FROM THE DESK OF DEBORAH WEINSWIG

Seamless Where It Matters

“Seamless” is perhaps the most overused word in retailing. Everything from mobile apps to personalization to ship-from-store is proclaimed as contributing to a seamless cross-channel shopping journey. However, a couple of recent shopping experiences underlined for us that the kind of seamlessness that really matters has to do with inventory—specifically, the view and management of it. Both of our recent experiences were at major retailers that have poured money into cross-channel services such as buy-and-collect and reserve-and-collect (where the payment is made in-store).

On our first trip, we opted to reserve a couple of sweaters at a major fast-fashion retailer, using its reserve-and-collect service. After finalizing the process on our part, we turned up at the store only to find the staff had no record of the reservation, although the sweaters were indeed in stock in the store. Fully 36 hours after the reservation was placed, this retailer sent us emails to advise us that the items we wanted could not be reserved because they were not in stock. This may have been because we had bought them in the meantime, but it also may have been because the company had an inaccurate view of its stock.

Before we set out on our second shopping trip, we checked availability online of a laptop at a local branch of a major electronics retailer. Confident that the product was in stock at the price we wanted to pay, we headed to the store. However, the retailer would not sell us the laptop at the price listed on its website: it wanted to charge a premium because the only one in stock had been “pre-set up” for less-tech-savvy customers. In this case, then, the issue was that the product listed online was not the same one being offered in-store.

Retailers have been highly focused on getting the logistics right for buy-and-collect services—and rightly so. While online stock availability checkers and reserve-and-collect services tend to be less common than buy-and-collect services, they require similarly precise visibility into where and what a retailer’s stock is.

Radio-frequency identification (RFID) is perhaps the most promising technology for tracking products across the supply chain, and we expect more retailers to adopt this technology due to the several benefits it can provide. RFID can help retailers locate inventory, and management consultancy Kurt Salmon estimates that finding inventory in time can boost a retailer’s sales by 3%–5%. It can also help retailers limit out-of-stock situations, reducing the likelihood of an item being out of stock by 60%–80%, according to ABI Research. RFID can facilitate the pooling of inventory between stores and distribution centers, too, which allows retailers to ship online orders more quickly: Nordstrom claims that such integration contributed to a jump in its online sales. Finally, better inventory management arising from use of RFID reduces overstocks and, in turn, the need for markdowns.

Technology aside, this is about retailers getting the basics right, and making promises to customers only if they are confident they can deliver on them. For shoppers, being able to buy the product they expect to buy is likely to be far more important in terms of a seamless journey than bells and whistles such as a personalized home page or a mobile app providing a live count of their reward points.

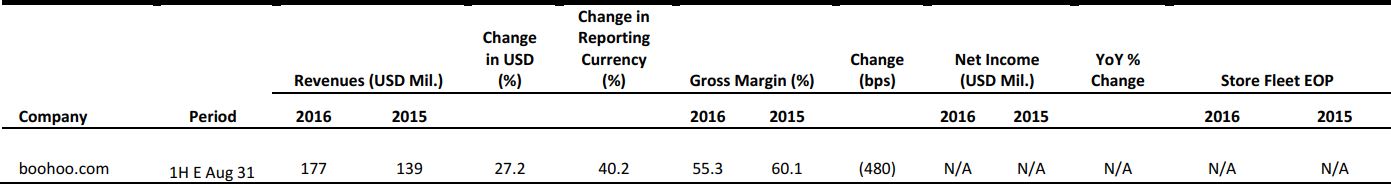

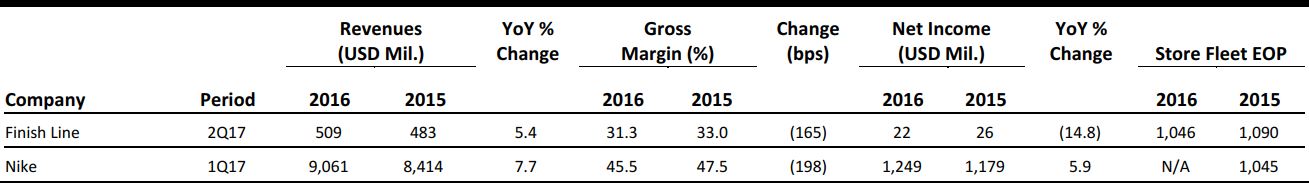

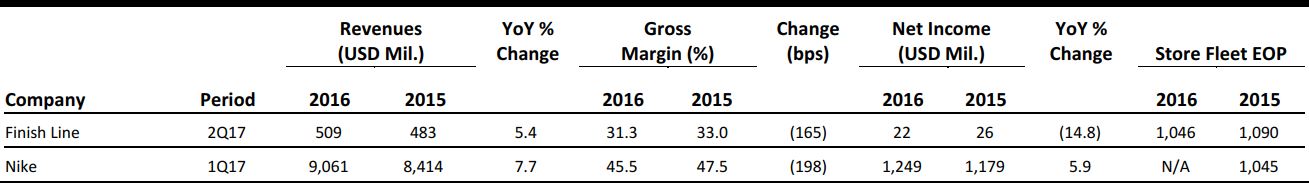

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Why Can’t a Store Be More Like a Website?

(September 27) The Wall Street Journal

Why Can’t a Store Be More Like a Website?

(September 27) The Wall Street Journal

- Luxury retailers are struggling with the paradox of online versus in-store traffic. Online, they are getting a lot of traffic, but sales are relatively low. Meanwhile, in stores, conversions are better, but they struggle to bring in shoppers.

- Saks Fifth Avenue thinks it has the solution with its new store, called Saks Downtown, located in lower Manhattan. The new store offers web-inspired features that aim to meld the online and offline experiences.

Why Fashion Brands Are Gaga for Chatbots

(September 23) Glossy

Why Fashion Brands Are Gaga for Chatbots

(September 23) Glossy

- For fashion, chatbots bring an element of the in-store experience online through immediacy, intimacy and personalization. Both Tommy Hilfiger and Burberry introduced Facebook Messenger chatbots during their recent Fashion Week shows.

- According to retailers, the next step for chatbot development is figuring out how to give chatbots a personality that is consistent with their brand. For example, Tommy Hilfiger’s chatbot, which launched as part of its collaboration with Gigi Hadid, is designed to sound like it is Hadid herself who is talking to the user.

Google Lets Retailers Connect the Dots Between Digital Ads and Offline Sales

(September 26) Internet Retailer

Google Lets Retailers Connect the Dots Between Digital Ads and Offline Sales

(September 26) Internet Retailer

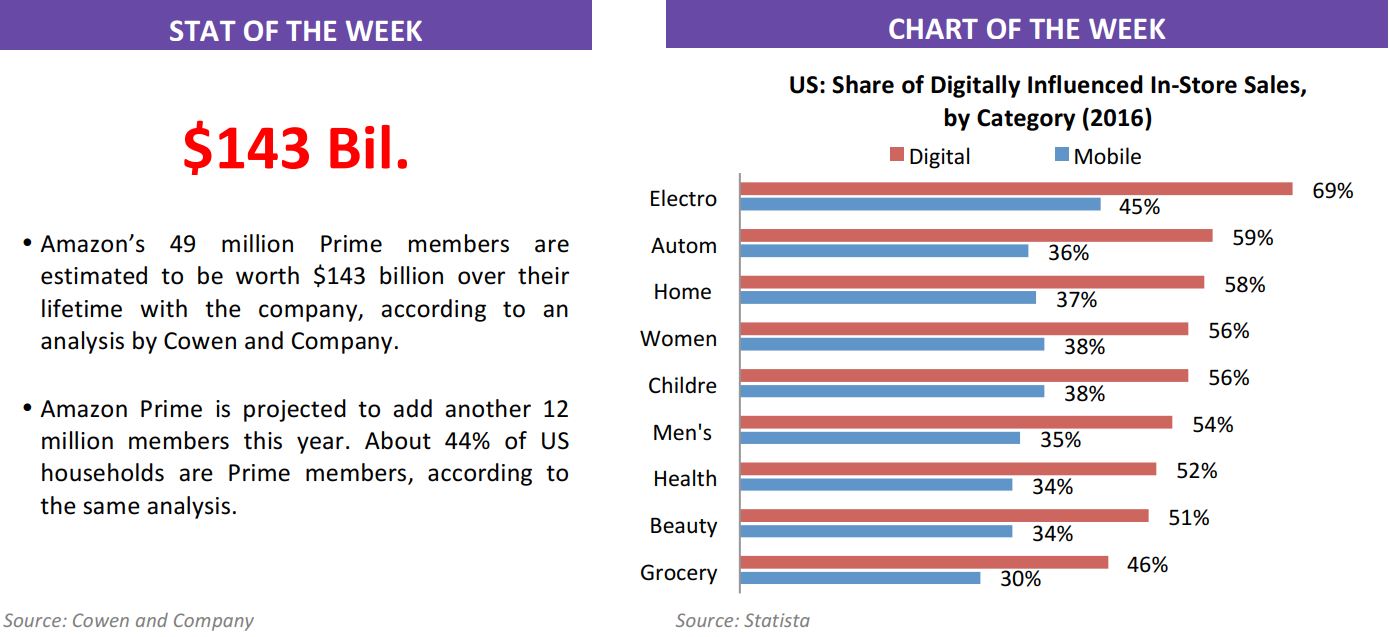

- Google released new methods for marketers to track the impact of ads on in-store sales. The search giant seeks to address the facts that 75% of consumers’ online time is spent on mobile devices and 49% of purchases are digitally influenced.

- Rather than relying on cookies and mobile IDs to track users, Google will begin using users’ login information to identify them and tie together information across their devices. Since users have an average of 3.64 devices, this method will be much more accurate for targeting ads and tying them to purchases.

FedEx Reveals Anticipated Holiday Delivery Trends

(September 27) Business Insider

FedEx Reveals Anticipated Holiday Delivery Trends

(September 27) Business Insider

- FedEx is preparing for a holiday season filled with online shopping. The company’s US holiday shipments rose by 12% year-over-year last year. In response to the expected increase in e-commerce during the coming holiday season, FedEx plans to hire 50,000 seasonal workers.

- FedEx is also preparing for other e-commerce-driven trends: it anticipates busier Mondays—in response to retailers using their brick-and-mortar stores to fulfill online orders—and that larger items will become more common. The company believes that as consumers become more comfortable with e-commerce, they will order a wider variety of things online, including more large items.

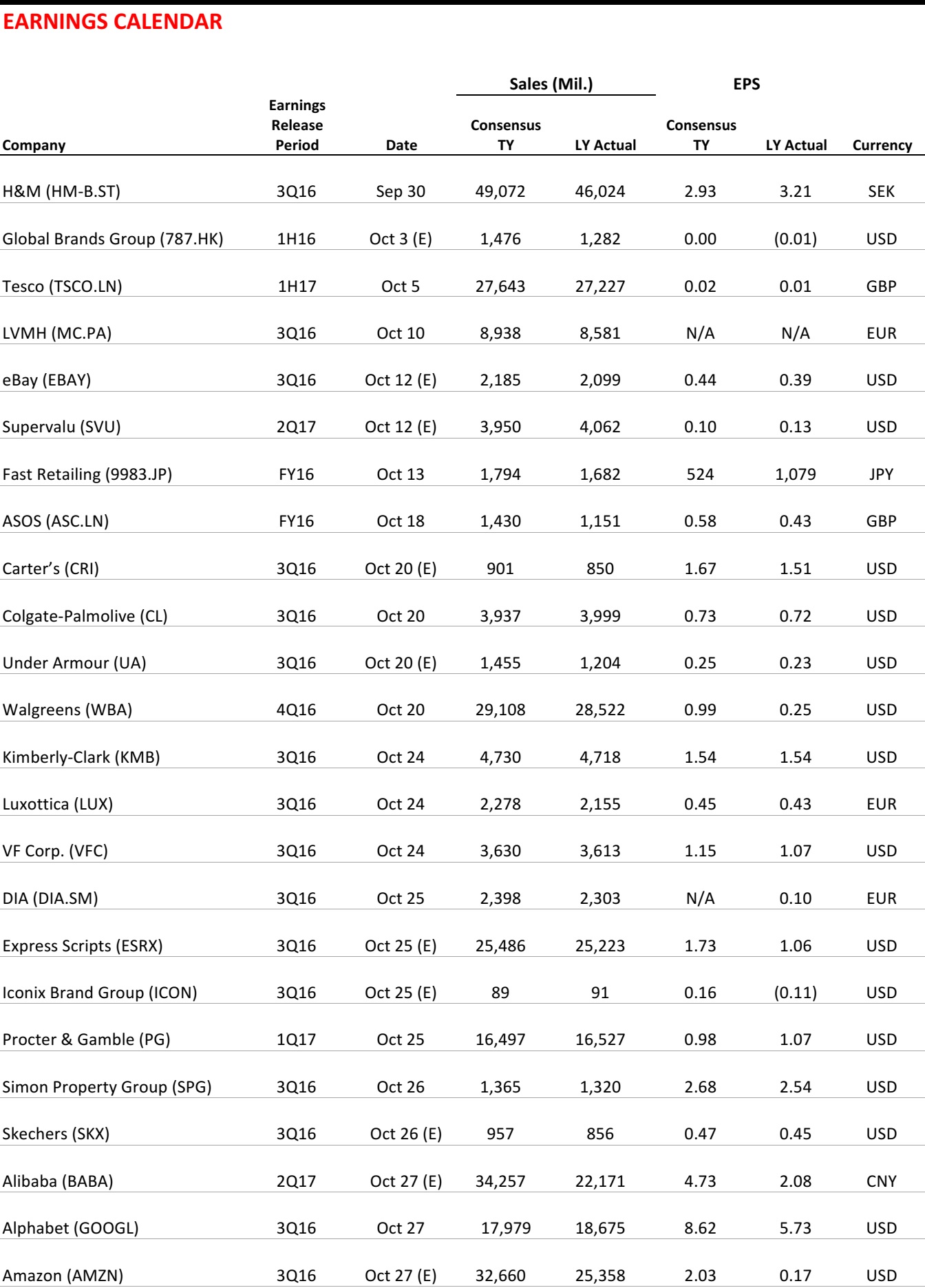

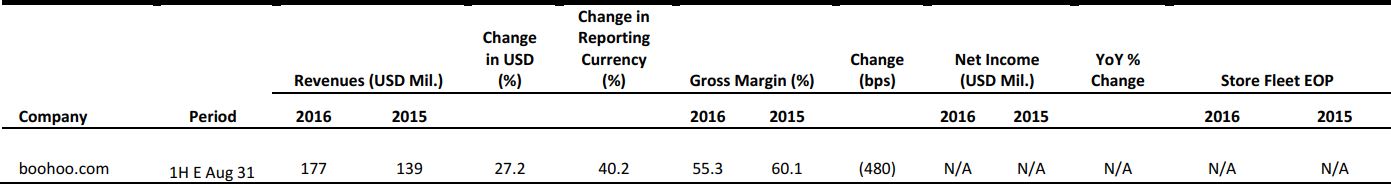

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

Sainsbury’s to Launch One-Hour Delivery in London

(September 26) The Guardian

Sainsbury’s to Launch One-Hour Delivery in London

(September 26) The Guardian

- British supermarket chain Sainsbury’s has developed an app called Chop Chop, through which shoppers in selected areas in London can order up to 20 items to be delivered from a local store within an hour. Groceries will be delivered by bicycle with the help of a team of 40 cyclists and grocery pickers.

- The service is expected to especially rival Amazon’s one-hour grocery delivery service, which launched in the UK last year.

BHS to Relaunch Online

(September 25) The Guardian

BHS to Relaunch Online

(September 25) The Guardian

- On September 29, collapsed British retailer BHS relaunched its online shop, BHS.com. The company closed its last department stores in August.

- At first, the website will sell lighting and home furnishing products; clothing lines and kitchen and dining ranges are to be added in the coming weeks.

Iceland May Have to Give Up Its Brand Name

(September 23) The Telegraph

Iceland May Have to Give Up Its Brand Name

(September 23) The Telegraph

- The Icelandic government is considering a lawsuit against British supermarket chain Iceland over its trademark.

- Promote Iceland, the Icelandic tourism board, argues that the supermarket chain has benefited from positive media coverage of the country.

Adidas Speedfactory Produces Its First Shoe

(September 23) VampFootwear.com

Adidas Speedfactory Produces Its First Shoe

(September 23) VampFootwear.com

- The Adidas Speedfactory in Ansbach, Germany, which utilizes robots to automate the shoe production process from start to finish, has produced its first sneaker, called the Futurecraft M.F.G. (Made for Germany).

- Adidas claims that Speedfactory enables greater customization in terms of fit and faster design adjustments, if needed, as well as providing more sustainable manufacturing processes. The company is planning to open a similar factory in Atlanta, and construction is set to be completed in 2017.

Amazon Handmade Expands Across Western Europe

(September 22) Fortune

Amazon Handmade Expands Across Western Europe

(September 22) Fortune

- One year after Amazon Handmade, Amazon’s digital marketplace for craft goods, debuted in the US, the Etsy competitor is expanding to Europe.

- Customers in Germany, France, Italy, Spain, the UK and other countries in Europe can shop the e-commerce platform for more than 30,000 handcrafted items, including jewelry, home décor and furniture.

ASIA TECH HEADLINES

Huawei Launches Low-Tier Smartphone in Korea

(September 27) ZDNet

Huawei Launches Low-Tier Smartphone in Korea

(September 27) ZDNet

- China’s Huawei has launched a budget smartphone, the H phone, in South Korea. The handset, to be sold only through local cellular company LG Uplus, will cost KRW242,000 (US$217) and will be available in both black and white.

- The smartphone market in South Korea, which is dominated by local vendor Samsung, is seeing rising demand for budget-friendly phones. Foreign firms are either reentering the market or continuously launching low-end models.

Alipay Targets Chinese Outbound Tourists

(September 26) Reuters

Alipay Targets Chinese Outbound Tourists

(September 26) Reuters

- China’s Alipay payments platform has reached deals with 10 overseas airports and has signed up more than 80,000 merchants worldwide to meet the demand of Chinese outbound tourists, who are growing rapidly in number.

- Alipay owner Ant Financial, an affiliate of e-commerce giant Alibaba, is focusing on markets favored by Chinese travelers. The company aims to help foreign merchants sell products to Chinese tourists.

Linked Data Analytics Firm Latize Secures US$1.4 Million

(September 27) e27.co

Linked Data Analytics Firm Latize Secures US$1.4 Million

(September 27) e27.co

- Singapore-based linked data analytics firm Latize has secured US$1.4 million in funding from Tembusu ICT Fund 1, ACP and Spring Seeds Capital. The funding will be used to sharpen “productization” strategies and expand business and operations globally.

- Latize has expanded its support to key government clients and has scaled into new industry segments in Singapore and abroad, according to ACP.

Tencent to Donate 2% of Profits as Chinese Online Philanthropy Develops

(September 25) Reuters

Tencent to Donate 2% of Profits as Chinese Online Philanthropy Develops

(September 25) Reuters

- Tencent’s CEO announced that the company will donate 2% of its annual profits to charity. China’s charity sector is growing, supported by the use of mobile Internet.

- China recently introduced its first laws on charity, which went into effect on September 1. Tencent, Alibaba and Baidu are among the 13 platforms that are allowed to raise and manage funds for charity under the new laws.

LATAM RETAIL HEADLINES

Coca-Cola Femsa Buys Vonpar in US$1.09 Billion Wager on Brazil

(September 23) Bloomberg

Coca-Cola Femsa Buys Vonpar in US$1.09 Billion Wager on Brazil

(September 23) Bloomberg

- Coca-Cola Femsa, the largest soft-drink bottler in Latin America, agreed to buy Brazil’s Vonpar for US$1.09 billion. This marks the company’s third acquisition in Brazil since 2013.

- The purchase will boost Coca-Cola Femsa’s volume in Brazil by 25%. Vonpar is one of the largest privately owned bottlers in the Brazilian Coca-Cola system, and it generated sales of R$2.03 billion (US$620 million) in the 12 months ended June 30.

Your Morning Sip Will Cost More Thanks to Brazil’s Weather Woes

(September 25) Bloomberg

Your Morning Sip Will Cost More Thanks to Brazil’s Weather Woes

(September 25) Bloomberg

- Brazil has been experiencing dry weather across its coffee belt, hurting the production of arabica and robusta beans and pushing up the cost of the commodity. At the same time, the country has seen too much rain in citrus areas, hampering the production of orange juice, and frost in sugar-growing regions, which has cut yields.

- Brazil is the largest producer and exporter of all three products. Sugar and orange juice futures are trading near four-year highs in New York, and arabica coffee, the variety favored by Starbucks, reached its highest price since February 2015 in mid-September.

Brazil’s Economy Probably Starting to Rebound, Moody’s Says

(September 27) WSJ.com

Brazil’s Economy Probably Starting to Rebound, Moody’s Says

(September 27) WSJ.com

- Samar Maziad, Senior Analyst at Moody’s Investors Service, said that Brazil’s economy has probably started to rebound from its worst recession since the 1930s and that growth could surprise and come in positive next year.

- The completed impeachment process of Dilma Rousseff has cleared up some of the uncertainty that was weighing on the economy, and consumer sentiments are better than they have been in over a year.

Mexicans Remain Gloomy, but Still Spending Heavily

(September 26) Financial Times

Mexicans Remain Gloomy, but Still Spending Heavily

(September 26) Financial Times

- Unemployment is low in Mexico, and Mexicans are jumping into the formal job sector—although one would not know this speaking to consumers, due to their outward lack of faith in the administration of President Enrique Peña Nieto. According to the country’s national statistics agency, Mexicans have never been so pessimistic about the economy.

- Consumer credit is growing, however, and retailers are reaping the gains, with near double-digit sales growth for the past two years. Many retailers are also adopting their own loan divisions to stay in line with the credit system that consumers prefer in Mexico.

Why Fashion Brands Are Gaga for Chatbots

(September 23) Glossy

Why Fashion Brands Are Gaga for Chatbots

(September 23) Glossy