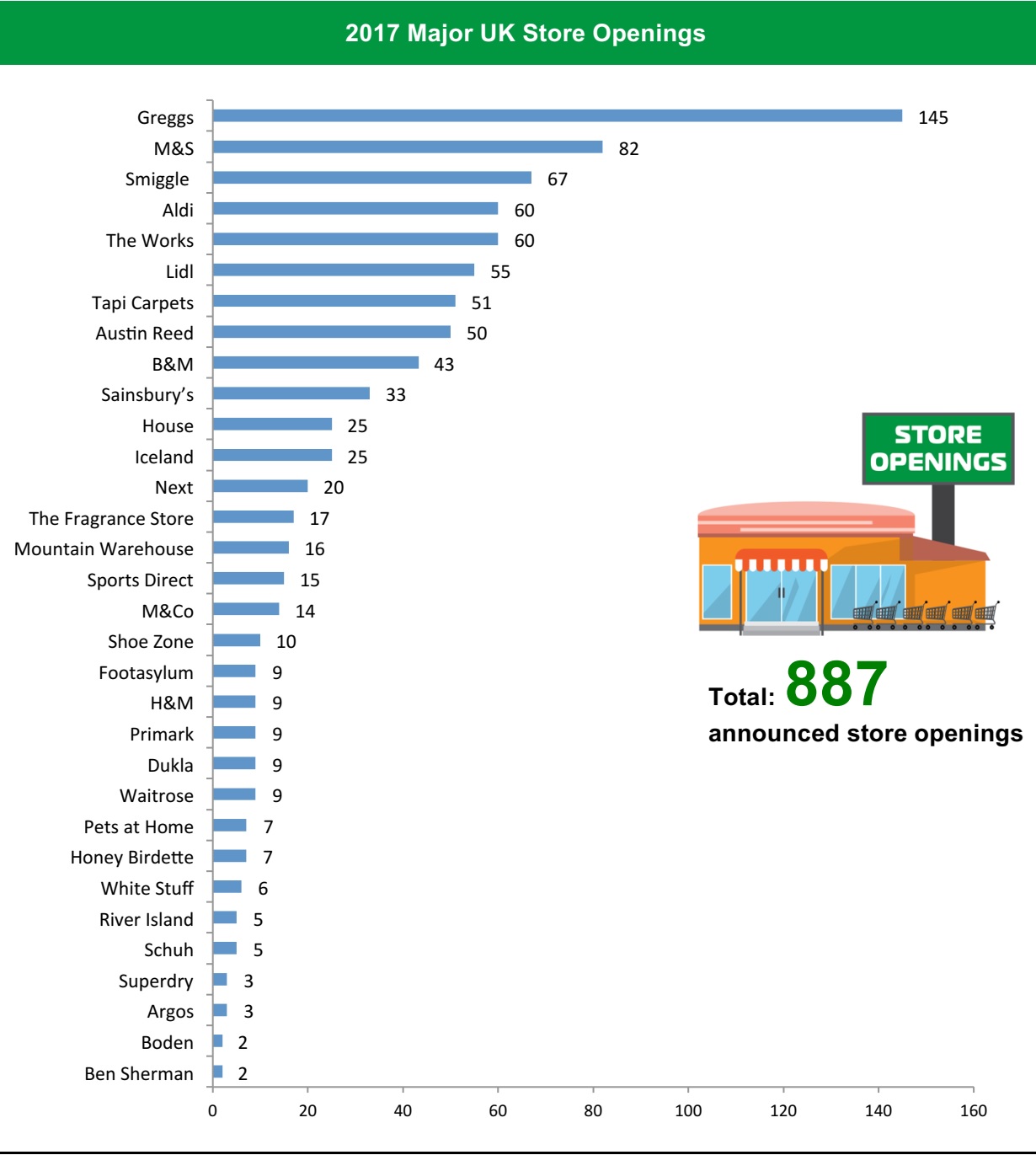

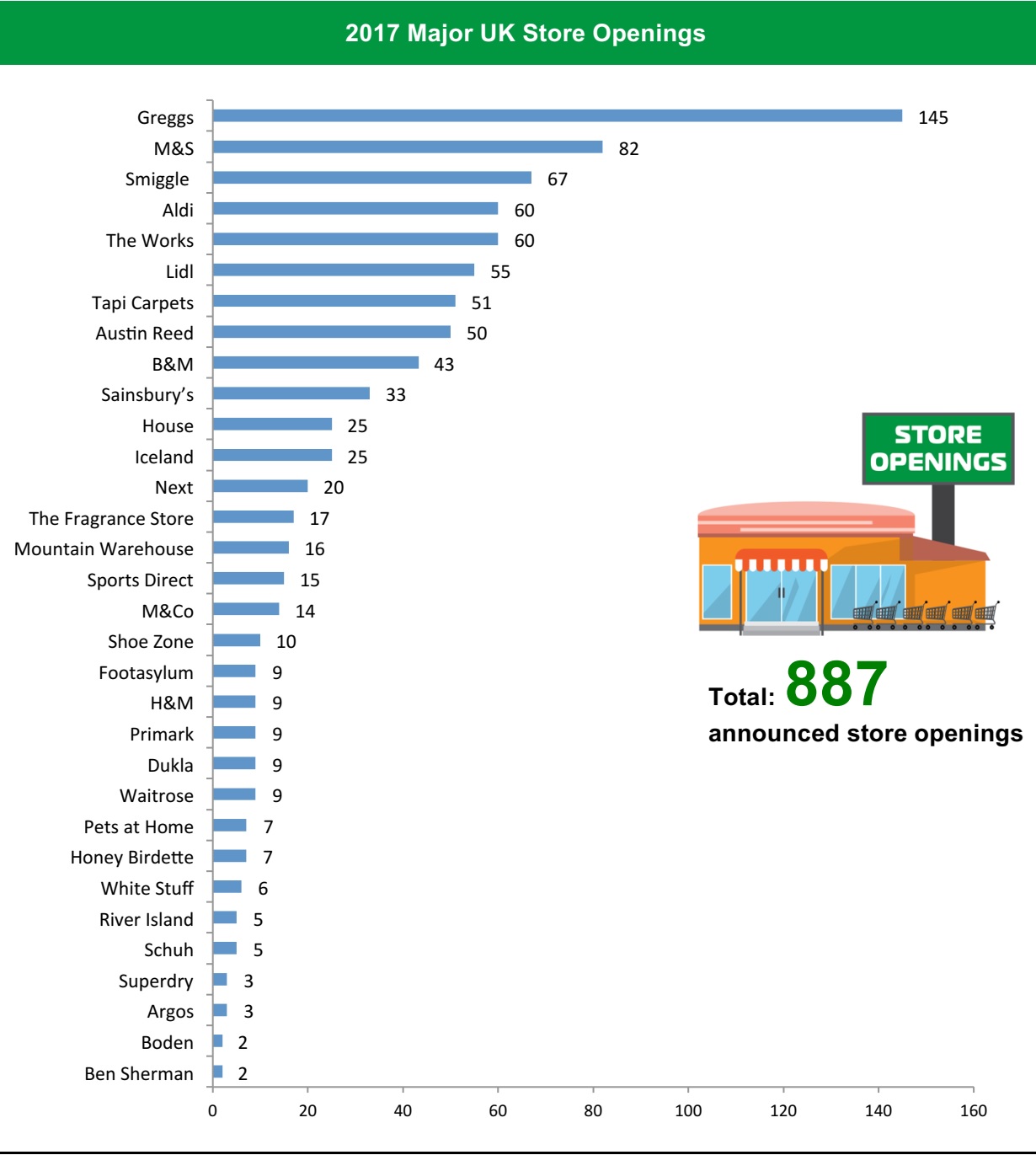

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Aldi will complete a 300-store expansion by 2022. Smiggle will open 200 stores by 2019. Pets at Home will open five stores in fiscal 2017 and 10 stores in fiscal 2018. M&Co will open 60–75 stores by 2022. Footasylum plans to open 8–10 new stores a year.

Source: Company reports/FGRT

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Aldi will complete a 300-store expansion by 2022. Smiggle will open 200 stores by 2019. Pets at Home will open five stores in fiscal 2017 and 10 stores in fiscal 2018. M&Co will open 60–75 stores by 2022. Footasylum plans to open 8–10 new stores a year.

Source: Company reports/FGRT

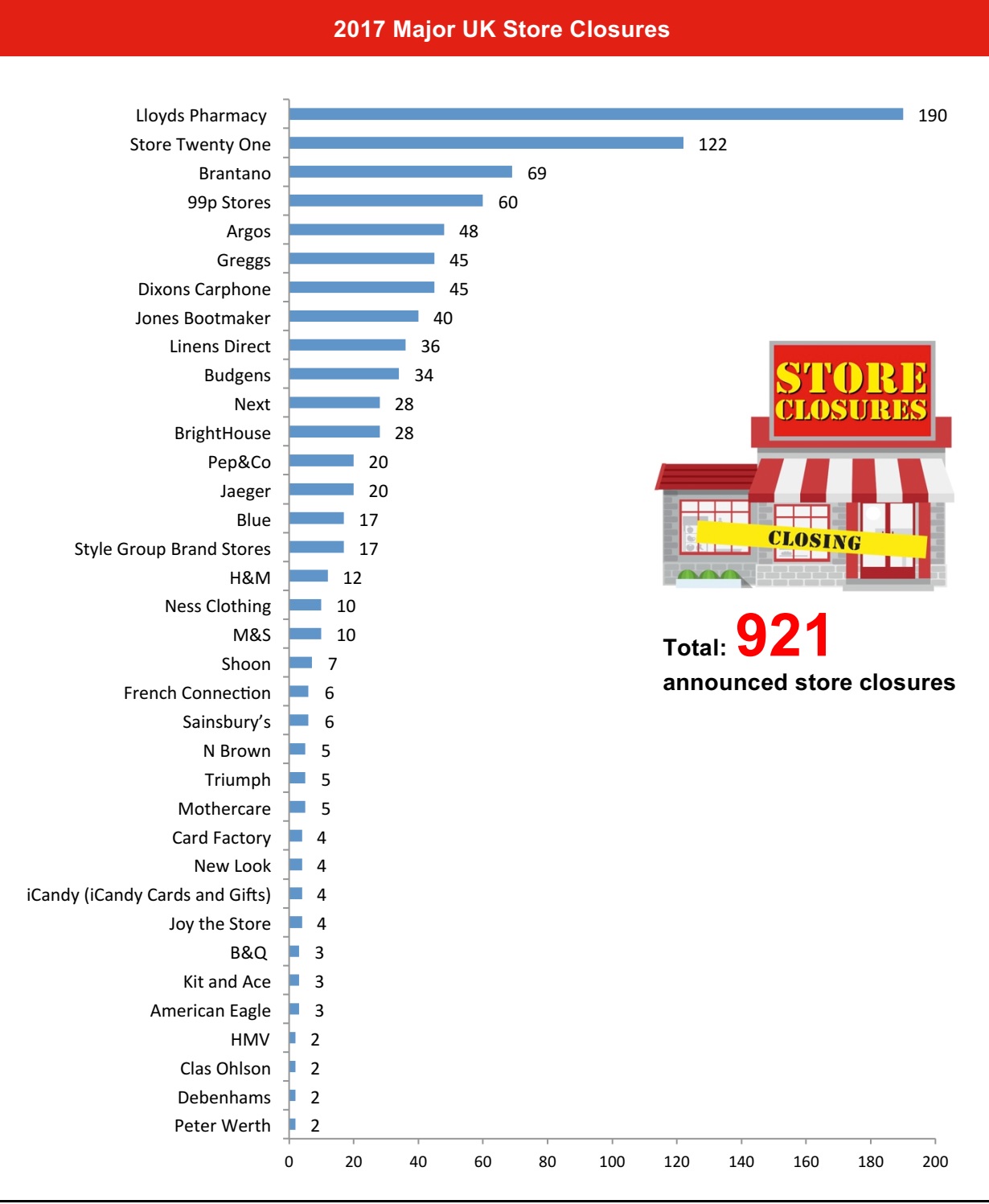

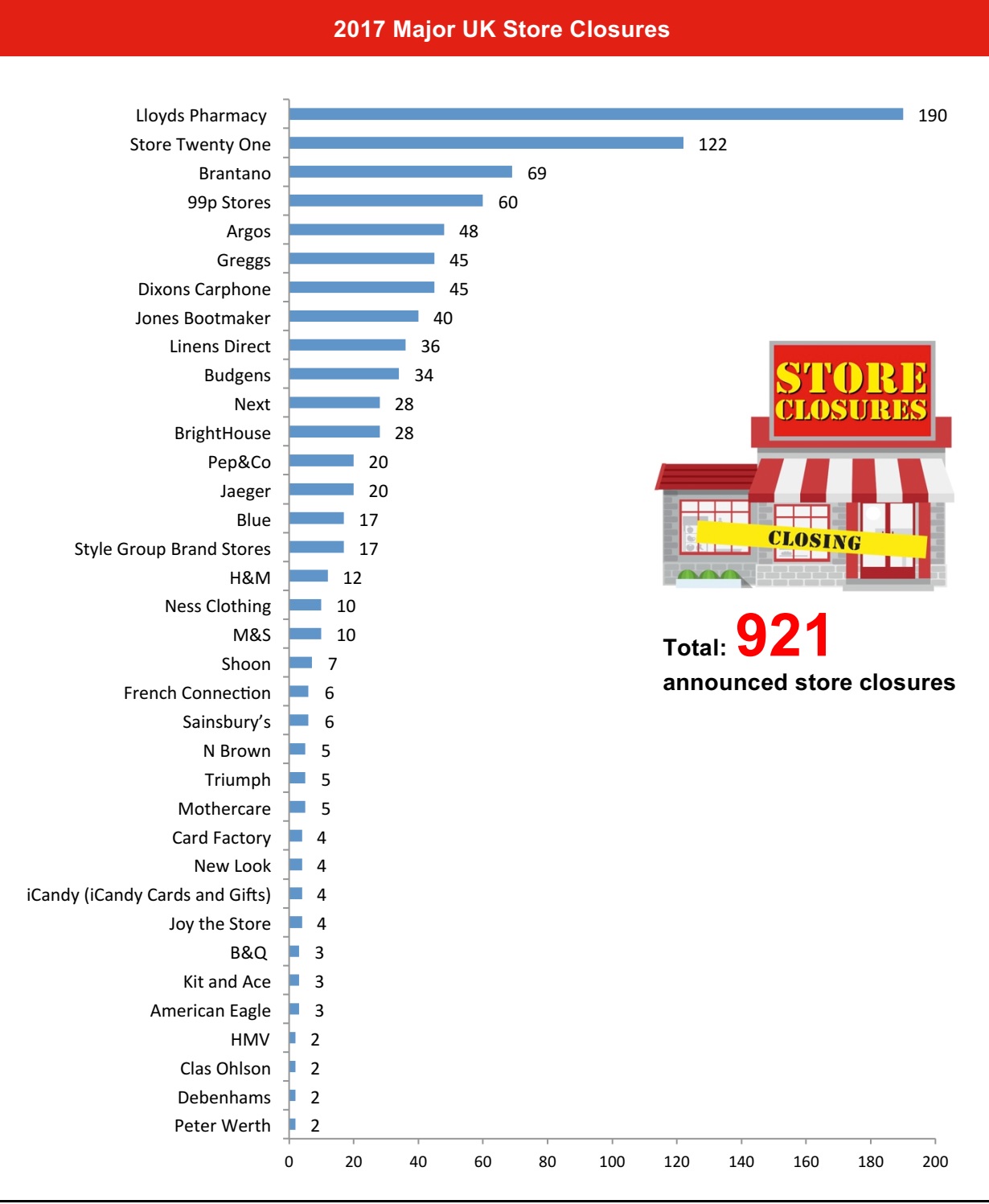

2017 Major UK Store Openings and Closures

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Source: Company reports/FGRT