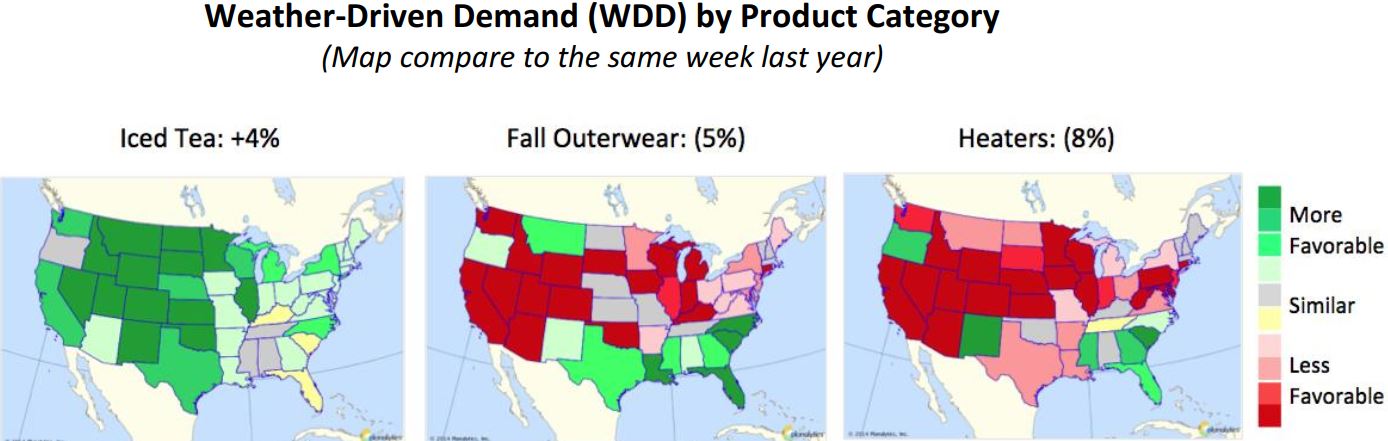

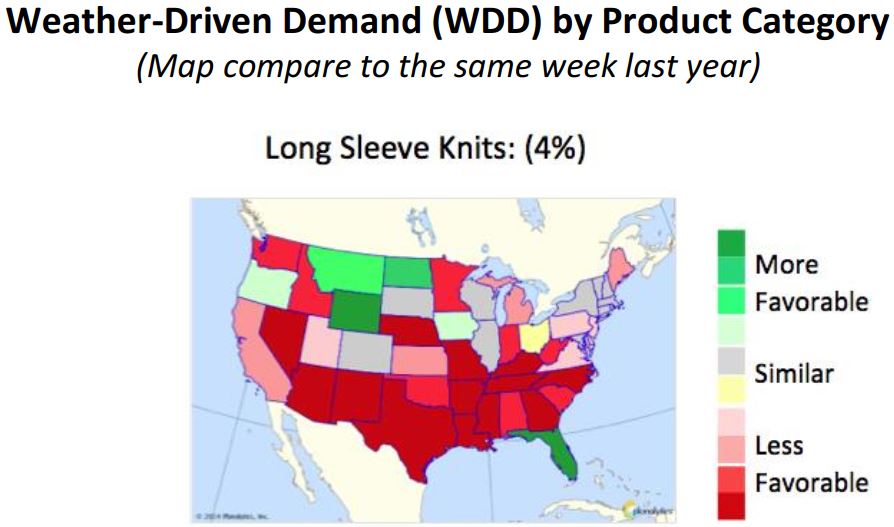

RETAIL WEATHER ANALYTICS

What to Expect this Week (Oct. 13 – Oct. 19, 2014)

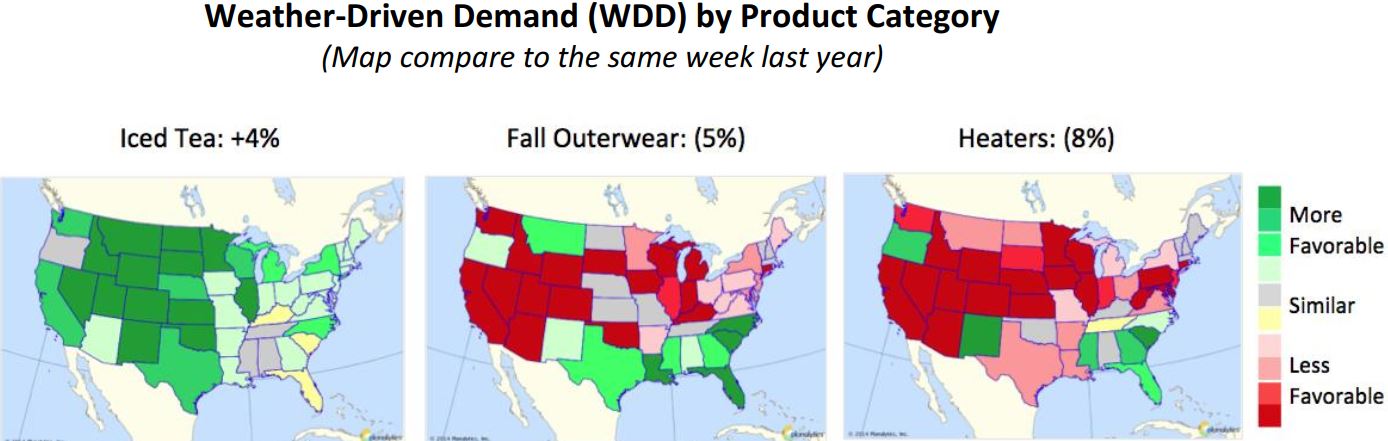

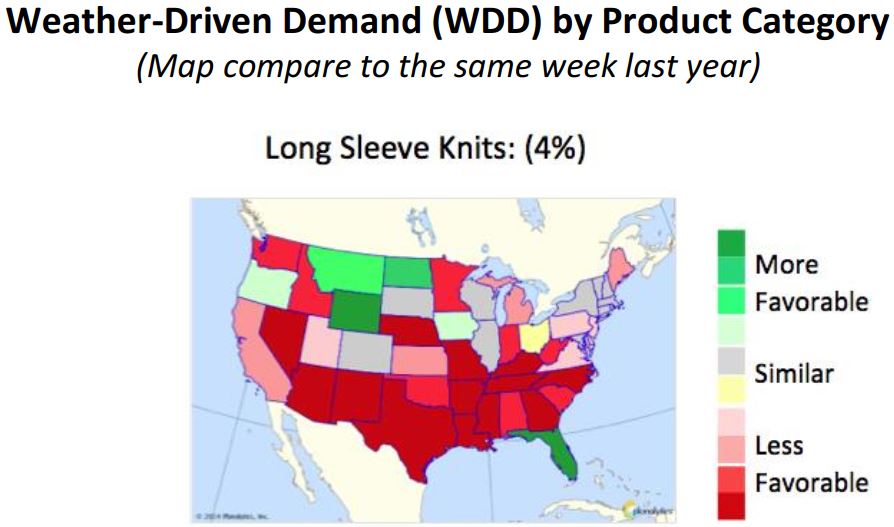

- Severe Weather Outbreak to Dominate the Headlines. A line of severe weather is expected to move across the Southern Plains and Southeast on Columbus Day (Monday), and track into Florida on Tuesday. Markets along the Mid-Atlantic regions, including the Eastern Seaboard, will be affected mid-to-late week. Demand for emergency and clean-up items will drive early week traffic into stores.

- Cool Temperatures Follow Severe Weather in the Southeast. Atlanta will start the week with highs in the 80s, before dropping into the low 70s mid-week; highs in Pensacola, Florida, will dip into the low 70s, a double-digit decrease from last year. The severe weather system will affect most major markets throughout the region; localized flooding will be a concern associated with these storms.

- Comfortable Temperatures across the North, Although Warmer Than Last Year. Much of the US northern-tier states will have daytime highs in the 60s and 70s. Markets from Chicago to Minneapolis will stay in the low 60s, while the Northeast will be warm and pleasant, with major markets enjoying mid-week highs in the 70s. Late summer and early fall seasonal categories, such as grilling equipment and outdoor pest control, should see strong sales.

- Western US Markets Much Warmer than Last Year. While coastal markets from Los Angeles to San Francisco will enjoy mild, seasonal temperatures, interior regions will see double-digit warm-ups compared with last year. Mid-week high temperatures from Utah to Colorado will be above 20°F warmer than last year. Rain will be concentrated in the Pacific Northwest.

- Tropics Come Alive. Tropical Storm Fay is dissipating in the Atlantic. Tropical Storm Gonzalo continues to strengthen as it tracks near Puerto Rico, potentially reaching hurricane strength. Gonzalo is expected to curve away from the US and move towards Bermuda late in the week. In the Pacific, there is the potential for another tropical storm to form. Early indications show this tropical disturbance approaching the Big Island of Hawaii.

Source: Planalytics

What to Expect the Following Week (Oct. 20 – Oct. 26, 2014)

- Warmer Than Last Year Across Most of North America. Overall conditions in the US will be warmer than last year, with a mid-week rain system that is likely to hover over the Southeast and parts of the Mid-Atlantic. Expect demand for seasonal merchandise to lag last year’s levels.

- Northeast to Start Cold, End Warm. While temperatures will be warmer than last year, they will trend below normal for the week. Consumers will be grabbing light jackets as high temperatures dip into the low and mid-50s from Pennsylvania to eastern Massachusetts, warming slightly into the weekend. There is the potential for rain throughout the week in the Northeast and Mid-Atlantic regions.

- Southeast Temperatures Trend Seasonal. Mild temperatures will settle in across much of the Southeast region. Nashville, Tennessee, will see highs in the mid-60s for most of the week; New Orleans, Louisiana, in the mid-70s; Miami, Florida, peaking in the mid-80s.

- Seasonal to Warm West. Temperatures across the West will moderate close to those of last year for most major markets, and conditions will be dry across the region except for the Pacific Northwest coast. Opportunities to drive demand for seasonal merchandise will be limited across most of the region.

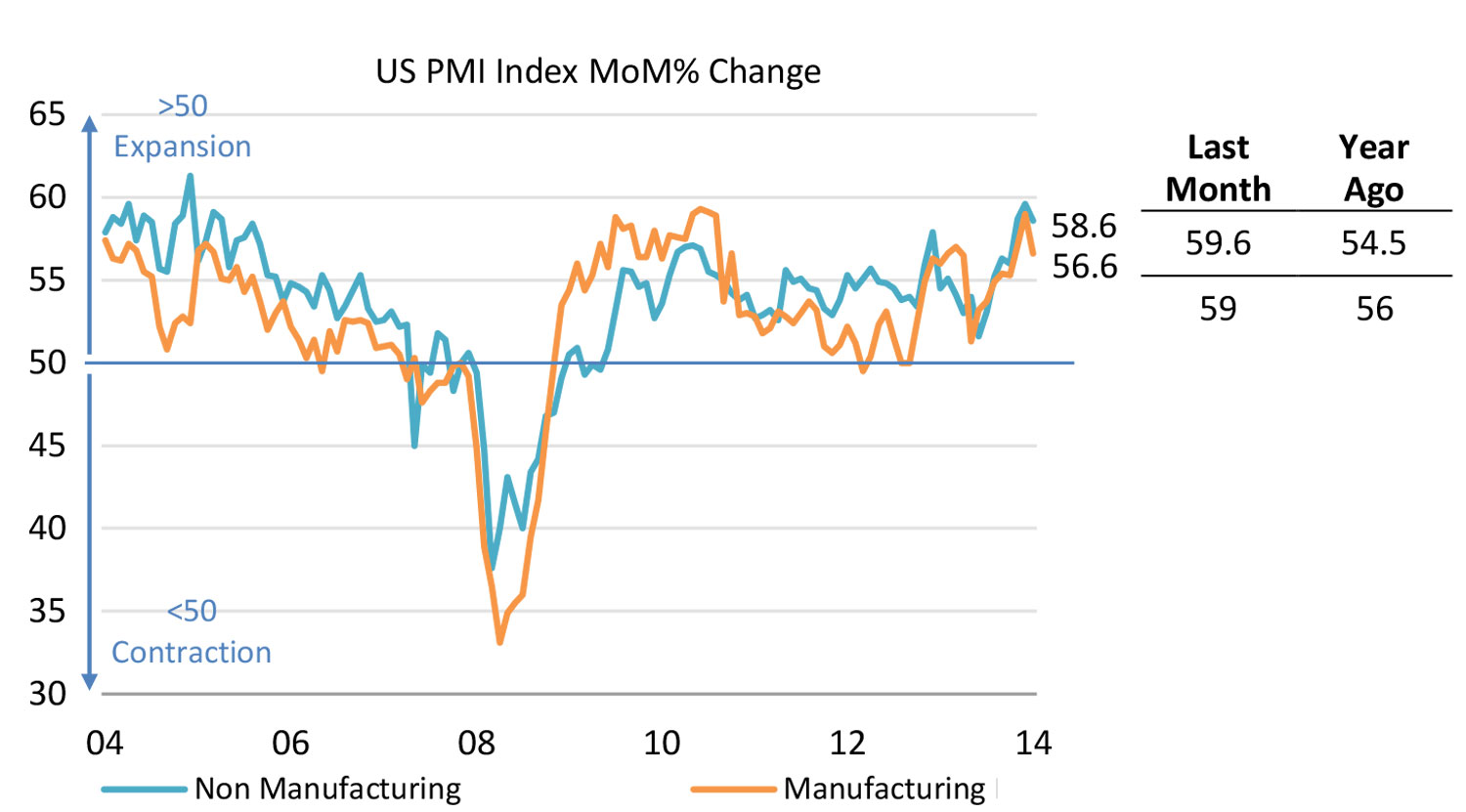

WEEKLY ECONOMIC NEWS

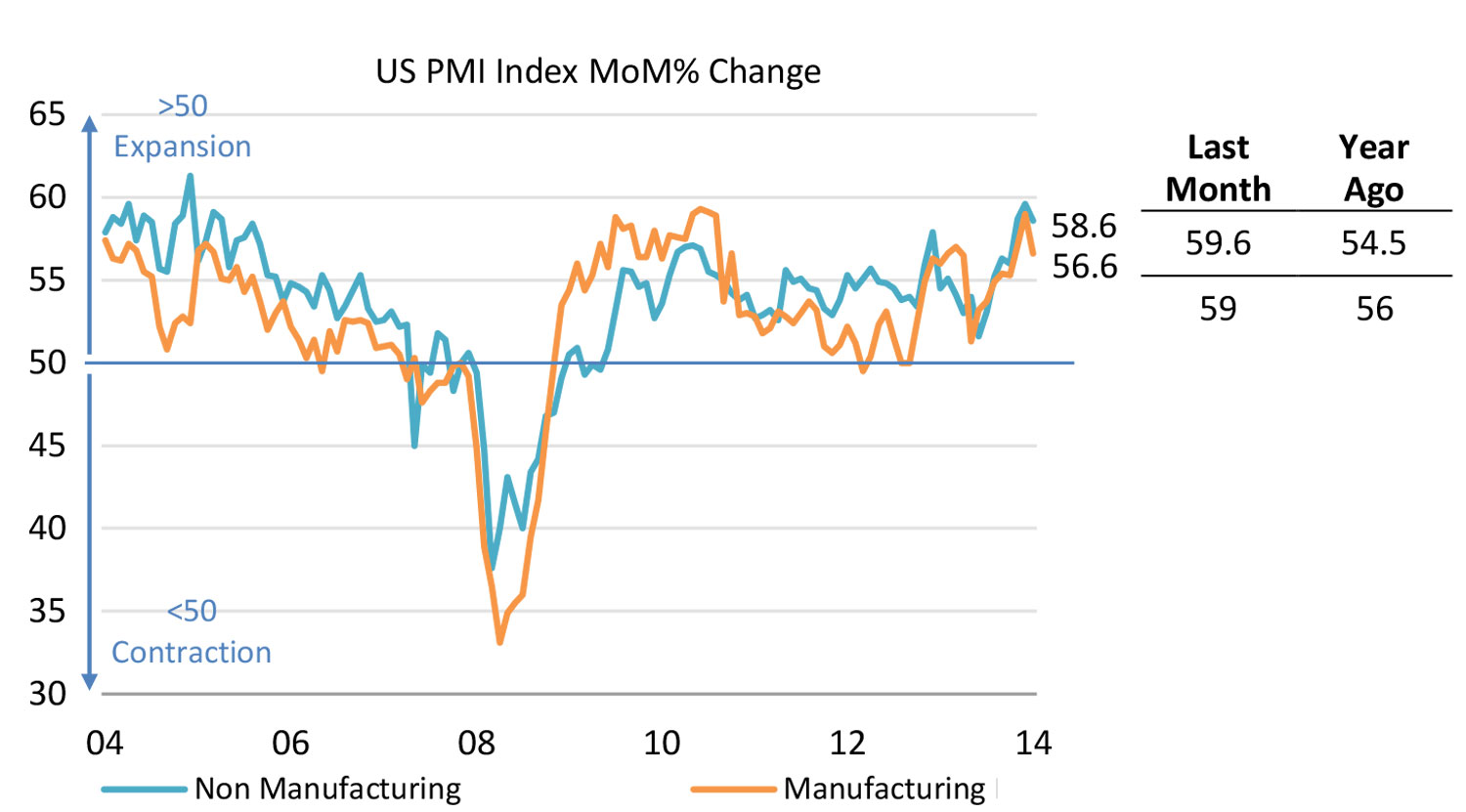

US Manufacturing Expands for the 16th Consecutive Month

Through September 30, 2014

Source: Institute of Supply Management

- Inventories are expanding among US manufacturers

- 15 of 18 US manufacturing industries reported growth for the month

- Non-manufacturing respondents indicate that business momentum has slowed modestly

- 12 of the 18 non-manufacturing industries reported growth, led by construction and retail trade, respectively

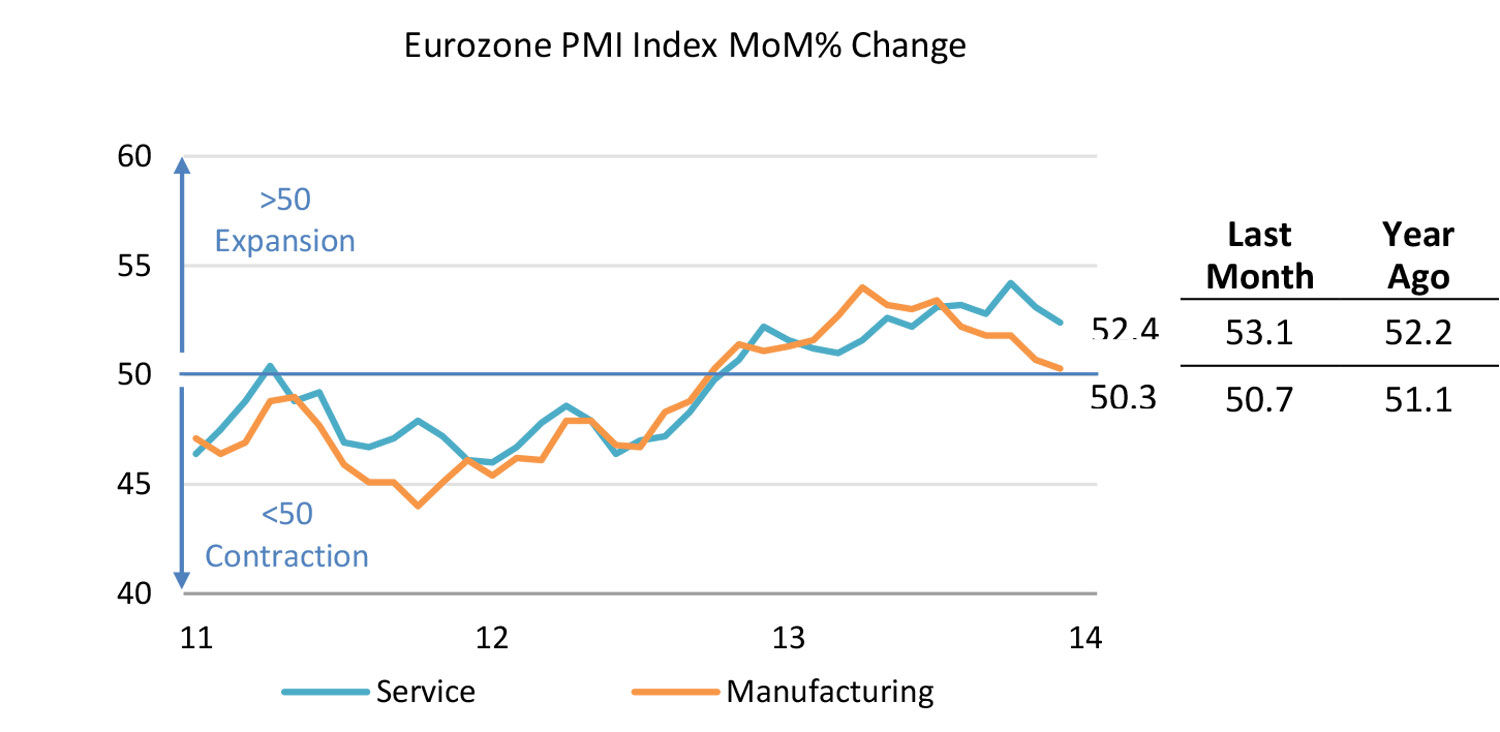

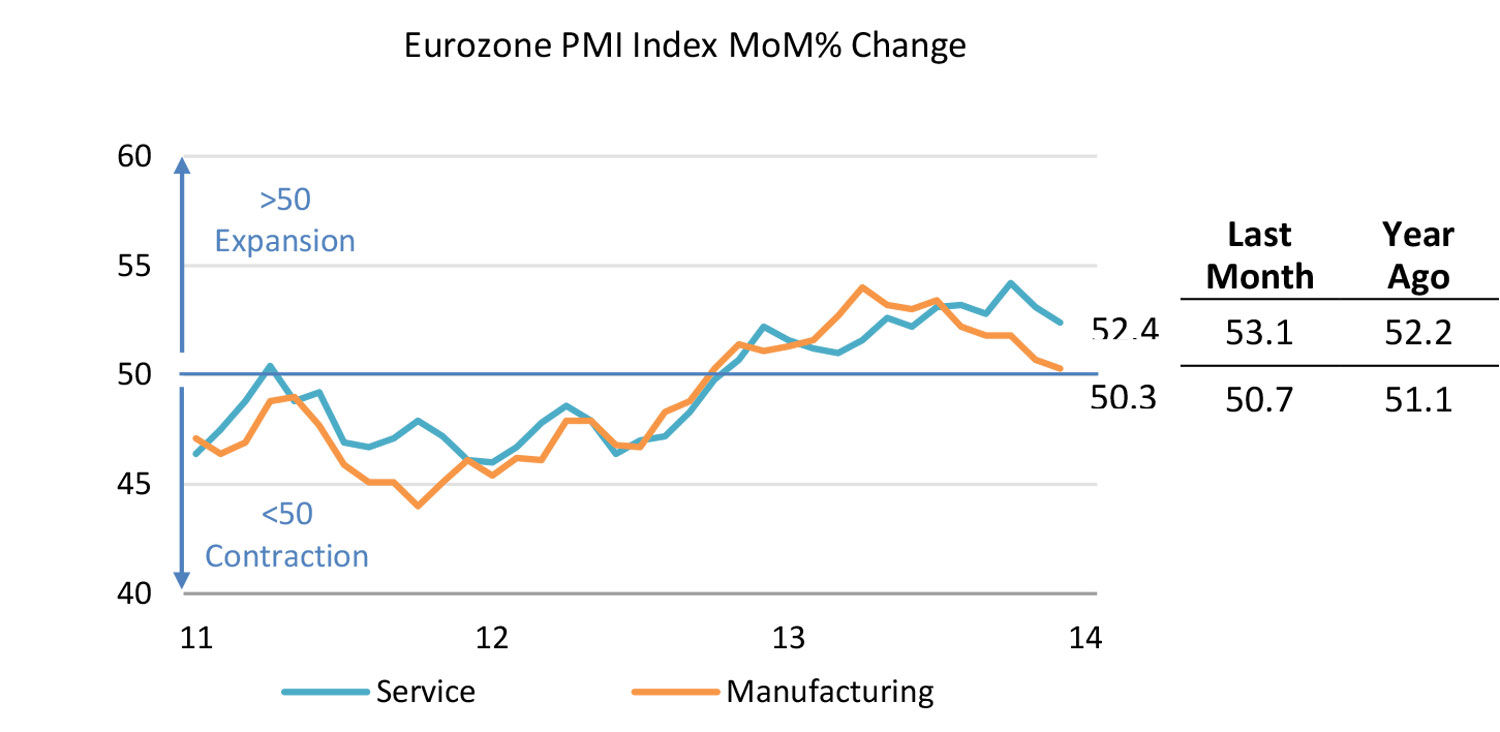

Eurozone Activity Expanding, But at the Slowest Pace in 2014

Through September 30, 2014

Source: Markit

- Manufacturing PMI falls back below 50 for Austria, Germany and Greece

- Ireland manufacturing PMI leads the region, at 55.7

- Eurozone services economy expanded for the 14th consecutive month, but signs of the upturn are waning as growth in business activity and new business slowed to six-month lows

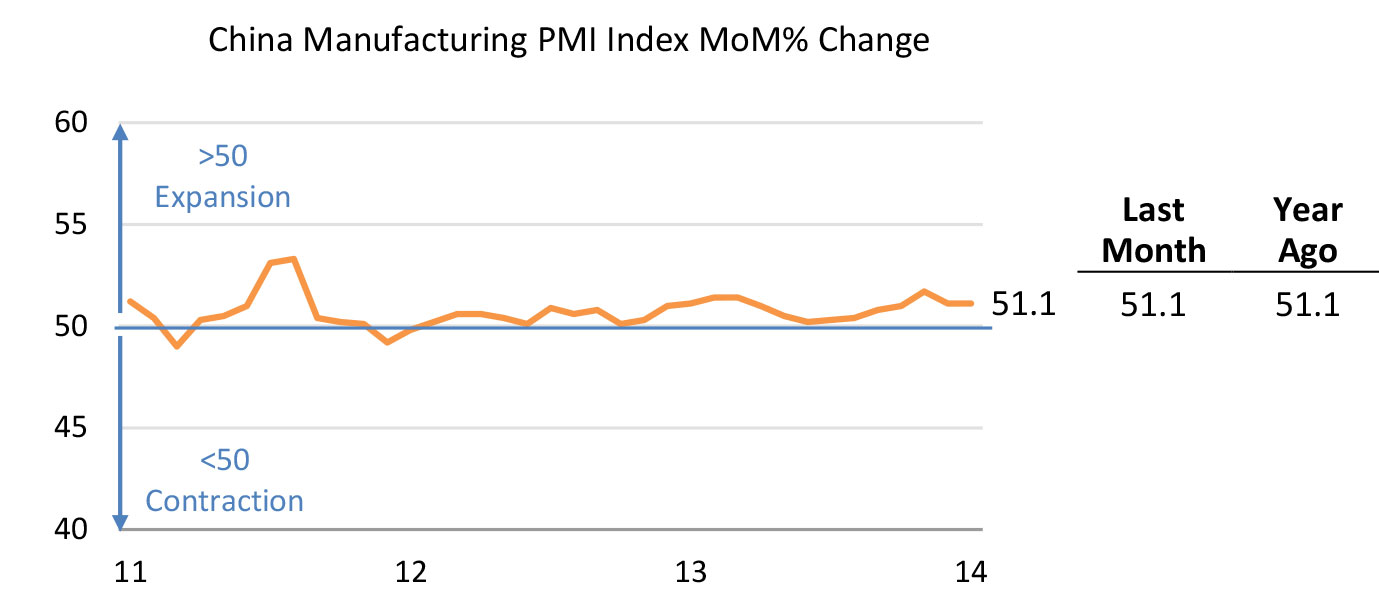

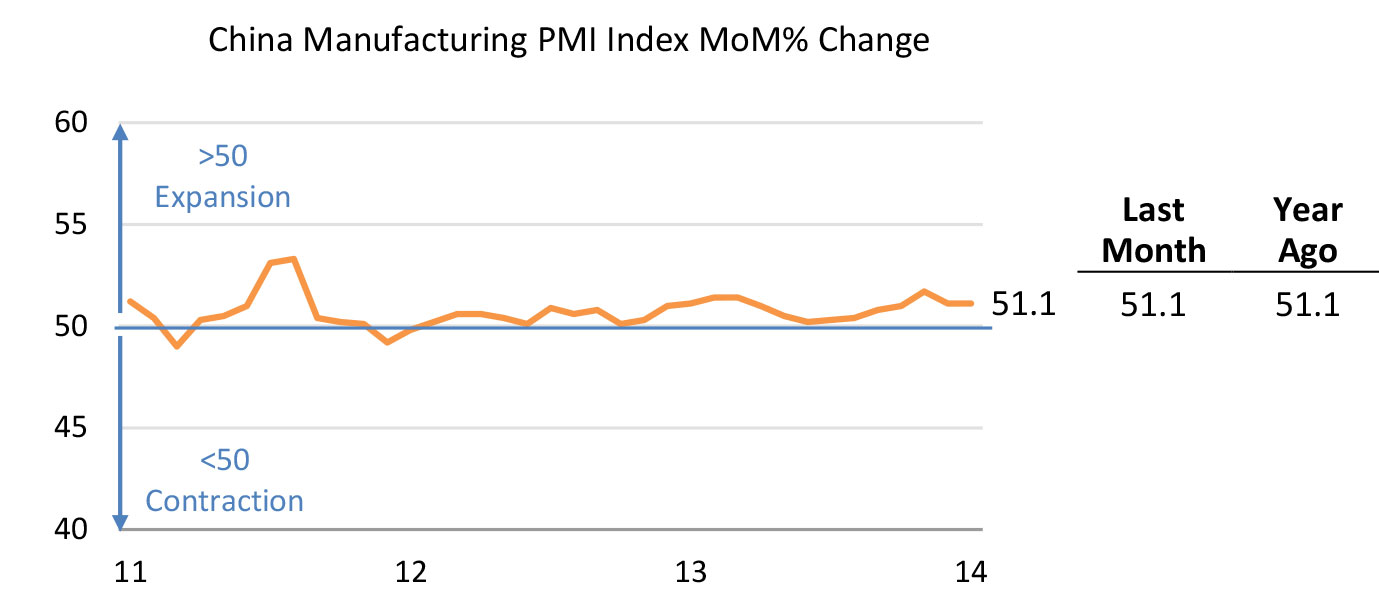

China’s Manufacturing Sector Stalls

Through September 30, 2014

Source: China Federation of Logistics and Purchasing

- Four of 12 sub-indices were higher versus August, and seven sub-indices were lower

- New export orders index, at 50.2, suggests modest improvement in export demand

- New orders dropped for the second consecutive month (to 52.2), indicating slowing in domestic demand

International Monetary Fund Shave Global Growth Forecasts (October 7)

- The IMF lowered its 2014 GDP growth forecast to 3.3% from its previous 3.4% forecast in July (versus 3.3% in 2013), reflecting the harsh winter and a sharper inventory correction in the first quarter in the US, the fallout in Russia and neighboring countries from the conflict in Ukraine, and slower growth in Latin America.

- The 2015 global growth forecast was reduced to 3.8% from 4.0% in July

- Conditions in the US are ripe for a stronger economic pickup: an accommodative monetary policy stance and favorable financial conditions, a much-reduced fiscal drag, strengthened household balance sheets and a healthier housing market.

Euro area growth outlook reduced on downward revisions for the France and Germany and continued negative growth in Italy.

OTHER US ECONOMIC NEWS

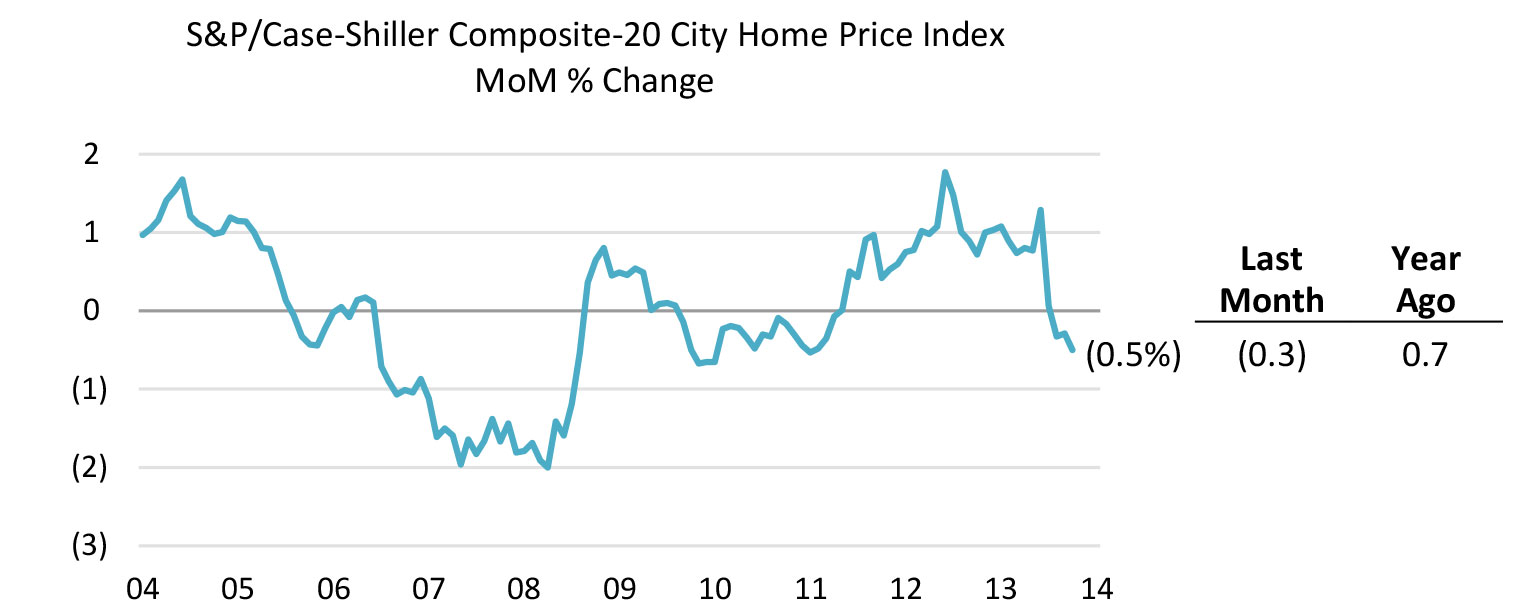

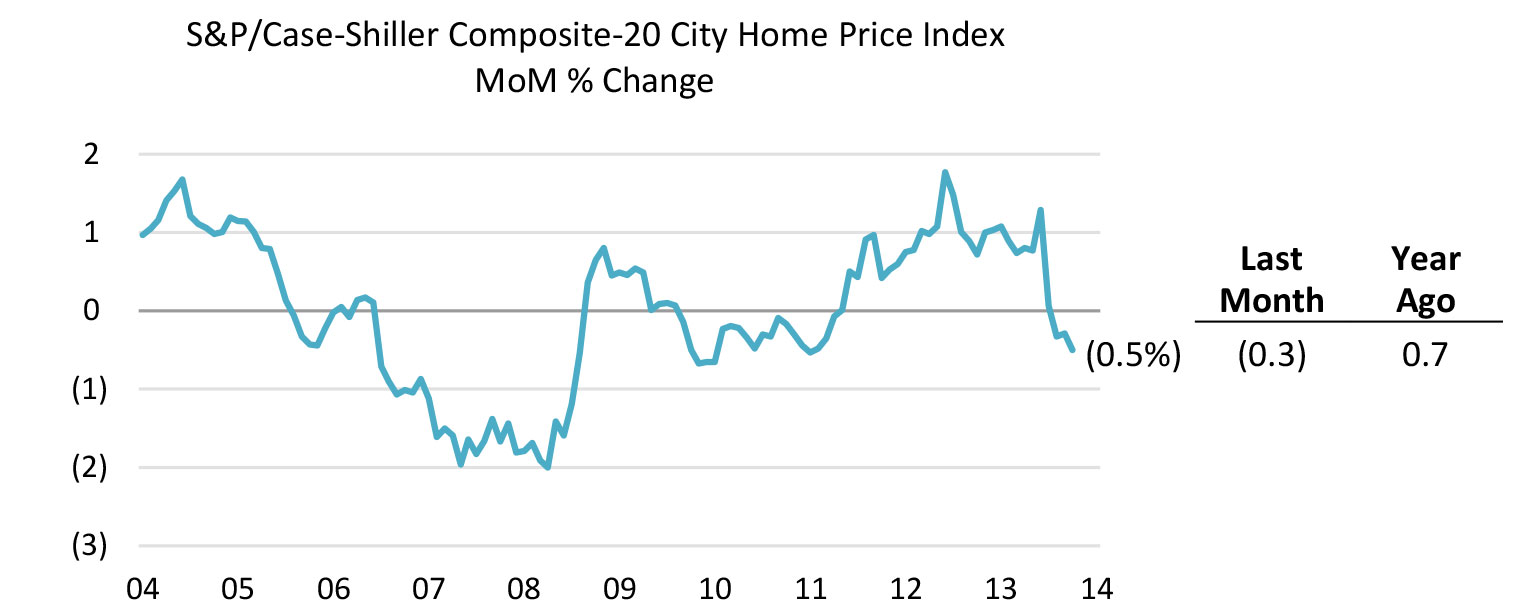

US Home Price Gains Continue to Ease

Through July 31, 2014

Seasonally adjusted

Source: S&P

- The slowdown was countrywide, with 19 of the 20 cities posting lower annual price gains in July versus June

- Las Vegas, Miami, and San Francisco were the only cities reporting double-digit annual price gains

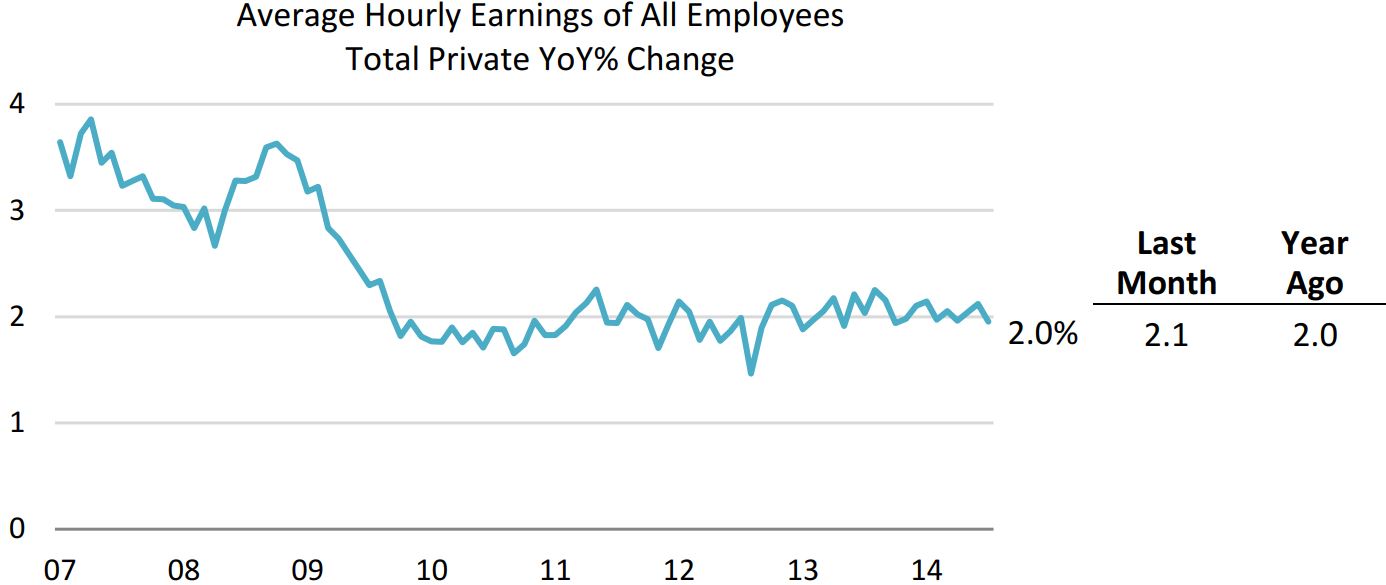

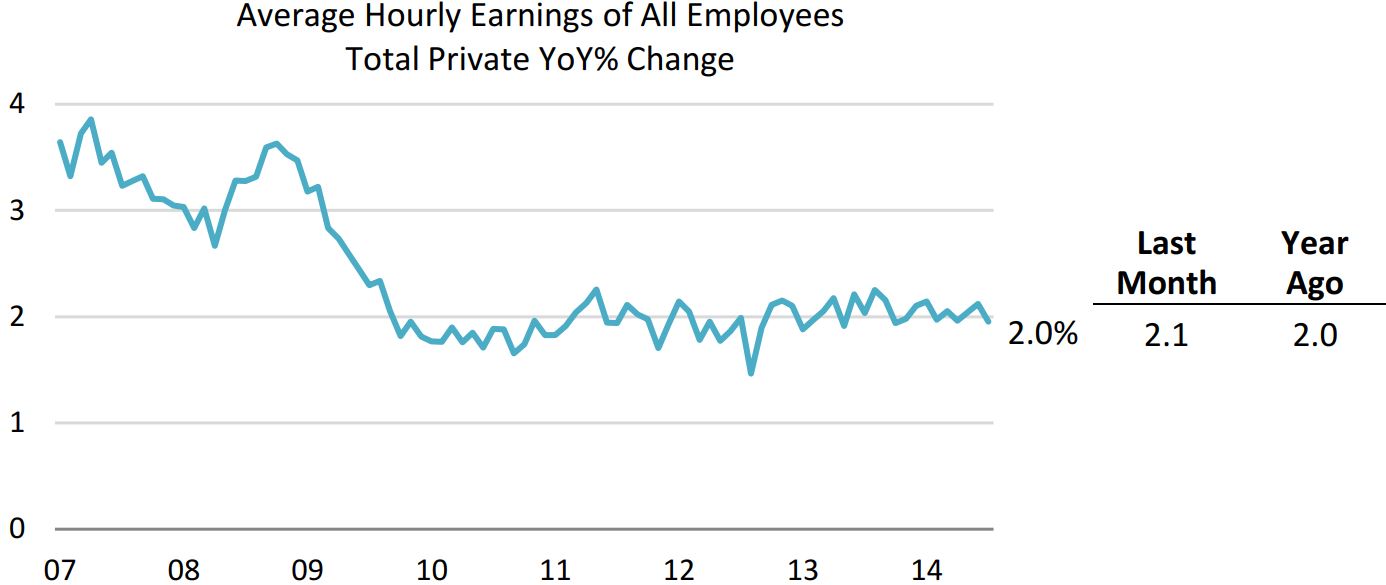

US Workers’ Hourly Earnings Stagnate

Through September 30, 2014

Source: U.S. Department of Labor

- Hourly earnings rise 2% YoY and are flat MoM (up a mere $0.01, to $24.53)

- Until the civilian labor participation rate (62.7%) and employment/population ratio (59%) improve, hopes of higher wages are likely to be elusive

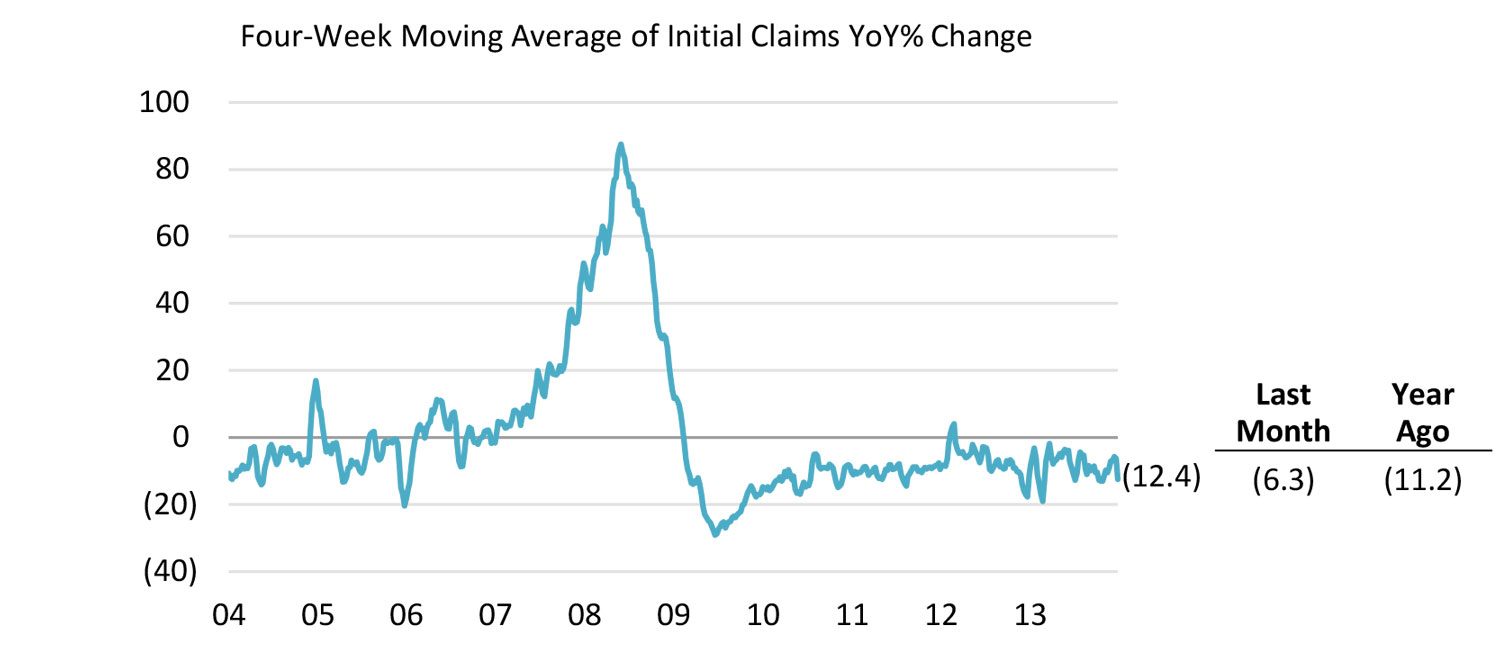

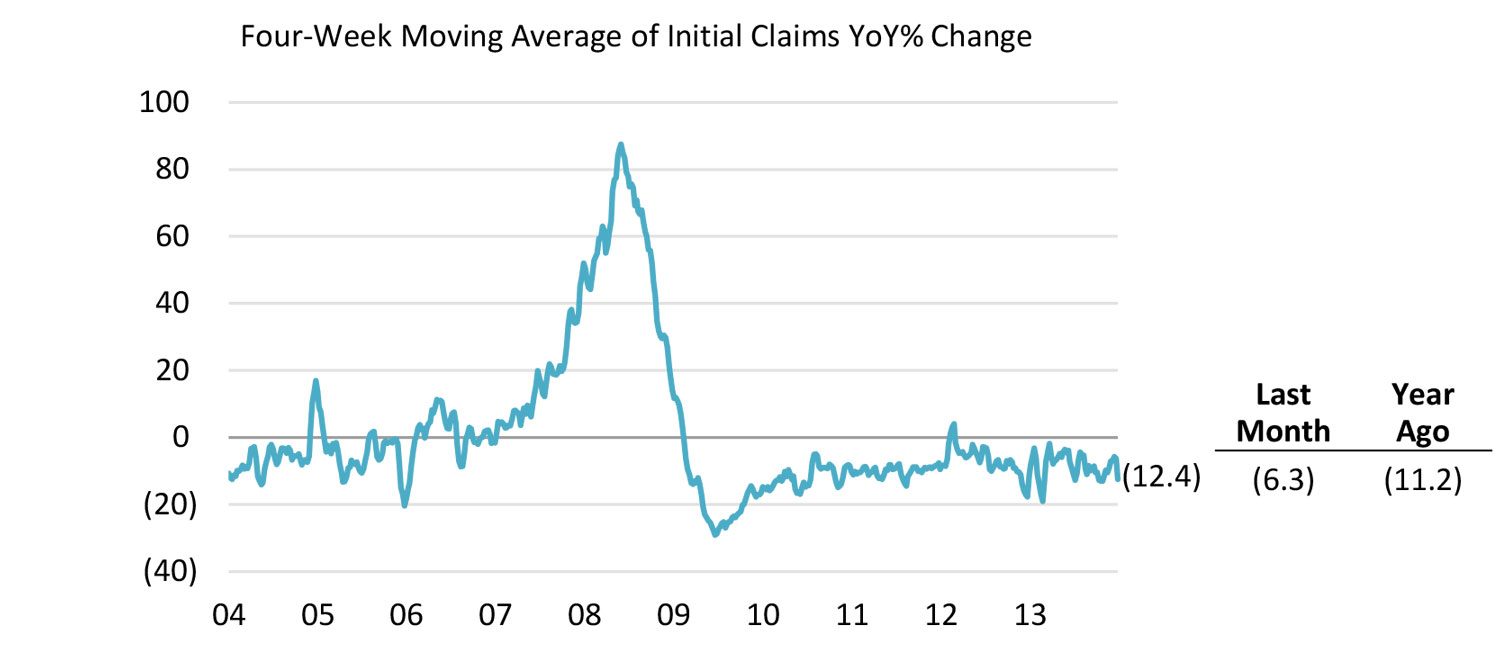

Initial Jobless Claims Dip to Seven-year Low

Through week ended October 4, 2014

Seasonally adjusted

Source: US Department of Labor

- At 287,000, new jobless filings fell to levels not seen since 2006, pointing to a strengthening labor market

- Improvement suggests that a consumer spending rebound may be forthcoming, especially in light of pent-up demand for many discretionary products

US Regular Gasoline Prices

Source: U.S. Energy Information Administration

- WoW, the average price for retail gasoline dropped in 48 states and Washington, DC

- MoM, the average price has fallen in every state and Washington, DC, led by the Midwestern states

- Cheaper gas at the pump frees up cash for discretionary purchases and bodes well for consumer spending heading into holiday

US RETAIL HEADLINES

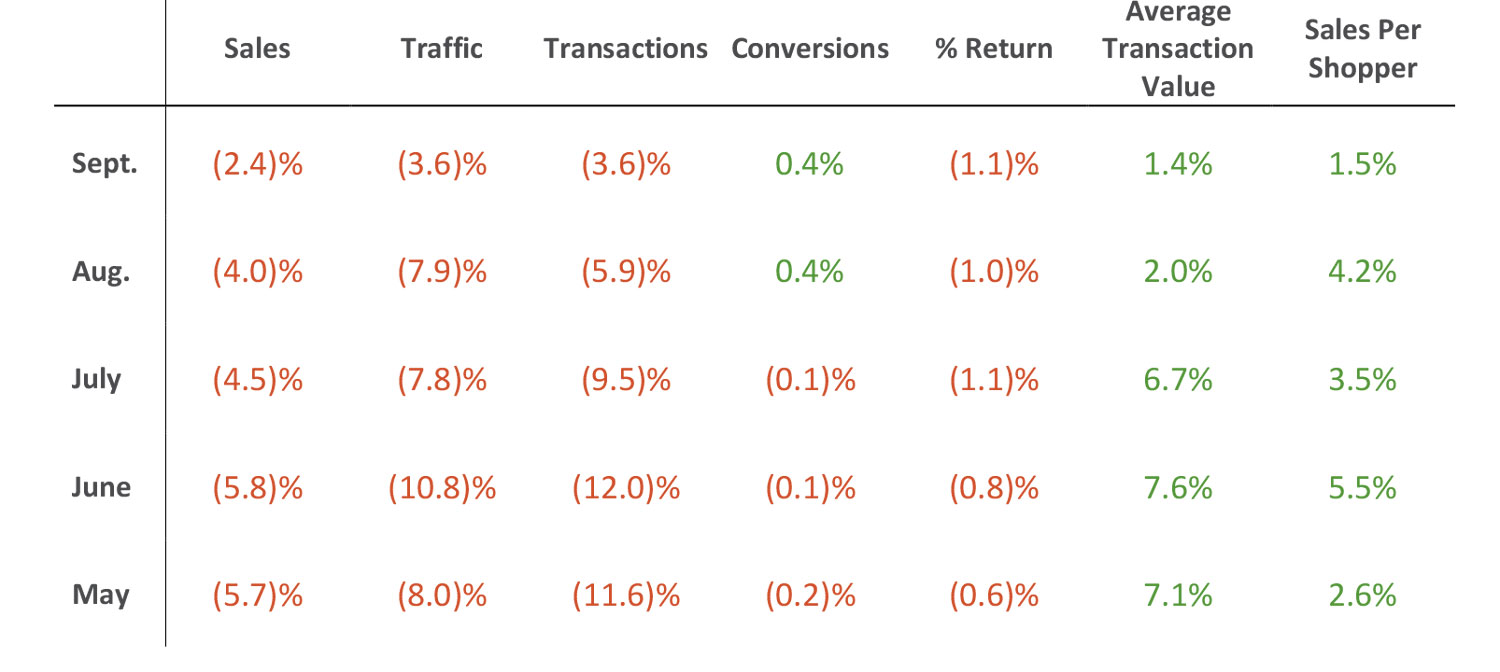

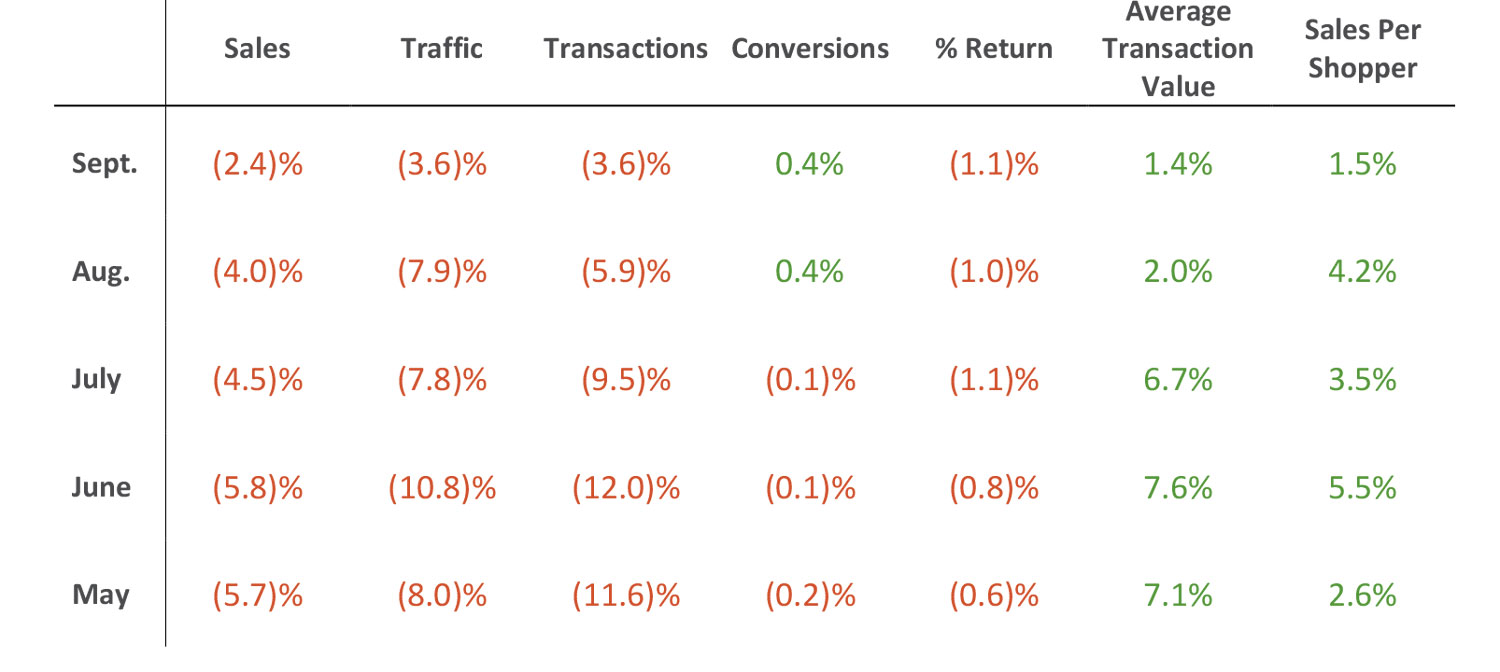

US consumer confidence in September has dropped for the first time since the first quarter of this year. This is reflected in the drop in the Consumer Confidence Index (CCI) from 93.4 to 86.0 and the softer increase in average transaction values (ATVs) from the prior months. Both conversions and ATC increased modestly, by 0.4% and 1.4%, respectively. A positive sign for retailers going into the fourth quarter is the minimal traffic decline of 3.6%, versus declines ranging from 7.9% to 10.8% in the past several months.

Source: RetailNext, Comprehensive In-Store Analytics

Holiday Retail Sales Forecasts

In September,

the Fung Business Intelligence Center (FBIC) projected holiday retail sales growth of 3%-5%, which includes a 13%-15% jump in online sales.

On October 6, the

Consumer Electronic Association (CEA) forecast that total tech holiday can rise 2.5% (from a 0.9% gain in 2013), to a record $33.76 billion.

- In the CEA’s recent survey, 26% of the more than 1,019 respondents said they plan to do more shopping on line this year than last, underpinning the CEA’s forecast for a 14.9% increase in online holiday purchases.

- The CEA expects aggregate spend this holiday to grow 4.5%, with mobile sales rising 19% and GAFO sales climbing 1.1%.

- In July, the CEA forecast that 2014 consumer electronics sales will grow 2%, to $211.3 billion, led by emerging categories (namely, wearable devices, ultra HD TV and 3D printers) growing 242%, to $5 billion.

On October 8,

National Retail Federation (NRF) projected that combined holiday sales for November and December will increase 4.1%, to $619.9 billion; Shop.org is looking for online holiday sales to grow in the 8%–11% range.

- Holiday sales growth has averaged 2.9% for the past 10 years

- Consumer spending is projected to increase to $767 per person

- The NRF sees holiday hiring reaching its highest level in 10 years

On October 9, the

International Council of Shopping Centers (ICSC) released its research for combined November and December shopping center sales, forecasting YoY growth of 4%, to $488.6 billion.

- ICSC expects holiday hiring to rise by 7.3%, to 794,258 jobs

Gap Announces Succession (October 8). Gap CEO Glenn Murphy plans to pass the reins to Art Peck, Gap’s president of Growth, Innovation and Digital, on February 2015. The move surprised investors, given Murphy’s strong tenure at the company over the past seven years, as he stabilized the business by closing stores and cutting costs domestically, while also pursuing growth internationally and via acquisitions (Athleta and Intermix).

In tandem with the announcement, Gap released disappointing September sales results of $1.46 billion, which included a flat comp sales result: +2% at Banana Republic, +1% at Old Navy and a 3% decline for Gap brand. Guidance for Q3 included a modest gross margin contraction and an approximate 8% increase in operating expenses versus Q3 a year ago.

JC Penney Gets Credit Upgrade (September 29). Moody’s raised its outlook on JC Penney debt to stable from negative, reflecting the successful completion of $400 million senior unsecured notes, which will be used to fund the partial tender offer for the company’s $200 million 6.875% notes due October 2015, $200 million 7.675% notes due August 2016, and $285 million 7.95% notes due April 2017. Moody's views this financing as a credit positive event, as it extends the company’s 2015 maturities and a portion of its 2016 and 2017 debt maturities.

The stable rating acknowledges JC Penney's good liquidity and lack of near-dated debt maturities, providing the company time to address its operating losses. Given the significant weakness in its credit metrics, an upgrade is unlikely at the present time. Over time, ratings could be upgraded should earnings improve such that it achieves debt/EBITDA will remain below 7.25× and EBITDA/interest expense approaches 1.0×.

JC Penney Provides Guidance on 2017 Cost Savings (October 8). At a recent meeting with analysts, JP Penney management projected that it could achieve $1.2 billion in EBITDA savings by 2017. Initiatives for incremental sales growth through 2017 include revitalizing the center core as a leading destination for beauty, jewelry and fashion accessories; improving Home Store productivity with value products and promotions; and maximizing omnichannel capabilities. It also reduced guidance for Q3 comp-sales to a low-single-digit gain from mid-single-digit gain, based on weaker September sales.

JC Penney Names New CEO (October 13). US Stores Head Marvin Ellison will succeed Myron E. (Mike) Ullman, III, as JC Penney CEO on August 1, 2015. Mr. Ellison will join JC Penney on November 1 as President and CEO-designee. In addition to his 12-year career at Home Depot, culminating as the most senior operations leader for Home Depot’s 2,000+ stores, Mr. Ellison also was at Target for 15 years.

Recent Retail Cyber Security Breaches (October 10). Kmart, owned by Sears Holdings, discovered and is investigating a breach to its store-payment data systems. No kmart.com customers were affected.

(September 9). G.H. Bass & Co. discovered that an unauthorized person had connected a small-data-capture device to a cash register in its International Drive, Orlando Florida, store. The device recorded information from payment cards, including cardholders’ names, card numbers, expiration dates, verification codes and e-mail addresses, if they were provided. Only one register was targeted in the attack.

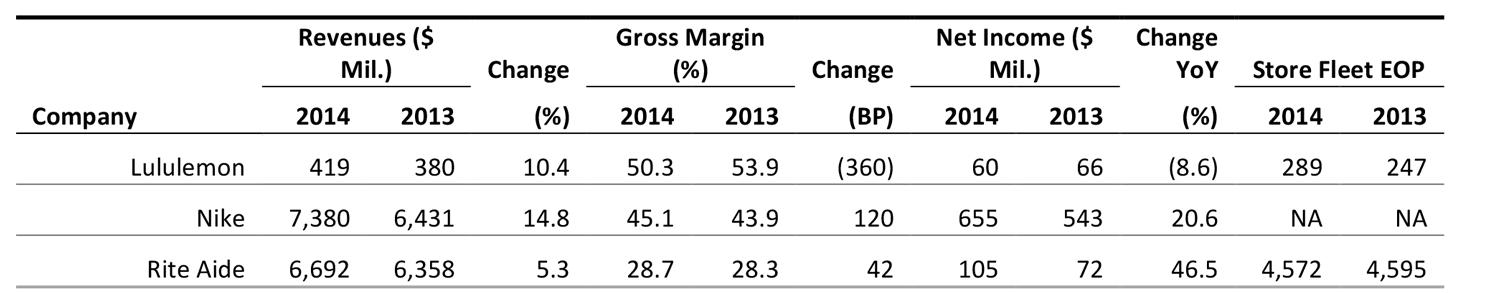

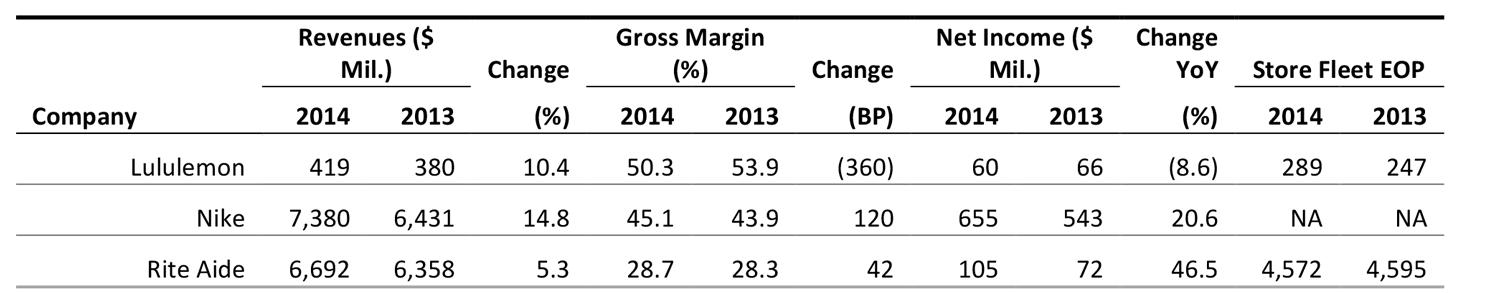

Selected Retail Company Earnings Results

* The acquisition of Hudson in September 2013 accounted for almost the entire sales increase ($22.7 million).

CHINA RETAIL HEADLINES

China’s Ministry of Commerce Reports a 12.1% YoY Increase in “Golden Week”

Retail Sales (October 8). This suggests a weakened momentum compared with the 13.6% YoY growth last year, and heightens concerns over a slowdown in the Chinese economy. The “Golden Week” is the weeklong national holiday that takes place between October 1 and October 7, which is intended to allow millions of people to take time out of work and travel. The holiday is also a prime period for spending, with retailers axing prices and rolling out huge discounts. According to the Ministry of Commerce, the “Golden Week” reeled in 975 billion yuan ($158.7 billion).

Fung Retail Unit Inks Pact with Sinopec (October 8). Convenience Retail Asia, one of the Fung Group’s retail units, announced a partnership with Sinopec (also known as China Petroleum & Chemical) to operate some of the latter’s petrol stations and convenience stores in China. The company is expected to operate 10 petrol stations and Easy Joy convenience stores for Sinopec Marketing under a pilot program in Guangzhou. If successful, the two sides may consider expanding the partnership to other districts in Guangdong and even other parts of China, according to Convenience Retail Asia’s filing to the Hong Kong Stock Exchange made on October 8.

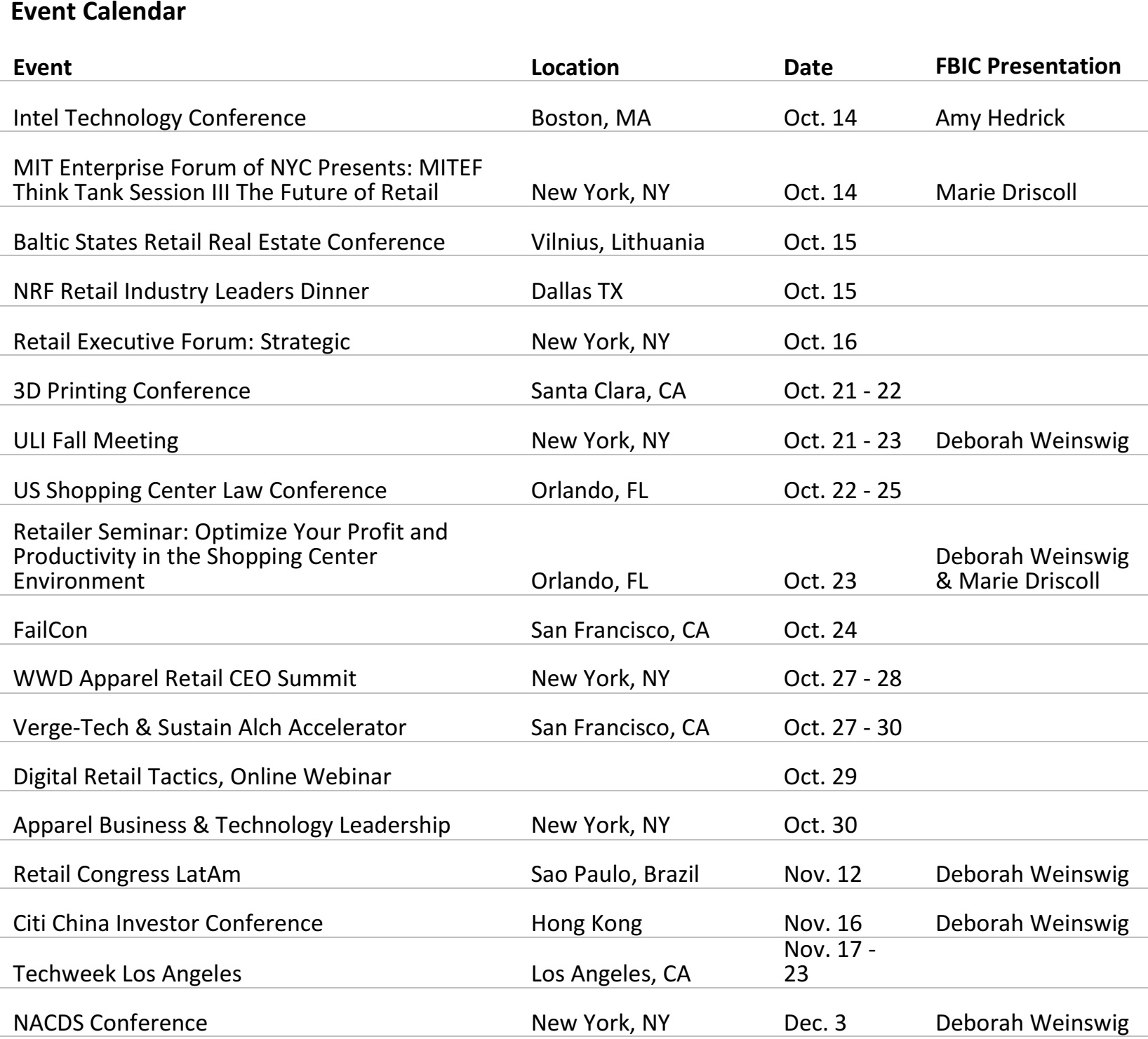

UPCOMING EVENTS