FROM THE DESK OF DEBORAH WEINSWIG

FROM THE DESK OF DEBORAH WEINSWIG

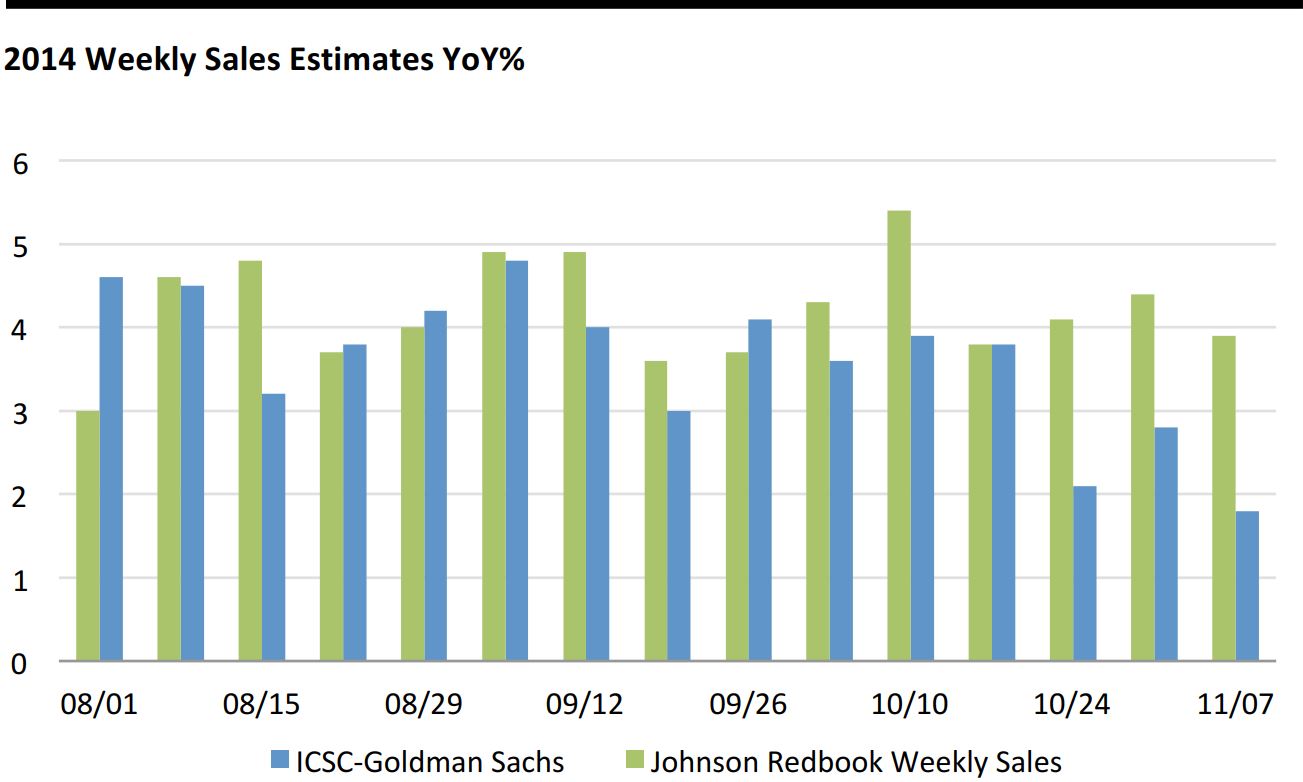

We enter November fresh from a weekend of Halloween festivities. With the day falling on a Friday, grownups joined their kids in the candy hunt, and then used it as an excuse for a party the next day. Johnson Redbook reports that retail sales were up 3.9% YoY for the week, led by a 5% gain at discount stores.

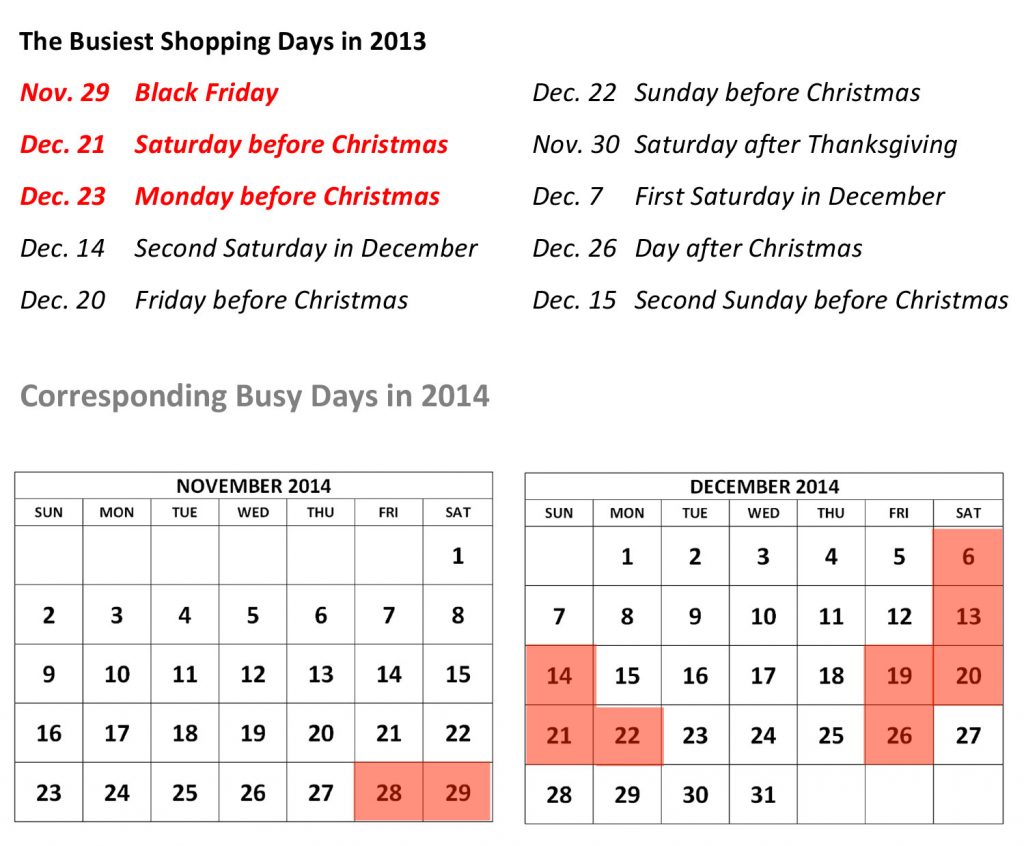

Does this signal a brightening of holiday spirits? That remains to be seen. Last week’s September economic news showed that Americans are still keeping a tight grip on their purse strings. But with rising consumer confidence and plunging pump prices—equating to a much-welcome tax cut for most Americans—we remain optimistic that holiday sales can edge closer to the high end of our 3%─5% forecast range.

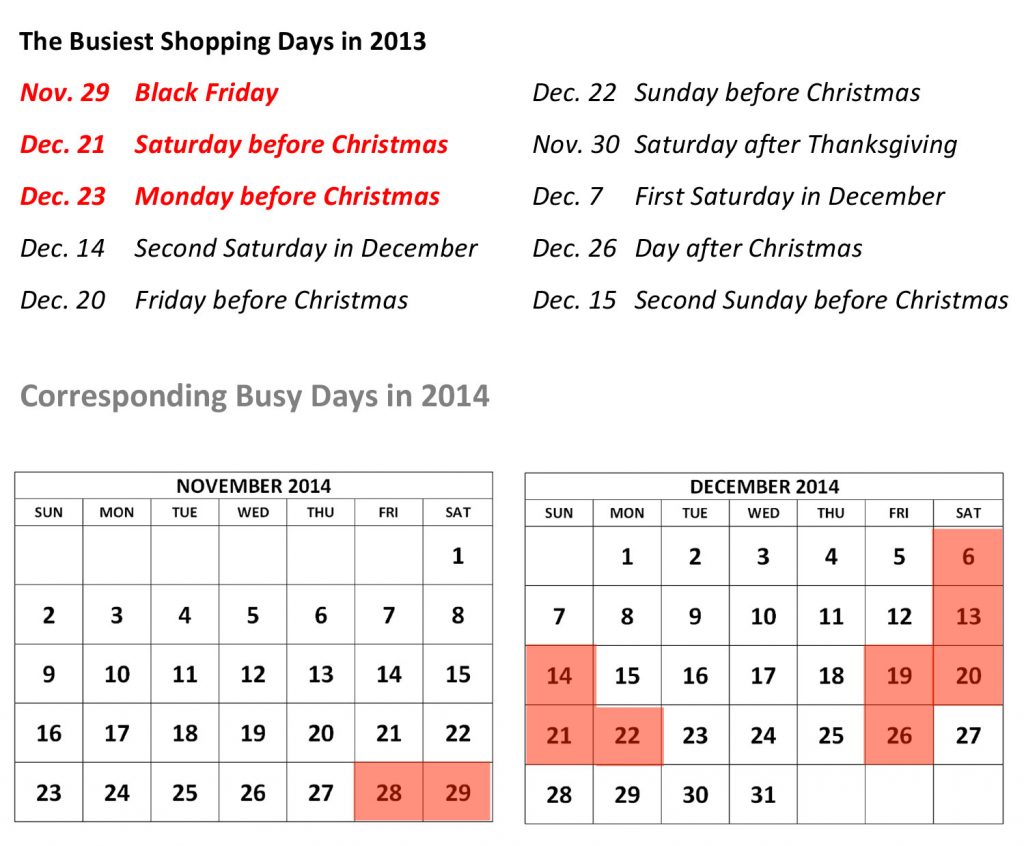

We’ll get a stronger reading as we approach Black Friday, which has long topped the list of the Busiest Shopping Days of the Year. For now, however, there’s little reason to believe that consumers will break from their longstanding traditions—that is, doing most of their gift-buying on the weekends in December.

Still, retailers aren’t waiting around. Promotional activity has gone into overdrive both offline and online (did you notice Walmart’s "begin your holiday shopping earlier than you thought" online promotion this past weekend?). Chains are already preparing for the Thanksgiving-Black Friday-Cyber Monday trifecta with bigger and earlier door-busting bargains, earlier store hours and smarter online marketing tie-ins.

Let the holiday fun begin!

EVENT OF THE WEEK – WWD APPAREL & RETAIL CEO SUMMIT

We attended this high-powered, informative event. Here are some of the key takeaways:

- Customers Want More “Made in America”. Michelle Gloecker, consumables and US manufacturing lead at Walmart (WMT), spoke about the company’s $250 billion, 10-year commitment to America manufacturing and jobs, an initiative launched in response to a growing customer demand. In recent surveys, the desire for “made in America” products ranked second to price in importance to Walmart customers, with roughly 85% of them saying that they would like to see more products assembled or produced in the US in Walmart stores. US goods are more expensive, and meeting this demand is particularly challenging when it comes to textiles, given the shortage of skilled workers needed for spinning, weaving, dyeing and cut and sew. However, several categories have already been re-shored from overseas, including footwear, bike helmets, bandages, lawn art, baby and pet products.

- Theater and Romance Are Key to Department Store Survival. Leaders from Saks Fifth Avenue (HBC), Macys (M) and the UK’s Fenwick Bond Street chain addressed the future of department stores. The executives bemoaned the alarming falloff in market share, declining mall traffic and the ever-increasing need for promotional activity to lure customers to their stores. But they also focused on the many opportunities to create experiences and interactions with brands in today’s stores by fostering a sense of theater and romance. As Marigay McKee, president of Saks, put it: "Retailing lives and dies by the spread sheet. Fashion lives and dies by the product. Get people to fall in love with the product and the shopping experience, then you have a successful formula for retail."

- Multichannel Helps Brands Fight Back. At 161-year old Levi Strauss & Co., macroeconomic stresses and trends in the US women’s apparel wholesale market are jeopardizing 2014 profits. Chip Bergh, president and CEO, said that reconnecting the heart and soul of the Levi and Dockers brands and restoring their status as "must have" items are his greatest tasks. Wholesale represents about two-thirds of the company’s $4.7 billion revenues, but the goal is to transform Levi into more of a retail brand. According to Bergh, "The combination of four-wall retailand the digital experience coming together into one seamless, integrated experience for the consumer is going to be a major way that brands are built in the future." In his view, this is how brands can navigate the relentless disruption of technological innovators that are diverting consumer attention.

- Socially Conscious Consumerism on the Rise. From organic apparel to locally sourced, handmade to "made in the USA", high-quality and sustainable raw materials to a transparent, environmentally healthy supply chain: These are the values that matter to Millennials—and may pose a serious challenge to fast fashion and disposable fads. New companies are rising up to meet these demands. They can succeed, provided they offer customers differentiated products and experiences along with social consciousness and authenticity. Check out Zady’s and Everlane!

US RETAIL HEADLINES

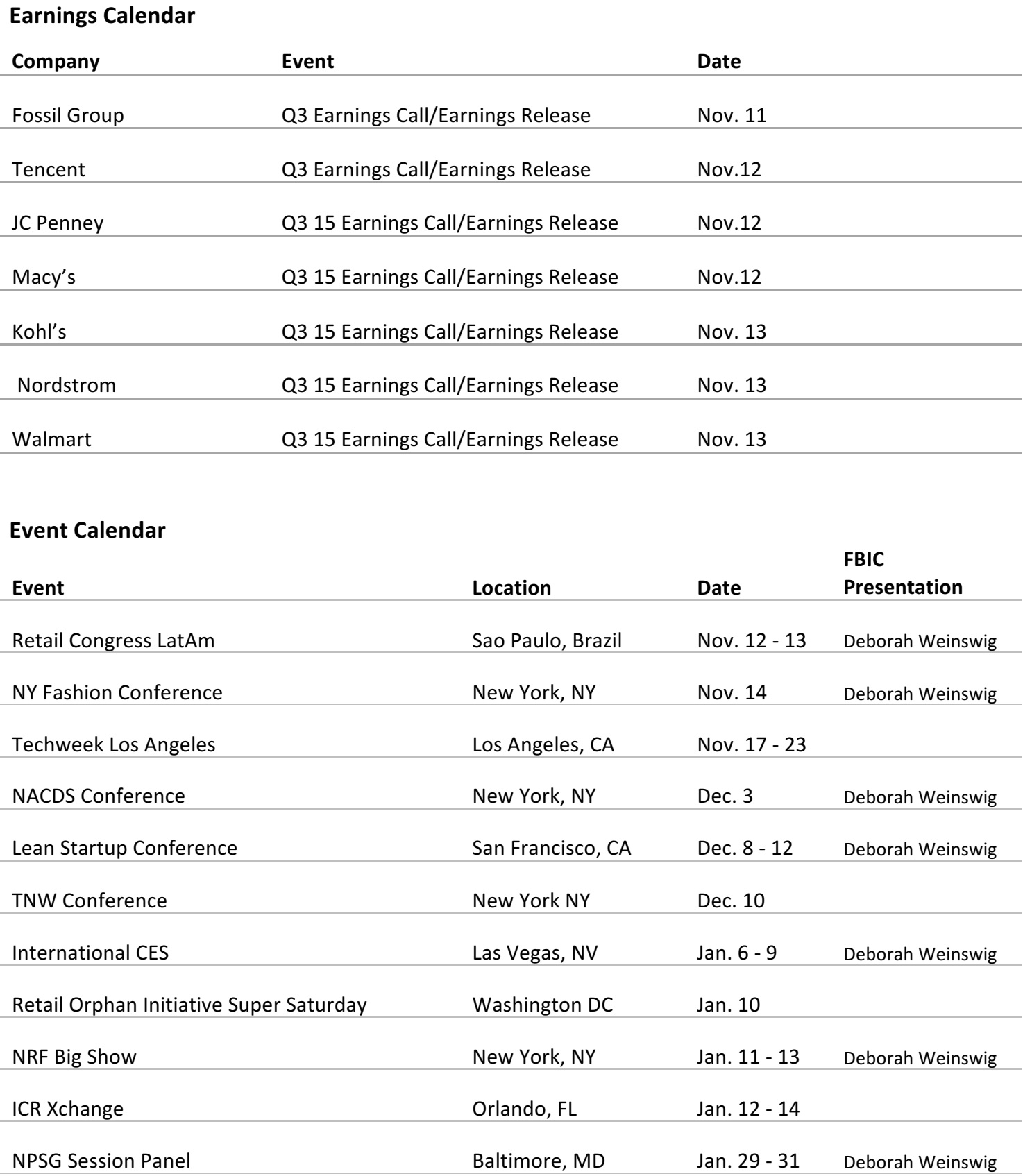

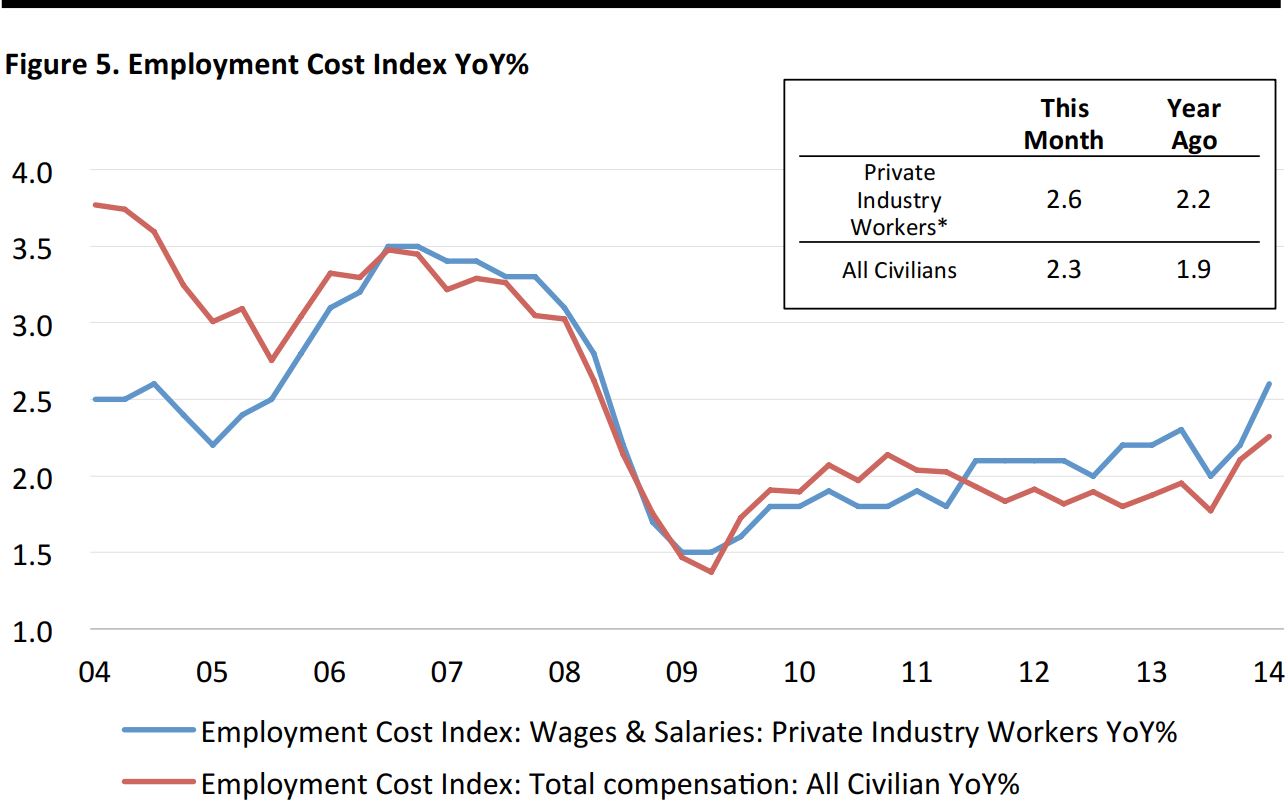

Weekly US Sales Indices

Note: The differential between the two index results reflects differences in coverage and methodology. ICSC-Goldman Sachs index is a statistically derived estimate of industry sales that is weighted by sales volume. Redbook’s index encompasses 13 retailers, spanning apparel specialty, department store and discounters.

- Redbook reported a 3.9% YoY retail sales gain for the week ended November 1, as a 5% uptick at discount stores was tempered by a 1.8% gain at department stores. Last-minute Halloween shopping may have diverted spending from department stores, especially since Halloween fell on a Friday.

- For the same week, ICSC reported a gain of 1.8%, a slowdown from the 2.8% increase the week before and the worst weekly sales reading since April 5.

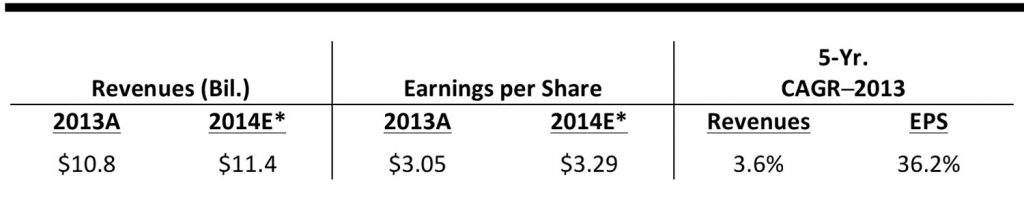

A Formidable Contender among Global Retail Olympians

A Formidable Contender among Global Retail Olympians

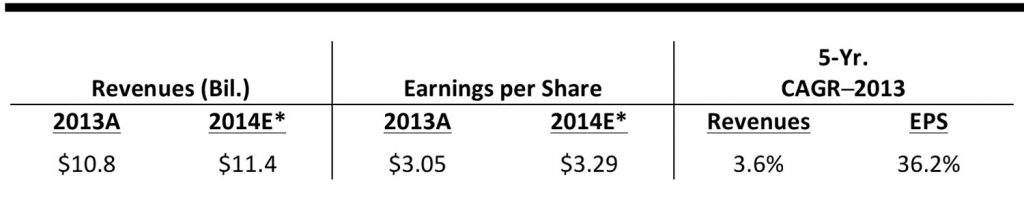

*Consensus estimates

As of November 4, 2014

Source: S&P Capital IQ

The day after the

L Brands (LB) aftermarket announcement on November 3, its management raised its 3Q EPS guidance to the $0.38-$0.40 range from the $0.26-$0.31 range (compared with $0.31 a year ago), the executive team met with investors to provide its annual update. We attended the November 4 meeting, which covered store visits and provided greater clarity about its holiday promotional calendar and the international growth strategy.

- International Expansion Revs Up. With the latter initiative most germane to L Brands’ long-term value, we are enthused by the company’s acceleration of international store openings (~180 planned for 2015). Leading with Victoria’s Secret Beauty & Accessories (VSBA) is a capital-light strategy for testing the brand’s potential in new markets. The first nine China VSBA stores open in the next few weeks, and 15 more are slated for 2015. LB believes China could be home to 1000 or more VSBA stores longer term. Lingerie could follow beauty. Closer to home, Canada and Mexico provide ample growth prospects, ultimately representing ~$1.5 billion versus about $800 million in Canada and virtually nil in Mexico.

- Foray into Sports Bras. The Victoria’s Secret and Bath & Body Works brands are differentiated in the marketplace, providing high emotional content to customers and attractive margin opportunities for the business. Cueing off its category authority in bras, Victoria’s Secret is aggressively expanding into the sports-bras arena with a product that is unique in construction and appeal and trademarked. The new line allows for entry into the natural sports adjacencies of capris, yoga pants, jackets, etc. and with price points on par with those of Nike (NKE) and about 20% below lululemon (LULU). We see activewear as a natural extension for Victoria’s Secret and a driver of domestic growth.

- Surgical Approach to Holiday Promotions. Our conversations with brand leaders and at Bath & Body Works (BBW) and Pink suggest that these brands will be surgical in their approach to promotions this holiday season, with an attempt to make “big days bigger.” Integral to the organization’s DNA is a “read, react and adjust” strategy that we believe gives L Brands the ammunition to enhance its value proposition if necessary as the season unfolds. Entering the Q4 with 90% open to buy (10% committed) suggests a very short supply chain and strong inventory management.

- Stores All A-Trim for the Holidays. The holiday floor set is in place at the BBW store fleet. This year marks the chain’s keener focus on holiday festivities. The stores have a distinctive holiday look and smell (home fragrance represents 25% of BBW sales). In retrospect, BBW looked too sophisticated in 2013, and its seasonal fragrance launch was priced too high (~50% above that of the BBW fragrance collection). This year, we see that the holiday fragrance, A Thousand Wishes, is selling at a lower price point. White Barn Candle in being tested in remodeled BBW stores and generating a 30%-40% sales lift without any incremental square footage.

Providing emotional content to consumer staples is L Brands’ competitive advantage. An increased focus on store selling and servicing—along with vigilant inventory and brand management—are keys to success this season and beyond.

Posts Impressive 3Q Gains (November 6). Buttressed by 3% comp sales growth in October, L Brands reported a 7% net sales gain (to $2.3 billion) for 3Q. Comps for the three-month period were up 5%, reflecting a flat comp at Victoria's Secret Stores (on top of a 10% gain last year), and +5% at Bath & Body Works (on top of 4% increase last year). Sales at Victoria's Secret Direct were down 7%, on the heels of a 7% decline a year ago, driven by the exit of multiple apparel categories.

Q3 Earnings and Guidance Disappoint (October 23)

Q3 Earnings and Guidance Disappoint (October 23).

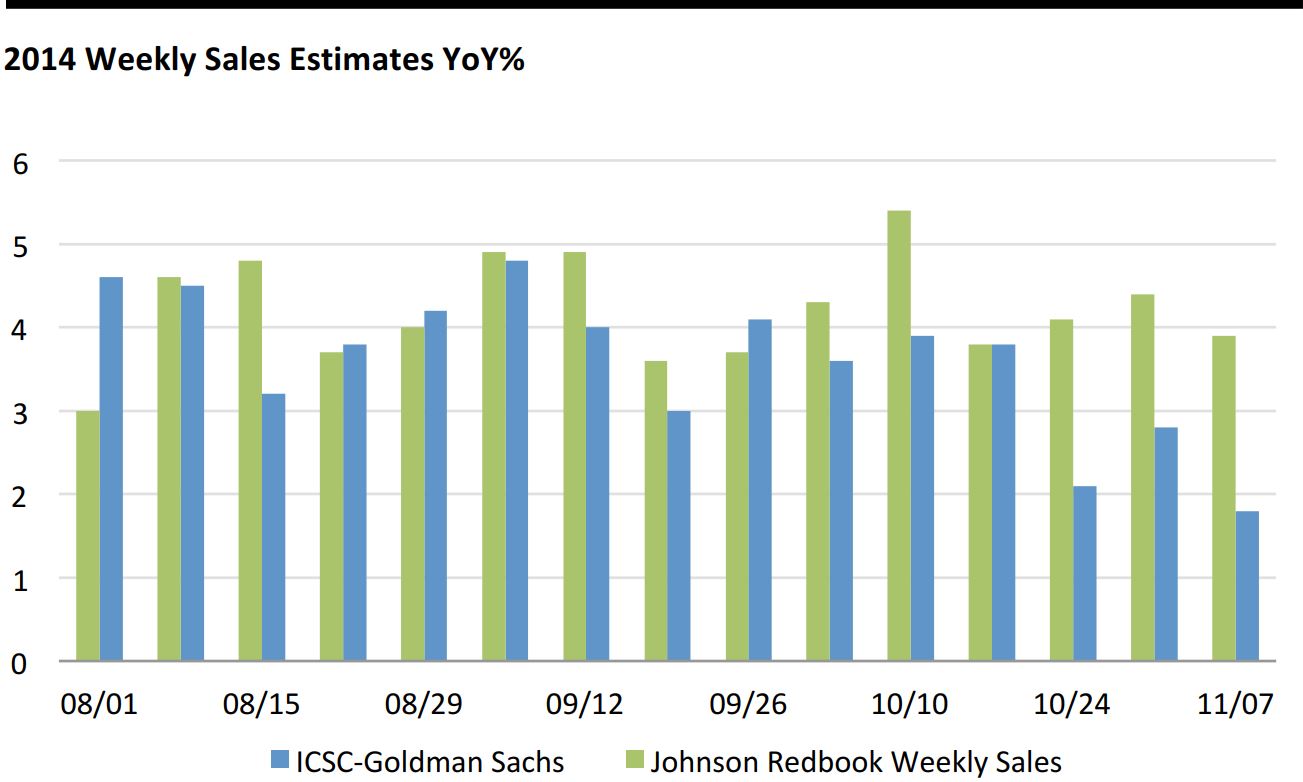

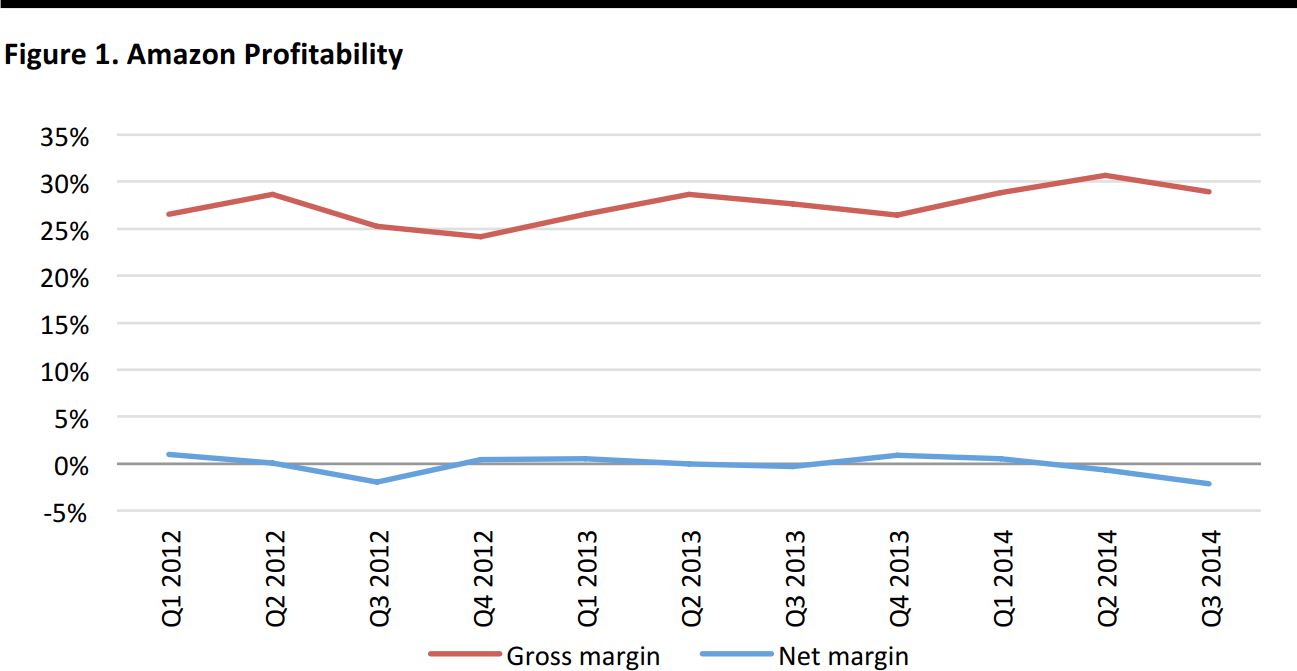

Despite a 20% revenue increase (to $20.9 billion) and modest 120-basis-point gross margin improvement (to 28.9%),

Amazon (AMZN) disappointed investors on both the top and bottom line, as expenses for fulfillment, marketing, technology and content rose to a combined 29.8% of sales (+350 bps). North America operating income decreased 70%, to $88 million, and the international operating loss increased nearly 10-fold, from $28 million to $224 million. The GAAP net loss of $437 million, or (-$0.95) per share, compares with a $41 million loss, or (-$0.09) per share, and was after a $205 million income tax benefit. The balance sheet suffered as well, with an $806 million drop in cash to $6.9 billion, a 21% increase in inventory to $7.3 billion and a slowing of inventory turns to 8.9 from 9.2 in Q3 2013.

Trailing 12-month capital expenditures were up 0.8% YoY, to $4.6 billion, as Amazon invests in technology infrastructure, web services and additional capacity to support fulfillment operations. Amazon plans to open 15 sort centers in the US by yearend, offer same-day delivery in 12 cities and make Sunday delivery available for 50% of the US population. On the guidance front, Amazon projects Q4 net sales in the $27.3─$30.3 billion range, representing gains of 7%─18%, and an operating loss of $570─$430 million, which compares with operating income of $510 million in the same period a year ago. Following the disappointing earnings and guidance, shares of AMZN tumbled as much as 9.3% on the next day's trading session to a 52-week low of $284, and volume was elevated at 5 times normal trading. AMZN shares are down 23.3% year to date, ranking the stock among the worst performers in the S&P 500.

Through September

Source: Amazon company report

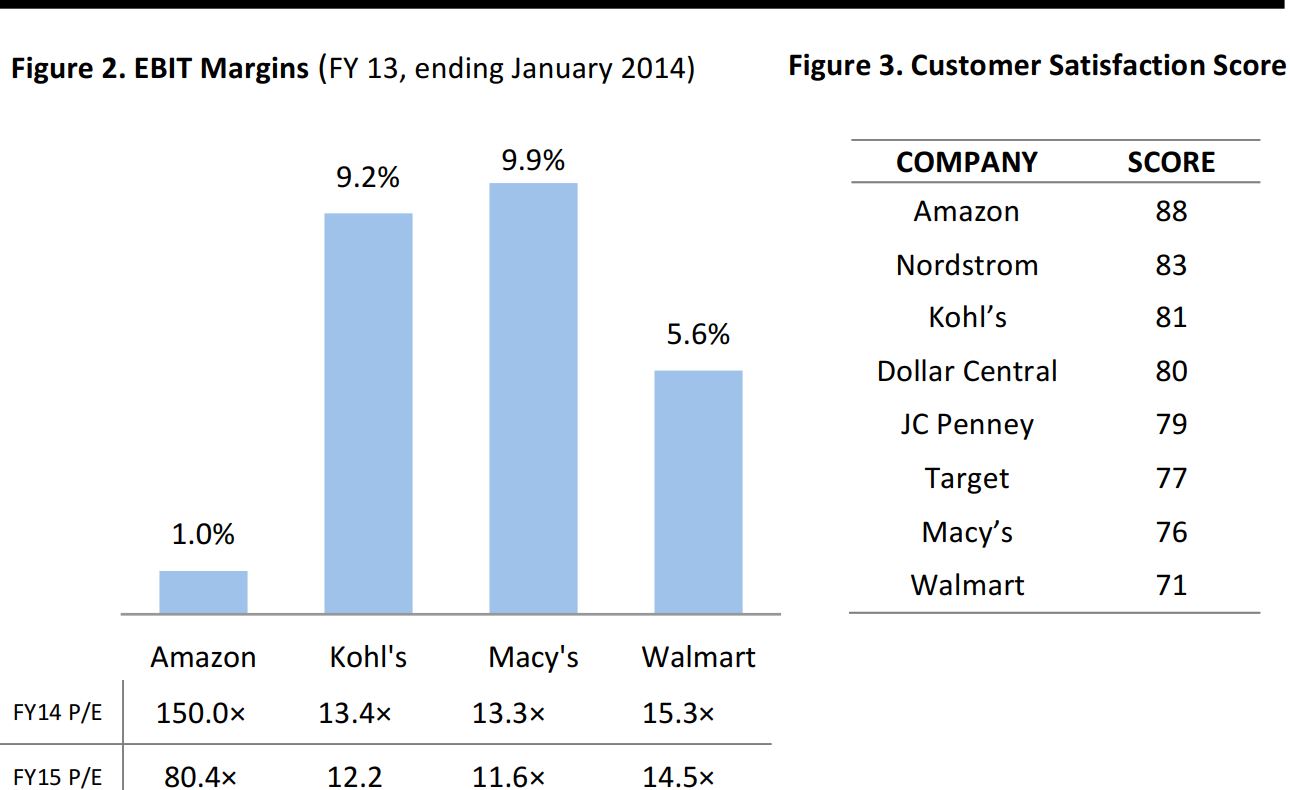

While Amazon is executing well along many fronts, from its Fire and Kindle hardline products to its subscription services, content creation and Amazon Web Services, the prospect of improved operating margins has perhaps been kicked down the road one too many times

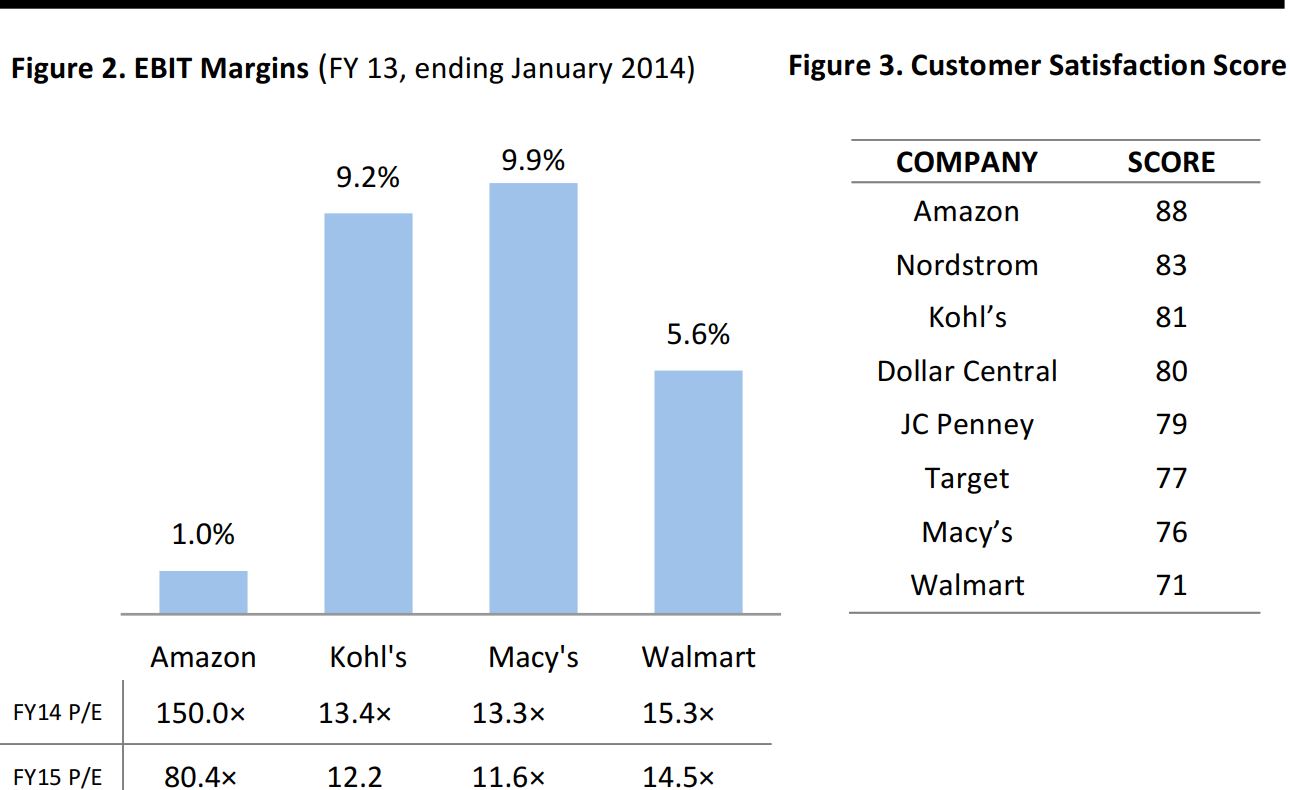

(Figure 1). Moreover, with the opening of a store/fulfillment center on 34th Street, in New York City, right down the street from Macy’s and dozens of specialty retail shops, the large valuation disparity between AMZN shares and those of other leading retailers becomes more apparent

(Figure 2, next page).

We view Amazon’s opening in the heart on NYC, during the busiest shopping season of the year, as particularly revealing. Amazon has been preparing to enter food retailing in a big way, which requires local distribution centers. Opening stores in physical reality risks damaging Amazon’s lofty customer satisfaction levels and will likely increase its fixed expenses and labor costs. It also suggests that growth in e-commerce is slowing. An O2O (online to offline) strategy potentially erodes Amazon's slim profit margins given real estate and labor costs. That said, it’s probably too early to bet against Amazon and Jeff Bezos, who may ultimately dazzle investors with his vision for the future of brick-and-mortar retailing. We live in interesting times.

As of November 5, 2014

Source: Bloomberg

"Greatness Agenda" Pushes Forward (October 29)

"Greatness Agenda" Pushes Forward (October 29)

We came away from the

Kohl's (KSS) recent analyst meeting with more information about its ongoing "Greatness Agenda" initiatives. The chain has set a 2017 sales goal of $21 billion, up from $19 billion in 2013, while targeting an operating margin of 9%, versus 9.2% in 2013, implying no growth.

The blueprint for reviving growth harkens back to Kohl’s "brands-value-convenience" roots, with a focus on new national brands such as Juicy Couture and Izod, growing its active & wellness and beauty categories, expanding its e-commerce and mobile businesses and forging stronger bonds with customers through loyalty and personalization programs. On this last point, we are impressed with Kohl’s progress in amassing 15.5 million Yes2You members.

In addition to editing assortment size, reducing store clutter and spotlighting new exciting brands such as Juicy Couture and Izod, Kohl’s can potentially reduce operating complexity while improving engagement with customers. Kohl’s is also investing in the store experience. Its" Aisles of Inspiration" strategy, aimed at raising awareness of new

brands at the store entrance, is the centerpiece of this new initiative. About 800 stores are functioning as dual distribution centers/retail stores, aimed as faster deliveries. It now has 100 stores offering "buy online, pickup in the store" sites and plans to rollout this service to the entire ~1,100-unit fleet in 2015. With the imminent re-launch of a mobile app, Kohl’s will simplify the online buying experience (online sales are growing at a 30% rate and outpacing the industry).

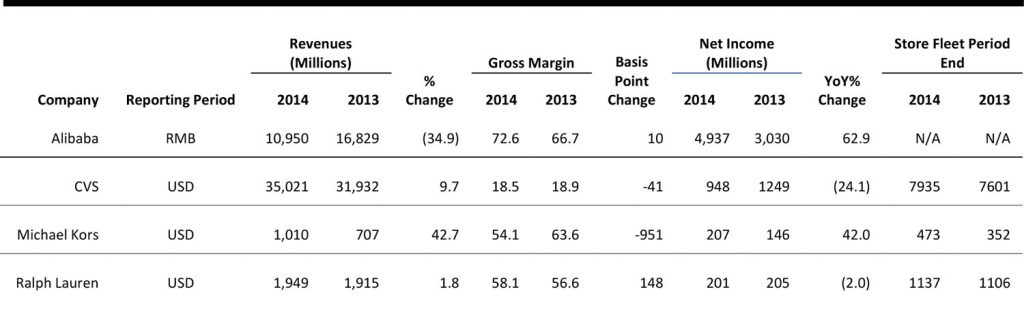

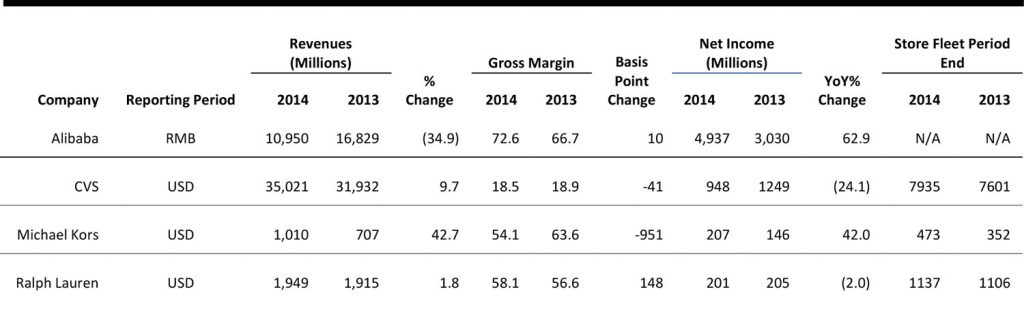

Selected Retail Company Earnings Results

Source: Fung Business Intelligence Centre

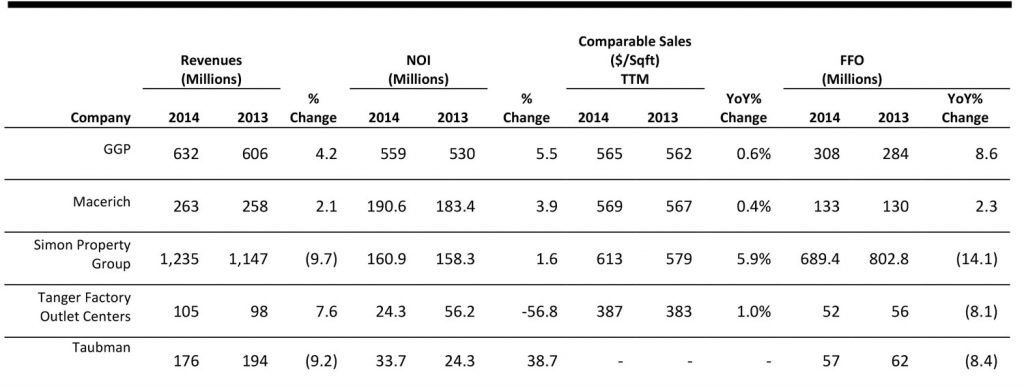

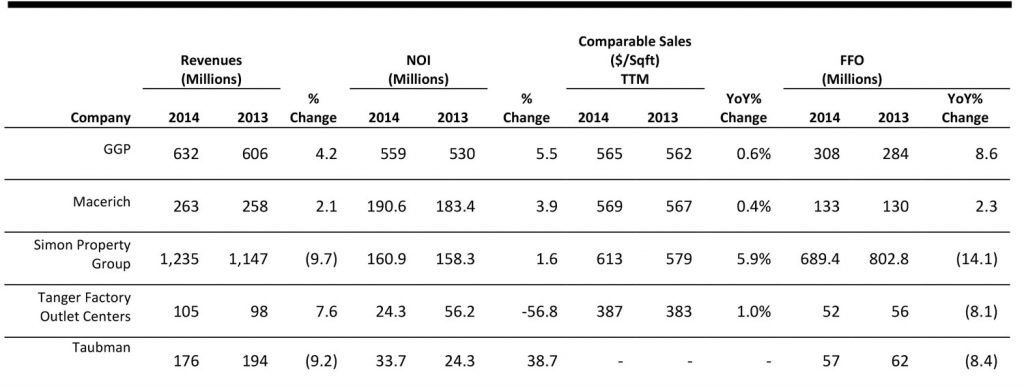

Selected REITs Earnings Results

Source: Fung Business Intelligence Centre

US Regular Gasoline Prices

Source: US Energy Information Administration

CHINA HEADLINES OF THE WEEK

Hermès’ Chinese Brand, Shang Xia, Slow to Gain Traction (October 21).

Hermès’ Chinese Brand, Shang Xia, Slow to Gain Traction (October 21). Shang Xia is not expected to break even until 2016, despite seven years of investment to date, including $2.6 million to open Shang Xia’s new Shanghai retail and VIP entertainment complex. Patrick Thomas, chairman of Shang Xia, expects the location, the largest of three stores, to generate ~$13 billion in three years.

(Wall Street Journal)

Uniqlo Targets Little China (October 29).

Uniqlo Targets Little China (October 29). Fast Retailing, parent of Uniqlo, says it will continue seeking growth in China, with focus on smaller cities. Uniqlo has 316 stores in 70 cities across China; more than 100 are located in tier-one cities of Beijing, Guangdong, Shanghai and Shenzen. Now Fast Retailing will open more shops in tiers two, three and four cities, as it views China as a key market in its plan to become the world’s largest apparel retailer by 2020.

(Inside Retail Asia)

Hangzhou Eyes Online Free Trade Zone (November 2).

Hangzhou Eyes Online Free Trade Zone (November 2). Hangzhou, the capital of East China’s Zhejiang Province, will apply to the central government to set up an online free-trade zone in a bid to boost cross-border e-commerce, according to Tong Guili, a senior city official, at an e-commerce expo. Hangzhou has introduced 122 cross-border e-commerce enterprises since launching the cross-border e-commerce industrial part in July 2013.

(Chinanews.com)

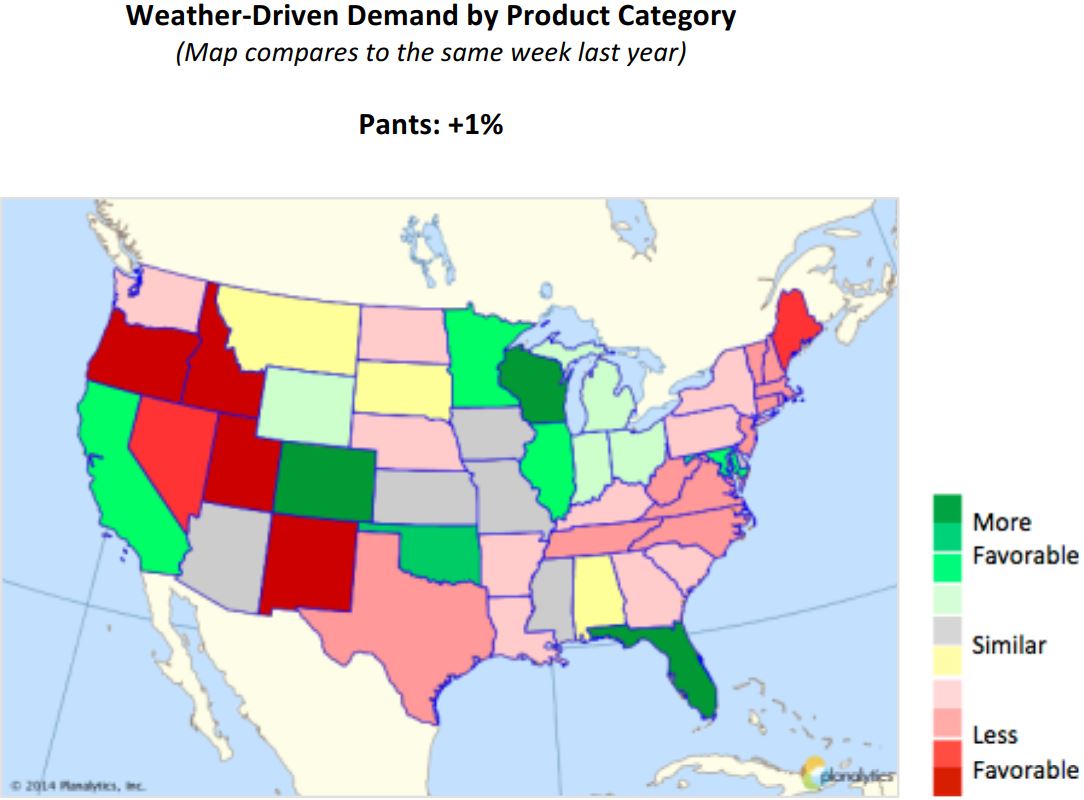

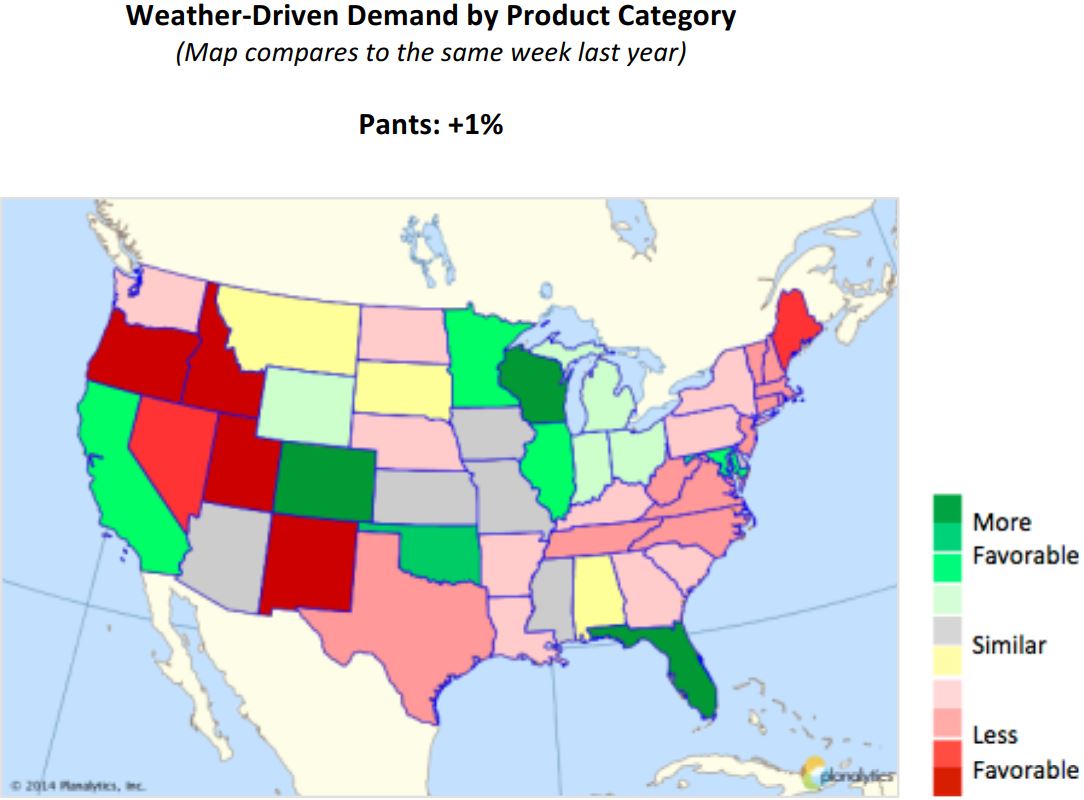

US WEATHER ANALYTICS

What to Expect for the Week of Nov. 10 ─15

What to Expect for the Week of Nov. 10 ─15

Colder Temps in Northeast to Support Demand for Fall Apparel and Consumables; Southern Tier to Enjoy Fall Conditions

- Cold East, Warm West. Fall seasonal categories can expect a boost next week as temperatures will trend colder than both last year and normal for most eastern markets in North America. The week will trend dry for most markets, although a rain system will hit interior locations and the East Coast mid-to-late week.

- Great Lakes Brace for Cold. Markets across the Northern Plains, Great Lakes, Midwest, and Northeast all brace for the first prolonged period of cold weather this fall, with temperatures plunging double-digits. Major markets such as Detroit, Chicago, and Cleveland will linger in the low 40s throughout the week. Further east, New York City, Philadelphia, and Boston will have highs near 50ºF.

- Interior US Getting Colder. Markets from Kansas City to Roanoke, Virginia, will see temperatures barely topping the 50ºF mark for most of the week, stimulating demand for outerwear and hot beverages.

- West to be Similar to Last Year, But Much Warmer than Normal. Warm conditions continue to challenge seasonal demand in western markets.

Source: Planalytics

Through September 30, 2014

Source: US Department of Commerce

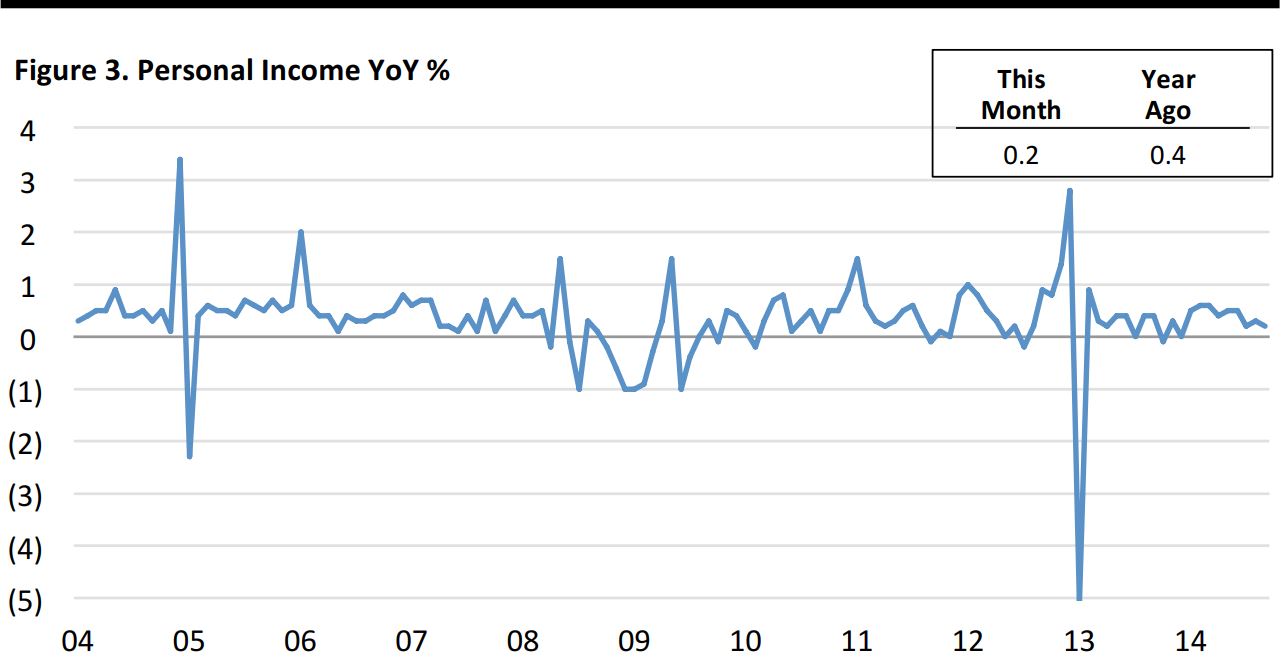

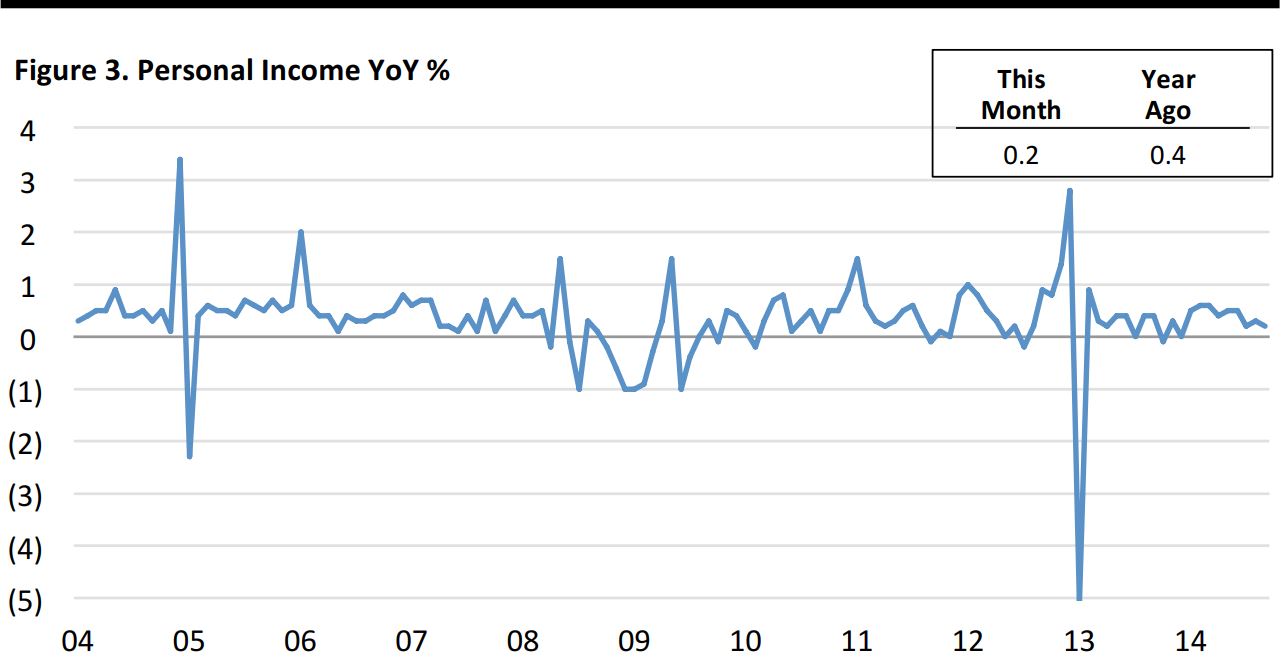

Tepid Income Growth Continues Despite Robust Hiring

- Personal income rose by the smallest amount since December 2013 and was below consensus expectations for a 0.3% gain

- Disposable income, after adjusting for inflation, was flat, failing to rise for the first time this year

Economists attribute results to increased part-time and temporary jobs in the mix of new jobs

Through September 30, 2014

Seasonally adjusted annual rate

Source: US Department of Commerce

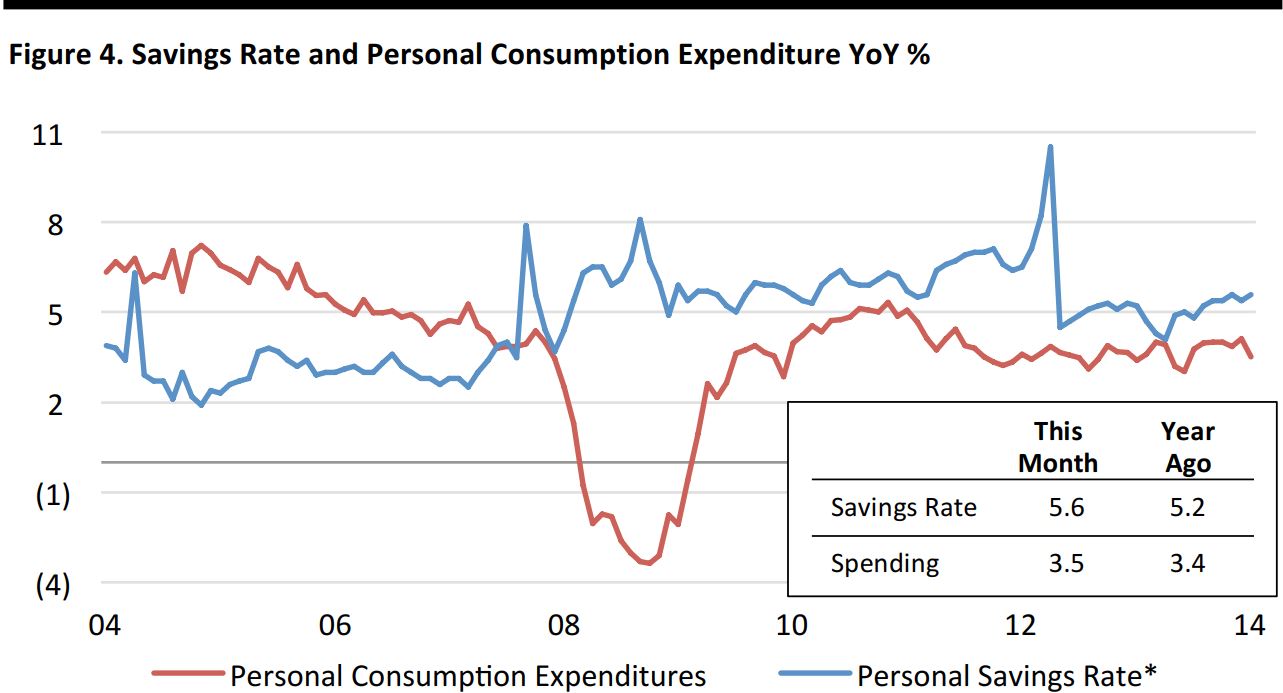

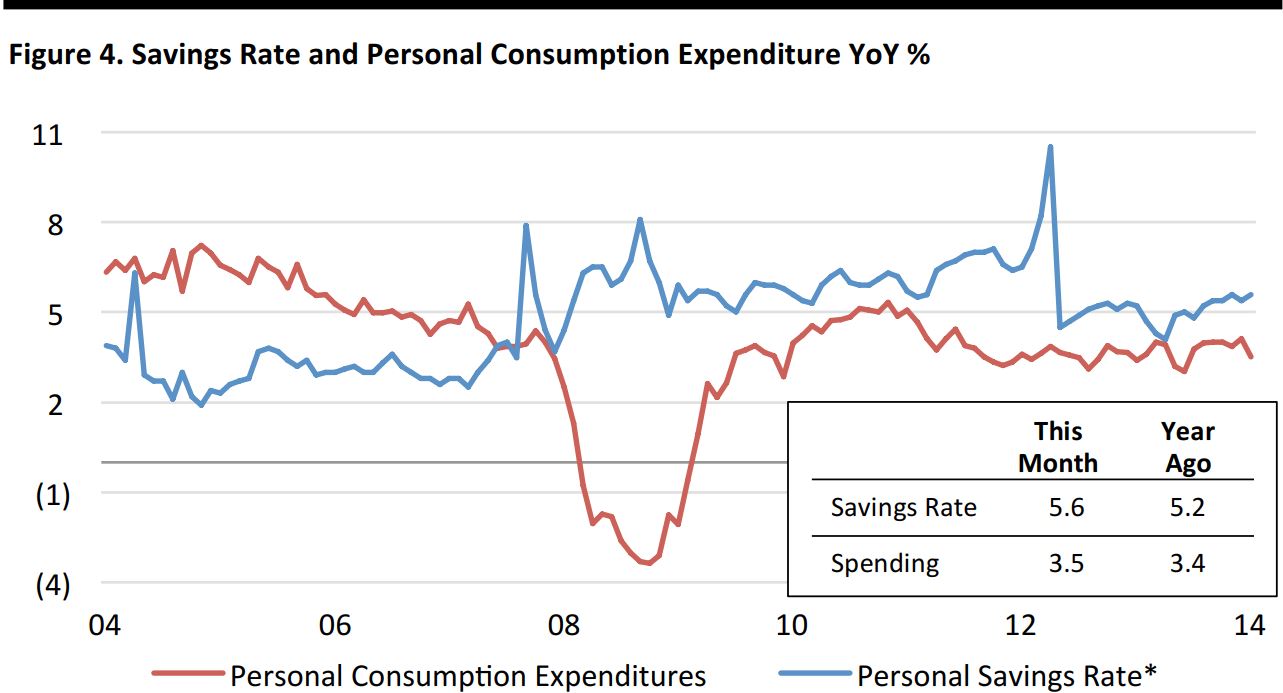

Consumers Continue to Show Constraint

- YoY growth in personal spending has barely budged this year, while the savings rate has risen

- Spending slowed in September for the first time since January and was below consensus forecasts for a 1% gain

- September marked the third monthly decline since the recession ended in mid-2009

Through September 30, 2014

Seasonally adjusted

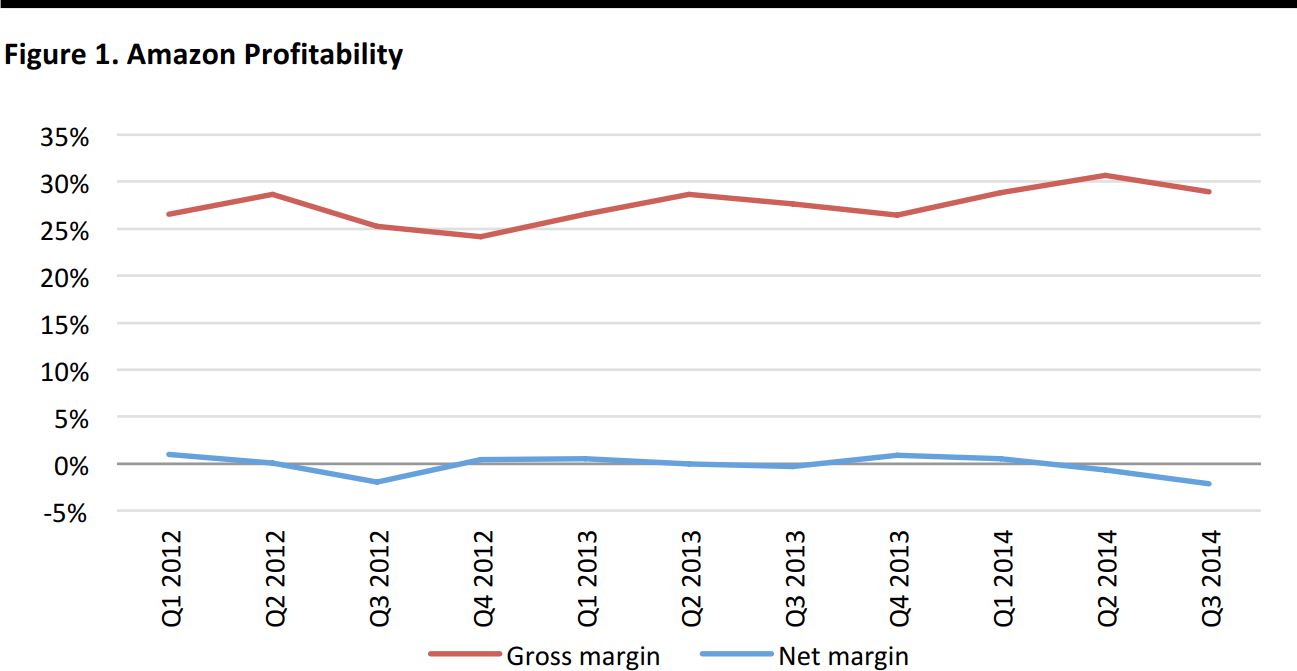

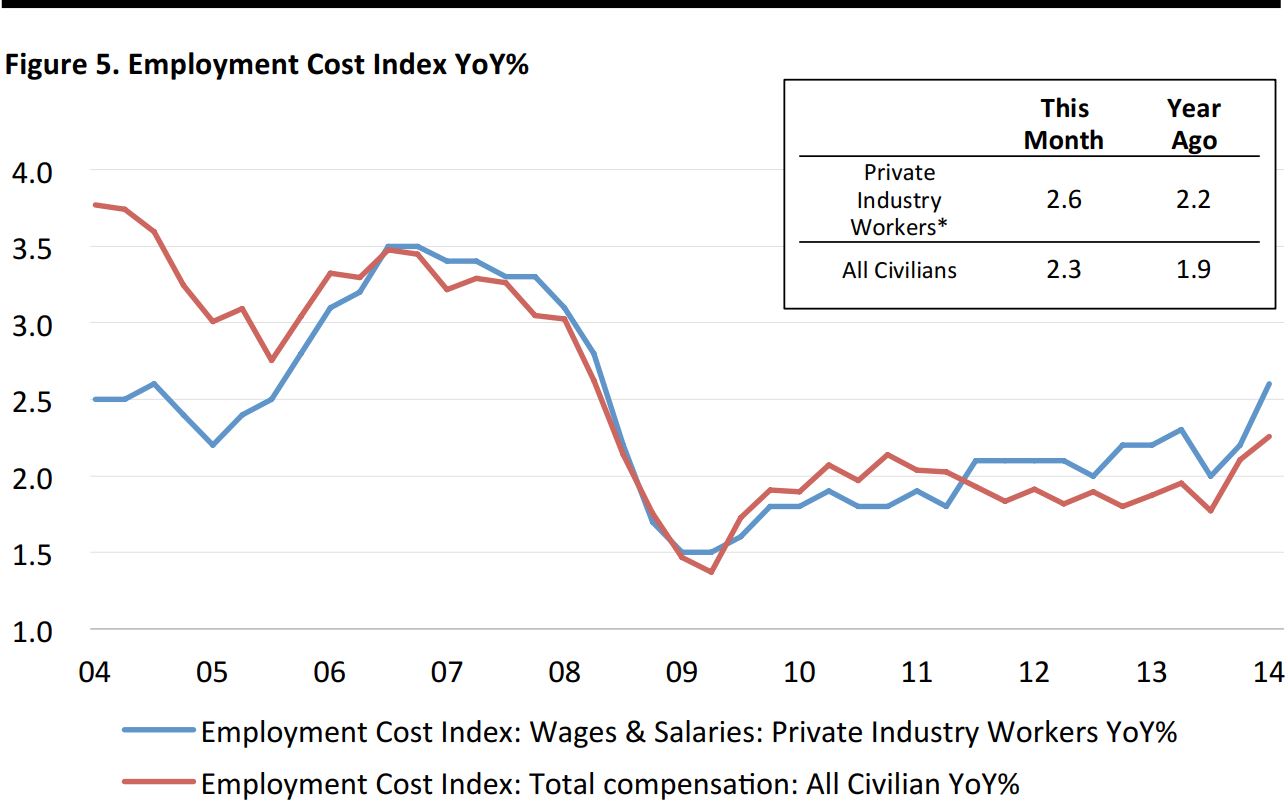

Source: US Department of Labor

- Showing a stronger recent pickup in wages than other income measures suggest

Through October 28, 2014

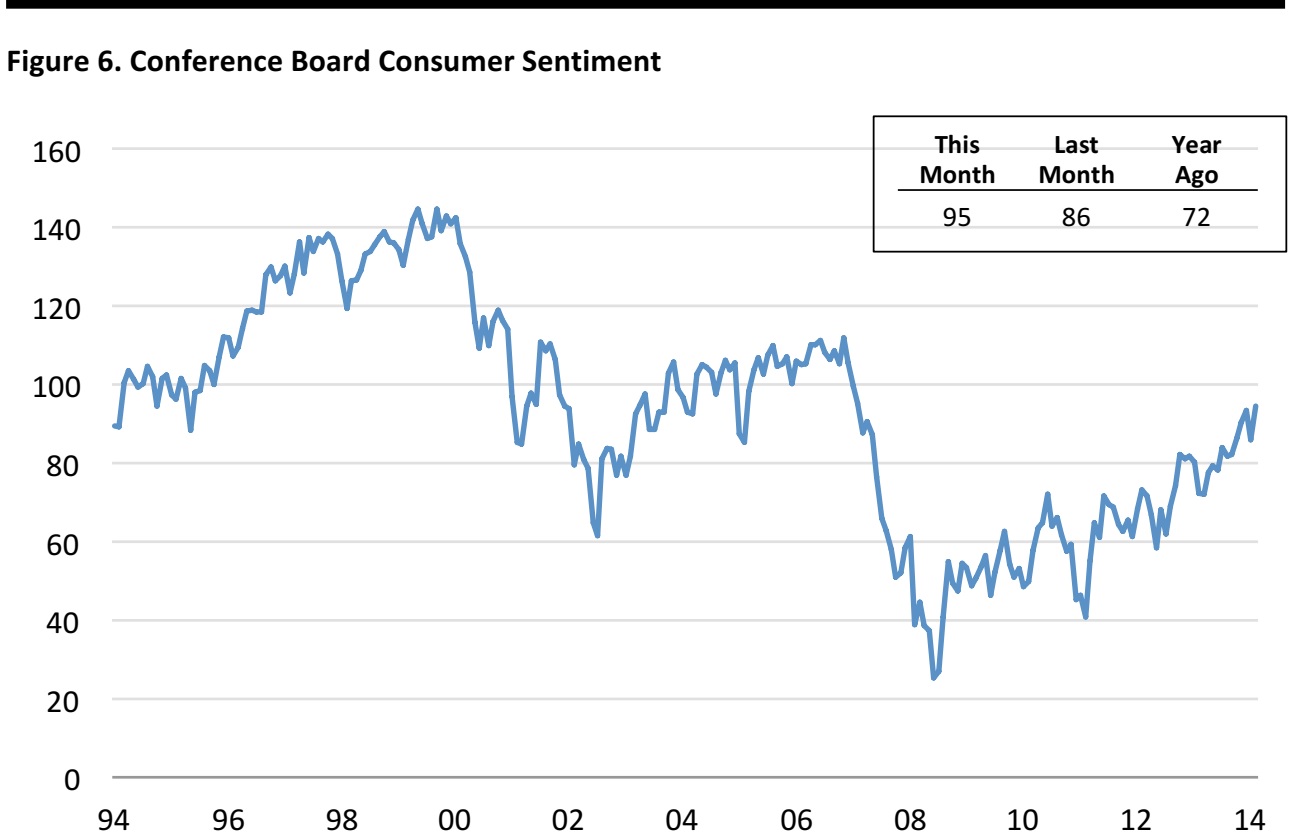

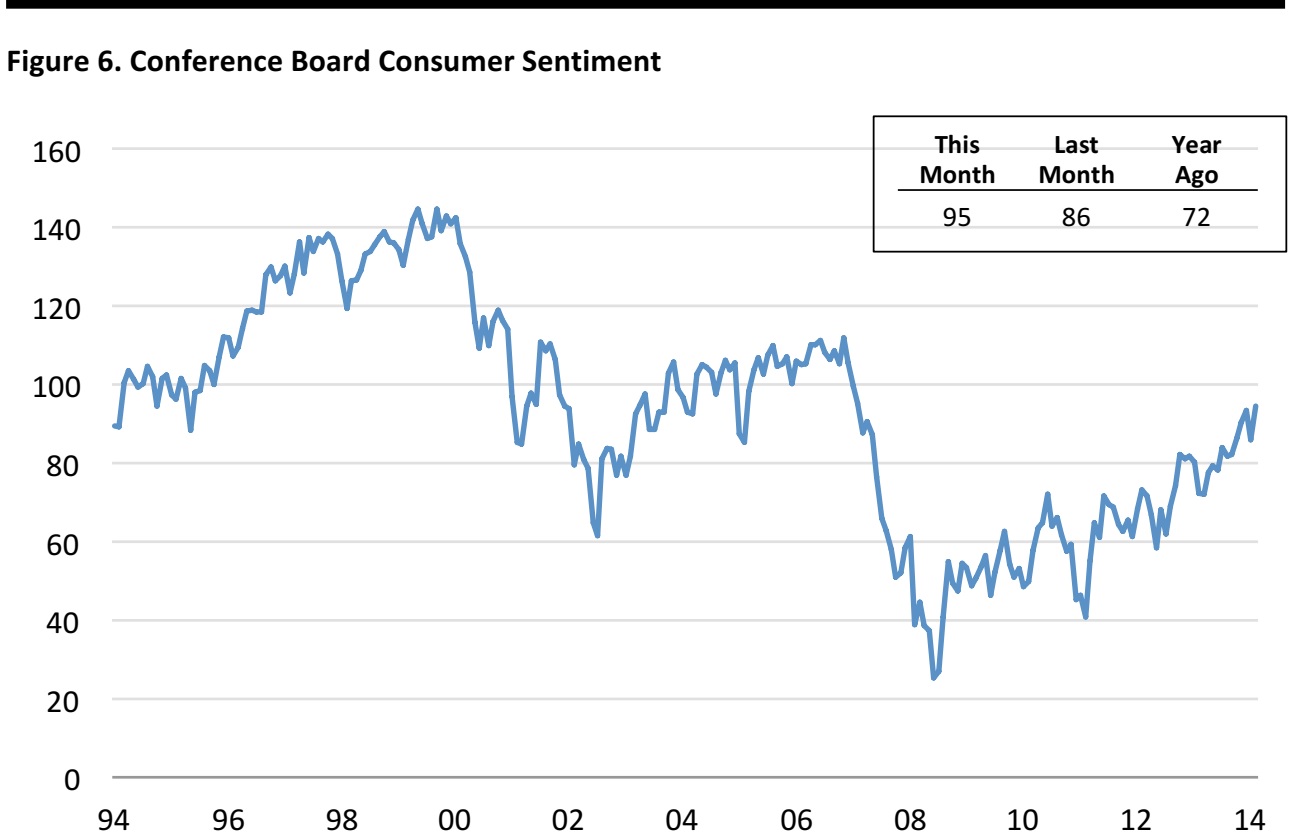

Source: The Conference Board

Consumer Sentiment Rebounds in October

- Conference Board sentiment was the best since October 2007

- Attributable to steady improvements in job market and economic activity

- A welcome sign for retailers this holiday season

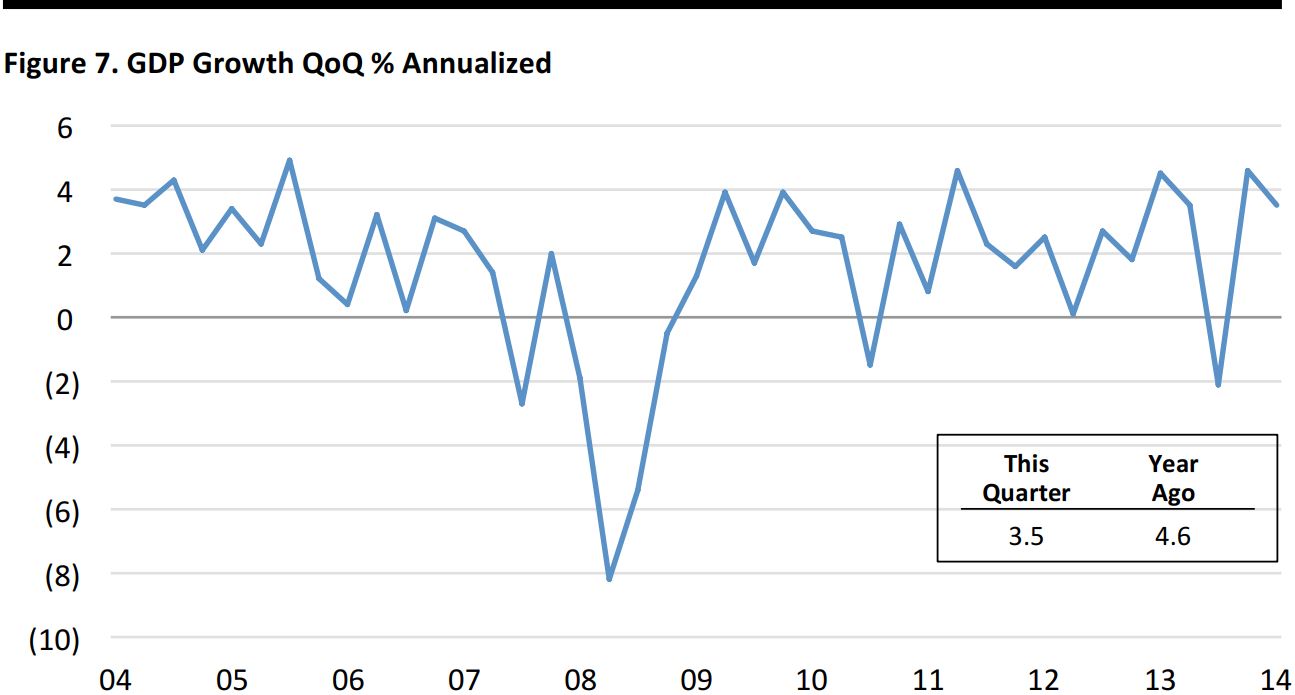

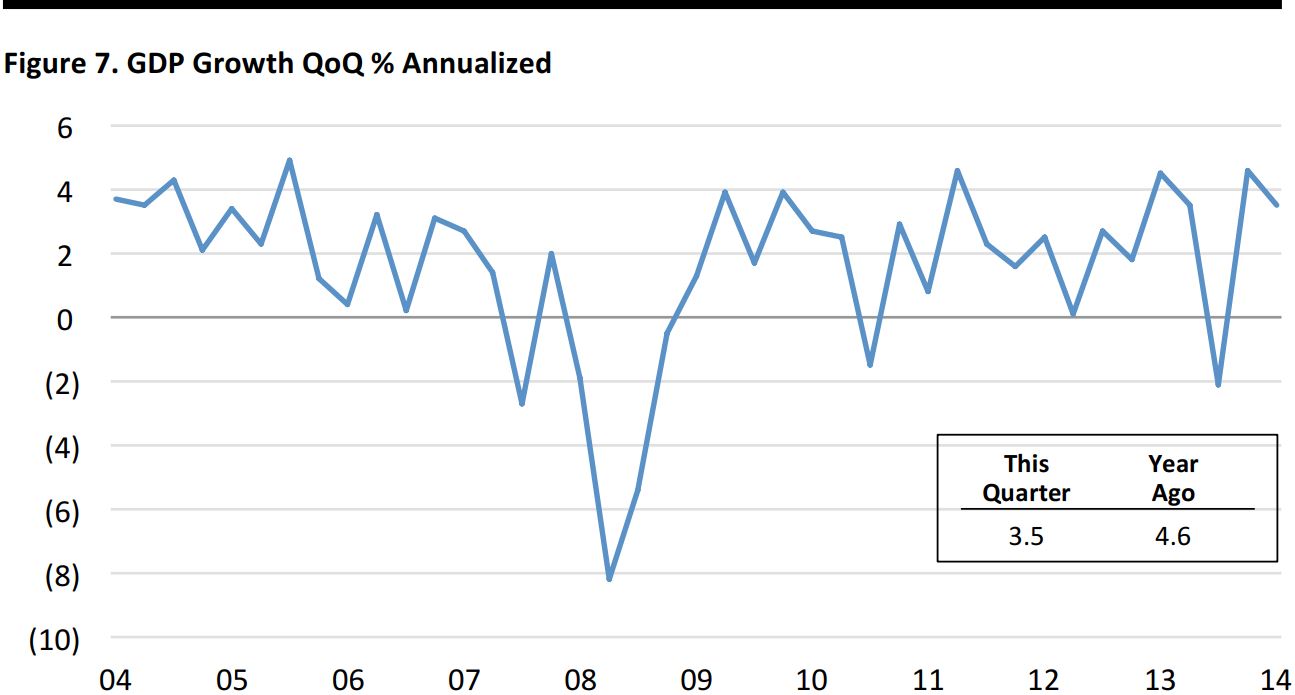

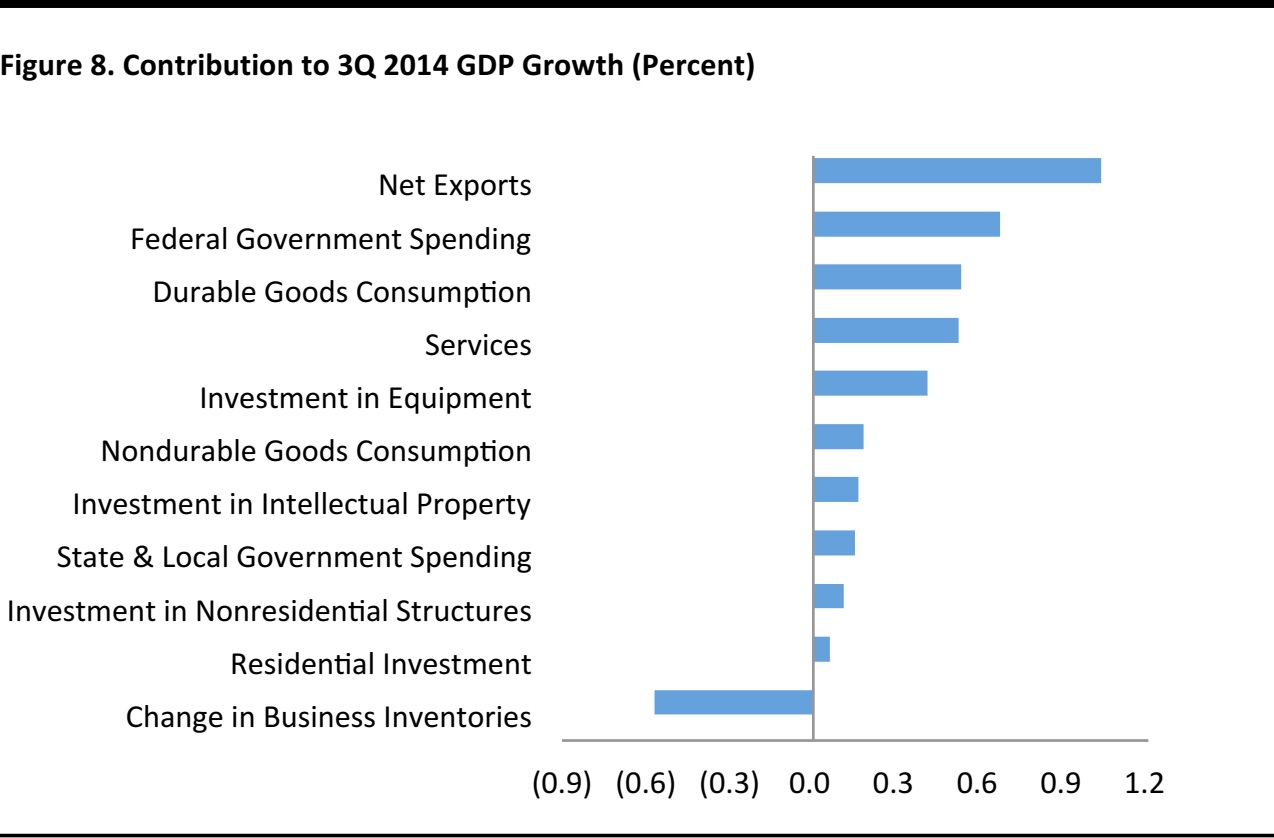

Through September 30, 2014

Source: Bureau of Economic Analysis

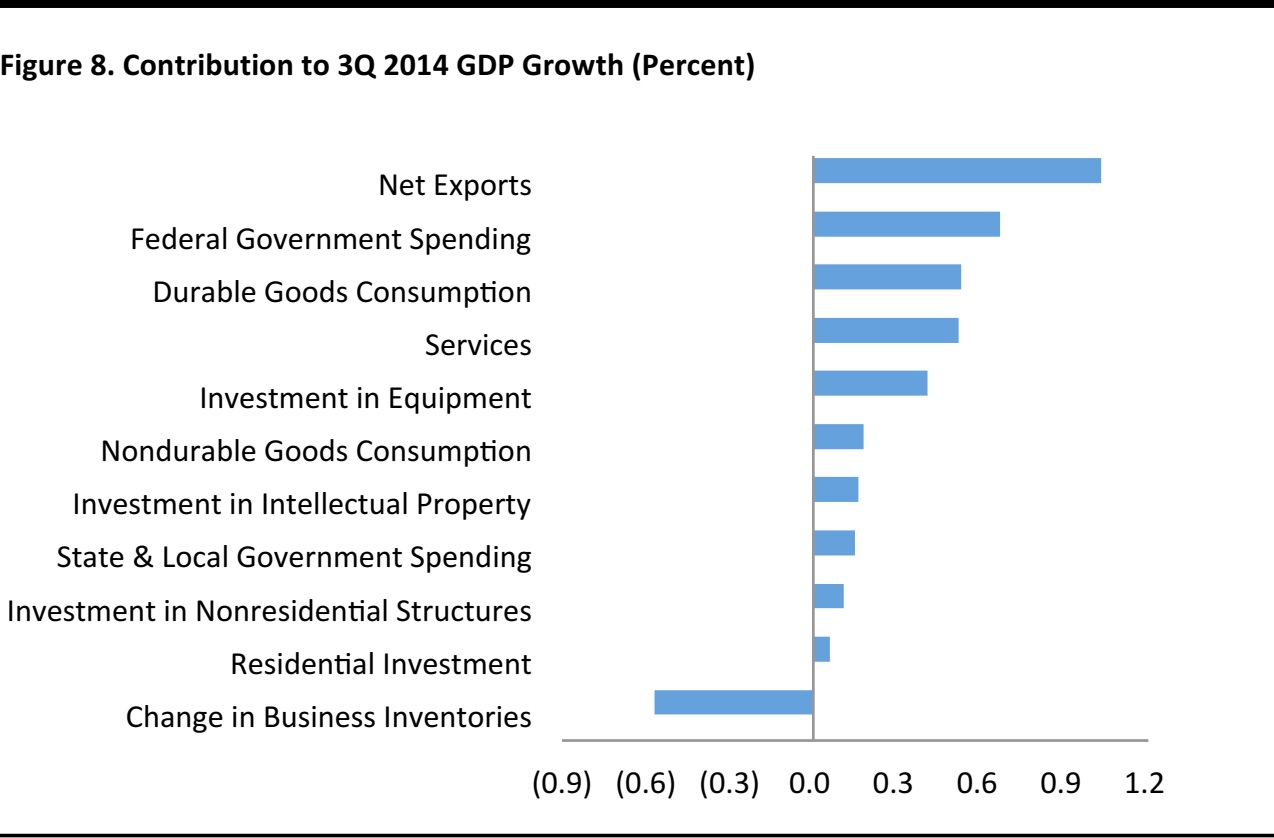

US Continues to Grow at Healthy Clip but Concerns Remain

- The economy grew at a solid pace, driven by an uptick in military spending and strong net exports (mostly from a drop in imports)

- Exports face headwinds from the recent rise in the US dollar vs. other major currencies

- Government outlays were boosted by military spending plus improving budget picture in cities and states

- Various measures of consumer spending, a major economic engine, remained lackluster

- Residential housing is still failing to generate meaningful momentum

Through September 30, 2014

Source: Bureau of Economic Analysis

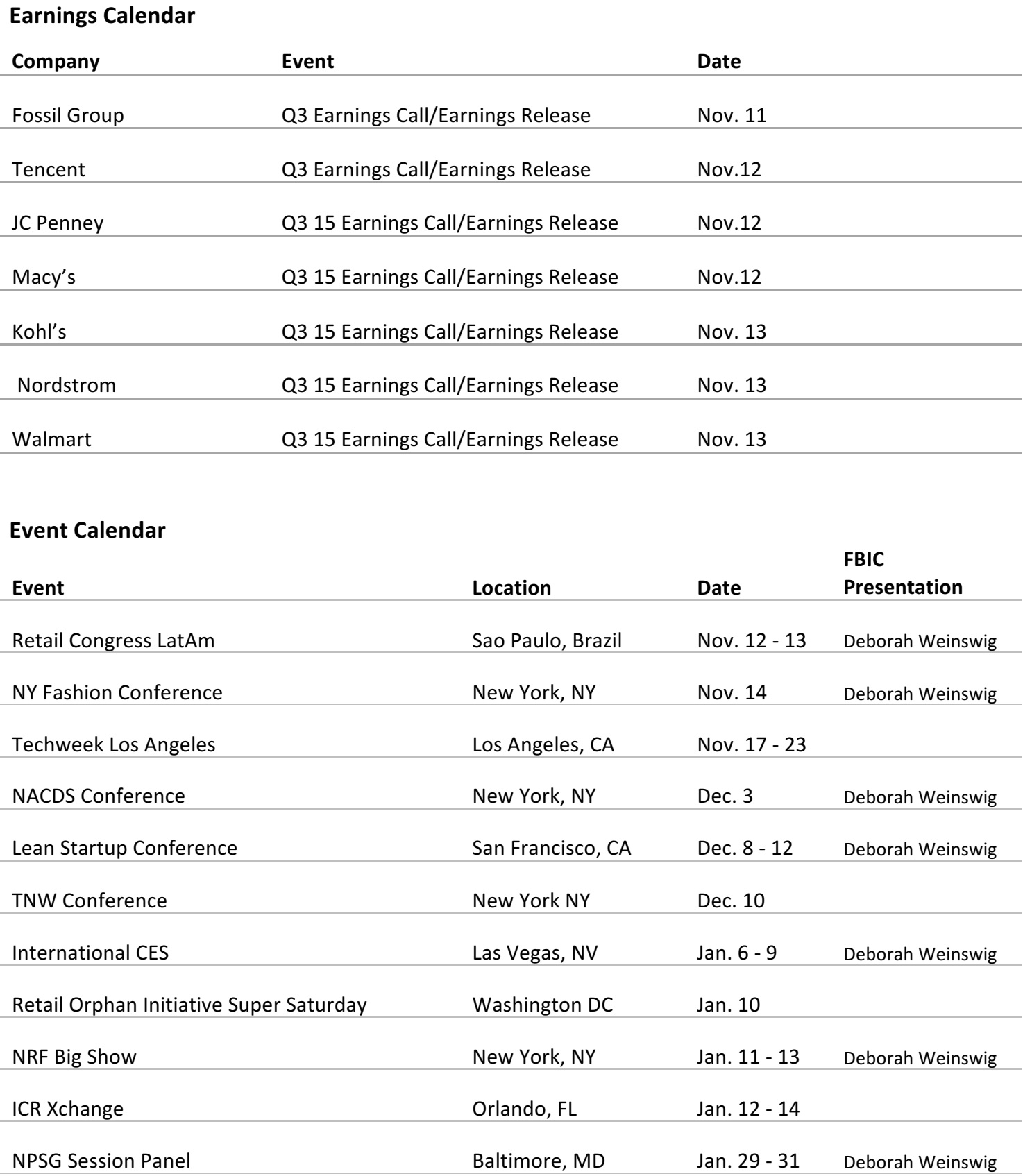

UPCOMING EVENTS

FROM THE DESK OF DEBORAH WEINSWIG

FROM THE DESK OF DEBORAH WEINSWIG

We attended this high-powered, informative event. Here are some of the key takeaways:

We attended this high-powered, informative event. Here are some of the key takeaways:

Q3 Earnings and Guidance Disappoint (October 23).

Despite a 20% revenue increase (to $20.9 billion) and modest 120-basis-point gross margin improvement (to 28.9%), Amazon (AMZN) disappointed investors on both the top and bottom line, as expenses for fulfillment, marketing, technology and content rose to a combined 29.8% of sales (+350 bps). North America operating income decreased 70%, to $88 million, and the international operating loss increased nearly 10-fold, from $28 million to $224 million. The GAAP net loss of $437 million, or (-$0.95) per share, compares with a $41 million loss, or (-$0.09) per share, and was after a $205 million income tax benefit. The balance sheet suffered as well, with an $806 million drop in cash to $6.9 billion, a 21% increase in inventory to $7.3 billion and a slowing of inventory turns to 8.9 from 9.2 in Q3 2013.

Trailing 12-month capital expenditures were up 0.8% YoY, to $4.6 billion, as Amazon invests in technology infrastructure, web services and additional capacity to support fulfillment operations. Amazon plans to open 15 sort centers in the US by yearend, offer same-day delivery in 12 cities and make Sunday delivery available for 50% of the US population. On the guidance front, Amazon projects Q4 net sales in the $27.3─$30.3 billion range, representing gains of 7%─18%, and an operating loss of $570─$430 million, which compares with operating income of $510 million in the same period a year ago. Following the disappointing earnings and guidance, shares of AMZN tumbled as much as 9.3% on the next day's trading session to a 52-week low of $284, and volume was elevated at 5 times normal trading. AMZN shares are down 23.3% year to date, ranking the stock among the worst performers in the S&P 500.

Q3 Earnings and Guidance Disappoint (October 23).

Despite a 20% revenue increase (to $20.9 billion) and modest 120-basis-point gross margin improvement (to 28.9%), Amazon (AMZN) disappointed investors on both the top and bottom line, as expenses for fulfillment, marketing, technology and content rose to a combined 29.8% of sales (+350 bps). North America operating income decreased 70%, to $88 million, and the international operating loss increased nearly 10-fold, from $28 million to $224 million. The GAAP net loss of $437 million, or (-$0.95) per share, compares with a $41 million loss, or (-$0.09) per share, and was after a $205 million income tax benefit. The balance sheet suffered as well, with an $806 million drop in cash to $6.9 billion, a 21% increase in inventory to $7.3 billion and a slowing of inventory turns to 8.9 from 9.2 in Q3 2013.

Trailing 12-month capital expenditures were up 0.8% YoY, to $4.6 billion, as Amazon invests in technology infrastructure, web services and additional capacity to support fulfillment operations. Amazon plans to open 15 sort centers in the US by yearend, offer same-day delivery in 12 cities and make Sunday delivery available for 50% of the US population. On the guidance front, Amazon projects Q4 net sales in the $27.3─$30.3 billion range, representing gains of 7%─18%, and an operating loss of $570─$430 million, which compares with operating income of $510 million in the same period a year ago. Following the disappointing earnings and guidance, shares of AMZN tumbled as much as 9.3% on the next day's trading session to a 52-week low of $284, and volume was elevated at 5 times normal trading. AMZN shares are down 23.3% year to date, ranking the stock among the worst performers in the S&P 500.

Hermès’ Chinese Brand, Shang Xia, Slow to Gain Traction (October 21). Shang Xia is not expected to break even until 2016, despite seven years of investment to date, including $2.6 million to open Shang Xia’s new Shanghai retail and VIP entertainment complex. Patrick Thomas, chairman of Shang Xia, expects the location, the largest of three stores, to generate ~$13 billion in three years. (Wall Street Journal)

Hermès’ Chinese Brand, Shang Xia, Slow to Gain Traction (October 21). Shang Xia is not expected to break even until 2016, despite seven years of investment to date, including $2.6 million to open Shang Xia’s new Shanghai retail and VIP entertainment complex. Patrick Thomas, chairman of Shang Xia, expects the location, the largest of three stores, to generate ~$13 billion in three years. (Wall Street Journal)

Uniqlo Targets Little China (October 29). Fast Retailing, parent of Uniqlo, says it will continue seeking growth in China, with focus on smaller cities. Uniqlo has 316 stores in 70 cities across China; more than 100 are located in tier-one cities of Beijing, Guangdong, Shanghai and Shenzen. Now Fast Retailing will open more shops in tiers two, three and four cities, as it views China as a key market in its plan to become the world’s largest apparel retailer by 2020.

(Inside Retail Asia)

Uniqlo Targets Little China (October 29). Fast Retailing, parent of Uniqlo, says it will continue seeking growth in China, with focus on smaller cities. Uniqlo has 316 stores in 70 cities across China; more than 100 are located in tier-one cities of Beijing, Guangdong, Shanghai and Shenzen. Now Fast Retailing will open more shops in tiers two, three and four cities, as it views China as a key market in its plan to become the world’s largest apparel retailer by 2020.

(Inside Retail Asia)

Hangzhou Eyes Online Free Trade Zone (November 2). Hangzhou, the capital of East China’s Zhejiang Province, will apply to the central government to set up an online free-trade zone in a bid to boost cross-border e-commerce, according to Tong Guili, a senior city official, at an e-commerce expo. Hangzhou has introduced 122 cross-border e-commerce enterprises since launching the cross-border e-commerce industrial part in July 2013. (Chinanews.com)

Hangzhou Eyes Online Free Trade Zone (November 2). Hangzhou, the capital of East China’s Zhejiang Province, will apply to the central government to set up an online free-trade zone in a bid to boost cross-border e-commerce, according to Tong Guili, a senior city official, at an e-commerce expo. Hangzhou has introduced 122 cross-border e-commerce enterprises since launching the cross-border e-commerce industrial part in July 2013. (Chinanews.com)

What to Expect for the Week of Nov. 10 ─15

What to Expect for the Week of Nov. 10 ─15