FROM THE DESK OF DEBORAH WEINSWIG

The US Is in the Grips of Election Fever

It is now less than five weeks until the US general election, which will be held on November 8, the first Tuesday after the first Monday in November. Voters are both energized by the coming election and relieved that the long preelection period—which has included contentious caucuses, primaries and political conventions—is now nearly behind them. Although most of the attention has been devoted to the presidential election, there are several other seats up for grabs, including 34 seats in the Senate—whose members serve for a term of six years and which has a Republican majority—and all 435 seats in the House of Representatives—whose members serve for two years and which also has a Republican majority. The party affiliation of the future occupant of the White House will have important consequences: a party mismatch between the executive branch and the legislative branch majority could cause a continuation of political gridlock.

One presidential debate and the sole vice presidential debate have already taken place, and the second and third presidential debates are scheduled for October 9 and 19. For the first presidential debate this year, 84 million viewers tuned in to watch, making it the most-watched debate since the Carter-Reagan debate in 1980. Viewership totals also beat those for the 2012 Obama-Romney debate, which drew just 67 million viewers. There was extra drama behind the scenes prior to this year’s debate, as each party threatened to invite attendees who could have been disruptive to the other party.

What is different this time is our dependence on social media. In an Edison Research/Triton Digital survey, 78% of interviewees said they currently use social media, compared with 53% in 2012 (during the run-up to the last presidential election) and just 24% in 2008. Facebook is the most-used social-media brand, with more than 60% of respondents saying they use the platform. Voters are increasingly using social media to follow political news or candidates, with one-quarter of respondents saying they use Facebook to follow politics, followed by 11% saying they use Twitter.

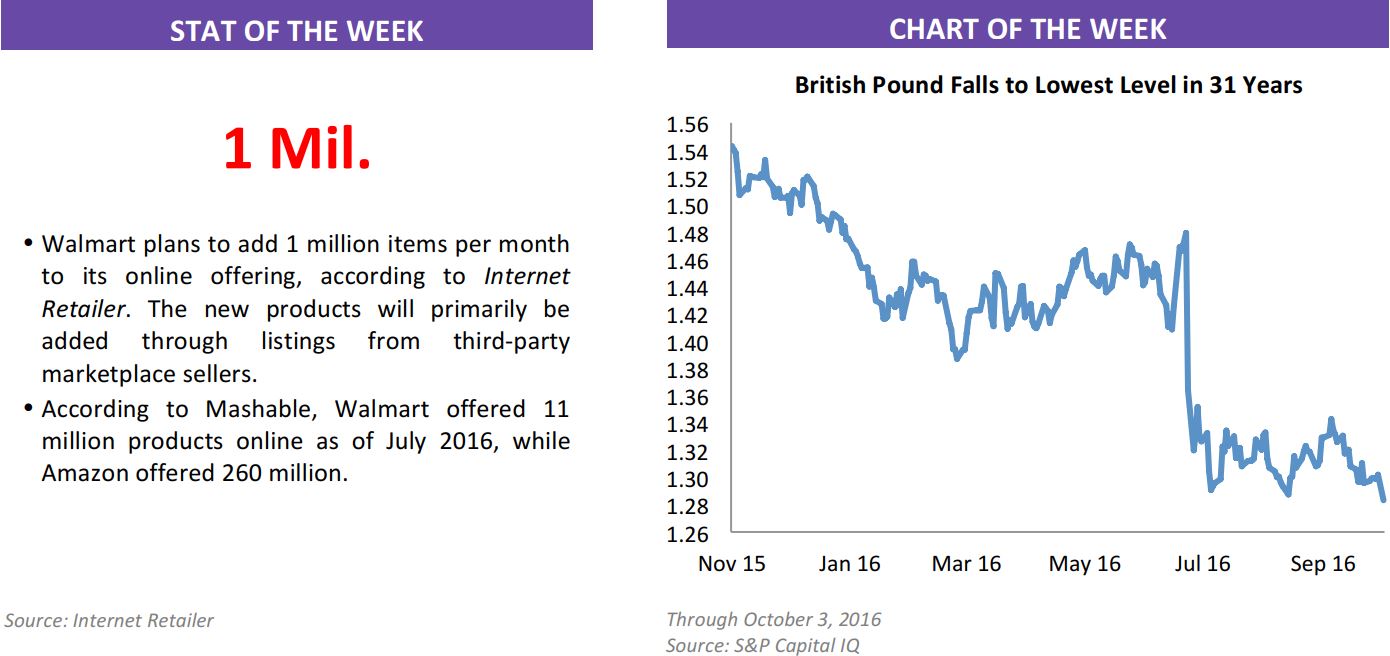

With voters focusing on the presidential candidates and their positions, we have to ask, what is the impact on retailers and retail? There are two main effects. First, shopper traffic tends to decline both the week before the election and the week of the election, according to data from ShopperTrak for the 2004, 2008 and 2012 election years, as voters are likely focusing on the election and the issues during those weeks. However, traffic tends to bounce back after the election, and the National Retail Federation (NRF) recently forecast a 3.6% increase in holiday spending this year, despite it being an election year. The forecast growth rate is higher than the 3.0% increase seen last year, a nonelection year. Second, there is greater competition for advertising during election years, which means much advertising from retailers and other sources gets crowded out. Borrell Associates forecast that political advertising will hit a record $11.4 billion this year. It is logical to conclude that less product advertising would result in lower product sales. But Americans’ holiday spending plans are relatively unaffected by the ultimate outcome of the election: in a recent Harris Poll, at least 68% of respondents said that the election results will not affect their spending plans.

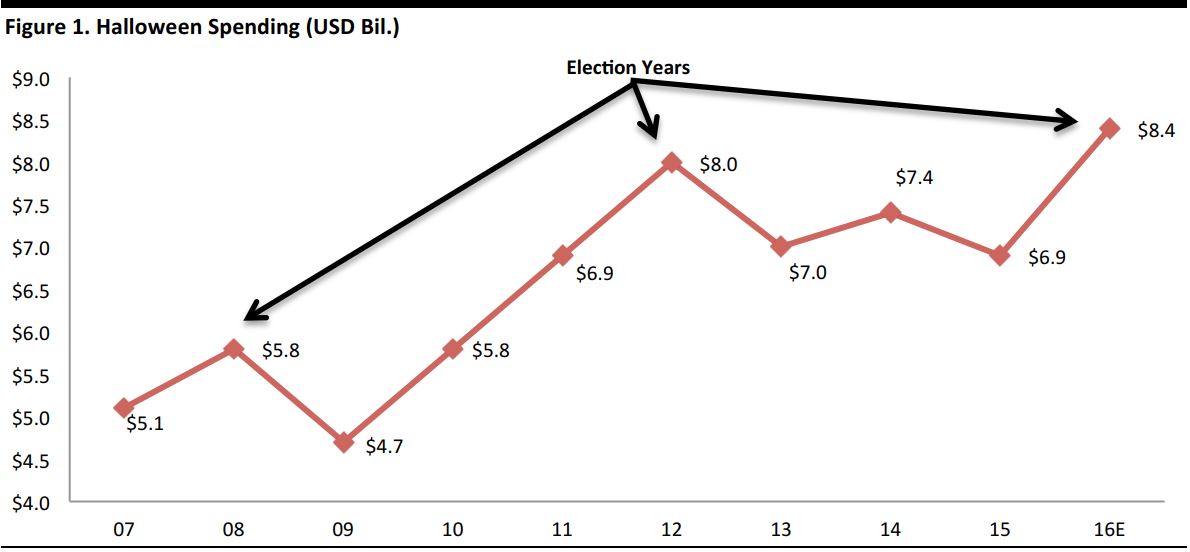

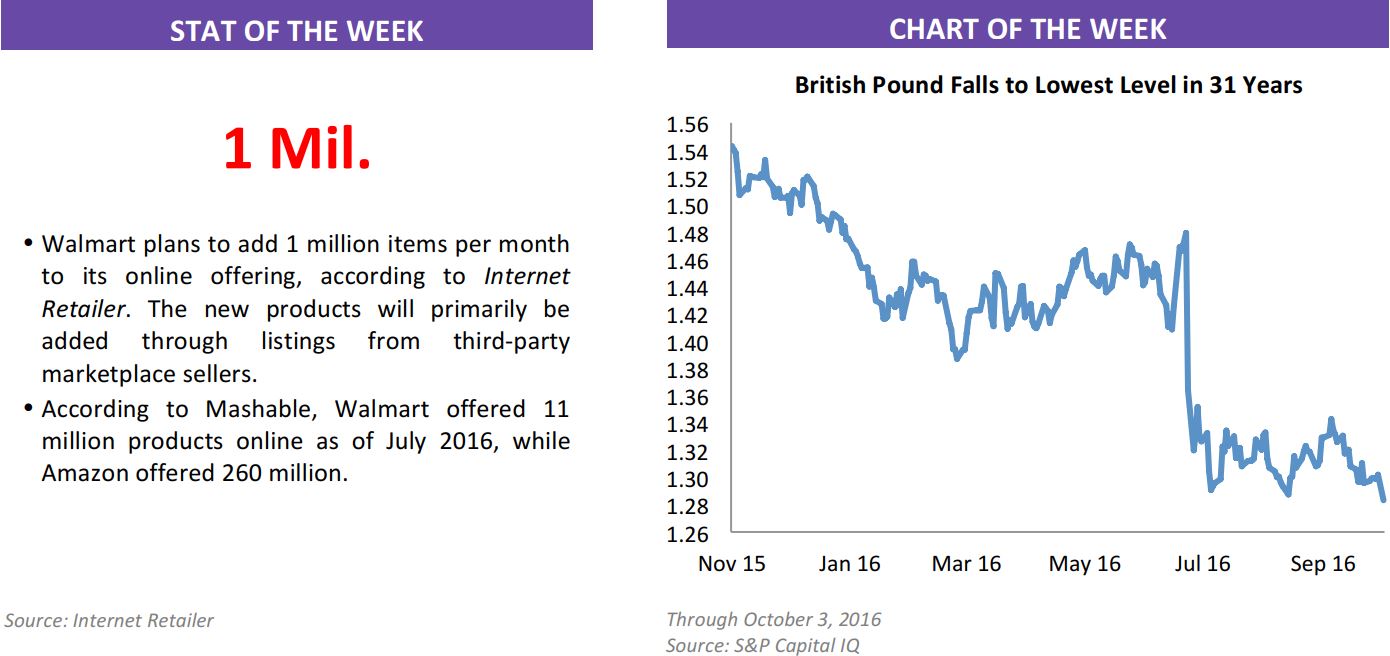

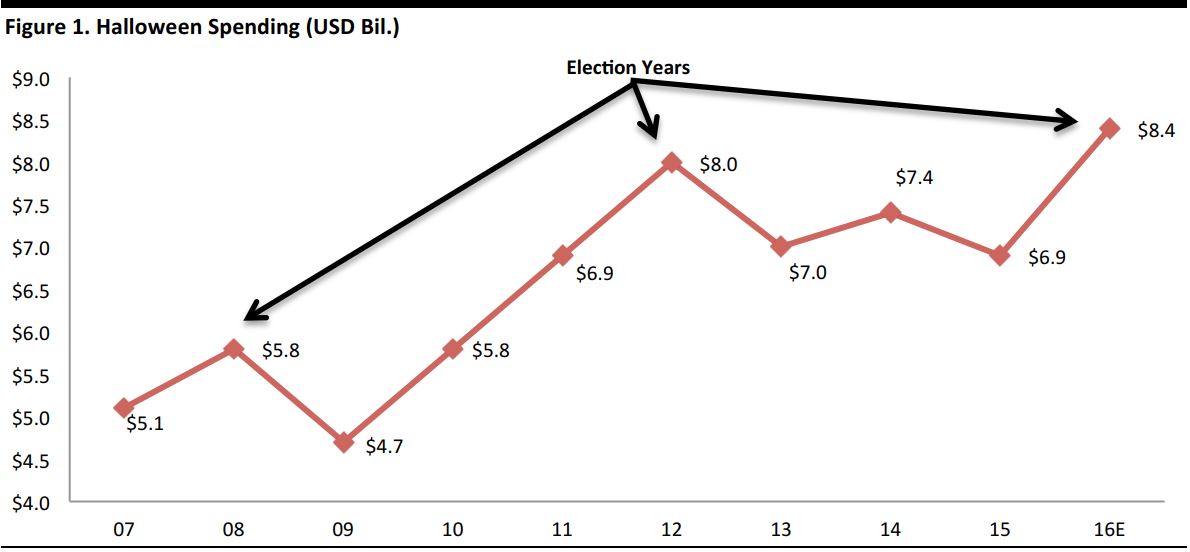

There is still one shopping event between now and the general election: Halloween. However, spending on that holiday also seems unlikely to be hindered by the election. An NRF/Prosper Insights & Analytics survey found that Americans plan to spend a record $8.4 billion on Halloween this year, up 22% from $6.9 billion last year. Interestingly, there appears to be a correlation between election years and relative peaks in Halloween spending, perhaps owing to consumers’ fondness for political candidate masks.

Source: NRF Halloween Spending Survey, conducted by Prosper Insights & Analytics

Fung Global Retail & Technology will be following the election events as they unfold and as we move closer to the all-important holiday shopping season.

US RETAIL & TECH HEADLINES

Some Retailers Choose Turkey over Thanksgiving Shopping

(September 29) Sun Herald

Some Retailers Choose Turkey over Thanksgiving Shopping

(September 29) Sun Herald

- A growing list of retailers are saying that they will remain closed on Thanksgiving, and wait until Black Friday to kick off their holiday shopping sales.

- According to Bfads.net, a website that tracks Black Friday sales and store hours, GameStop, Home Depot, Nordstrom and Costco will all be closed on Thanksgiving. Website BlackFriday.com reports that BJ’s, Lowe’s, Pier 1 Imports, Petco, PetSmart, Sam’s Club, T.J. Maxx and Dillard’s, among others, will also be closed on the holiday.

Why Retailers Are Gender-Bending

(October 3) Glossy

Why Retailers Are Gender-Bending

(October 3) Glossy

- While smaller brands have been experimenting with gender-neutral or unisex lines for years, high-street retailers are also starting to launch these collections. Guess and Zara have joined the ranks of Marc Jacobs, Alexander Wang and Hermes in offering genderless collections.

- The boost in demand for unisex apparel comes from young shoppers, including Gen Zers— only 44% of whom buy things aimed at their gender. Data from Lyst, a fashion e-commerce platform, support that there is a trend of gender-blurring apparel. The site has seen a 108% increase in sales of unisex products in the last year and genderless searches make up 23% of site traffic, up 9% from last year.

Mobile Apps Outpace Mobile Web Commerce for First Time: Report

(October 4) Luxury Daily

Mobile Apps Outpace Mobile Web Commerce for First Time: Report

(October 4) Luxury Daily

- According to a report from Astound Commerce, m-commerce sales are up 40% this year, growing faster than e-commerce, which has seen an 11% increase. These numbers show that mobile is the fastest-growing digital commerce channel.

- Of the $40 billion in online sales made in the first quarter of 2016, $26.6 billion came from mobile and $13.5 billion from desktops. Within m-commerce, $13.4 billion in sales were made through mobile apps versus $13.2 million through mobile web.

Fast-Fashion Tricks Are on Display at Department-Store Chains

(September 29) The Wall Street Journal

Fast-Fashion Tricks Are on Display at Department-Store Chains

(September 29) The Wall Street Journal

- Lord & Taylor is getting in on the fast-fashion movement, speeding up its supply chain to get trends into its stores more quickly. Major apparel retailers are struggling to speed up this process, but for department stores that rely on wholesalers to design and produce most of their products, the strain has been particularly tricky.

- The solution of Xcel Brands, which has partnered with Lord & Taylor to improve the supply chain process, is to pair proprietary brands with more nimble sourcing to help retailers sell more at full price by delivering merchandise in real time.

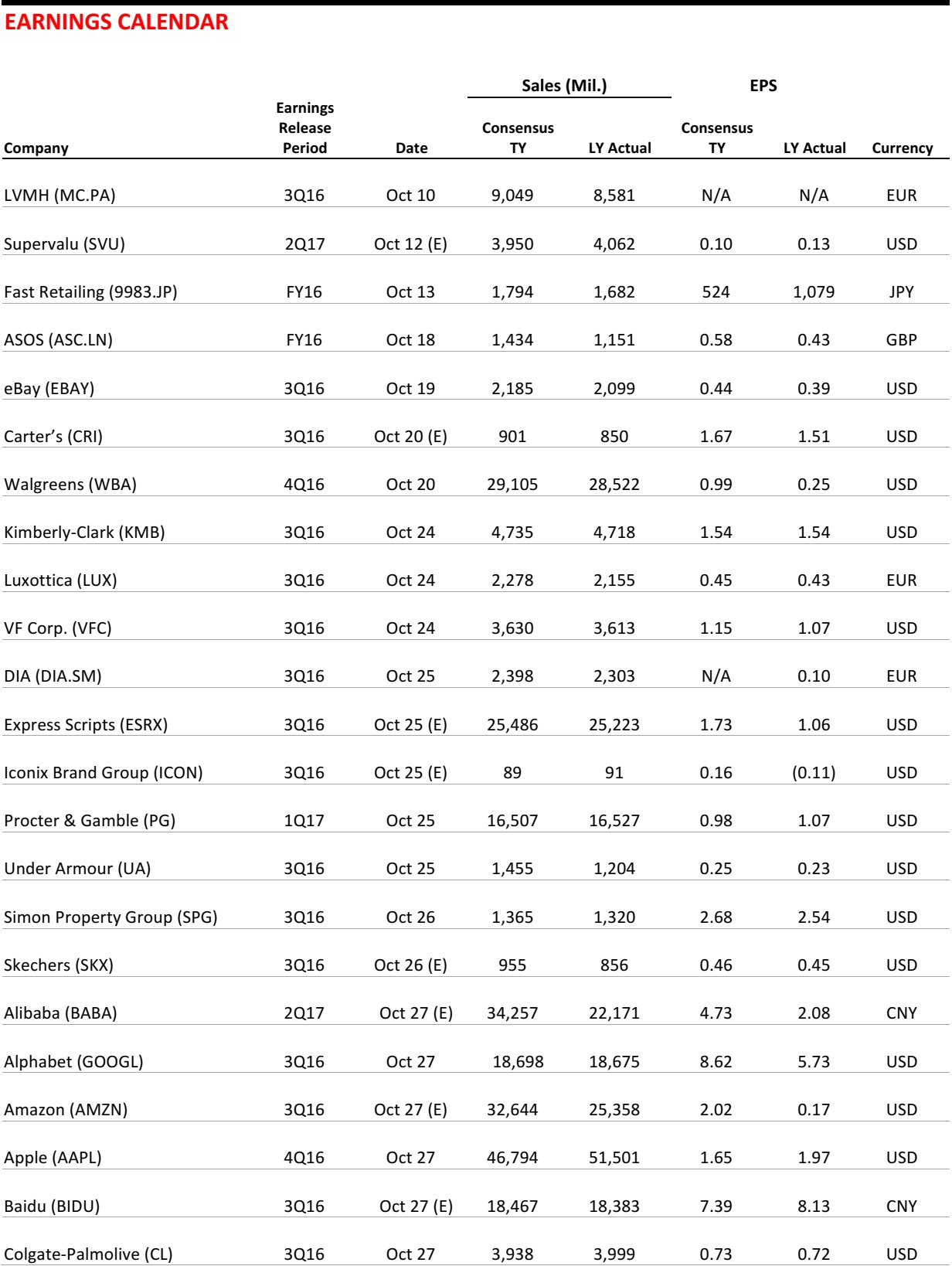

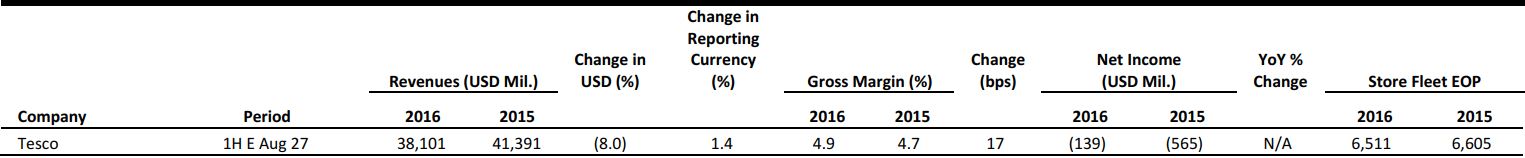

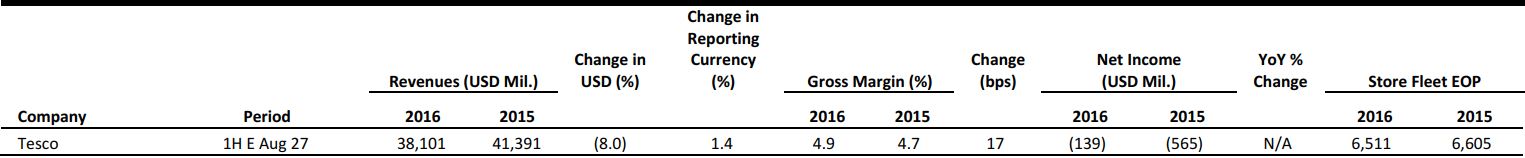

EUROPE RETAIL EARNINGS

Source: Company Reports

EUROPEAN RETAIL HEADLINES

LVMH Buys Majority Stake in Premium Luggage Group Rimowa

(October 4) Company press release

LVMH Buys Majority Stake in Premium Luggage Group Rimowa

(October 4) Company press release

- French luxury group LVMH has agreed to acquire an 80% stake in German premium luggage maker Rimowa for €640 million (US$715 million), subject to the approval of competition authorities. This is the first acquisition in Germany for the owner of the Louis Vuitton brand.

- Rimowa was founded in Cologne in 1898, and it expects to make over €400 million (US$446 million) in revenue this year. The company is currently headed by the founder’s grandson, Dieter Morszeck, who will retain his leadership role and a stake in the company.

Luxottica and Intel Unveil Smart Eyewear

(October 3) Company press release

Luxottica and Intel Unveil Smart Eyewear

(October 3) Company press release

- Italian eyewear group Luxottica and software giant Intel have launched a smart eyewear device called Radar Pace. The device will be sold through Luxottica’s Oakley stores and online through Oakley.com.

- The smart eyewear’s system allows real-time tracking of the wearer’s athletic performance, provides instant coaching and responds to voice commands. The device features sophisticated lens technology that can fine-tune the color of the lens and enhance details according to the environment.

Private Equity Group Baring Asia Acquires Cath Kidston

(October 3) Retailgazette.co.uk

Private Equity Group Baring Asia Acquires Cath Kidston

(October 3) Retailgazette.co.uk

- Hong Kong–based private equity firm Baring Asia has acquired British lifestyle brand Cath Kidston. Paul Mason, the current chairman, will step down and be replaced by William Flanz, the former CEO of Gucci.

- Cath Kidston has been actively expanding in Asia, and the region has been a key focus for the brand in recent years. Some 70% of Cath Kidston’s stores are located outside the UK; the company operates 133 stores in Asia already, and has plans in the pipeline to open more.

Media Markt Tests Starship Technologies Home Delivery Robots

(September 29) Company press release

Media Markt Tests Starship Technologies Home Delivery Robots

(September 29) Company press release

- German electronics retailer Media Markt is testing robots to deliver orders to customers’ homes in the Grafental district of Düsseldorf. For the time being, the robots need to be accompanied by a human escort.

- To try out delivery by the robots, customers who live in the test area need to place their orders online and choose express delivery. Customers will also need to provide their mobile phone numbers for the robot to text them the time it will arrive at their homes. If the product is in stock, the robots will be able to deliver the order to the customer’s home in 30 minutes.

Aldi to Invest £300 Million (US$383 Million) in its UK Store Network

(September 29) Retaildetail.eu

Aldi to Invest £300 Million (US$383 Million) in its UK Store Network

(September 29) Retaildetail.eu

- Over the next 12 months, German retailer Aldi is set to invest some £300 million (US$383 million) to expand its UK store network. The grocer announced its plans when it published its annual results. In 2015, Aldi’s UK turnover was £7.7 billion (US$9.8 billion), up 12% from the previous year and a record for its business in the UK.

- Aldi’s operating profit fell by 1.8% year over year, to £255.6 million (US$326.1 million), which the company attributed to its continued investment in pricing. The investment in UK expansion will be used to open at least 70 new stores and to remodel another 100 stores.

ASIA TECH HEADLINES

Samsung BioLogics Plans IPO of up to $2 Billion

(October 4) Bloomberg

Samsung BioLogics Plans IPO of up to $2 Billion

(October 4) Bloomberg

- Drugmaker Samsung BioLogics is seeking to raise as much as KRW 2.25 trillion (US$2 billion) from a South Korean initial public offering as a step toward its goal of becoming the world’s largest contract manufacturer of biological medicines.

- Samsung Group, the country’s largest conglomerate, controls more than 50 companies, with interests that range from TVs to finance, and has invested in areas that include pharmaceuticals.

Alibaba Leads US$ 10 Million Investment in Fashion E-Tailer Grana

(October 4) e27.co

Alibaba Leads US$ 10 Million Investment in Fashion E-Tailer Grana

(October 4) e27.co

- Alibaba is the leader of a US$10 million series A round of funding for Grana, a direct-to-consumer online fashion retailer. Alibaba will also help Grana in its entry into Mainland China.

- Grana is a fashion brand based in Hong Kong. It produces its own high-quality fashion products and sells exclusively through the online channel.

OnePlus Adopts a More Aggressive Strategy in India

(October 3) TechinAsia

OnePlus Adopts a More Aggressive Strategy in India

(October 3) TechinAsia

- Chinese smartphone manufacturer OnePlus is developing its first large-format experience center in India, adopting the “online for sales, offline for the experience” strategy.

- India was among the top seven markets for OnePlus’s phones, even though the phones were not sold in the country: Indians were buying them using addresses in other countries, then having the phones shipped to India. OnePlus has trained its eyes on the Indian market by closely watching buying behavior, building and engaging with the community of buyers and fans.

Toyota to Launch Robot Baby to Target Maternal Instinct in Aging Japan

(October 3) Reuters

Toyota to Launch Robot Baby to Target Maternal Instinct in Aging Japan

(October 3) Reuters

- Toyota Motor unveiled a baby companion robot called Kirobo Mini in Japan, where plummeting birth rates have left many women childless. The product is a doe-eyed, palm-sized robot that speaks with a babylike, high-pitched voice.

- Toyota, which plans to sell the robot for ¥39,800 (US$392) in Japan next year, is also investing heavily to develop artificial intelligence for self-driving cars.

LATAM RETAIL HEADLINES

Mexico’s Grupo Axo Eyeing IPO in or After 2018

(October 3) WWD.com

Mexico’s Grupo Axo Eyeing IPO in or After 2018

(October 3) WWD.com

- Mexico’s fastest-growing apparel franchiser, Grupo Axo, is considering an initial public offering in or after 2018 in order to finance expansion. The company’s investor relations director said that while the company is considering this as an option, it currently has no firm IPO plans in place.

- Fitch Ratings expects Grupo Axo’s revenues to rise by 15% annually over the next two years. The past four years have seen revenues increase by 30%. Grupo Axo licenses and distributes nearly 20 foreign lifestyle brands in Mexico and South America, including Abercrombie & Fitch, Brooks Brothers, Emporio Armani, and Crate and Barrel.

In Guatemala, Allegations Fly Over Shuttered Apparel Factory

(October 3) WWD.com

In Guatemala, Allegations Fly Over Shuttered Apparel Factory

(October 3) WWD.com

- Bruce Masters, President of the American Chamber of Commerce in Guatemala, is fighting a fierce legal battle with hundreds of workers who he alleges looted his loss-making Alameda apparel factory. Masters says the workers looted $3.5 million worth of machinery, fabric and other goods, bankrupting him and leaving him unable to pay wages and $2 million owed to banks.

- The American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) is representing the workers, claiming Masters’s accusations are false while they pressure the apparel manufacturer to pay back wages and severance.

Zara Opens Its New Doors in Lima, Peru

(October 4) América Retail

Zara Opens Its New Doors in Lima, Peru

(October 4) América Retail

- Spanish retailer Zara opened its first store in Peru, on the north side of the capital city, Lima. The opening was planned for mid-October, but the store opened ahead of schedule despite some aspects being still unfinished.

- Growth has slowed in Latin America for the retailer, which currently has a presence in Venezuela, Colombia, Ecuador, Peru, Central America and Mexico, which leads in terms of sales in the region. The store is joining other fast-fashion companies, including H&M, in its new home in Peru.

Lowe’s Mexico Enhances CX with Price Optimization

(September 28) Retail TouchPoints

Lowe’s Mexico Enhances CX with Price Optimization

(September 28) Retail TouchPoints

- Lowe’s Mexico has partnered with Upstream Commerce—a provider of cloud-based, automated competitive pricing and product analytics solutions for e-commerce retailers—in order to deploy competitive pricing and assortment for the home improvement company’s products.

- Lowe’s Mexico is working to improve its omni-channel customer experience. Upstream Commerce already operates in Latin America, so its partnership with Lowe’s Mexico will help it expand its footprint.