Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

This week, we attended the Goldman Sachs 22nd Annual Global Retailing Conference. Below are several themes that emerged as key topics of conversation over the two-day conference. More retailers see omnichannel as the solution. The rapid adoption of online shopping has happened significantly faster than the 50 years it took for mall shopping to become widespread. Retailers and pure-play e-commerce companies alike are working to understand what the landscape will look like in the future and what their roles will be. We believe the answer is some combination of stores, e-commerce and mobile commerce. A number of pure-play e-commerce companies—including Warby Parker, Nasty Gal and Bonobos—are starting to open stores, given the high cost of customer acquisition online. Several omnichannel retailers commented at the conference that, despite lower traffic in stores, conversion is higher. That suggests that customers who do come into stores are more valuable; they have done their research and are ready to make their purchases. One surprising benefit to omnichannel retailers has been the popularity of the buy-online, pick up in-store method of delivery. This eliminates the cost of shipping to customers and minimizes the chance that they will return the merchandise, which is always a significant expense to retailers. What role does real estate have in the future of retail? Questions about real estate and the value of opening stores came up often, due to the rapid growth of the online channel. Retailers still see value in stores, as many customers still want to shop in them because they enjoy the experience and want to touch and feel the products. That said, we do not know of many established retailers that are growing their store bases significantly. Mall owners are investing in improving the customer experience and their offerings at A malls. At the same time, there are questions surrounding B and C malls and what their place will be going forward.. Historically, apparel retailers made up about half of a mall’s volume. Today, that percentage is closer to 35%—and likely declining. In addition, some retailers have sought to monetize their real estate. For example, Macy’s recently worked with Tishman Speyer in Brooklyn to sell off a portion of one of its sites there and to secure additional funds to be used to renovate the location. The consumer is healthy; spending is bifurcated. Commentary from retailers at the conference suggests that consumers are doing just fine—they have money to spend, although they are selective about where they spend it. The apparel category has been weaker, as spending has been skewed toward experiences such as entertainment and dining out at restaurants. In addition, strength in categories such as athleisure and beauty has pressured apparel. Still, the consensus seems to be that denim is making a comeback. Off-price is thriving as consumers seek brands at a discount. Consumers have come to expect branded merchandise at a deep discount. That bodes well for the off-price channel. At the conference, we heard leaders from Hudson’s Bay Company comment on the strong performance of its Off 5th stores; Macy’s executives say that feedback on its Macy’s Backstage concept is favorable; and Nordstrom executives say that the company has plans to expand its Nordstrom Rack stores into Canada over the next few years. Private labels are emerging in the beauty category. We heard from a number of management teams, including those from ULTA and Macy’s (which recently bought Bluemercury), about the successes in their private label and exclusive businesses in the beauty space, in both skincare and color. We believe Sephora has a strong private label business, too. Anthropologie has seen early favorable results, as well, and its management has identified beauty as a growth opportunity. In addition, H&M will launch a private label beauty collection in stores this fall. Everyone is targeting millennials. There was a lot of discussion at the conference about millennial customers, defined as those ages 15 to 35. The focus is on this group because, at the high end of the age range, they are approaching their peak spending years, their mid-30s. Millennials are more technologically savvy than prior generations and are 50% more likely to research a product before buying it. They are also early adopters and have a culture of peer review, all of which make them a valuable retail consumer demographic.

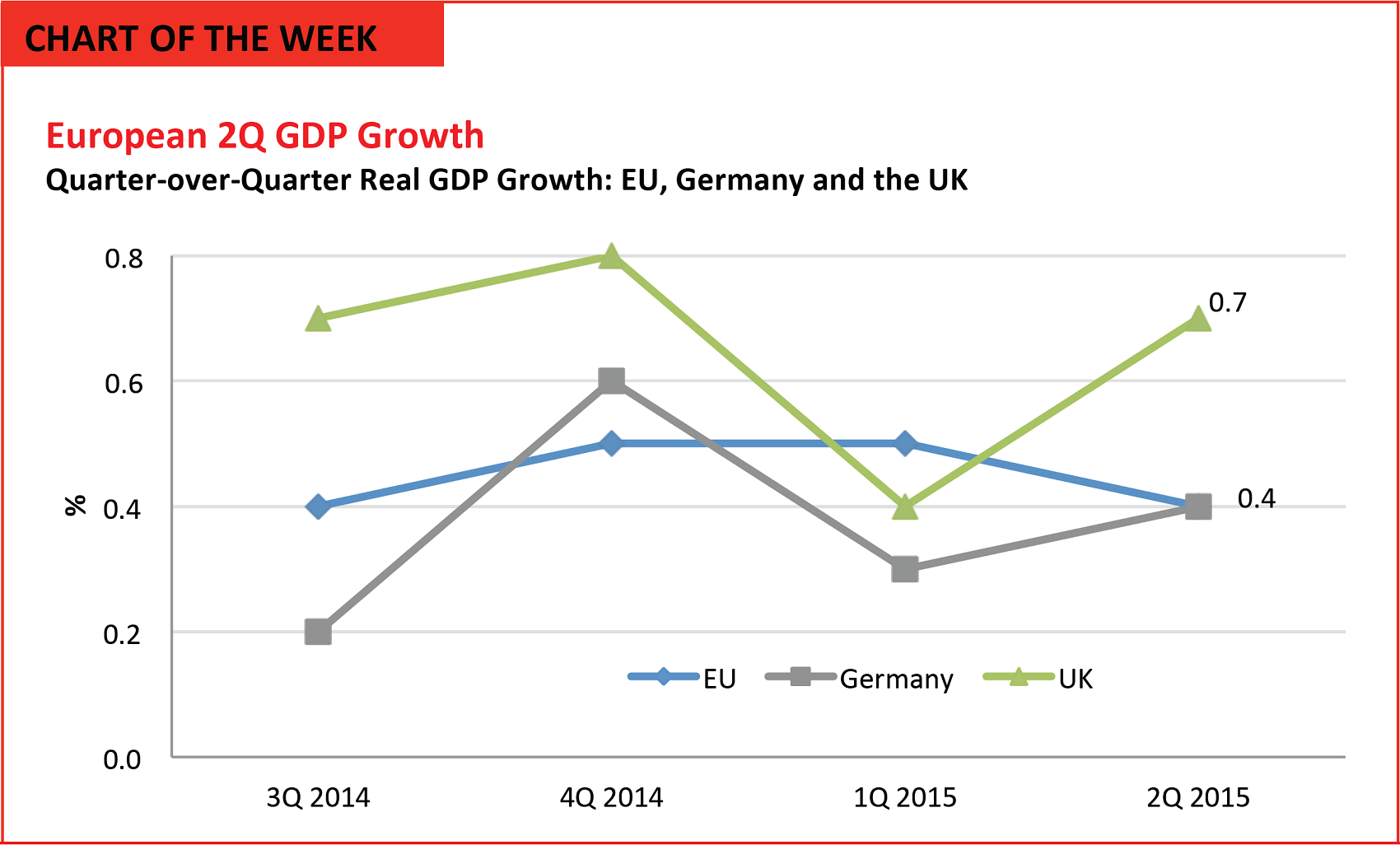

Seasonally adjusted data Source: Eurostat

- The 28 EU countries saw quarter-over-quarter economic growth of 0.4% in the second quarter, according to new, second estimates from Eurostat.

- The smaller, 19-country eurozone also saw total economic growth of 0.4% in the quarter, as did Germany.

- The strongest GDP growth was seen in Latvia (1.2%), Malta (1.1%) and Sweden (1.0%).

- The weakest growth was seen in France (0.0%), the Netherlands (0.1%) and Austria (0.1%).

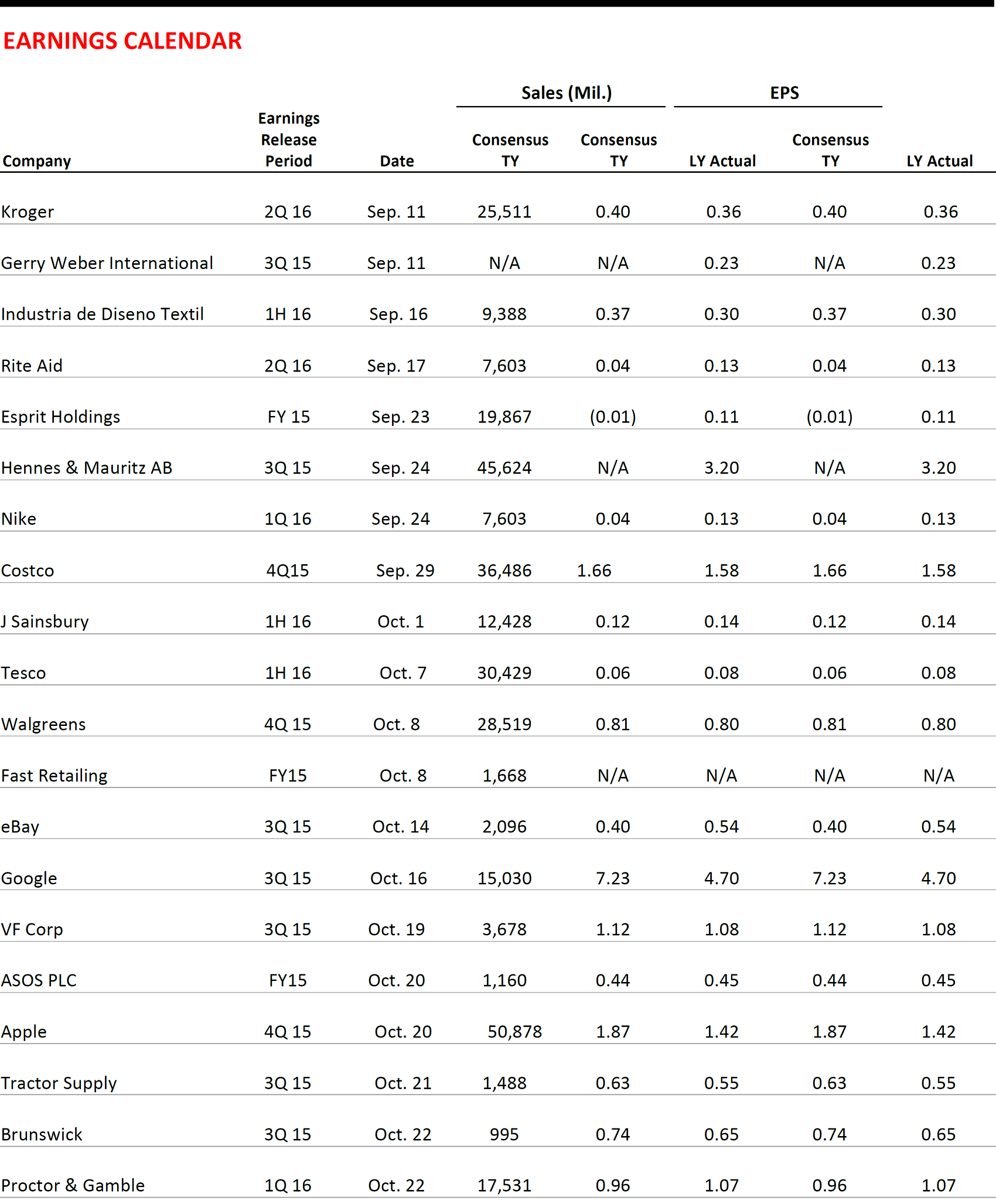

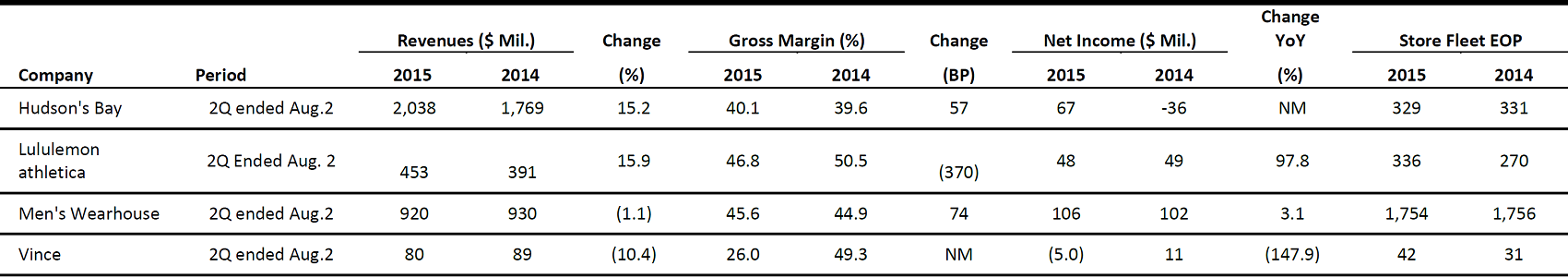

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- Department store giant Macy’s announced that Best Buy will open 10 shops in Macy’s stores in November. The goal is to offer a greater product mix, as consumer spending is favoring electronic gadgets and experiences. Macy’s has also felt investor pressure to make better use of its real estate.

- The 300-square-foot shops will be staffed with Best Buy employees and sell Samsung smartphones, tablets and smartwatches as well as accessories.

- Fashion retailer Primark officially opened its first store in the US on Thursday. Situated in the historic Burnham Building in downtown Boston, the flagship store spans four floors across 77,000 square feet, and was officially opened by the mayor of Boston.

- The company also announced plans to open an additional seven stores across the Northeast. One of the largest clothing retailers in Europe, Primark currently operates 292 stores and employs over 62,000 people.

- Google announced that it would partner with Whole Foods and Costco to test a new delivery service for fresh food and groceries. The trial will begin in San Francisco and another city yet to be named, said Brian Elliott, General Manager of Google Express. The new service will compete with other delivery services such as Instacart and AmazonFresh. Google is also expanding next-day deliveries in the Midwest for more than 25 million potential customers.

- According to IBISWorld, online groceries are a $10.9 billion industry in the US, and the market is expected to grow by 9.6% annually through 2019.

Apple Announcement

(September 9) WSJ.com

Apple Announcement

(September 9) WSJ.com

- Apple unveiled its new iPhone 6s and iPhone 6s Plus this week. The models have improved glass display durability and new camera technology (including a 12-megapixel sensor compared to the previously used 9-megapixel and 1080p video recording compared to the 720p offered on previous models). Like the Apple Watch, the new iPhones also have a variant of Force Touch called 3D Touch.

- The company also announced a revamped Apple TV, with a new voice-controlled remote and updated software. The new remote has a touchpad and responds to voice commands with Siri. It will be available in November for $149 for 32 gigabytes of memory and $199 for 64 gigabytes.

- Apple also launched the new iPad Pro. It has a 12.9" screen, significantly larger than the 9.7" screen on the previous model. The new iPad also has a new, pressure-sensitive stylus and keyboard cover, and will cost $1,067. Apple is targeting business customers with the new device. Finally, the company announced an agreement with Hermès for new designs and apps for its Apple Watch.

ASIA HEADLINES

- China’s top transportation app startup, DidiKuaidi, has now raised US$3 billion in total funding, according to Reuters sources. The company’s latest US$1 billion in funding comes on top of the US$2 billion it raised in July.

- Capital International Private Equity Fund and Ping An Ventures led the July round, but the latest investors were not named.

Uber CEO Kalanick Confirms at Least US$1.2B Funding for China Growth

(September 7) TechinAsia

Uber CEO Kalanick Confirms at Least US$1.2B Funding for China Growth

(September 7) TechinAsia

- Uber CEO and founder Travis Kalanick said the company is raising US$1.2 billion for its China business

- This funding round is still not finalized, and the total raised could ultimately be higher.

- In China, Uber is currently battling top transportation app startup DidiKuaidi.

- Zomato, a restaurant discovery site, closed $60 million in new funding. The India-based company is pushing into new verticals, including food delivery, payments and table reservations.

- The company’s core service is a restaurant discovery site that covers 1.4 million restaurants across 22 countries, including the US.

- Germany-based Rocket Internet announced that it would launch one new venture in Asia per quarter.

- Asia Pacific Internet Group, a joint venture between Rocket Internet and Qatari telecom firm Ooredoo, will manage the expansion. The company currently represents 14 companies across 15 countries.

- Rocket Internet already has a strong presence in Southeast Asia, where its e-commerce companies, Lazada and Zalora, do business. The two companies have collectively raised nearly US$1 billion in funding.

- Video-streaming service Netflix will enter South Korea by January 2016. The company will make an official announcement next week, The Korea Times reported. South Korea’s broadband is among the best in the world, and 4K streaming is widely available there.

- Netflix first entered the Asian market when it launched in Japan on September 2. The Netflix Japan service will include original Japanese films and TV series, as well as original Netflix series from the US, such as Marvel’s Daredevil.

- Mobile fraud is increasing: although mobile payments account for only 14% of transactions, they represent a disproportionate 21% of fraud cases.

- According to Apsalar, a mobile metrics firm, for every valid in-app purchase made in China, there are 273 fraudulent ones. Taiwan sees 54 fake in-app purchases for every valid one, Saudi Arabia sees 24.6, and Israel and Hong Kong both see 18.

- Toyota will invest US$50 million over the next five years to establish joint research facilities at Stanford and MIT. Their goal will be to build vehicle-based artificial intelligence and robotics that will make automobiles safer to drive.

- Toyota, unlike Google, is steering its research toward technologies that will assist human drivers, rather than replace them altogether.

- Samsung Electronics said it would make its next smartwatch technology available to competitors that also use the Android platform, in an effort to increase its share of the market, which is currently dominated by Apple.

- The Apple Watch enjoys a 75% global smartwatch market share, followed by Samsung with an 8% share.

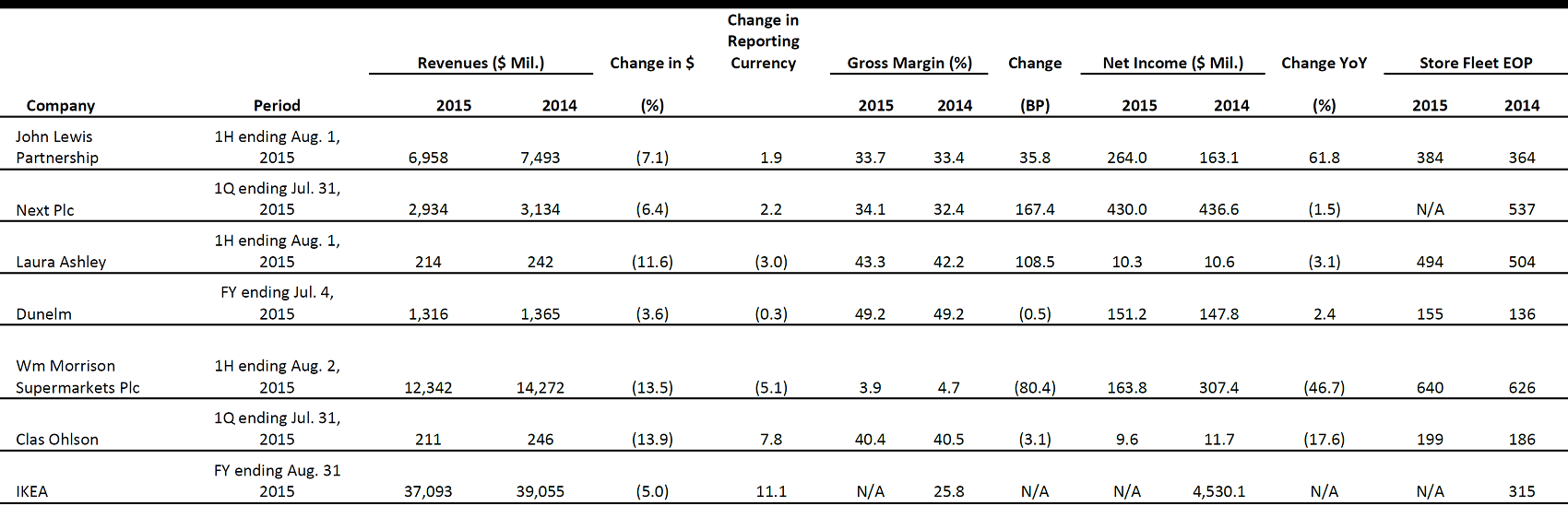

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

- Auchan’s French turnover declined by 2.9%, to €9.1 billion (US$10.2 billion), in the half year ending June 30, 2015. Auchan’s group operating profits for the first half increased by 17.0%, to €376 million (US$422 million). The group’s total turnover increased by 3.4%, to €26.9 billion (US$30.3 billion). A 28.6% turnover increase in Asia was the major contributor. Exchange rates significantly impacted the company’s results, which would have reflected 2.0% turnover at constant exchange rates.

- Auchan’s Western European markets excluding France showed a 4.4% drop in sales, down to €4.8 billion (US$5.4 billion). Its Central and Eastern European operations posted a 6.4% turnover decline, and they have been particularly affected by exchange rate fluctuations, with 10.6% growth at constant exchange rates.

Net-a-Porter Founder Natalie Massenet Resigns as Executive Chairman of The Net-a-Porter Group (September 2) Yooxgroup.com

- Natalie Massenet, who founded Net-a-Porter in 2000 from her London flat, resigned as Executive Chairman of The Net-a-Porter Group, ahead of the company’s merger with Italian firm Yoox Group, which is expected to be finalized later this year.

- The merger between Yoox and Net-a-Porter was announced on March 31, 2015. The all-share transaction was between Yoox and Richemont, which acquired Net-a-Porter back in 2010. The merger aims to create the largest luxury e-commerce company: the two companies’ combined 2014 net revenues were €1.3 billion (US$1.4 billion).

- Spanish retailer El Corte Inglés reported 2.6% growth in sales, to €14.59 billion (US$16.36 billion), for its fiscal year ending February 28, 2015. This was the company’s first revenue increase after three years of declining sales. The core department store operation grew sales by 3.6%, to €8.77 billion (US$9.83 billion), and drove the group’s revenue increase: its hypermarkets and supermarkets reported declining revenues during the same period.

- El Corte Inglés hypermarkets were the worst-performing operations, with a decline in sales of 8.5%, to €1.57 billion (US$1.76 billion). Revenues from the company’s supermarkets declined by 4.0%, to €591 million (US$663 million). The company’s upmarket positioning hit grocery retail performance, as there is price sensitivity in the market in which the retailer operates.

- Tesco sold Homeplus, its South Korean business, for £4.2billion (US$6.3 billion) to MBK Partners, a South Korean buyout firm. With the move, the retailer aims to strengthen its balance sheet and switch its focus back to its core UK market.

- The deal is expected to be finalized before the end of 2015, and to generate after-tax and other cost savings of £3.35 billion (US$5.0 billion) in cash, which will be used, according to Tesco CEO Dave Lewis, to deliver material value to Tesco’s shareholders and to strengthen the retailer’s balance sheet.

- Marks & Spencer may miss its objectives for opening international stores, a company executive said this week. In 2014, Marks & Spencer revealed plans to open 250 stores over the following three years, with a focus on China, Russia, India, Western Europe and the Middle East. However, in an interview with Reuters, Executive Director of Marketing and International Patrick Bousquet-Chavanne admitted that the retailer might no longer be able to achieve its original targets.

- Bousquet-Chavanne said that challenges in Russia, China and the Middle East have had an impact on numbers, but that M&S is still confident it will succeed in these regions over the longer term.

- Primark’s sales are expected to have risen by around 13% at constant exchange rates in the year ending September 12, according to a pre-close update from its parent company, Associated British Foods. At actual exchange rates, sales are expected to have grown by 8%. Associated British Foods said that the strength of the pound had cut its operating profits by some £30 million (US$46 million) over the period.

- Primark has heavily expanded in overseas markets, and much of the growth has come from opening new stores in markets such as the Netherlands, Germany, France and Spain. Primark’s first US store opened this week, in Boston.

- British retailer Laura Ashley reported that comparable retail sales were up by 7.0% for the 26 weeks ending August 1, 2015, with total group sales down 3.0%. Pretax profits were down 1.2%, to £8.4 million (US$12.9 million).

- Of its retail categories, the top-performing divisions were home accessories and furniture, with total sales growth of 8.2% and 8.8%, respectively. Fashion sales fell 5.0% over the financial period, although comps in the category were up 0.6%. Hotel sales increased by 44.0%.

- Germany’s biggest retailer, Metro Group, agreed to an e-commerce partnership with Alibaba that will allow Chinese consumers to buy more than 100 German products on Metro’s flagship store on the Tmall website. The product assortment will thereafter be increased with food items from the METRO Cash & Carry shops and nonfood items from the Real hypermarket chain.

- Metro Group’s shares rose 3.4% after the announcement. The company has 82 wholesale stores in China. Metro Group and Alibaba said the partnership would encompass collaboration in cross-border e-commerce, logistics, online supermarkets and online-offline initiatives.

LATAM HEADLINES

- Retail franchiser Axo is planning to open seven Bath & Body Works stores in Mexico and Chile. The company also plans to open more Victoria’s Secret Beauty and Accessories stores.

- The first Bath & Body Works was opened in Mexico City last February, and the first shop in Santiago, Chile, will be opened within two weeks.

- There are currently 16 Victoria’s Secret Beauty and Accessories stores in Mexico and three in Chile.

- Axo is planning to open 2,700 stores this year, following its acquisition of the off-price Promoda Outlet and its opening of Hollister and Abercrombie & Fitch stores in Mexico.

- The franchiser is looking to expand Promoda and hopes to exit 2015 with 100–115 stores and then open another 40–50 stores over the next couple of years.

- The Mexican off-price market is expected to grow by 30%–40% annually.

- Chilean group Falabella reported 10% revenue growth in the second quarter of 2015, with especially strong performance in its supermarket businesses.

- The company operates supermarkets in Chile and Peru, and the second quarter represented the sixth consecutive quarter of positive same-store sales growth for supermarkets in both countries.

- Falabella plans to invest US$4.4 billion from 2015 through 2018, of which more than half will be used toward its goal of operating a total of 140 stores and 11 shopping centers across its markets.

- Alibaba plans to expand its presence in Latin America, mostly in Argentina and Brazil, according to a company executive’s remarks at a recent conference.

- South and Central America contribute about 6% of the company’s total revenue, largely owing to Brazil and Argentina, which are the main targets of future expansion.

- The company has created Spanish and Portuguese versions of its websites in order to better facilitate this expansion and attract more consumers to its services.

- Apparel exports from Nicaragua are expected to fall by 5%, to US$1.3 billion, this year, following the expiration of the US’s Tariff Preference Level last December.

- The change is expected to result in 5,000 job cuts as trouser and jean makers are forced to downsize and import expensive twill and denim from the US or Mexico, rather than from Pakistan and China.

- The US previously accounted for 25% of Nicaragua’s textile exports.