Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

This week, we attended Under Armour’s Investor Day at its headquarters in Baltimore, MD. The company generated positive buzz among sports fans and investors alike with two announcements. First, NBA star Stephen Curry has extended his contract with Under Armour through 2024. Second, the company has set a 2018 revenue target of $7.5 billion, representing a 25% compound annual growth rate from the $3.1 billion in revenue the company reported in 2014. The figure represents a step up from the prior growth rate target of 22%.

CEO Kevin Plank characterized the company’s first 20 years as having been built on a promise to make athletes better. Now, by leveraging its Connected Fitness network, Under Armour is positioning itself to evolve from a company focused on changing the way athletes dress to one focused on changing the way athletes live. At the same time, the company says that it is just getting started in its evolution from a leading performance sports brand to a great global brand. The establishment of retail stores, particularly in Asia, should enable Under Armour to reach more athletes.

How does management plan to more than double revenue by 2018? By focusing on the sports category, developing innovative products, merchandising globally, maintaining its speed and reaching more athletes. For example, Under Armour soon plans to enter the sportswear category. A key focus is women’s athletic wear—and the company’s women’s team business grew by more than 40% this year. The motto is “We design for her.” In footwear, the company plans to establish product leadership (which leads to market leadership), build franchises and market its products by creating an emotional connection.

EVP of Innovation Kevin Haley said that Under Armour is an unconventional, contrarian brand, zigging where other have zagged. The company offers performance apparel and tight T-shirts made from synthetic materials and priced at $50; it sells over the phone; and it does not discount its prices. Its technologies include microthreaded apparel, which reduces drying time and weight by 30% and increases breathability by 70%, and its CoolSwitch technology, which uses a proprietary coating that pulls heat away from the skin, enabling greater endurance and, therefore, higher performance.

The company’s unconventional approach has created the world’s largest health and fitness community, Connected Fitness, with a total of 150 million registered users. Within this group are 60 million active users, engaging in 1.3 billion workouts per year, and recording the intake of 6 billion foods. Under Armour’s Connected Fitness platform can monitor daily activity, nutrition, fitness and sleep, and interface with connected apps, connected devices, Under Armour shirts and shoes, and advertisers. The platform includes a Consumer Insight Engine, which creates personalized content, communications, experiences, recommendations and products for users. The platform has $200 million in direct revenues today and can access the $8 trillion health and fitness industry, the $2 trillion food and nutrition industry, and the $250 billion sports apparel and footwear industry.

Stephen Curry, the winner of the league MVP award, who drove the Golden State Warriors to their first championship in 40 years, made a surprise appearance at the investor meeting. Curry’s first basketball shoe, the Curry One, and his signature apparel line were launched in February 2015, and the shoes continue to nearly sell out across all retail distribution channels. The Curry Two has already been launched in Asia, in conjunction with Curry’s Under Armour tour there. The shoes will be released in the US and globally on October 24. Curry’s relationship with Under Armour will continue to grow, as his signature product line expands and is increasingly sold on a global basis. At the same time, Curry will be a centerpiece of the company’s marketing campaigns, including for Connected Fitness: he will have a presence on fitness apps, and will design new training programs that will be available to everyone.

In addition to Curry, Under Armour highlighted its relationship with the NBA, announcing a 10-year partnership as well as its participation in the NBA FIT App, which will be powered by the Connected Fitness platform.

Plank also showed artwork of the company’s new headquarters, located in South Baltimore, which employees will begin occupying in January 2016. The company spent more than $90 million acquiring 130 acres of waterfront property, which will serve both Under Armour employees and Baltimore residents. It will encompass innovation labs, sporting fields, fitness centers, manufacturing facilities, public parks and green spaces. While the company has historically spent 3% of revenues on capital investment, it expects to spend 8%–10% of revenues on capex through 2018, with about half devoted to the new campus, investments in technology and expanding distribution centers.

Even after its huge success, Under Armour is excited about taking itself to the next level through a strong combination of connected and garment technologies, expanding its reach, and creating buzz about its brand through associations with leading athletes and professional leagues. We are fascinated by the company’s leadership in combining connectivity and smartphones with athletic wear, and we look forward to future innovations in this space.

This week, we attended Under Armour’s Investor Day at its headquarters in Baltimore, MD. The company generated positive buzz among sports fans and investors alike with two announcements. First, NBA star Stephen Curry has extended his contract with Under Armour through 2024. Second, the company has set a 2018 revenue target of $7.5 billion, representing a 25% compound annual growth rate from the $3.1 billion in revenue the company reported in 2014. The figure represents a step up from the prior growth rate target of 22%.

CEO Kevin Plank characterized the company’s first 20 years as having been built on a promise to make athletes better. Now, by leveraging its Connected Fitness network, Under Armour is positioning itself to evolve from a company focused on changing the way athletes dress to one focused on changing the way athletes live. At the same time, the company says that it is just getting started in its evolution from a leading performance sports brand to a great global brand. The establishment of retail stores, particularly in Asia, should enable Under Armour to reach more athletes.

How does management plan to more than double revenue by 2018? By focusing on the sports category, developing innovative products, merchandising globally, maintaining its speed and reaching more athletes. For example, Under Armour soon plans to enter the sportswear category. A key focus is women’s athletic wear—and the company’s women’s team business grew by more than 40% this year. The motto is “We design for her.” In footwear, the company plans to establish product leadership (which leads to market leadership), build franchises and market its products by creating an emotional connection.

EVP of Innovation Kevin Haley said that Under Armour is an unconventional, contrarian brand, zigging where other have zagged. The company offers performance apparel and tight T-shirts made from synthetic materials and priced at $50; it sells over the phone; and it does not discount its prices. Its technologies include microthreaded apparel, which reduces drying time and weight by 30% and increases breathability by 70%, and its CoolSwitch technology, which uses a proprietary coating that pulls heat away from the skin, enabling greater endurance and, therefore, higher performance.

The company’s unconventional approach has created the world’s largest health and fitness community, Connected Fitness, with a total of 150 million registered users. Within this group are 60 million active users, engaging in 1.3 billion workouts per year, and recording the intake of 6 billion foods. Under Armour’s Connected Fitness platform can monitor daily activity, nutrition, fitness and sleep, and interface with connected apps, connected devices, Under Armour shirts and shoes, and advertisers. The platform includes a Consumer Insight Engine, which creates personalized content, communications, experiences, recommendations and products for users. The platform has $200 million in direct revenues today and can access the $8 trillion health and fitness industry, the $2 trillion food and nutrition industry, and the $250 billion sports apparel and footwear industry.

Stephen Curry, the winner of the league MVP award, who drove the Golden State Warriors to their first championship in 40 years, made a surprise appearance at the investor meeting. Curry’s first basketball shoe, the Curry One, and his signature apparel line were launched in February 2015, and the shoes continue to nearly sell out across all retail distribution channels. The Curry Two has already been launched in Asia, in conjunction with Curry’s Under Armour tour there. The shoes will be released in the US and globally on October 24. Curry’s relationship with Under Armour will continue to grow, as his signature product line expands and is increasingly sold on a global basis. At the same time, Curry will be a centerpiece of the company’s marketing campaigns, including for Connected Fitness: he will have a presence on fitness apps, and will design new training programs that will be available to everyone.

In addition to Curry, Under Armour highlighted its relationship with the NBA, announcing a 10-year partnership as well as its participation in the NBA FIT App, which will be powered by the Connected Fitness platform.

Plank also showed artwork of the company’s new headquarters, located in South Baltimore, which employees will begin occupying in January 2016. The company spent more than $90 million acquiring 130 acres of waterfront property, which will serve both Under Armour employees and Baltimore residents. It will encompass innovation labs, sporting fields, fitness centers, manufacturing facilities, public parks and green spaces. While the company has historically spent 3% of revenues on capital investment, it expects to spend 8%–10% of revenues on capex through 2018, with about half devoted to the new campus, investments in technology and expanding distribution centers.

Even after its huge success, Under Armour is excited about taking itself to the next level through a strong combination of connected and garment technologies, expanding its reach, and creating buzz about its brand through associations with leading athletes and professional leagues. We are fascinated by the company’s leadership in combining connectivity and smartphones with athletic wear, and we look forward to future innovations in this space.

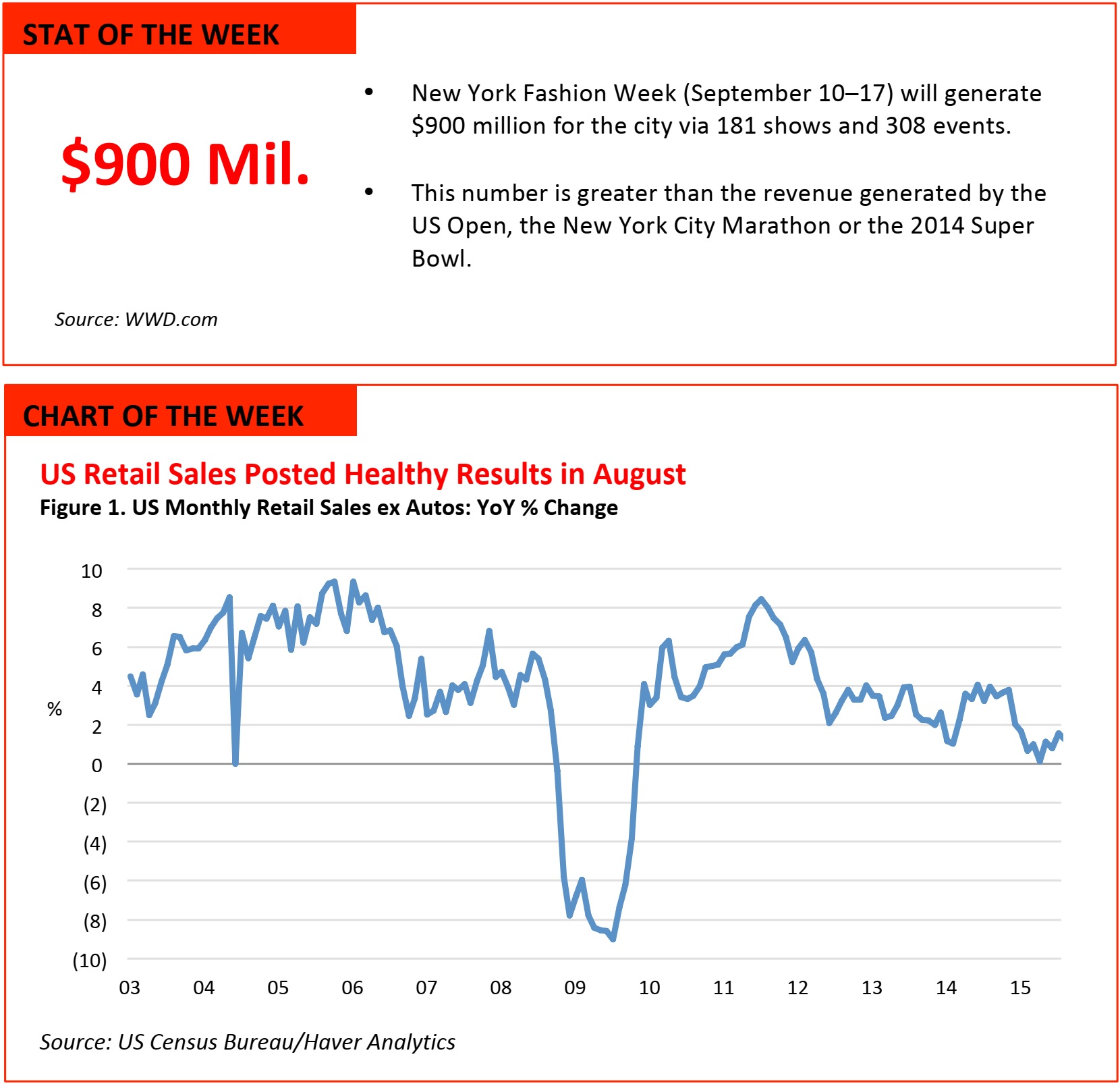

Source: US Census Bureau/Haver Analytics

- Total US retail sales were healthy in August, rising 0.2% month over month (adjusted). The results met economists’ expectations. Excluding autos, sales rose 0.1% in August.

- In August, consumers continued to benefit from lower gas prices, a strong dollar and a healthy labor market. Ten out of the 13 major retail categories posted gains. Auto and auto parts sales posted a solid 0.7% increase over July, as did sales at bars and restaurants.

- Fed Chairman Janet Yellen pointed to strong car sales in May and June as a sign that “many households have both the wherewithal and the confidence to purchase big-ticket items.”

US RETAIL HEADLINES

- On September 16, Tory Burch will open a Tory Sport pop-up shop at 257 Elizabeth Street, the same location where Burch started the brand 11 years ago. The collection will be exclusively available at TorySport.com. A permanent store will open in the Flatiron District in March 2016.

- The new sports line features clothing, shoes, bags and accessories for running, studio, tennis, golf and swim. Retail prices range from $55 to $550.

- Global Brands Group just closed an acquisition of Joe’s Jeans for $13 million, and will hold the long-term license agreement for the brand’s core categories. Joe’s Jeans will use the proceeds to repay some of its outstanding debts.

- Bruce Rockowitz, CEO and Vice Chairman of Global Brands, told Women’s Wear Daily that “We really have been focused on what are the categories that we want to be big in and have some scale. Denim was one.”

- Walmart is adding several dozen grocery pickup locations to the parking lots of existing Neighborhood Markets in Northwest Arkansas.

- The company wants to test customers’ responses to picking up groceries without getting out of their cars. The additional locations are part of a bigger expansion of the service.

- Target is piloting one-hour grocery delivery service with Instacart in the Minneapolis metropolitan area. The collaboration will allow customers to purchase select Target household items, such as health and beauty, pet, and baby products, in addition to groceries.

- Jason Goldberger, President of com and Mobile, stated, “Our team is constantly listening to guests’ needs and looking for new ways to help them shop Target wherever, whenever and however they want.”

- Wayfair announced a partnership with tech solutions provider roOomy to use high-resolution image renderings based on 3D product models for DwellStudio and Birch Lane products.

- Now, customers shopping on these sites will be able to experiment with multiple textures and fabrics, and see 360-degree views to find the perfect pieces of furniture for their home.

ASIA HEADLINES

- Tencent announced it is launching its own filmmaking arm, Penguin Pictures. The subsidiary will focus primarily on original online programming, but it will also invest in a dozen or so feature films each year.

- Alibaba launched its own film business, Alibaba Pictures Group, last year, and it cofinanced a summer blockbuster, Mission Impossible: Rogue Nation. Recently, the company launched its own Netflix-style subscription streaming service, and it also runs a crowdsourced film-investing platform.

- India’s Ola is raising more than US$500 million at a valuation of about US$5 billion, with US$225 million committed so far. In April, the company was valued at US$2.5 billion.

- Documents filed with India’s Registrar of Companies revealed Falcon Edge Capital as the lead investor. Tiger Global Management, SoftBank, Hong Kong’s Steadview Capital Management, Pittsburgh’s ABG Capital and the FII LTR Focus Fund are all previous investors that are also involved in this round. New investors include JS Global Capital, Parkwood Bespin and Daniel E. Neary.

- Japanese video game maker Nintendo said that it was promoting Managing Director Tatsumi Kimishima to replace former President Satoru Iwata, who died of cancer in July.

- Genyo Takeda, one of the lead developers of the Wii, and Senior Managing Director Shigeru Miyamoto, creator of the Mario and Donkey Kong games, will remain Nintendo’s other two representative directors.

- Shares of Alibaba, which recently slipped below their initial offering price after having rocketed 75% in their first two months of trading, could lose another 50% of their value, Barron’s said in its September 14 issue.

- Barron’s cited China’s struggling economy, increasing competition in e-commerce, and more scrutiny of the company’s culture and governance as the reasons for its dour outlook.

- Alibaba issued a sharp retort, accusing Barron’s of publishing a report that lacked “integrity, professionalism and fair play.” It said the forecasts were based on incorrect calculations; for instance, Barron’s compared Alibaba’s stock performance to eBay’s, although the latter did not have operations in China.

- Alibaba explained that it transferred ownership of Alipay into a separate private partnership controlled by Jack Ma in order to meet Chinese banking licensing requirements that say that nonbank payment processors have to be domestically owned. Barron’s had commented that both before and after the transfer, Alipay was domestically owned.

- Founded in May 2015, Quyi develops medical apps designed to shake up China’s medical sector. The Shanghai-based startup has developed three services that target core links in the industry.

- All of Quyi’s apps are constructed on the company’s comprehensive information platform, which is supported by patient data collected from Quyiyuan and which is integrated with the systems of partner hospitals. The company claims to have more than 1,000 public hospitals on board and expects the number to reach 2,000 by the end of this year.

Japanese Edtech Startup Acquired by US Startup amid Online Tutoring Boom

(September 13) TechinAsia

Japanese Edtech Startup Acquired by US Startup amid Online Tutoring Boom

(September 13) TechinAsia

- American edtech startup EnglishCentral announced it would acquire a Japanese startup, Langrich, which offers similar online tutoring for English learners. Tokyo-based Langrich will be acquired in a share-swap agreement in which its investors, KLab Ventures and Hitomedia, will become minority shareholders in EnglishCentral.

- Founded in 2010, Langrich uses English tutors in the Philippines to provide English instruction via Skype. The site’s users will now benefit from a video lesson archive available online and via mobile, as well as EnglishCentral’s speech recognition technology for studying vocabulary and pronunciation.

- Snapdeal announced that it will offer instant refunds via an IMPS (immediate payment system or interbank mobile payment service) transfer, a service that is well known to consumers in India. IMPS is granted to banks that are registered with a mobile-banking-service license. The instant refund can be accessed on mobile phones and computers.

- Flipkart made a similar move weeks ago, promising IMPS refunds within 24 hours of receiving a returned product. Snapdeal wants to shorten the wait to 90 minutes, possibly because the company thinks that this will help attract Indian consumers who are still wary of shopping online.

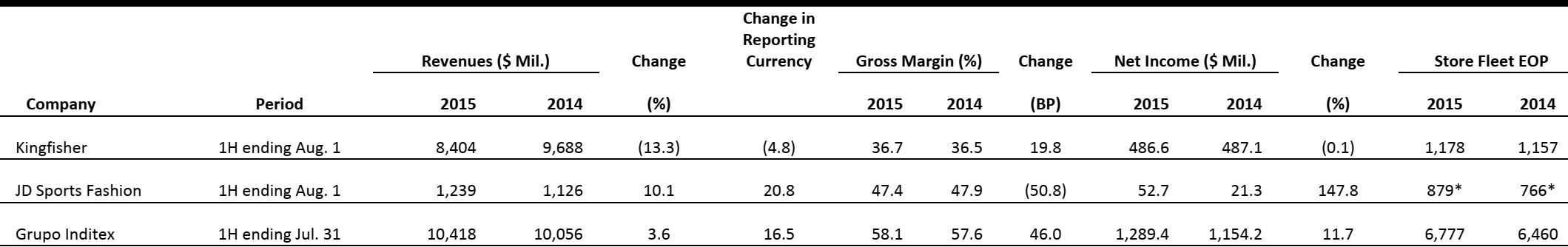

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

- Swedish fashion retailer H&M reported a strong year-over-year sales increase of 11% for its third quarter (June 1 through August 31), in local currencies. In Swedish krona, sales increased by 18%, to SEK5.3 billion (US$6.3 billion), due to the weakening of the Swedish krona against the euro during the reporting period.

- August sales increased by only 1% in local currencies, year over year. The company stated that sales, which were below analysts’ expectations, were pulled down by unseasonably warm weather in most of its main European markets.

- NEXT half-year results through July showed that total group sales were up by 2.7%, to £1.9 billion (US$3 billion), and that NEXT brand year-over-year sales increased by 3.3%, to £1.8 billion (US$2.9 billion). Profits before tax increased by 7.1%, to £347.1 million (US$534.5 million). Retail margin increased by 14.9% year over year thanks to better currency rates, productivity improvements and closure of underperforming stores.

- NEXT also outlined the impact of the Living Wage Premium (LWP, which sets a new minimum wage for employees who are 25 or older) on the company’s balance sheet. NEXT stated that it estimates the cost of implementing LWP will be £27 million (US$42 million) per year during the next four years. The company deems the cost manageable, but said it will need to pass part of the burden on to consumers by raising prices by 1% during the same period.

- Morrisons’ half-year results showed a like-for-like sales decline (excluding fuel and VAT) of 2.7% and a total turnover decline of 5.1% (to £8.1 billion, US$12.6 billion). Profit before tax declined by 35%, to £117 million (US$182 million). To revive its business, the retailer is reconsidering its priorities. Its immediate strategic focus is to improve performance in its core supermarkets—which explains its decision to exit the convenience store channel.

- The company announced it would sell 140 of its M Local convenience stores, all but five in operation, to private equity firm Greybull Capital and a team led by retail entrepreneur Mike Green for £25 million (US$30 million). The remaining stores are either on forecourts or will be converted to small Morrisons supermarkets. Morrisons expects to incur a loss of around £30 million (US$47 million) from the sale. The outlets will be rebranded as My Local stores by the new owners and will continue to operate.

- IKEA reported strong sales growth for its fiscal year ending August 31. Total sales, adjusted for currency impacts, increased by 8.9%, while turnover (reported in euros) increased by 11.2%, to €31.9 billion (US$34.9 billion). IKEA’s bed and bathroom furnishing solutions contributed to comparable store sales growth, as did the opening of new stores and new multi-channel solutions.

- During fiscal year 2015, China remained IKEA’s fastest-growing market, followed by Russia. Germany and North America performed strongly, too, as did the majority of the markets in which IKEA operates. Even Southern Europe showed improvements. Only a few markets were still struggling due to the persistence of challenging economic conditions.

- Ocado recorded a 15.3% increase in gross retail sales in its third quarter, with average orders per week going up 16.6%, to 190,000. The average order size, however, dipped £1.15 to £110.46 (US$170). CEO Tim Steiner stated that he expects future growth to be “slightly ahead of the online grocery market.”

- CFO Duncan Tatton-Brown told reporters that Ocado is targeting an overseas technology partnership this year. Previously, the company had said that it was looking toward Western Europe or North America for a partnership in licensing its technology.

- Boden intends to open more shops in the UK and its first US store in response to increased demand for its clothes. Currently, the online and catalog retailer has just one shop in West London, but the newly appointed Deputy Chairman, Julian Granville, informed the Financial Times that the company plans to open shops in key markets over the next few years.

- Granville mentioned that Boden wants to give customers a chance to “come to [their] brand” and that those who “buy a limited part of a range can buy more at stores.” Customers can also pick up products ordered online at the stores. Granville stated that the company has been expanding successful products in its womenswear range, particularly dresses in printed fabrics.

- Truworths, a South African company, is looking to buy British shoe chain Office from Silverfleet Capital. Truworths did not disclose the deal price and said it had not yet made a binding offer.

- Silverfleet, a US buyout group, had acquired Office from a Scottish entrepreneur five years ago for £150 million (US$230.81 million). Asda’s former chief executive is the current chairman of Office. The chain has about 99 stand-alone outlets and 48 concessions in department stores Selfridges, House of Fraser, Harvey Nichols and Topshop.

Lidl Announces Store Opening Strategy that Targets Areas within London’s M25

(September 14) Retailanalysis.igd.com

Lidl Announces Store Opening Strategy that Targets Areas within London’s M25

(September 14) Retailanalysis.igd.com

- Lidl plans to open 281 new stores, many of them in central London. It previously focused on locations that were in the suburbs. Currently, Lidl operates about 70 stores that are within the M25 motorway that almost encircles Greater London; 10 of these stores are either in or around central London.

- Lidl has been investing heavily in brand campaigns that emphasize its value and quality, which have reportedly attracted new customers, including more affluent shoppers. The German retailer is looking for sites that are between 10,000 and 28,000 square feet for some stores and properties that are up to four acres for bigger developments. The property director of Lidl told reporters that prices of products in the city stores will remain the same as those at Lidl’s other stores.

LATAM HEADLINES

- Last week, Standard & Poor’s downgraded Brazil’s sovereign debt to below-investment-grade status. Brazil’s currency is off 40% year over year from the US dollar and down 60% since 2011, and the real is expected to fall another 16%.

- The unemployment rate currently stands at 7.5%, as compared to 4.3% last December, and is expected to hit 10% by the end of the year.

- The government’s ability to intervene has been severely weakened by the Petrobras scandal.

- The Mexican textile industry is expected to grow by 4% this year, to about US$26 billion, aided by a recovery in US exports and strong demand.

- Exports are expected to increase by 10% this year, to $4.5 billion, based on a sharp increase in the first half following a 10%–15% decline last year.

- Domestic apparel consumption is expected to increase by 3%–4% in 2015, after a 2% increase last year.

- Walmex hopes to maintain stable pricing throughout the remainder of the year, amid a strong recovery in consumption and thanks to strong foreign remittances.

- Sales increased by 7.4% during the first eight months of the year, and same-store sales increased by 5.4% in the same period.

- Walmex expects to double in size over the next 10 years.

- Billionaire Carlos Slim Helú’s companies recently announced their intention to expand Philosophy Jr. Studio, a new fashion brand for young women, into a stand-alone retail chain.

- Beginning this September, Philosophy is expected to be offered in two malls in Mexico City and in the state of Mexico.

- Slim plans to invest US$20 million to open 100 stand-alone stores by 2017.

- Fashion Week Mexico, which is held biannually in Mexico City, is expected to expand to the cities of Guadalajara and Monterrey.

- The Guadalajara show, held in Mexico’s second-largest city, is expected to attract 1,000 attendees, versus 1,600 attendees at its first occurrence in 2014.

- The Monterrey show was held May 9–11 and attracted 1,200 attendees.