FROM THE DESK OF DEBORAH WEINSWIG

Lidl Learnings as the Company Prepares to Enter the US

News reports this week confirmed that Lidl is getting ready to open stores in dozens of US cities along the East Coast. Stores could number 150 in the Mid-Atlantic region by 2018, according to property research firm CoStar. A focus on the East Coast will put Lidl in competition with Aldi, which already has a significant presence in the Eastern US. So, what can American consumers expect from the privately owned German discounter?

For those readers unfamiliar with the format, “hard discounters” such as Lidl and its bigger rival, Aldi, focus on private-label goods and offer a very limited selection of products. Consequently, they operate smaller stores. In-store merchandising is basic, staff levels are low and efficiencies are squeezed out at every stage, resulting in a no-frills offering. The gain for customers is in very low prices, usually without any significant compromise on quality versus products from nondiscount retailers.

Lidl Moves Toward “Soft Hard Discount”

Lidl has led the charge to soften the hard-discount format, and competitors such as Aldi have followed. We think the flexible approach Lidl has shown to catering to shoppers in various international markets bodes well for its US operations. Here are some of the ways in which Lidl has adjusted its format as it has expanded worldwide:

- The retailer has adjusted the small-store format. In France, its largest store is believed to be 17,200 square feet and it has been remodeling existing stores in the country to make them larger. In the UK, its largest store is 15,100 square feet and new-format stores in Italy have been around 14,000 square feet.

- Similarly, Lidl has been growing the number of stock-keeping units (SKUs) it offers shoppers. In the UK, the SKU count was around 1,450 in 2012; it grew to 1,600 in 2013 and to 1,700 in 2014. In Italy, the SKU count was 1,650 in April 2015. These are well above the 1,000 or fewer SKUs that discounters have traditionally offered.

- Lidl has moved well beyond the discount tradition of offering just one SKU per category, and offers premium ranges under the Deluxe brand. Likewise, it offers organic foods. Lidl has also been more aggressive than Aldi in bringing in third-party brands, such as Coca-Cola and Kellogg’s.

- Quality fresh food is at the core of Lidl’s offering and the company uses fresh categories to draw in shoppers in markets such as France and the UK, where many consumers are less familiar with discounters. In-store bakeries and an emphasis on quality and provenance in fresh foods have attracted shoppers in categories where brand names are not important.

- Lidl has been dipping its toes into the e-commerce waters, too. Full online grocery services and the discount model are incompatible due to the costs that fulfilling orders adds to a company’s operations. Yet Lidl has pushed online in a cost-effective way. For example, it has sold ambient grocery products in Germany since 2014: these goods can be sent via regular mail rather than via the temperature-controlled trucks that most online grocery services use. It also sells nongrocery ranges, including apparel and DIY goods, in countries such as the Netherlands and Belgium.

What to Expect in the US

We think Lidl will further evolve its format for American shoppers. The company has reportedly been looking for stores with a gross area of 30,000–36,000 square feet, suggesting its US shops will be bigger even than its largest European stores. We do not, however, expect it to use this space to radically increase the number of private-label grocery SKUs it offers, as that would demand adding substantial sourcing capacity for a relatively small store network. Instead, we expect Lidl to use the extra space to improve the shopping experience and to go big on fresh foods, as it has done in other markets where shoppers are unaccustomed to the hard-discount format.

- You can find our in-depth report on European grocery discounters at bit.ly/FungGroceryDiscounters

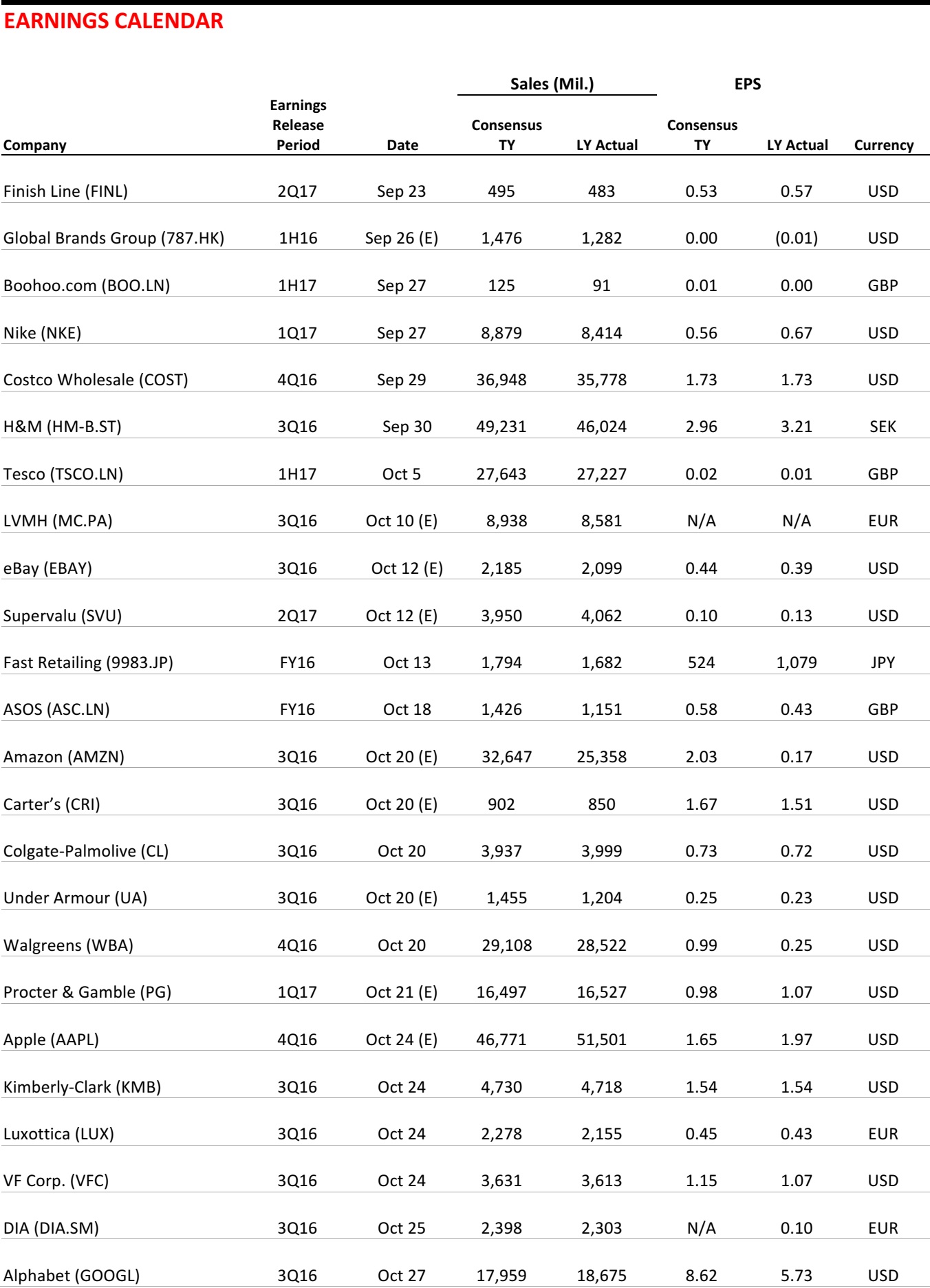

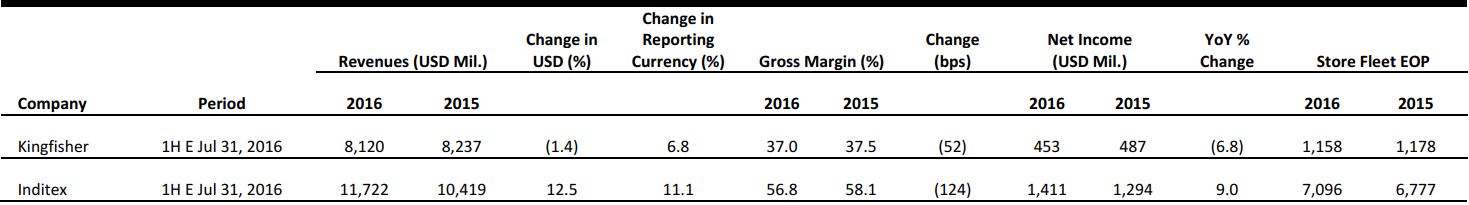

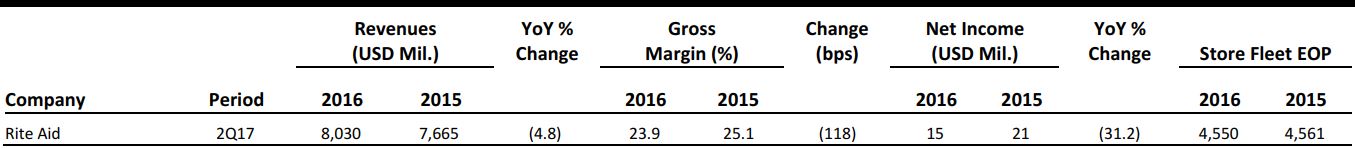

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

See-Now, Buy-Now Fractures Industry

(September 19) Women’s Wear Daily

See-Now, Buy-Now Fractures Industry

(September 19) Women’s Wear Daily

- At New York Fashion Week, a number of designers grabbed attention as they adapted to the shifting fashion calendar; Tommy Hilfiger’s carnival runway, Tom Ford’s cocktail dinner show and Rebecca Minkoff’s shutdown of a street in SoHo all garnered headlines. However, not everyone in the fashion industry is embracing the see-now, buy-now strategy.

- Those opposed argue that see-now, buy-now puts smaller brands at a disadvantage and adds too many complexities to the process. Some also point out that the sales strategy could hinder the in-store experience because eager customers will gobble up new product as it is released, leaving those who wander into stores only once every month or so with little to be excited about.

Parents and Millennials Will Drive Online Holiday Purchases This Year

(September 19) Internet Retailer

Parents and Millennials Will Drive Online Holiday Purchases This Year

(September 19) Internet Retailer

- According to a new study from the Rubicon Project, 72% of millennials will shop online this holiday season and 58% will make purchases on mobile devices. In addition, 22% do not plan to shop in stores at all during the holiday season.

- Consumers are already looking forward to the holiday shopping season. As of August, about 22% of Americans had already searched for Cyber Monday deals, up 10% from last year. And Cyber Monday seems to be taking over the start of the holiday shopping season, with 47% of consumers saying they plan to participate in the event, while only 42% say they plan to shop on Black Friday.

Study: Shoppers Willing to Increase Order to Qualify for Free Shipping

(September 21) Chain Store Age

Study: Shoppers Willing to Increase Order to Qualify for Free Shipping

(September 21) Chain Store Age

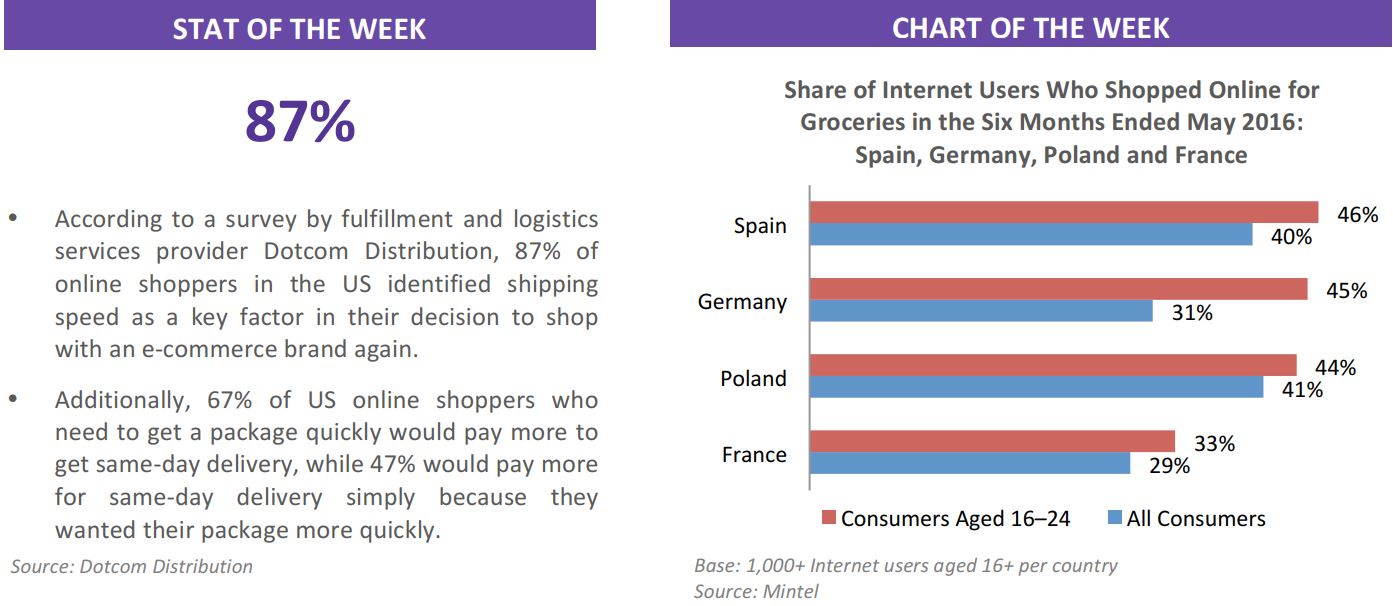

- A study by Radial and CFI Group found that 91% of consumers surveyed would increase the size of their order online to qualify for free shipping. Social media also plays a big role in online shopping; 77% of survey respondents said they are likely to share their experience on a social media platform.

- Furthermore, 89% of respondents said that a 5–10-day shipping window was acceptable if it meant keeping costs low. This could be a relief for retailers who struggle to compete in terms of providing fast and free shipping to online shoppers.

It Is a Breakout Year for Online Food Sales

(September 20) Internet Retailer

It Is a Breakout Year for Online Food Sales

(September 20) Internet Retailer

- Recent analysis by Morgan Stanley indicates that online grocery sales in the US will increase by 157% this year, and account for 6% of total grocery sales. While grocery stores have been historically slow to move online, they have become more aggressive in expanding their offerings to include online order, in-store pickup and home delivery.

- US Department of Commerce data show that 2015 grocery sales were about $690 billion, so the potential for online food sales is huge. There are more niche players joining the market as well, offering preportioned meal kits, organic food and subscription models.

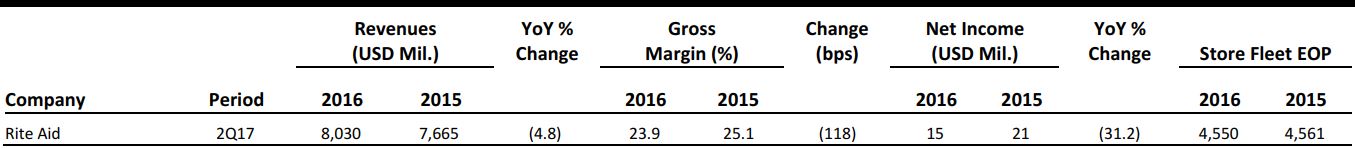

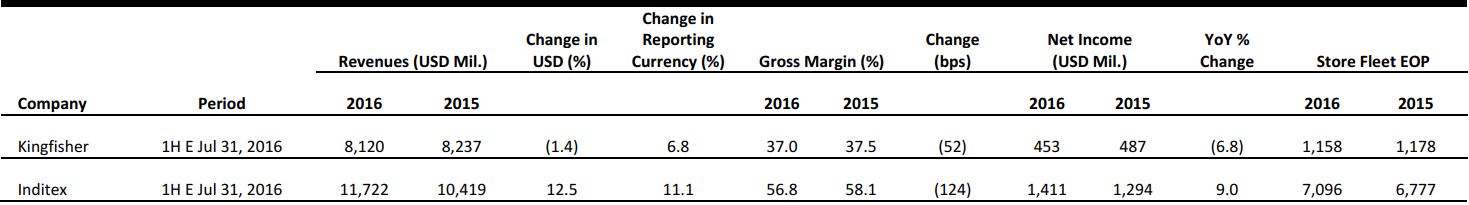

EUROPE RETAIL EARNINGS

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

Summer Drinks Boost Britain’s Grocery Sales

(September 20) Kantar Worldpanel

Summer Drinks Boost Britain’s Grocery Sales

(September 20) Kantar Worldpanel

- British grocery sales grew by 0.3% year over year, helped by alcohol sales, in the 12 weeks ended September 11, 2016, according to market-measurement service Kantar Worldpanel. Market leader Tesco saw sales fall by 0.2% year over year during the period, but that was its best performance since March 2014.

- Sainsbury’s saw sales decline by 1.4% and Asda saw sales fall by 5.4% during the period. Two of the more notable performers were Aldi and Lidl, whose sales grew by 11.6% and 9.5%, respectively.

French Connection’s 1H17 Revenue Falls by 8.7%

(September 20) Company press release

French Connection’s 1H17 Revenue Falls by 8.7%

(September 20) Company press release

- British fashion chain French Connection saw sales fall by 8.7% year over year, to £69.2 million (US$97.7 million), in the first half ended July 31, 2016. The operating loss was £7.9 million (US$11.2 million), flat versus the same period last year. Comps grew by 6.5% in the UK and Europe.

- The company attributed the decline in revenues to a challenging retail environment and disappointing performance in its wholesale and licensing segments. Management stated that the second half “has started well,” and that the company expects Christmas trading to provide a boost to overall sales.

Very Exclusive Introduces Menswear Offer

(September 20) Company press release

Very Exclusive Introduces Menswear Offer

(September 20) Company press release

- Shop Direct’s premium e-commerce banner, VeryExclusive.co.uk, unveiled its first menswear offering on September 20. The offering currently has 25 brands, including Kenzo, Whistles, PS by Paul Smith and Vivienne Westwood, and the company plans to increase the list to about 35 by summer 2017.

- Shop Direct stated that “co.uk’s menswear offer will target 26–45-year-old aspirational males,” many of whom are existing customers of its flagship brand, Very.co.uk. The company added that it is close to signing up a concessions partner for the banner, which will be another first for it.

Casino and Conforama Forge Purchasing Alliance for Nonfood Merchandise

(September 19) Company press release

Casino and Conforama Forge Purchasing Alliance for Nonfood Merchandise

(September 19) Company press release

- Groupe Casino’s nonfood e-commerce banner, Cdiscount, and Groupe Conforama have forged a purchasing alliance that will be operational in time for 2017 negotiations. The strategic alliance will help the French groups centralize the sourcing of household appliances and other consumer electronics.

- This move is expected to strengthen Casino’s nonfood position, as it will be part of a buying group and has also formed a purchasing alliance for food and grocery sourcing. Both Cdiscount and Conforama will continue to operate their websites independently.

Rewe Group Launches a New Private-Label Brand

(September 15) Retailanalysis.igd.com

Rewe Group Launches a New Private-Label Brand

(September 15) Retailanalysis.igd.com

- German retailer Rewe Group has launched a new product line of healthy food, called Rewe To Go, in a move to target customers looking for convenient snack and meal options. The product range includes cereals, smoothies, fresh-cut fruit, salads, sandwiches, wraps and precooked, reheatable meals.

- All products in the range are free of artificial flavors, enhancers and other additives. This is Rewe’s latest move in enhancing its private-label offering of niche ranges such as gluten-free and dairy-free items.

ASIA TECH HEADLINES

China’s Tencent Pictures to Develop Tuzki Animated Movie

(September 19) South China Morning Post

China’s Tencent Pictures to Develop Tuzki Animated Movie

(September 19) South China Morning Post

- Tencent Pictures, the film production arm of Tencent, will partner with Turner Asia-Pacific to develop a movie based on Tuzki, a popular cartoon rabbit emoticon used on WeChat. The movie will combine 3D animation and live action.

- Tencent Pictures will be responsible for the movie’s production and distribution, while Turner Asia-Pacific will pursue licensing opportunities in terms of consumer products and family entertainment centers.

Japanese Firm Releases Dual Robot-Armed Drone

(September 19) Reuters

Japanese Firm Releases Dual Robot-Armed Drone

(September 19) Reuters

- Japan’s Prodrone has unveiled a dual robot-arm drone, which is able to carry heavy items; grasp objects of varying shape and size; and cut cables, turn dials and flick switches. The drone is also designed to perform tasks in perilous environments. For example, it can retrieve hazardous materials or objects at high altitudes.

- The company intends to develop drones for task-oriented uses such as carrying and transporting.

Grab Secures US$750 Million Led by SoftBank

(September 20) e27.co

Grab Secures US$750 Million Led by SoftBank

(September 20) e27.co

- Grab, a Southeast Asian ride-hailing platform, has raised US$750 million in financing, led by SoftBank. The capital will be used to conduct expansionary campaigns in Asia, particularly in Indonesia, and to grow the company’s mobile payment service, GrabPay.

- The company will also continue to invest in machine learning and data science in order to improve back-end routing capabilities and build its proprietary point-of-interest mapping database.

Vickers Leads US$3.5 Million Series A in Irish Biotech Startup

(September 19) TechinAsia

Vickers Leads US$3.5 Million Series A in Irish Biotech Startup

(September 19) TechinAsia

- Vickers Venture Partners, a Singapore-headquartered venture capital firm, led a US$3.5 million series A investment in Irish biotech company SiSaf. The funding will be used to boost research and development. Vickers will help open up pathways and networks for SiSaf in Asia and the US.

- SiSaf, founded in 2008, developed a nanotechnology to customize drugs in order to make them easier to administer and to allow more control of the dosage and time of release.

LATAM RETAIL HEADLINES

Gains in Apparel Fuel Growth in El Salvador’s Exports

(September 16) Women’s Wear Daily

Gains in Apparel Fuel Growth in El Salvador’s Exports

(September 16) Women’s Wear Daily

- According to the World Trade Organization, El Salvador’s goods exports increased by roughly 50% between 2009 and 2015, largely due to gains in apparel export shipments thanks to preferential access to the US market.

- The percentage of exports accounted for by textiles and apparel increased to 37.4% in 2015, up from 28.2% in 2009, excluding maquila-related exports. Within the maquila-related industry, textiles and apparel accounted for 82.5% of the total, up from 79.6% in 2009.

Peruvian Connection Named Brand Ambassador for Alpaca del Perú

(September 16) Women’s Wear Daily

Peruvian Connection Named Brand Ambassador for Alpaca del Perú

(September 16) Women’s Wear Daily

- Alpaca Moda 2016 is a new event specializing in alpaca textiles and fashion. The event’s producers have chosen Annie Hurlbut, CEO of Peruvian Connection, as the guest of honor due to the company’s close ties to alpaca.

- Alpaca Moda’s main objective is to publicize and promote the use of alpaca fiber and textile products internationally via the use of the brand name Alpaca del Perú.

CorreosChile Closes Deal with AliExpress

(September 21) América Retail

CorreosChile Closes Deal with AliExpress

(September 21) América Retail

- State-owned packaging and shipping company CorreosChile is getting a boost from overseas e-commerce retailer Alibaba. The company’s recently announced partnership with AliExpress is expected to reduce delivery times.

- CorreosChile says the most popular e-commerce sites in Chile include AliExpress, Amazon, eBay, ASOS and DealExtreme. In 2015, nearly 65% of e-commerce purchases in Chile came from Asia.

Sally Beauty Supply Continues Expansion in Colombia

(September 21) América Retail

Sally Beauty Supply Continues Expansion in Colombia

(September 21) América Retail

- The beauty industry in Colombia continues to grow, and Sally Beauty Supply is taking note. The company is expanding quickly in the country, and plans to open its eighth store there this year.

- Sally Beauty’s private-label brands have played a large part in its success in Colombia, and the company looks to have nine or 10 functioning stores in the country going into next year.