Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

This week, we attended Kroger’s 2015 Investor Conference, where we heard from the grocery giant how it will sustain growth. Kroger outlined a focus on five pillars:- Friendly and fresh—catering to shoppers’ greater demand for fresh, more natural foods.

- What’s for…dinner? Lunch? Tapping foodies’ interest in new and different products.

- Targeting fill-in markets to drive market share.

- Productivity initiatives, such as automated temperature monitoring that can cut waste and staff hours.

- The company identified shopper demand for clean, healthy ingredients, and met it with the Simple Truth brand, which has now reached more than $1 billion in annual sales. Kroger’s broader natural and organics offering represents more than $11 billion in sales.

- Kroger also used insights to identify the foodie trend and customers who have a passion for food. As a result, its gourmet Private Selection range is now the sixth-biggest-selling brand in its stores.

- Price is not one of Kroger’s five strategic pillars, but the company did affirm its commitment to lower prices every day, and told us how it is using insights to discover which items shoppers most want to see priced low. The result? Some $3.5 billion in targeted price investment over the last 11 years.

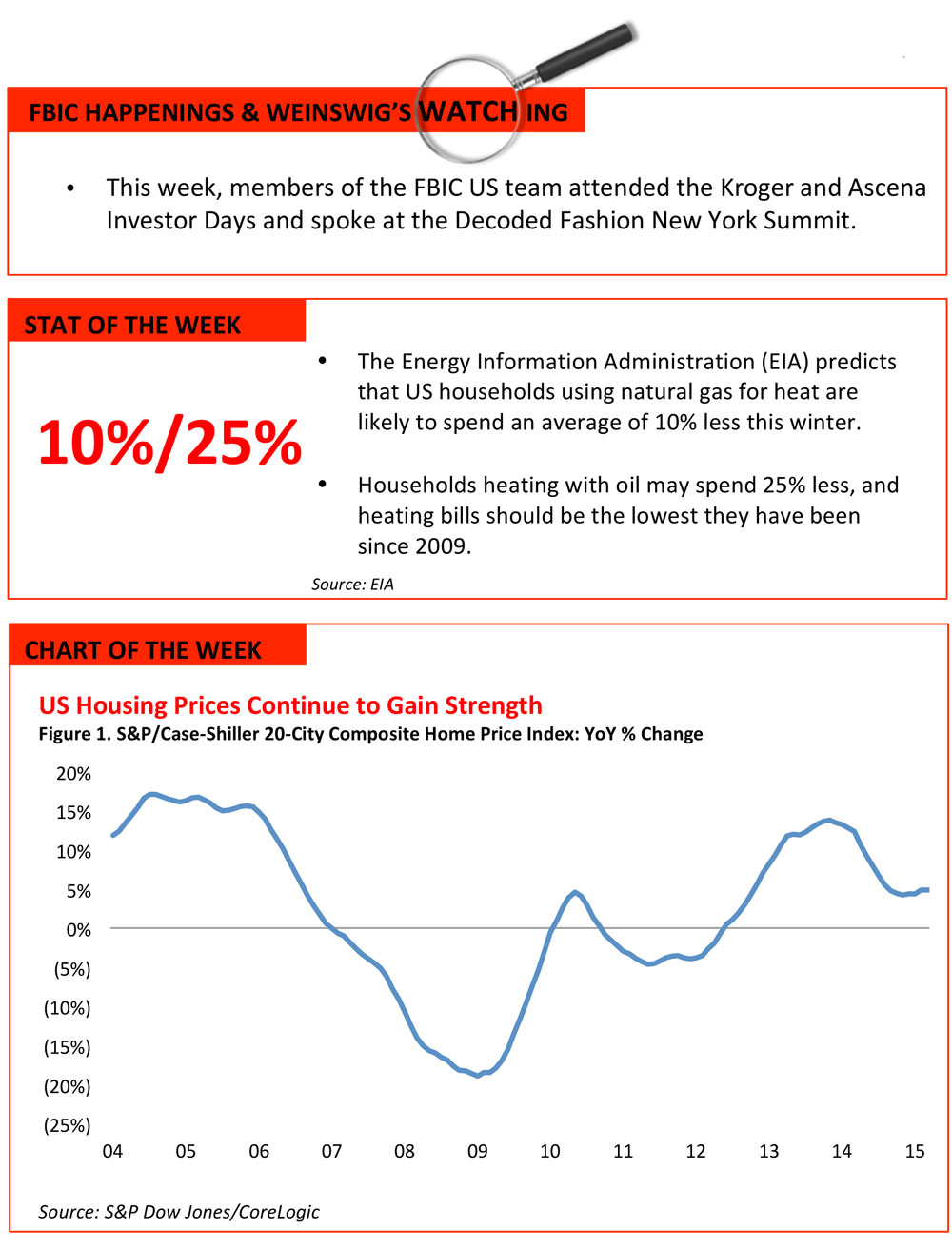

- US city home prices continued to rise in August, reflecting improving demand in the housing market. The S&P/Case-Shiller 20-City Composite Home Price Index rose by 5.1% in August, meeting economists’ expectations.

- All 20 cities in the composite showed year-over-year increases in August. In July, only 14 out of 20 did. Denver and San Francisco topped the list, with 10.7% gains.

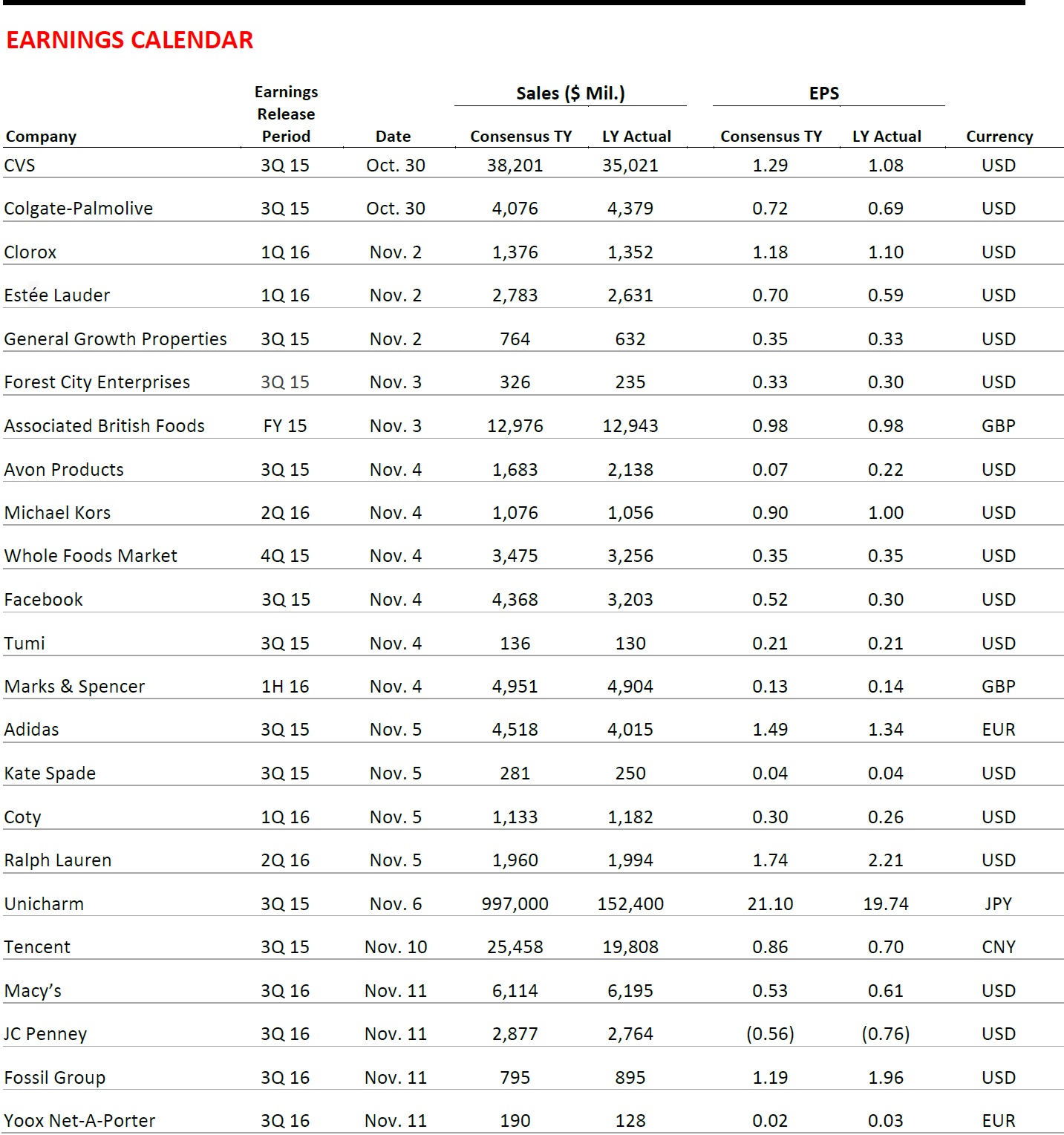

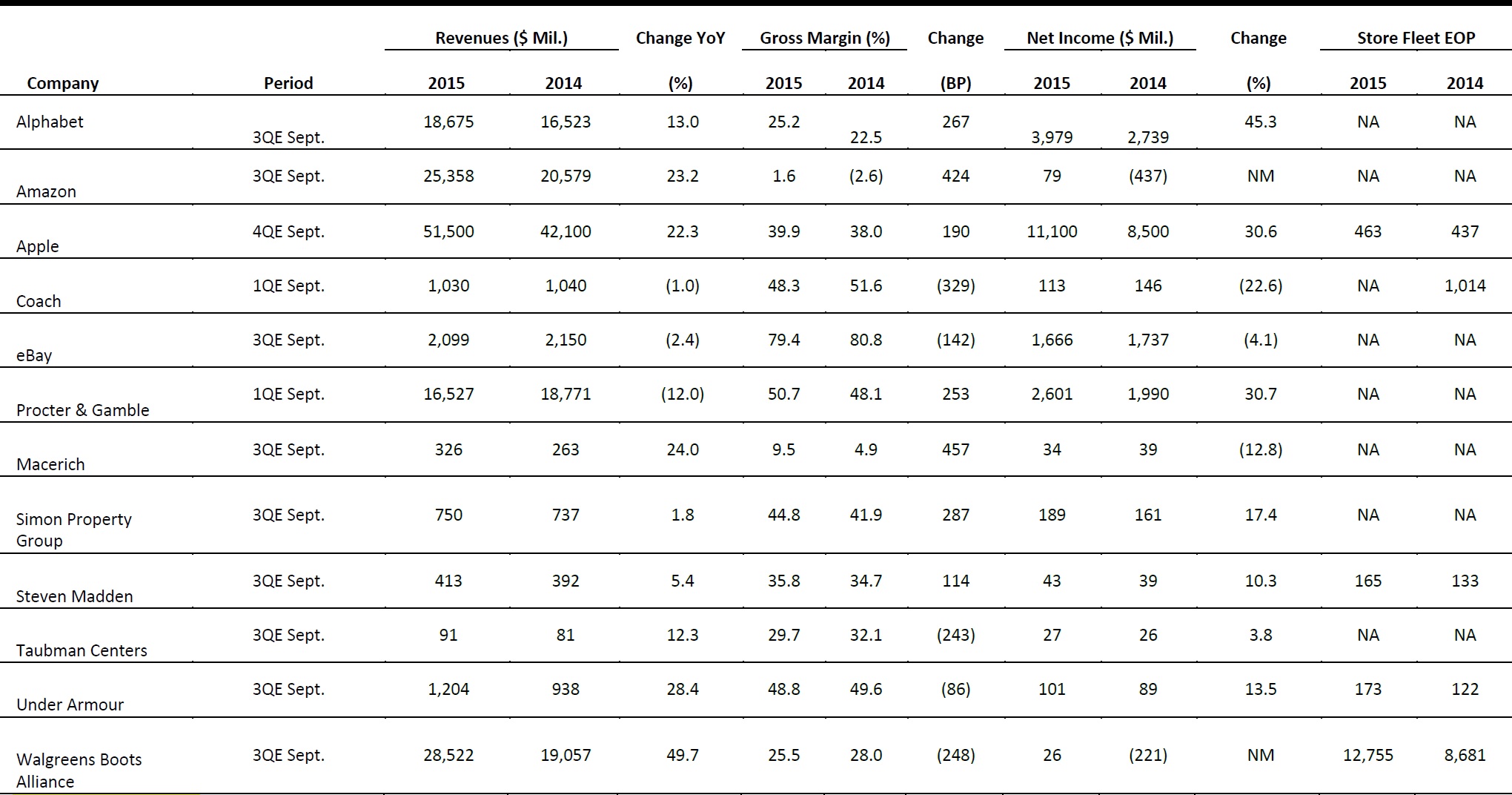

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- Lord & Taylor said it plans to open its first off-price store, called Find @ Lord & Taylor, in Paramus, New Jersey, in November, and that it will open an additional six stores next year. The company also operates 85 Saks Off 5th stores.

- The new Find concept is designed to appeal to a younger, millennial audience at a lower price point than Saks Off 5th offers. This makes Lord & Taylor the third department store brand to launch an off-price store format.

Etsy Launches Delivery Service Etsy ASAP in Partnership with Delivery Startup Postmates

(October 26) CNBC.com

Etsy Launches Delivery Service Etsy ASAP in Partnership with Delivery Startup Postmates

(October 26) CNBC.com

- Online artisan marketplace Etsy launched its delivery service, Etsy ASAP, which will service select parts of Manhattan, Brooklyn and Queens for a flat fee of $20. Shoppers in these areas will be able to enjoy same-day or next-day delivery.

- The Etsy ASAP launch follows the recent rollout of the Etsy Local mobile offering, which helps shoppers find Etsy items and sellers nearby. Recently, Uber started to offer UberRUSH service for local businesses in New York City, San Francisco and Chicago. Amazon also offers same-day delivery for items from Amazon Handmade.

- Tuesday, Oct. 27, after the market close, Walgreens Boots Alliance announced an agreement to acquire smaller drugstore chain Rite Aid for $9.4 billion in cash, offering $9 per share, which represents a 48% premium to Rite Aid’s closing price of $6.08 on Monday. Including debt, the deal is valued at $17.2 billion, the company said.

- The deal would bring together the number 1 and number 3 retail pharmacy companies, creating a pharmacy giant with over 13,000 stores and more than $67.1 billion in combined revenue, according to Drug Store News’s Annual PoweRx Industry Rankings.

- Chico’s announced on Wednesday that Shelley Broader would become President and CEO of Chico’s FAS on December 1. Broader will succeed David Dyer as he retires. Broader is a seasoned retail executive with a combined 25 years of experience at Walmart, Michael’s Stores and Delhaize Group. Most recently, she was the CEO of Walmart’s EMEA region.

- Broader also previously served as CEO of Walmart Canada, chief merchandising officer for Walmart Canada and senior vice president for Sam’s Club.

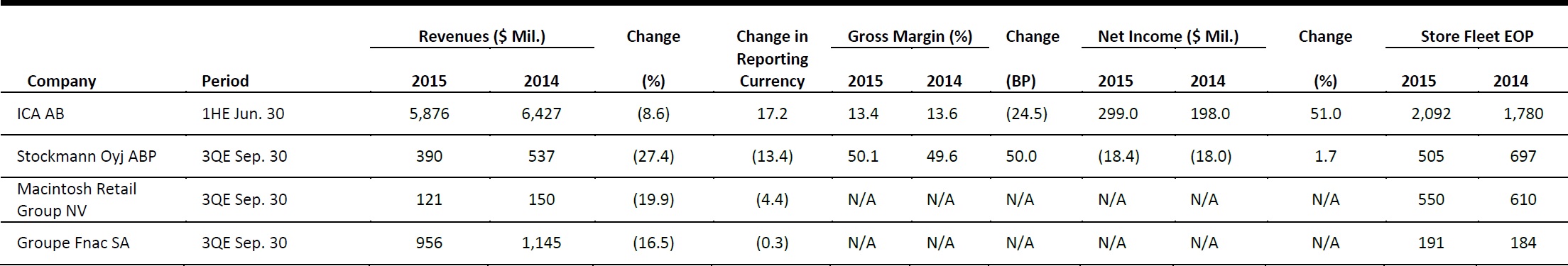

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

- Liu Jo, the Italian clothing brand, wants to expand its travel retail offering and open more shops in airports and train stations. The company has 320 stores of its own and concessions in 5,550 multibrand stores across 45 countries. It made its first foray into travel retail this year.

- The company currently has airport stores in Bergamo, Venice, Rome, Lisbon, Brussels and the largest German cities. Liu Jo will target the cities where its brand is popular for the first stage of its expansion, and later expand to the Middle East and Asia.

- UK grocery retailer Sainsbury’s is experimenting with a new design and layout for six of its stores. In response to emerging shopping trends, the store layout will be “mission-based,” with new till formats and technology that enables quicker checkout.

- The retailer plans to increase the focus on its private label clothing and homeware merchandise through this trial. In addition to staffed checkout points and self-checkout tills for basket purchases, Sainsbury’s has also introduced a larger self-checkout point for customers with small shopping carts.

- Belgian fashion designer Raf Simons, who was in charge of Christian Dior’s creative direction for three and a half years, has decided not to renew his contract. His last collection for the French fashion house was presented in Paris on October 2.

- In a press statement, Simons said that his decision is “based entirely and equally on [his] desire to focus on other interests in [his] life, including [his] own brand.” Dior has yet to announce his successor.

- British department store chain Debenhams is set to expand its international presence by opening new stores in the Australian and Vietnamese markets in early 2016. Prior to the launch, Debenhams plans to unveil a dedicated e-commerce site in Australia before Christmas 2015. This will be the retailer’s first entry into the Southern Hemisphere.

- For the venture in Australia, Debenhams has partnered with Pepkor, part of the global retail giant Steinhoff Group. In Vietnam, the company has signed with VinDS, part of Vingroup, as its local market partner.

- German grocer Aldi has pledged to pay £9.45 (US$15.35) per hour to its London staff and £8.40 (US$13.64) per hour to staff across the rest of the UK, outstripping Chancellor of the Exchequer George Osborne’s suggested living wage of £7.20 (US$11.70) per hour. These rates also exceed the hourly rates that discount rival Lidl had revealed last month—£9.35 (US$15.18) for London staff and £8.20 (US$13.32) for staff in the rest of the UK.

- Aldi has also disclosed plans to hire and train 600 new apprentices beginning in 2016. It opened its 600th UK store in Cardiff this year, and has a target of opening 1,000 stores across the country by 2022. The national living wage of £7.20 (US$11.70) an hour, which Osborne unveiled during the summer Budget this year, is set to come into force in April 2016, and is expected to rise to £9 (US$15) by 2020.

ASIA TECH HEADLINES

- Apple’s location for its first official store in Singapore might have been confirmed in a press release by Pure Fitness. The fitness chain issued a statement saying it will be closing its branch in Knightsbridge to make way for the opening of a new Apple store in late 2016.

- Pure Fitness had stated in an earlier email to customers that it, along with other tenants of the building, will be handing the space back to the landlord in order to make way for the new Apple store.

- Paraplou shut down its site on Saturday, October 24, with a farewell message on its home page. The company said that market immaturity, certain financial conditions and a difficult funding environment were the primary reasons for its closure.

- The company was headed by Bede Moore and Susie Sugden, two former Rocket Internet managing directors. They had worked at Lazada Indonesia for two years before starting Paraplou in order to provide e-commerce services for premium fashion brands in Indonesia.

- Tencent’s all-in-one WeChat app will now charge a 0.1% fee on mobile transfers over ¥20,000 (US$3,155) to cover bank transaction fees for its WeChat Wallet service.

- WeChat Wallet is used by 200 million people and is supported by an estimated 200,000 physical stores, including 25,000 supermarkets and 40,000 vending machines. It can be connected to most major banks, allowing cash from bank accounts to be easily transferred into online accounts.

- In a press release on Monday, Sharp warned shareholders to expect a six-month operating loss due to poor smartphone display sales.

- According to the firm, “intensified competition” in the small and medium-sized LCD business will result in a forecast operating loss of ¥26 billion (US$215 million). The company has struggled in recent years due to stiff competition, the recession and currency fluctuations.

- Toshiba plans to sell its image sensor business to Sony for around ¥20 billion (US$164.68 million) as part of a restructuring plan laid out earlier this year, sources with knowledge of the deal said on Saturday.

- Masashi Muromachi, who became Toshiba’s CEO following the accounting scandal that hit the company, has promised to restructure lower-margin businesses. Nikkei reported that the deal for the image sensor business would be the beginning of the restructuring.

LATAM RETAIL HEADLINES

- Luxottica reported a 1.4% year-over-year decline in third-quarter revenues, equating to a 13.6% increase when adjusted for currency.

- Positives included sales of the “Made in Italy” collection in Brazil, continuing growth in Mexico, and encouraging results in Chile and Colombia, which were helped by the opening of two wholesaling subsidiaries earlier in the year.

- In August, online order volume in Brazil declined for the first time in 15 years; it was down 7% year over year, according to consulting firm E-bit.

- Brazilian retailers are adapting by reducing costs through eliminating free shipping and charging a premium for rapid shipping.

- BRMALLS’ total sales reached R$5.1 billion (US$1.3 billion) in the third quarter of 2015, which represented total year-over-year sales growth of 1.8%, excluding recently divested properties.

- Same-store sales grew by 2.3% despite deteriorating macroeconomic conditions, and same-store rent grew by 7.4% during the quarter, with a 96.8% occupancy rate.

- The Guararapes Group, the parent company of Riachuelo, the #3 retail group in Brazil after C&A and Lojas Renner, has cut its planned number of store openings to 80 from 160.

- Delays in mall openings were cited as the reason, and other retailers, such as Hering and Marisa, have also reduced their forecasts of store openings.

- Both Soriana and Comercial Mexicana have accepted a restriction to exclude 14 stores from Soriana’s acquisition of its rival’s operations, which will reduce the total deal value by MXN3.6 billion (US$218 million). Another 12 stores will be acquired for subsequent divestment.

- The original agreement centered on Soriana acquiring 160 stores from Comercial Mexicana for MXN39 billion (US$2.4 billion).