FROM THE DESK OF DEBORAH WEINSWIG

We are excited about the reports on Singles Day, the Chinese holiday coming up on November 11. On this day last year, Alibaba handled $5.8 billion of transactions in 24 hours. That was 80% higher than what it did the prior year and three times what US retailers sold on Cyber Monday in 2013. Volumes are expected to reach $7.7 billion this year, according to Tompkins International.

Back in the US, we’re seeing a big jump in door-buster promotions for Black Friday, which can be followed on BlackFriday.com and bfads.net and many other sites.

In this week’s issue, we focus on the US housing market, which remains on a steady, albeit grinding, road to recovery—and, as a major engine of the US economic growth, should continue to spur stronger consumer spending. With the affordability still high, the recent across-the-board declines in mortgage rates and ongoing job growth, the ingredients for a continued pickup in the housing market remain in place. Furniture, home-goods and electronics sales should get a boost.

Together with falling pump prices and rising confidence, a healthier housing market is another reason why retailers seem headed for a happier holiday this year.

FBIC’S HALLOWEEN SALES UPDATE

Halloween isn’t just for candy-seeking toddlers and pre-teens dressed as their favorite

Frozen or

Teenage Mutant Ninja Turtle character

(this year’s hottest kids costumes.) It’s also a full-blown adult holiday—complete with haunted houses, zombie hayrides and elaborate costume parties. According to the NRF, Halloween is gaining momentum as one of the fastest growing consumer holidays in the US, with Halloween sales this year beginning as early as the first week of October.

This year Halloween is expected to contribute $7.4 billion to retail sales, up more than 7% from last year. Because the holiday falls on a Friday this year (and parties started as early as last weekend), retailers are preparing for a boost in merchandise sales. Some stores have already started using a tactic usually reserved for the Thanksgiving/Christmas holidays—

extending store hours to draw in more shoppers.

Both Redbook and ICSC's weekly read on retail store sales showed year-over-year improvement, with Halloween sales a factor.

Companies expected to benefit the most include Target, Walmart, Dollar Tree, CVS and Rite Aid.

US RETAIL HEADLINES

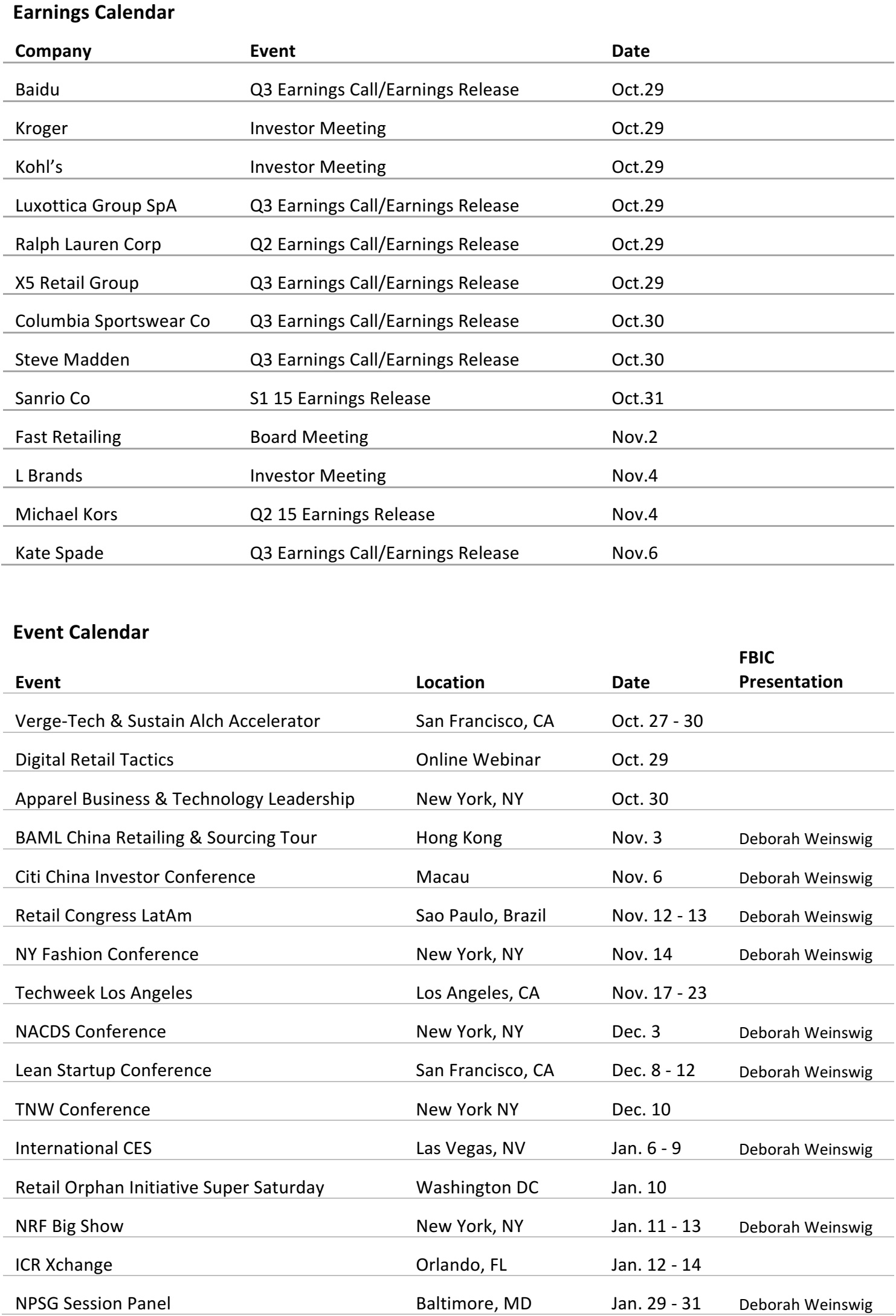

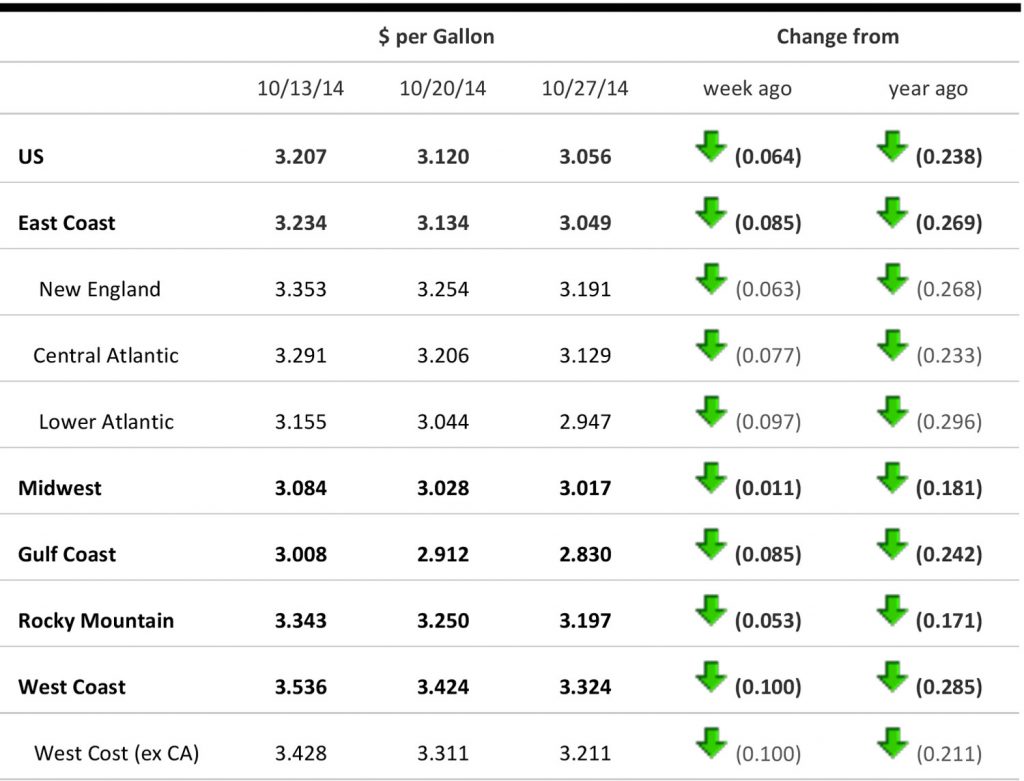

US Regular Gasoline Prices

Source: US Energy Information Administration

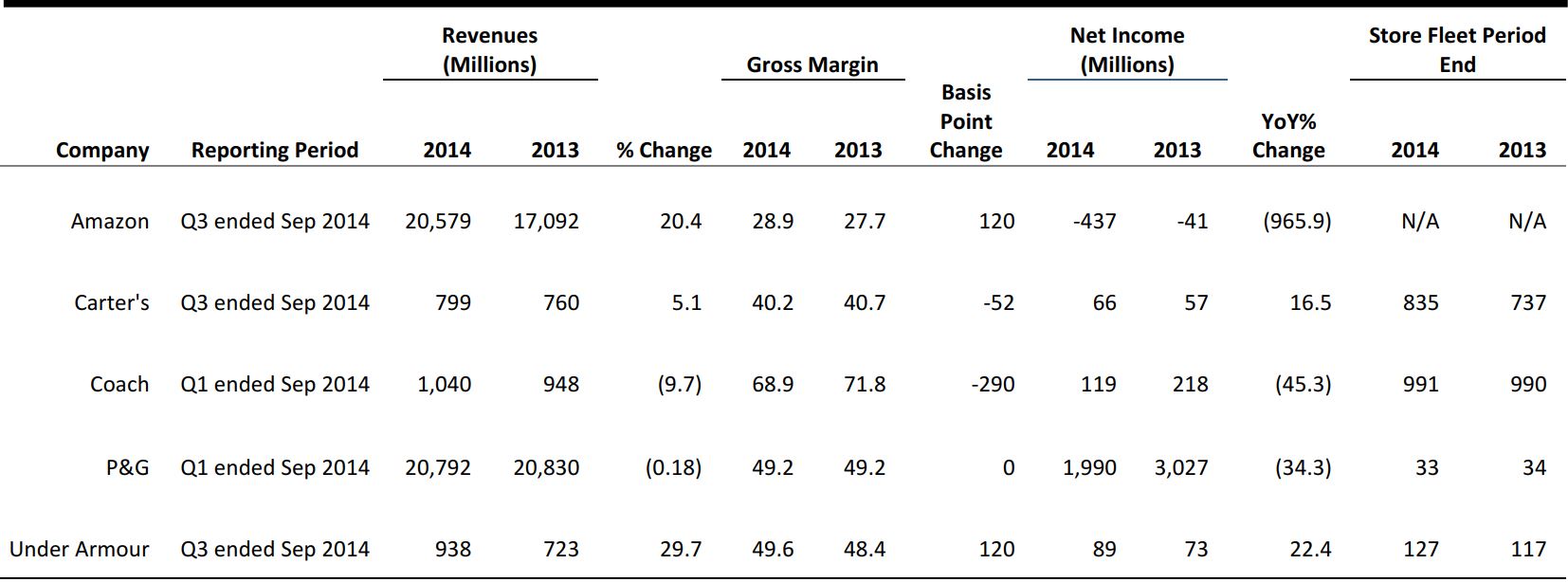

Coach’s Turnaround Shows Sign of Progress (October 28).

(COH) First the bad news, North American sales were off (-‐19%), in tandem with a comp decline of (-‐24%) for the fiscal 1Q, as the company strategically curtailed promotions activity in the outlet channel, despite an overall increase in promotional activity for the category at outlets. Coach Factory store traffic was weak, and conversion was negative despite slightly higher average ticket sales. International sales rose 4% (+6% on a constant currency basis), reflecting a 10% increase in China, a (-‐7%) decline in Japan and very strong sales in Europe. Excluding transformational expenses, EPS were $0.53, down from $0.77. Despite beating consensus estimates on the revenues and EPS lines, COH shares closed down (-‐6.0%).

The good news is Coach is making progress in its transformation on product, stores and marketing. Its Stuart Vevers collection shown at New York’s Fashion Week was well received and his factory product is set to launch next spring. On the store front, Coach plans to have 20 stores opened in its new store modern luxury concept in time for holiday and will renovate 150 stores by June 2015, while closing 70 locations, most of them shortly after the holiday. Marketing positioning was much improved, with the brand receiving more attention in in September fashion books and editorials. Promotional activity was reduced from three a week to once a week. By the end of its fiscal year (June 2015), that number should be down to once a month. This is a multiyear transformation, but the green shoots are promising. For instance, in full-‐price

locations, sales of handbags selling for $400 or more rose to 30% of category sales from 21% in the fiscal 1Q a year ago, as Coach elevates its product and as women’s footwear, at 9% of retail sales (in stores selling footwear), held steady. Meanwhile, the expanded footwear assortment in the outlet channel is being responded to positively.

Company press release

Macy’s and Bloomingdales Plan Abu Dhabi Store Openings in 2018 (October 28). This is part of a strategic partnership with Al Tayer Group LLC, a leading United Arab Emirates (UAE)-‐based company with diversified interests. This will be the first international location for Macy’s

(M) and the second one for the Bloomingdales banner (the first was in Dubai). The new stores will anchor a new super-‐regional shopping destination, Al Maryah Central, on Al Maryal Island. This is a 3.1 million sq. ft. mixed-‐use development, which will include retail, cafes and restaurants, entertainment, a cinema, health club, a luxury hotel and residential towers. While macys.com and bloomingdales.com have been selling in about 100 countries around the world since 2011, this new development is part of their omni-‐channel strategies. Al Tayer Group represents more than 600 leading global brands and its retail division represents 35-‐plus retail brands and operates 200 stores in the Middle East region. M shares closed down (-‐2.1%).

Company press release

Kohl’s Updates Guidance in Advance of Its October 29th Investor Meeting (October 27). Kohl’s

(KSS) now projects a 3Q comp-‐sales decline of (-‐1.4%), as October sales have been weaker than the rest of the period. The retailer expects sales patterns to be consistent across geographies, and looks for e-‐commerce sales gains of more than 30%. According to management, comp sales should be higher for children’s clothing but lower for accessories, footwear and men’s—although are expected to outperform the company average. Home and women’s sales are expected to underperform the company average. Based on actual sales to date, the company expects its 2014 diluted EPS to be at the low end of its prior guidance, which was previously $4.05−$4.45 per diluted share. KSS shares closed down (-‐6.6%) the day following this announcement. C

ompany press release

Sears Rationalizes Store Fleet During Key Holiday Season (October 20). Sears Holding

(SHLD), with one of the largest retail real estate portfolios in the US, has entered into lease agreements with Primark, a leading fashion retailer in Europe, for seven standalone stores. Sears will continue to have a significant presence in six of these locations, with a streamlined store format of up to 100,000 selling sq. ft. for each store. Primark will lease approximately 520,000 gross sq. ft. of retail space (approximately 400,000 net sq. ft. retail space) in mall-‐based stores in the northeastern US. Primark will take the space in the next 12 to 18 months.

Locations include King of Prussia Mall, where it joins Dick's Sporting Goods

(DKS) as a Sears’ subtenant, occupying over 100,000 gross sq. ft. on the lower level, and the Staten Island Mall, where Primark will lease approximately 70,000 gross sq. ft. and joins Lands' End as a direct tenant of Sears. This Primark store will open in 2016. The remaining five specific locations and projected store openings will be announced in due course. SHLD closed up 23.1% on October 20.

Company press release

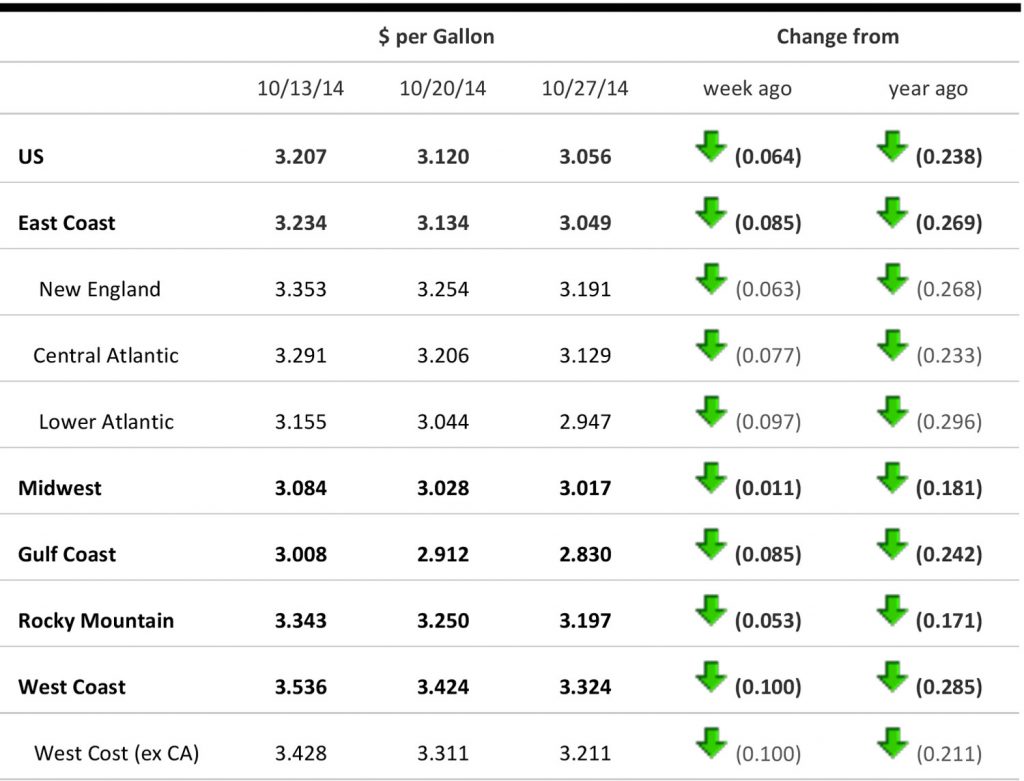

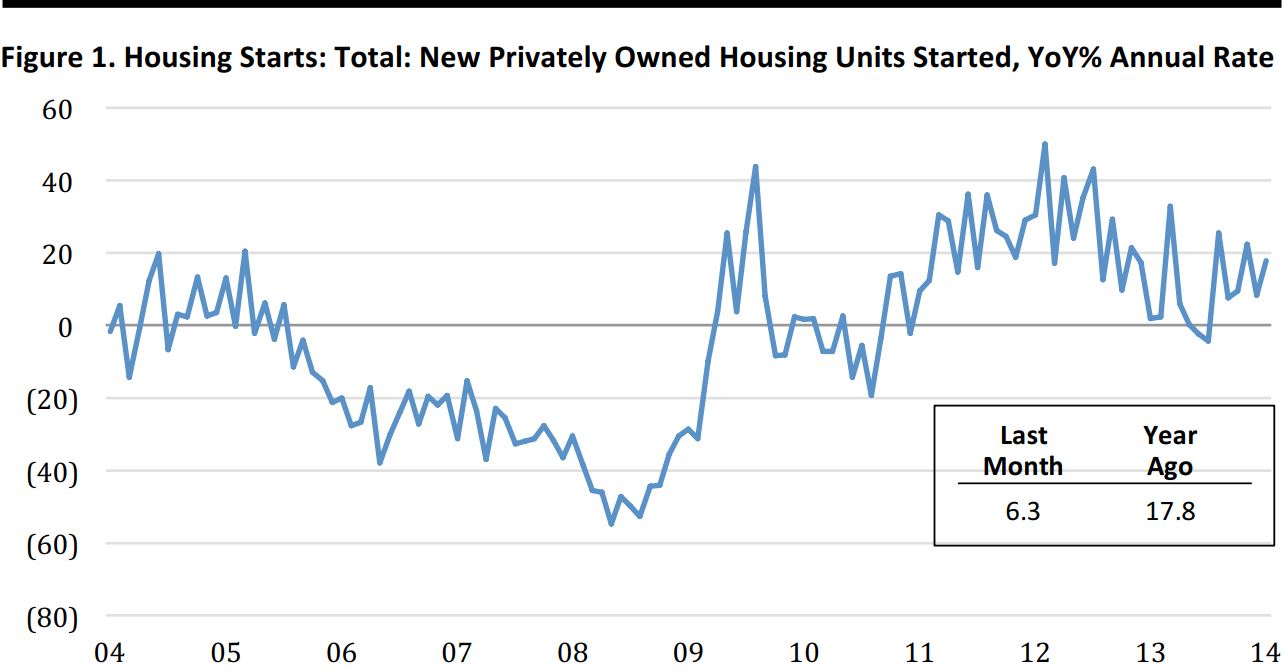

Selected Retail Company Earnings Results

Source: Fung Business Intelligence Centre

Brick-‐and-‐Mortar Stores Are Here to Stay

(If Only for the Halo and For Grabbing Shoppers’ Attention)

The US online retail market is huge and growing fast. Forrester Research projects that e-‐ commerce sales can hit $294 billion this year, and that it could account for 11% of US retail sales by 2018 versus ~9% in 2014. E-‐commerce was once thought of as the death knell for traditional retail, but physical stores and shopping centers are likely to remain a vibrant part of the retailing ecosystem—although the players and categories are likely to change. Moreover, many traditional retailers are evolving their omni-‐channel strategies to address consumer expectations and compete more directly with e-‐commerce pure plays. Those retailers that have seamlessly integrated their brick-‐and-‐mortar and online endeavors have enjoyed the strongest online results, with sales gains in the double-‐digit area.

The offline assets of traditional retailers provide a solid foundation for an omni-‐channel strategy. According to A.T. Kearney’s Omni-‐channel Shopping Preferences Study, the store plays a crucial role in online purchases, as two-‐thirds of customers purchasing online use a physical store before or after the transaction. The store makes a significant contribution in conversion regardless where the transaction occurs.

Online to Offline (or O2O). Pure play online retailers are also realizing that brick-‐and-‐ mortar stores are a critical part of the customer experience and, ultimately, long-‐term profitability, and are thus are increasingly venturing into the physical world. In the process, they are finding that their e-‐commerce roots can bring a unique touch to the brick-‐and mortar retail experience that they create. Notable examples of e-‐commerce pure plays that have gone offline include designer-‐gown rental service Rent the Runway, eyeglasses purveyor Warby Parker, clothing retailer Bonobos, and beauty-‐products subscription company Birchbox.

Los Angeles/Long Beach Port Threatens US Retailers Holiday Plans (October 24). The busiest port in the US is experiencing a shortage of chassis (the wheeled metal frames that carry containers behind trucks, now outsourced to third-‐party operators), truck trailers and other equipment, which is slowing the unloading of cargo from containers at the port for as much as three weeks. Along with rail congestion, the delay is threatening

timely merchandise deliveries of retailers’ assortments for the holiday shopping season, particularly for hot items that may need replenishing. The NRF said protracted labor negotiations are a problem as well. According to the Pacific Maritime Association, which represents 29 ports along the West Coast, 750,850 inbound containers arrived at the Los Angeles/Long Beach complex in September, up roughly 11% YoY.

Bloomberg and Reuters

CHINA RETAIL HEADLINES

Costco Looks For China Path That Sidesteps Walmart’s Potholes (October 20). By selling directly to Chinese consumers on Alibaba’s platform, Costco aims to employ local knowledge and a low-‐cost structure to avoid missteps that caused some of the world’s largest retailers to stumble. Many global retailers opening in China have struggled to find product mixes and store designs favored by local customers. Costco's virtual storefront on Alibaba’s Tmall is designed to help the warehouse store operator study consumer shopping habits with no bricks-‐and-‐mortar costs and fewer risks, signaling a new approach to expanding in China.

Shanghai Daily

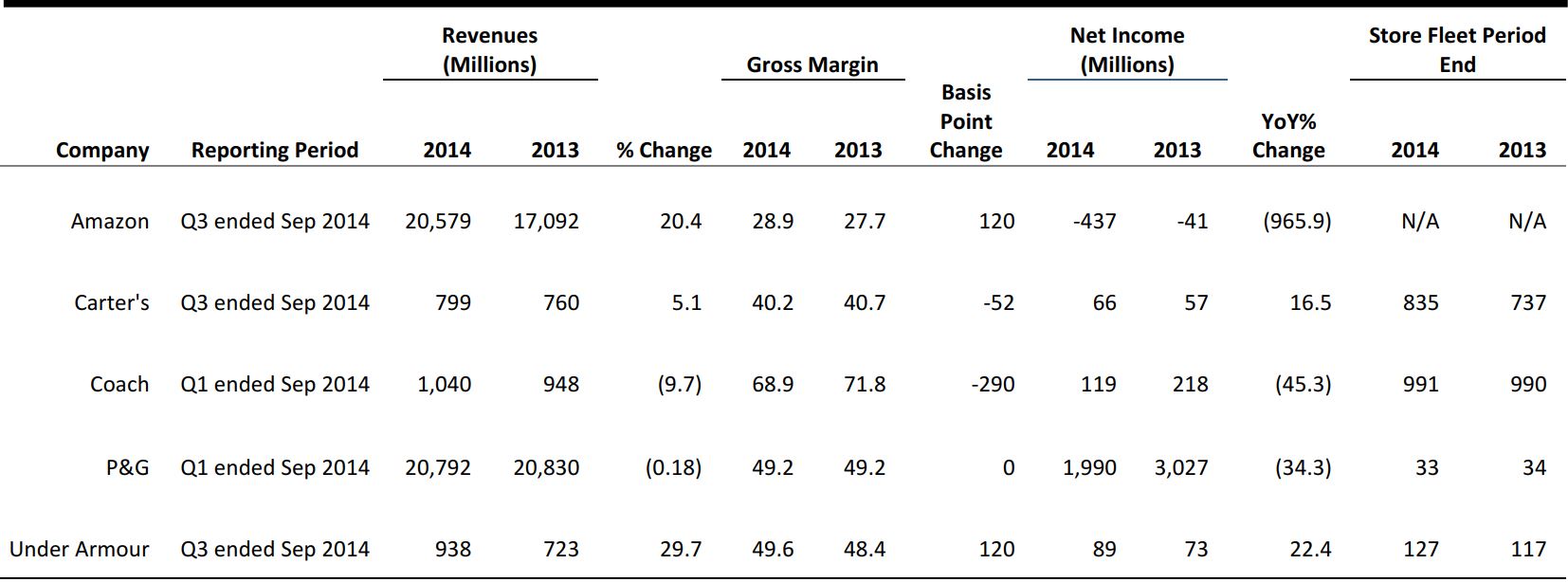

A FOCUS ON US HOUSING MARKET

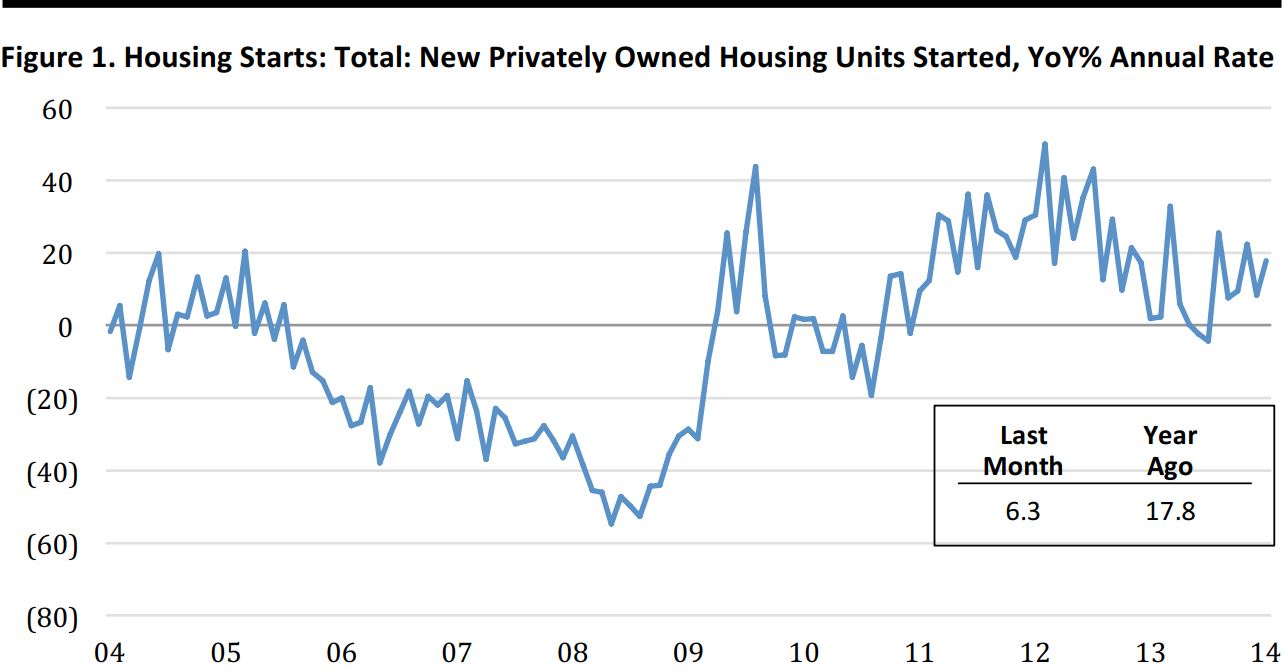

Single-‐Family Housing Starts Still Below Post-‐Recession Peaks

Through September 30, 2014

Seasonally adjusted

Source: US Department of Commerce

- In September, housing starts rose to an annual rate of 02 million units.

- Despite overall strong growth, single-‐family starts—a better indicator of economic growth— rose 1.1% MoM, but were still down 9% from the post-‐crisis peak reached in November 2013.

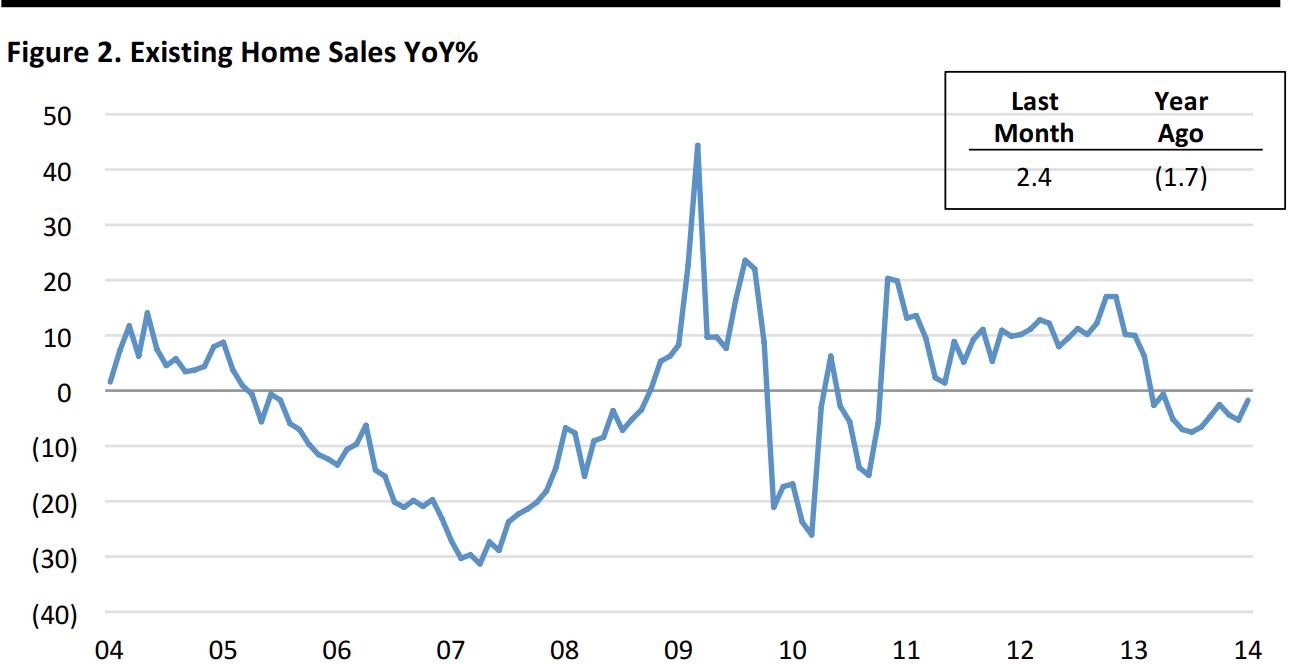

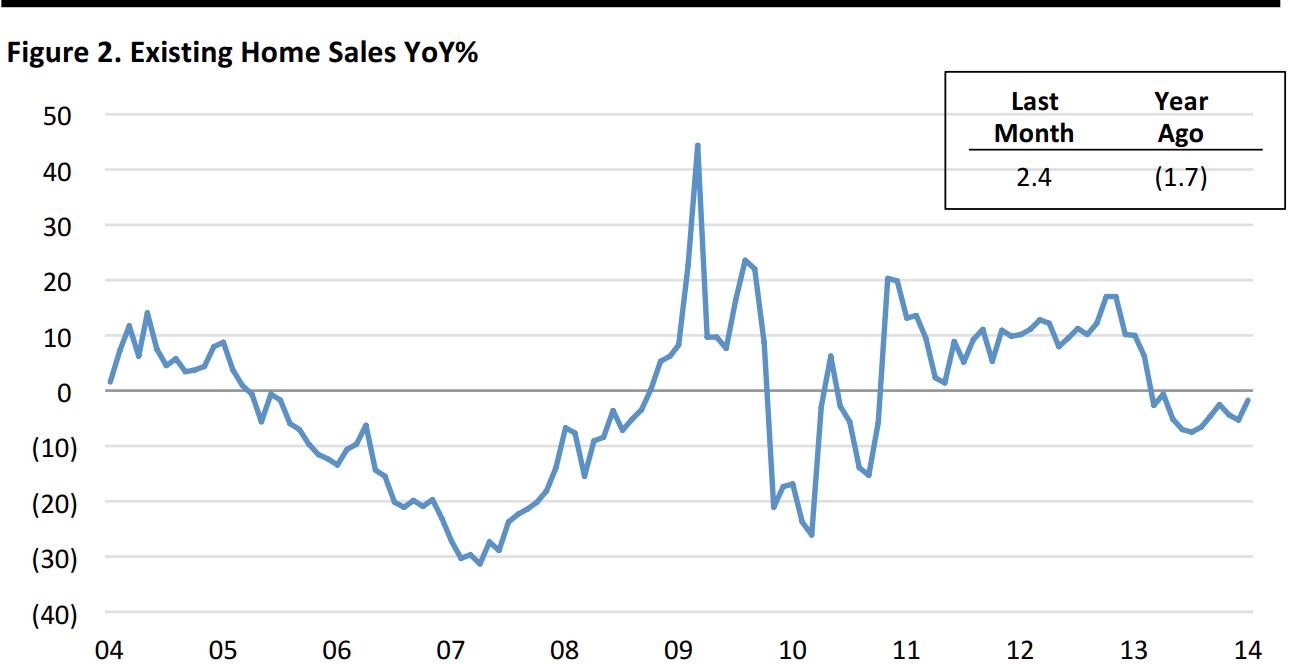

Existing Home Sales Gained Momentum in September

Through September 30, 2014

Seasonally adjusted

- Existing home sales rose to an annual rate of 17 million in September, the highest level this year.

- The results reflect a 33-‐basis-‐point YoY decline in the 30-‐year fixed mortgage rate and an improved economic

- The unsold inventory of 3 million existing homes is currently 6% higher than it was last year, equivalent to 5.3 month’s supply, at the current sales rate.

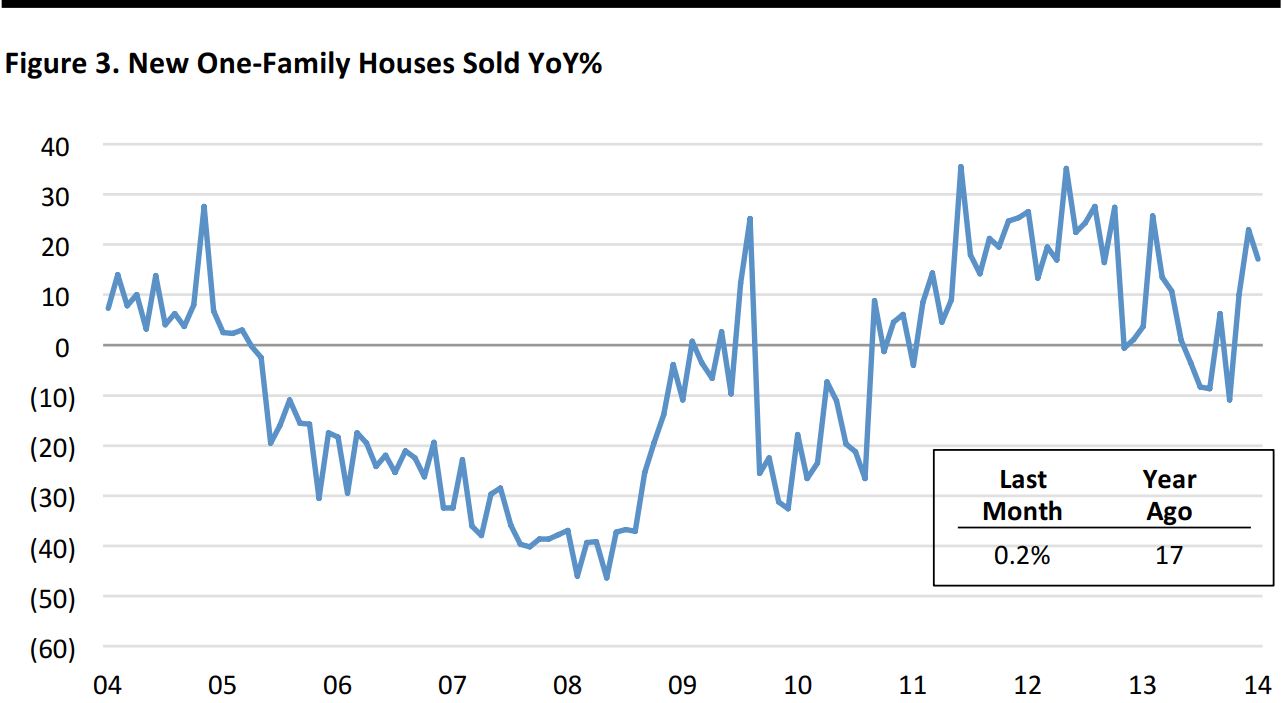

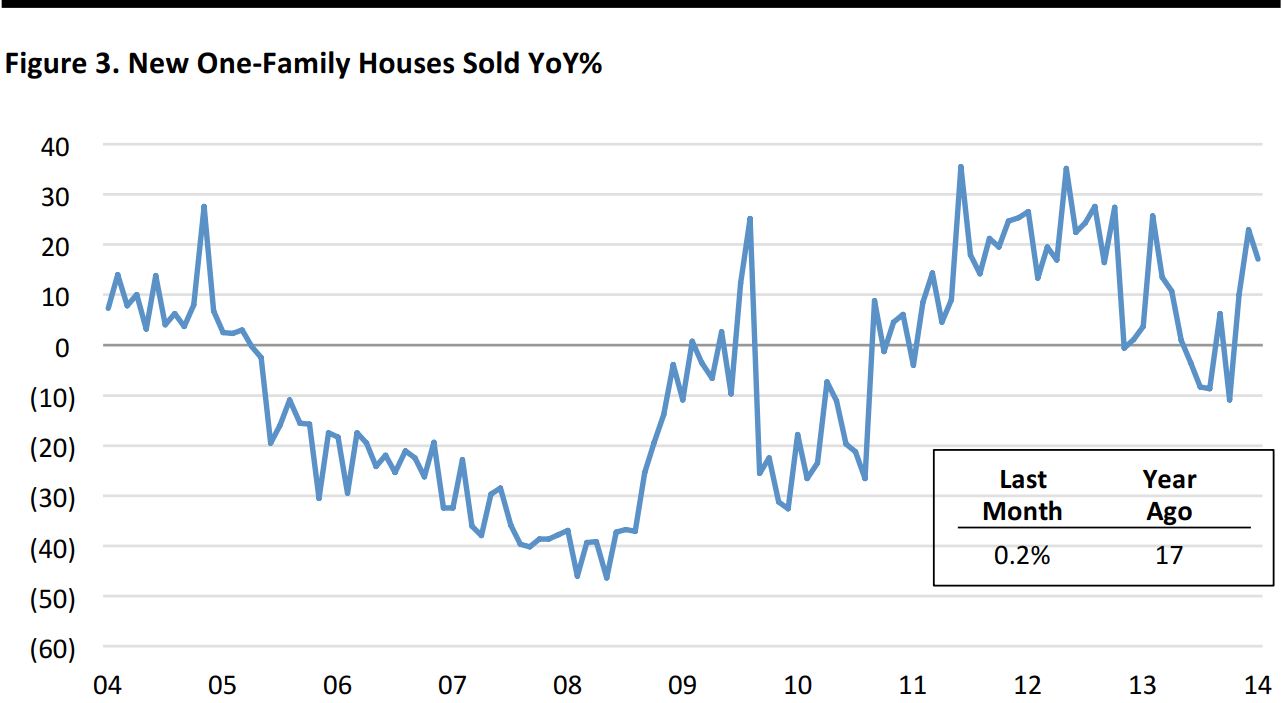

New Home Sales Growth Remains Tentative

Through September 30, 2014

Seasonally adjusted

Source: US Department of Commerce

- Highest sales level in six years, but August’s number were sharply revised

- The stock of new houses grew at a 5% rate — the fastest pace since 201.0

- New home sales fell 9% in the West, increased 12.3% in the Midwest and stayed flat in Northeast.

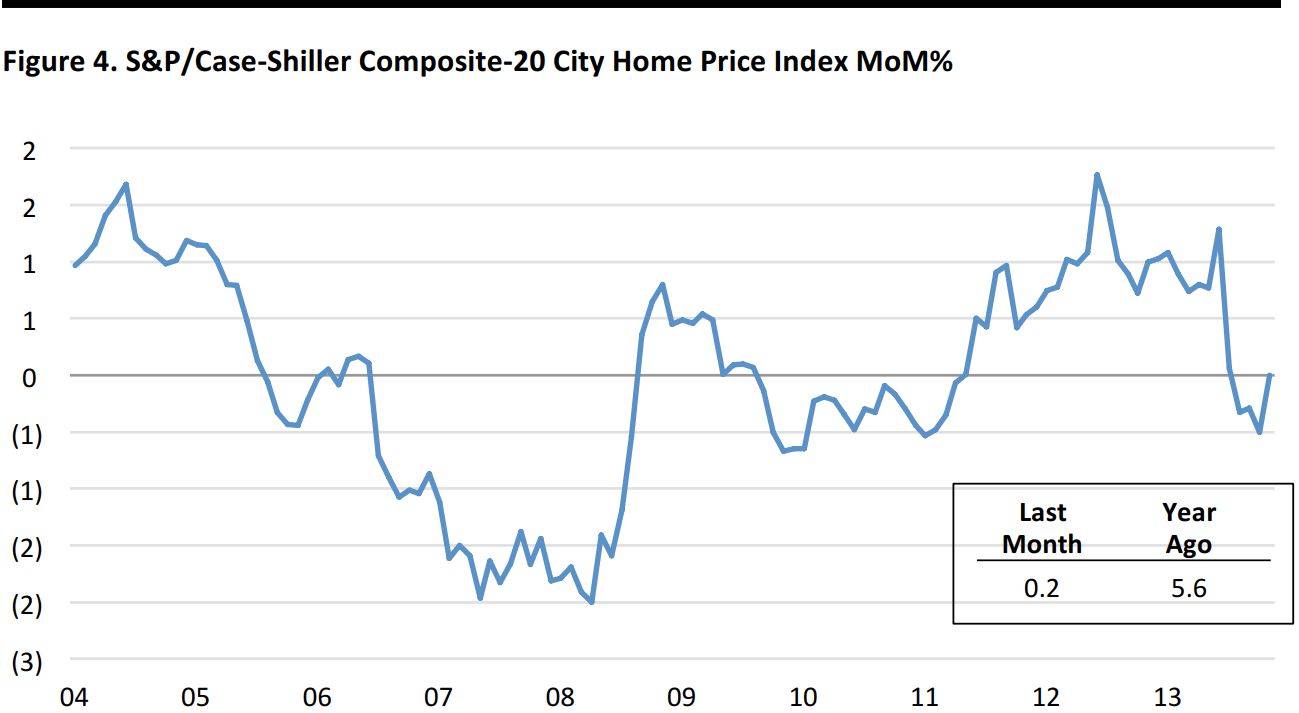

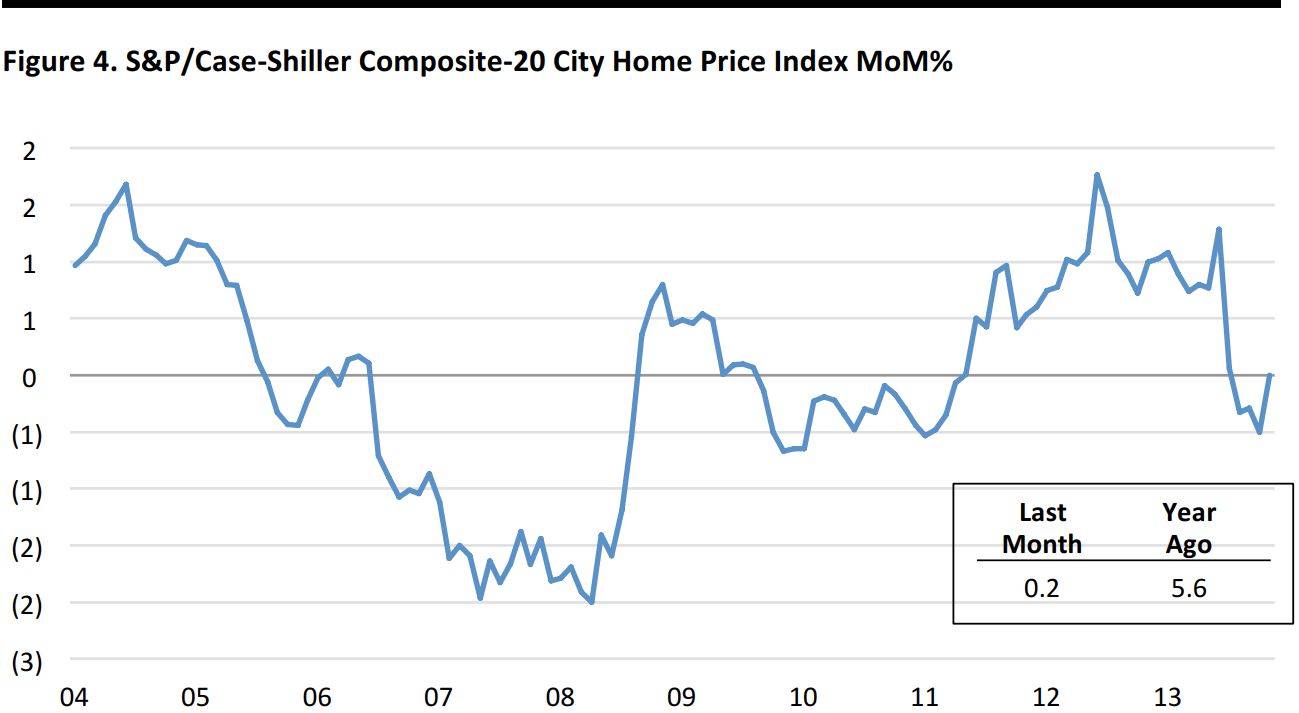

20-‐City Home Prices Decelerate

Through August 31, 2014

Source: S&P Dow Jones and CoreLogic

- Home prices in the largest 20 US cities rose at a 6% YoY annual rate in August, slowing from the 6.7% pace in July and the double-‐digit gains in most months over the past two years.

- On a MoM basis, prices gains were highest in Detroit, rising 8%, followed by Dallas, Denver, Las Vegas at 0.5% each. Home prices in San Francisco fell 0.4%, while Charlotte and San Diego each saw 0.1% declines.

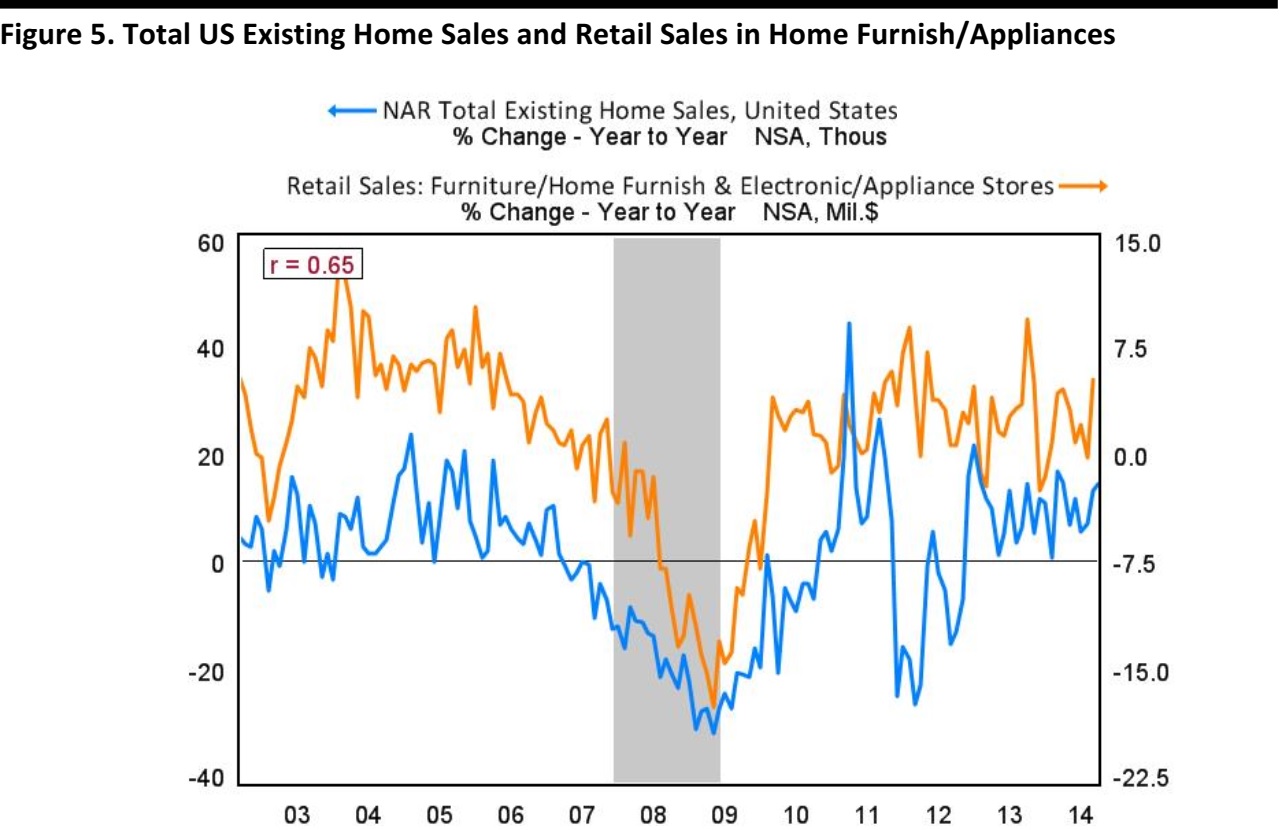

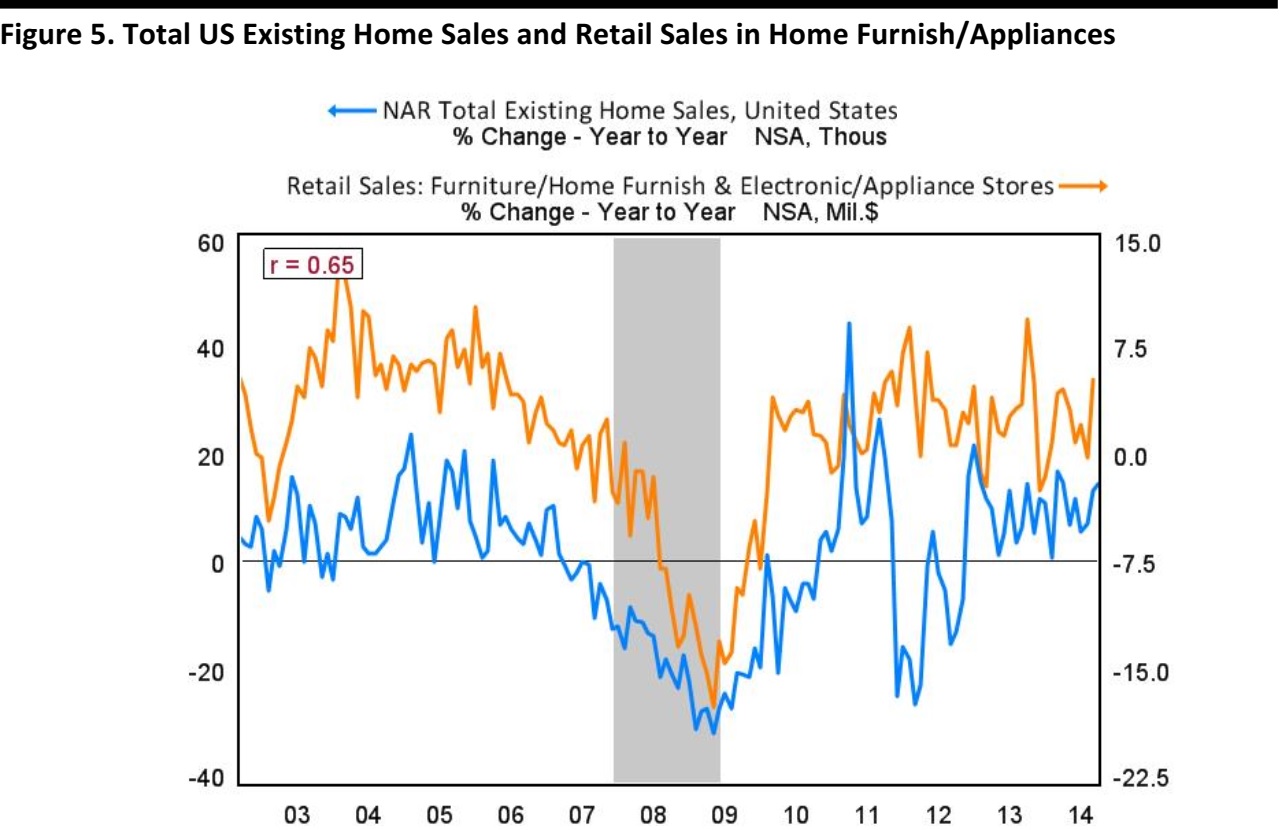

Through September 30, 2014

Source: National Association of Realtors, Census Bureau and Haver Analytics

- The home-‐furnishing sales (with a 17-‐month lag) and existing home sales are strongly

- With the steady recovery in the housing market, we expect furniture, home-‐furnishings and appliance store sales to continue to strengthen over the next year and more