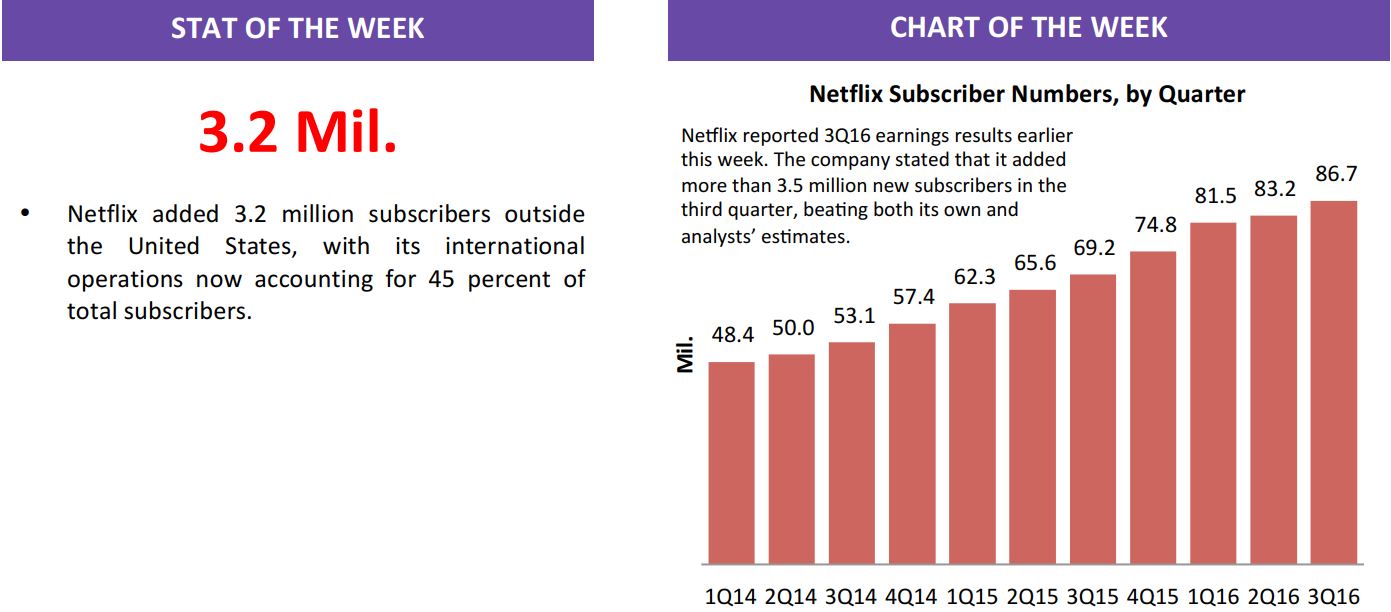

Source: Netflix

FROM THE DESK OF DEBORAH WEINSWIG

US Holiday Preview: Three Online Trends to Watch

Our global research teams are in the middle of preparing our holiday 2016 reports: keep an eye out for our upcoming US retail outlook and our holiday themes report, among others. In this week’s note, we draw on our research to showcase three online shopping trends that we think will impact US retail this holiday season.

1. The New Christmas Market

This year, more consumers will cut out the retailer and buy direct from brands or other types of sellers on online marketplaces. This channel is much bigger than just eBay; big names from the world of conventional retail, such as Amazon and Walmart, also operate major online marketplaces.

Amazon is likely to become a majority marketplace in the second half of this year, as measured by share of units sold, and third-party sellers are expected to sell more units on Amazon’s site than Amazon does itself. The company’s marketplace offering has received a recent boost via improvements to its ePacket small-and-light-delivery program, which helps Chinese merchants ship directly to US shoppers. Amazon Prime members in the US can now get their orders from China in just five days versus eight previously.

Meanwhile, Walmart is growing its marketplace by bringing new sellers on board. And it has acquired Jet.com, thereby adding Jet’s 14.8 million product listings, 210 million unique visitors and US$1.2 billion product sales run rate (as of August 2016) to its business.

2. Online Grocery Will Grow Fast

We expect online grocery sales to accelerate this holiday season. Consumers will buy more turkeys, cranberry sauce and stuffing online than ever before as a result of Walmart, Kroger and others ramping up their e-grocery services. Walmart and Kroger are now each offering pickup services at around 400 locations, while Target, Whole Foods Market and Publix are each either partnering with, or at least trialing, third-party delivery service Instacart. AmazonFresh is fighting back by lowering its fees from $299 per year to $14.99 per month.

E-commerce is still a nascent channel for grocery in the US: according to Kantar Worldpanel, just 1.4% of all US sales of fast-moving consumer goods were made online in June 2016. Yet that figure represents a near doubling of share in just two years, and we expect the full-service offerings from major grocery chains to drive up the number of shoppers using e-commerce for bulk grocery purchases at a time of year when they are looking for convenience.

3. Prime Shopping Time

Almost half of American households will have an Amazon Prime membership by this holiday season. The core benefit, as most readers likely already know, is two-day delivery at no additional cost, but additional benefits include Prime Now two-hour delivery in some areas and access to AmazonFresh where it is offered.

In September, financial services firm Cowen and Company estimated that 44% of US households were Prime members. Cowen further estimated that US Prime memberships could climb by fully 12 million across 2016. Even if this figure is merely in the right ballpark, that is a lot of extra holiday shoppers who are likely to take advantage of their Prime benefits to save money and effort in a busy season.

Prime members spend more with Amazon than do non-Prime customers—$1,100 per year versus $600 for nonmembers, according to Consumer Intelligence Research Partners. Prime members also convert to a sale more often, on average, than do nonmembers. Acting as a magnet for up to half of all American consumers, Prime will be the gift that keeps on giving for Amazon this festive season.

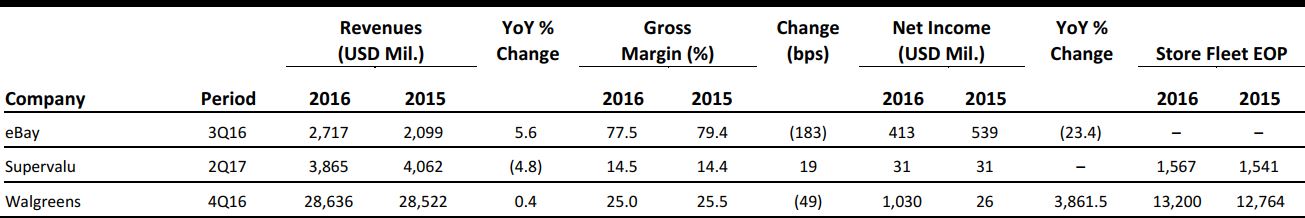

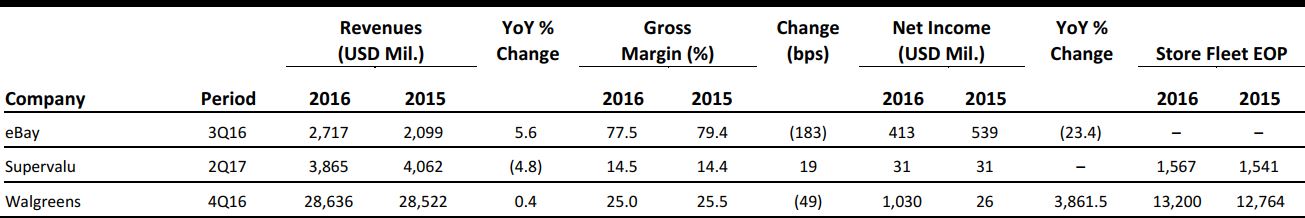

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Millennials Drive Earliest, Most Digital Shopping Season Ever

(October 18) Chain Store Age

Millennials Drive Earliest, Most Digital Shopping Season Ever

(October 18) Chain Store Age

- According to a recent report from performance marketing company Criteo, this holiday shopping season will be led by the millennials, who will help drive the highest e-commerce sales revenue yet. According to Criteo, more than one-fifth (21%) of millennials had started their holiday shopping by November 1 last year—versus 18% of Gen Xers—and more than a third (38%) had started shopping before Black Friday.

- The report encourages retailers to take advantage of several trends this season, including earlier shopping, product research and mobile shopping. The small screen will be key for millennials shopping online, as 37% of them research products on a smartphone, versus 18% on a tablet.

Nordstrom Launches Hermès Concept Shop

(October 17) Women’s Wear Daily

Nordstrom Launches Hermès Concept Shop

(October 17) Women’s Wear Daily

- Nordstrom and Hermès have collaborated to create a temporary pop-up boutique at Nordstrom’s Seattle flagship. Open through the end of 2017, the shop will feature only accessories, and will focus on men’s silk, women’s silk and fashion jewelry.

- The collaboration started when Olivia Kim, Nordstrom’s Vice President of Creative Projects, reached out to Hermès to be part of Nordstrom’s Space boutiques. However, Hermès agreed to the yearlong pop-up in hopes of gaining “exposure to a broader audience,” said Robert Chavez, President and CEO of Hermès USA.

40% of New Pinterest Users Are Men

(October 17) Internet Retailer

40% of New Pinterest Users Are Men

(October 17) Internet Retailer

- Pinterest says it now has more than 150 million monthly active users, having grown the figure by 50% after reaching 100 million users in September last year. The site also says its new users are more diverse, that 75% of new signups are from outside the US and 40% are men.

- This growth and diversification are important for Pinterest at a time when it is pitching its tools and data to retail advertisers. The company has rolled out new advertising tools recently as it tries to capture merchants’ attention by allowing them to target users. Despite its significant recent growth, Pinterest still has fewer active users than its competition.

Brands Are Testing Programmatic Catalogs

(October 19) Glossy

Brands Are Testing Programmatic Catalogs

(October 19) Glossy

- Brands are working to bring together customers’ digital behavior and physical advertisements. Brands such as ModCloth, UncommonGoods and 1stdibs are working with programmatic mail platforms such as PebblePost to bridge the gap between consumers’ online behavior and catalogs.

- For example, ModCloth’s campaign with PebblePost takes a shopper’s online behavior and translates it into material to fill a few pages of a catalog that is then delivered to the customer’s home within 48 hours of their Internet browsing. PebblePost then tracks the customer’s behavior for 30 days to follow up on conversion rates.

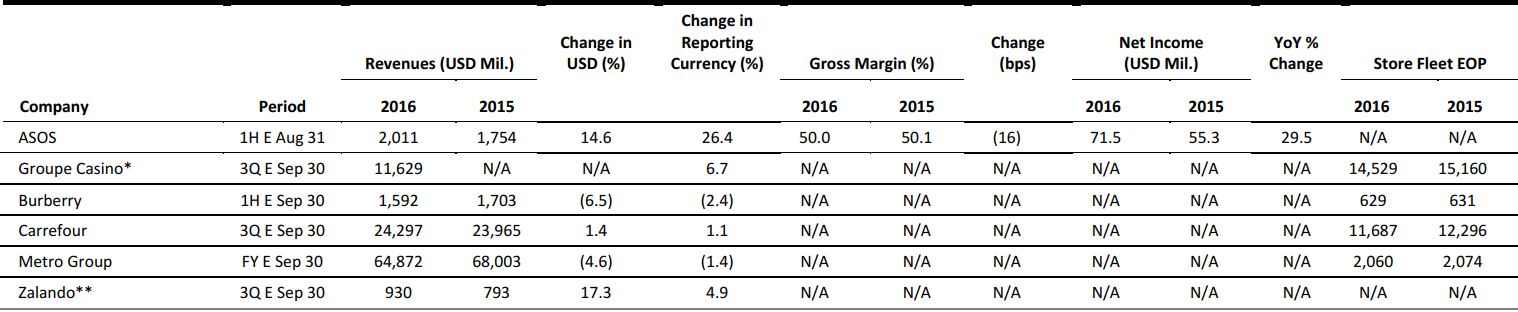

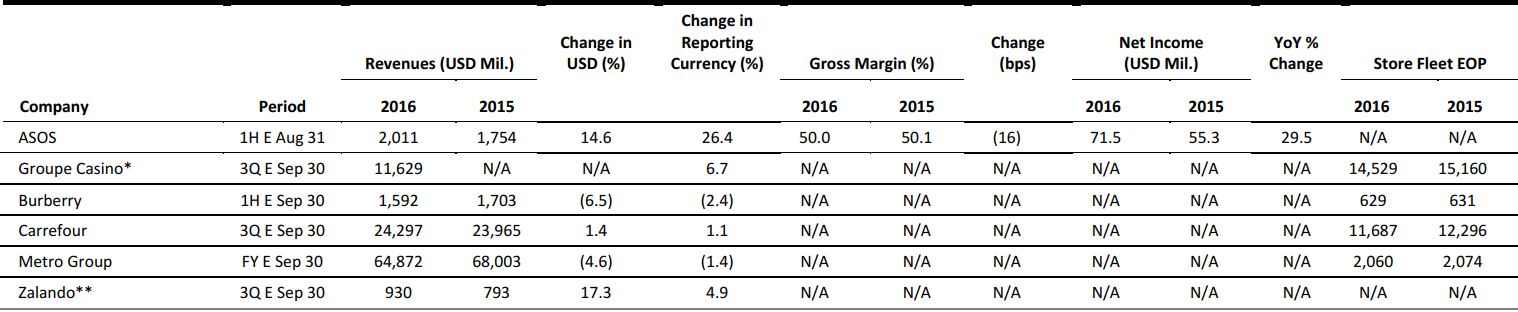

EUROPE RETAIL EARNINGS

*Groupe Casino completed the sale of its Thailand and Vietnam businesses earlier in 2016. Casino has restated results for the Asia segment for the periods presented in the interim statements to reflect the dispositions. The restated numbers were unavailable for 3Q15.

**Zalando provided a range of €827–€841 million for its 3Q16 revenues; the midpoint has been used to calculate the changes shown in this table.

Source: Company reports

EUROPE RETAIL HEADLINES

Gap to Close Banana Republic Fascia in the UK

(October 18) Retail-Week.com

Gap to Close Banana Republic Fascia in the UK

(October 18) Retail-Week.com

- US apparel group Gap may close its eight struggling Banana Republic UK stores in the next three months. Banana Republic has stores in London on Regent Street and in Covent Garden and Canary Wharf, as well as in Bath.

- According to a source, the retailer has agreed to cede store leases to fellow apparel retailers Zara and H&M, as well as to Metro Bank. Other locations could be split into two stores and leased to two separate parties. Banana Republic may exit the stores within 12 weeks.

Coty Purchases UK Hair Appliance Company GHD

(October 17) FT.com

Coty Purchases UK Hair Appliance Company GHD

(October 17) FT.com

- US fragrance and cosmetics group Coty has acquired London-based GHD for US$510 million from private equity firm Lion Capital. GHD, short for Good Hair Day, produces electrical hair appliances, including curling irons and straighteners, and has operations in Australia, the US, Germany, France, Spain and Italy.

- GHD generated 2015 revenues of £178 million (US$219 million) and has increased its sales by 30% over the past three years.

H&M Monthly Sales Growth Slows to 1% in September

(October 17) Company press release

H&M Monthly Sales Growth Slows to 1% in September

(October 17) Company press release

- H&M reported that sales grew by 1% year over year, in constant currency, in September. This marked a clear deceleration from sales growth of 7% in August.

- The company attributed weak September sales to unseasonably warm weather during the month.

Wickes Announces One-Hour Delivery Service for Online Orders

(October 14) Retail-Week.com

Wickes Announces One-Hour Delivery Service for Online Orders

(October 14) Retail-Week.com

- British home improvement retailer Wickes announced the launch of a one-hour delivery service through a partnership with delivery technology firm On the Dot. On the Dot allows customers to choose specific one-hour time slots in which to receive deliveries.

- Wickes is the first UK DIY retailer to provide a one-hour delivery service for online orders.

Costa Launches Trial Concept Store that Sells Coffee and Alcohol

(October 13) RetailGazette.co.uk

Costa Launches Trial Concept Store that Sells Coffee and Alcohol

(October 13) RetailGazette.co.uk

- British high-street coffee chain Costa has launched a trial concept store that sells a selection of alcoholic beverages after 4 pm.

- Costa’s UK Managing Director, Jason Cotta, stated that the company’s coffee options are well established in the UK market and that he believes coffee lovers are ready for the next generation of beverages.

ASIA TECH HEADLINES

Samsung to Invest US$296 Million for Expansion of Indian Plant

(October 18) TechinAsia

Samsung to Invest US$296 Million for Expansion of Indian Plant

(October 18) TechinAsia

- Samsung Electronics revealed in a statement that it will invest 19.7 billion rupees (US$296 million) to expand its plant in Northern India.

- The plant, located in Noida, near the capital of New Delhi, makes mobile phones, refrigerators and televisions.

ZTO Express Eyes the Largest US IPO by a Chinese Company Since Alibaba

(October 17) CNBC

ZTO Express Eyes the Largest US IPO by a Chinese Company Since Alibaba

(October 17) CNBC

- ZTO Express is planning an IPO in the US later this month that could raise as much as US$1.5 billion. The offering would be the biggest US IPO by a Chinese company this year, and the biggest by a Chinese company since Aliaba’s US$25 billion IPO in 2014.

- ZTO Express, which delivers parcels for Alibaba and JD.com, is a major player in China’s quickly expanding e-commerce market. With 21 billion parcels delivered in 2015, China is the world’s largest express delivery market, according to market research firm iResearch.

Alibaba to Raise Around US$1 Billion for Local-Services Platform Koubei

(October 18) WSJ.com

Alibaba to Raise Around US$1 Billion for Local-Services Platform Koubei

(October 18) WSJ.com

- Alibaba is planning to raise around US$1 billion to fund the expansion of its local-services platform, Koubei, which enables online ordering of offline services such as food delivery.

- China’s Internet giants have been striving for market share in smartphone applications that connect users with physical services such as taxi rides, food deliveries, restaurant bookings and movie ticketing.

India’s Freshdesk Acquires Chatimity to Strengthen AI Capabilities in Chat

(October 18) e27.co

India’s Freshdesk Acquires Chatimity to Strengthen AI Capabilities in Chat

(October 18) e27.co

- India’s Freshdesk, which makes cloud-based customer engagement software, has announced the acquisition of Chatimity, a social chat platform that has developed artificial intelligence (AI) and chatbot technology.

- The acquisition is Freshdesk’s sixth in just over a year as the company looks to strengthen product development and capabilities within the chat platform.

LATAM RETAIL HEADLINES

Can Uber Conquer Latin America?

(October 13) Bloomberg

Can Uber Conquer Latin America?

(October 13) Bloomberg

- Uber’s future depends on its ability to grow internationally, making Latin America one of its most important markets right now. Uber currently operates in more than 65 cities in Latin America, and plans to double that number by the end of 2017.

- Currently, Brazil is Uber’s third-biggest market, after the US and India. Mexico City is Uber’s busiest city in the world and São Paulo, Brazil, is the company’s second-busiest city.

eBay Will Sell Most of Its Stake in Latin American Online Marketplace MercadoLibre

(October 13) Bloomberg

eBay Will Sell Most of Its Stake in Latin American Online Marketplace MercadoLibre

(October 13) Bloomberg

- eBay said it will sell most of its stake in MercadoLibre, Latin America’s largest online marketplace, in order to use the proceeds for other purposes. With the sale, eBay expects to realize a significant gain on its investment in MercadoLibre.

- eBay has been MercadoLibre’s largest shareholder since 2001, when the latter acquired iBazar Com from eBay in exchange for a 20% stake. MercadoLibre and eBay will continue to work on cross-border transactions to help eBay sellers reach shoppers in Latin America.

Homegrown Fashion Industry Bursts onto Scene in Cuba

(October 17) Associated Press

Homegrown Fashion Industry Bursts onto Scene in Cuba

(October 17) Associated Press

- A small, homegrown fashion industry is gaining clout and beginning to win a share of Cubans’ limited clothing budgets, as simple but stylish clothing produced in Cuba with natural fabrics debuts with competitive prices.

- In early October, the five-day Havana Fashion Week event showcased private designers that debuted wedding dresses, bathing suits, linen pants and event uniforms for state businesses. Hundreds turned out for the shows, private fittings and cocktail parties.

Carrefour Sales Lifted by Latin America

(October 19) WSJ.com

Carrefour Sales Lifted by Latin America

(October 19) WSJ.com

- French retailer Carrefour beat analysts’ expectations in the third quarter. The company cited strong sales growth in Latin America as contributing to the results. Sales rose by 1.1%, to US$23.9 billion, in the three months ended September 30.

- International sales grew by 4.5%, with Latin America driving growth. In Brazil, like-for-like sales grew by 12% despite the country’s current economic recession. In Asia, sales fell by 5%.

Jean Paul Gaultier Goes on Latin American Snapchat Trek

(October 17) Luxury Daily

Jean Paul Gaultier Goes on Latin American Snapchat Trek

(October 17) Luxury Daily

- French fashion label Jean Paul Gaultier is taking its fans on a tour of Latin America through its latest Snapchat activation. From October 16–26, Jean Paul Gaultier will visit three Latin American cities: Rio de Janeiro, Buenos Aires and Mexico City.

- Using the hashtag #JPGLovesLatinAmerica, the company is promoting its trip as part of its attempt to expand its presence in Latin America. Snapchat followers can follow Gaultier himself around as he tours the cities, and enjoy candid, not overtly branded, content.

Millennials Drive Earliest, Most Digital Shopping Season Ever

(October 18) Chain Store Age

Millennials Drive Earliest, Most Digital Shopping Season Ever

(October 18) Chain Store Age

Nordstrom Launches Hermès Concept Shop

(October 17) Women’s Wear Daily

Nordstrom Launches Hermès Concept Shop

(October 17) Women’s Wear Daily