Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

[caption id="attachment_73735" align="alignright" width="332"] A rendering of the exterior of the new Primark in Downtown Crossing, Boston

A rendering of the exterior of the new Primark in Downtown Crossing, BostonSource: Primark[/caption] Next week, on September 10, UK budget retailer Primark will open the first of its US stores, in Boston. The large (70,000-square-foot) store will be the first of eight initial US locations, and the opening is much anticipated. Primark is well known in Europe, but there is little awareness of the retailer in the US. We think that will quickly change. Primark’s mix of ultralow prices and fashionable—and, ultimately, disposable—product gives it a distinct market niche, and one that we expect to go over well in the States. For the benefit of our US readers, here is a Primark primer: It is not H&M or Zara. Some analysts have been tempted to put H&M, Zara and Primark in one “European fast-fashion” bucket. We think this is based on a misunderstanding of the distinct positioning of each of these retailers and, in Primark’s case, such a categorization understates its value positioning. A recent study by Morgan Stanley found H&M to be, on average, 107% more expensive than Primark across 100 items and three European cities. In Britain, for instance, Primark offers women’s dresses from £5 (US$8), men’s jeans from £8 (US$12) and men’s chinos from £10 (US$15). H&M’s cheapest options are women’s dresses at £7.99 (US$12), men’s jeans at £14.99 (US$23) and men’s chinos at £19.99 (US$31). Price drives volume. Because prices are so attractive, impulse purchasing is high. In our store visits, we have observed that browsing shoppers are hard pressed to limit their purchases, so they often heap another item onto their overflowing shopping baskets. But it is not just low prices. Primark’s strengths are that it mixes compelling prices with a fast-fashion outlook, bringing new ranges to stores frequently and offering on-trend product that young shoppers want to buy. These fashion ranges are complemented by a strong range of basics. This is not about drab, supermarket-style clothing; it is about semidisposable clothing with a convincing fashion edge. Primark invests in stores. Primark stores are typically big, multifloor spaces—and they have been getting bigger in recent years, partly as a result of a strategy to put flagships in major European cities. The average Primark store offered a little over 37,000 square feet of net selling space in the first half of 2015, we calculate, up from just under 32,000 square feet at year-end 2010. Moreover, the glossy, feature-heavy appearance of these stores shows that Primark does not neglect the in-store experience, despite its price positioning. US stores will be bigger. Primark’s new US stores will be even bigger than the average, which is already substantial. Seven of its first US stores will be sublet from existing Sears department stores, and their average size will be nearly 57,000 square feet, we estimate. We expect the biggest, at the King of Prussia Mall in Pennsylvania, to come in at 75,000 square feet of net selling space. Higher densities in new stores. Far from needing time for new space to mature, Primark consistently reports that its newer stores outperform. In its most recent trading update, the company said it had seen “very high sales densities” in stores opened within the past year. It also recently said that some of these new stores “now regularly feature in Primark’s top 20 stores by annualized sales.” The quality and size of its newest stores may be factors, but a much bigger one is that Primark is, in many cases, expanding into areas where shoppers have not previously had access to its stores—as will be the case when the Boston store opens next week. We think a number of these indicators bode well for Primark’s move into the US. Moreover, the midmarket American consumer has shown a recent reluctance to spend big on apparel—so Primark is likely to resonate with cautious shoppers who still want to look great. We expect a number of US apparel retailers are more than a little nervous—and they should be.

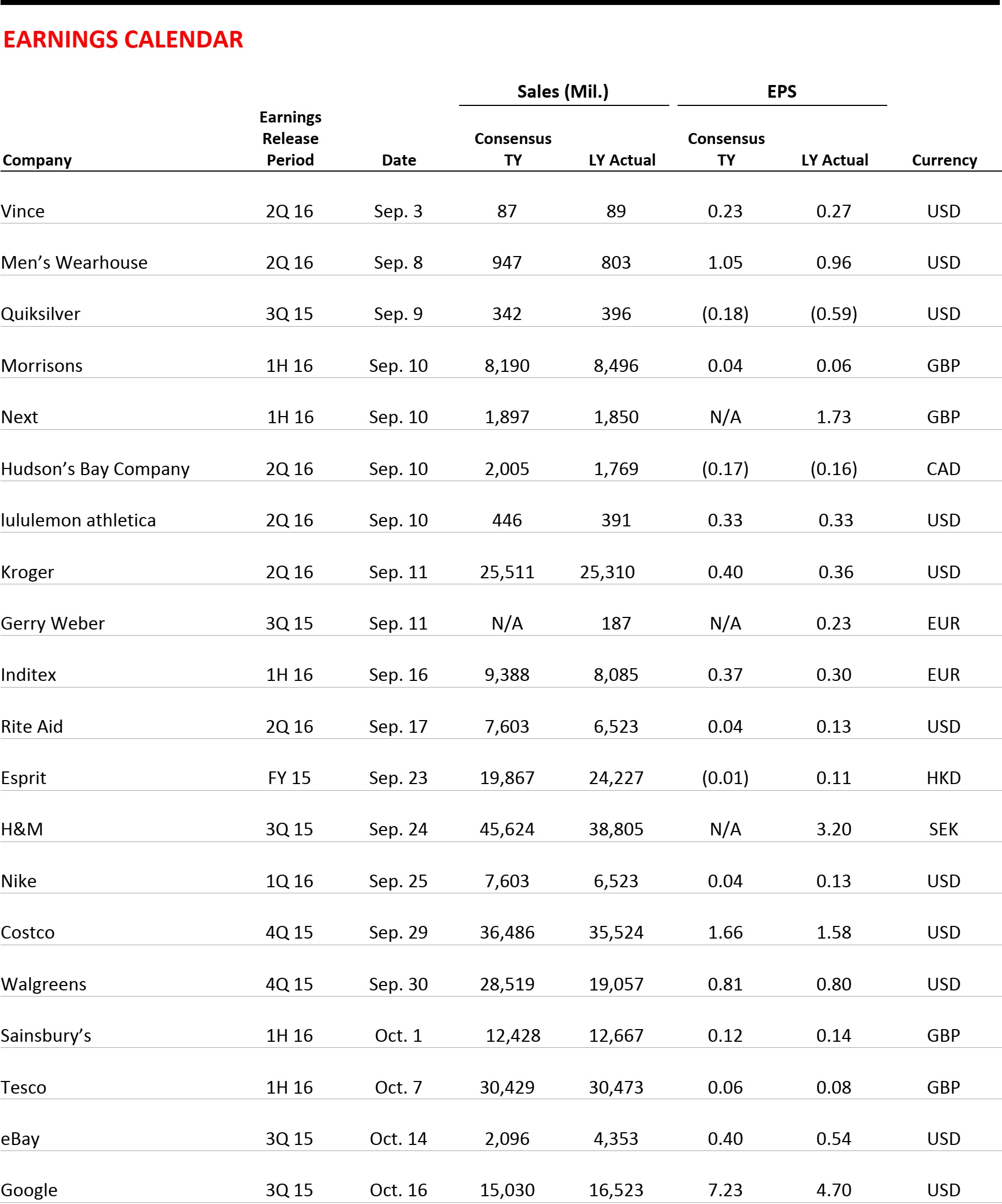

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- Department store giant Macy’s formed an exclusive partnership with young tech-fashion company Nineteenth Amendment. Nineteenth Amendment consists of 350 up-and-coming designers who present collections that, if purchased by a consumer or retailer, are produced in local US factories. Terry Lundgren, Chairman and CEO of Macy’s, said the service provides “independent designers a risk-free way to come to market.”

- The partnership’s goal is to connect Macy’s with millennial shoppers. For its part, Macy’s will link to Nineteenth Amendment on its website and eventually have the ability to give shoppers exclusive first-access pieces from specially selected collections.

- An Amazon Prime program nicknamed Ship by Region will allow select merchants to choose how far they are willing to ship goods to Prime members by evaluating the distance between customer and item ordered. The program aims to increase the number of Prime-eligible items. Previously, all merchants had to ship their goods to Amazon warehouses first in order for them to be Prime eligible.

- The move is expected to attract more sellers, but restrict some of the company’s free delivery service features. By allowing direct-to-consumer shipping, Amazon seeks to reduce shipping costs. Such expenses rose by 29%, to $2.34 billion, in this year’s second quarter, outpacing a 17% increase in all operating expenses, according to the The Wall Street Journal.

- Walmart is scaling back employee hours at some stores in an effort to reduce costs. The push to save on staffing comes as the company is spending money on increasing staffing at peak hours and making stores more efficient and pleasant to shop in. The cuts affect only stores that are exceeding their budget for staff.

- In April, Walmart increased the company-wide minimum wage to $9, and it plans to increase pay to $10 for many employees in February.

- Fresh Market named former Food Lion CEO Richard Anicetti as its new CEO late Tuesday. Anicetti served as President and CEO of Food Lion for eight years. Fresh Market shares were unchanged after hours at $21.16.

- In August, the company issued financial projections that were below Wall Street consensus, noting that its push to reverse a sales decline by cutting prices and increasing promotions has not paid off. Comparable-store sales fell 1% for the quarter ended July 26. The grocery retailer operates 176 stores, and its largest presence is in the southeastern US.

ASIA HEADLINES

- Pioneer has developed an inexpensive, laser-based, 3D measurement system for self-driving cars that is designed to serve as the vehicles’ eyes. Using existing manufacturing equipment at its factory in Saitama Prefecture, the cost could be less than ¥10,000 by 2025, once the product enters into mass production.

- Pioneer has completed a prototype and plans to begin road tests in 2016 on cars operated by a subsidiary that produces digital maps. It aims to have a version for commercial vehicles ready in 2017, and a version for consumer cars out as early as 2018.

- When it started last March in Kuala Lumpur and Jakarta, online grocery delivery service HappyFresh promised grocery delivery (by professional shoppers) to customers in an hour. The service is now available in Bangkok and will soon be available in Taipei.

- “Our plan is to become Southeast Asia’s leading food marketplace company, and we want to operate in all major, traffic-congested mega cities in the region,” said Markus Bihler, Group CEO and Cofounder of HappyFresh.

- People in India are slowly adopting digital and electronic payment modes. However, payment startups face challenges, such as lack of customer awareness regarding products and how to use them, fears about security, and concerns about product and service delivery.

- Android security scanner Appvigil found that e-wallet apps have vulnerabilities, including the possibility of Android malware infection and multiple loopholes that allow hackers to access databases with users’ credit card numbers, user names, session IDs and even passwords.

- HTC Cofounder Peter Chou has taken an Executive Director role with Hong Kong–based Digital Domain just weeks after HTC, which is struggling in its core smartphone business, said it was investing $10 million in virtual reality platform WEVR.

- Digital Domain was behind the effects in Iron Man 3, Transformers, Titanic, Her and Tron: Legacy, and has worked on major games such as Assassin’s Creed Unity, Destiny and Halo: The Master Chief Collection.

- Instead of having to search for special terminals that accept Apply Pay or Google Wallet, with Samsung Pay and a compatible device, customers can pay at just about every terminal in the US. Store owners do not need to add a special NFC reader, as Samsung devices and the Samsung Pay app communicate with the magnetic strip on the terminal.

- ZDNet reporter Matthew Miller visited a Target, a Walmart, a Haggen and a Shell gas station, and found that Samsung Pay worked at all of them, while neither Apple Pay nor Google Wallet worked at the Target he visited.

- A report by market research firm Daxue Consulting found that prospects are bright in China for mobile app makers. China has 1.28 billion mobile users, and the app market there is growing rapidly.

- While iOS downloads in China are increasing, Android users still account for the biggest share of the app market. The country has more than 200 Android app markets, with Baidu’s store ranking among the top.

- Bangalore-based Qwikcilver launched Woohoo, a gift card store that has partnered with brands from 400 cities. Woohoo allows a gift card receiver to choose a gift from categories such as kitchenware, apparel and jewelry. The cards can also be redeemed for experiences such as a trip to the movies, a spa visit, dining out or travel.

- The startup has partnered with 150 online and offline brands, including Shoppers Stop, Lifestyle, Titan, Madura Garments, Croma, Pizza Hut, Makemytrip, Flipkart and Amazon. Woohoo says it will add 1,000 new brands in the next year.

- The Henn-na Hotel (which translates as “Weird Hotel”) in Nagasaki is populated almost entirely by robots. A velociraptor robot and female humanoid check in guests at the front desk, while an automated cart takes luggage to guests’ rooms.

- This bodes ill for certain kinds of knowledge workers, who might face extinction. For example, expensive paralegals could be replaced by e-discovery software that rapidly sifts through documents. Dependable algorithms could replace financial planners. And the Associated Press is already using automated software to write stories that report quarterly earnings of companies.

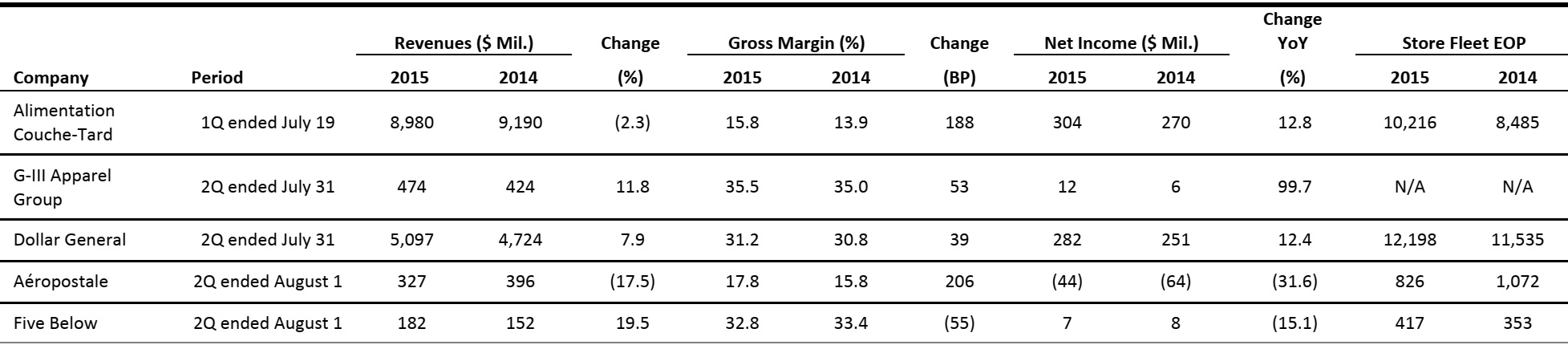

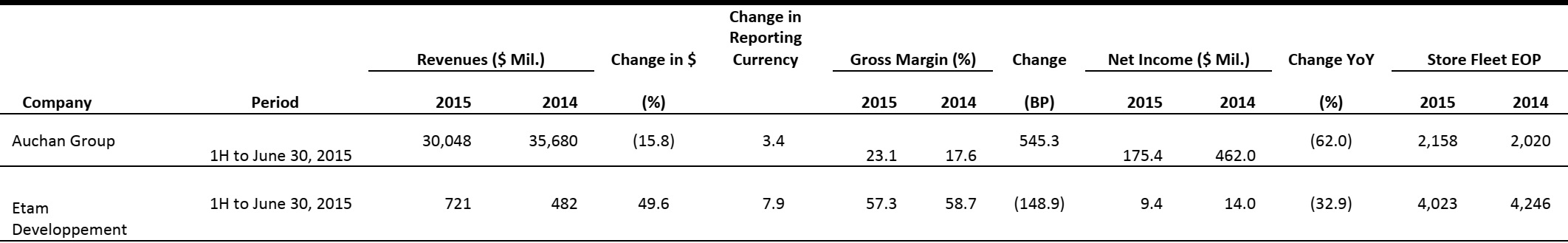

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

- Luxury retailer Net-a-Porter has made its social shopping network, The Net Set, available to the public. Launched in May 2015, the network was accessible by invitation only prior to August 27. The app allows users to create their own profiles with their image, and to interact with Net-a-Porter’s labels, search for products via the app’s visual search function and communicate with other users.

- The vice president of social commerce at Net-a-Porter stated the many benefits the app will bring to the retailer. Given the retailer’s access to customer data, the internal partners and brands will be able to analyze customers’ preferences through their discussions and comments, and provide products tailored to them.

- Toys R Us has secured its first retail locations in southern Ireland. One property, at Westend Retail Park in Dublin, comprises 10,000 square feet and has a mezzanine floor of an additional 7,000 square feet. The other is at Parkway Retail Park in Limerick; it has 17,800 square feet of floor space.

- The Ireland CEO of Toys R Us stated that the company plans to open 10 outlets in Ireland over the course of five years. Toys R Us operates more than 1,500 stores worldwide, with 50 in the UK.

- Asda has relaunched its e-commerce site with improvements in order to enhance the user experience and create a bigger brand impact. As a result, the number of site visitors has increased by 24,000 per day, and the percentage of visitors who leave without going past the first page has dropped by 37%, according to the agency that redesigned the site.

- Some of the main changes to the site were the addition of a “Popular on Asda.com” section, and a reduction in the number of top-visited sections from six to four: Groceries, George Fashion, George Home and Money. The website also highlights how Asda supports communities in which it operates and how it helps customers.

- Danish footwear chain Ecco will open 25 new stores in Britain to strengthen its position on the high street. The group has nearly doubled in size over the last three years, and its UK store count is currently 40.

- The new shops are set to open in Leeds, Bromley, Manchester and Newcastle. The retailer’s flagship store on London’s Oxford Street will reopen this week after refurbishment as part of the company’s expansion plan. The company’s UK managing director stated that Ecco plans to open about 35 stores in Europe per year.

- UK high street retailers experienced disappointing sales as customers chose to shop at retail parks due to heavy rainfall over the extended Bank Holiday weekend. The footfall at high street stores dropped by 1.4% over Sunday and by 0.1% through the weekend.

- Over the entire weekend, footfall at shopping centers increased by 6.2%, and at retail parks, footfall jumped 8.5%. Average footfall during this year’s August Bank Holiday weekend increased by 3.4% overall across the three formats, compared to a 5.4% decline last year.

- The limit for a single payment made through a contactless card in the UK has been raised from £20 (US$31) to £30 (US$46). The contactless method, which allows users to pay with a single swipe of their card without having to enter a PIN or sign, was introduced in 2007 for low-value payments.

- More contactless transactions are reported to have taken place in 2014 than in the previous six years combined, according to the UK Cards Association. Though the new limit took effect September 1, not all retailers will have the option to provide it until their payment terminals are upgraded with new software. Currently, there are 58 million contactless cards in use in the UK.

- Nick Robertson, the CEO of ASOS—the major UK online-only fashion retailer—will resign from his position, 15 years after he cofounded the business. COO Nick Beighton will replace Robertson, who will continue with the company as a nonexecutive director.

- ASOS grew to be a leader in fashion e-commerce, with annual sales in excess of £1 billion (US$1.54 billion). Robertson’s stake in the company is worth around £200 million (US$307.74 million).

- Considering the sales surge and impact of Black Friday last year, global e-commerce consultancy Salmon has predicted that this year’s Black Friday (November 27) will be the first shopping day when UK online sales will reach £1 billion (US$1.54 billion). This landmark value is expected to be driven by a heightened awareness of Black Friday and by the deals offered by retailers.

- Salmon predicts that the number of UK shoppers who will buy online on Black Friday will be four times higher than last year. The consultancy also stated that retailers would inform customers early about some sale items, which could cause demand to surge in the days leading up to Black Friday.

LATAM HEADLINES

- Internet sales for 41 US retailers (excluding Walmart) grew by 18% in 2014, according to Internet Retailer’s recently published Latin America 500.

- Sales are expected to accelerate despite some challenges due to increasing numbers of Internet users and online shoppers, and strong demand for US products.

- Particular opportunities exist in the fashion and apparel, sporting goods, and health and beauty categories.

- The default rate on speculative-grade, issuer-weighted corporate bonds increased to 4.2% in the 12 months ending June, up from 3.1% a year ago, according to Moody’s Investors Service.

- This percentage derives from 10 defaults, eight of which were in Brazil, four of which were in the capital industry sector and three of which were in the technology sector.

- Moody’s expects the default rate to range from 1.9% to 4.2% through the first half of 2016.

- São Paulo–based startup Nubank, backed by two venture capital firms, is trying to break into the Brazilian consumer debt market.

- Brazilian credit card companies currently charge rates as high as 500%, whereas Nubank plans to offer monthly rates of 7.75%, which amounts to 145% annually.

- Nubank’s customers have already opened 150,000 accounts. The company’s customer base has been growing by about 60% a month, moving Nubank closer to its goal of reaching 1 million customers, or 1% of the Brazilian market.

- Home Depot, now with coverage across Mexico, plans to moderate its number of new store openings in Mexico to five to six per year.

- The company plans to invest MXN500 million (US$29.5 million) in Mexico and bring its store count there to 116 by the end of the year.

- Since its arrival in the country in 2001, Home Depot has invested a total of MXN28.5 billion (US$1.7 billion) there.

- Fast-food chain Subway plans to open 100 new stores in Mexico in 2015, representing a 12.3% increase in the number of outlets.

- The company has 1,000 outlets in Mexico today; 60 new stores already opened this year and another 40 openings are planned during the remainder of the year.

- According to Euromonitor, Subway is the number-two fast-food chain in Mexico (ranked by sales) with an 8.7% share, after leader FEMSA, which leads via its OXXO shops.