FROM THE DESK OF DEBORAH WEINSWIG

New York Fashion Week Is on Now!

It is Fashion Week in New York City again, a twice-annual affair when designers show their collections for the upcoming season: this week, they are showing their spring 2017 collections. Fashion Week shows officially run from September 7–15, though there are also some previews that were held earlier and a closing party that is scheduled for September 16. In addition, Macy’s (in connection with Vogue) is holding a public fashion event for charity on September 17 that will be televised.

New York Fashion Week is held in February and September each year, and is one of the “Big Four” fashion weeks: the others are held in the fashion capitals of London, Paris and Milan. However, other cities have jumped on the fashion-week bandwagon, too. For example, Seoul held its own fashion week in March and the next São Paulo Fashion Week will be held in October.

Although shops and large department stores had been holding fashion shows since the turn of the last century, the first organized fashion week was held in New York in 1943. It was called “Press Week” and was organized to showcase American designers, since fashion industry people were unable to travel to Paris to attend the French fashion shows during World War II. In 1993, the Council of Fashion Designers of America (CFDA) consolidated the various citywide fashion events under the brand “7th on Sixth,” and held a single large event in tents in Bryant Park. CFDA sold the show to event and talent-management group IMG in 2001. Since then, IMG has added various sponsors to the event, including Olympus (in 2004) and Mercedes-Benz (2007–2015). In addition, Fashion Week relocated to Lincoln Center from Bryant Park in 2010, at which time video from the various events increasingly began being uploaded to YouTube and streamed from various Internet sites.

The fashion industry and Fashion Week have a huge positive impact on the economy of New York. According to the CFDA, the fashion industry employs more than 180,000 people in New York City, including 16,000 in manufacturing jobs. These companies pay about $11 billion in wages, generating nearly $2 billion in tax revenue every year. More than 230,000 people attend the two yearly Fashion Weeks in New York, generating nearly $550 million in visitor spending and impacting the city to the tune of of nearly $900 million, surpassing both the US Open and the New York City Marathon in terms of total economic impact. This fall’s Fashion Week features 97 runway shows, 50 presentations and more than 100 other events.

Although companies showing at fashion weeks typically collect orders for six months ahead, the fashion industry has begun to move in the direction of fast fashion, shortening lead times. One of the themes this year is “watch now, buy now,” and certain designers are offering small quantities of the demonstrated garments for sale immediately after their shows.

The events are publicity seeking by definition, with many designers strategically placing celebrities in the front row of their runway shows, for maximum visibility. This year, many shows were staged in unusual locations. Kanye West staged his Yeezy Season 4 show on Roosevelt Island (situated between Manhattan and Queens), which is normally accessible only via tram or subway. Rebecca Minkoff held her runway show on Greene Street in Manhattan’s SoHo district, which enabled 300 nonindustry people to view the show. However, the resulting traffic disruption due to the street closure generated some grumbling from New Yorkers (a group not traditionally known to keep their opinions to themselves). In addition, the models are different this year, with many designers using ordinary civilians, plus-sized models, older models and models of every ethnicity on their runways.

Fung Global Retail & Technology is attending shows and sifting through the explosion of trends on display at Fashion Week, and we look forward to providing updates as we progress into the fall and spring fashion seasons.

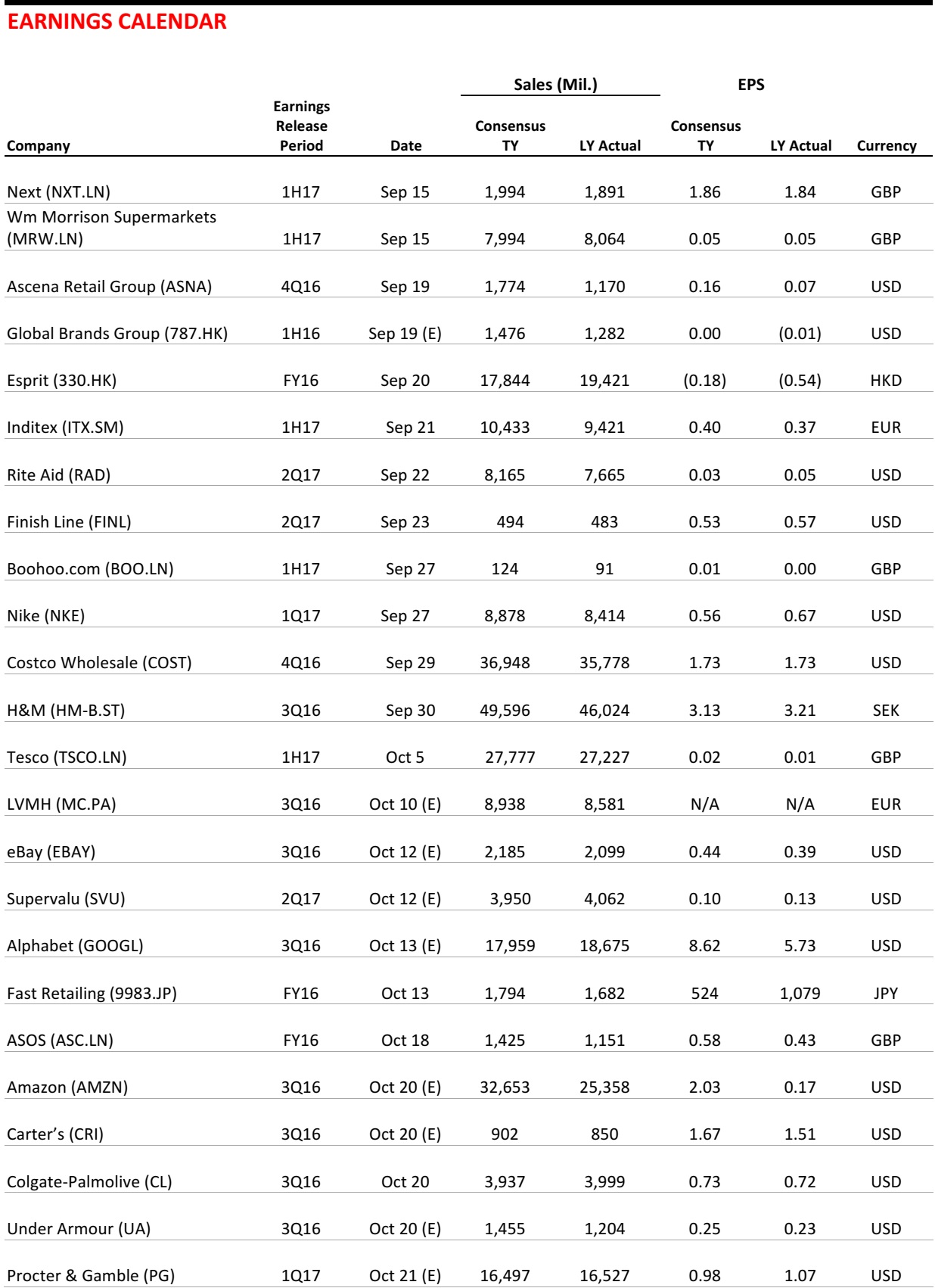

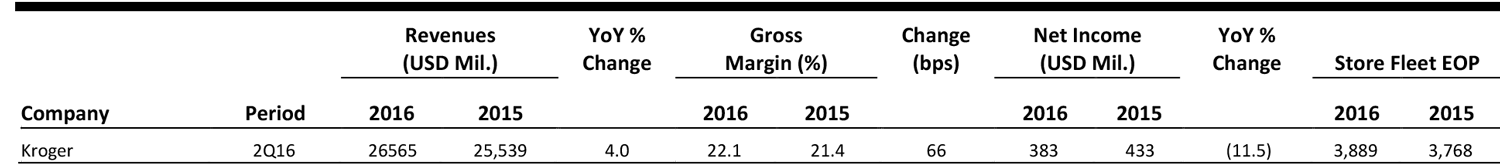

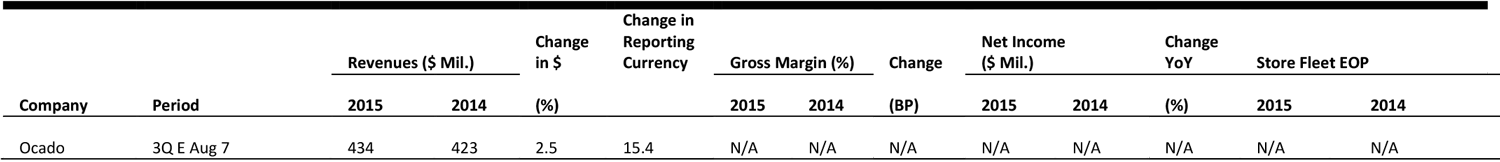

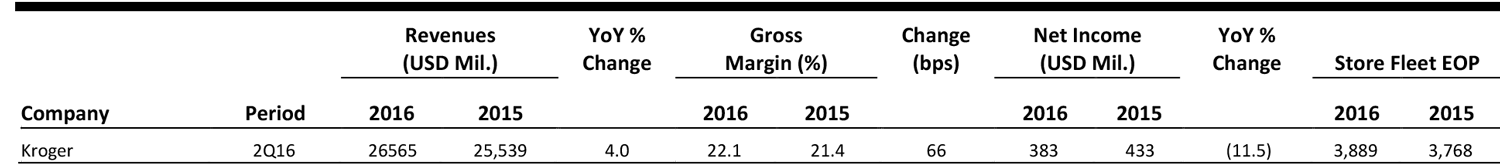

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

How Designers Are Getting You to Shop Fashion Week

(September 12) Glossy

How Designers Are Getting You to Shop Fashion Week

(September 12) Glossy

- New York Fashion Week (NYFW) is abuzz with “see-now, buy-now” shows. Designers such as Tommy Hilfiger, Rebecca Minkoff, Tom Ford and Thakoon are making their latest collections available for purchase online immediately after their NYFW shows. Designers have largely relied on their own e-commerce channels and selected retailers to make this possible.

- However, as this social-media-driven trend continues to capture more designers, various retail apps, shoppable videos, pop-up shows and Google search tools have all started to support the move toward immediacy. This increased support has boosted consumers’ awareness of the new-season fashion show.

E-Commerce Is a Boon for Rural America, but It Comes with a Price

(September 11) The Wall Street Journal

E-Commerce Is a Boon for Rural America, but It Comes with a Price

(September 11) The Wall Street Journal

- As shopping online has become increasingly convenient, consumers in rural areas have had more, and often cheaper, product options. Many rural consumers are opting to avoid driving the long distances to retailers and are just ordering online instead. However, due to these consumers’ relatively remote locations, this ends up costing retailers more.

- According to UPS, one mile per day across its US delivery fleet costs up to $50 million per year. This means that the cost of shipping to consumers located in rural areas can often be greater than the cost of the product being shipped. Since free shipping is now expected by most consumers, the cost of delivery often falls on the retailer.

Facebook Steps in to Prove the Value of Chatbots with Tommy Hilfiger

(September 9) TechCrunch

Facebook Steps in to Prove the Value of Chatbots with Tommy Hilfiger

(September 9) TechCrunch

- Facebook is looking to prove the usefulness of chatbots after a clumsy rollout of its first round of bots. This time, developers are partnering with the Tommy Hilfiger fashion brand to create a “flagship chatbot worthy to point to.”

- Promoting the launch of Tommy Hilfiger’s capsule fashion line with supermodel Gigi Hadid, the TMY.GRL A.I. Messenger Bot interacts with shoppers to share information about Hadid, go behind the scenes and help them shop the line.

Luxury Fashion Is Slowly Coming Around to Plus-Size Fashion

(September 14) Glossy

Luxury Fashion Is Slowly Coming Around to Plus-Size Fashion

(September 14) Glossy

- The market for luxury plus-size fashion is growing, and is estimated to be worth $20.4 billion this year, up from $17.4 billion in 2013. However, few luxury designers are devoted to making plus-size fashion.

- Partnerships and social media seem to be key for those luxury designers looking to launch plus-size lines. Designer Prabal Gurung recently partnered with Lane Bryant and referenced social media responses to Ashley Graham’s Sports Illustrated Swimsuit 2016 cover to highlight how sentiment regarding plus-size fashion is shifting, making it a crucial market for designers to capture.

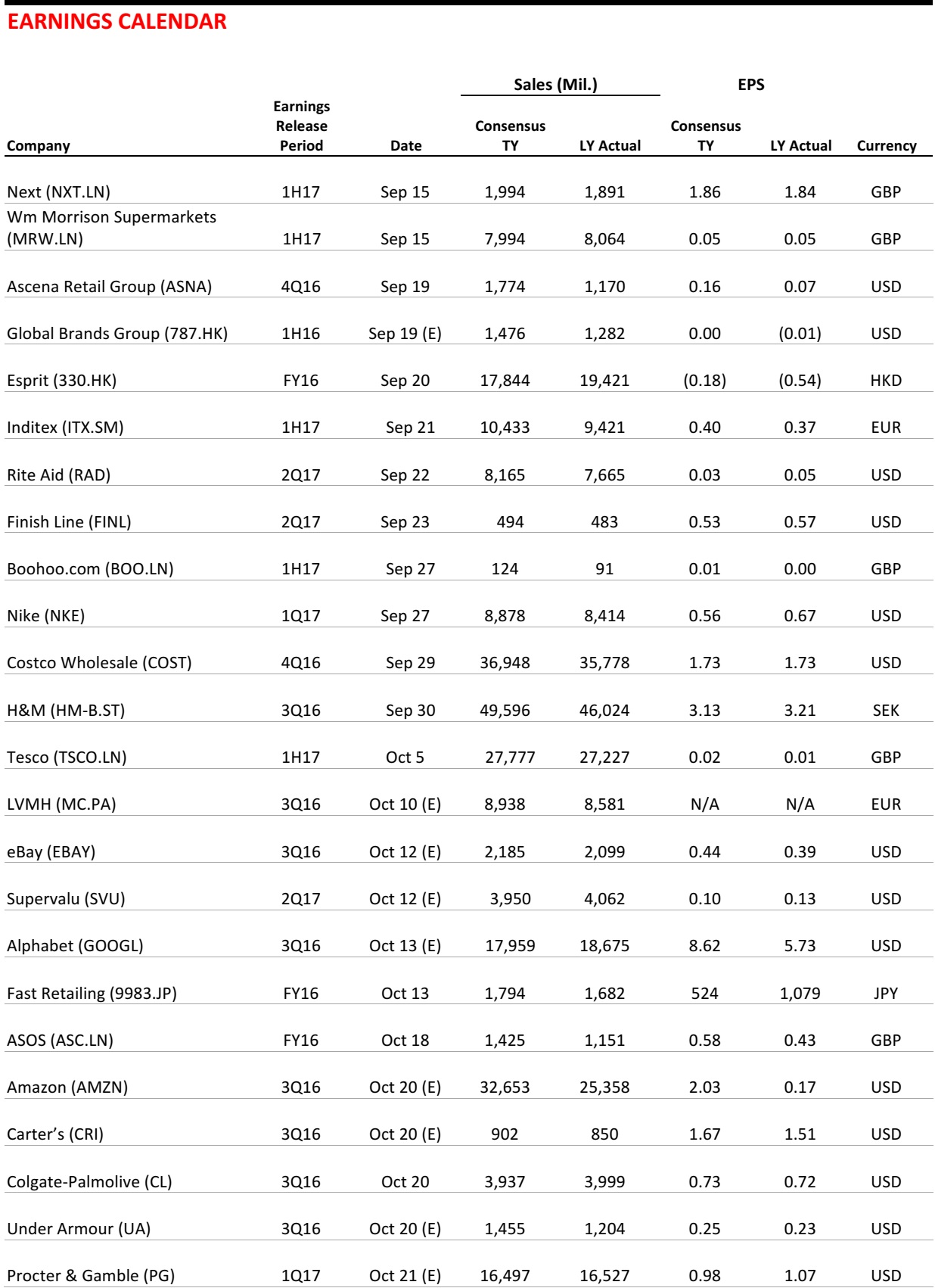

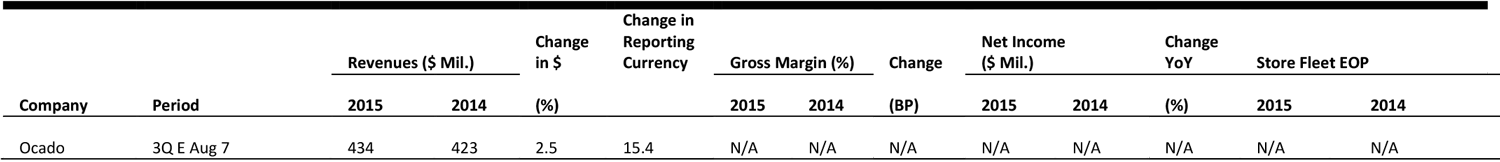

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Aldi Nord and Süd Campaign Together

(September 9) Retaildetail.eu

Aldi Nord and Süd Campaign Together

(September 9) Retaildetail.eu

- Discount retailers Aldi Nord and Aldi Süd have launched their first-ever joint marketing campaign in Germany.

- The campaign is also reportedly the first time Aldi has aired a television campaign in Germany, marking a diversification from its usual print advertising and reflecting the changing nature of the grocery discount sector.

Amazon Launches London Meal Delivery Service

(September 7) Retaildetail.eu

Amazon Launches London Meal Delivery Service

(September 7) Retaildetail.eu

- E-commerce giant Amazon has launched its restaurant delivery service in selected areas of London as part of its Prime Now offering. This pits it against delivery firms such as Deliveroo and UberEATS.

- As with other Prime Now orders, Amazon promises to deliver within an hour. The free service is available only for Amazon Prime Now subscribers.

Arcadia Group Launches Credit Scheme

(September 13) Retailgazette.co.uk

Arcadia Group Launches Credit Scheme

(September 13) Retailgazette.co.uk

- Apparel retail group Arcadia has launched a credit offering that will give online customers up to three months to pay for items. Aimed at millennials, the initiative sees Arcadia partner with financial technology supplier Klarna.

- Topshop, Dorothy Perkins, Miss Selfridge and Burton will all offer the “Buy Now, Pay Later” scheme.

JD Sports to Expand in Australia

(September 13) Retail-week.com

JD Sports to Expand in Australia

(September 13) Retail-week.com

- Sports fashion retailer JD Sports has acquired Australian retailer Next Athleisure as part of its continuing plan to set up shops in Australia. This follows a record half year in which pretax profits before exceptional items jumped 66%, to £77.4 million (US$102.07 million), and revenue climbed 20%, to £970.6 million (US$1.3 billion).

- JD Sports has also acquired two Dutch retail chains and three Malaysian chains in a bid to expand further globally.

Morrisons to Introduce Amazon Lockers in Stores

(September 12) Theretailbulletin.com

Morrisons to Introduce Amazon Lockers in Stores

(September 12) Theretailbulletin.com

- UK supermarket Morrisons is set to install the UK’s largest number of Amazon Lockers as part of a drive to introduce new services to its stores. The lockers give Amazon customers the option to collect their orders in-store rather than waiting at home for deliveries.

- This follows a supply agreement between Morrisons and Amazon, finalized earlier in the year, that has led to hundreds of Morrisons products becoming available on Amazon.

China and Poland Drive Sales Growth at IKEA

(September 13) WSJ.com

China and Poland Drive Sales Growth at IKEA

(September 13) WSJ.com

- Swedish furniture giant IKEA reported a 7.1% jump in sales, to €34.2 billion (US$38.4 billion), in the year ended August. The company said sales in Poland increased by around 20%. Global same-store sales climbed 4.8%.

- IKEA opened 12 new stores and 19 new online-order collection points in the year, taking the total number of collection points to 22. E-commerce contributed about 4% of group revenue.

ASIA TECH HEADLINES

Baidu Launches Tech Startup Program in Brazil

(September 12) ZDNet

Baidu Launches Tech Startup Program in Brazil

(September 12) ZDNet

- China’s Baidu is partnering with the Latin American Angels Society to launch a support and mentoring program for Brazilian tech startups. The startups are expected to benefit from Baidu’s traffic and experience, as well as its global connections.

- In exchange for providing support and mentoring, Baidu, which is undertaking an expansionary strategy in Brazil, will take a 10% stake in the selected companies.

Japan’s Renesas Buys Intersil for US$3.2 Billion

(September 13) Reuters

Japan’s Renesas Buys Intersil for US$3.2 Billion

(September 13) Reuters

- Renesas Electronics confirmed its purchase of US chipmaker Intersil, which produces chips for industrial, mobile and infrastructural uses. The transaction, worth US$3.2 billion, will help Renesas refocus on its automotive customers.

- Like many other chipmakers, Renesas has turned its focus toward auto electronics from traditional areas such as computers and smartphones, as sales growth in those sectors has slowed.

Volkswagen’s Audi Collaborates with Chinese Tech Groups

(September 13) The Star Online

Volkswagen’s Audi Collaborates with Chinese Tech Groups

(September 13) The Star Online

- Volkswagen’s luxury car unit, Audi, has signed letters of intent with China’s Alibaba, Baidu and Tencent to develop digital services for drivers.

- Through the partnerships, Audi aims to improve the use of in-car smartphone apps and the WeChat communication app, and to provide real-time traffic news services and 3D maps.

Alibaba’s Finance Arm Acquires US Eye-Scan Startup

(September 13) Bloomberg

Alibaba’s Finance Arm Acquires US Eye-Scan Startup

(September 13) Bloomberg

- Ant Financial, the payments affiliate of Alibaba, has acquired US-based EyeVerify for US$70 million. EyeVerify’s technology uses pictures of the human eyeball to unlock mobile services.

- Alibaba aims to expand its services with the help with EyeVerify’s biometric authentication technology, which can better secure consumers’ online data and transactions.

LATAM RETAIL HEADLINES

Mexican Debut of Victoria’s Secret Expected to Shake Up Market

(September 11) WWD.com

Mexican Debut of Victoria’s Secret Expected to Shake Up Market

(September 11) WWD.com

- L Brands has opened a 10,760-square-foot Victoria’s Secret store in partnership with Mexican retail franchiser Grupo Axo. Rivals such as Vicky Form and Leonisa are working on competitive strategies to bolster their presence, given the arrival of the mega-brand.

- This is the first full-assortment store in Mexico City, and it sells all of the Victoria’s Secret lines, including Body by Victoria, Very Sexy, Dream Angels, Bombshell and Victoria Sport.

Brazil Posts Worst July Retail Sales Performance in 15 Years

(September 13) Bloomberg

Brazil Posts Worst July Retail Sales Performance in 15 Years

(September 13) Bloomberg

- In July, Brazil’s retail sales fell by more than analysts had expected they would, marking the worst performance in that month in more than 15 years. Rising unemployment is taking a toll on the country. Sales fell by 0.3% month over month in July, following a 0.3% increase in June.

- Sales fell by 5.3% year over year, which was the most severe July decline since the series began in 2001, even though consumer confidence in Brazil has been steadily on the rise since Michel Temer assumed the presidency in mid-May.

Cencosud Puts Its Focus on Peru with New Paris Stores and Malls

(September 14) América Retail

Cencosud Puts Its Focus on Peru with New Paris Stores and Malls

(September 14) América Retail

- At its recent investors meeting in Buenos Aires, Cencosud announced plans to open four new locations of department store Paris by 2019. The company also said it plans to enhance its shopping center business in Peru and consolidate malls in Chile.

- Despite deceleration of growth in both Chile and Peru, the company remains optimistic, citing additional growth prospects in Argentina in 2017, the end of the Brazilian recession in 2018 and the peace agreement between the government and FARC in Colombia.

American Airlines Joins Rush to Cuba with First Flights

(September 8) USA Today

American Airlines Joins Rush to Cuba with First Flights

(September 8) USA Today

- American Airlines has launched a regularly scheduled flight service to Cuba, the first for the airline other than noncharter flights. American is the second big US airline, and third overall, to add regular service to Cuba in over 50 years.

- JetBlue was the first airline to operate regularly scheduled flights from the US. Both airlines fly to Havana, Cienfuegos and Holguin, with planned expansion to Santa Clara, Camaguey and Varadero. American will eventually offer four daily round-trip flights from Miami to Havana and one from Charlotte.