FROM THE DESK OF DEBORAH WEINSWIG

The Chinese shopper is coming, and big opportunities await retailers worldwide. That is the message from our newly published report,

The Chinese shopper is coming, and big opportunities await retailers worldwide. That is the message from our newly published report, Global Chinese Shoppers: The $200 Billion Opportunity

, a major study that we coproduced with consultancy firm China Luxury Advisors.

Chinese travelers are already the world’s biggest overseas spenders, and their average expenditure abroad is growing, giving a twofold boost to retail sectors globally. These consumers will continue to increase in importance over the coming years.

Our research found (or indicated) some startling numbers regarding these consumers’ value to retail:

- Overseas retail spending by Chinese tourists is expected to jump 23% in 2015, to $229 billion.

- By 2020, we estimate this group’s overseas retail spending will reach $422 billion—a projected five-year CAGR of 13%.

- We believe spending in some high-profile, long-haul destinations, such as the US, will grow at an even faster pace. And Hong Kong’s and Macao’s proportion of overall Chinese tourist spending will decrease as more travelers venture farther afield.

Underpinning these impressive retail numbers is a boom in outbound travel from China:

- Some 136 million international passenger journeys will originate in China in 2015, up 16% year over year, we estimate.

- We expect total outbound passenger journeys to roughly double between 2014 and 2020, to approximately 234 million journeys per year.

- Even amid concerns this summer over Chinese economic growth, the country’s international tourist numbers held up well, according to tourism offices and travel firms.

Our proprietary consumer research recorded the regional disparities in retail spending:

- The typical Chinese traveler currently spends an average of about $1,678 on retail purchases per overseas trip—and the greater the distance, the more he or she spends.

- In the US, the average retail spend per Chinese traveler will be $2,555 this year, while in Europe, it will be $2,548, we estimate. These figures are much higher than in closer destinations such as Hong Kong.

The numbers are promising, but there are still some challenges that arise from the changing nature of Chinese travelers. As more middle-income tourists venture overseas in the coming years, we think growth in average expenditure per tourist will moderate. And as more tourists gain confidence about traveling independently, tour groups will make up a diminishing proportion of the total, which means those retailers that have traditionally relied on funneling tour groups to their stores will have to work harder to attract tourist shoppers.

The impact of this coming growth will be felt most keenly by higher-end retailers. Already, more than 70% of Chinese luxury purchases are reportedly made outside China, and the clampdown on corruption is likely to push this number up as domestic luxury demand stagnates. It is imperative for high-end companies to carefully consider their strategy for reaching Chinese travelers.

Active brand management is crucial to capture the Chinese shopper’s attention and spend. This could necessitate opening stores in China, building media presence, working with Chinese celebrities and influencers, and/or engaging in an active ground game to reach Chinese tourists.

Big opportunities await, yet some things remain constant: retailers will, as ever, have to work hard to win share of wallet. We provide case studies of how some retailers and shopping centers are catering to Chinese travelers in our report, which also includes detailed results from our exclusive survey of Chinese consumers. You can download the full report from www.fbicgroup.com.

- Volkswagen’s share price crashed this week after the company admitted it had manipulated US car emissions tests. The world’s biggest carmaker said that software installed in 11 million of its vehicles was designed to reduce emissions only under test conditions.

- VW has set aside €6.5 billion (US$7.1 billion) for potential costs, but multiple sources say fines could run to US$18 billion.

- The company is now facing multiple probes in the US, including a criminal probe by the Department of Justice, according to BBC News. The UK and France have called for an EU investigation.

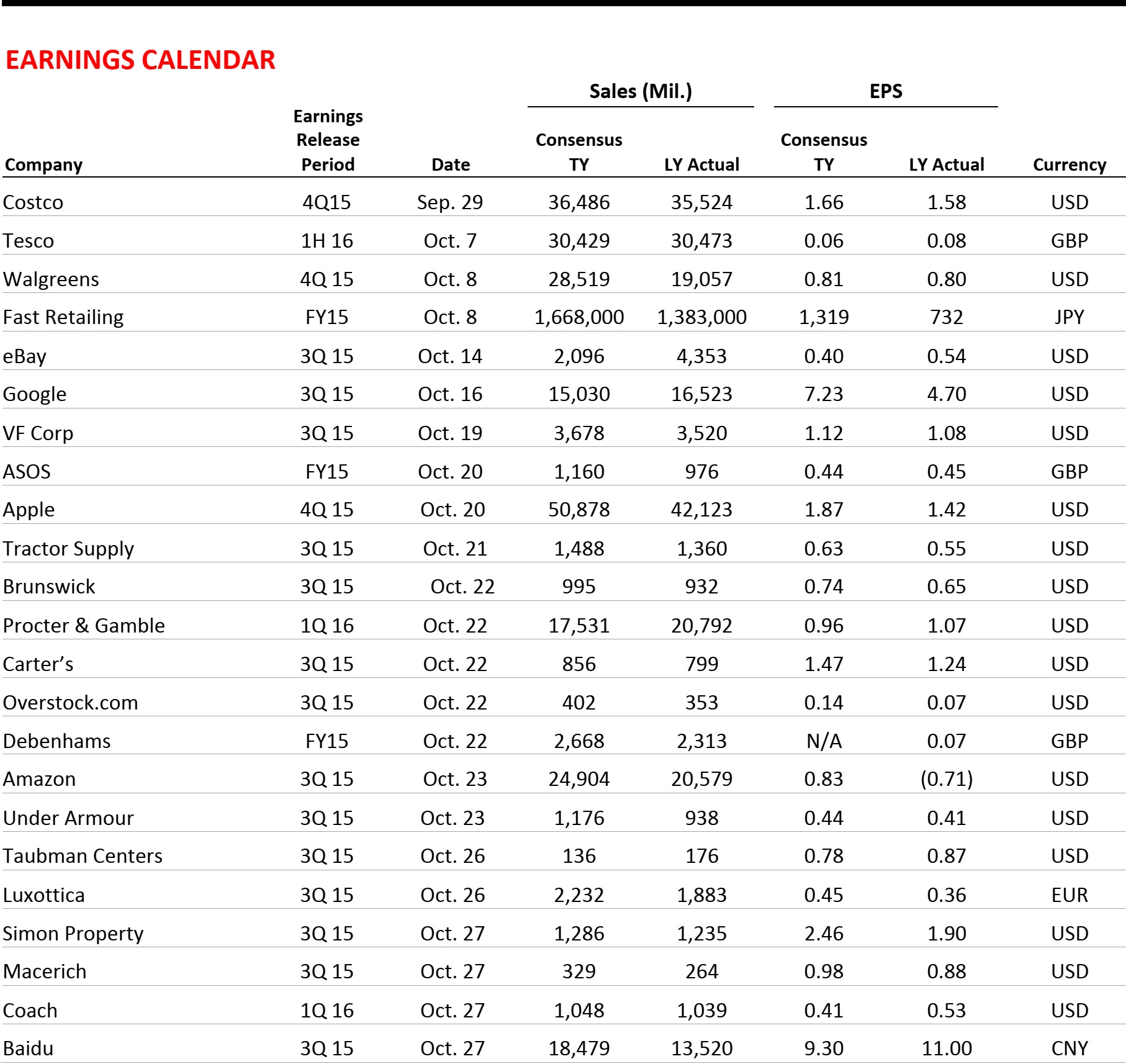

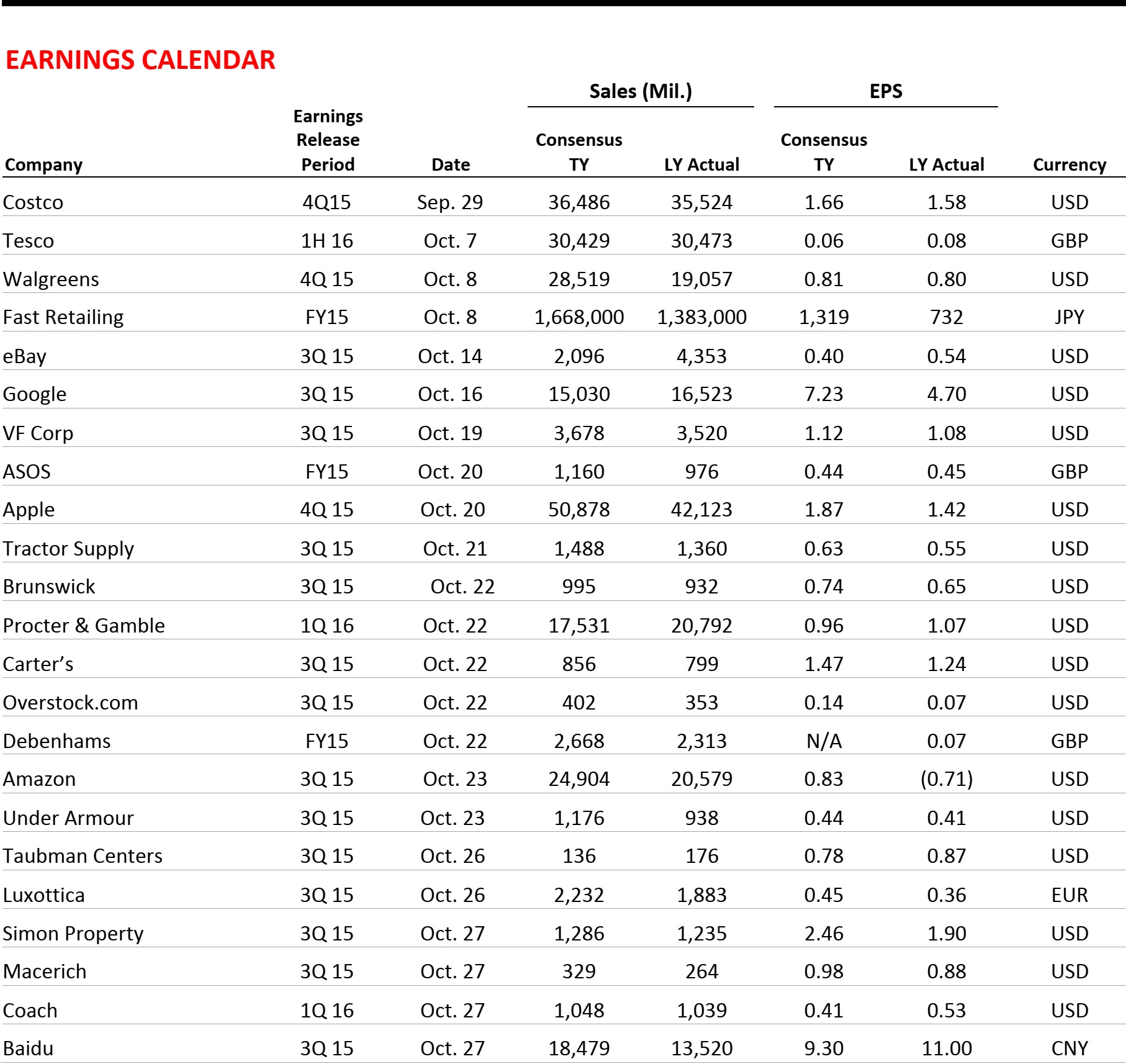

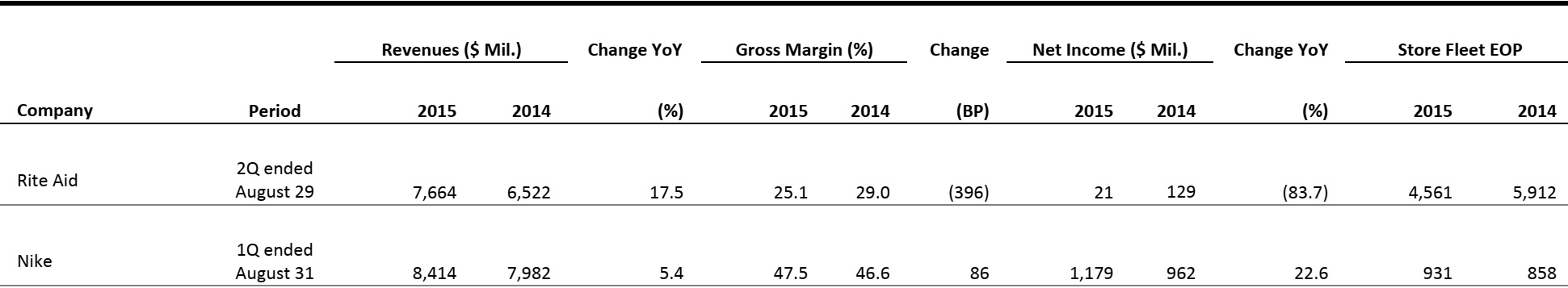

US RETAIL EARNINGS

Source: Company Reports

US RETAIL HEADLINES

JCPenney Replaces Chief Merchant Ahead of Holiday Season

(September 23) The Wall Street Journal

JCPenney Replaces Chief Merchant Ahead of Holiday Season

(September 23) The Wall Street Journal

- JCPenney has replaced its Chief Merchant and is promoting John Tighe, 46, to the role. As of October 1, he will be responsible for men’s, children’s and other sections.

- Tighe will be replacing Elizabeth Sweney, who has held the role since 2002. Sweney will continue in an advisory role until the end of the current fiscal year, when she will retire.

Macy’s Unveils Millennial Floor at Manhattan Flagship Store

(September 18) Women’s Wear Daily

Macy’s Unveils Millennial Floor at Manhattan Flagship Store

(September 18) Women’s Wear Daily

- Macy’s estimates that millennials have $65 billion worth of annual spending power for the level of products it offers. But the retailer knows that this group of consumers has favored specialty stores over department stores.

- At its Herald Square location, Macy’s has dedicated one floor, called One Below, as its “millennial floor” (the floor formerly housed home categories). The One Below floor blends fashion, food and technology, and houses junior apparel brands, accessories, beauty, a wearable technology shop and a 3D printing area.

Nordstrom Expanding Give-Back Brand

(September 22) Retailing Today

Nordstrom Expanding Give-Back Brand

(September 22) Retailing Today

- Nordstrom is expanding its cause-based brand, Treasure & Bond, to more merchandise categories. The brand is expanding to women’s footwear, handbags, accessories, and men’s and kid’s apparel.

- The brand has given almost $440,000 to Girls on the Run and to its first nonprofit partner, Girls Inc.

WalmartLabs Buys Tech Startup PunchTab for Sam’s Club

(September 22) Retailing Today

WalmartLabs Buys Tech Startup PunchTab for Sam’s Club

(September 22) Retailing Today

- WalmartLabs just acquired four-year-old startup PunchTab in an effort to help Sam’s Club better personalize its offers. The deal involves the purchase of the company, and six PunchTab employees will join WalmartLabs.

- The acquisition will help Sam’s Club enhance its customer relationship management tools. The deal is the 15th acquisition WalmartLabs has made within the last four years.

Staples Adds Online 3D Printing Service

(September 22) Retailing Today

Staples Adds Online 3D Printing Service

(September 22) Retailing Today

- Staples is bringing 3D printing service to a new online platform powered by Sculpteo. Customers can learn to use the service and upload their designs for Staples to print, or choose from some simple 3D-printed items at the online store.

- Staples was the first store to sell MakerBot 3D printers to consumers in 2013. IDTechEx expects the 3D-printing market to grow to $20 billion in the next 10 years.

ASIA HEADLINES

Singapore’s National Research Foundation to Invest Another S$28 Million in Startups

(September 21) TechinAsia

Singapore’s National Research Foundation to Invest Another S$28 Million in Startups

(September 21) TechinAsia

- Singapore’s state-run Early Stage Venture Fund (ESVF) announced that it will pour S$40 million (US$28.4 million) into establishing corporate venture funds by large local enterprises.

- Singapore’s National Research Foundation established the ESVF in 2008 in order to encourage researchers to commercialize their ideas and to help entrepreneurs establish and grow technology-based companies. The fund matches VC investments in early-stage tech startups on a one-to-one basis.

RedMart vs. HappyFresh: Southeast Asia’s Grocery War on the Horizon

(September 21) TechinAsia

RedMart vs. HappyFresh: Southeast Asia’s Grocery War on the Horizon

(September 21) TechinAsia

- HappyFresh currently operates in Jakarta, Kuala Lumpur and Bangkok, and plans to open stores in Taipei and Manila soon. RedMart operates in Singapore and Hong Kong, and plans to enter Indonesia, the largest and most important market in Southeast Asia.

- Apart from the US$12 million in funding that HappyFresh recently received, it is unclear how much money the firm actually has. Its seed round was undisclosed (as were its initial investors). RedMart, on the other hand, has raised nearly US$60 million in total.

Portea Medical, One of India’s Largest Home Care Providers, Gets US$37.5 Million from Accel

(September 21) TechCrunch

Portea Medical, One of India’s Largest Home Care Providers, Gets US$37.5 Million from Accel

(September 21) TechCrunch

- Portea Medical, a startup that provides in-home healthcare in India, has raised US$37.5 million in series B funding led by returning investor Accel. The round’s other participants include International Finance Corporation, a member of the World Bank Group, Qualcomm Ventures and Ventureast.

- Portea’s clinicians make 60,000 in-home visits every month in 24 cities, serving 50,000 patients. The company will use its new capital to expand into South/Southeast Asian markets and grow its employee count from 3,000 to 8,000 over the next 18 months.

Xiaomi’s Ambition to Rule the World of PCs

(September 21) ZDNet

Xiaomi’s Ambition to Rule the World of PCs

(September 21) ZDNet

- Sources say that Xiaomi has been holding chats with Samsung Electronics regarding using Samsung memory chips for a Linux-based laptop. The Xiaomi laptop would be priced around US$470 and introduced in early 2016. Xiaomi may even source displays from Samsung.

- PC shipments have been declining since 2012, when they dropped by 2.6%, according to Gartner. In 2014 and 2013, shipments declined by 0.8% and 11.1%, respectively.

Taiwan’s Hon Hai Offers to Buy Sharp’s LCD Business, Wants Apple Funds

(September 21) ChannelNewsAsia

Taiwan’s Hon Hai Offers to Buy Sharp’s LCD Business, Wants Apple Funds

(September 21) ChannelNewsAsia

- The Nikkei Business Daily reported that Taiwan’s Hon Hai Precision Industry (also known as Foxconn) offered to buy Sharp’s struggling liquid panel display business and that it plans to seek funding from Apple.

- Sharp was formerly a highly profitable premium TV manufacturer and one of Apple’s favored screen suppliers, but it has suffered under heavy pricing pressure from Asian rivals. In May, it sought a bailout of roughly US$1.9 billion from banks and said it would cut 5,000 jobs, or 10%, of its staff.

WeChat to Add Free Group Video Calls in China

(September 21) e27.co

WeChat to Add Free Group Video Calls in China

(September 21) e27.co

- In its latest test build, WeChat finally added the long-expected group call with voice and video service to its product line.

- Unlike Line, another popular messenger app, WeChat has successfully integrated unrelated services, such as a running tracker, e-books, mobile games, mobile payments and the Internet of Things, into its app.

Sydney’s Divvy Parking Plans to Drive into Hong Kong

(September 21) e27.co

Sydney’s Divvy Parking Plans to Drive into Hong Kong

(September 21) e27.co

- Divvy Parking is a Sydney-based startup that helps drivers find a parking space by allowing them to book a slot online and check the availability of parking spaces in a particular area. Listing a parking space is free; the company profits by taking a cut of the rentals.

- “Cities are growing at a rapid pace and there’s pressure to create smarter technologies for existing infrastructure. One thing that can be significantly improved is parking. In Hong Kong, you have hardly any street parking. There has been a growth in the number of car owners, but not parking,” says Nick Austin, CEO of Divvy Parking.

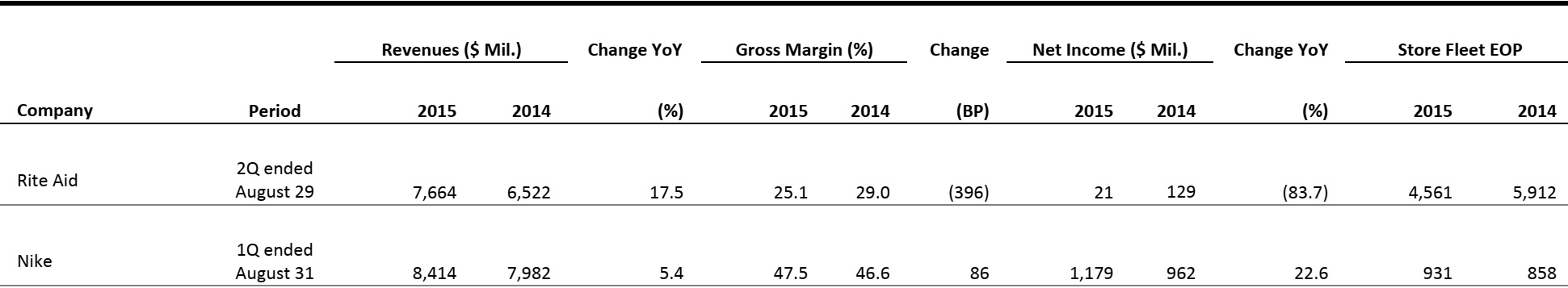

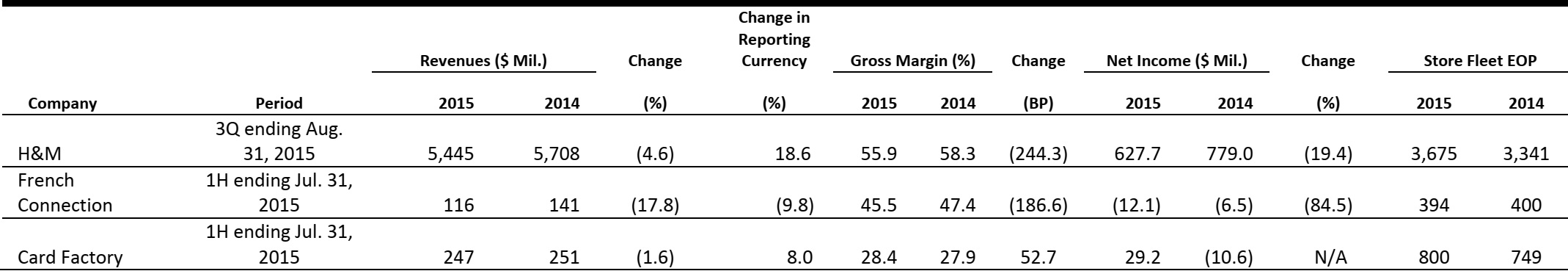

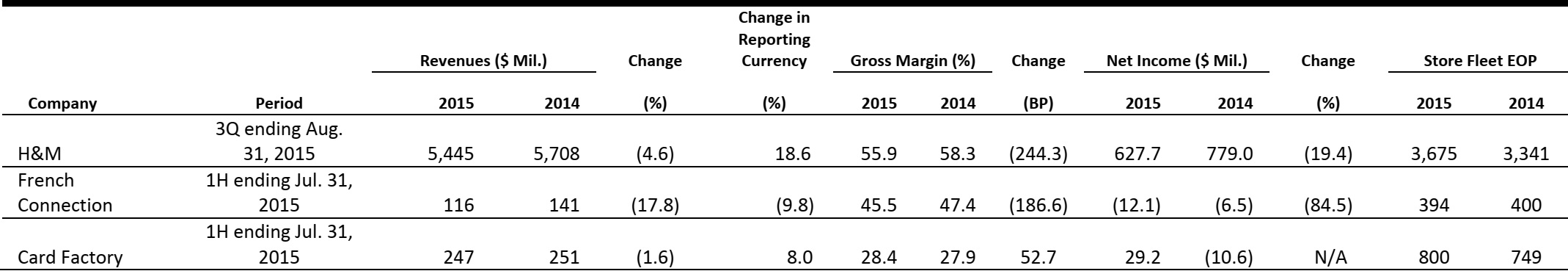

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

Mr. Bricolage Not Interested in Bricorama’s Bid

(September 16) Retaildetail.eu

Mr. Bricolage Not Interested in Bricorama’s Bid

(September 16) Retaildetail.eu

- Bricolage, one of the largest DIY chains in France, has declined Bricorama’s acquisition bid, which is reported to be for more than €150 million (US$164 million). Bricorama has 223 stores in its portfolio, with a turnover of over €1 billion (US$1.09 billion), and is much smaller than its target. Mr. Bricolage has 866 stores with a turnover of more than €2.2 billion (US$2.41 billion), although that is down 4.4% from the previous year.

- Groupe ADEO and Kingfisher (which Mr. Bricolage ended its association with a few months ago) currently dominate the French DIY market, holding 38% and 33% market share, respectively. Analysts feel a merger of Mr. Bricolage and Bricorama would benefit both chains by allowing them to compete more effectively.

Marimekko Grows Online Business in Europe

(September 18) WWD.com

Marimekko Grows Online Business in Europe

(September 18) WWD.com

- Finnish clothing and textile retailer Marimekko has launched e-commerce sites in the UK, France, Germany, Italy, Spain and the Benelux countries. The company, known for its characteristic prints and bold designs in clothing, textiles and home furnishings, already has online stores in Finland, Sweden, Denmark and the US.

- Tiina Alahuhta-Kasko, the President of Marimekko, stated that e-commerce sales contributed a significant proportion of revenues, but did not mention specific figures. Marimekko has 150 stores globally, and the company plans to open 10 to 20 shops this year, with a main focus on the Asia-Pacific region.

Tesco May Abort Sale of dunnhumby

(September 22) Retail-week.com

Tesco May Abort Sale of dunnhumby

(September 22) Retail-week.com

- Tesco may abort its initial plans of selling dunnhumby, its data division, for £700 million (US$1,092 million). All but one of the bidders withdrew from the sale process because of financial concerns. Dave Lewis, Tesco’s CEO, will reportedly make a decision about the sale this week, with colleagues and advisers.

- Sources familiar with the matter suggested that no decision had been reached, but that Lewis was determined to make a quick decision and focus on strengthening the Tesco’s financial position. Sources also mentioned that the sole remaining bidder was WPP Group, the marketing-services giant, leaving Tesco with limited space for price negotiations.

Tomorrowland Now Has Its Own Store

(September 22) Retaildetail.eu

Tomorrowland Now Has Its Own Store

(September 22) Retaildetail.eu

- Tomorrowland, the popular Belgian dance festival, is set to open its own store on October 3 in Antwerp. The Tomorrowland Boutique will house a fashion collection and gadgets from the festival. The shop will also include a Tomorrowland History Room showcasing stories from around the world.

- A press release by the company stated that Tomorrowland is looking for 10 ambassadors from around the world who will become the “People of Tomorrow” and help inaugurate the boutique in a festive way. It also stated that shoppers can browse Tomorrowland’s winter collection and find many collections made in collaboration with international designers at the store.

House of Fraser Reports Strong Growth in Online Sales and 6.5% Growth in Comps

(September 22) Company press release

House of Fraser Reports Strong Growth in Online Sales and 6.5% Growth in Comps

(September 22) Company press release

- House of Fraser reported 30.8% growth in online sales, which represent 17.5% of total sales. In its half-year trading update, the British retailer reported a total gross transaction value of £574.2 million (US$896 million), with 6.5% growth in comps. Gross profit was £204.7 million (US$319.40 million) and adjusted EBITDA amounted to £9.2 million (US$14.4 million).

- The statement mentioned a challenging trading environment in August, which improved in September, and that the retailer is optimistic about the coming autumn/winter season. Nigel Oddy, the CEO, stated that the company was pleased with sales and profit growth in the first half of the year. He also said that House of Fraser is continuing to make progress on its international expansion plans.

Metro and Auchan Take Partnership to Next Level

(September 22) Retailanalysis.igd.com

Metro and Auchan Take Partnership to Next Level

(September 22) Retailanalysis.igd.com

- Metro and Auchan’s initial partnership has now been extended nationwide in France, and will cover negotiations for brands at a local level. Metro has made Eurochan—Auchan’s buying organization in France—responsible for buying negotiations in certain product categories and suppliers. The companies are, however, responsible for their own individual commercial strategies and sales policies, including for product ranges, pricing and promotions.

- Auchan’s chairman stated that the company wants to take advantage of the network in France by working together with Metro across formats and distribution channels. Auchan has 380 stores in France, while Metro has 93 Cash & Carry outlets.

Amazon France Opens Grocery Site

(September 22) Retailanalysis.igd.com

Amazon France Opens Grocery Site

(September 22) Retailanalysis.igd.com

- Amazon has launched two new sites in France, one for grocery and the other for beer, wine and spirits; in total, the two sites will cover 34,000 products. The grocery site carries 30,000 products across more than 25 categories, which include specialist ranges, local products and brands. The online retailer might extend the ranges after studying customers’ reception of the products.

- In Europe, France is Amazon’s third-largest market. The online retail giant has already added food ranges to its Italy site and is expected to announce AmazonFresh’s arrival in the UK soon.

HelloFresh Revenues Leap in First Half

(September 23) Reuters.com

HelloFresh Revenues Leap in First Half

(September 23) Reuters.com

- HelloFresh, a German online food delivery company, stated that its revenues grew by 408%, to €112.50 million (US$125 million), in the first half of the year through June. It said that it delivered ingredients and recipes for 18.2 million meals during the period, a rise of 355%. HelloFresh currently operates in the UK, the Netherlands, the US, Australia, Germany, Belgium and Austria.

- Incubator Rocket Internet owns 57% of HelloFresh, and it has interests in various other e-commerce companies. HelloFresh reportedly had 402,000 subscribers as of the end of June, and it may apply for a stock market listing in October.

LATAM HEADLINES

The Mall Is Becoming King in LatAm

(September 23) Financial Times

The Mall Is Becoming King in LatAm

(September 23) Financial Times

- Poor urban planning and high crime rates in many Latin American cities have increased the focus of international brands on shopping malls, particularly destination malls. There are currently 1,800 malls in Latin America and another 150 are under construction.

- Inditex Group (the parent company of Zara) has opened 15 stores in Latin America, and most of them are located in malls; the company plans open more than 30 stores by the end of the year.

International Companies Adapt to Recent Changes in Latin America

(September 23) Financial Times

International Companies Adapt to Recent Changes in Latin America

(September 23) Financial Times

- For more than a decade, employment, wages and the availability of credit have risen in Latin America, creating new brand-seeking, digital and innovation-hungry consumers, which has attracted global brands. Many global brands saw their sales in Latin America double from 2005 through 2014. Nestlé now receives 15% of its revenues from the region, which accounts for just 9% of the world’s population.

- Brazilians, who have a reputation for being spenders rather than savers, are expected to cut back on luxuries due to the current economic downturn, and retailers are expected to adapt by offering smaller, lower-priced formats in Brazil.

Brazil B2C E-Commerce Market Forecast to Exceed US$22 Billion in 2018

(September 22) MarketWatch

Brazil B2C E-Commerce Market Forecast to Exceed US$22 Billion in 2018

(September 22) MarketWatch

- German market research firm yStats.com estimated that the Brazilian B2C e-commerce market will exceed US$22 billion (€20 billion) in 2018. Brazil is 11th largest B2C e-commerce market worldwide, and the fastest growing in Latin America. However, it trails Argentina and Mexico in terms of its expected growth rate.

- In Brazil, department stores rank highly in terms of online shopping, and a large share of online purchases are for clothing and luxury items.

Amazon Aims to Use the Corner Store to Coax Mexicans to Shop Online

(September 17) Quartz

Amazon Aims to Use the Corner Store to Coax Mexicans to Shop Online

(September 17) Quartz

- In Mexico, Amazon is conducting a trial with the Oxxo chain of convenience stores for the pickup of goods ordered on Amazon.

- Mexican shoppers are reluctant to make online purchases due to fears of theft and unreliable delivery services. In Mexico, online sales represent just 1.2% of total retail sales, according to eMarketer.

As Brazil’s Retail Sales Slow, Its Billionaires Go Shopping for Beer

(September 16) Forbes

As Brazil’s Retail Sales Slow, Its Billionaires Go Shopping for Beer

(September 16) Forbes

- As Brazilian retail sales slide, the billionaire owners of beverage giant Anheuser-Busch InBev are seeking to acquire beverage maker SABMiller, which would unite the American brands Budweiser and Miller. Anheuser-Busch InBev was created in 2008 through the merger of Anheuser-Busch and InBev, then a giant Brazilian-Belgian beverage company.

- Brazil retail sales were down 1.0% month over month in July and broad retail sales were down 7.0% year over year.

The Chinese shopper is coming, and big opportunities await retailers worldwide. That is the message from our newly published report, Global Chinese Shoppers: The $200 Billion Opportunity, a major study that we coproduced with consultancy firm China Luxury Advisors.

Chinese travelers are already the world’s biggest overseas spenders, and their average expenditure abroad is growing, giving a twofold boost to retail sectors globally. These consumers will continue to increase in importance over the coming years.

Our research found (or indicated) some startling numbers regarding these consumers’ value to retail:

The Chinese shopper is coming, and big opportunities await retailers worldwide. That is the message from our newly published report, Global Chinese Shoppers: The $200 Billion Opportunity, a major study that we coproduced with consultancy firm China Luxury Advisors.

Chinese travelers are already the world’s biggest overseas spenders, and their average expenditure abroad is growing, giving a twofold boost to retail sectors globally. These consumers will continue to increase in importance over the coming years.

Our research found (or indicated) some startling numbers regarding these consumers’ value to retail:

JCPenney Replaces Chief Merchant Ahead of Holiday Season

(September 23) The Wall Street Journal

JCPenney Replaces Chief Merchant Ahead of Holiday Season

(September 23) The Wall Street Journal

WeChat to Add Free Group Video Calls in China

(September 21) e27.co

WeChat to Add Free Group Video Calls in China

(September 21) e27.co

As Brazil’s Retail Sales Slow, Its Billionaires Go Shopping for Beer

(September 16) Forbes

As Brazil’s Retail Sales Slow, Its Billionaires Go Shopping for Beer

(September 16) Forbes