FROM THE DESK OF DEBORAH WEINSWIG

The past week brought the cognitive dissonance of an anemic September retail sales report juxtaposed against plunging pump prices and one of the most upbeat consumer sentiment readings since the summer of 2007. What gives? With the exception of hot new tech toys and perhaps a dinner out, still-frugal consumers are still putting off discretionary purchases of all kinds.

Our industry contacts remain cautiously optimistic. Nonetheless, it seems to us that, with the slow yet steady improvement in the economy and the big boost in spending power from lower energy prices, consumers may find themselves in much better holiday spirits as the big day approaches.

Given our recent channel checks and readings of the consumer’s spending appetite, we continue to expect holiday spending at brick-and-mortar retailers to stay within the recent trend of 3%C5%, and for online sales to jump +13% to +15%. But promotion activity is already running thick and heavy, and could be as fierce as we’ve seen in recent memory. The winners this holiday will be those retailers that provide the best service, the best price—and, of course, on-time delivery.

We’ll be keeping you updated on industry trends and results as we tick off the succession of holidays in the coming months.

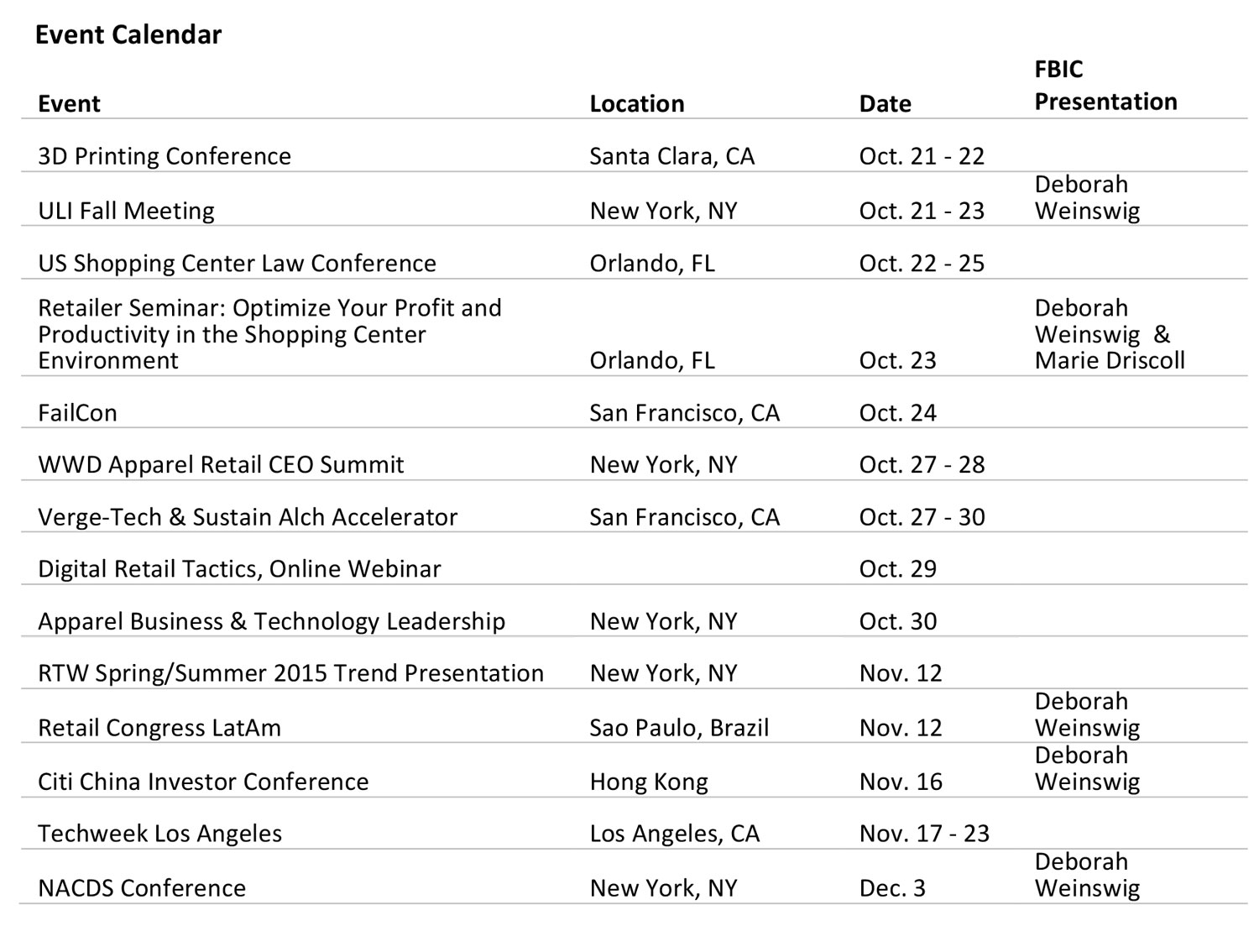

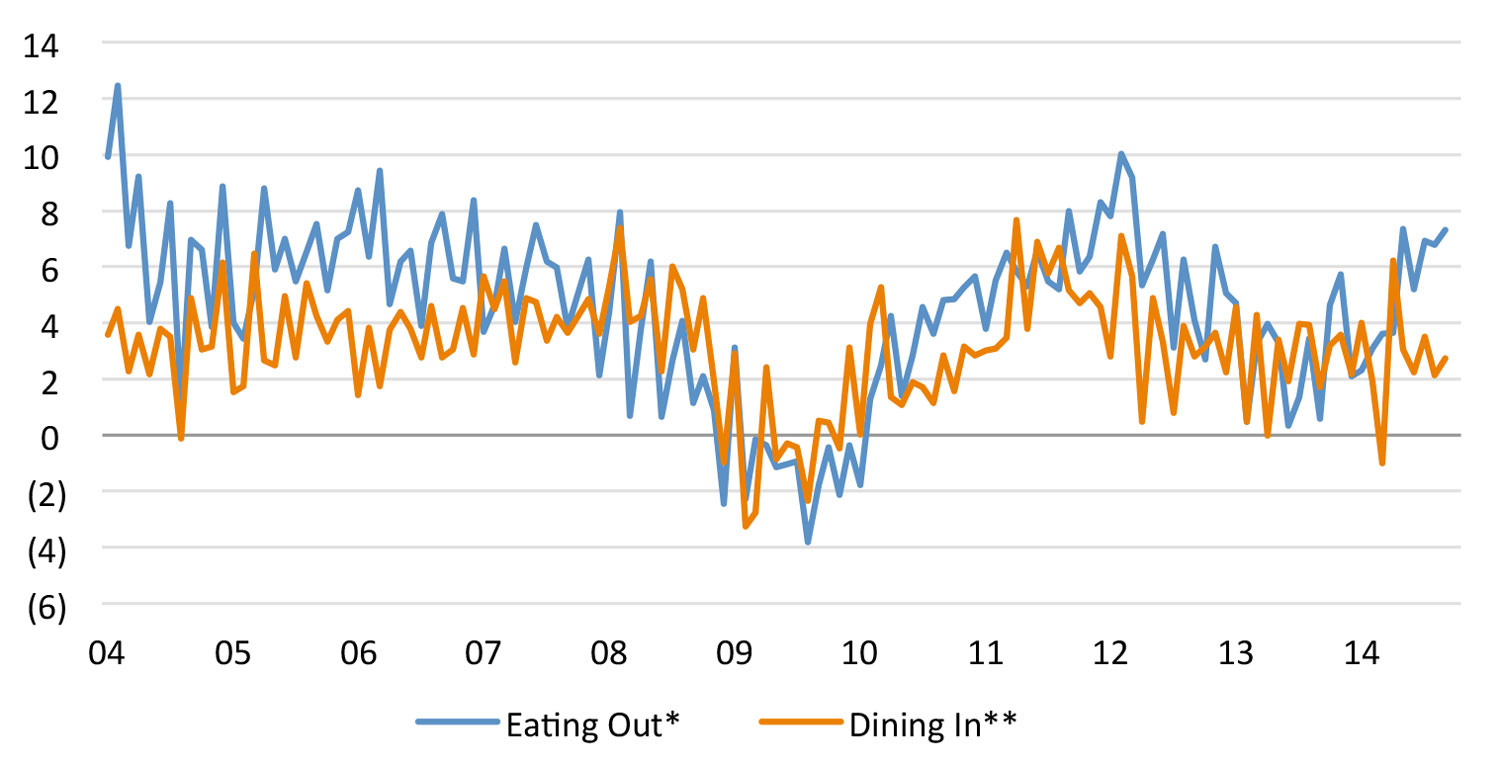

Eating In and Dining Out YoY%

Through September 30, 2014

Source: US Department of Commerce

*Sales of food services and drinking places

**Sales of grocery stores, beer, wine and liquor stores

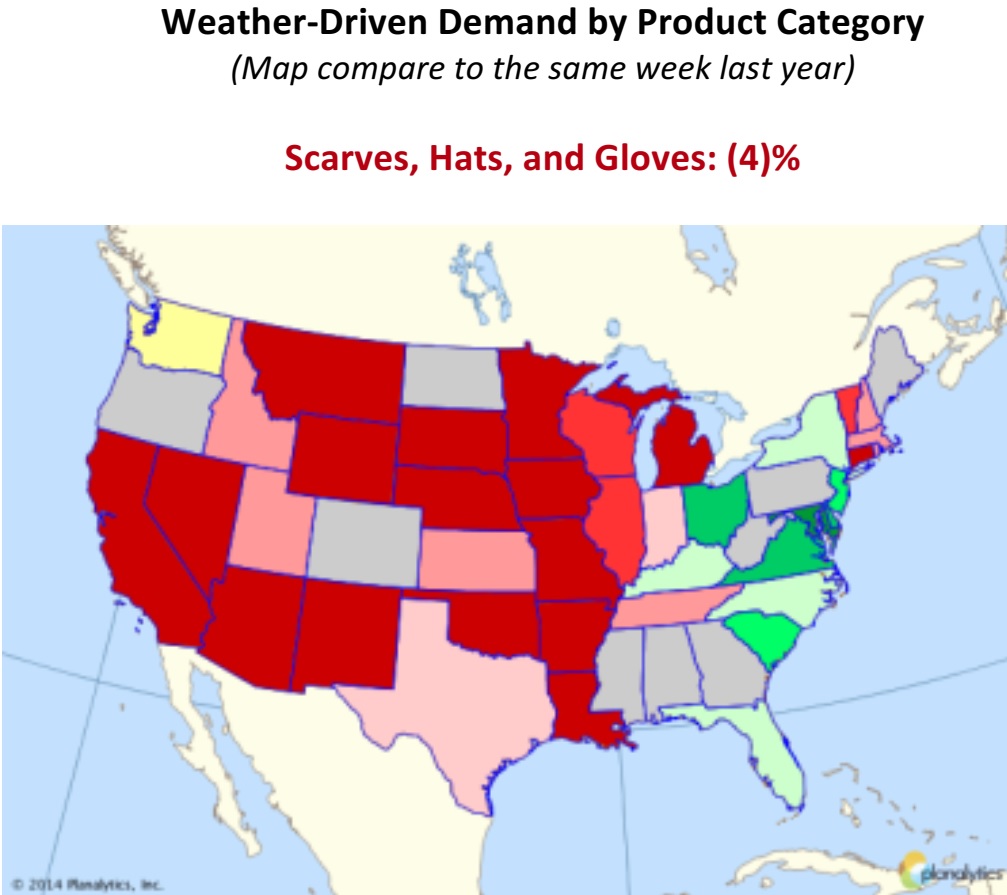

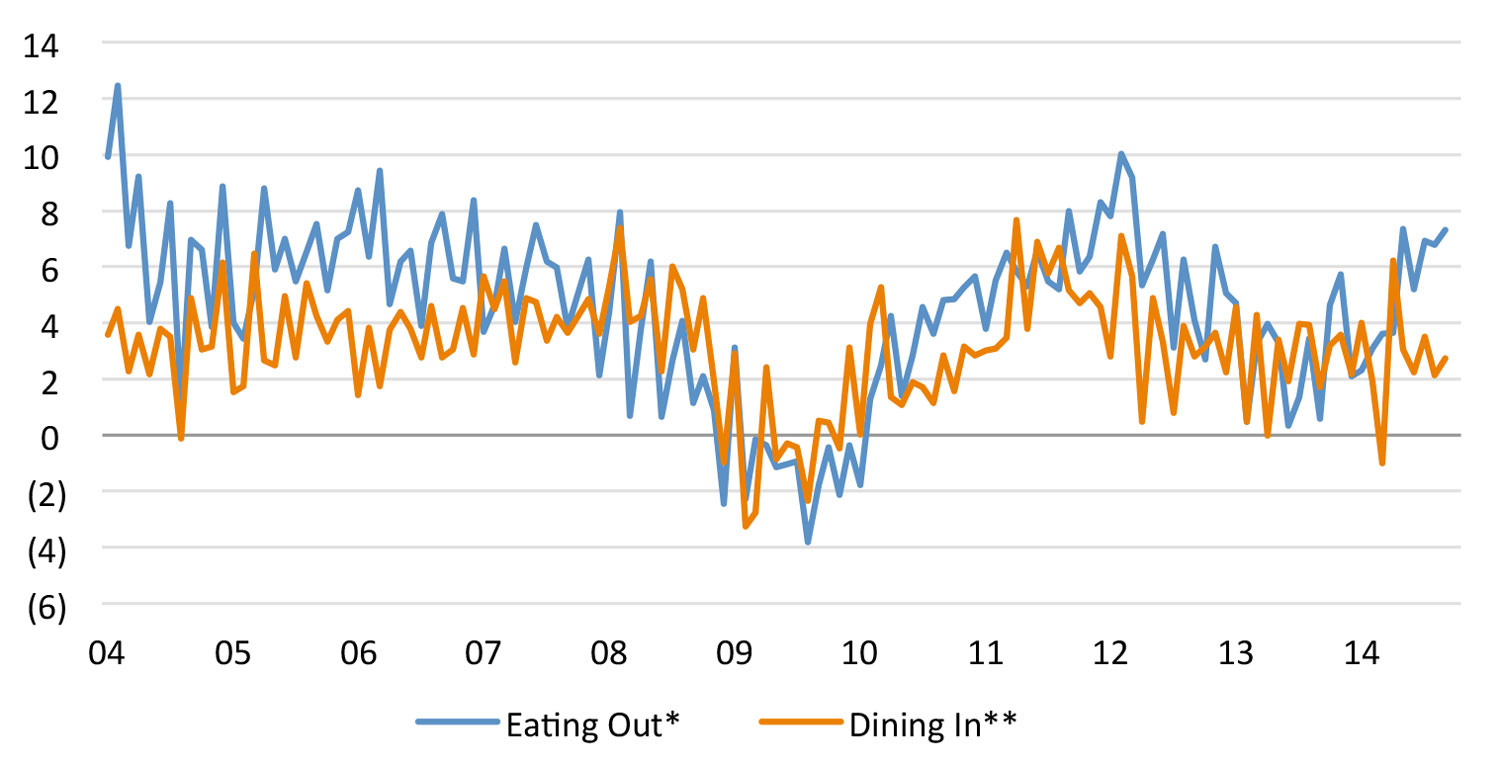

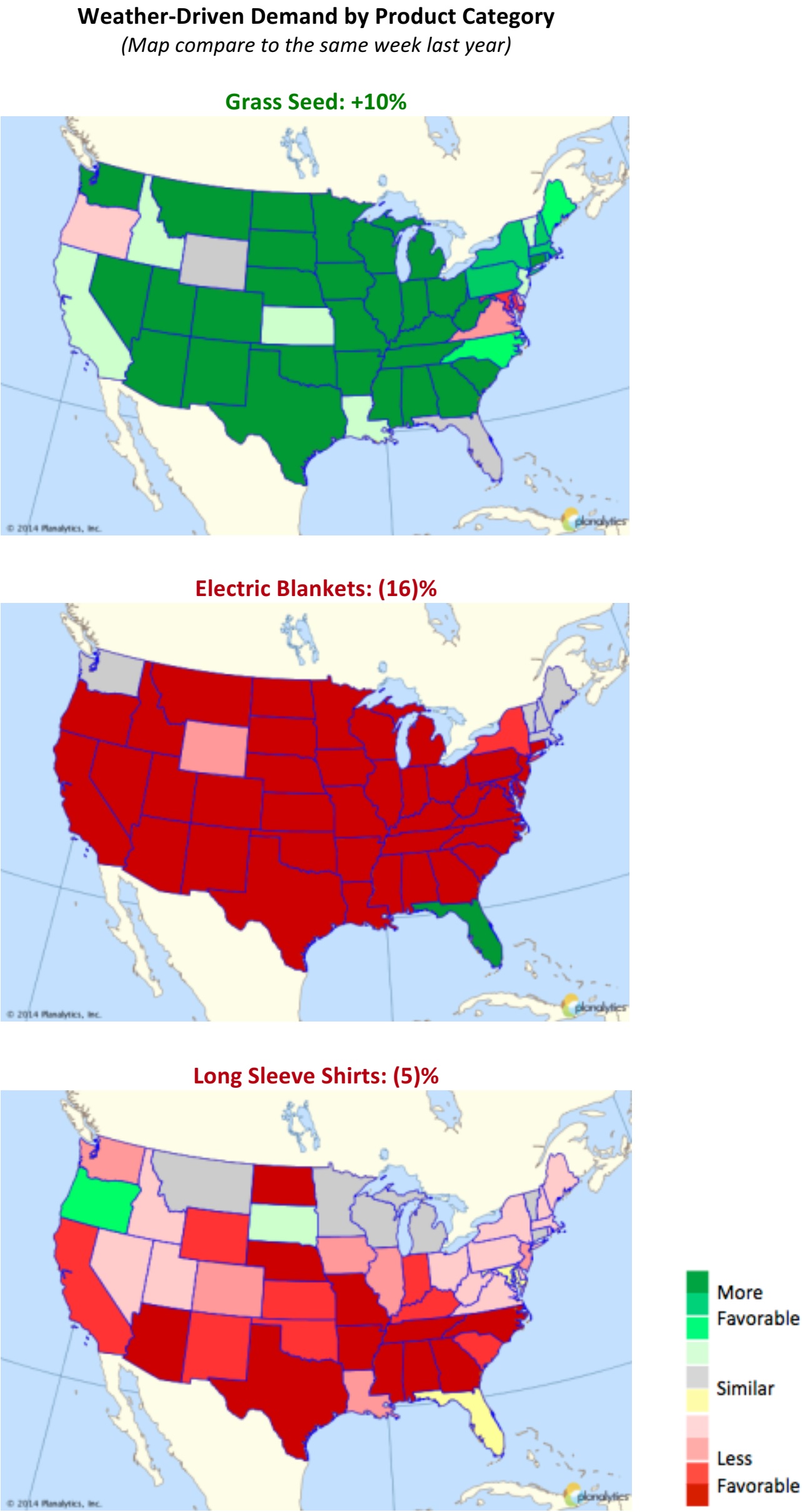

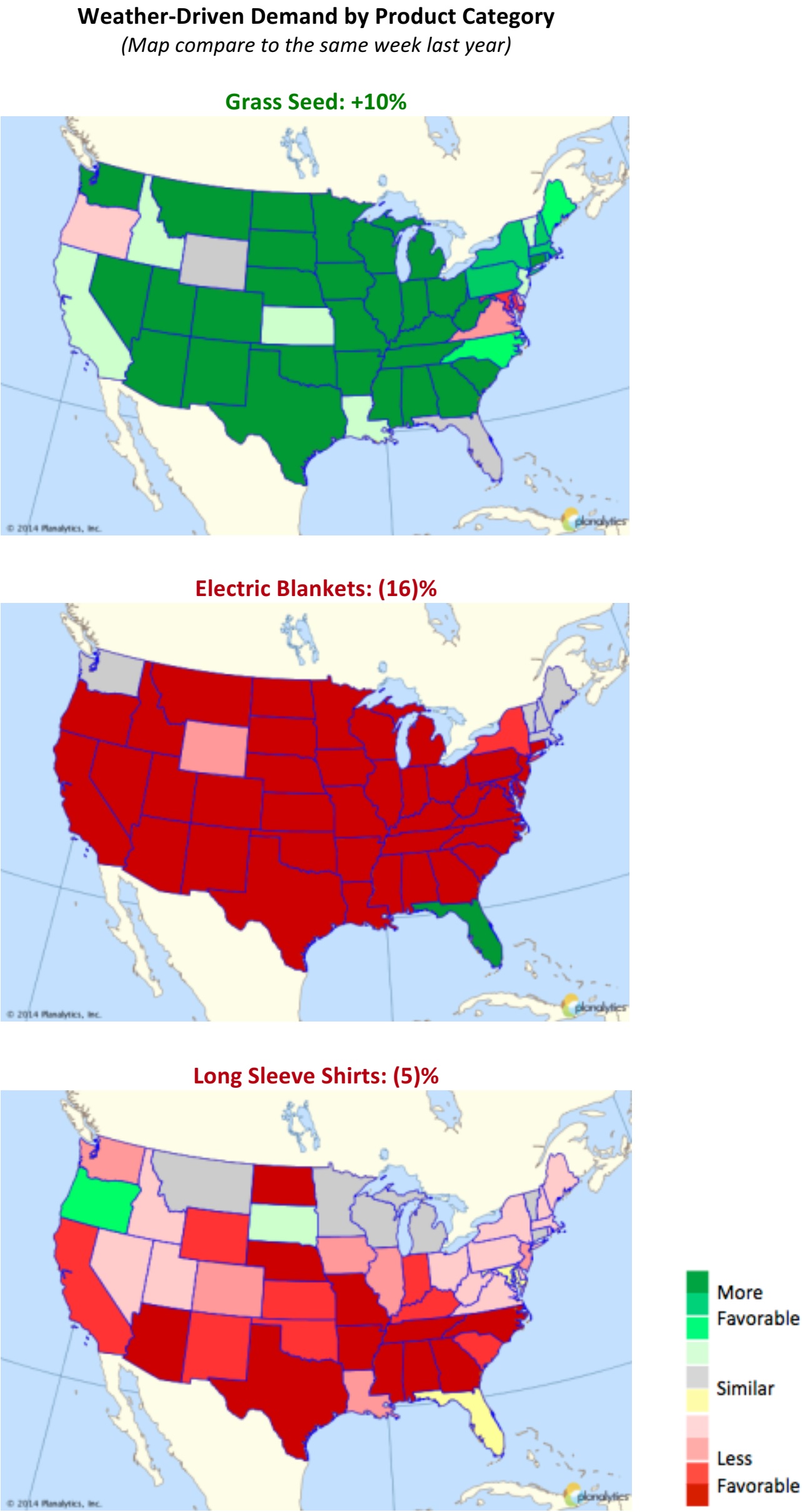

RETAIL WEATHER ANALYTICS

What To Expect This Week (October 20 – 26, 2014)

Warmer Temps for Most of North America to Challenge Seasonal Purchasing

Warmer Temps for Most of North America to Challenge Seasonal Purchasing

- Still Warmer than Last Year, but Getting Colder in the Northeast. The colder air and strong winds that were ushered in over the weekend will continue early in the week. Although moderating mid-week, colder temperatures should return later in the week, and persist into the weekend. Still, compared with the excessively cold weather last year, these relative warmer conditions could cause demand for seasonal items such as heaters, fleece and hot drinks to lag year-over-year.

- Unsettled Weather for Northeast. A slow-moving storm system will spread rain showers from the Great Lakes to the Northeast states by Tuesday. For the remainder of the workweek, the storm will meander off the coast, keeping the threat of wet weather in the forecast. The storm is expected to finally pull away by the weekend.

- Where’s Fall? While eastern regions will edge cooler, the remainder of the US is expected to average warmer than normal, and much warmer compared to the very cold week last year. Demand for seasonal categories such as electric blankets, outerwear, and firelogs will continue to lag.

- Grab the Umbrellas! Persistent Wetness Dampens the Pacific Northwest. The pattern for the week supports frequent periods of rain for coastal Washington, Oregon and British Columbia, along with mountain snow.

- Showers in the Southwest to Spread into the Plains Mid-Week. Watching much needed moisture across west Texas and the Southwest that will spread northeast early week, bringing moisture and possibly mountain snow to the Rockies. This will ultimately push out into the Plains by mid-week. Anticipate showers and thunderstorms to dampen interior regions. Some isolated areas of severe weather are possible.

- Gonzalo Is Gone, and the Tropics Quiet Down. The US stayed out of harm’s way last week, with powerful Hurricane Gonzalo remaining offshore. This extended the record drought for major hurricane landfalls in the US (Wilma/October 2005). We’re watching the remnants of Tropical Storm Trudy, which crossed Mexico into the Gulfof Mexico. Tropical moisture could possibly affect Florida late in the week.

Source: Planalytics

What to Expect the Following Week (Oct. 27 – Nov. 2, 2014)

Colder Temps Late-Week to Provide Treats for Seasonal Items in Time for Halloween

Colder Temps Late-Week to Provide Treats for Seasonal Items in Time for Halloween

- Pattern Expected to Change Mid-Week. Early week, the warmer West, colder East pattern is expected to persist. However, there are indications of a colder surge moving into the West during the week. By week’s end, almost all areas across the northern tier will enter more seasonal conditions, including periods of wet weather. Early seasonal snowfall will be limited and is not expected to affect any major markets. Versus this week a year ago, demand for autumn categories will be strongest in the Southeast and Mid-Atlantic regions.

- Tricks and Treats! Halloween Is “Spooktacular” for Some, Ghoulish for Others. For the kids’ favorite night of the year, the trend supports seasonal and mainly dry conditions for the southern tier states, making for a “treat” of a night. A “trick(y)” night is likely for revelers in the US northern tier states, with periods of showers possible.

- Tropics Beginning to Wind Down, Yet We Watch. This week is the two-year anniversary of Superstorm Sandy, which devastated much of the mid-Atlantic coast, much of which are still rebuilding. At this time, we see no organized tropical activity that could impact the US.

A FOCUS ON US RETAIL SALES

US Retail Sales Disappointed in September

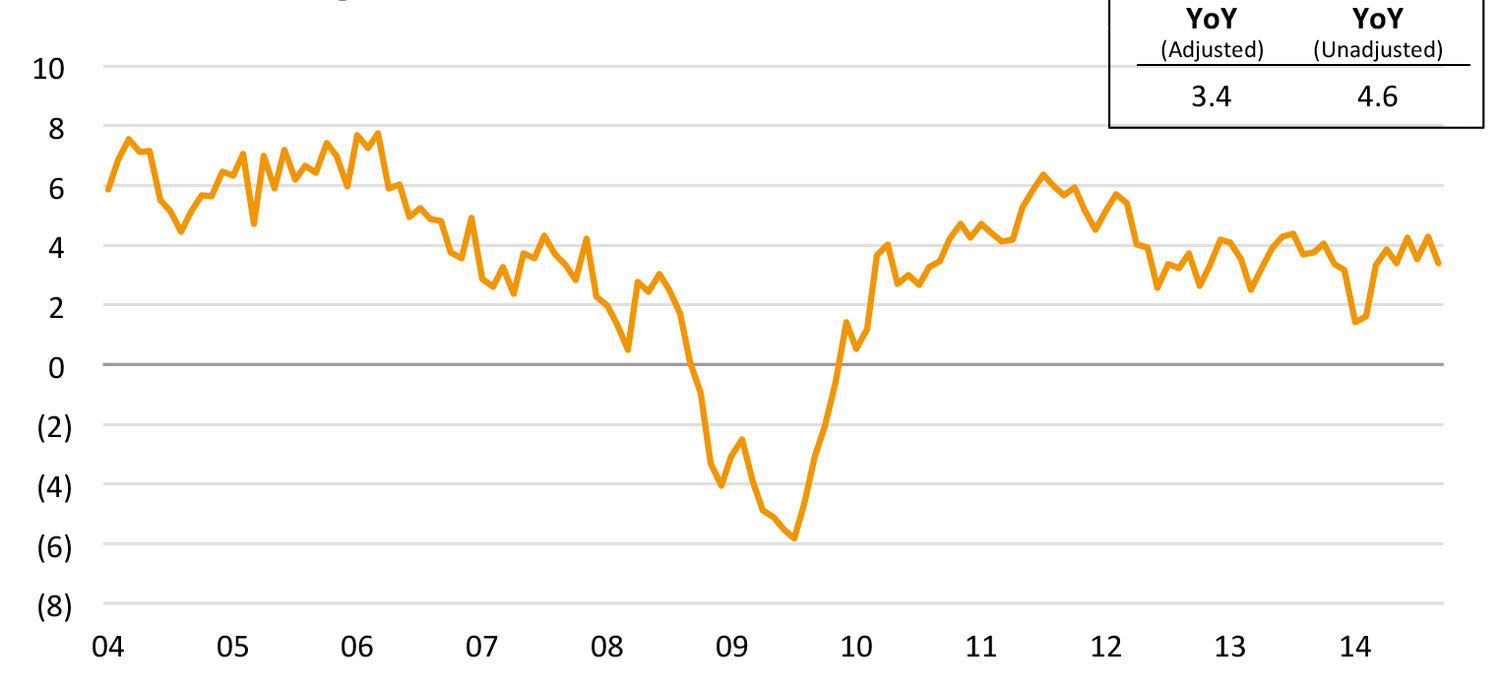

Retail Sales Excluding Auto, Food, Drinks and Gas YoY%

Through September 30, 2014

Seasonally adjusted

Source: US Department of Commerce

- Consumers continue to hold back on purchases of discretionary items

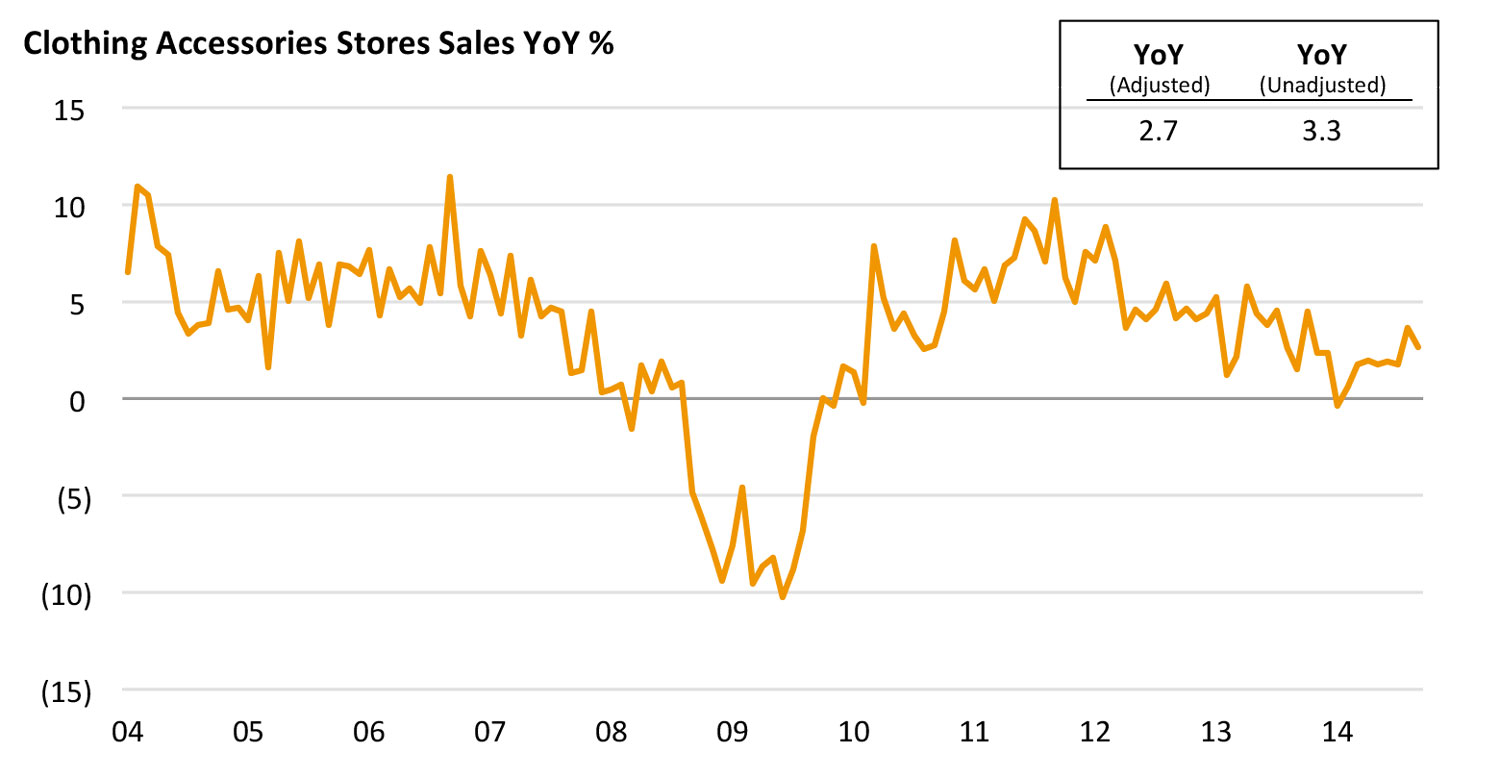

- Furniture, sporting-goods and apparel stores were among the biggest laggards YoY

September Monthly Sales by Retail Segment (%Change)

Through September 30, 2014

Seasonally adjusted

Source: US Department of Commerce

- Electronics and appliance stores posted the strongest MoM sales gains (up 3.4%)

- Clothing and home-related retailers saw the steepest monthly declines (down 1.2%and 1.1%, respectively)

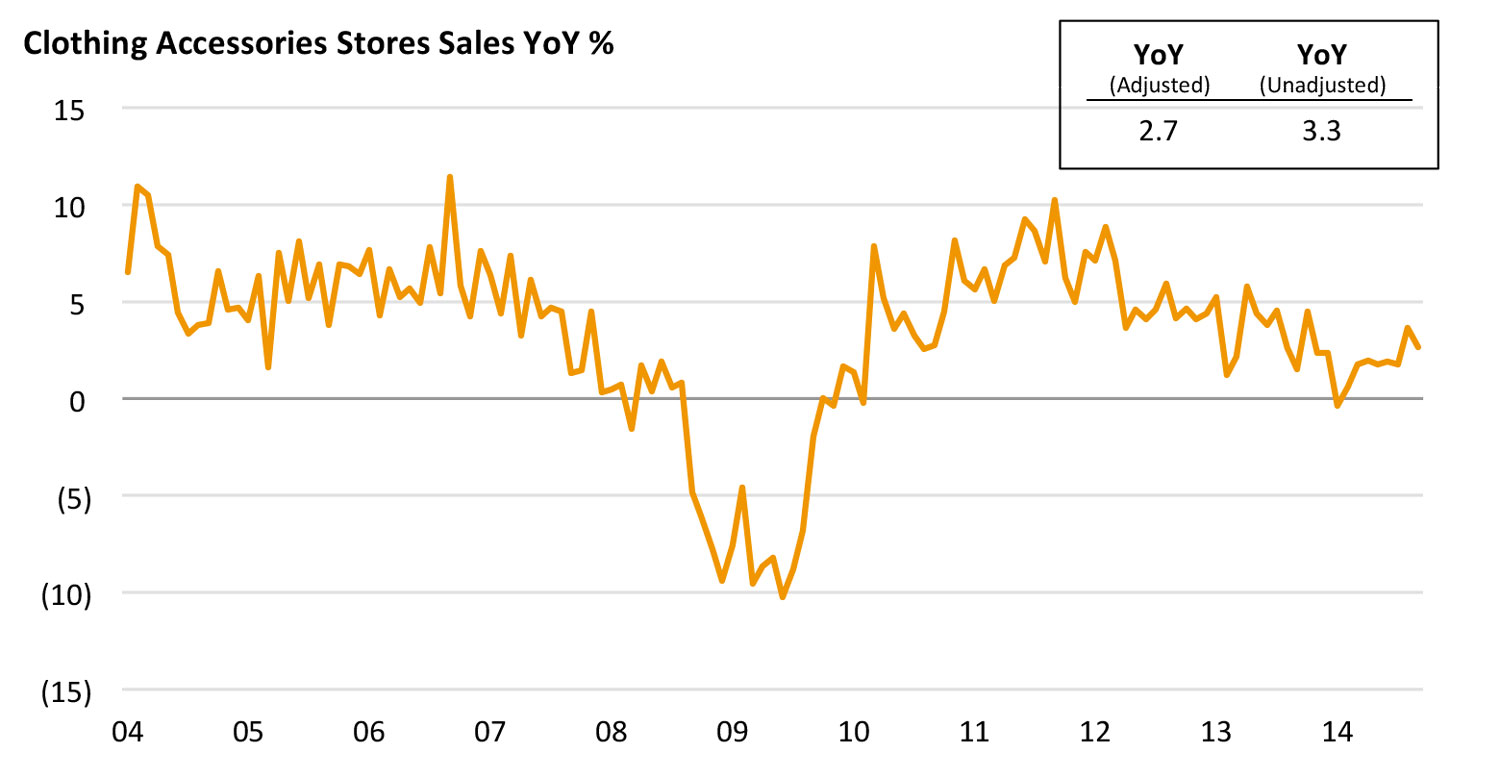

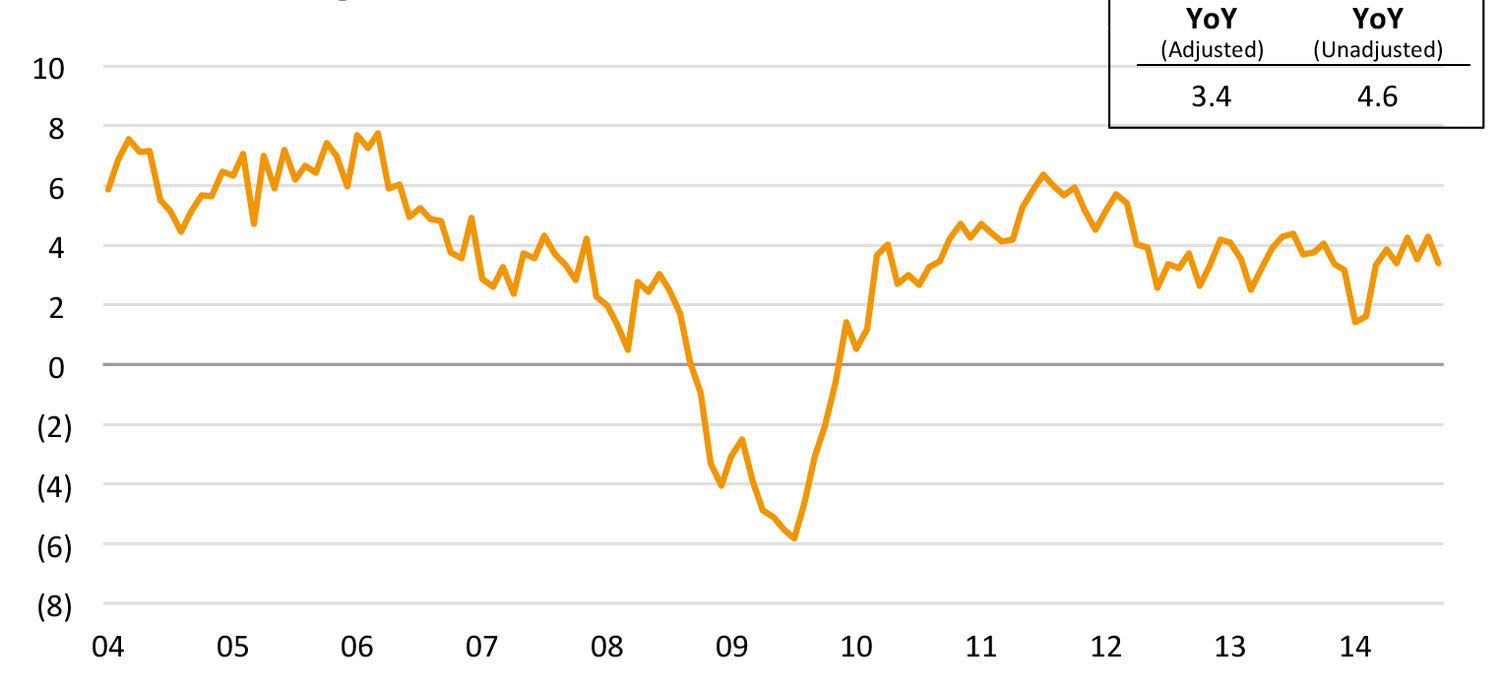

Apparel Store Sales Were Particularly Weak

Through September 30, 2014

Seasonally adjusted

Source: US Department of Commerce

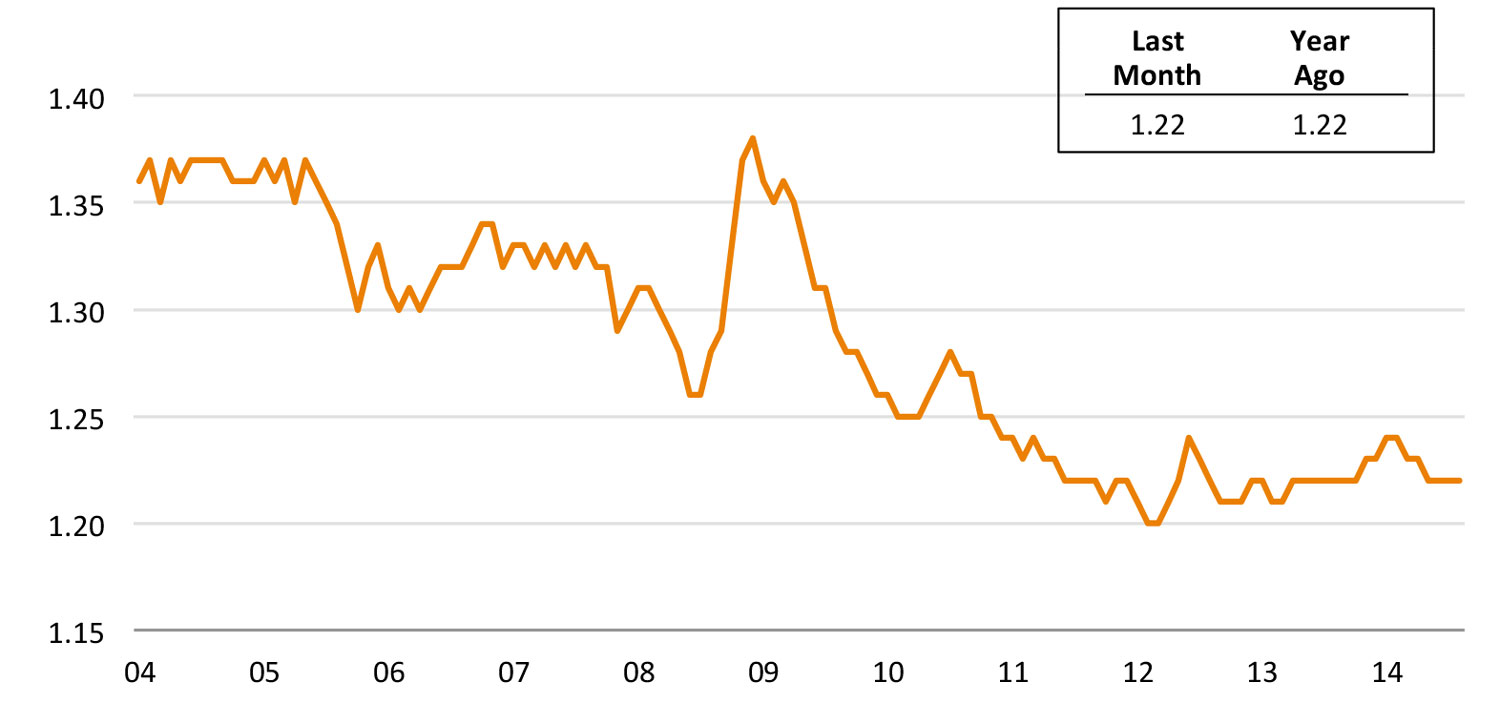

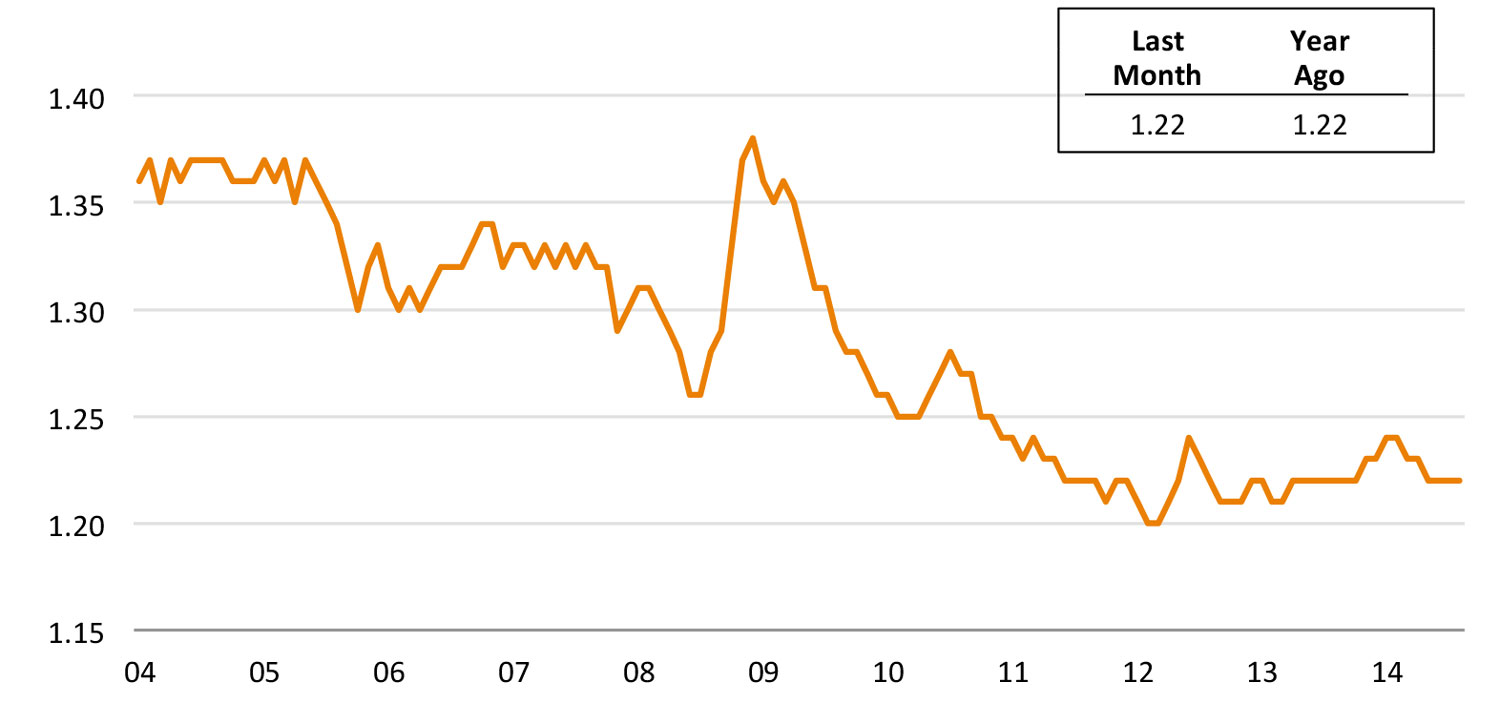

Retail Inventories Remain Under Control

Retail (Ex-Auto) Inventory-to-Sales Ratio

Through August 31, 2014

Source: US Department of Commerce

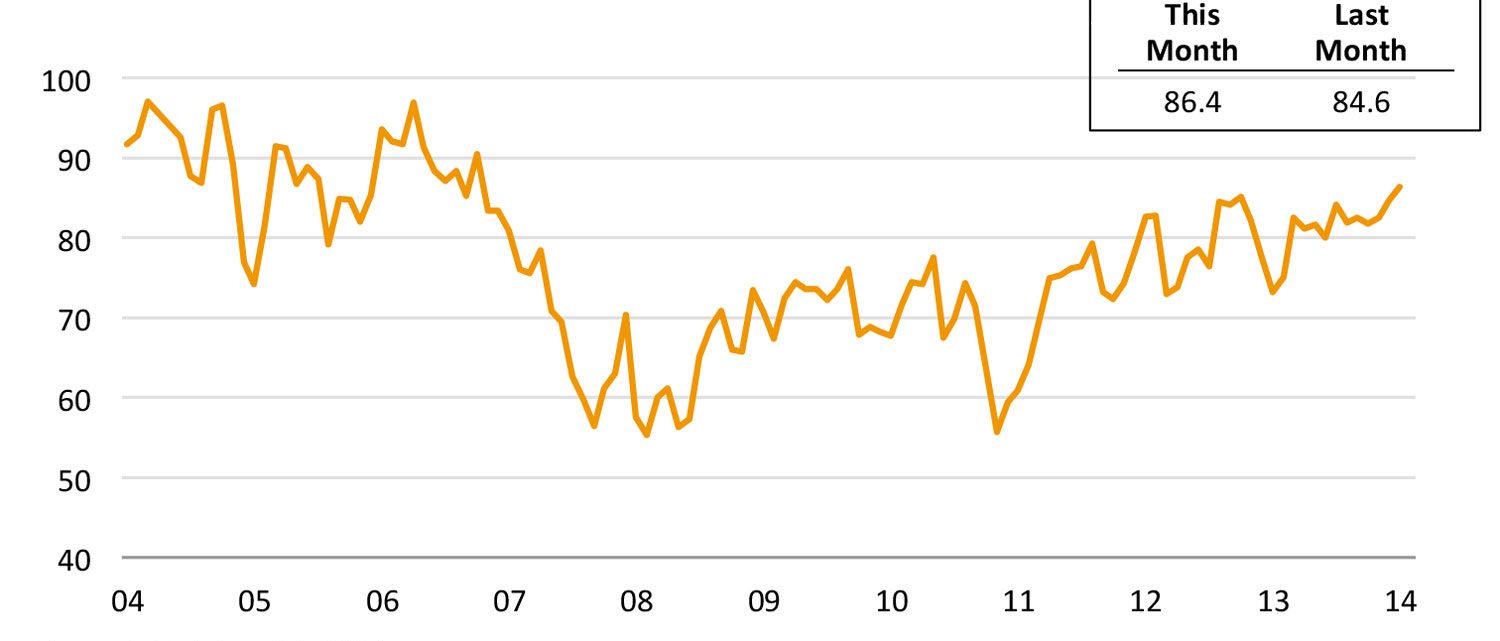

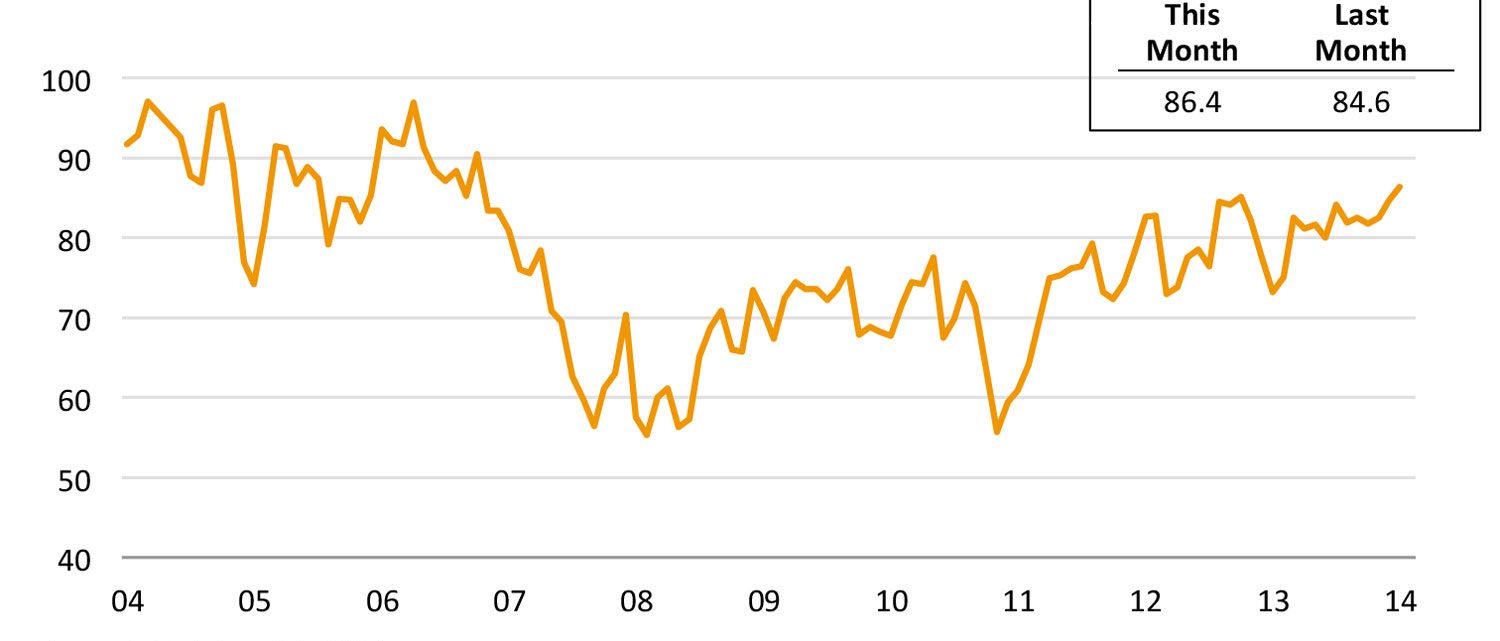

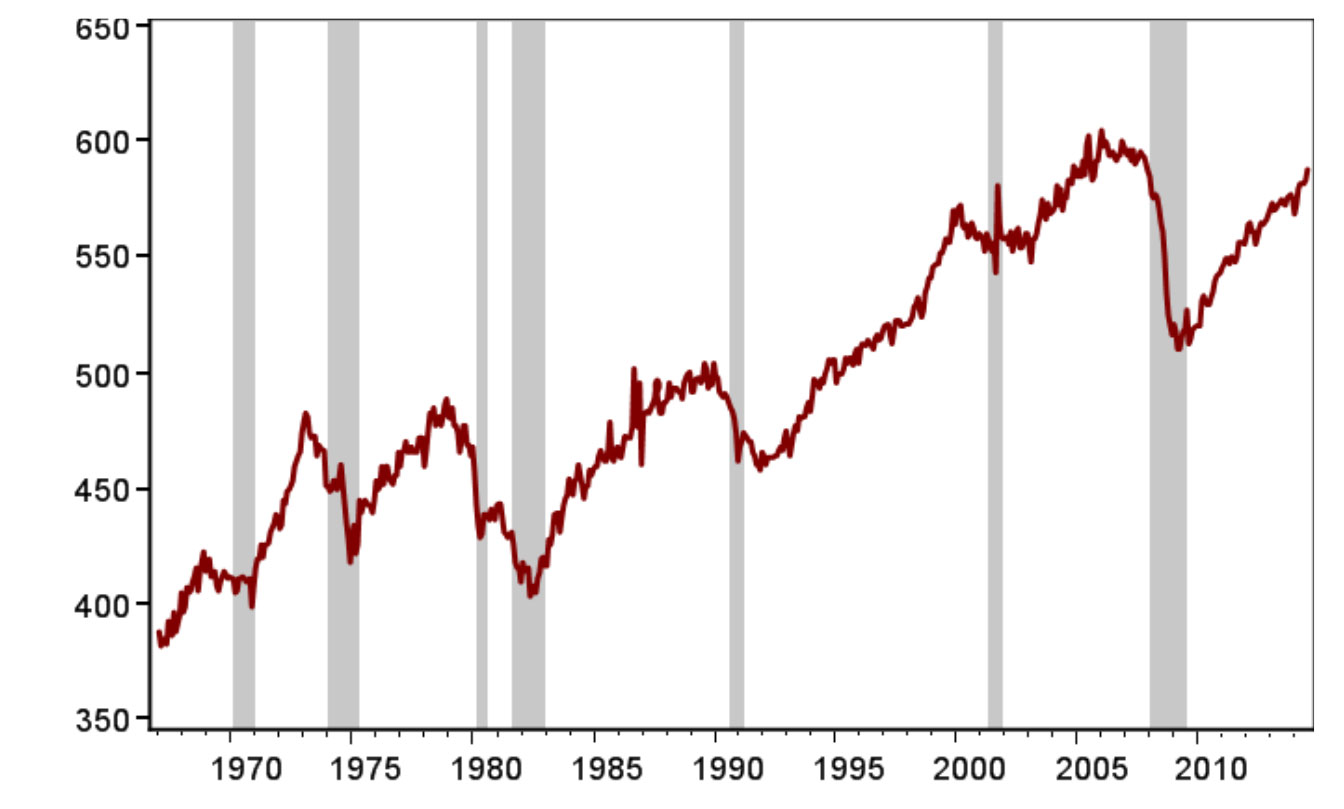

Consumer Sentiment Surprisingly Upbeat

University of Michigan Consumer Sentiment

Through October 17, 2014

Source: University of Michigan

- The strongest reading since July 2007

- Bested the median projection (of 84) in a Bloomberg survey of 67 economists

- This upbeat mood certainly doesn’t jibe with September retail sales!

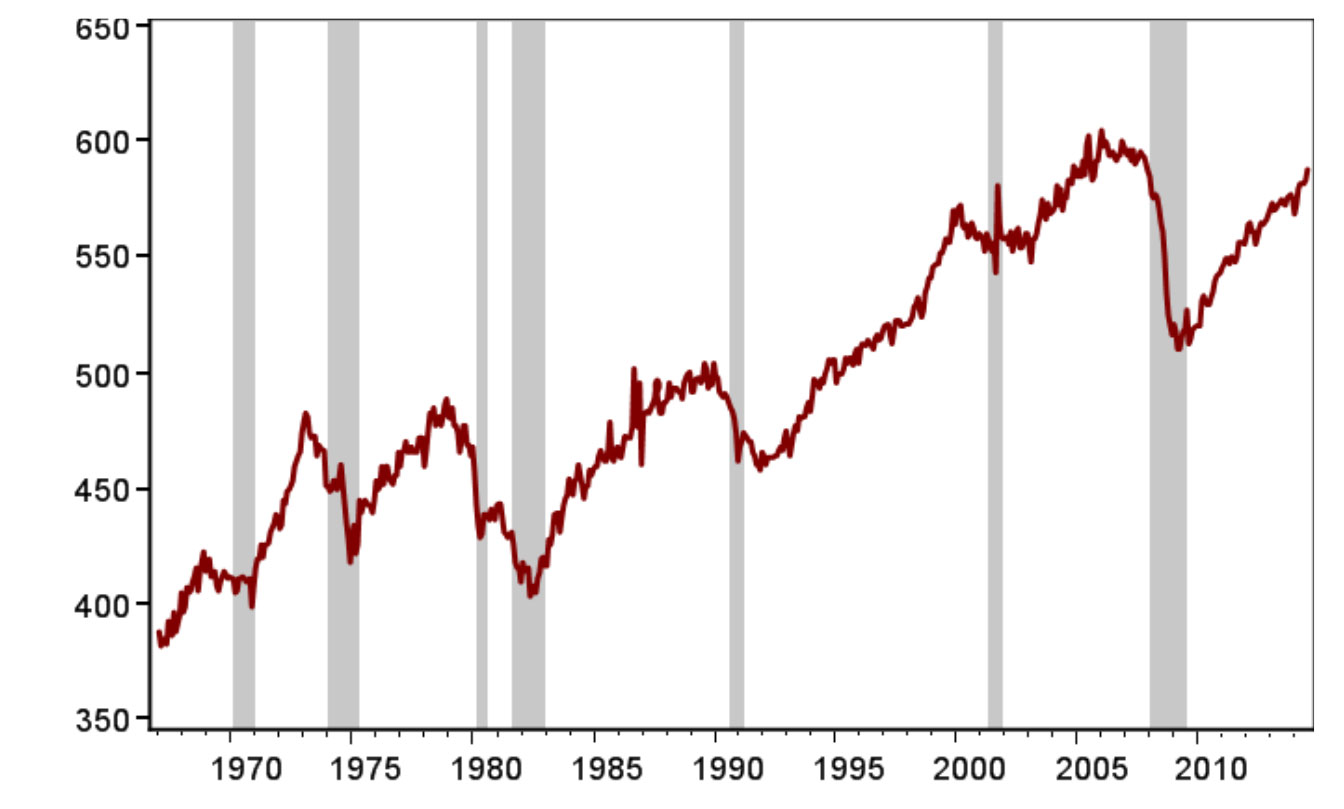

It’s been a slow upward grind for retail spending since the Great Recession. As the accompanying chart reveals, real per-capital retail sales are only just now getting back to the pre crisis peaks reached in 2007. With the wind at our backs in terms of healthy corporate profits, job growth and lower gasoline prices, Santa just might make retailers jolly this year.

Real Retail Sales Per Capita (USD)

Through September 30, 2014

Source: Haver Analytics

US Regular Gasoline Prices

Source: US Energy Information Administration

FBIC’s US HOLIDAY 2014 OUTLOOK

FBIC continues to forecast a 3%-5% sales increase for US holiday 2014 spending (i.e., brick-and-mortar sales for November and December) and a 13%-15% online sales gain. We have heard mixed results from retailers thus far in October. In addition, promotions appear deeper and more aggressive than at any time in recent memory. We also believe that retailers are worried about more online competition—and retailers that are stepping up their omnichannel/multichannel game—than ever before. This could be a gloves-off holiday season, with the best service and lowest prices winning the day. On-time delivery will be the key!

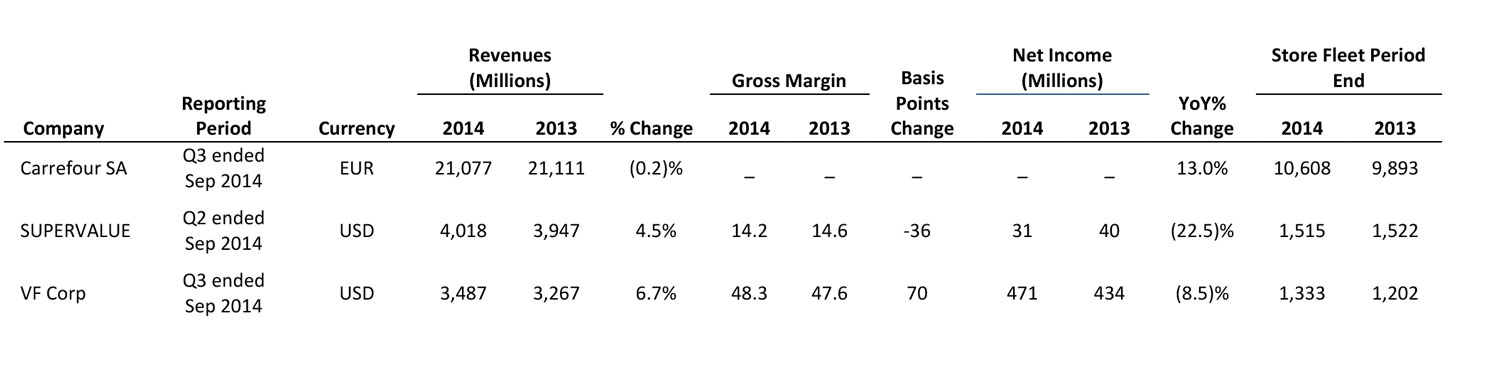

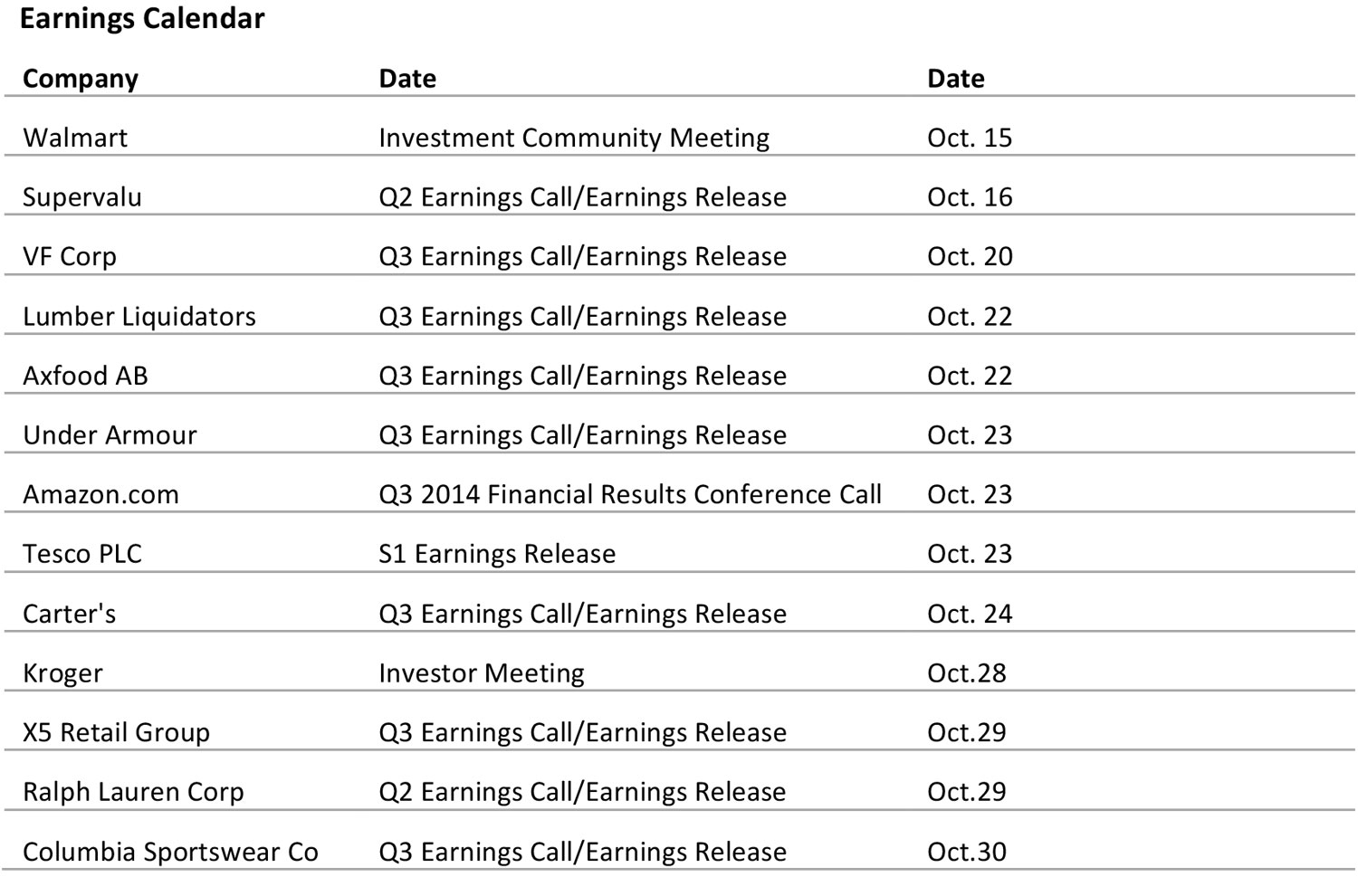

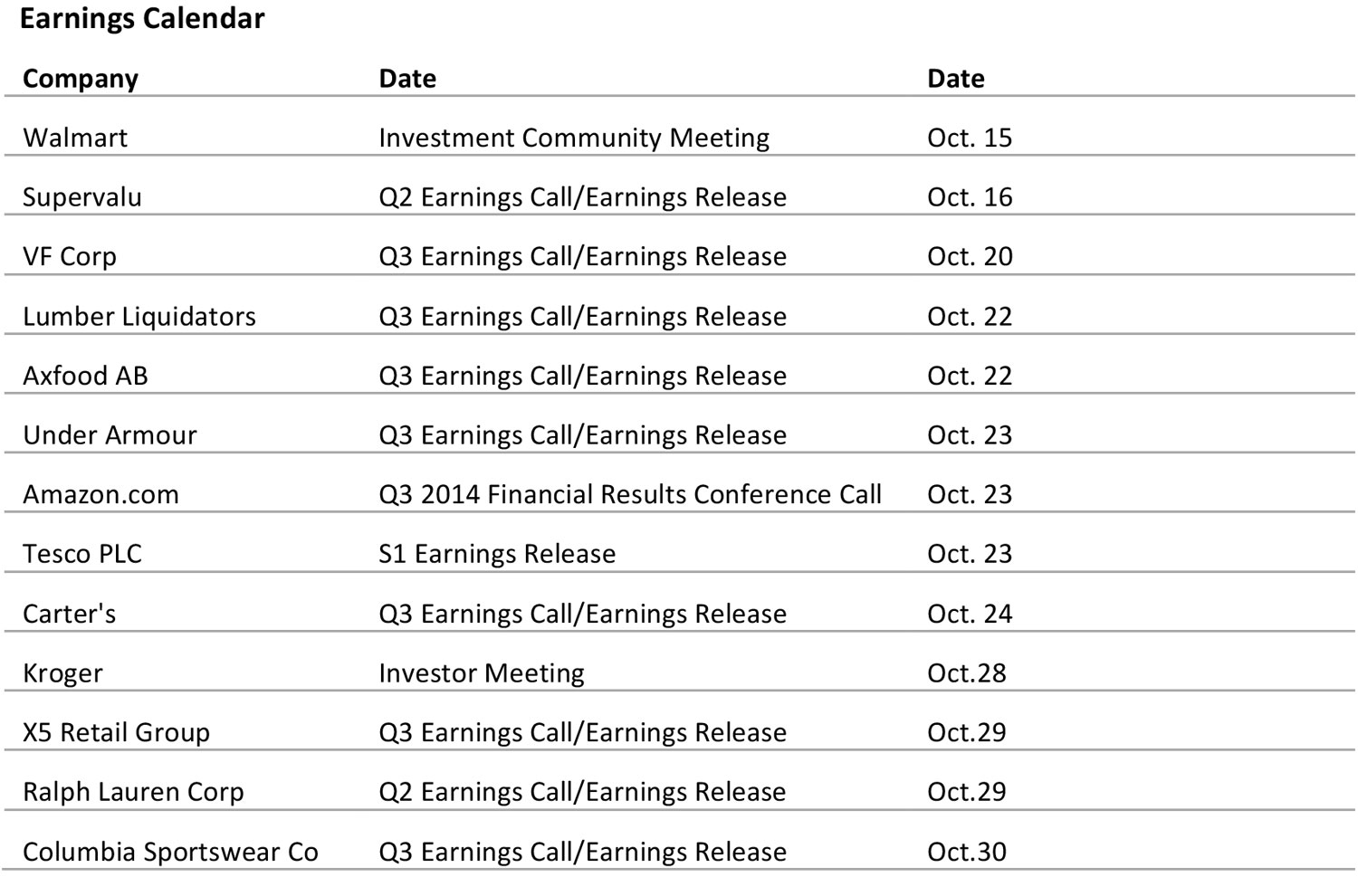

US RETAIL EARNINGS HEADLINES

IBM (IBM) Focused on Cybersecurity on Analyst Call (October 20). CEO Virginia (Ginni) Rometty relayed how cybersecurity, along with omnichannel, was top of mind among some of the largest CEOs she’s meeting with in financial services and retail. That is only heightened as we approach holiday and lap the year ago snafu at Target (TGT). There have been other recent widelyJpublicized data breaches at Home Depot (HD), Kmart (SHLD) & Staples (SPLS). Our conversations with retailers suggest that they are targeting IT budgets to this growing concern, and away from other priorities. The tech titan reported a broadJbased global slowdown in September, affecting revenues of its high transaction businesses. IBM lowered 2014 and 2015 operating EPS guidance, and is now looking for declines of (-2%) to (-4%) versus 16.64 in 2013 and no longer views at least 20 in 2015 operating EPS doable. IBM shares closed up +1.3%.

NCR Lowers Earnings Guidance amid Tough US Retail Climate (October 20). This global supplier of consumer-transaction technologies lowered 2014 guidance this week, citing the challenging retail environment, weak same-store sales and retail industry consolidation. According to NCR, retail conditions deteriorated during Q3, causing retailers to pull back on their IT solutions spending. Management lowered its forecast for 2014 revenue growth to a 7%-8% range from 10%-12%, and EPS from 2.60- 2.70, to 3.00- 3.10.

A harbinger of further retail weakness? NCR shares closed down (9.7%) after the close, after dropping (12.4%) during intraday October 20.

Urban Outfitters (URBN) Also Sees Soft Sales (October 16). Urban announced that QTD comparable retail segment net sales were continuing at a negative low-single-digit pace and, as such, gross profit margin could narrow at a greater rate than the 200 basis-points contraction in the first half 2014.

URBN shares tanked the following day, down (14.3 %).

VF Corp. (VFC) Posts Healthy Quarter (October 20). VF reported that 3Q 2014 EPS gained 11% to 1.08 on a sales gain of 7% to 3.5 billion, modestly undershooting consensus estimates by 0.01 and 50 million, respectively. At the same time, management raised its 2014 earnings outlook. VF’s three growth engines—Direct-to-Consumer (DTC), the Outdoor & Action Sports coalition and International all grew above the consolidated 7% gain, led by DTC up 16%, e-commerce up 30%. The improved guidance reflects management’s outlook for an incremental 0.02 to EPS to 3.08 (+14%) in 2014, helped by the strengthening outlook for Timberland sales (from a 12% to 13% gain). The company also reiterated its forecast for an 8% revenue gain, gross margin of 49% and an operating margin of 15%. Heading into 2015, VF is closely watching inventory levels in the mid-tier department store channel.

VFC shares closed up 0.5% on the day.

Walmart (WMT) Shaves Full-year Guidance (October 15). At its annual investor meeting, the retail behemoth lowered its full-year 2014 sales forecast to a range of 2%-3%, down from previous guidance of the low end of 3%-5% provided in February, citing weakening retail sales trends. The stock dropped significantly during the day, but was flat at the market close.

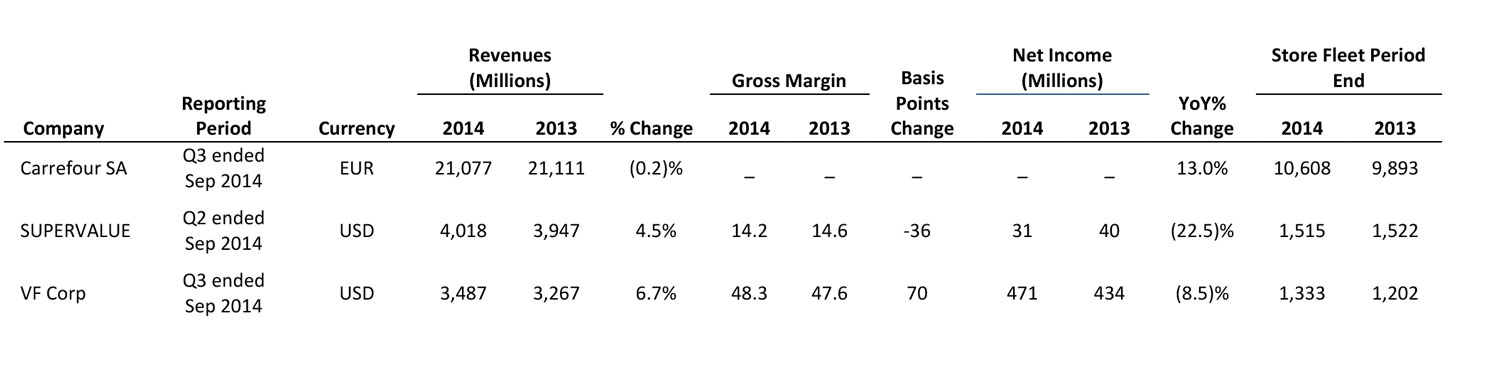

Selected Retail Company Earnings Results

CHINA RETAIL HEADLINES

AliPay Offers US Brands an Online Entrée to China (October 15). Alipay, the online payments arm of Alibaba, officially launched its ePass, a suite of services that will enable Chinese eJcommerce shoppers to buy directly from US and other Western retailers’ websites. According to AliPay US president, Jingming Li, the ePass tool can ease many of the vexing issues of crossJborder trade, such as currency exchange (it transmits shoppers’ payments to merchants in 14 different currencies) and customs duties (which are paid to China at checkout). The AliPay platform already has 800 million account holders in China, a massive market of consumers eager for US brands. Chinese shoppers visiting a US retailer’s website will see an ePass payment option when they check out. AliPay has signed brands such as Uber, Gap, Gilt, Asos and AirBnB as partners. The cost to merchants will depend on whether they sign up for payment, logistics, marketing or any combination of the three services.

More Luxury Brands Feel Pinch of China’s Austerity Push (October 16). LVMH Moet Hennessy Louis Vuitton SA and Burberry Group Plc became the latest luxury brands to forecast difficulties as Chinese shoppers curb spending. LVMH said it saw a significant slowdown in sales across Asia in the 3Q, with demand for handbags and cognac in China particularly weak. Burberry reported a YoY sales gain of 14% for the six months ended September 30, but noted “softening in growth from Chinese consumers both at home and when traveling.

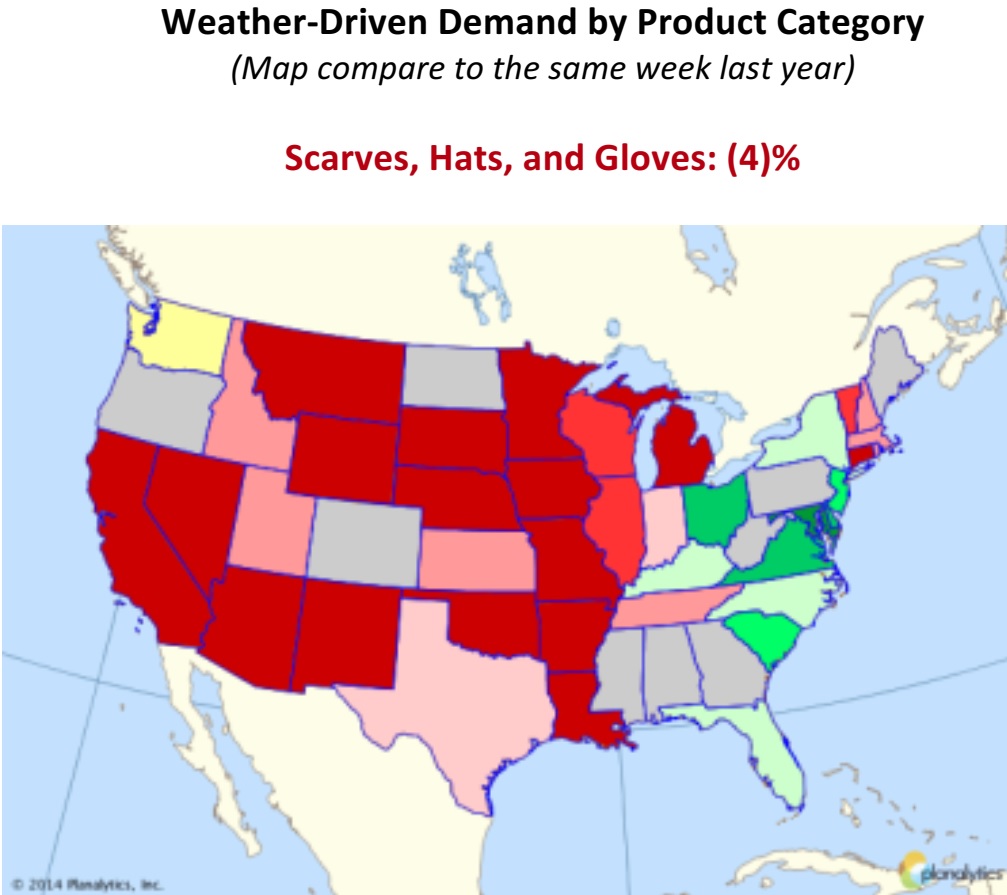

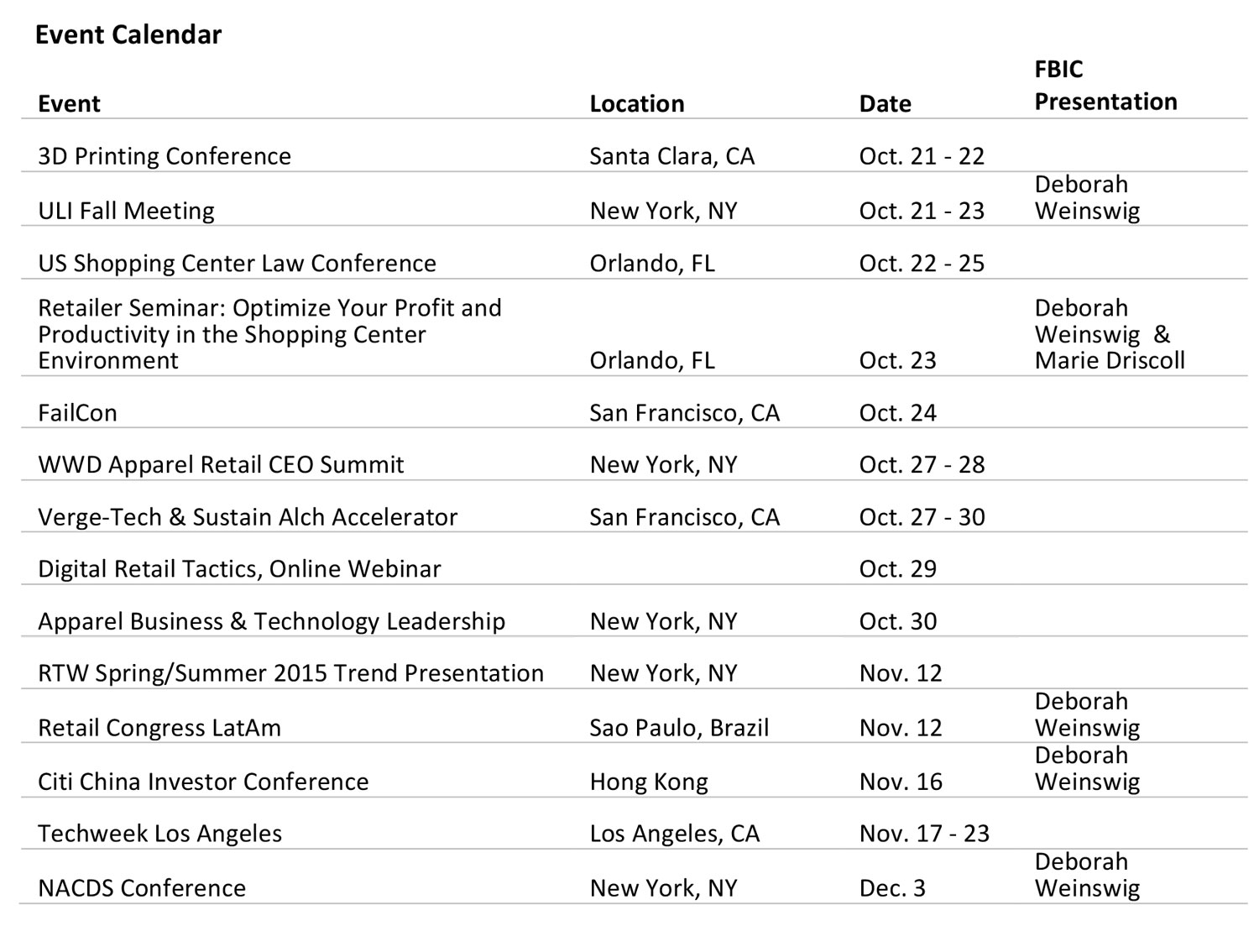

UPCOMING EVENTS

Warmer Temps for Most of North America to Challenge Seasonal Purchasing

Warmer Temps for Most of North America to Challenge Seasonal Purchasing

Colder Temps Late-Week to Provide Treats for Seasonal Items in Time for Halloween

Colder Temps Late-Week to Provide Treats for Seasonal Items in Time for Halloween