FROM THE DESK OF DEBORAH WEINSWIG

This week, the Fung Global Retail & Technology team attended the WWD Apparel & Retail CEO Summit, which was held October 25–26 in New York City. This year, the event celebrated its 20th anniversary and carried the title “Reframing Fashion and Retail.” The conference featured leaders and luminaries from retail, fashion, business and the fashion press. The speaker list included fashion icons and celebrities such as Diane von Furstenberg, Marc Jacobs, Norma Kamali and Chuck Todd, who moderates the NBC political talk show Meet the Press. Discussion and presentation topics included consumer opportunities, the in-store experience, the fashion calendar, consumer expectations, luxury, influence, online retail trends and the new consumer.

Panelists generally offered a positive outlook for holiday spending this year. Jerry Storch, CEO of Hudson’s Bay Company, said that last year’s terrorist attacks and the upcoming US presidential election will soon be things of the past, freeing consumers to hit the stores again. Sarah Quinlan, Senior Vice President & Group Head of Market Insights at MasterCard Advisors, offered her view of this year’s holiday season, predicting that sales will increase by 3.4% and that shoppers will start shopping late. Quinlan then gave a summary of key consumer markets around the world, noting that sales figures in Hong Kong, Japan and the UK were negative, but that US luxury sales were positive in September. She also noted that e-commerce continues to exhibit locomotive-like power.

The beauty category also appears to be fairly robust. Mary N. Dillon, CEO of Ulta Beauty, commented that beauty is the most innovative category within retail and said a quarter of her company’s same-store sales last quarter were driven by new products. Ulta holds only a 4% share of the beauty market and, in a growing market, there remains plenty of room for the company to achieve its goals of doubling its market share and roughly doubling its store count.

Several panelists commented on the acceleration of the apparel delivery process due to the rise of social media, which has spurred the “see now, buy now” trend. For example, the most recent New York Fashion Week featured fashion shows that were open to the public and streamed via the Internet. Viewers could purchase the items they saw on the runway immediately following the shows, rather than having to place orders and then wait as in the past.

The artistic, high-end fashion designers are resisting the current social media–fueled environment, which runs at Internet speed. Fashion icon Diane von Furstenberg offered some risqué remarks about her goals for dress design and then bemoaned the current state of “product pollution,” noting that there are so many products currently being offered that consumers lose focus and interest. Moreover, she said this surplus of product has led to a “triumph of mediocrity” that is fueled by reality TV, and that the apparel industry needs to prune its offerings and focus on craft, design and value.

Sidney Toledano, President and CEO of Christian Dior Couture, recognized the challenges in the industry, noting that there is no creativity without constraints and that designers must respect the laws of gravity. Instant/fast retail means that consumers constantly want to see something new in stores. Online and digital channels need to feature more product and more luxury, he said, and Dior wants to lead this category. Retailers are using chat and other technologies in order to forge a special relationship with customers, Toledano noted.

A common theme across nearly all of the retailer panels was the apparel industry’s need to reinvent itself in response to the challenges posed by social media, changes in the display and marketing of apparel, and other economic factors. Jerry Storch was emphatic that retailers must make stores—both physical and online—fantastic in order to give customers a reason to visit them. Jim Gold, President and Chief Merchandising Officer at Neiman Marcus, said that his company is transforming its sales and marketing processes, focusing on personalization and transforming customer service for “anything, anytime, anywhere.”

The Fung Global Retail & Technology team learned a great deal from these industry leaders and icons and looks forward to continuing to report on key industry events and conferences.

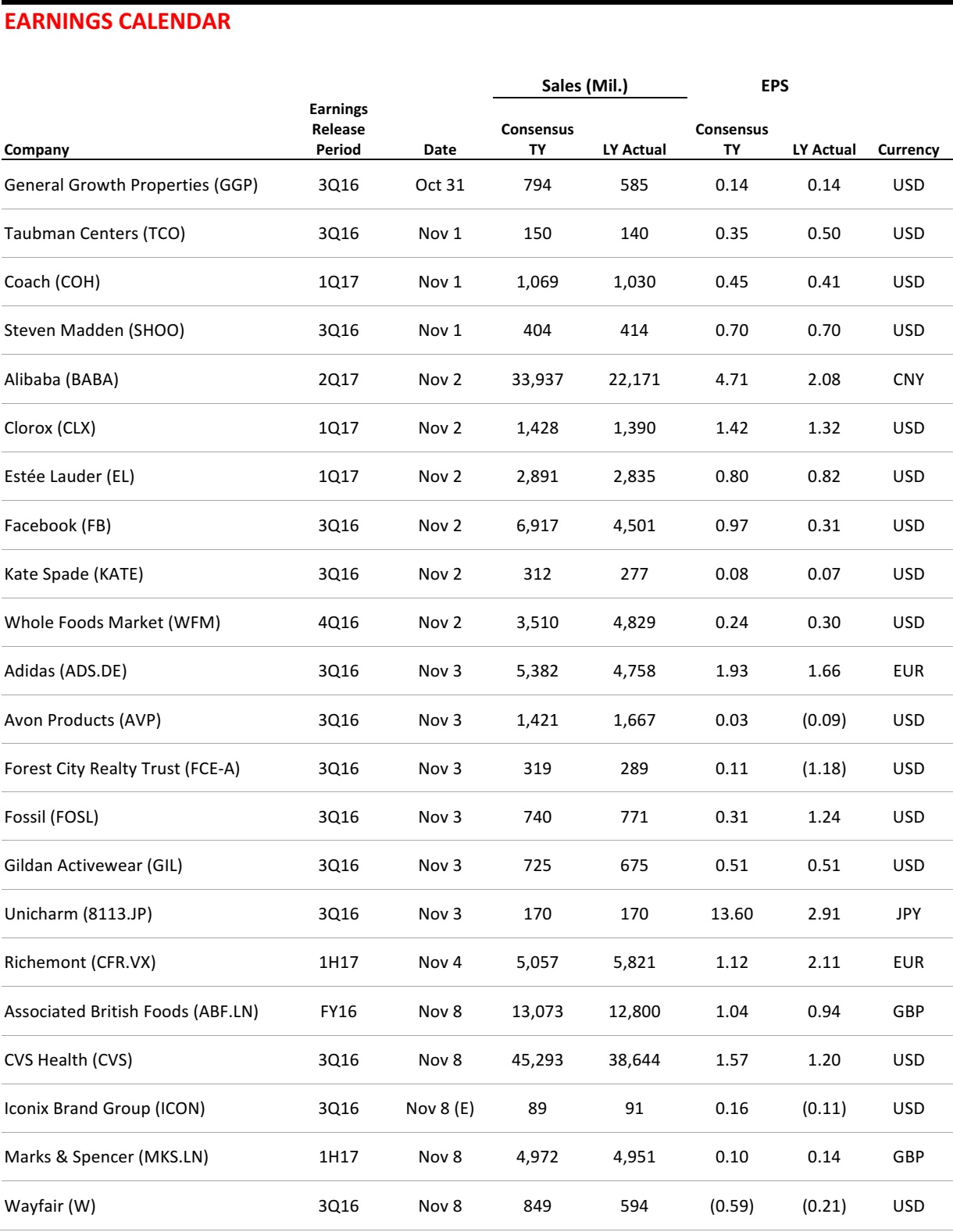

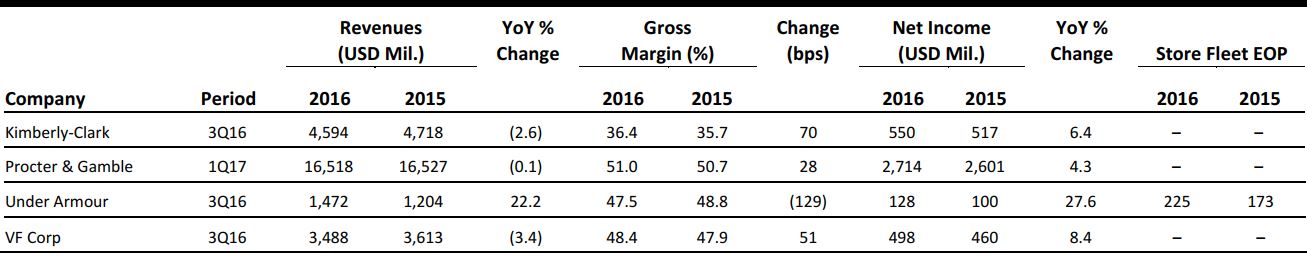

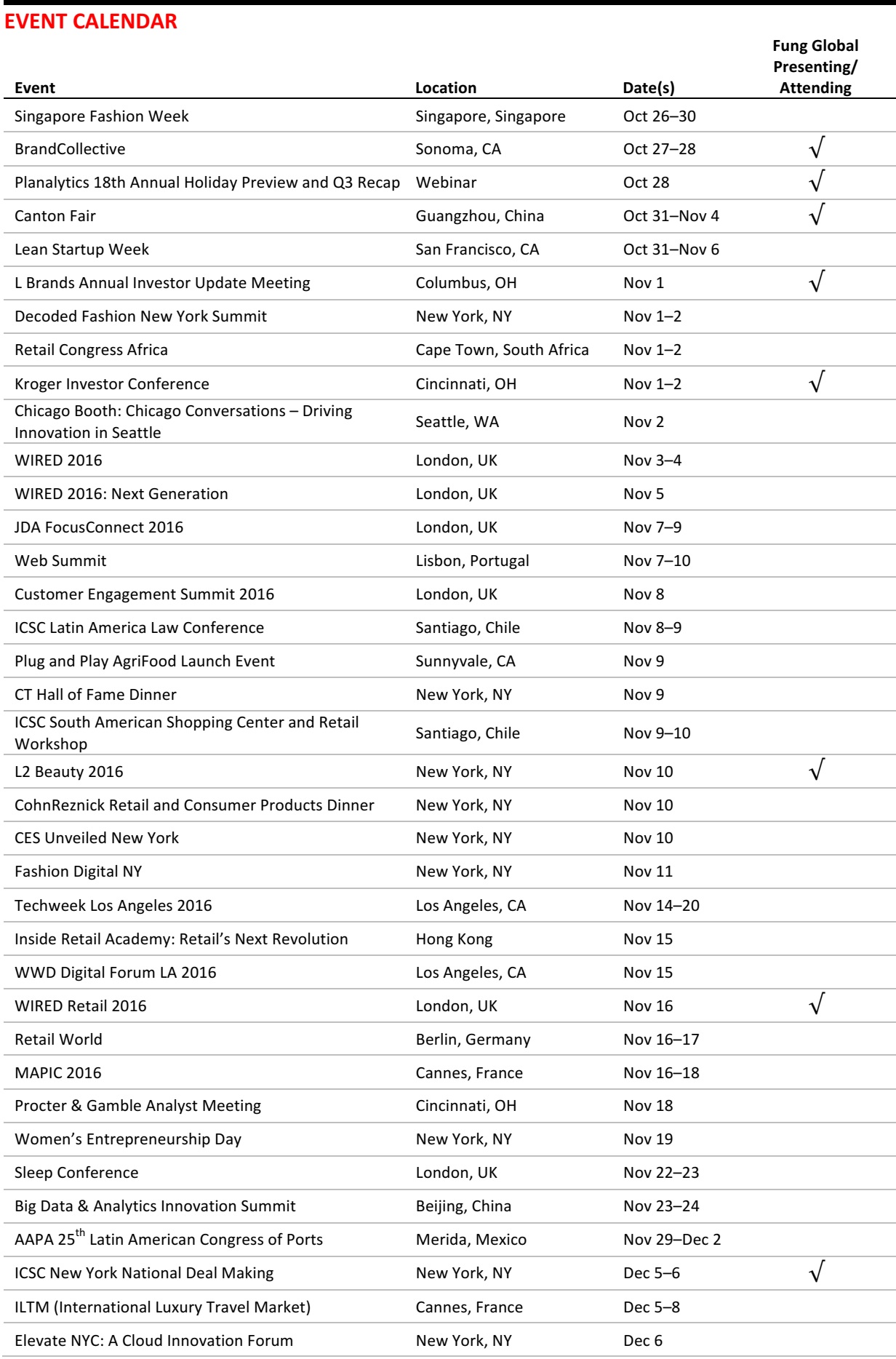

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Will Instant Fashion Mean the End of Fast Fashion?

(October 21) Women’s Wear Daily

Will Instant Fashion Mean the End of Fast Fashion?

(October 21) Women’s Wear Daily

- With “see now, buy now” gaining momentum in the fashion industry, fast-fashion retailers could stand to lose. Zara, H&M, ASOS, Forever 21 and others could be negatively impacted by the instant runway-to-store presentation trend.

- Some experts argue that the see-now, buy-now model will not impact fast-fashion retailers, as they operate at different price points. However, it could cause other factors—such as strong and relevant product offerings, improved service options, e-commerce options and increased sales productivity—to play a bigger role in retailers’ success.

Retailers Rushed to Hire for Holidays, a Sign of Tight Labor Market

(October 24) The Wall Street Journal

Retailers Rushed to Hire for Holidays, a Sign of Tight Labor Market

(October 24) The Wall Street Journal

- Despite starting to recruit seasonal workers earlier this year, retailers are still rushing to hire temporary help for the holidays. Data from Indeed.com show that retailers started searching for seasonal help in August, a month earlier than in recent years, signaling that they anticipate a strong holiday season.

- Experts say several trends are at work here. Many consumers are starting their holiday shopping before Halloween, rather than waiting until after Thanksgiving. Also, with unemployment holding around 5%, there are fewer workers available. And retailers are now competing with logistics firms and distribution centers for seasonal hires as e-commerce continues to grow.

MasterCard Users Will Soon Be Able to Manage Their Accounts over Facebook Messenger

(October 25) TechCrunch

MasterCard Users Will Soon Be Able to Manage Their Accounts over Facebook Messenger

(October 25) TechCrunch

- Soon, MasterCard account holders will be able to use Facebook Messenger to check their accounts, track their spending, review purchases and more. MasterCard will incorporate Kasisto’s conversational artificial intelligence platform into Facebook’s chatbot platform for its bot tool.

- The bot is currently in pilot testing, but will be available to Facebook’s 1 billion users early next year. MasterCard will also be releasing a bot for merchants that allows online shoppers to make purchases right in the messaging platform.

Everlane’s Social Strategy: Drive Community Engagement, Not Sales

(October 25) Glossy

Everlane’s Social Strategy: Drive Community Engagement, Not Sales

(October 25) Glossy

- Direct-to-consumer apparel startup Everlane is working to make its social media presence as personal as possible. The idea is consistent with the brand’s commitment to transparency; it seeks to enable customers to see into the brand and actually help shape it themselves. However, its strategy also gets around the pay-to-play model that is becoming more common in social media advertising.

- In addition to its primary Instagram account—which boasts 274,000 followers—Everlane has a private, secondary account with a curated group of followers who are provided with customer feedback and sneak peeks of product offerings. The company also recently asked its Facebook followers if they would be interested in a Facebook group to discuss all things Everlane. The response was very positive.

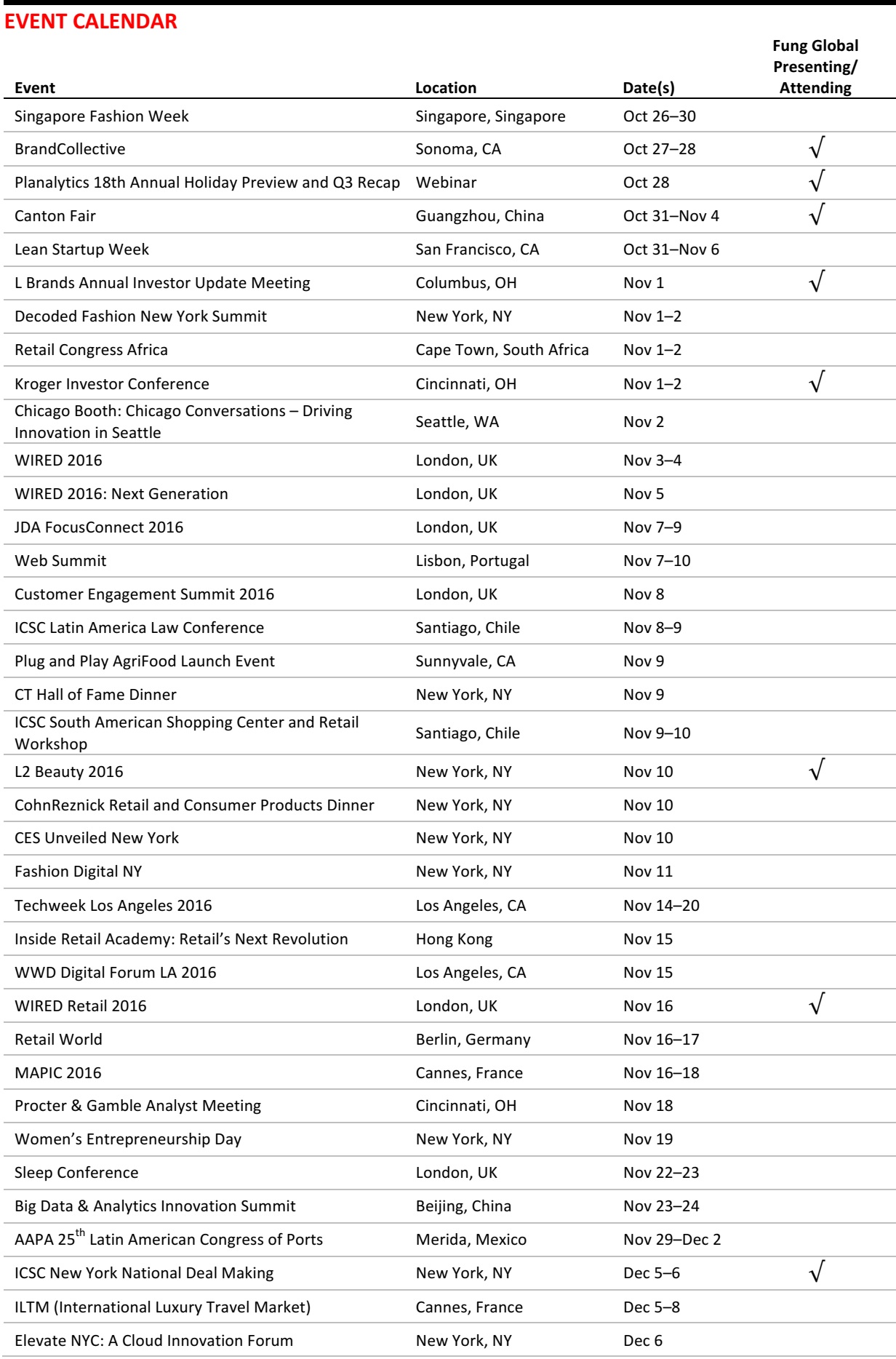

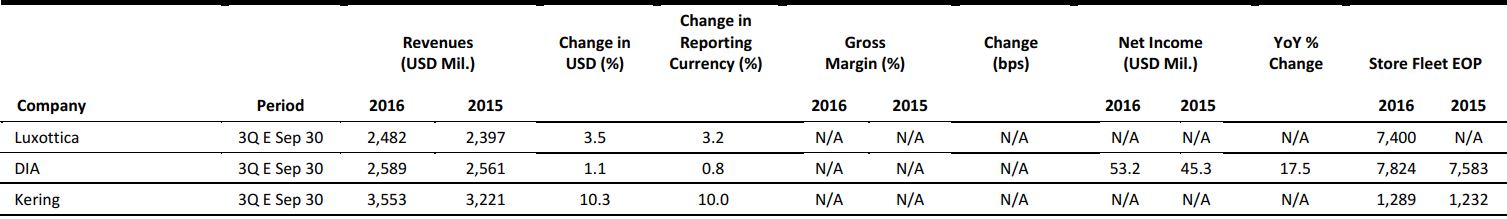

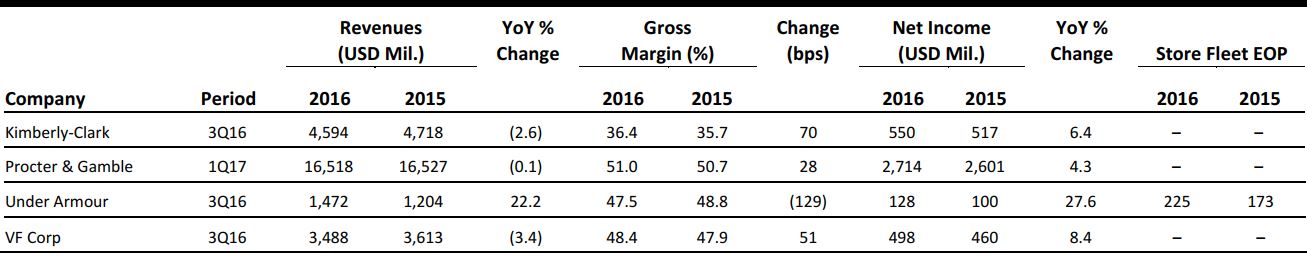

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

Lidl Ramps Up Online Presence

(October 25) The Drinks Business

Lidl Ramps Up Online Presence

(October 25) The Drinks Business

- German discounter Lidl is expected to trial click-and-collect service for fresh and frozen products in Hamburg beginning in December this year. This marks an expansion of its offering from its existing website in Germany that sells ambient grocery and nonfood products.

- Lidl’s parent company, Schwarz Group, is reported to be investing “a three-digit million figure” to improve its global online presence. A spokesman for the grocer noted that there are no plans yet to launch an online shop in the UK.

French Connection Eyed by Overseas Buyers

(October 24) The Telegraph

French Connection Eyed by Overseas Buyers

(October 24) The Telegraph

- Shares in fashion retailer French Connection jumped on Monday after rumors of a takeover emerged over the weekend. It was speculated that several foreign buyers are looking to acquire the company. French Connection has reported a spate of losses and has seen a drop in its share price.

- French Connection has reportedly appointed investment boutique Moelis to advise on the matter. Several European and US firms are said to be considering approaches, including US company Neuberger Berman, which previously acquired the parent of British shirt brand Ben Sherman.

BHS International Reveals International Expansion Plans

(October 24) Retail Week

BHS International Reveals International Expansion Plans

(October 24) Retail Week

- BHS International has announced plans to expand its operations across the world. It has nearly completed deals with three new franchise partners, to open new stores across 10 countries in Africa, Europe and the Middle East.

- Managing Director David Anderson stated that the franchise partners of BHS have made significant investments in stores and that the British firm will help them “by providing a greater focus on market-specific products, and by introducing new ranges.”

Magnit Accelerates Closure of Loss-Making Stores

(October 21) CNBC

Magnit Accelerates Closure of Loss-Making Stores

(October 21) CNBC

- Russia’s biggest food retailer, Magnit, has implemented a major program to close inefficient stores and refurbish around 1,000–1,500 shops next year. The company currently operates about 13,000 stores.

- Magnit’s sales growth has slowed since Russia’s economy was struck by low oil prices and Western sanctions, which have impacted consumer spending in the country.

Tesco Trials New Anti-Fraud Tap&Tag Technology

(October 21) Retail Gazette

Tesco Trials New Anti-Fraud Tap&Tag Technology

(October 21) Retail Gazette

- British grocer Tesco has launched a trial at two stores in Essex for a new technology called Tap&Tag, which replaces paper receipts with digital ones when a customer completes a purchase. To use the technology, customers simply need to tap a contactless card or NFC-enabled phone on the Tap&Tag console to pay. A digital receipt will then be sent to them following an online registration.

- The Tap&Tag trial will end in November, after which Tesco will decide whether to roll it out across the network. The technology is designed to help the grocer tackle fraudulent returns, which cost Tesco an estimated £8 million (US$9.7 million) a year.

ASIA TECH HEADLINES

Ant Financial Partners with US Payment Tech Companies Verifone and First Data

(October 25) e27.co

Ant Financial Partners with US Payment Tech Companies Verifone and First Data

(October 25) e27.co

- Ant Finanical, Alibaba’s digital payments affiliate, has partnered with US-based payment tech companies Verifone and First Data to expand its business overseas.

- The new deal will make it more convenient to conduct cross-border transactions for Chinese shoppers, who are showing an increasing interest in traveling overseas to purchase luxury items.

India’s Ola Cooperates with BMW for Luxury Cabs Segment

(October 24) Reuters

India’s Ola Cooperates with BMW for Luxury Cabs Segment

(October 24) Reuters

- To strengthen its luxury mobility segment, Indian ride-sharing service provider Ola has partnered with German carmaker BMW. The collaboration will enable Ola cab operators to purchase BMW cars at cheaper credit and to receive after-sales support.

- Other automakers, such as Volkswagen, Toyota Motor and General Motors, have also signed tie-ups with ride-sharing companies.

Tencent Collaborates with Mattel to Develop Toys

(October 25) ShanghaiDaily.com

Tencent Collaborates with Mattel to Develop Toys

(October 25) ShanghaiDaily.com

- Tencent signed an agreement with US-based Mattel, the largest toy manufacturer in the world, to develop high-tech and intelligent toys based on the QQ Family figures.

- China has few original brands to rival the global manufacturers, despite its large toy manufacturing and exporting volume, according to the China Toy & Juvenile Products Association.

Singapore’s Edtech Startup Cialfo Heads to China

(October 25) e27.co

Singapore’s Edtech Startup Cialfo Heads to China

(October 25) e27.co

- Following a pre-series A fund raise round two months ago, Singaporean edtech startup Cialfo has announced the launch of its first overseas office, in Shanghai, China. The company aims to help students more easily find their dream college, and China is a big market for it. Cialfo has also minted 10 new strategic partnership agreements in the country.

- Cialfo is looking to collaborate with more education service providers and after-school enrichment programs, and to connect them with existing consultancies on the platform.

LATAM RETAIL HEADLINES

Carcel, a Sustainable Knitwear Collection Made by Peruvian Prisoners, Ready to Launch

(October 25) WWD.com

Carcel, a Sustainable Knitwear Collection Made by Peruvian Prisoners, Ready to Launch

(October 25) WWD.com

- Carcel, a new company based in Copenhagen, is planning to launch an e-commerce site that sells only sustainable knitwear produced by female prisoners in Lima, Peru. Through a 30-day, $23,000 Kickstarter campaign, the company succeeded in getting enough preorders to finance knitting machines for the prison.

- Depending on the demand, the company can employ up to 180 women to produce its collection of six styles of alpaca designs in multiple colors. The pieces will retail for $125–$350, and the producer of each garment will have her name printed on its label in order to create a sense of worth for the prisoners.

Apple Watch Nike+ Will Be Sold in Brazil Starting October 28

(October 25) América Retail

Apple Watch Nike+ Will Be Sold in Brazil Starting October 28

(October 25) América Retail

- One of the most awaited watches in Brazil, the Apple Watch Nike+, will arrive just one month after the second edition of the Apple Watch launched in the country. This arrival comes much faster than usual for the Latin America region, where consumers usually wait longer than the rest of the world for new novelties.

- The watch will also arrive in Mexico and Puerto Rico. In Brazil, it will sell for R$2,999, which is nearly US$1,000 at current exchange rates, and will be available at Apple and Nike stores.

Mexico’s Retail Sales Rise for Fourth Straight Month

(October 25) Reuters

Mexico’s Retail Sales Rise for Fourth Straight Month

(October 25) Reuters

- Retail sales in Mexico were up 0.6% in August from July, when adjusted for seasonal swings, according to the country’s national statistics agency. The monthly increase was the fourth in a row.

- Year over year, retail sales increased by 8.9% in August, signifying strong growth in Mexico’s retail market as the middle class continues to expand and gain spending power.

Walmart Will Open New Stores in Tabasco, Mexico

(October 26) América Retail

Walmart Will Open New Stores in Tabasco, Mexico

(October 26) América Retail

- Walmart is investing more than MXN 157 million (US$8.5 million) to open two new stores in the state of Tabasco that will generate more than 250 permanent jobs. The company will have created 4,500 jobs in total, with 1,350 in its distribution centers across the state.

- The company now has 30 stores in the 13 municipalities in Tabasco, where Walmart has invested MXN 2.7 billion (US$144.7 million).

Ant Financial Partners with US Payment Tech Companies Verifone and First Data

(October 25) e27.co

Ant Financial Partners with US Payment Tech Companies Verifone and First Data

(October 25) e27.co

India’s Ola Cooperates with BMW for Luxury Cabs Segment

(October 24) Reuters

India’s Ola Cooperates with BMW for Luxury Cabs Segment

(October 24) Reuters