Web Developers

Source: National Association of Realtors (NAR)

FROM THE DESK OF DEBORAH WEINSWIG

As we write, Black Friday is imminent, and we have seen a greater build-up to the event than ever before in the US, as well as a newfound explosion of interest in the promotion over in the UK. “Holiday creep” is a theme common to both countries: As US retailers attempt to steal an advantage over one another, Black Friday has expanded from a post-Thanksgiving shopping day to a whole season of discounts. Meanwhile, in the UK, Black Friday has pulled forward Christmas shopping and is now threatening to turn into an extended promotional event.

As we write, Black Friday is imminent, and we have seen a greater build-up to the event than ever before in the US, as well as a newfound explosion of interest in the promotion over in the UK. “Holiday creep” is a theme common to both countries: As US retailers attempt to steal an advantage over one another, Black Friday has expanded from a post-Thanksgiving shopping day to a whole season of discounts. Meanwhile, in the UK, Black Friday has pulled forward Christmas shopping and is now threatening to turn into an extended promotional event.

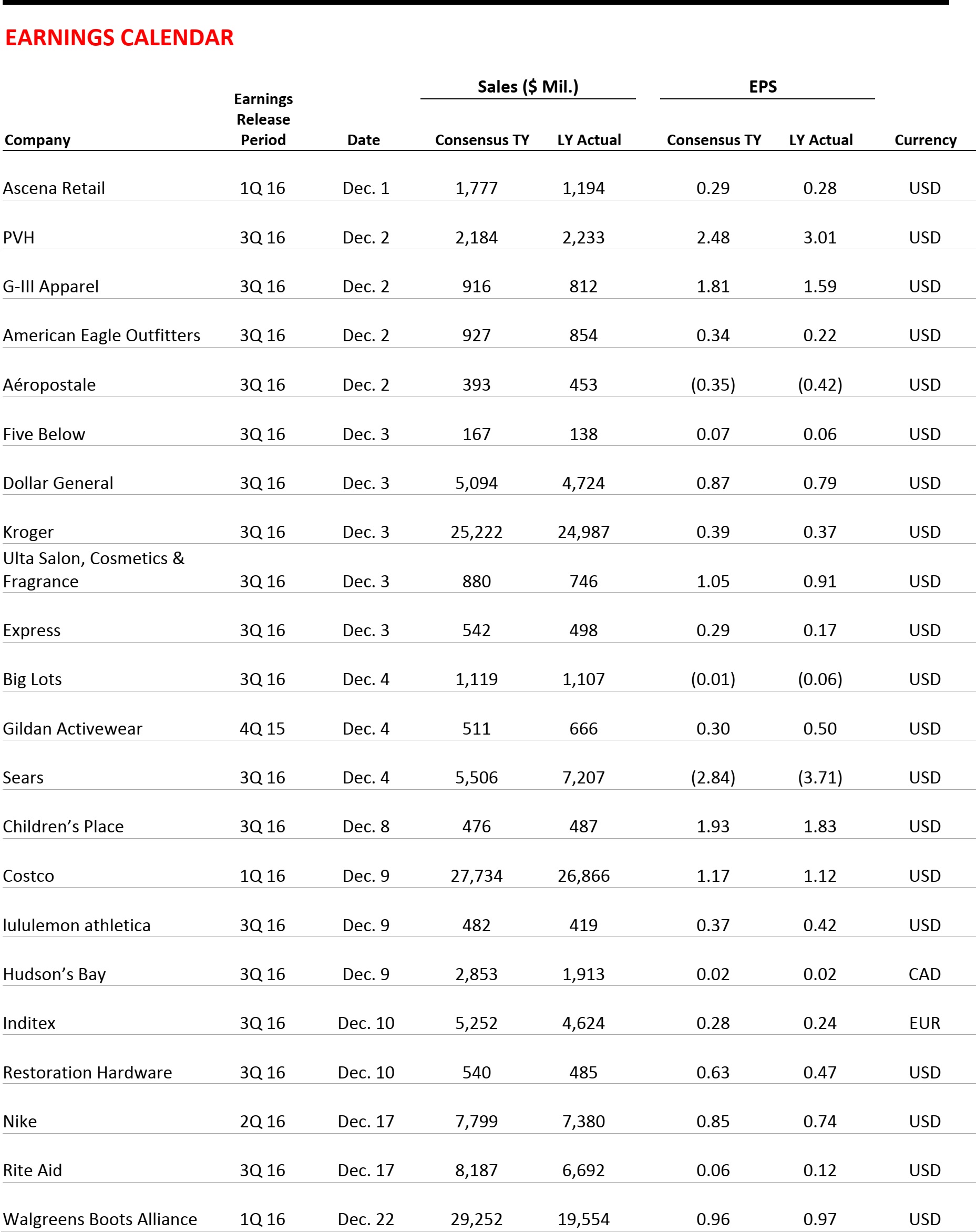

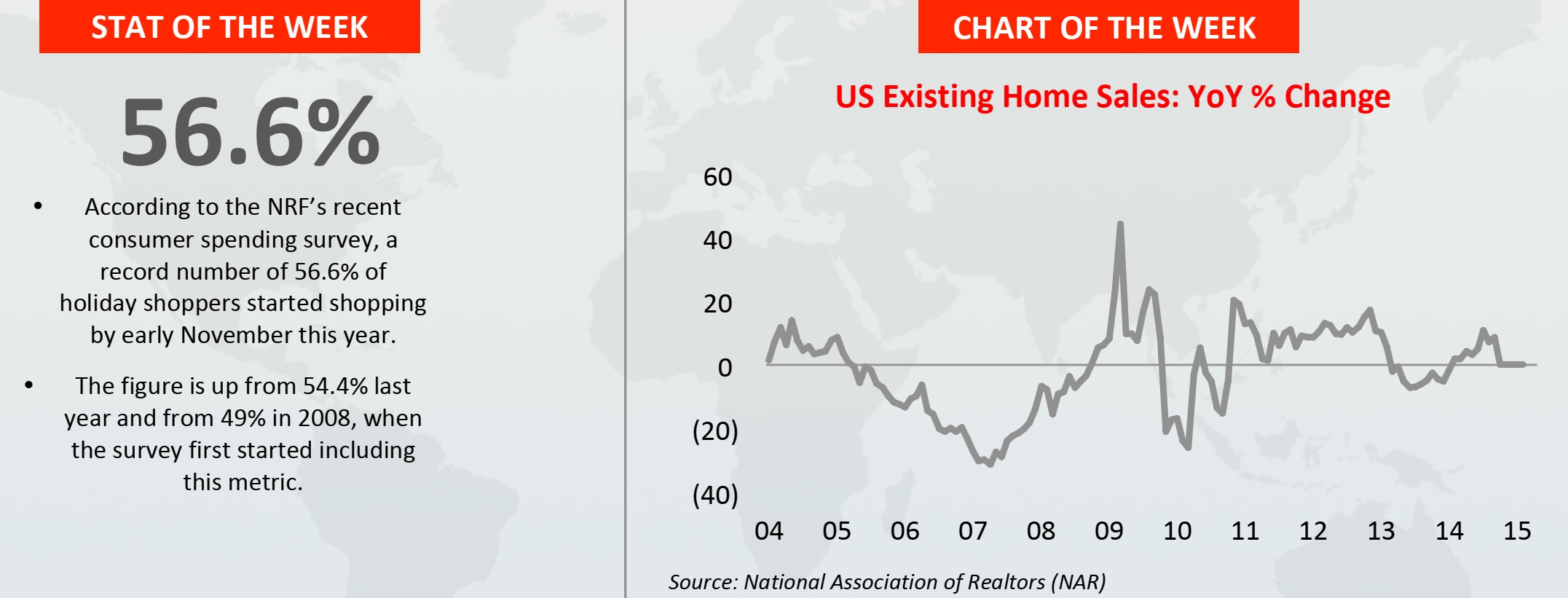

In the US, Black Friday Is No Longer Enough…

More Americans than ever are starting their holiday shopping well before Black Friday, new research finds. According to the NRF’s recent consumer spending survey, a record 56.6% of holiday shoppers started shopping by early November this year, up from 54.4% last year and 49.0% in 2008, when the survey first started including this metric. Many retailers are enticing consumers to shop early instead of concentrating their spending activities on Black Friday. For example, this year, a number of retailers released their Black Friday promotions earlier than last year. Walmart made its Black Friday playbook available two weeks earlier than it did in 2014, as did Lowe’s and Sears. At Target, Black Friday deals start on Thanksgiving Day, whereas last year, they started at 1 am on Friday. Amazon has extended its Black Friday sales to two weeks, starting 12 days before Black Friday. Overall, the dominance of Black Friday single-day sales continues to wane as retailers spread their promotions across the Thanksgiving weekend and emphasize deals throughout the entire month of November. The result has been an annual decline in Thanksgiving weekend retail sales in both 2013 and 2014, according to the NRF. And, given the earlier promotions this year, the declining trend is likely to continue. The negative consequence for retailers is that consumers have begun to expect that Black Friday promotions will be extended: American shoppers have now been conditioned to expect near-constant discounts, which makes them loathe paying full price in retail.…Which Should Provide a Lesson for the UK, Where Black Friday Is New

Over in the UK, meanwhile, Black Friday is a new retail event—but one that is probably entrenching similar expectations of discounting among holiday shoppers. Amazon launched Black Friday into the UK market in 2010, but the event really exploded in 2014, when a number of retailers jumped on board. Much retail demand was pulled forward from December into November, distorting traditional trading patterns and likely cannibalizing some full-price sales. The unexpected boom in demand resulted in widespread chaos—from fights in stores to website crashes to delayed orders—as retailers and couriers in the UK struggled to cope. Black Friday is expected to be bigger still this year, and we are seeing three types of responses from UK retailers hoping to cope better with the event: ensuring they are more prepared, softening the effects by spacing out discounts over a longer period instead of running them for just one day and pulling back on Black Friday promotions altogether. The problem is that spacing out promotions over a longer period is likely to result in an echo of what we are seeing in the US. Black Friday, which has only just taken hold in the UK, could end up as an extended period of pre-Christmas discounting in British retail. It may be too late to scrub Black Friday from the UK retail calendar altogether (although Walmart’s subsidiary Asda has decided to forgo the event this year), but it may be to retailers’ advantage to try to minimize shopper expectations of discounting. Once shoppers become accustomed to prolonged discounting, the path back to full-price sales can be challenging. This is the negative legacy of Black Friday. Keep an eye out for our series of Black Friday reports, available on www.fbicgroup.com.

- Existing home sales declined 3.4% to an annual rate of 5.36 million units. September number remained unchanged. At current pace, it would take 4.8 months to clear housing inventory on the market, up from 4.7 months in September.

- With inventories tightens, the median house price increased 5.8 % from a year ago to $219,600, marking the 44th straight month of year-on-year gains.

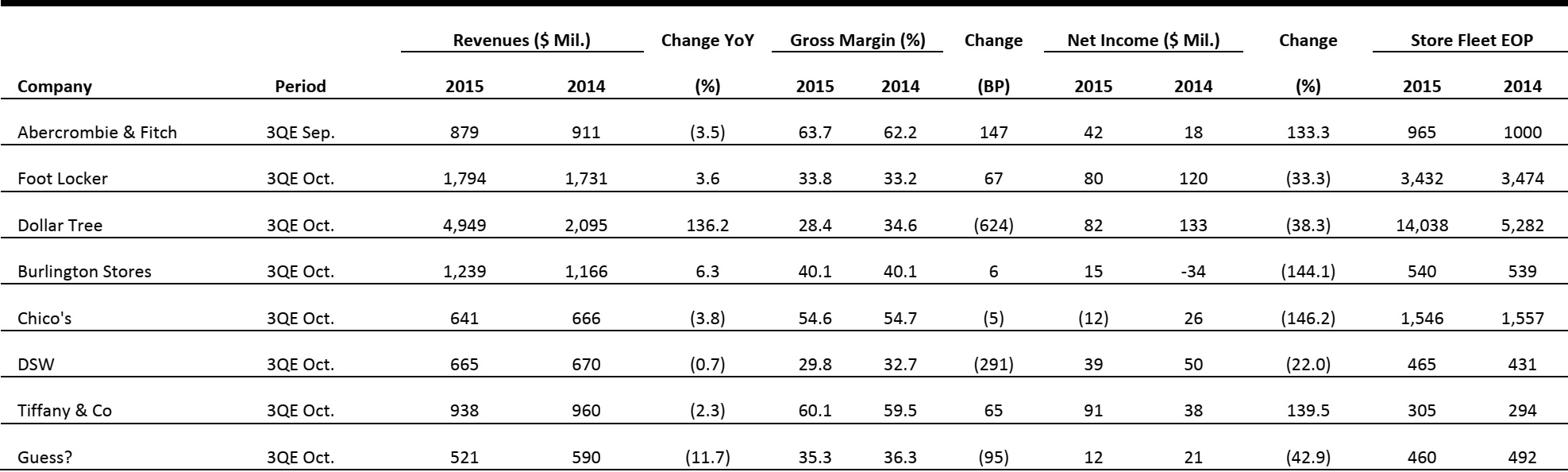

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- From Friday, November 20, through the day after Thanksgiving, Amazon will offer Black Friday deals in five-minute increments this year, instead of every 10 minutes as it did last year, the company said. The online retailer will also offer up to 10 deals of the day on both Thanksgiving and Black Friday.

- Additionally, it will offer more than 150 “lightning deals” exclusively on its mobile shopping app, in an effort to encourage shoppers to download the app. And to increase customer loyalty, the company is offering Amazon Prime members access to many deals 30 minutes before it offers them to the general public.

- Walmart announced that it will begin Cyber Monday earlier this year by launching the first of its online deals on more than 2,000 items (four times the number of discounts last year) at 8 pm ET the Sunday night before. The company noticed a surge in online traffic on the Sunday after Thanksgiving, and so decided to start its e-commerce specials that night, said Fernando Madeira, President and CEO of Walmart.com..

- Walmart and other retailers are spreading out discounts over a longer period of time this holiday season. The NRF expects online sales to increase by 8% this year, to about $105 billion, outpacing the growth of brick-and-mortar sales.

- Target said it will expand tests of its food-shopping experience to 25 stores in the Los Angeles area early next year. The tests—which include expanding the selection of local, seasonal and healthy food offerings and changing the design and decor in the retailer’s food aisles—were initially launched in Chicago, and resulted in consistent boosts in sales, Target Chairman and CEO Brain Cornell said.

- Cornell said the company is “very pleased” with test results of localized assortments of food and beverage offerings in Chicago, where the company is “consistently seeing” comparable store sales lifts of 100 to 200 basis points. In Target’s third-quarter financial results, Cornell said wellness items in the food category were the best performers.

- Private-equity firm CVC Capital Partners and the Canada Pension Plan Investment Board (CPPIB) are nearing a deal to acquire Petco Holdings for between $4.5 billion and $4.7 billion, including debt, according to people familiar with the matter. The San Diego–based pet retailer operates more than 1,400 stores in 50 US states, and had approximately $4 million in sales in the 12 months ending January 31. In August, Petco filed papers for an IPO and also put itself up for sale.

- The US pet industry, which includes food, supplies, veterinary services and nonmedical services, was a $74 billion market in 2014 and is projected to grow to $92 billion in 2019, according to Petco’s IPO registration document. CVC and the CPPIB have secured more than $3 billion in debt financing for the acquisition. The deal is expected to close in early 2016, and comes a year after a consortium led by private-equity firm BC Partners agreed to take rival PetSmart private for more than $8.2 billion.

- Lowe’s named Marci Grebstein Chief Marketing Officer, effective immediately, to replace Thomas Lamb, who left the company after nearly 17 years. Grebstein joined Lowe’s earlier this year as Vice President of Advertising to lead the US advertising strategy and marketing operation. She will oversee the marketing and communications strategy to consumers. “Marci’s deep experience in retail marketing will help Lowe’s continue to create more personalized and relevant communications to consumers,” said Lowe’s Chief Customer Officer Michael Jones.

- Erin Sellman was named Senior Vice President of Strategy, Insights and Planning. She will be responsible for corporate strategy, consumer insights, and the planning and process organization. Sellman joined Lowe’s in 2004 and recently served as Vice President of Strategy and Insights. “Erin’s innovative thinking and data-driven insights will help Lowe’s continue to develop effective strategies for the future and further enhance the customer experience across all consumer touch points,” said Jones.

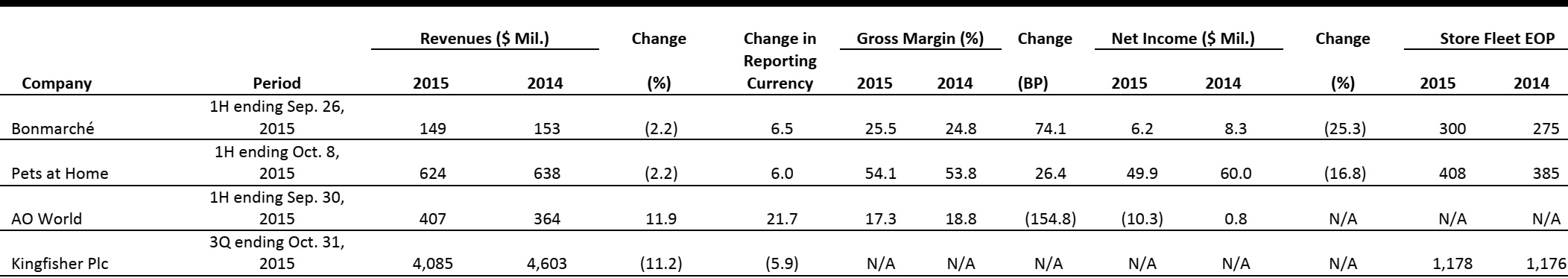

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

- Total retail sales in the UK rose by just 0.8% year over year in October. Clothing specialists’ sales grew by 2.0%, with small retailers mainly driving the growth, while large retailers fell by 1.3%, according to the Office for National Statistics. Other categories that contributed to the upward trend were furniture stores (up 5.2%), book and newspaper retailers (up 7.6%) and Internet pure plays/mail order retailers (up 13.8%)

- Grocery retailers’ sales declined by 1.8% year over year—the worst monthly performance in over a decade, except for April 2015, when sales were affected by the timing of Easter. Other categories that declined were electrical goods specialists (down 0.5%), automotive fuel retailers’ sales value (down 3.6%) and floor coverings (down 26.6%). The value of online sales increased by 11.2% year over year, and constituted a 12.7% share of the UK’s total retail sales.

- Amazon Germany’s employees will reportedly go on strike during the Christmas holiday period, according to Verdi, the German labor union. The organization did not confirm which distribution centers are likely to be affected..

- The labor union wants Amazon to meet its demands of adhering to the wage requirements in the retail industry. The retailer feels its employees are part of the logistics industry, where wages are lower than in retail and, hence, reportedly refuses to meet the union’s demands.

- Apple’s British customers can now buy Apple products online and pick them up from a store instead of having them delivered. The service is similar to one already in use by several retailers in the UK.

- A customer can buy through Apple’s online store and choose to collect the product rather than having the purchase delivered. The customer can then select the preferred store from which she would like to pick up the purchase. If the shopper is unable to pick it up, she can nominate someone else to do it, as long as the person has proof that he or she has been authorized by the original shopper to collect the product.

- Media-Saturn’s same-day delivery service has reached most of Germany. On November 19, the company announced the expansion of the service to approximately 240 Media Markt stores and 155 Saturn stores, making same-day delivery available to over 80% of the German territory. The service was launched by the company in May 2014, initially in seven German cities. Gradually, same-day delivery was added to other Media Markt and Saturn outlets.

- Wolfgang Kirsch, CEO of Media-Saturn, said that offering the option of receiving same-day delivery within three hours from placing the order is a crucial part of the company’s multi-channel strategy, which aims to deliver a seamless shopping experience to its customers in order to compete against Amazon and other players in the German market.

- Argos and Homebase owner Home Retail Group saw its shares surge by up to 7.4% on November 23, after reports that private-equity companies are vying to take it over.

- Several industry experts have reportedly been asked to advise on potential bids for Home Retail, according to The Sunday Times. The potential acquisition is valued at £1 billion (US$1.6 billion), but before the jump in shares, the company’s value was about £841 million (US$1.34 billion). Interest in the company’s takeover was sparked after it issued a shock profit warning in October, which it blamed on the volatile nature of Black Friday and Christmas trading.

ASIA TECH HEADLINES

- NumberMall, a startup that helps offline merchants sell things online, just announced the acquisition of BankSmarts for an undisclosed sum.

- Acting as a payment gateway, NumberMall allows merchants to process credit top-ups, bill payments and bus tickets, among other things. With the acquisition of BankSmarts, an analytics platform, merchants can now analyze customers’ behavior based on their purchases.

- On-demand motorbike taxi app GrabBike, a unit of Southeast Asian mobile transportation giant GrabTaxi, has announced the launch of its first door-to-door courier service, GrabExpress, in Jakarta.

- GrabExpress is a part of GrabTaxi, which recently secured US$400 million in funding from China Investment Corp. With a valuation estimated to be over US$1.6 billion, it has also received funding from SoftBank, Tiger Global Management, Vertex Venture Holding, CIC and other investors in the past.

- Following rumors earlier this month that Alibaba was investing in the SCMP Group (first noted by China Daily), Bloomberg now reports that “discussions are at an advanced stage,” and that “a signing ceremony will be announced soon.”

- Wang Xiangwei, SCMP’s Editor-in-Chief, has come under scrutiny before, for allegedly downplaying certain stories involving Mainland China. An association with China’s Alibaba may lead some to wonder if editorial policy will be influenced as well.

- The Indian IT industry is likely to hit $225 billion in revenue by 2020 and $350 billion by 2025, and the share of digital technology investment in cumulative expenditures is expected to rise to 60% in 10 years’ time.

- India is the world’s largest sourcing destination for the IT industry, accounting for approximately 67% of the $124–$130 billion market. The industry employs about 10 million people, accounting for more than 50% of the jobs created in the technology sector in the last decade.

- Earlier this month, Toyota announced that it would establish the Toyota Research Institute in Silicon Valley to advance its artificial intelligence (AI) and robotics research. The carmarker will inject $1 billion over the next five years, adding to a $50 million investment in AI research it made with MIT and Stanford in September.

- Besides autonomous driving and its industrial automation infrastructure, Toyota has also specifically mentioned its interest in developing assistive technologies to help the elderly. The company is already developing a Human Support Robot to coexist with family members in the home to improve living conditions and overall quality of life.

LATAM RETAIL HEADLINES

- Latin American consumers are increasingly going to shopping malls for reasons other than shopping: meeting friends, visiting restaurants, working out, seeing a movie or going to the spa.

- In a recent survey by FT Confidential Research, 79.1% of respondents in Colombia saw a movie at a mall in the third quarter of 2015, versus 76.8% of Peruvians and 76.6% of Mexicans.

- E-commerce leader Avenida raised US$30 million in a series C round led by Naspers, with participation from Tiger Global (both firms are returning investors). This boosted Avenida’s total capital raised so far to US$52 million.

- The company was launched in 2013 after its cofounders realized that Argentina had no pure-play e-commerce business with its own warehouses and in-house logistics system.

- The Central Bank of Brazil’s IBC-Br Index, which is used as a proxy for GDP, showed that economic activity fell by 6.2% year over year in September.

- A contraction in the third quarter would mark the third in a row for Brazil. Its economy contracted by 0.7% in the first quarter and by another 1.9% in the second quarter.

- Shares of Chile’s Ripley Corp. climbed 35% following a report in the Mexican newspaper Excelsior that El Puerto de Liverpool, Mexico’s largest retailer, would buy a 50% stake in Ripley.

- Ripley, which also operates banks and offers credit cards in the Andes, said in a filing that it is constantly in talks with other global retailers

- Tommy Hilfiger held a star-studded party to celebrate the opening of two new stores in São Paulo, which are operated in partnership with InBrands.

- The two new stores include a new flagship on the upscale Rua Oscar Frere, and will increase the Hilfiger store count to more than 30 in Brazil