FROM THE DESK OF DEBORAH WEINSWIG

It’s Thanksgiving Time…Pass the Stuffing and Get the Credit Cards Ready

This Thursday is Thanksgiving Day in the US, always falling on the fourth Thursday of November, a time when families gather and eat traditional foods such as turkey, stuffing, cranberry sauce and pumpkin pie, and give thanks for the things that went well in their lives that year. Canadians, on the other hand, have already celebrated their Thanksgiving, which falls on the second Monday in October. While Americans trace their celebration back to a good-harvest celebration in 1621 in Plymouth, Massachusetts, the holiday likely stems from earlier autumn harvest festivals in Europe, and there are similar types of holidays around the world.

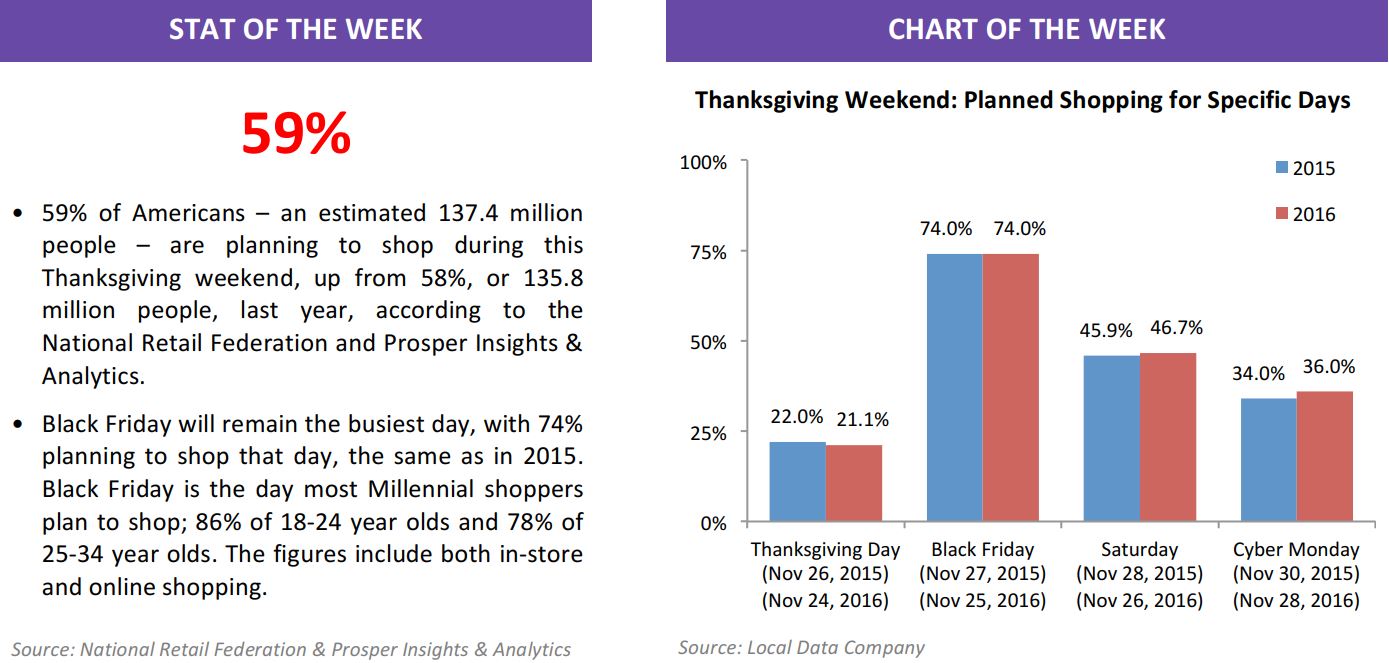

With Thanksgiving come other quintessentially American activities, such as the need to watch non-stop football games – both national and college teams – starting on Thanksgiving Day and throughout the weekend. Then there is the annual shopping frenzy that used to start the day after Thanksgiving (Black Friday), but has recently seen stores opening on Thanksgiving Eve and deals beginning even earlier. Stores used to abide by a tacit agreement to not display holiday decorations until after Thanksgiving. However, times have changed and the decorations (and holiday music) come out much sooner, just like holiday shopping is no longer confined to the post-Thanksgiving period. Stores used to offer “doorbuster” deals in the early morning of Black Friday, when crowds would assemble and actually press on store front doors, threatening to break them in. However, with the advent of ecommerce and mobile commerce, we consumers can get many of the same deals without having to get up early, leave our sofas and brave the cold, and these deals are increasingly getting as good as, or even better than, those offered on Black Friday.

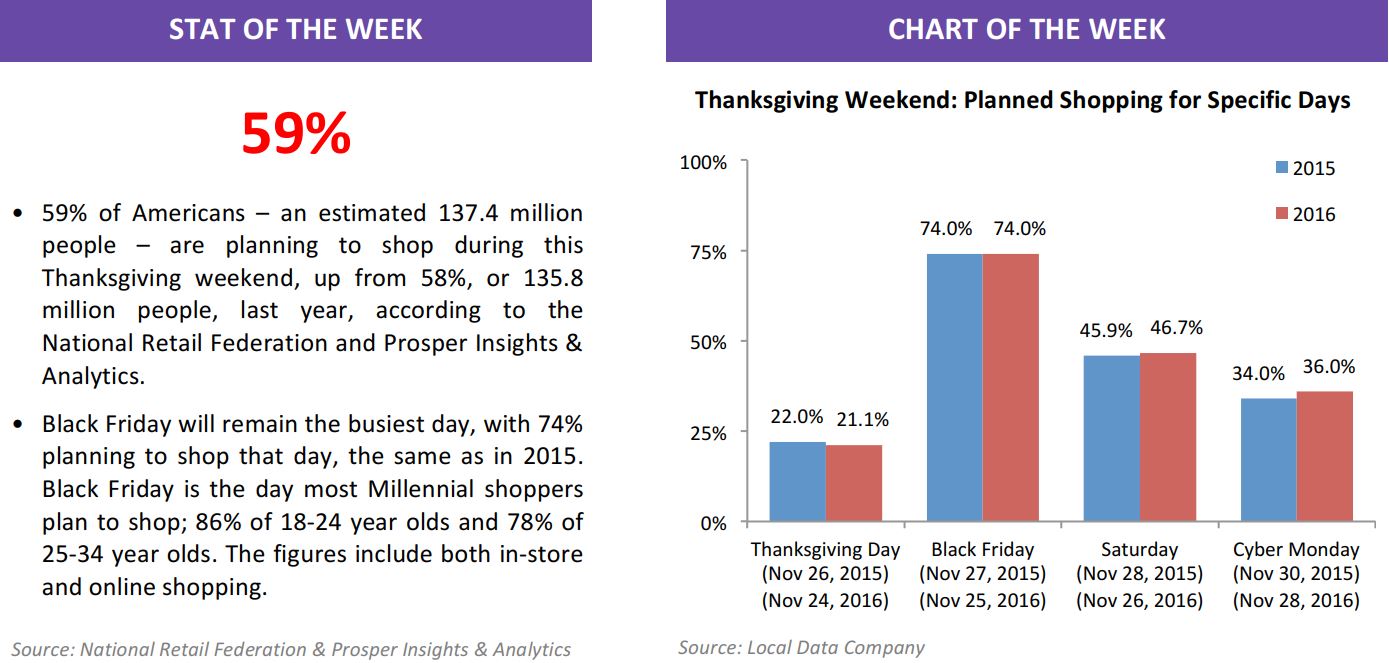

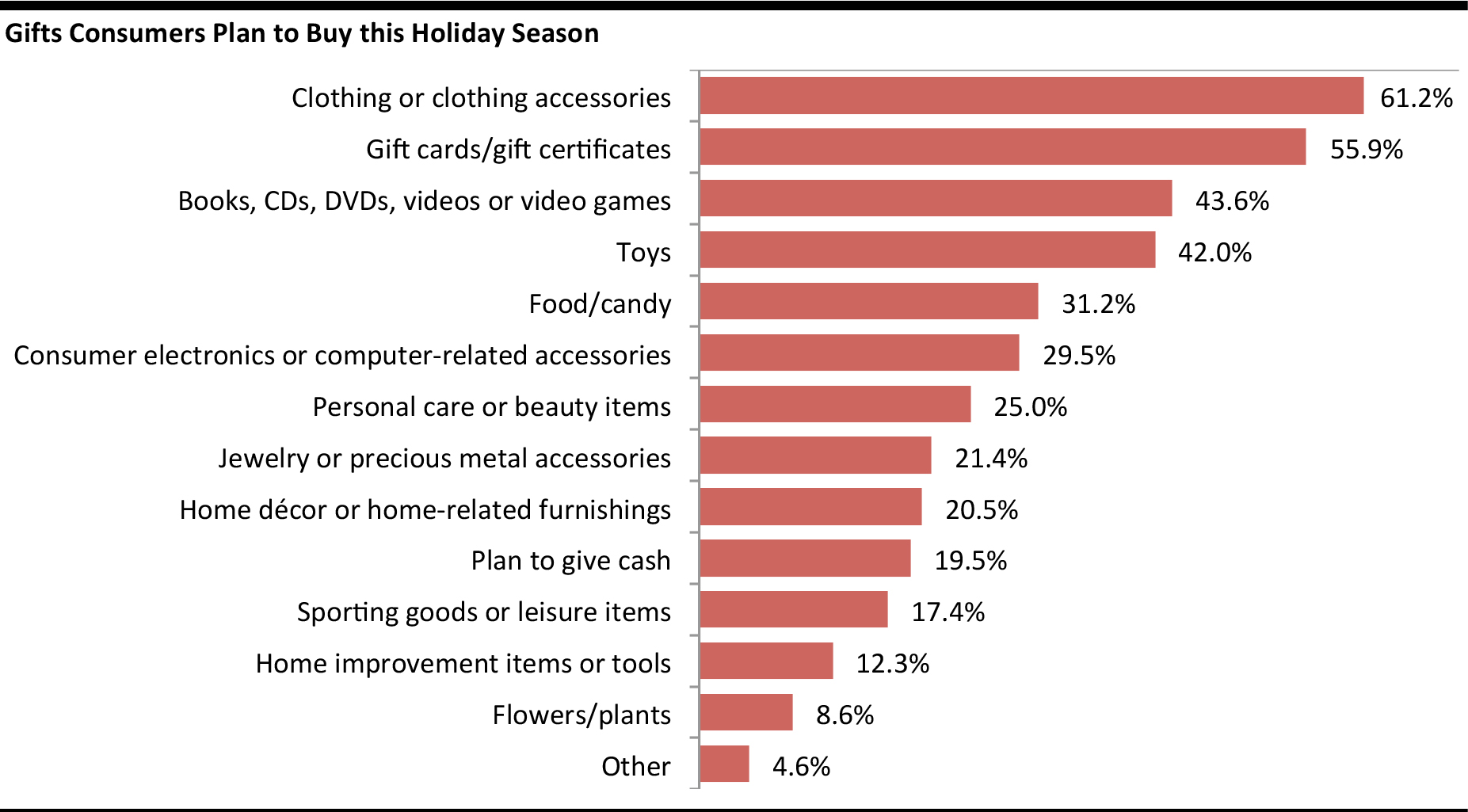

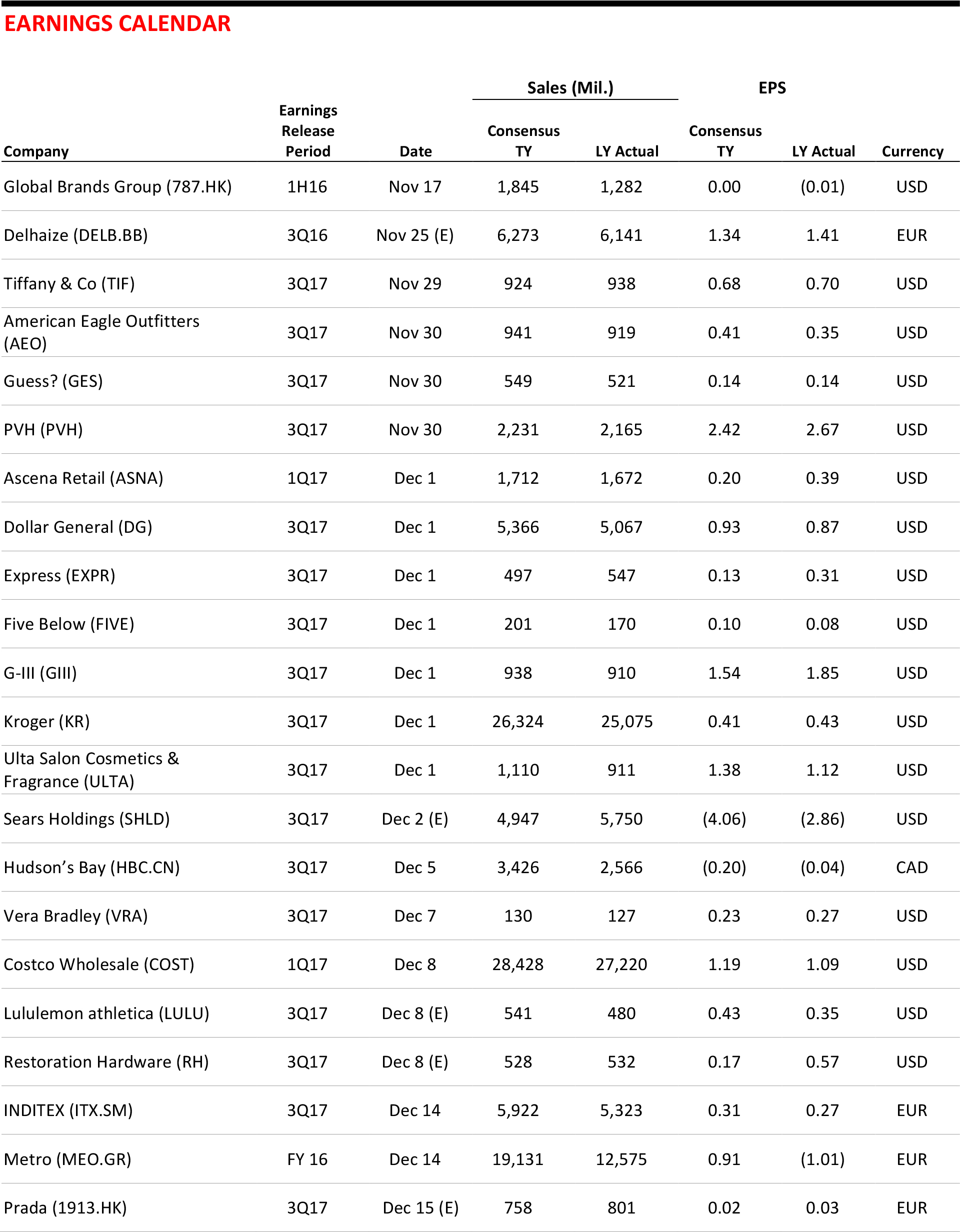

The National Retail Federation recently published the results of a survey, conducted by Prosper Insights & Analytics, that reported that more than half (55.7%) of shoppers had already begun their holiday shopping. This figure seems understandable, given all the preceding shopping opportunities such as Amazon Prime Day, Back to School and Singles’ Day. The good news here is that 44.3% of the respondents have not yet begun shopping, so they will likely begin to mobilize. Moreover, the survey reported that only 3% of those surveyed had finished their shopping, so the remaining 97% still has more shopping to do. The graph below shows the top gifts that consumers plan to buy this holiday season.

Source: NRF November Holiday Survey, conducted by Prosper Insights & Analytics

It is interesting that gift cards ranked second in the survey, which estimates spending on gift cards of $27.5 billion this year, up 6% from $26.0 billion last year. While it is a challenge to predict the hot toys each holiday season, Barbie already ranks highest among gifts for girls for the second consecutive year, and Lego tops the list again for boys.

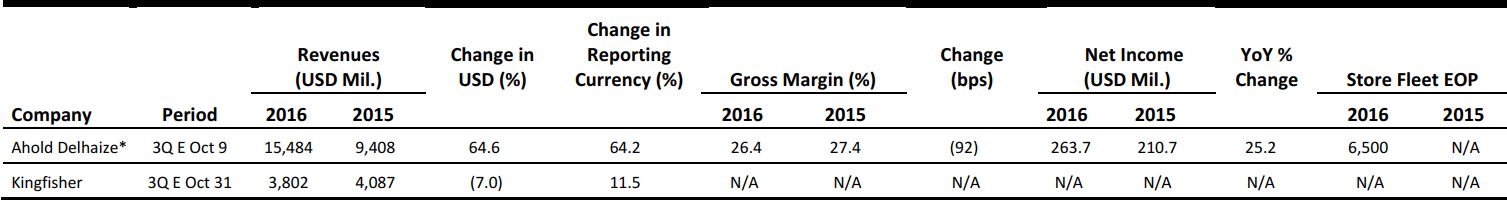

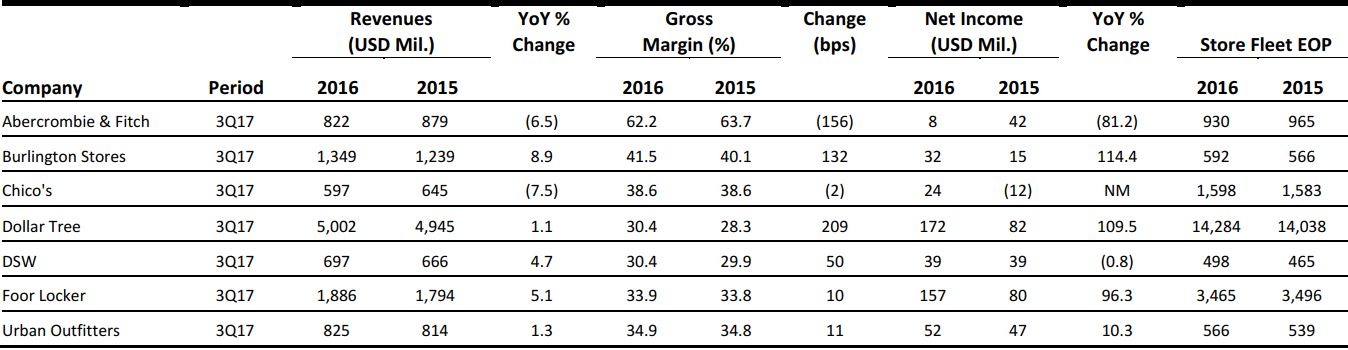

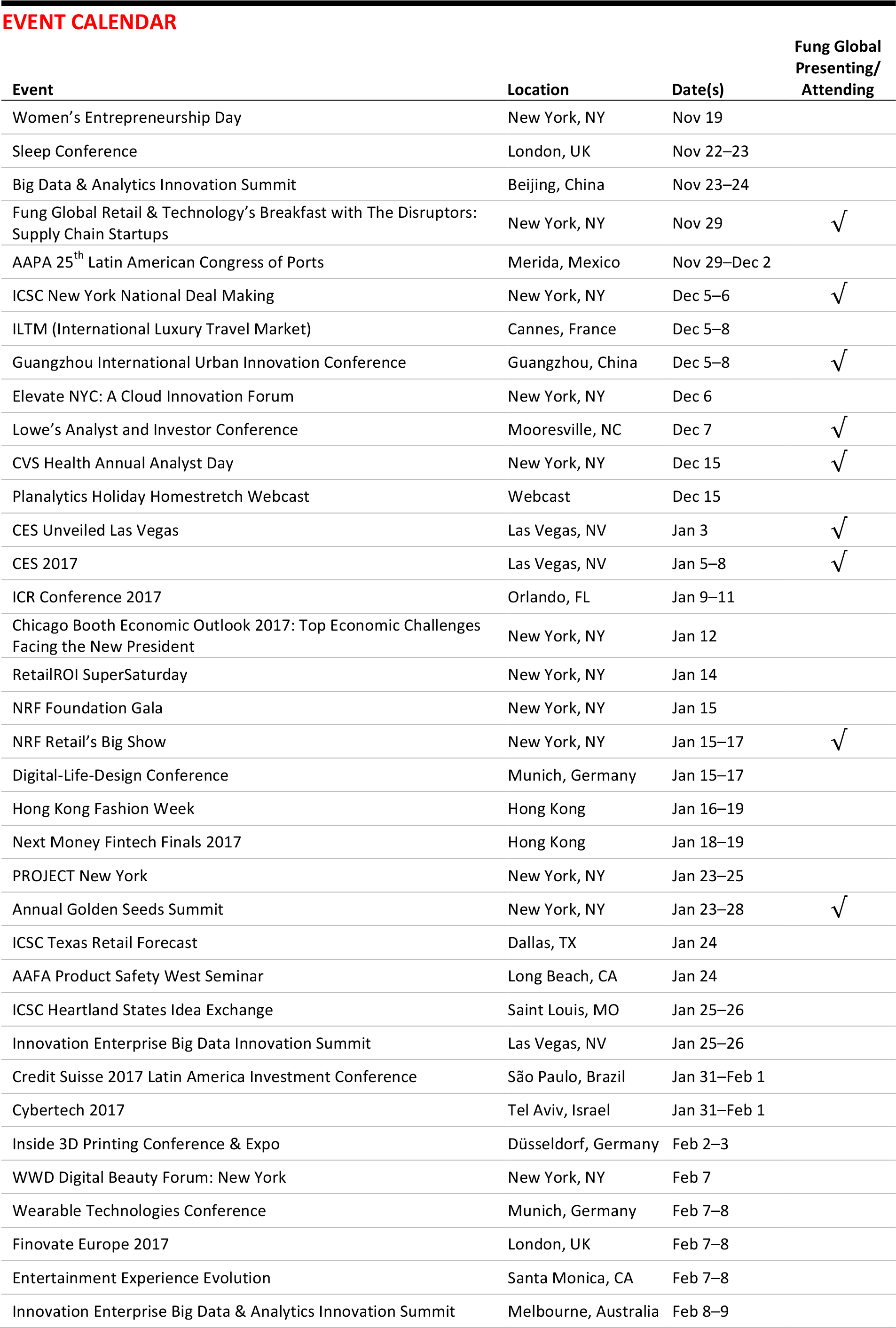

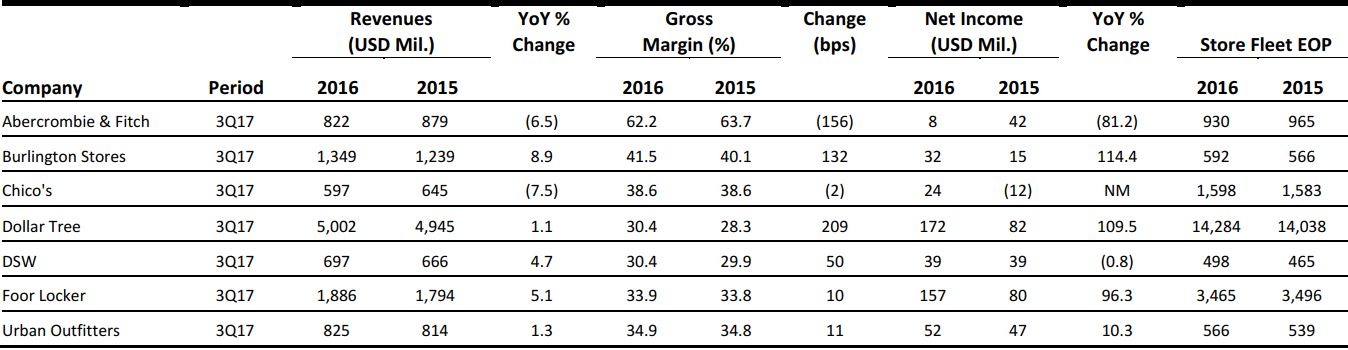

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Shoppers Expect Deep Discounts, Will Travel 100 Miles for 50% Savings

(November 22) Women’s Wear Daily

Shoppers Expect Deep Discounts, Will Travel 100 Miles for 50% Savings

(November 22) Women’s Wear Daily

- Consumers are expecting markdowns of 30-40% this holiday season, not only in brick-and-mortar locations, but online as well. A recent survey from First Insight revealed that consumers believe they will find the best deals online.

- Shoppers are expecting to find the best deals on Black Friday, Cyber Monday and the day after Christmas. Some 33% of those polled said they would “travel more than 100 miles” to find these savings. Retailers are feeling this pressure to provide the best deals so that consumers will walk through their doors.

How Luxury Retailers are Navigating Black Friday

(November 21) Glossy

How Luxury Retailers are Navigating Black Friday

(November 21) Glossy

- Discounting products can deteriorate luxury brand names, so retailers are looking to get involved in other ways. They are vamping up their in-store experience in order to get consumers through the doors and then convincing them to buy at full price.

- Other brands are opting out of Black Friday all together by staying closed. By not pressuring consumers to go out and shop, retailers are instead creating brand loyalty. Shoppers feel as if the stores are on their side.

Amazon Faces Holiday Shipping Disaster as Pilots go on Strike

(November 22) Business Insider

Amazon Faces Holiday Shipping Disaster as Pilots go on Strike

(November 22) Business Insider

- On Tuesday morning, 250 pilots from ABX Air went on strike to protest alleged staffing shortages. Amazon and DHL, both customers of ABX, will see the side effects of this challenge.

- Major disruptions and delays will occur, as ABX operates 35 flights daily for Amazon and 45 flights daily for DHL. The pilots are striking because they have been forced to work “emergency assignments” due to lack of staffing.

Shoppers Say They’ll Spend More During the Thanksgiving Weekend

(November 21) Internet Retailer

Shoppers Say They’ll Spend More During the Thanksgiving Weekend

(November 21) Internet Retailer

- Consumers are planning on spending an average of $400 each during the five days between Thanksgiving and Cyber Monday. Half of that money (51%) will be spent online. Among all of the consumers surveyed, 87% who plan to shop at some point will do so online.

- The Thanksgiving to Cyber Monday period is crucial for online retailers. Last year, consumers made nearly half of their online holiday purchases by Cyber Monday. The National Retail Federation and Proper Insights and Analytics released a report stating that Thanksgiving shopping weekend spending will be higher than last year.

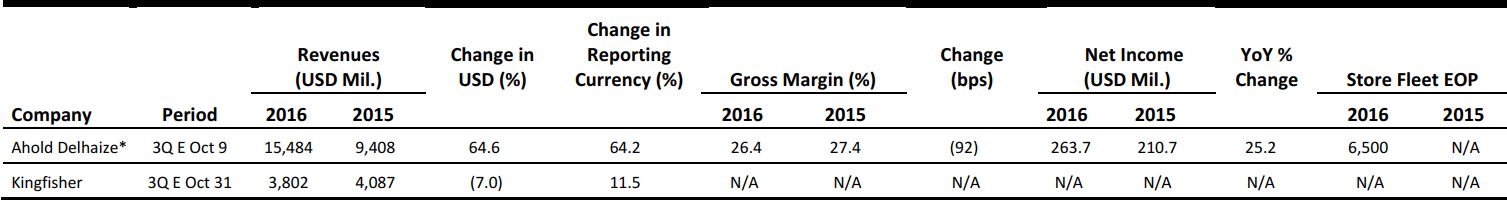

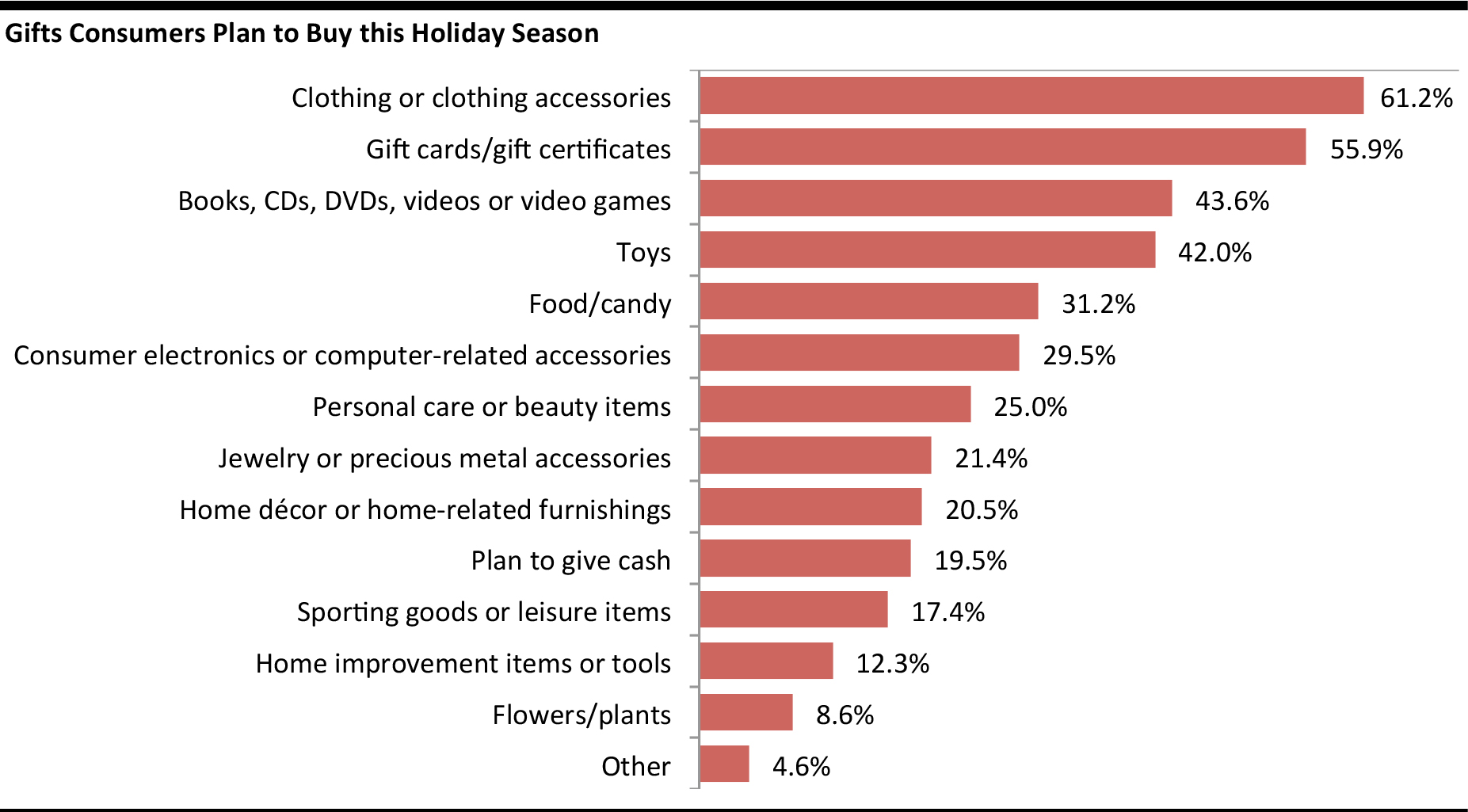

EUROPE RETAIL EARNINGS

*The merger between Ahold and Delhaize came into effect on July 24, 2016, to form Ahold Delhaize. These are reported and not pro forma figures.

Source: Company reports

EUROPEAN RETAIL HEADLINES

Lidl UK Launches New Twitter Price-Drop Campaign up to Christmas

(November 21) IGD

Lidl UK Launches New Twitter Price-Drop Campaign up to Christmas

(November 21) IGD

- Lidl UK has launched a new price campaign, called Social Price Drop, running from November 21 to December 17. The more Twitter users tweet about Lidl's products, the more the in-store price drops.

- A selected product will be announced every Monday on Twitter at 8am and the price drop will close the following day at 6pm. The price will drop according to how many consumers tweet about the product, and the lower price will be offered on the Saturday for shoppers to buy in-store.

Zara Leads the Online Fashion Industry in Spain

(November 15) Ecommercenews.eu

Zara Leads the Online Fashion Industry in Spain

(November 15) Ecommercenews.eu

- Market-research company GfK has declared Zara the online fashion leader in Spain. In second and third positions are ASOS and Zalando.

- Zara also has the best conversion rate (12%) in the Spanish online fashion sector, with ASOS at 9% and Zalando at only 3%.

Tesco Takes on Sainsbury’s with New Arcadia Concessions

(November 18) RetailGazette.co.uk

Tesco Takes on Sainsbury’s with New Arcadia Concessions

(November 18) RetailGazette.co.uk

- UK grocery retailer Tesco has announced plans to extend its partnership with fashion retailer Arcadia Group to open more concessions in Tesco stores.

- Arcadia launched concessions in 14 Tesco stores last year, and a further four Tesco supermarkets will host six more concessions by the end of this year.

AO World Sees 1H Revenues Grow by 22.9% and Returns to Positive EBITDA

(November 22) Company Press Release

AO World Sees 1H Revenues Grow by 22.9% and Returns to Positive EBITDA

(November 22) Company Press Release

- European online electrical retailer AO World announced 1H16 revenues of £324.7 million ($403.1 million), an increase of 22.9% year over year. Its UK revenues rose by 18.7% to £295.1 million ($366.7 million) and its Rest of Europe revenues surged by 66.9% to £29.6 million ($36.8 million).

- The company posted EBITDA of £1.5 million ($1.9 million), after incurring a loss of £4.5 million ($5.6 million) during the same period last year. Due to investment in its expansion across Germany and the Netherlands, AO World posted an operating loss of £2.8 million ($3.5 million), an improvement from 1H15’s loss of £8.9 million ($11.1 million).

Bonmarché’s 1H16 Revenue and Profit Fall

(November 21) Company Press Release

Bonmarché’s 1H16 Revenue and Profit Fall

(November 21) Company Press Release

- UK-based women’s fashion retailer Bonmarché announced 1H16 sales of £93.1 million ($115.7 million), a fall of 4.0% year over year. Comps declined by 8.6% and profit before tax decreased by 61.6% to £2.5 million ($3.1 million).

- The company stated that the main negative factors were: lack of demand for products repeated from previous seasons; slow-moving product lines; and long lead times, and a Chinese-factory-dominated supply chain that did not allow flexible responses to changes in seasonal demand. It added that BHS’s clearance of residual stock at marked down prices, after it went into administration, also affected its own sales.

ASIA TECH HEADLINES

Alibaba Opens Four More Data Centers Globally

(November 21) TechCrunch

Alibaba Opens Four More Data Centers Globally

(November 21) TechCrunch

- Alibaba announced the opening of four new data centers across the world – Dubai, Australia, Japan and Germany – which reveals its strategy to expand its Alibaba Cloud business globally.

- Alibaba Cloud, Alibaba’s fastest-growing business unit, has reported six successive quarters of triple-digit growth.

Baidu to Start Autonomous Vehicle Testing in Wuzhen, China

(November 21) TechWireAsia

Baidu to Start Autonomous Vehicle Testing in Wuzhen, China

(November 21) TechWireAsia

- Baidu announced it will start testing autonomous vehicles in Wuzhen, China. The vehicles are supplied by local car manufacturers BYD, Chery and BAIC.

- The autonomous vehicles are equipped with Velodyne LiDar, video cameras, milimeter wave radar and a computer brain to process all Baidu in-house data, according to the company.

- Baidu aims to get the vehicles road-ready in 2018. The company also plans a full product rollout and mass production in 2021.

China’s Getui Pockets USD58 Million to Fuel Customisable Ad Business

(November 22) e27.co

China’s Getui Pockets USD58 Million to Fuel Customisable Ad Business

(November 22) e27.co

- China’s Getui, a third-party push notification service provider, secured D round funding of ¥400 million (USD58 million) from several returning investors. The funds will be used to provide customized services to a specific demographic audience more efficiently.

- The Beijing-based startup helps app developers set up and send notifications to users across iOS, Android and other platforms by leveraging data-driven analysis of customer profiles.

Alibaba to Buy One-Third of Chinese Discount Grocery Chain Sanjiang

(November 21) Bloomberg

Alibaba to Buy One-Third of Chinese Discount Grocery Chain Sanjiang

(November 21) Bloomberg

- Alibaba plans to invest more than ¥2 billion (USD290 million) to buy about one-third of Sanjiang Shopping Club, a regional Chinese discount supermarket chain.

- The move is the company’s latest acquisition of brick-and-mortar retail, as it tries to revamp traditional offline and online models.

- Alibaba has invested in physical retail such as Suning and Intime Retail to flesh out its online shopping offerings, open up new sales channels and improve its logistics network.

Japan’s Edtech Startup Arcterus Scores US$1 Million Funding for Southeast Asia Expansion

(November 22) TechinAsia

Japan’s Edtech Startup Arcterus Scores US$1 Million Funding for Southeast Asia Expansion

(November 22) TechinAsia

- Japan’s Arcterus, an edtech startup that enables students to view, share and rate class notes, raised USD1 million to further develop its product and expand in Southeast Asia.

- The company has forged an alliance with distance-learning company Z-Kai and Japan’s second-largest national newspaper company, Asahi, to provide users with premium content.

- Arcterus plans to enter Vietnam, Indonesia and the Philippines in 2017 and 2018, according to the company.

LATAM RETAIL HEADLINES

Mexican Fashion Industry Vows to Fight Trump’s NAFTA Plans

(November 17) WWD

Mexican Fashion Industry Vows to Fight Trump’s NAFTA Plans

(November 17) WWD

- Top executives within the textile and apparel industry in Mexico have said that the country will not tolerate more than a 10% duty on exports to the US, vowing to fight any move by President-elect Donald Trump to change the North American Free Trade Agreement.

- Trump has said that the US would leave NAFTA if Mexico and Canada refuse to negotiate changes that could include a 35% duty on Mexican goods, which could work to reverse a fivefold surge in clothing shipments from Mexican maquilas since the trade agreement started.

Latin American Leaders Open Door to Tighter Chinese Trade Ties

(November 18) WSJ

Latin American Leaders Open Door to Tighter Chinese Trade Ties

(November 18) WSJ

- Donald Trump’s plan to change US trade agreements is leading to some reassessments of trade policies in Latin America, opening up the door for China to strengthen ties in the region.

- President Xi Jinping of China is heading to Peru for a meeting with 21 Pacific Rim countries that make up the Asia Pacific Economic Cooperation, which accounts for half of all global trade. The meeting’s agenda will largely look at how to renegotiate ties should Trump change current trade policies.

Retailers Are Building Stores Not Walls in Mexico

(November 21) RetailWeek

Retailers Are Building Stores Not Walls in Mexico

(November 21) RetailWeek

- Despite common sentiments in the US, many retailers are going south of the border and opening stores in Mexico. Apple, Victoria’s Secret, Williams-Sonoma, Gap, Forever 21 and Amazon have all expanded in Mexico in the past year. Walmart Mexico is outperforming its US parent.

- Real estate developers have forecast that by 2025 there will be 200 new malls in Mexico, along with a boom in ecommerce, making Mexico an attractive destination for retailers, particularly with the rise of the young, urban middle class.

Brazil Finance Ministry Says 2017 GDP to be Lower than Expected

(November 21) WSJ

Brazil Finance Ministry Says 2017 GDP to be Lower than Expected

(November 21) WSJ

- The Brazilian government lowered its 21017 annual GDP forecast to 1.0% from 1.6%, as the economy continues to struggle and is slow to rebound. Unemployment hit 11.8% in the June-to-August period, with around 12 million Brazilians being unemployed.

- Rising joblessness and falling incomes have hurt retailers, with sales of cars and homes plummeting. Companies are afraid to invest, and consumers are not willing to spend, weighing on Brazil’s growth.

Shoppers Expect Deep Discounts, Will Travel 100 Miles for 50% Savings

(November 22) Women’s Wear Daily

Shoppers Expect Deep Discounts, Will Travel 100 Miles for 50% Savings

(November 22) Women’s Wear Daily