From the Desk of Deborah Weinswig

Is Europe Ripe for an Off-Price Boom?

This summer saw the opening of what is only the second major off-price chain in Europe. Hudson’s Bay Company brought its Saks Off 5th off-price format to Europe in June with the opening of its inaugural store in Düsseldorf. It joined TJX Companies, which trades as TK Maxx in Europe and has stores in the UK, Ireland, Germany, Poland, Austria and the Netherlands. TK Maxx has so far been the only off-price brick-and-mortar chain of note in Europe, although we view Amazon as a de facto off-price fashion retailer, too.

The immaturity of the off-price channel in Europe suggests opportunities for growth. TJX Companies has stated that it aims to operate 1,100 stores in Europe and Australia over the long term, of which 125 would be in Australia, implying 975 stores in Europe. As of January 2017, the company operated a total of 582 stores across these regions. The company plans to open 45 more European TK Maxx stores by

January 2018, the end of its current fiscal year.

Saks Off 5th already has five German stores and one Dutch store, according to its website. A second store in the Netherlands will open this autumn, the company says.

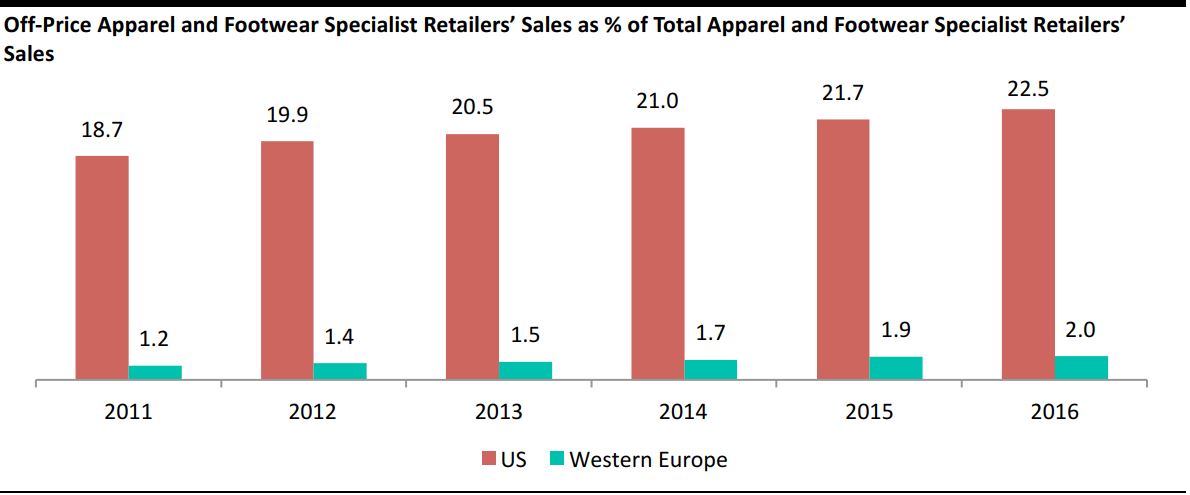

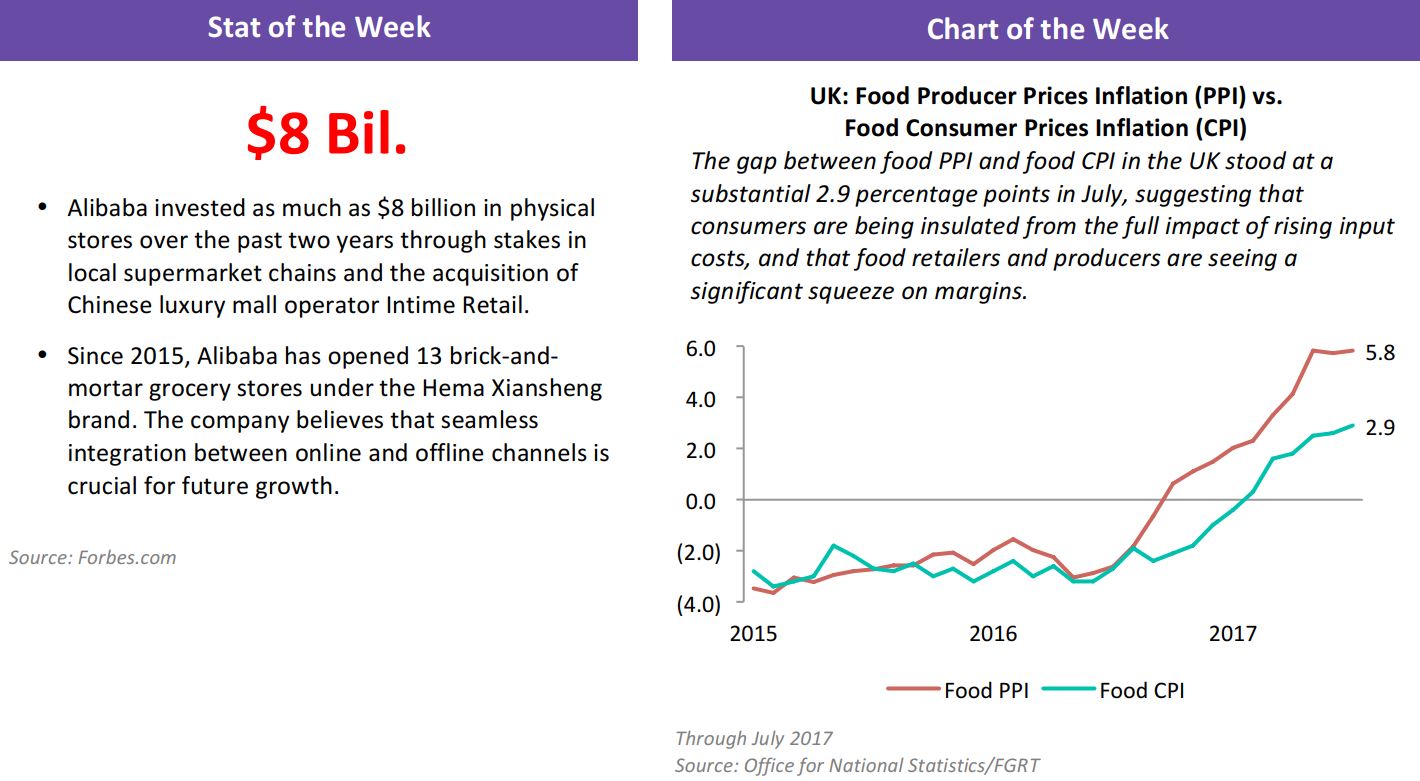

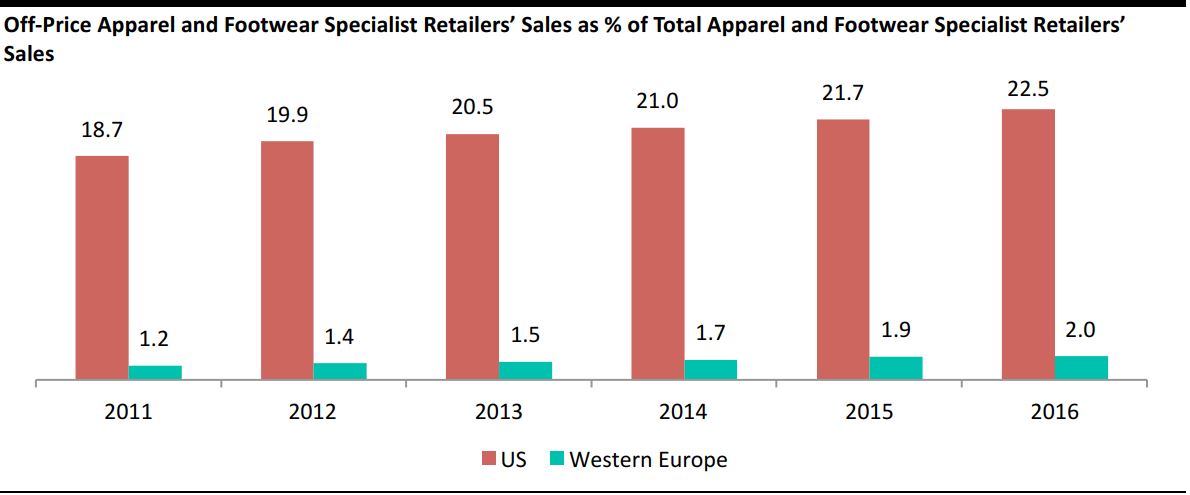

Data from Euromonitor International show that the off-price sector accounted for only 2% of European apparel specialist retail sales last year. Some $232 billion of sales will flow through apparel and footwear specialist stores this year, according to Euromonitor. If off-price retailers can, in time, capture 5% of the sector, it implies the potential for almost $12 billion in annual sales, at 2017 prices.

Source: Euromonitor International

However, we think the off-price segment will achieve a lower penetration of the apparel sector in Europe than it has in the US. The relative strength of full-price retailing in Europe will likely make established retailers more reluctant to push into off-price formats there in the way that Nordstrom, Saks Fifth Avenue, Macy’s and Lord & Taylor have done in the US. Retailers’ wariness about possible cannibalization could cap the scale of the off-price sector in Europe.

That, in turn, suggests that international entrants such as TK Maxx and Saks Off 5th could enjoy a free run to build share in the European apparel sector in the near term.

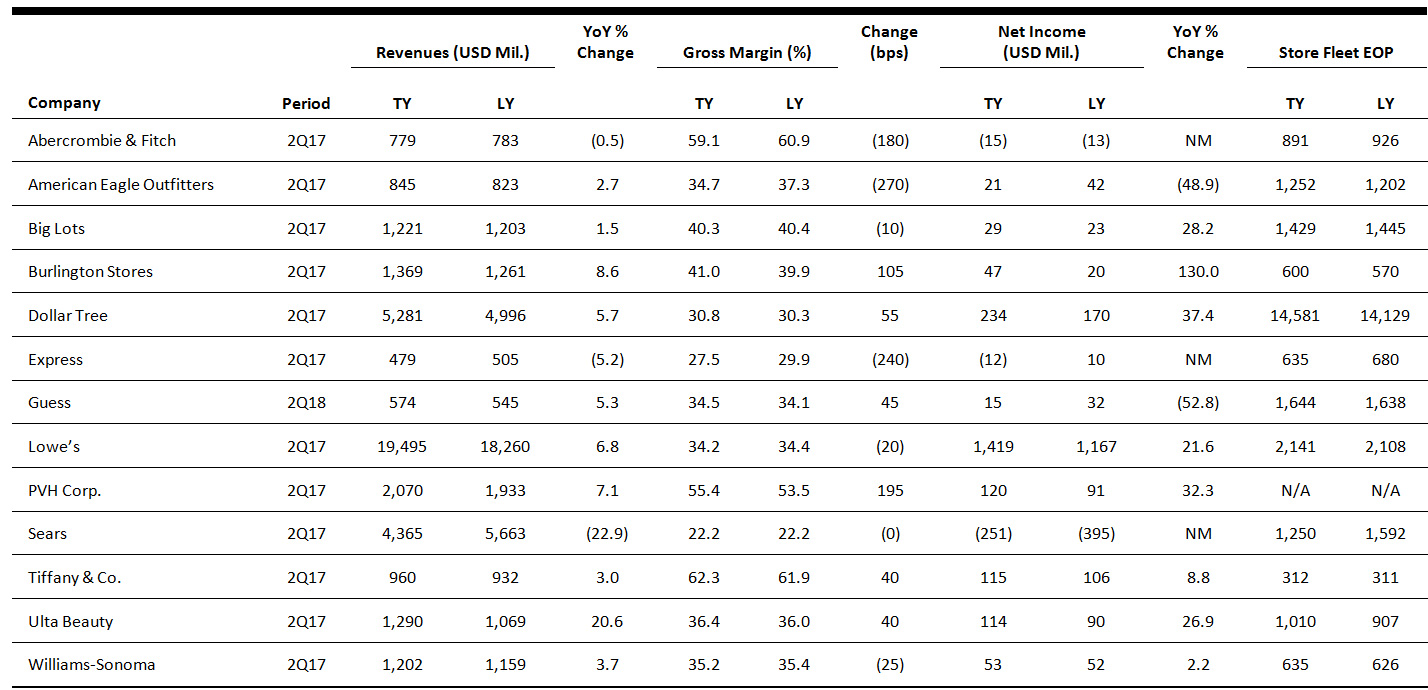

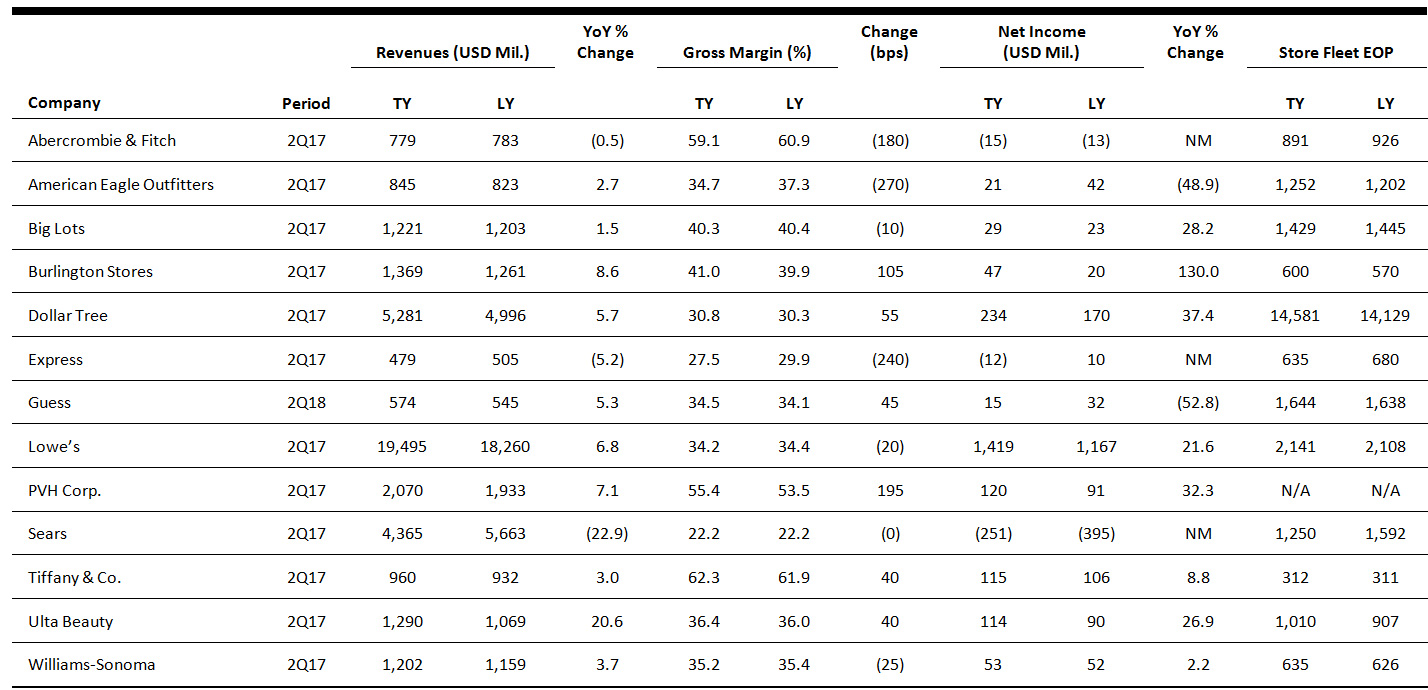

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

At Whole Foods, Amazon Takes Rare Lead in Cutting Prices

(August 28) The Wall Street Journal

At Whole Foods, Amazon Takes Rare Lead in Cutting Prices

(August 28) The Wall Street Journal

- Amazon.com put itself in the unusual position of being a first mover on price cuts when it slashed the sticker price on more than 100 items at Whole Foods Market, many by more than 30%.

- Amazon typically relies on algorithms that scrape competitors’ prices before automatically matching or narrowly undercutting them on its website. It focuses on items that are most popular on the site and that drive traffic, according to former executives in Amazon’s retail divisions. That gives the retail giant a reputation for having the lowest prices, part of its strategy of driving more shopper traffic.

Why Hurricane Harvey Is a “Double Whammy” for Texas Retail

(August 28) FootwearNews.com

Why Hurricane Harvey Is a “Double Whammy” for Texas Retail

(August 28) FootwearNews.com

- With a heavy blast of devastating rain and flooding, Category 4 storm Hurricane Harvey pummeled through some of the most populous cities in Texas, leaving in its wake destruction and chaos. “This comes as a double whammy,” said Marshal Cohen, chief industry analyst with The NPD Group. “In some parts of Texas, there is already a pullback from the Hispanic consumer, [which has affected] some of the retailers that rely heavily on that customer base.”

- “But now, you’ve got to add in the fact that there is this new environmental issue [that is] totally changing the focus of spending,” Cohen said. For footwear and apparel retailers, the end of August and early September marks a critical time in the back-to-school shopping period.

The Parent Company of Saks Fifth Avenue Is Thinking About Going Private

(August 28) BusinessInsider.com

The Parent Company of Saks Fifth Avenue Is Thinking About Going Private

(August 28) BusinessInsider.com

- Hudson’s Bay Company, owner of the Saks Fifth Avenue and Lord & Taylor retail chains, plans to review its options, including going private, following pressure from an activist shareholder, people familiar with the matter said.

- Hudson’s Bay Company, which is already working with an investment bank to defend itself against activist hedge fund Land and Buildings, has been seeking to hire another financial advisor to carry out the review, the sources said this week.

Perfumania Seeks Bankruptcy Protection

(August 27) The Wall Street Journal

Perfumania Seeks Bankruptcy Protection

(August 27) The Wall Street Journal

- Mall-based retail chain Perfumania has sought Chapter 11 protection, with plans to reorganize around its better-performing stores. “Unlike many retailers who have filed for bankruptcy, Perfumania sees a viable path forward,” Chief Executive Michael Katz said in court papers filed Saturday.

- The company plans to close 64 of its 226 stores during the bankruptcy process, court papers show. Despite closing nearly 100 stores since 2015, the company still took losses each year, Katz said. Its stores will remain open while under bankruptcy protection. Perfumania’s Parlux and Five Star Fragrance subsidiaries are not included in the bankruptcy filing.

Walmart and Google Are Plotting to Change Your Shopping Habits

(August 23) The Washington Post

Walmart and Google Are Plotting to Change Your Shopping Habits

(August 23) The Washington Post

- Move over, Alexa. Walmart is going high-tech in its fight against Amazon.com. Beginning next month, shoppers will be able to buy Walmart products by speaking to their Google Home devices. The retailer is the latest—and largest—to make its goods available on Google Express, Google’s e-commerce and delivery platform.

- he partnership, which brings together the world’s largest retailer with the world’s largest search engine, is the latest effort by Walmart to chip away at Amazon’s online dominance.

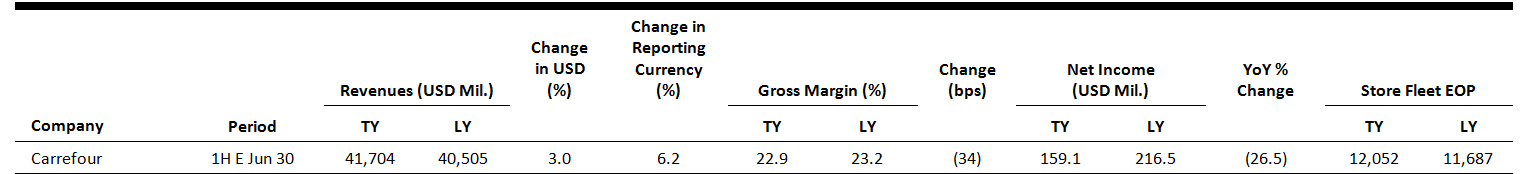

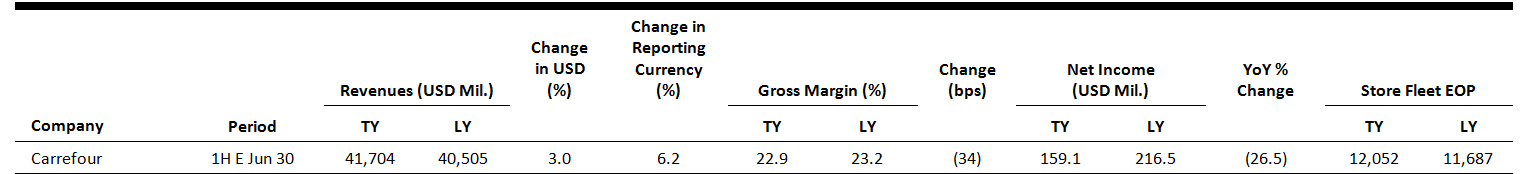

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

Source: Company reports/FGRT

EUROPE RETAIL HEADLINES

Sainsbury’s Announces Argos Click-and-Collect Points at 100 Convenience Stores

(August 29) Retail-Week.com

Sainsbury’s Announces Argos Click-and-Collect Points at 100 Convenience Stores

(August 29) Retail-Week.com

- British grocer Sainsbury’s has announced plans to introduce Argos click-and-collect services at 100 convenience stores. This move will allow shoppers to collect Argos and Tu clothing orders placed online at stores “closer to where they live or work.”

- The retailer successfully trialed the initiative in six Sainsbury’s Local convenience stores and expects the plan to be completed by the end of 2017.

Arcadia Agrees to Pay BHS Creditors £30 Million

(August 25) TheGuardian.com

Arcadia Agrees to Pay BHS Creditors £30 Million

(August 25) TheGuardian.com

- UK fashion group Arcadia has agreed to pay £30 million (US$39 million) to the unsecured creditors of BHS, a department store chain that it owned previously. BHS collapsed into administration in 2016, leaving behind a pension fund deficit of £571 million (US$740 million).

- BHS’s liquidator, FRP Advisory, has agreed to drop legal action filed against Arcadia with this settlement.

Matchesfashion.com Valuation Reportedly Rises, but Company Remains Mum on Sale

(August 27) WWD.com

Matchesfashion.com Valuation Reportedly Rises, but Company Remains Mum on Sale

(August 27) WWD.com

- London-based luxury e-commerce firm Matchesfashion.com is now reportedly worth £800 million (US$1.04 billion), up from £650 million (US$843 million) as reported by various newspapers earlier in August.

- News reports suggest that the retailer also has several private equity bidders, including Apax Partners, Permira, KKR and Bain Capital, lined up to table their offers, but Women’s Wear Daily was unable to reach them for comment. Matchesfashion.com has not made a formal announcement and the owners have declined to comment concerning the sale of a majority or minority stake in the firm.

Spar Becomes First Retailer to Launch in Belarus

(August 25) ESMMagazine.com

Spar Becomes First Retailer to Launch in Belarus

(August 25) ESMMagazine.com

- Dutch retail chain Spar has announced plans to enter Belarus and open 60 new stores in the country by 2020. Spar is partnering with Belarusian firm Almi Group, whose Unifood CKSC subsidiary will operate the brand in the country.

- Almi Group runs 43 stores in Belarus under the banners Almi and Zakrama. Spar will provide the group with retail design, staff, training, supply chain review and marketing campaigns.

Ocado Launches Voice-Shopping App for Grocery on Amazon’s AI Speakers

(August 29) TechCrunch.com

Ocado Launches Voice-Shopping App for Grocery on Amazon’s AI Speakers

(August 29) TechCrunch.com

- UK online supermarket Ocado has unveiled an app for Amazon’s Alexa voice assistant that will enable owners of Amazon’s artificial intelligence–powered Echo smart speakers to add groceries to their shopping list by voice command. This news follows Amazon’s acquisition of American grocer Whole Foods Market.

- Ocado says that it is the first British supermarket to launch an app for Alexa. Currently, the app only allows users to amend existing orders and does not support creating new orders.

ASIA TECH HEADLINES

China Doubles Down on Real-Name Registration Laws, Forbidding Anonymous Online Posts

(August 27) TechCrunch.com

China Doubles Down on Real-Name Registration Laws, Forbidding Anonymous Online Posts

(August 27) TechCrunch.com

- China’s crackdown on Internet freedom is getting even more intense. Last Friday, the country’s top Internet censor announced a new set of regulations meant to eliminate posts by anonymous users on Internet forums and other platforms. The Cyberspace Administration of China will start enforcing those rules on October 1.

- According to the new regulations, Internet companies and service providers are responsible for requesting and verifying real names from users when they register and must immediately report illegal content to the authorities. Tech firms, including Baidu, Alibaba and Tencent, are under more pressure to serve as the government’s gatekeepers, which is expected to result in the placement of new people in several key leadership positions.

Uber Running Again in the Philippines After Paying $9.6 Million in Penalties

(August 29) TechCrunch.com

Uber Running Again in the Philippines After Paying $9.6 Million in Penalties

(August 29) TechCrunch.com

- Uber’s one-month suspension of its service in the Philippines was lifted early, after the company agreed to pay nearly $10 million in fines and aid for drivers affected by the service being suspended, Reuters reports. Earlier in August, the ride-hailing giant suspended its services in the country on order of a national regulator, the Land Transportation Franchising and Regulatory Board.

- The suspension was ordered after Uber apparently flouted a temporary ban on adding new drivers while the regulator worked to catch up with a backlog of applications for drivers seeking ride-hailing permits—though Uber has claimed it had not been adding new drivers during this period.

Renault-Nissan and Dongfeng Partner to Build Electric Cars for China

(August 29) TechCrunch.com

Renault-Nissan and Dongfeng Partner to Build Electric Cars for China

(August 29) TechCrunch.com

- Renault-Nissan and China’s Dongfeng Motor are setting up a dedicated joint venture to build electric vehicles for the growing demand in China, joining Ford and Volkswagen. Automakers from outside China basically need a local partner in order to make and sell vehicles in the country without incurring huge import taxes that would basically render their operations unsustainable.

- Renault-Nissan’s new partnership with Dongfeng is called eGT New Energy Automotive Company, and it will be split between Nissan, with 25% ownership, Renault with another 25%, and Dongfeng with the remaining 50%, according to Reuters. The first vehicle from the joint venture will be a new electric vehicle based on one of Renault-Nissan’s subcompact crossover-SUV platform designs.

SoftBank and Line Further AI Ambitions by Joining This Startup’s $33 Million Series C

(August 30) TechinAsia.com

SoftBank and Line Further AI Ambitions by Joining This Startup’s $33 Million Series C

(August 30) TechinAsia.com

- Artificial intelligence startup Appier revealed that it has secured $33 million in series C funding from investors such as SoftBank, Line and Singapore’s EDBI. The Taipei-based company said in a statement that it will use the investment to hire new team members—particularly in engineering and research and development—as it looks to grow its global presence.

- Appier offers a number of products built around technology that tracks individual users’ activity across all of the web-connected devices they own—including smartphones, tablets, laptops and desktop computers—enabling advertisers to better target their campaigns.

LATAM RETAIL AND TECH HEADLINES

Rio de Janeiro to Open Taxi App API

(August 28) ZDNet.com

Rio de Janeiro to Open Taxi App API

(August 28) ZDNet.com

- The city of Rio de Janeiro will open the API of its newly created taxi app to other Brazilian cities. The tool, Taxi.Rio, connects licensed taxi drivers with passengers. The difference between Taxi.Rio and other commercial tools, such as Uber, is that drivers can use it free of charge.

- A proprietary payment gateway for the app is also being developed by IplanRio, the city’s informatics company. According to IplanRio, the API for the tool will be available to any city wanting to create a local version. Cities that have shown interest include state capitals São Paulo, Curitiba, Recife and Aracaju.

Facebook Opened a “Hack Station” in Brazil to Teach Startup Skills to Thousands of Locals

(August 28) BusinessInsider.com

Facebook Opened a “Hack Station” in Brazil to Teach Startup Skills to Thousands of Locals

(August 28) BusinessInsider.com

- Facebook unveiled its first training center in Latin America for coders and entrepreneurs, encouraging technology careers for young Brazilians saddled with staggering unemployment after a deep economic crisis.

- The company’s regional Vice President, Diego Dzodan, told Reuters the space in midtown São Paulo, known as Estação Hack, will bridge the gap in Brazil between a tech sector hungry for skilled talent and an eager but untrained generation with time on their hands.

Brazil Makes Inroads into Biometric Citizen Registration

(August 28) ZDNet.com

Brazil Makes Inroads into Biometric Citizen Registration

(August 28) ZDNet.com

- The Brazilian Superior Electoral Tribunal (TSE) has been granted access to data from all drivers as the country advances in its biometric data collection efforts. TSE has been collecting biometric data for voter identification as a means to prevent fraud since 2013.

- Ultimately, the government wants to collect biometric information from 140 million citizens by 2020. The ultimate goal is to create a single citizen database and unified ID card, which would gather information such as tax, driver and voting records. TSE is responsible for leading the single biometric database efforts.

Walmart to Invest over $300 Million in Brazil

(August 30) TheStreet.com

Walmart to Invest over $300 Million in Brazil

(August 30) TheStreet.com

- Walmart intends to invest roughly R$1 billion (US$316 million) in Brazil through 2019 to restore about 120 stores as rivals in South America’s biggest economy ratchet up investments to retain cash-strapped consumers, Reuters reports.

- “We’ve already done about 10% of it this year,” said Flavio Cotini, Walmart’s chief executive in Brazil. Walmart is the third-largest diversified retailer in Brazil. The report added that Goldman Sachs projects that Brazil’s largest food retailer, Carrefour Brasil, will double its number of stores in the next three years.

MACRO UPDATE

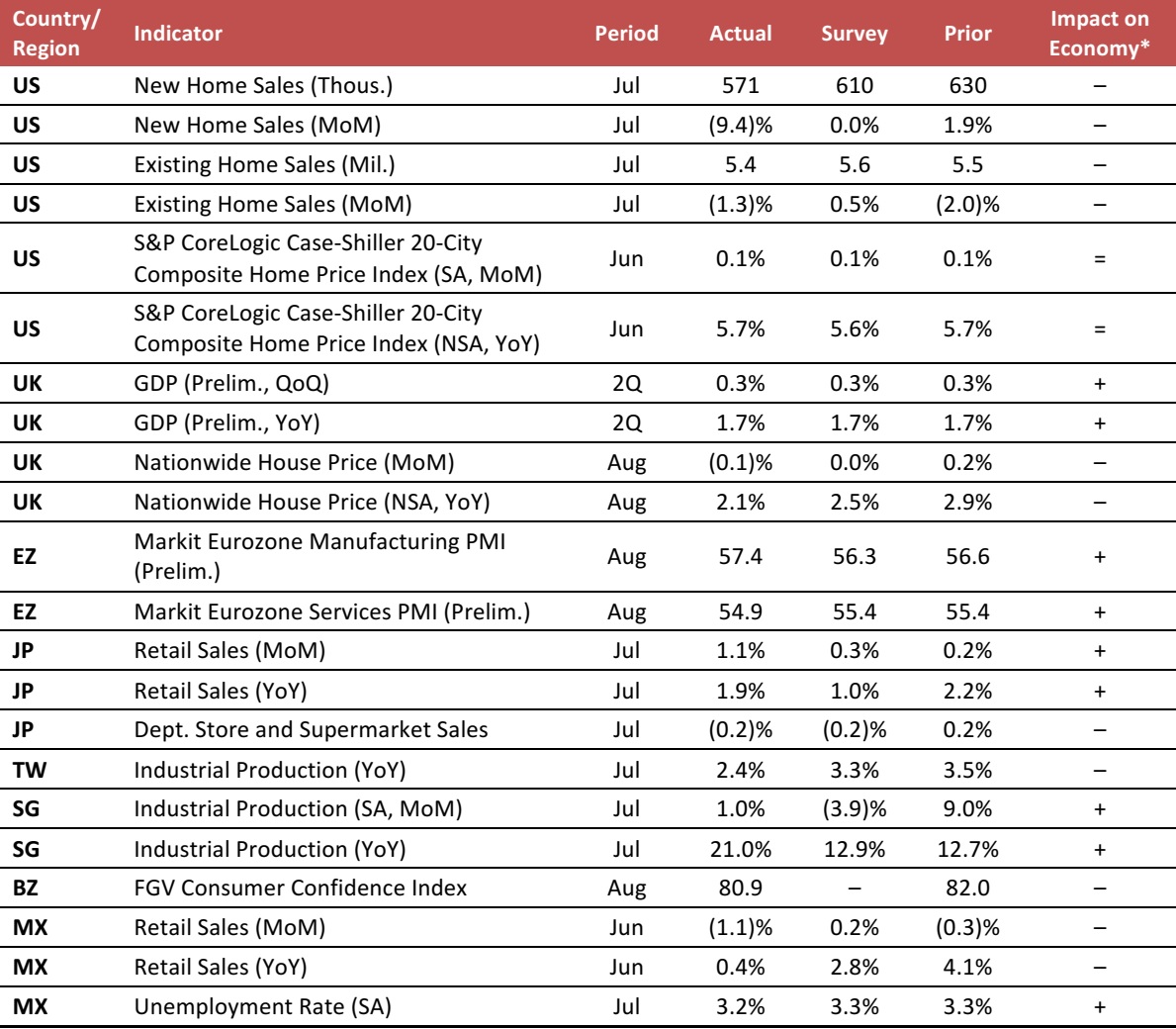

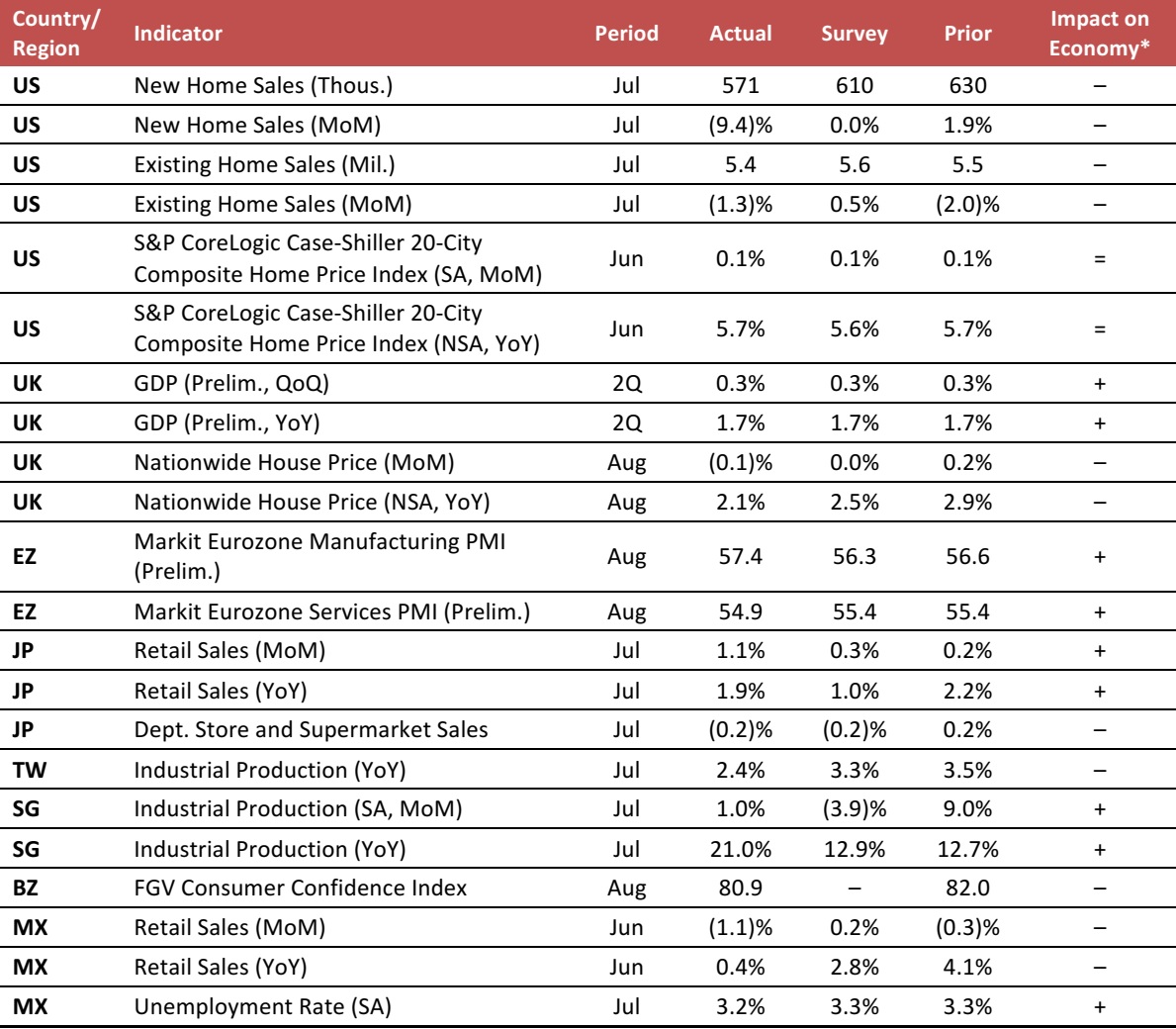

Key points from global macro indicators released August 23–30, 2017:

- US: Home sales came in lower than expected in July. New home sales stood at 571,000 and existing home sales totaled 5.4 million. In June, housing prices rose by 0.1% month over month (after seasonal adjustment) and by 5.7% year over year (before seasonal adjustment).

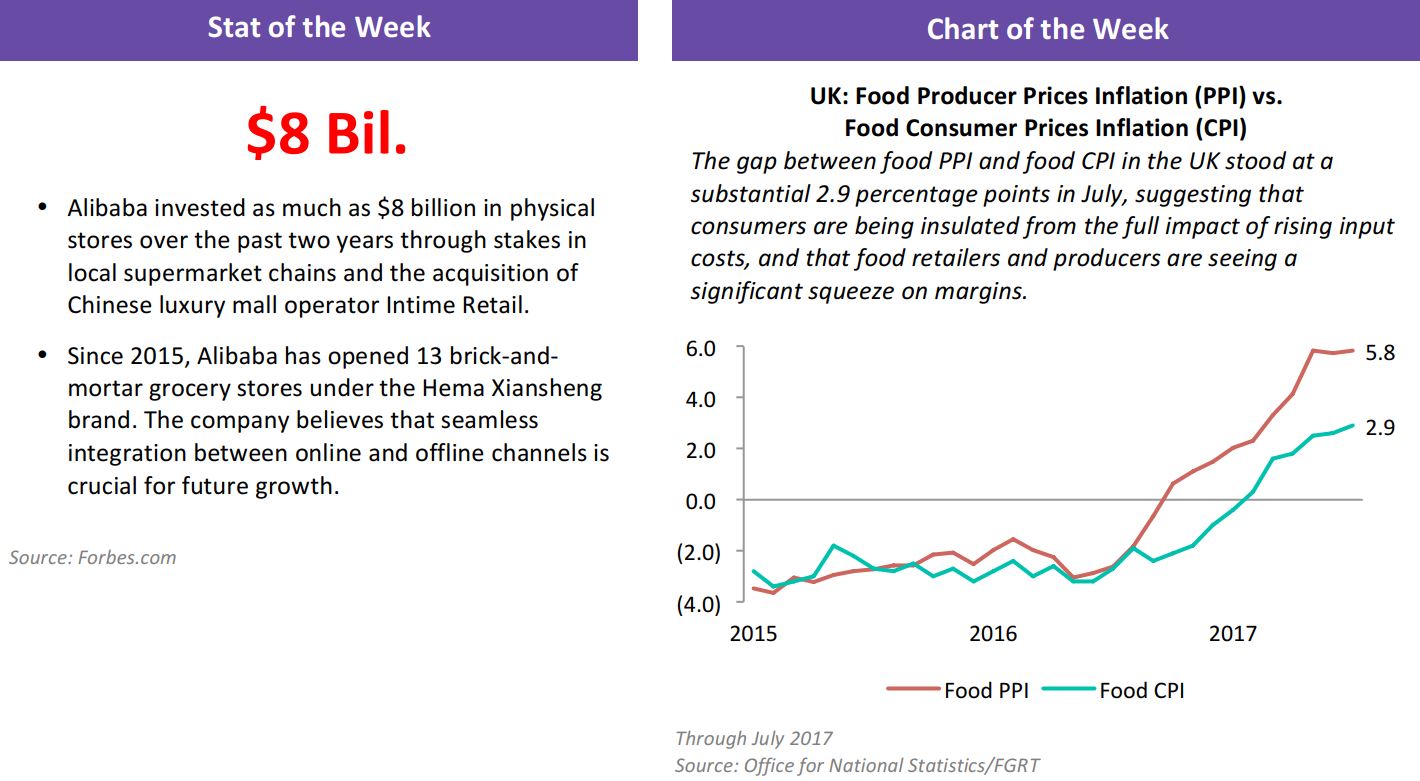

- Europe: In the UK, GDP increased by 0.3% quarter over quarter in the second quarter, in line with the consensus estimate. UK housing prices edged down by 0.1% month over month in August. In the eurozone, the Manufacturing and Services Purchasing Managers’ Indexes (PMIs) stood at levels above the expansion threshold of 50.0 in August.

- Asia-Pacific: In Japan, retail sales increased by 1.1% month over month in July, exceeding the market’s expectation. In Taiwan, industrial production increased by 2.4% year over year in July. In Singapore, industrial production leaped by 21.0% year over year in July.

- Latin America: In Brazil, consumer confidence dropped to 80.9 in August. In Mexico, retail sales dropped by 1.1% month over month and increased by 0.4% year over year in June.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/National Association of Realtors/S&P Dow Jones/UK Office for National Statistics/Nationwide Building Society/Markit/European Commission/Japan Ministry of Economy, Trade and Industry/Ministry of Economic Affairs Taiwan/Singapore Economic Development Board/Banco Central do Brasil/Fundação Getulio Vargas/Instituto Nacional de Estadística y Geografía/FGRT

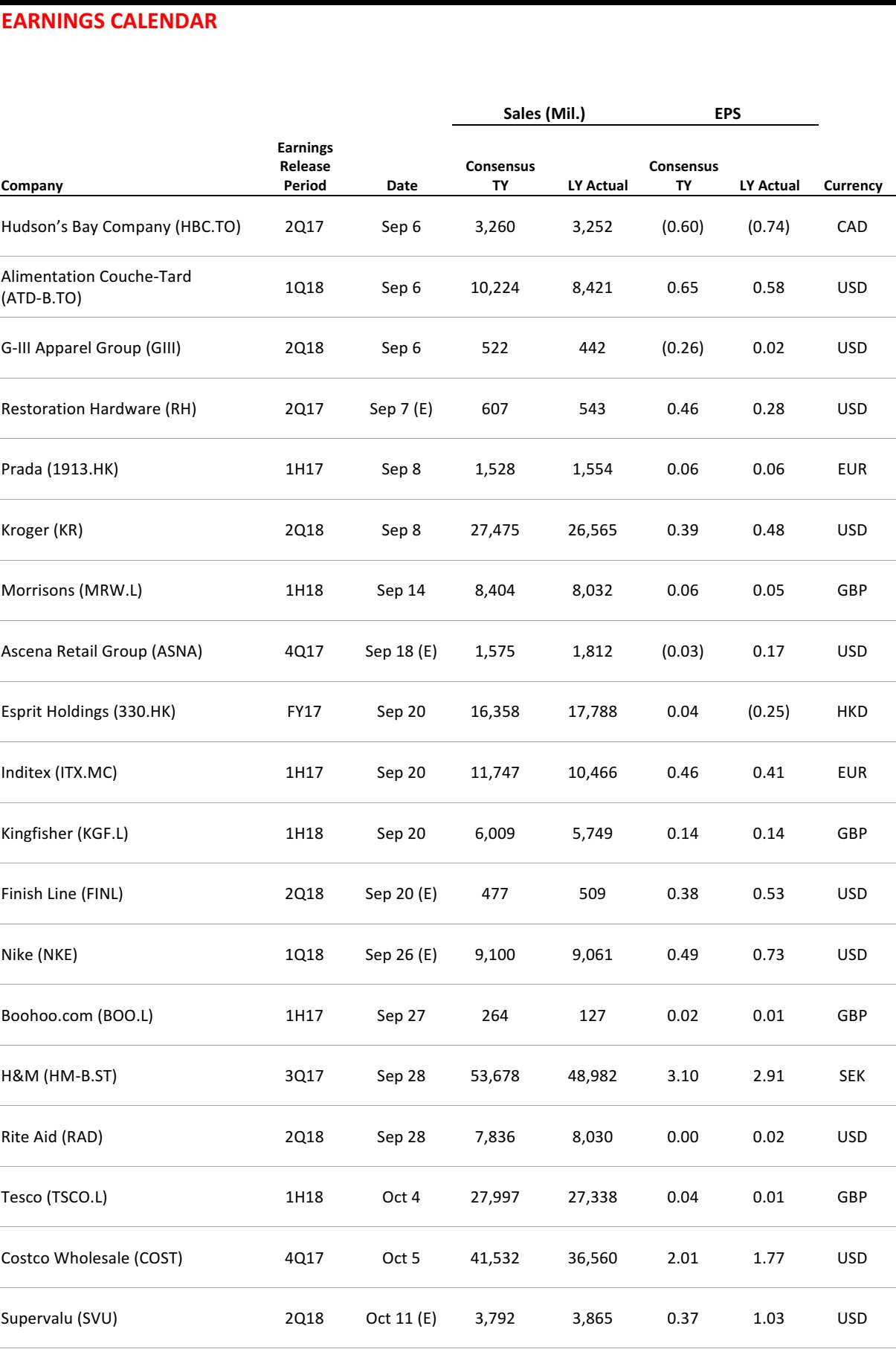

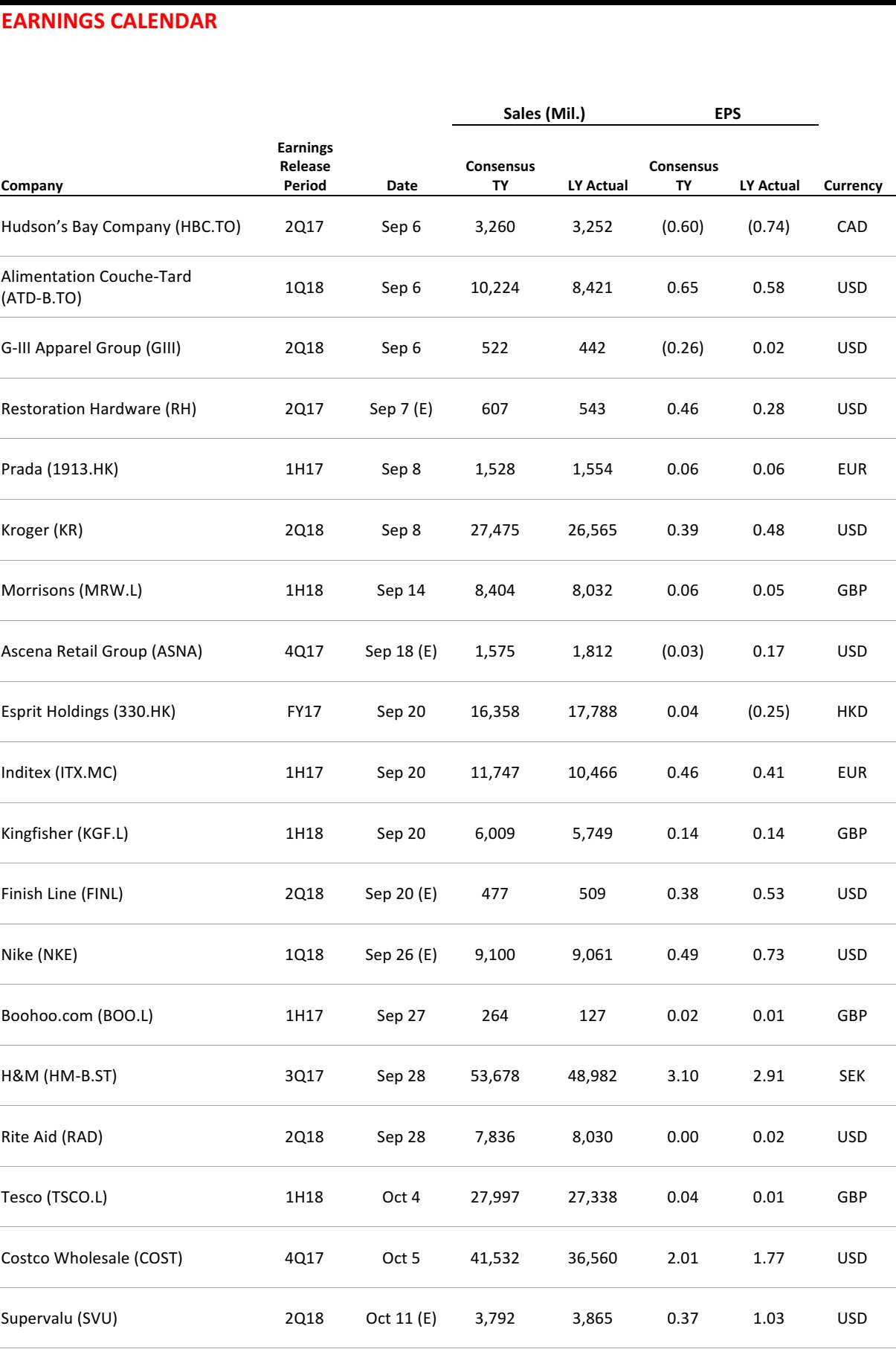

Source: Company reports/FGRT

Source: Company reports/FGRT