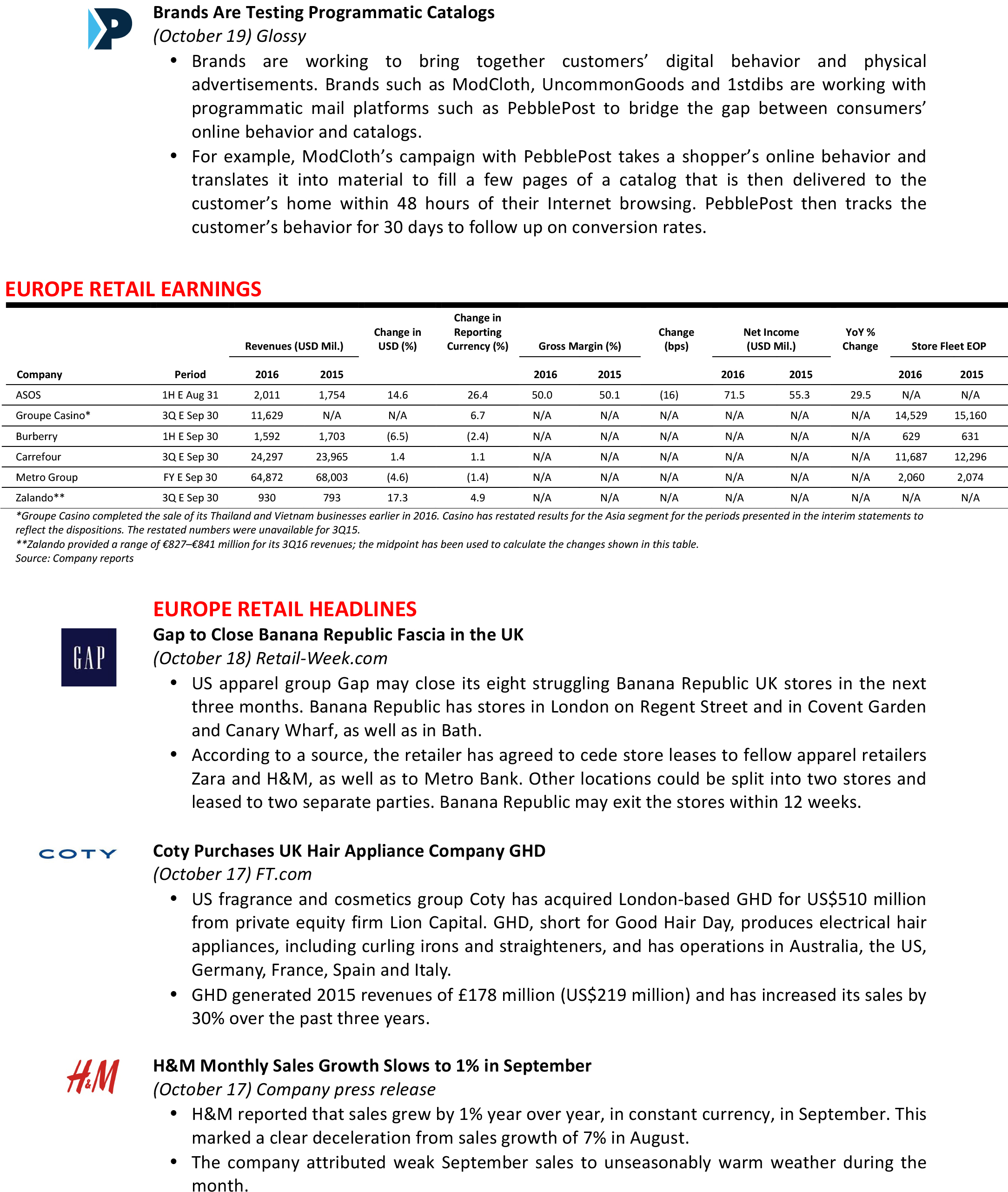

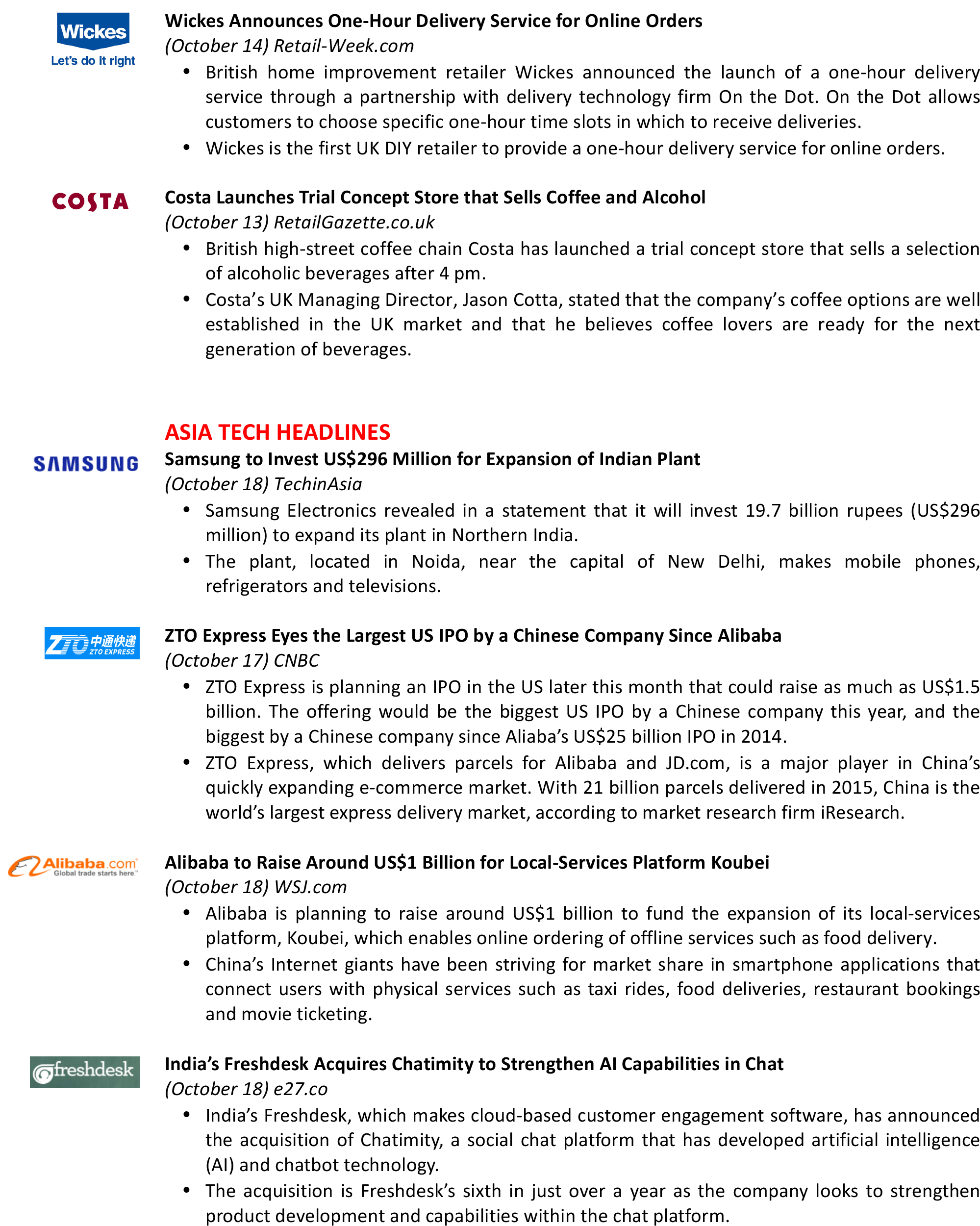

Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

FROM THE DESK OF DEBORAH WEINSWIG

US Holiday Preview: Three Online Trends to Watch

Our global research teams are in the middle of preparing our holiday 2016 reports: keep an eye out for our upcoming US retail outlook and our holiday themes report, among others. In this week’s note, we draw on our research to showcase three online shopping trends that we think will impact US retail this holiday season.- The New Christmas Market

- Online Grocery Will Grow Fast

- Prime Shopping Time