From the Desk of Deborah Weinswig

Amazon Pushes Further into Fashion in Europe

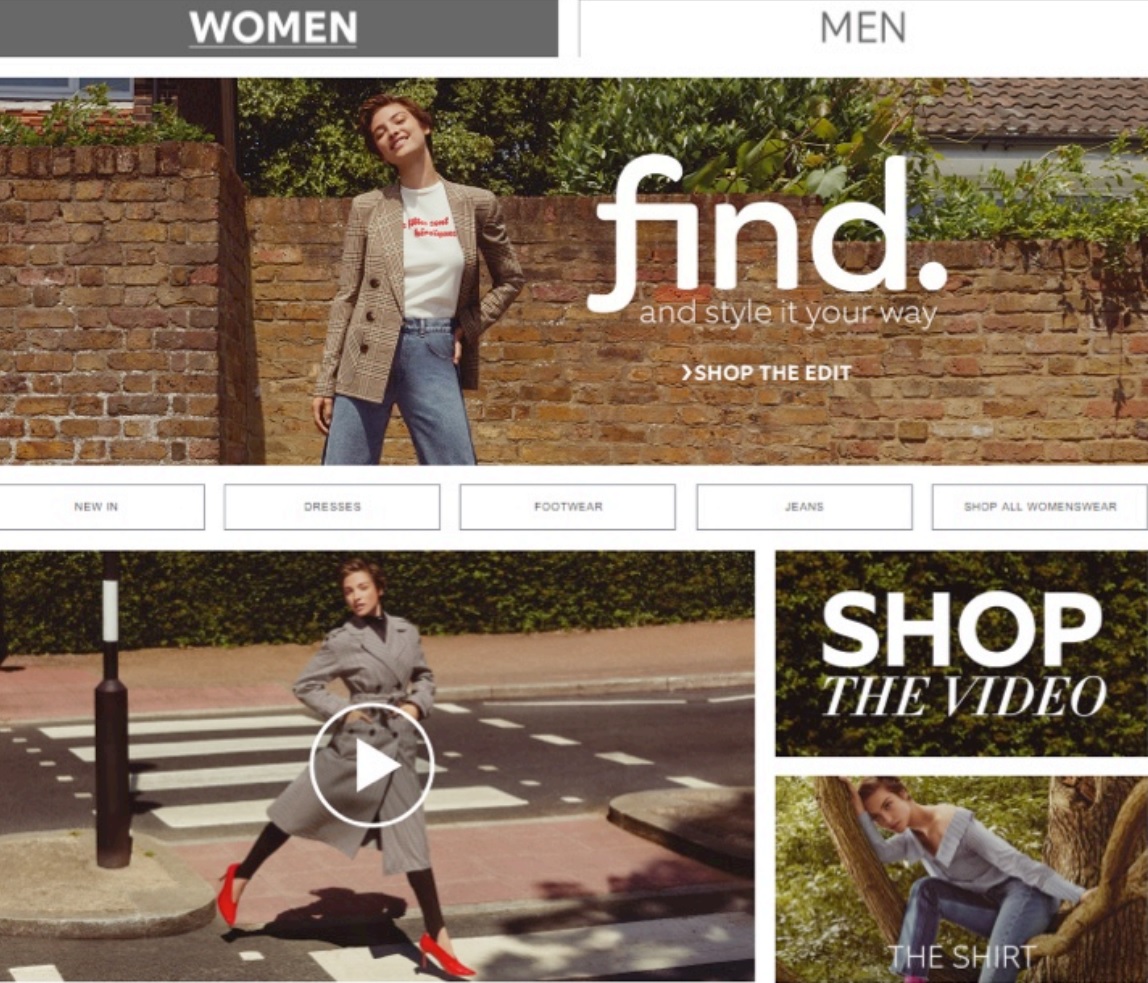

This week, Amazon officially launched its first fashion private label that is designed in Europe specifically for European shoppers. The Find brand launched with a flurry of press coverage as well as an unusually stylish subsite on Amazon.co.uk. We note two characteristics of the brand:

- Low prices: Prices are highly affordable, with most men’s jeans priced between £24 and £30 (US$31 and US$39) and women’s dresses starting at £16 (US$21).

- Middle ground: In menswear in particular, the Find brand’s styling looks “safe,” with low-price staples mixed with somewhat conservative, smart-casual fashion ranges. Amazon appears to have

dropped some more fashion-forward items into the womenswear ranges.

The current range looks broadly akin to “supermarket fashion,” and so appears to present little near-term

threat to specialist retailers—even those in the midmarket—that enjoy strong fashion credentials.

We wonder if this positioning is partly due to the fact that Amazon is still finding its feet in apparel. The retailer’s ultra-broad positioning likely makes it tough for management to know to whom, exactly, it should pitch its inaugural fashion range: How does the “everything store” successfully position a category as diverse and segmented as fashion?

Who Is Behind the Find Range?

Amazon recruited experienced names from UK mass-market retailers to develop its fashion offering. In 2016, it hired former Marks & Spencer head of womenswear Frances Russell. In 2017, Amazon poached Karen Peacock, formerly the head of design for womenswear and accessories at Marks & Spencer, and Glen George, formerly the director of buying for menswear at Primark.

Moving Amazon from Off-Price to On-Trend

We have long viewed Amazon as a de facto off-price fashion retailer. One competing Internet retailer recently characterized Amazon’s fashion offering to us as consisting of “95% past seasons’ ranges.”

Getting brands on board to supply in-season product directly is one way to challenge this off-price image. But offering private labels is more important, because a retailer does not establish fashion credentials in its own right simply by selling other companies’ brands.

We think there is scope for Amazon to offer more fashionable private-label ranges, and in the coming years, we expect to see the retailer use data as the springboard for its offering. In particular, we expect to see Amazon make use of the kind of test-and-repeat model that pure-play names such as Boohoo.com use to develop their offerings—with that model, the retailer tests products on its site and then orders larger volumes for those items that prove popular with customers.

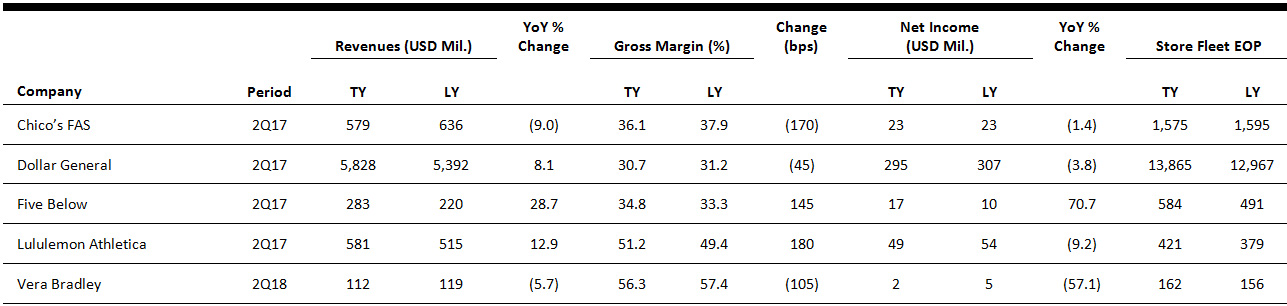

US RETAIL EARNINGS

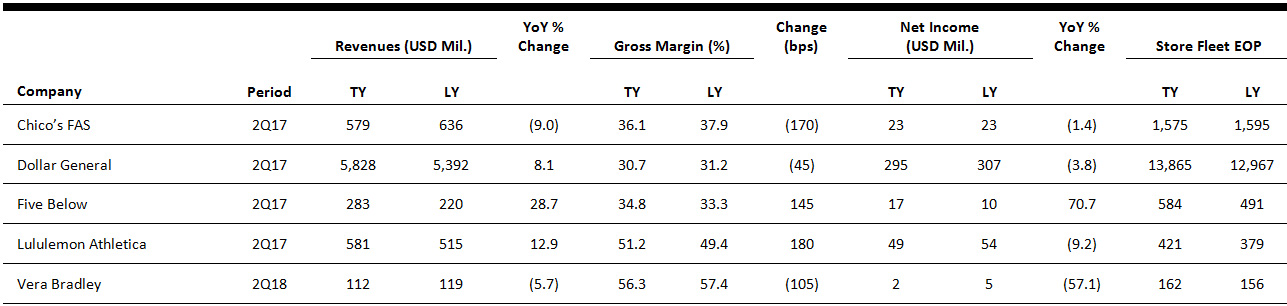

Source: Company reports

Source: Company reports

US RETAIL & TECH HEADLINES

Best Buy’s Digital Resurgence Continues with Record Online Revenue, Fueled by Seattle Office

(August 29) GeekWire.com

Best Buy’s Digital Resurgence Continues with Record Online Revenue, Fueled by Seattle Office

(August 29) GeekWire.com

- Best Buy just hit a revenue record, and the once-struggling electronics retailer continues to flourish thanks to a push to unite its in-store and online experiences. In the last quarter, Best Buy reported $1.1 billion in US online revenue, a company record for a non-holiday quarter, and a 31% year-over-year increase. This is the second time in a row that Best Buy has achieved more than $1 billion in online revenue in a non-holiday quarter.

- On Best Buy’s recent earnings call, CEO Hubert Joly said that digital will continue to be an investment priority for the company. “So much of the customer experience has been starting online,” he said. “So what we’re seeing today is the continued effect of the cumulative investments we’ve made in simplifying and streamlining the customer experience. There’s a lot of details that you do to tweak and eliminate the frictions in log-in, in checkout, every step in the journey.”

Calvin Klein Tests Its Luxury Line’s Staying Power

(September 3) The Wall Street Journal

Calvin Klein Tests Its Luxury Line’s Staying Power

(September 3) The Wall Street Journal

- On opening night of New York Fashion Week, Calvin Klein is hoping to prove that its much-lauded new luxury line is more than just a one-hit wonder. The company hired acclaimed fashion designer Raf Simons last year to lead what CEO Steve Shiffman calls a “creative revolution,” overhauling everything from its clothes to its logo, now officially in all caps and in a new custom font called “Klein.”

- The designer’s debut runway show for the brand’s highest-end ready-to-wear collection in February drew widespread raves from critics and retailers. While the bulk of sales growth will continue to come from the company’s midprice jeans and underwear, which Simons described as “incredibly important” to the brand, he envisions more sales coming from the higher-end collection than in the past.

Sources: Department Store Operator Bon-Ton Turns to Turnaround Advisors

(August 31) Reuters.com

Sources: Department Store Operator Bon-Ton Turns to Turnaround Advisors

(August 31) Reuters.com

- US department store chain Bon-Ton Stores is hiring advisors to help it turn around its business and slash its debt load as it struggles to cope with the sector’s downturn, according to people familiar with the matter. The move underscores the woes of the brick-and-mortar retail sector, which has been plagued by numerous bankruptcies this year as consumers increasingly move their spending to e-commerce companies such as Amazon.com.

- Bon-Ton has tapped advisory firm AlixPartners to provide operational advice on its turnaround efforts and is also interviewing banks to appoint an advisor to review strategic options that include debt restructuring, the sources said this week.

Produce-Focused Remodels Show Promise at Dollar General

(August 31) SupermarketNews.com

Produce-Focused Remodels Show Promise at Dollar General

(August 31) SupermarketNews.com

- Dollar General said Thursday that food-focused store remodels—including some that introduce fresh produce assortments—are generating three to four times the sales results of typical remodels. The retailer, based in Goodlettsville, TN, said it had completed approximately 185 store remodels, around a third of which include a test of fresh produce, through the end of its fiscal second quarter.

- In keeping with the chain’s emphasis on consumables as a driver of traffic and larger baskets, CEO Todd Vasos said that the remodeling has been focused on older stores with fewer than 10 cooler doors, adding an average of around seven new doors per location. “We believe that, overall, this could be a real win for Dollar General and for our consumers, because what it does [is offer] our consumers items such as produce, expanded fresh, frozen and dairy-type products, as well as expanded areas of dry grocery [and] some of our nonconsumable areas,” Vasos said.

Macy’s, Best Buy Expanding Same-Day Delivery Service

(August 31) St. Louis Post-Dispatch

Macy’s, Best Buy Expanding Same-Day Delivery Service

(August 31) St. Louis Post-Dispatch

- Macy’s and Best Buy are expanding their same-day delivery offers as they try to be more competitive with online leader Amazon. Best Buy, the nation’s largest consumer electronics chain, said that it will expand to 27 metropolitan markets from 13 starting next week. That number should reach nearly 40 cities by the winter holidays. In a separate announcement, Macy’s said that it will offer same-day delivery in 15 additional markets, for a total of 33 areas.

- Macy’s is working with startup Deliv, based in Menlo Park, CA, backed by UPS, while Best Buy is now working with two companies to handle deliveries, including its original partner, Deliv. Best Buy declined to name its new partner since it is still finalizing the deal. Macy’s will charge an $8 fee for the service, while Best Buy has cut its fee to $5.99 per order from $14.99.

US Second-Quarter GDP Growth Revised Up to 3%

(August 30) FoxBusiness.com

US Second-Quarter GDP Growth Revised Up to 3%

(August 30) FoxBusiness.com

- The US economy grew faster than initially thought in the second quarter, notching its quickest pace of growth in more than two years, and there are signs that the momentum was sustained at the start of the third quarter.

- The upward revision from the 2.6% pace reported last month reflected robust consumer spending as well as strong business investment. Retail sales and business spending data so far suggest that the economy maintained its stamina early in the third quarter.

EUROPE RETAIL HEADLINES

Nonfood Drives UK Retail Sales Growth in August

(September 5) Retail-Week.com

Nonfood Drives UK Retail Sales Growth in August

(September 5) Retail-Week.com

- Retail sales in the UK increased by 2.4% in August, up from 1.4% recorded in July. Comparable sales grew by 1.3%, above July’s 0.9% rise, driven by growth in nonfood categories, particularly homewares, autumn clothing ranges and school items, according to the British Retail Consortium (BRC).

- Helen Dickinson, Chief Executive of the BRC, cautioned that although “August provided a welcome pickup in retail sales across channels,” nonfood sales have only just recovered to the levels seen two years ago and strong growth in food is mainly due to rising prices rather than volume growth.

ASOS Unveils Own-Brand Beauty Range

(September 5) DrapersOnline.com

ASOS Unveils Own-Brand Beauty Range

(September 5) DrapersOnline.com

- British online fashion pure play ASOS has unveiled its first own-brand beauty range in a push to grow market share in the category. The retailer already sells third-party beauty products.

- The 46-piece makeup range, called Face and Body, includes eyeshadows, lipsticks, contouring palettes, bronzers and highlighters. Prices range from £5–£12 (US$7–US$16).

Auchan Holding Reports 2.1% Revenue Growth in 1H17

(September 4) Company press release

Auchan Holding Reports 2.1% Revenue Growth in 1H17

(September 4) Company press release

- French retail group Auchan reported revenue growth of 2.1% (0.2% at constant currency) and profit growth of 23.2% (17.2% at constant currency) for the first half of 2017, ended June 30.

- Among the company’s segments, Auchan Retail reported 2.1% revenue growth (0.1% at constant currency) and shopping center business Immochan’s revenue grew by 5.1% (4.4% at constant exchange rates). Banking business Oney saw income rise by 9.1%.

Galeries Lafayette to Acquire Stake in La Redoute

(August 31) FashionNetwork.com

Galeries Lafayette to Acquire Stake in La Redoute

(August 31) FashionNetwork.com

- French department store Galeries Lafayette announced plans to acquire a 51% stake in mail-order and online retailer La Redoute, with the remaining stake expected to be acquired at a later stage.

- The acquisition will take place through Galeries Lafayette’s holding company, Motier, and is expected to be completed over the next few months, subject to regulatory approval.

Eldercare Tech Startup Aifloo Raises €5.1 Million

(September 5) TechCrunch.com

Eldercare Tech Startup Aifloo Raises €5.1 Million

(September 5) TechCrunch.com

- Swedish startup Aifloo, which creates smart wristbands to help care for senior consumers, has raised €5.1 million (US$6.1 million) in series A funding. The funding round was led by Swedish venture capital firm EQT Ventures.

- Henrik Landgren, EQT’s analytics partner, said that the e-health startup was uniting “vast amounts of data and modern AI” to help older people live independently for longer and that the team and technology were the key reasons to invest in Aifloo.

ASIA TECH HEADLINES

GoGoVan Becomes Hong Kong’s First $1 Billion Startup Following Merger Deal

(September 1) TechCrunch.com

GoGoVan Becomes Hong Kong’s First $1 Billion Startup Following Merger Deal

(September 1) TechCrunch.com

- GoGoVan, a logistics on-demand provider that connects van drivers and customers for transporting goods, is Hong Kong’s first $1 billion startup, following a merger deal with 58 Suyun, a fellow logistics on-demand platform that is focused on serving consumers.

- 58 Suyun, which is owned by online classifieds giant 58.com, is present in over 100 cities in China and has 1.2 million registered drivers, while GoGoVan is present in eight cities in China as well as in Taiwan, Singapore, South Korea and India.

India’s Treebo Raises $34 Million for Its Budget Hotel Network

(August 31) TechCrunch.com

India’s Treebo Raises $34 Million for Its Budget Hotel Network

(August 31) TechCrunch.com

- Treebo Hotels, India’s largest budget hotel network, has closed a $34 million series C round of funding. The deal was led by new backers Ward Ferry Management and Karst Peak Capital, two Hong Kong private equity firms, with participation from existing investors SAIF Partners, Matrix Partners India and Bertelsmann India Investments.

- Startups such as Treebo and OYO have sprouted up to offer a tech-enabled response to the problem of vastly differing hotel quality across India. They propose a base standard for guests that includes clean linens, bedding, free Wi-Fi and more, for a price range of 1,000–3,000 INR, or roughly US$15–US$50, per night. In addition, they use a mobile app as a virtual concierge service to help with check-in and orders and to answer questions.

Thailand’s Kasikorn Bank Backs Cloud Accounting Startup in First Deal for $30 Million Fund

(August 30) TechCrunch.com

Thailand’s Kasikorn Bank Backs Cloud Accounting Startup in First Deal for $30 Million Fund

(August 30) TechCrunch.com

- Kasikorn Bank (KBank) has made the first investment from its $30 million fund—a $1.15 million round for Bangkok-based FlowAccount. The bank was joined in the round by Japan-based conglomerate SBI Group, and FlowAccount’s seed investors, 500 Startups and Golden Gate Ventures.

- FlowAccount is a cloud-based platform for business accounting. It plans to use these new funds to grow its team of 20 and develop new products that extend its reach from cloud-based accounting systems into other services for small and medium-sized enterprises. This week, it launched a solution for accounting firms themselves, and it is planning payroll and other HR services for small businesses.

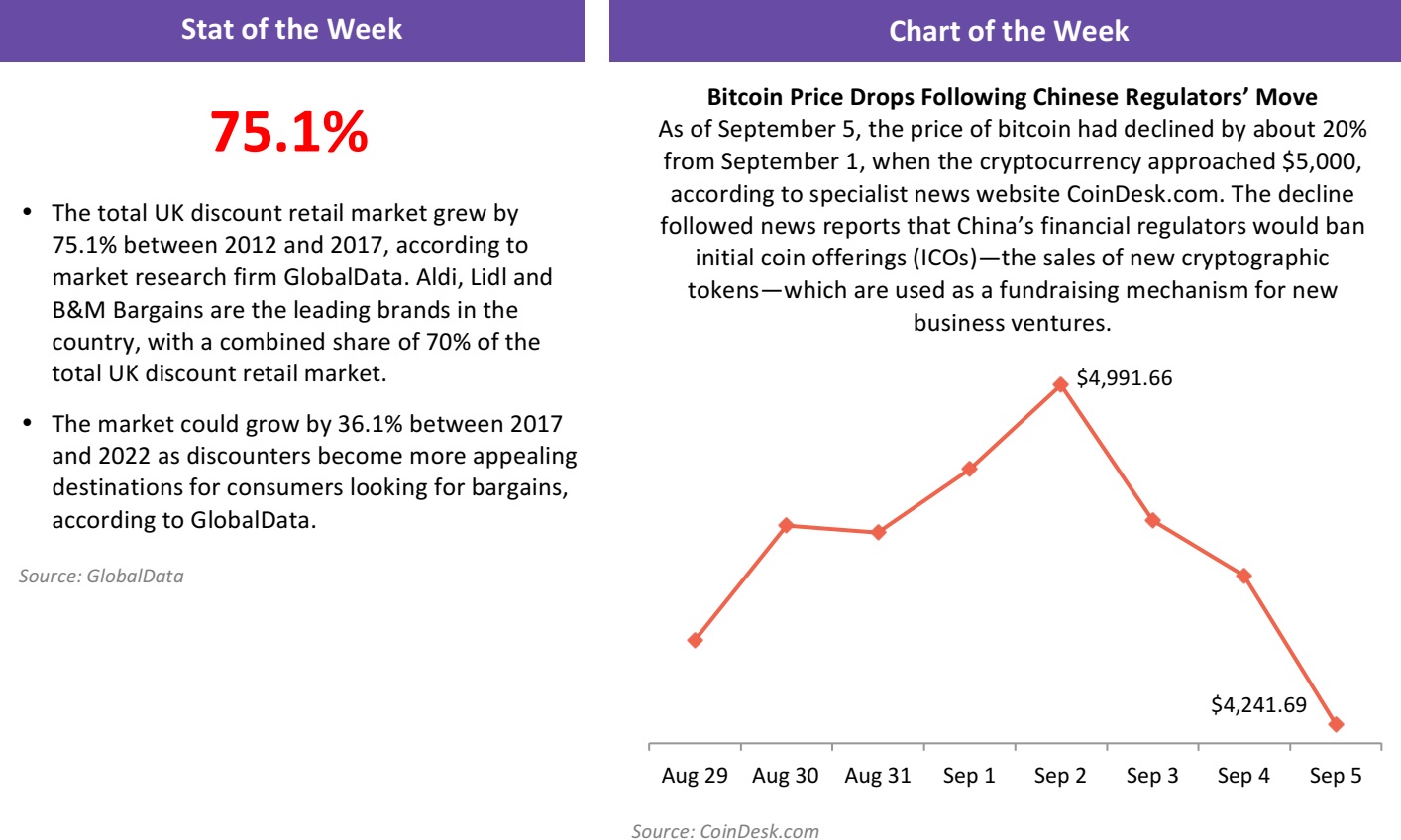

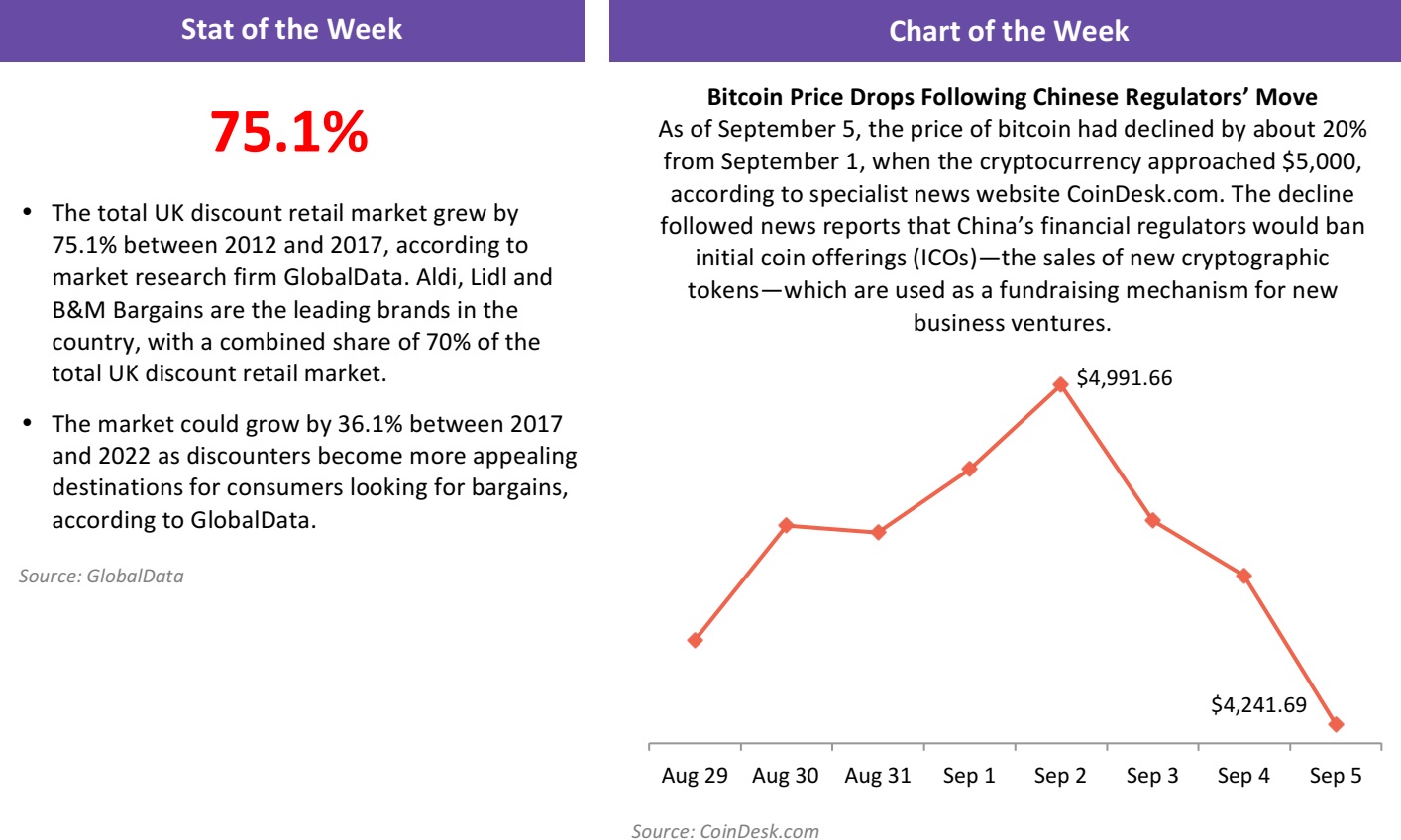

Cryptocurrencies Have Crashed 20% in Two Days After China’s ICO Ban

(September 4) TechCrunch.com

Cryptocurrencies Have Crashed 20% in Two Days After China’s ICO Ban

(September 4) TechCrunch.com

- A notice from a committee led by China’s central bank announced an immediate ban on initial coin offering (ICO) funding, which has “seriously disrupted the economic and financial order.” Financial news site Caixin reported that the committee has prepared a list of 60 exchanges that will be subject to inspection and a report. In the meantime, there will be an ICO freeze in China.

- ICOs involve raising funding by creating and selling new crypto tokens—commonly based on Ethereum—to investors. That has led to comparisons with securities, with much speculation over whether financial regulators will look to regulate the space. The Chinese committee voiced concern that some ICOs are financial scams and pyramid schemes.

LATAM RETAIL AND TECH HEADLINES

Brazil Debates Sharing Economy Regulations

(September 4) ZDNet.com

Brazil Debates Sharing Economy Regulations

(September 4) ZDNet.com

- The Brazilian government is looking to find ways to regulate new services coming up under the collaborative economy umbrella. Given the impact on traditional services caused by alternatives such as Uber and Airbnb, the lower house of the congress created a special group to discuss the creation of a legal framework for the new services.

- According to the leader of the special group, Congressman Thiago Peixoto, the goal is to come up with recommendations to propose regulations across the various segments of the sharing economy—from ride sharing to crowdfunding—that will not restrict new businesses too much, but also not impact the traditional economy.

Brazilian Mobile Market Shows Signs of Recovery

(September 1) ZDNet.com

Brazilian Mobile Market Shows Signs of Recovery

(September 1) ZDNet.com

- Mobile phone sales in Brazil have been showing signs of recovery in 2017 following a decline that resulted from the economic slowdown, according to a new study by analysis firm IDC. Some 12.8 million devices were sold in the second quarter, up 5.9% from the same period in 2016. The number is in line with first-quarter figures, which showed that mobile sales grew by 3.7% year over year, with 12.3 million devices sold.

- “The mobile market has returned to very expressive numbers, mainly because Brazilians [are] replacing handsets bought at least three years ago, since this has been the average lifespan of the battery and screen,” says Leonardo Munin, IDC research analyst for the Latin American mobile market.

Timid Growth Predicted for IT Spending in Brazil

(August 31) ZDNet.com

Timid Growth Predicted for IT Spending in Brazil

(August 31) ZDNet.com

- Budgets for technology in Brazil will not see a substantial increase this year, and predictions for 2018 are not all that different, according to a new trends study, the Brazil IT Snapshot, by Logicalis. IT budgets will grow by about 3% this year and the forecast is about the same for 2018, which may even see a decrease, according to the study.

- Some 71% of those polled said that IT budgets in 2016 were mostly spent on running existing estates, while 41% of CIOs surveyed said that there has been a decrease in innovation investments. Conversely, about 82% of the respondents said that they had made some kind of cloud computing investment, the highest percentage seen since 2013. Of that total, 40% have used a hybrid approach, while 35% have used private clouds and 7% public clouds.

Hijackings Push Brazilian Retailer Via Varejo to Overhaul Logistics

(September 4) Reuters.com

Hijackings Push Brazilian Retailer Via Varejo to Overhaul Logistics

(September 4) Reuters.com

- Faced with a surge in cargo hijackings, Brazilian furniture and home electronics retailer Via Varejo has invested in security, drawn no-go zones for deliveries and beefed up in-store pickup services. The company has also begun using its own trucks to stock 80 stores in the states of São Paulo and Rio de Janeiro, and it intends to reach all 730 stores in those states by the end of the year.

- The company’s logistics unit, VVLog, which was created after the consolidation of CNova (an e-commerce unit of controlling owner Groupe Casino), has reduced costs by 20% for in-store pickup compared with home delivery. The logistics overhaul highlights how a rise in crime tied to Brazil’s worst recession in over a century is forcing companies to reconsider even the most basic services.

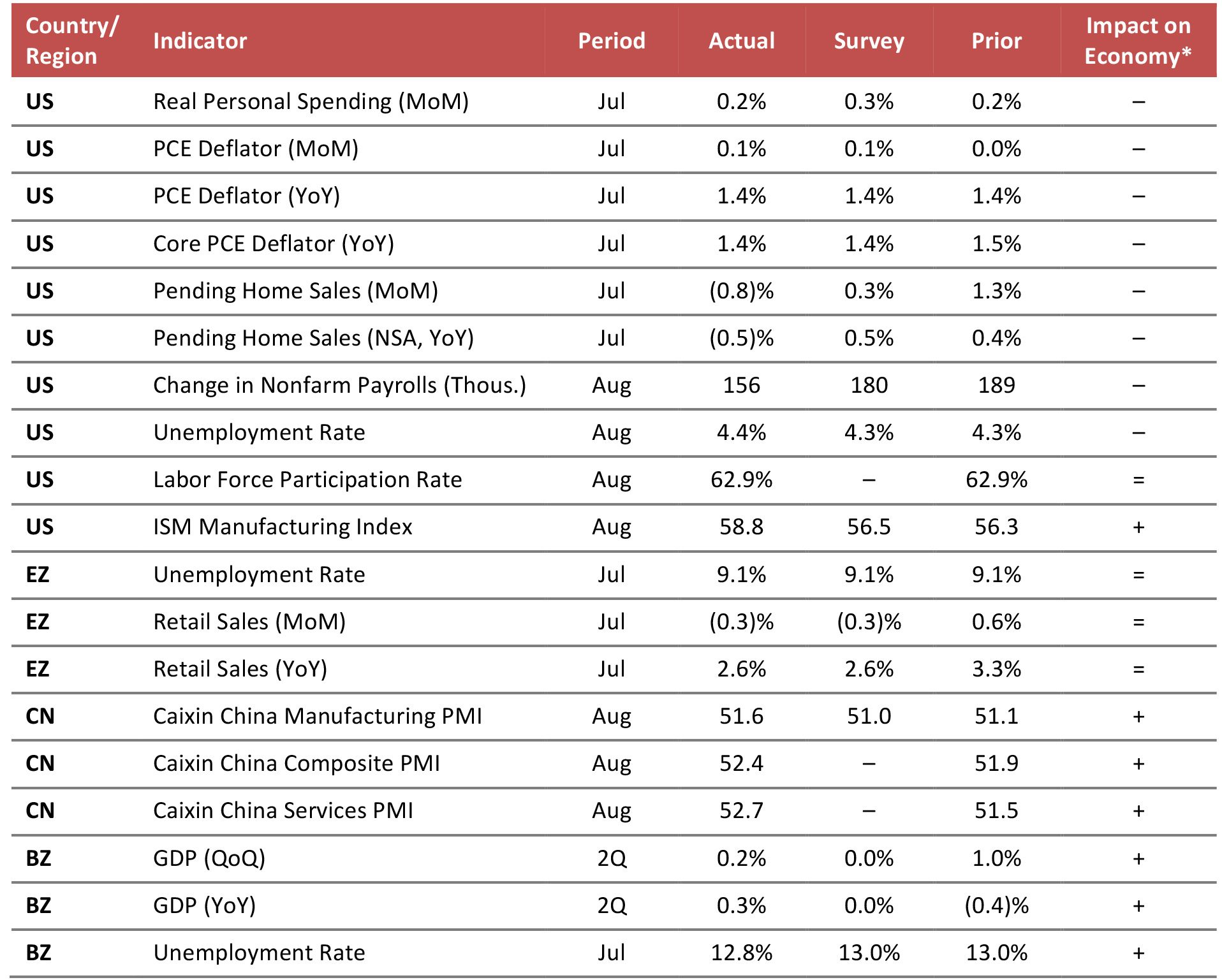

MACRO UPDATE

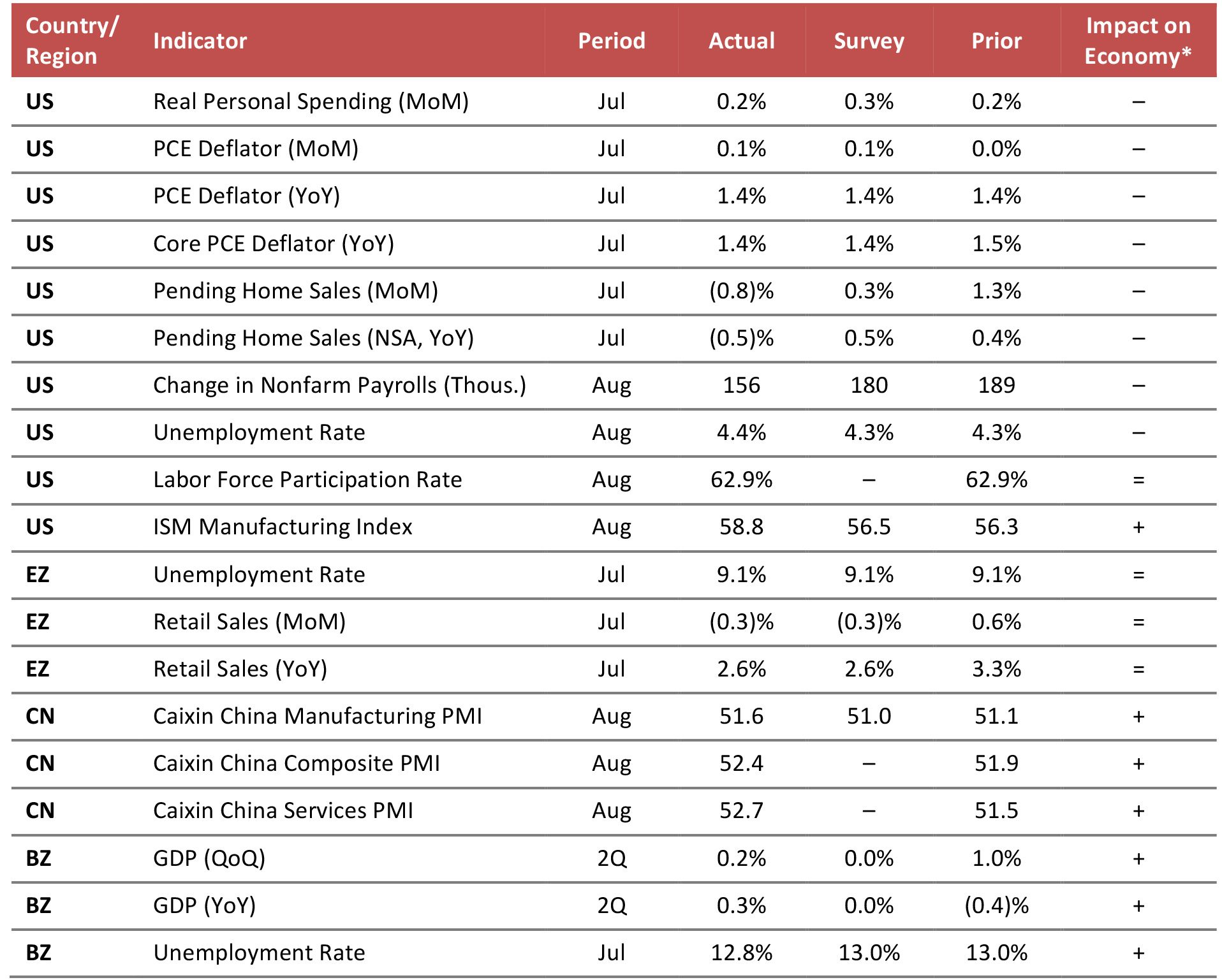

Key points from global macro indicators released August 30–September 6, 2017:

- US: Real personal spending ticked up in July, while the inflation rate moderated. In August, the nonfarm payrolls figure came in weaker than expected and the unemployment rate ticked up slightly. The ISM Manufacturing Index reading for August pointed to an expansion in the manufacturing sector.

- Europe: In the eurozone, the unemployment rate stayed at 9.1% in July. Retail sales in the eurozone dropped by 0.3% month over month and increased by 2.6% year over year in July; the metrics for both time periods were in line with consensus estimates.

- Asia-Pacific: In China, the Caixin Manufacturing Purchasing Managers’ Index (PMI) ticked up to 51.6 in August, which was better than the consensus had estimated. The Caixin Services PMI reading also pointed to an expansion, ticking up to 52.7 in August from 51.5 in July.

- Latin America: In Brazil, GDP in the second quarter increased by 0.2% quarter over quarter and by 0.3% year over year, exceeding the market’s zero-growth expectation. The unemployment rate in Brazil edged down to 12.8% in July.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/National Association of Realtors/US Bureau of Labor Statistics/Institute for Supply Management/Eurostat/Markit/Instituto Brasileiro de Geografia e Estatística/FGRT

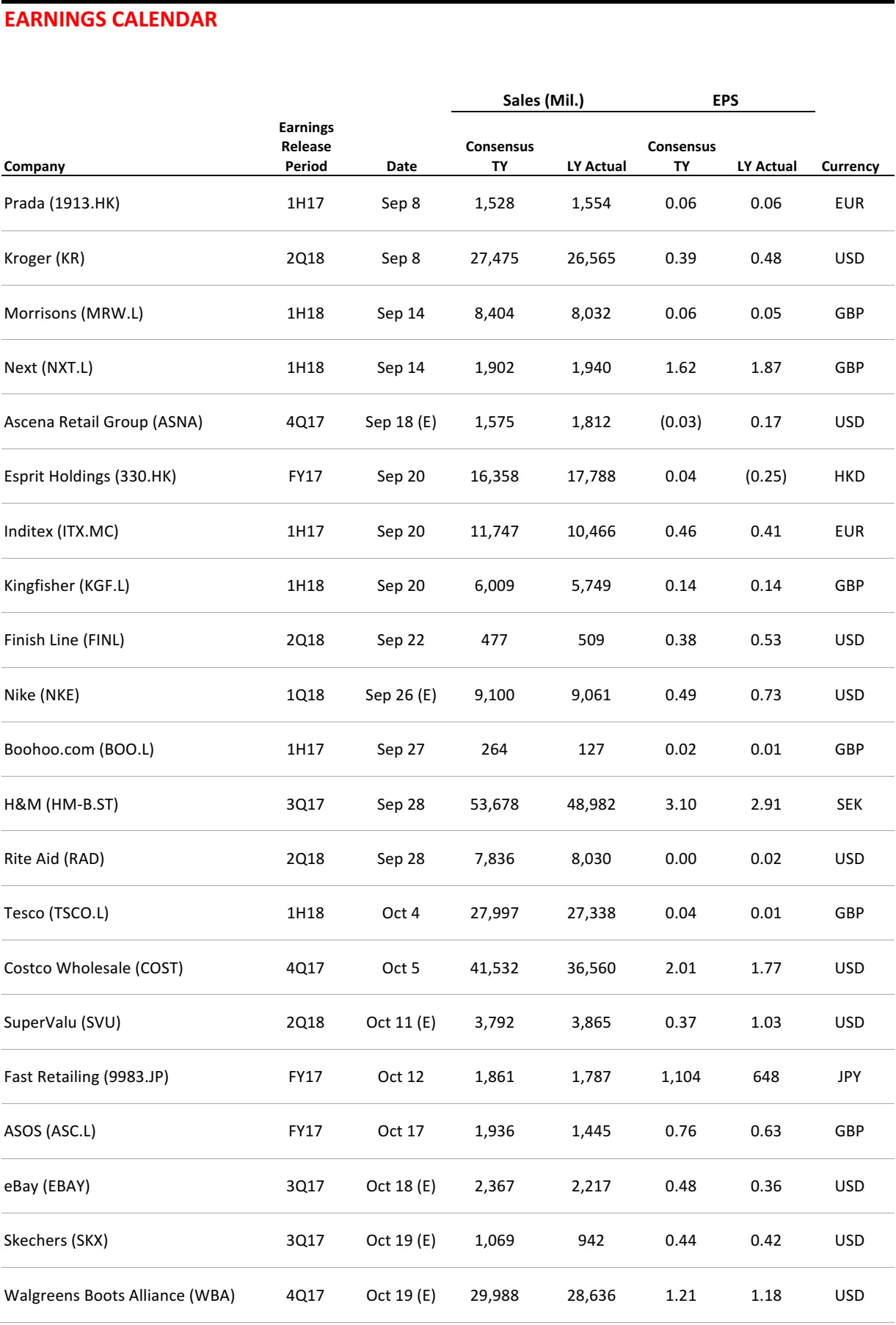

Source: Company reports

Source: Company reports