FROM THE DESK OF DEBORAH WEINSWIG

Can Multi-Channel Retailers Win Online?

“Multi-channel is the future of retailing,” is a mantra we often hear. But in the battle to win share in the fast-growing online channel, how true is it? This week, we look at how multi-channel retailers on both sides of the Atlantic Ocean appear to be losing share of e-commerce sales.

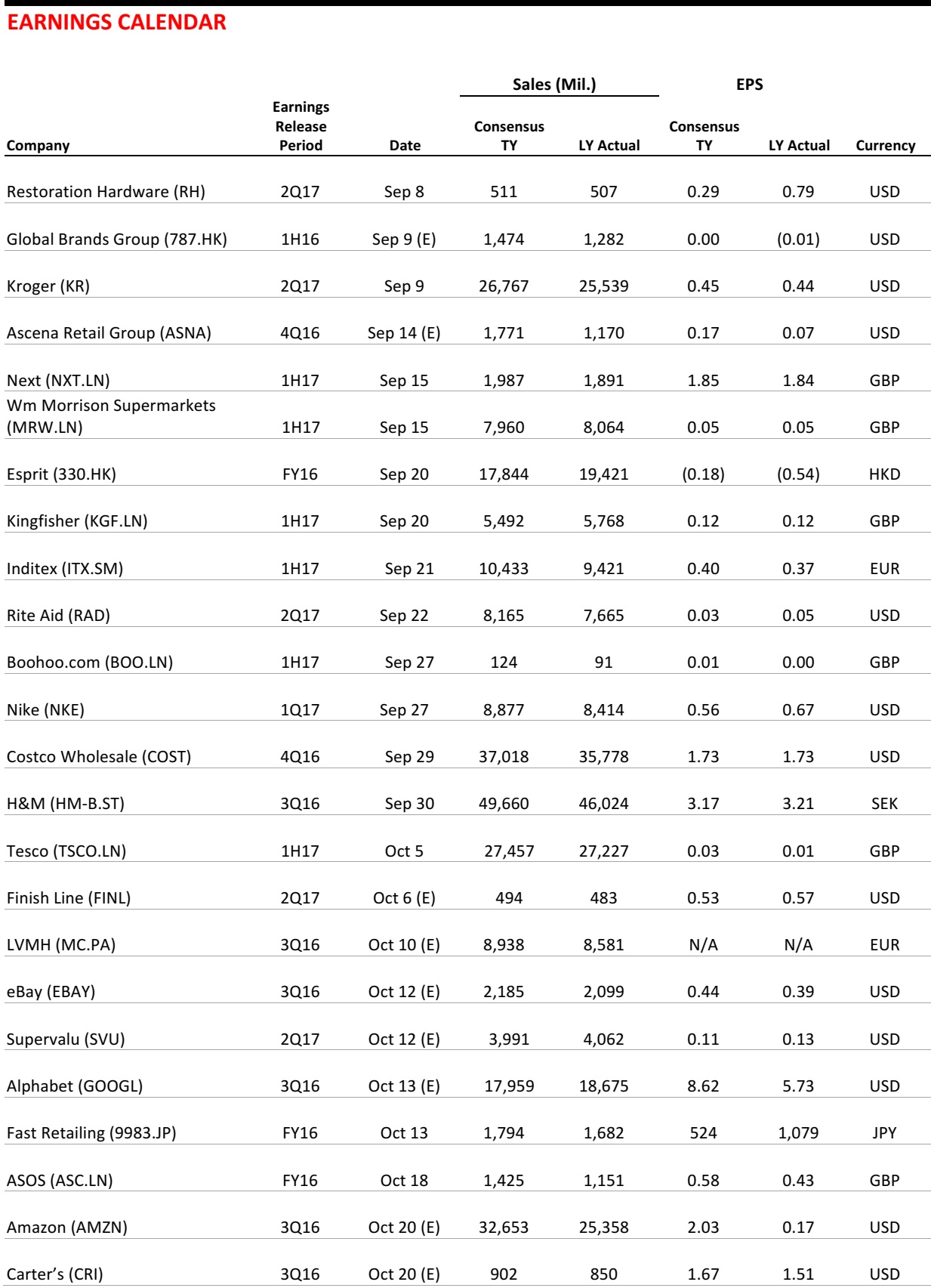

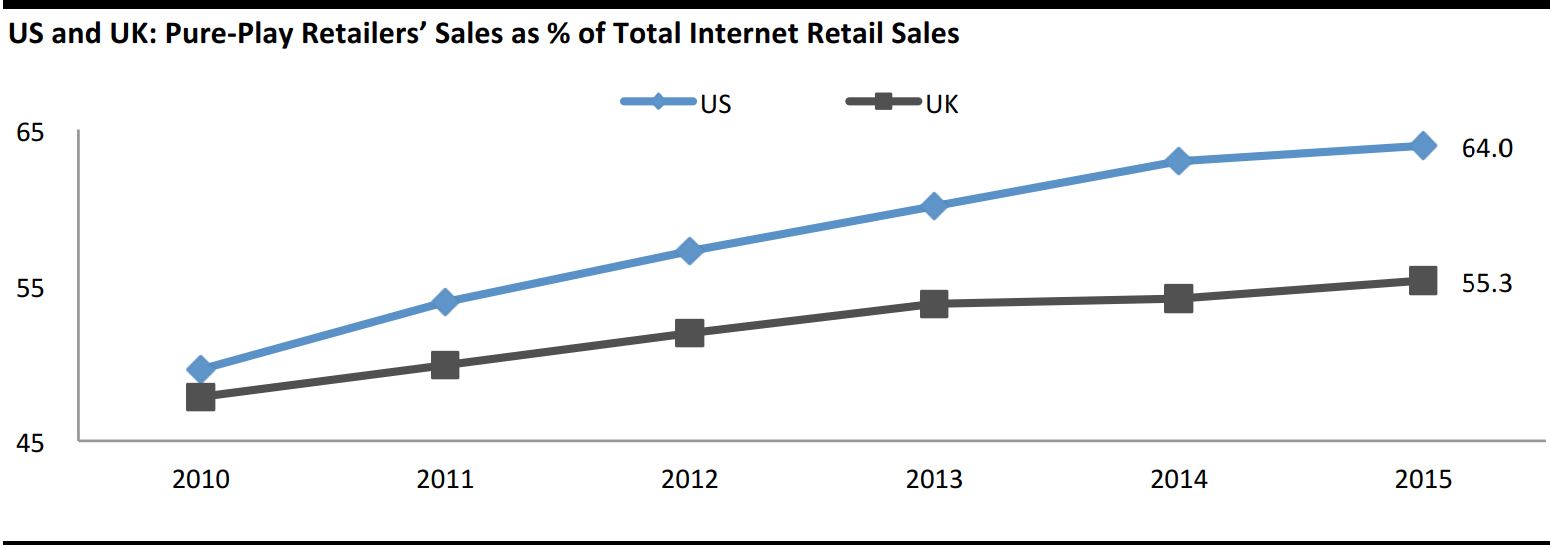

Internet Pure Plays Are Winning Share Online

The medium-term trend is clear: Internet pure plays are gaining share of total e-commerce sales in countries such as the US and the UK. According to our analysis of Euromonitor International data, between 2010 and 2015, the pure-play segment gained 1,438 basis points of online share in the US and 749 basis points of online share in the UK. This occurred despite major brick-and-mortar retailers pouring investment into logistics and fulfillment, including the relatively recent rollout of click-and-collect (buy online, collect in-store) services by many major US stores.

Source: Euromonitor International/Fung Global Retail & Technology

At the company level, this trend was reflected in some major US retailers’ second-quarter 2016 results. Stripping out currency effects, Walmart grew its global e-commerce sales by 11.8% in the second quarter, while Target grew its e-commerce sales by 16%. Meanwhile, Amazon grew its own global sales by 30.4%. We see a similar pattern in the UK, especially in fashion, where pure plays such as boohoo.com and ASOS consistently post revenue growth that is higher than their multi-channel rivals’ online growth.

Click-and-Collect Is Not Enough

The integration of online and physical stores is often held up as the ideal retail model, while click-and-collect and ship-from-store are lauded as the saviors of brick-and-mortar retailing. The evidence suggests, however, that offering these kinds of cross-channel services is not enough. Multi-channel retailers that offer these still face some significant disadvantages compared to online pure plays:

- Pure plays are often more sharply focused than their store-based counterparts. For instance, they may specialize with authority in a particular category or demographic, in contrast to broad-ranging, middle-ground, store-based rivals that seek to appeal to a mass market.

- Pure plays appear to be more innovative, especially in terms of adding services that enhance convenience (think Amazon Prime and Prime Now). We cannot help but think that many store-based retailers are perpetually playing catch-up with their nonstore rivals in terms of adding convenience to the shopping process.

So, What Can Brick-and-Mortar Players Do?

This note is too short to provide all the answers, but we offer two concluding thoughts:

- First, we think too many brick-and-mortar retailers are relying too heavily on in-store fulfillment (click-and-collect) to “rescue” them online. If a retailer’s brand positioning, product range, pricing, mobile offering, range of fulfillment options and other services are not sufficiently appealing, offering click-and-collect will do little to fight off the pure plays.

- Second, brick-and-mortar retailers would stand a better chance against pure plays if they genuinely led in online innovation, such as in the areas of rapid delivery, other fulfillment services or mobile commerce. In other words, stores should stop trying to chase Amazon and become leaders in their own right.

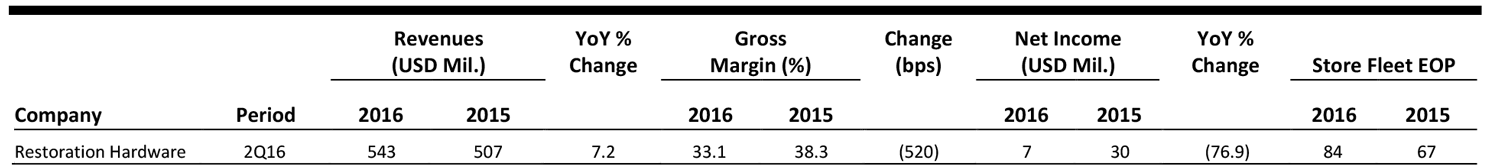

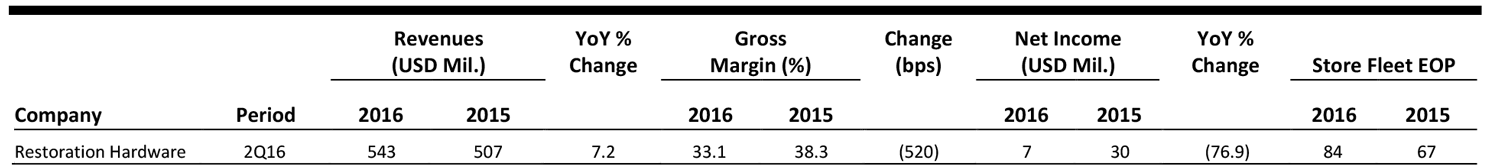

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

Condé Nast Has Started Using IBM’s Watson to Find Influencers for Brands

(September 6) Adweek

Condé Nast Has Started Using IBM’s Watson to Find Influencers for Brands

(September 6) Adweek

- Condé Nast is using IBM’s Watson supercomputer to help its brands build and strategize their social influencer campaigns. Watson will consider 52 attributes of each influencer to better target the correct audience for each campaign.

- Condé Nast is also partnering with influencer platform Influential, and will use big data to analyze influencer traits to better align brands with their target audiences. With so many places for shoppers to consume content, Condé Nast hopes to use Watson to ultimately create a better customer experience.

Smashbox Cosmetics Takes the Virtual Reality Plunge

(September 1) Glossy

Smashbox Cosmetics Takes the Virtual Reality Plunge

(September 1) Glossy

- Smashbox, an Estée Lauder brand, is using virtual reality to take shoppers on a tour of its Smashbox Studios in Los Angeles. The 360-degree video features the studio, its technology and Smashbox products. It is the next step in the beauty brand’s digital strategy; Smashbox does no print advertising.

- The launch of the virtual reality campaign coincides with the brand’s website redesign. To promote the video, Smashbox is sending Google Cardboard viewers to the 400 people in its influencer network and to sales associates at Sephora and Ulta stores, which sell Smashbox products.

Google Tests a New Way for Shoppers to Discover Products

(September 6) Internet Retailer

Google Tests a New Way for Shoppers to Discover Products

(September 6) Internet Retailer

- Google is testing a new mobile tool called “Shop the look,” which aims to help shoppers who are not seeking a specific product. The tool lets consumers shop for items featured in images from brands, bloggers, retailers and publishers.

- For example, if a shopper enters “cocktail attire” into Google search, she can then shop the look she sees in a blog image to find the exact products featured there, or products that are similar, via Google Shopping ads. Retailers pay on a cost-per-click basis and receive Google Shopping analytics.

Buoyed by Millennials and Gen Zers, Snapchat to Reach $1 Billion in Ad Revenue in 2017

(September 6) Women’s Wear Daily

Buoyed by Millennials and Gen Zers, Snapchat to Reach $1 Billion in Ad Revenue in 2017

(September 6) Women’s Wear Daily

- Advertisers are increasingly drawn to Snapchat, as it continues to attract millennials and Gen Zers. Currently, the social media platform represents about 31% of the social media market in the US, but only 2.3% of social media ad revenues.

- eMarketer predicts that the platform’s ad dollars will increase to $935 million next year, up from $366 million this year. While Snapchat will have to compete with the more established Facebook and Twitter platforms, it has improved its targeting capabilities to bring a better return on investment to advertisers.

EUROPE RETAIL HEADLINES

Olympics and Outdoor Activities Slow Down British Retail Sales

(September 6) British Retail Consortium

Olympics and Outdoor Activities Slow Down British Retail Sales

(September 6) British Retail Consortium

- In the four weeks ended August 27, 2016, total UK retail sales fell by 0.3% year over year and comps fell by 0.9% year over year, according to the British Retail Consortium-KPMG Retail Sales Monitor. Excluding the effects of Easter, this was the weakest performance since September 2014.

- The slowdown in sales was attributed to lower footfall due to warmer weather, as consumers pursued more leisure and outdoor activities. On a three-month basis, total UK retail sales grew by 0.6%, while food sales grew by 0.9% and nonfood sales grew by 0.4%.

Zalando’s Bread & Butter Draws 20,000 Consumers

(September 5) WWD.com

Zalando’s Bread & Butter Draws 20,000 Consumers

(September 5) WWD.com

- German e-commerce retailer Zalando acquired Berlin-based trade show Bread & Butter in 2015, and converted it from a business-to-business event to a business-to-consumer event. The first edition of the consumer-oriented Bread & Butter took place over the weekend of September 2–4 and drew a crowd of 20,000 that included industry experts and young fashion aficionados alike.

- The event featured fashion shows, musical performances, exhibition booths and activities held by 31 participants, including Zalando’s private-label brands and others sold by the e-tailer. Some brands, such as G-Star Raw and Levi’s, sold their newest collections at their exhibition booths, while sports brands Adidas and Nike conducted workout sessions.

Marks & Spencer to Axe at Least 525 Head Office Roles

(September 5) Company press release

Marks & Spencer to Axe at Least 525 Head Office Roles

(September 5) Company press release

- British retailer Marks & Spencer (M&S) has announced proposals to significantly change its UK head office structure. In a move designed to save about £30 million (US$40 million), the company intends to reduce its number of head office roles by about 525 and its number of permanent roles, across IT and logistics in its central London office, by some 400.

- M&S stated that the proposals were developed following a detailed review of the organization. The review highlighted several areas that were inefficient and resulted in unnecessary costs, which the company aims to address by reshaping its organizational structure. M&S employs more than 71,000 people in the UK, including 3,500 employees in its seven UK head offices.

Metro Group Confirms Demerger

(September 5) Company press release

Metro Group Confirms Demerger

(September 5) Company press release

- Germany’s Metro Group confirmed that it is proceeding with its plans to split its food and consumer electronics businesses. Olaf Koch, the conglomerate’s chairman, said that the supervisory board had approved the split and that the separation will take place on September 30, 2016, but that the formal split and public listing of the spun-off companies will take place in mid-2017.

- The wholesale and food business (Metro Cash & Carry and Real) and its related business activities will be spun off to form one entity, headed by Koch. The consumer electronics business (Media-Saturn) and its related activities will form the other entity, to be headed by Pieter Haas. Metro Group confirmed that it can advance with the demerger without having to raise additional capital, and that it expects an investment-grade rating for both companies.

Auchan’s 1H16 Revenues Grow by 0.8%, but Net Profit Falls by 16.0%

(August 31) Company press release

Auchan’s 1H16 Revenues Grow by 0.8%, but Net Profit Falls by 16.0%

(August 31) Company press release

- French retail group Auchan posted 1H16 revenues of €26,106 million (US$29,138 million), up 0.8% year over year at constant currency. However, in the six months ended June 30, 2016, operating profit fell by 13.2%, to €296 million (US$330 million) and net profit fell by 16.0%, to €117 million (US$131 million).

- Auchan significantly overhauled its operations in 2015, reorganizing its business into three segments: Auchan Retail, Immochan and Oney Bank. Sales in the Auchan Retail division, consisting of hypermarkets, convenience stores and e-commerce, grew by 0.7% year over year, to €25,369 million (US$28,315 million). Immochan, consisting of shopping centers, saw sales grow by 1.2% year over year, to €311 million (US$347 million).

ASIA TECH HEADLINES

Tencent Becomes China’s Most Valuable Company

(September 5) Bloomberg

Tencent Becomes China’s Most Valuable Company

(September 5) Bloomberg

- On September 5, Tencent became China’s most valuable corporation. With a market value of HK$1.99 trillion (US$257 billion), Tencent surpassed state-owned China Mobile’s valuation of HK$1.97 trillion (US$254 billion).

- Tencent’s strategy of driving revenue growth via advertising, gaming and entertainment has proven successful, and it now ranks among the world’s 10 largest public companies.

Hong Kong to Launch Fintech “Sandbox”

(September 6) Reuters

Hong Kong to Launch Fintech “Sandbox”

(September 6) Reuters

- Hong Kong confirmed its plan to establish a regulatory regime known as a “sandbox” for financial technology innovation in the banking sector. The initiative will allow the testing and trial of newly developed technology without the usual supervisory requirements.

- Hong Kong is taking this action to regain its competitiveness in the fintech race as it competes with Mainland China, Australia and Singapore.

Alibaba to Invest in Yum China

(September 5) Inside Retail

Alibaba to Invest in Yum China

(September 5) Inside Retail

- Alibaba will invest US$50 million in Yum China, an established leader in China’s retail and restaurant industry.

- Alibaba aims to improve mobile payment services for Yum China through this collaboration, including shortening queues at cash registers through the use of its Alipay mobile payment system.

Samsung Accelerates Phone Launch to Compete with Apple

(September 6) Reuters

Samsung Accelerates Phone Launch to Compete with Apple

(September 6) Reuters

- Samsung is speeding up new phone launch cycles in order to compete with Apple, and has brought forward the launch of its Galaxy S and Galaxy Note series models by roughly a month since 2015.

- The company, which faces concerns over quality testing, says that its products go through “extensive preparation” and that they will be released to the market “only after proper completion of the development process.”

LATAM RETAIL HEADLINES

Brazil: Impeachment and Olympics Fail to Boost Ailing Retailers

(September 1) WWD.com

Brazil: Impeachment and Olympics Fail to Boost Ailing Retailers

(September 1) WWD.com

- The impeachment of Dilma Rousseff is not expected to have a significant effect on retail sales in Brazil in the short term, although it could gradually boost consumer confidence in the near-to-medium term. Most retailers are not expecting high growth this year, but next year may be more promising.

- The 2016 Olympics in Rio de Janeiro proved to have little effect on apparel sales in Brazil. However, Brazilian department store chain Lojas Renner will see same-store sales gain 5% in 2016 as the company restructures to mirror fast-fashion companies such as Zara.

Walmart’s Long Game Poised to Reap Rewards in Mexico

(August 31) STORES Magazine

Walmart’s Long Game Poised to Reap Rewards in Mexico

(August 31) STORES Magazine

- Walmart of Mexico and Central America is working to enhance its logistics and the integration of its digital platforms, while sustaining funding across its diverse portfolio to ensure it can execute on various offerings. Competition is increasing with local players, including Soriana, which recently absorbed Comercial Mexicana.

- The company is also working to ramp up its e-commerce offerings following the entrance of Amazon into the Mexican market. Unlike in the US, in Mexico, Amazon is having to work to catch up with Walmart in terms of infrastructure.

Femsa Suffers Collateral Damage from Mexico’s Crackdown on Slim

(September 7) Bloomberg

Femsa Suffers Collateral Damage from Mexico’s Crackdown on Slim

(September 7) Bloomberg

- Femsa is known for controlling Latin America’s biggest Coca-Cola bottler and operating the region’s largest convenience store chain, Oxxo. Traffic to the stores fell by 0.5% in the second quarter, the first drop in over two years.

- The decline in traffic was due to the Mexican government’s overhaul of its telecommunications system, which resulted in fewer customers visiting Oxxo stores to buy prepaid cards for their mobile phones. The government is attempting to chip away at the dominance of Carlos Slim’s América Móvil, and thus has allowed AT&T to enter the market, dropping prices and encouraging contract plans.

Cuba Beckons, but US Airlines and Passengers Face Hurdles

(September 7) WSJ.com

Cuba Beckons, but US Airlines and Passengers Face Hurdles

(September 7) WSJ.com

- The technology at Cuban airports is far from up to date, with no self-service or advanced check-in, so travelers can expect to wait in long lines. US airlines are facing difficulties with some technical systems that are not currently compatible and constraints on vital passenger-service encrypted-software systems.

- JetBlue flew the first regularly scheduled flight between the US and Cuba on August 31, and American will begin flying to five of the six Cuban cities it will serve starting this week. Southwest, Delta, United, Spirit, Frontier, Alaska and Florida-based Silver Airways have also all received rights to fly to Cuba.