FROM THE DESK OF DEBORAH WEINSWIG

On Thursday afternoon, we held our third Disruptors Meeting in Hong Kong—dubbed “Disruptors Cocktails”—in partnership with incubator and cowork space CoCoon and Hong Kong’s first social innovation hub, The Good Lab.

The event kicked off with Li & Fung CFO Ed Lam introducing the program to a packed room of over 200 employees and friends, including leaders from a diverse set of nine innovative startups.

Plukka, founded in 2011, is a Hong Kong–based, online international retailer of curated collections of designer fine jewelry. The company has evolved into the world’s only international distribution platform for fine jewelry, and it features exclusive designers whose jewelry has been worn by celebrities such as Lady Gaga, Katy Perry and Madonna. Plukka’s founder, Joanne Ooi, explained the company’s recently launched View On Demand service, which allows clients in Hong Kong and New York to make an appointment for a Plukka representative to bring a trunk show to their home or office. FBIC Global Retail & Technology recently wrote about the innovative offering in this report.

Next up was OurCrowd, introduced by Elad Goz, Head of Economic & Trade Mission of the Consulate General of Israel in Hong Kong. OurCrowd is a venture capital/crowdfunding hybrid platform for accredited investors to invest in Israeli and global startups. OurCrowd sources deals, performs due diligence and opens investments to its members, leading every investment with its own money. OurCrowd VP Denes Ban said that his team has looked at over 2,000 startups and invested in just 1% of them.

DotKids aims to make the Internet safer and more accessible for kids through technology and community partnership globally. The organization has applied for regulatory approval from ICANN to run “.kids” as a generic top-level domain (just like “.com”). DotKids must obtain the operating rights for “.kids” over two other commercial applicants, Google and Amazon, in order to be at the forefront of building a child-safe Internet ecosystem. DotKids cofounder Cheney Cheng explained that if the company can get 400,000 domains to use the .kids top-level domain, it can earn up to $10 million to return to charities that support children’s interests.

Blue Sky makes conserving energy simple and fun. Through an easy-to-install power sensor and web platform, people receive insights on their energy consumption and personalized tips to live or work comfortably with less energy. The platform also runs saving competitions across companies, departments and properties. Founder Christina Tang explained that Hong Kong businesses spend $31 billion on electricity each year, or 2% of the total GDP. With Blue Sky’s panels (think of them as Nest for business), businesses can reduce these costs by up to 10%.

Grana is a fashion brand that has been completely reimagined from the ground up. Its mission is to create timeless wardrobe essentials made from the world’s best fabrics at the most disruptive prices ever seen. Grana opened its first Fitting Room, a brick-and-mortar showroom space, in Hong Kong in September 2015. Founder Luke Grana said he chose to relocate from Australia to Hong Kong based on Hong Kong’s textile tradition and the fact that it has the largest single air cargo terminal in the world.

PAKT bills itself as “Your Wardrobe on Demand!” The startup offers a climate-controlled clothing storage solution. From wedding dresses to baby clothes, PAKT cures consumers’ space and clothing care headaches. Founder Barbara Yu Larsson explained how customers can digitize their wardrobes in their smartphones to better manage them, and how the service allows for items to be easily swapped and traded.

Established in Hong Kong in December 2014, Rumi Yoga Wear is an active lifestyle brand focusing on apparel that is ethically engineered and designed to make customers feel good. The brand utilizes high-performance and sustainable fibers such as recycled plastic bottles and upcycled coffee grinds in its garments. Founder Melissa Chu demonstrated the yoga pants, and introduced us to the soon-to-be-released sports bra, tank top and long-sleeve additions, as well as the upcoming men’s line.

Advwhere provides influencer marketing intelligence to change the way influencers and marketers collaborate. The team is only two months into its work, but founder Edwin Yuen showed how Advwhere will use advanced dynamic algorithms to determine the right marketing influencer for any brand and any budget.

BessUP is a social media company in Asia that provides inspiring content and builds various interest communities. BessUP is redefining online media and content marketing by leveraging its in-house technology, which includes trend-centric, modeling and machine-learning systems. Founder Ryan Cheung explained that, although it is just a few months old, BessUP has already amassed 100,000 Facebook “likes” using its proprietary technology.

We enjoyed the opportunity to hear from these amazing startups and look forward to hosting future events in New York and Hong Kong!

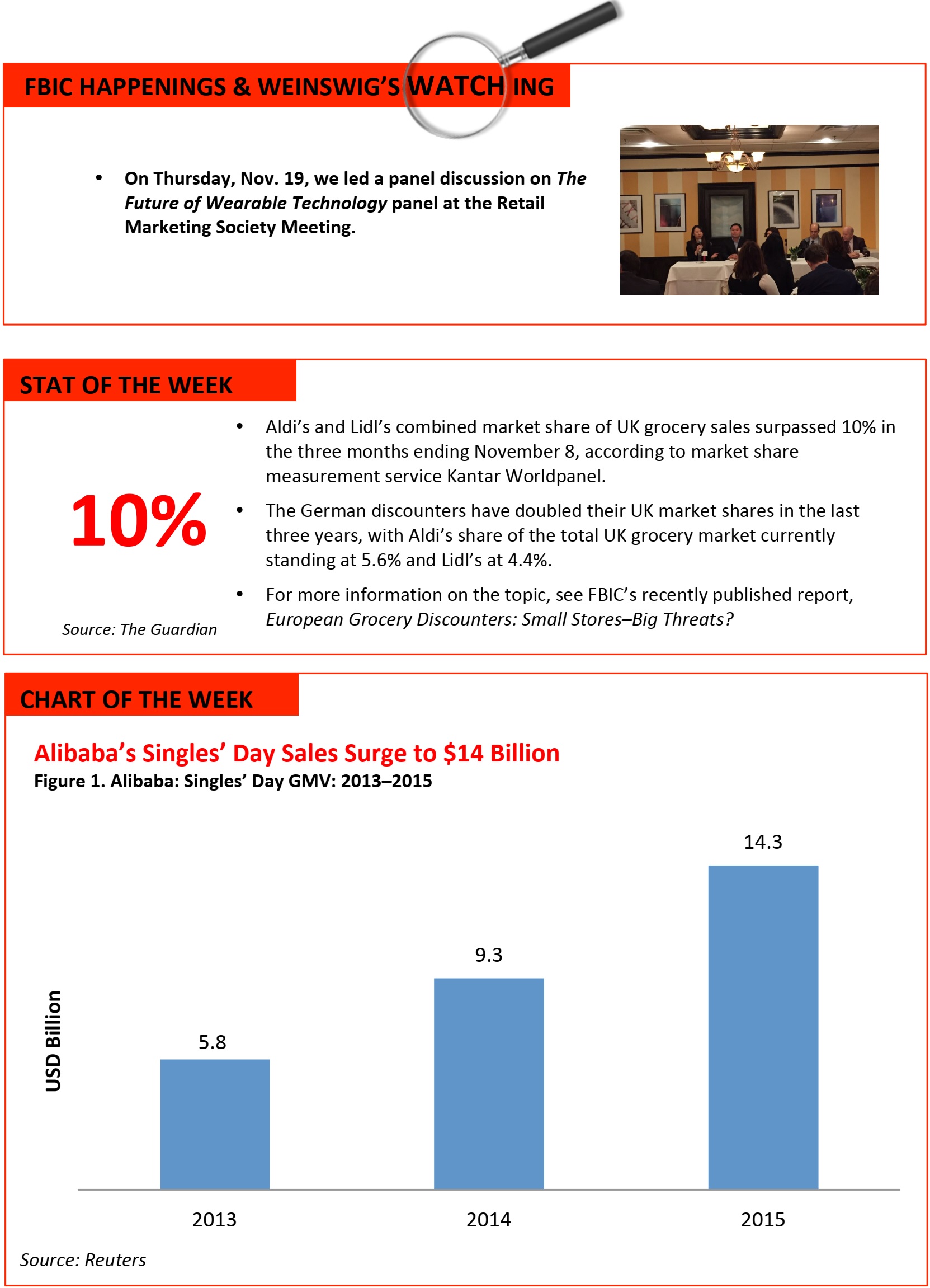

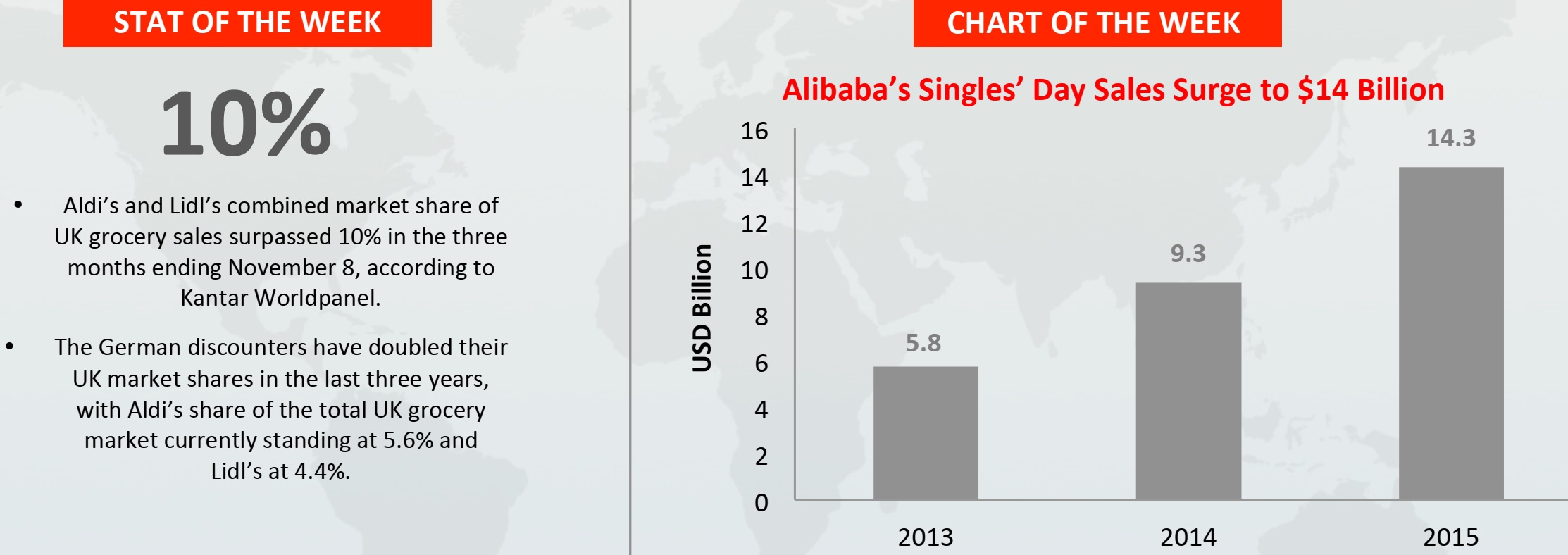

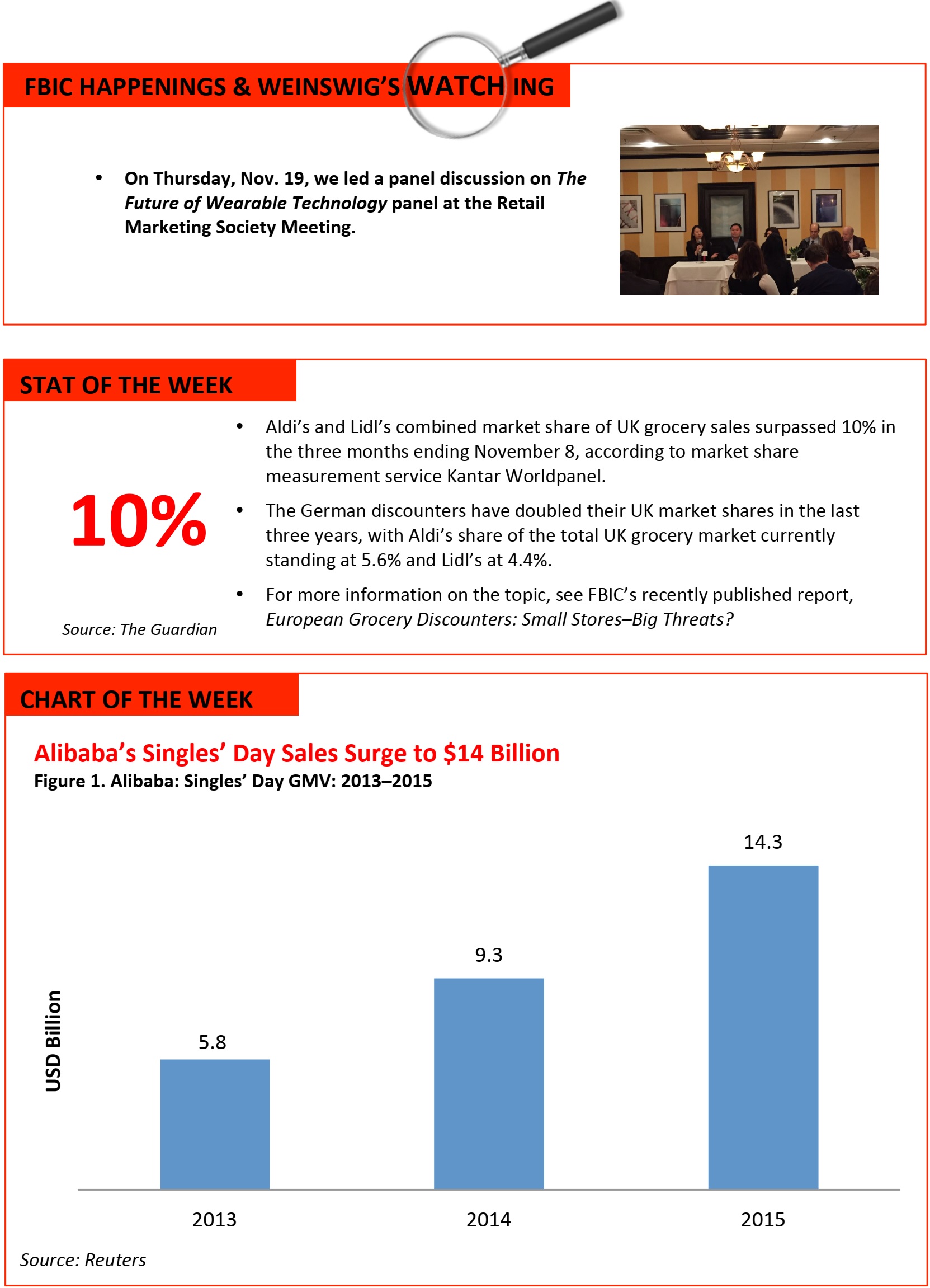

- Six years ago, Alibaba launched Singles’ Day, or 11.11, an online shopping event similar to Cyber Monday in the US. On Singles’ Day 2015, Alibaba’s gross merchandise volume (GMV) rose by 59.7% year over year in local-currency terms, to ¥91.2 billion (US$14.3 billion).

- Fully 68% of the total value of Alibaba’s Singles’ Day transactions came from mobile devices this year.

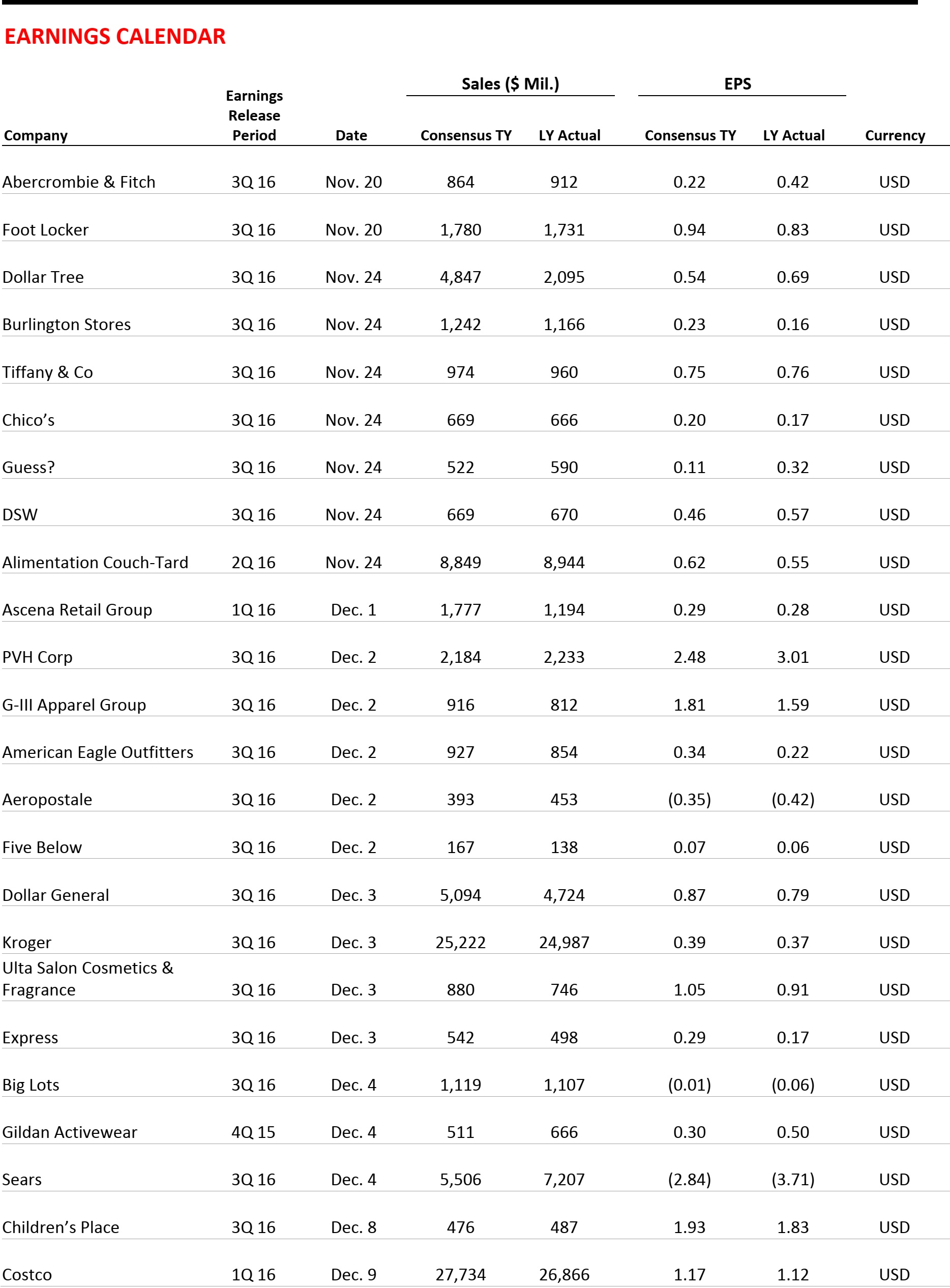

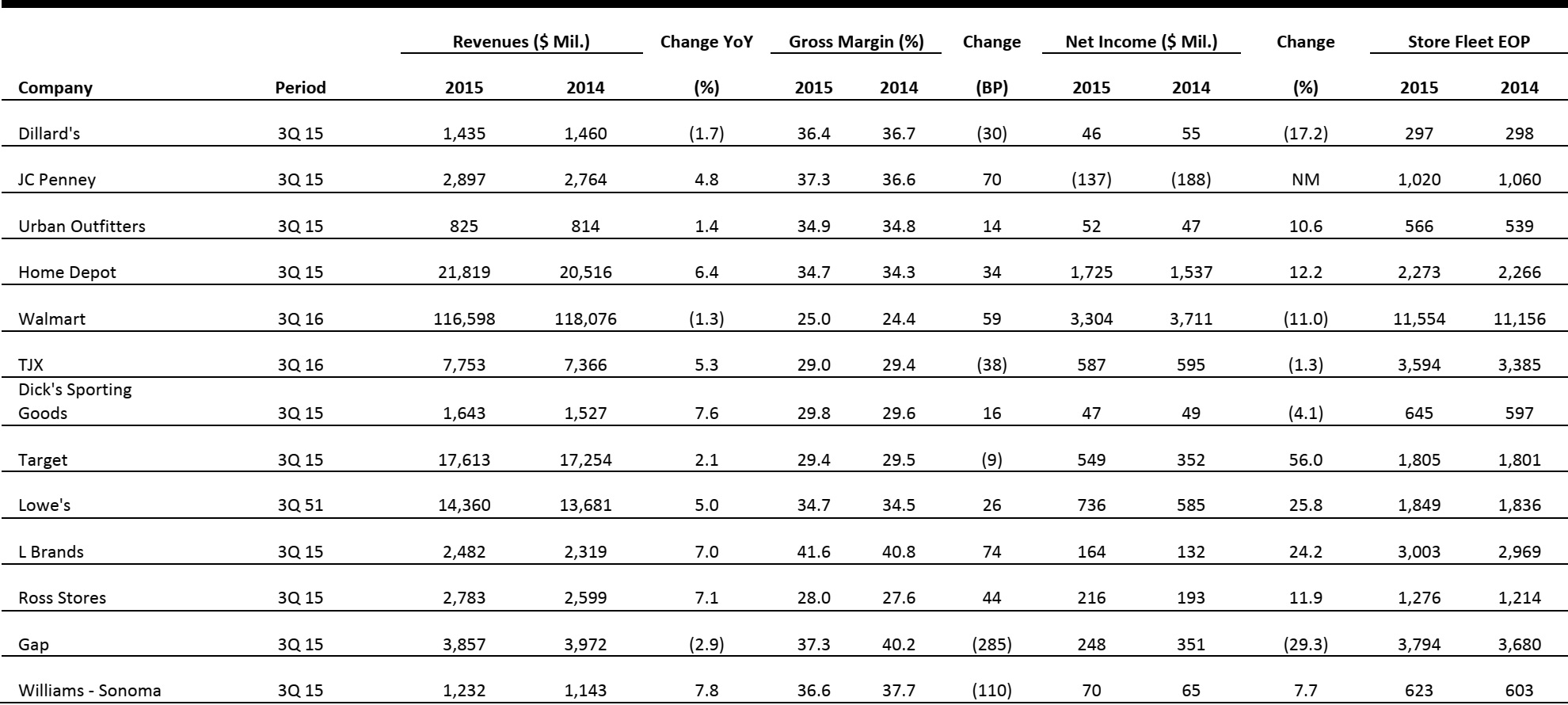

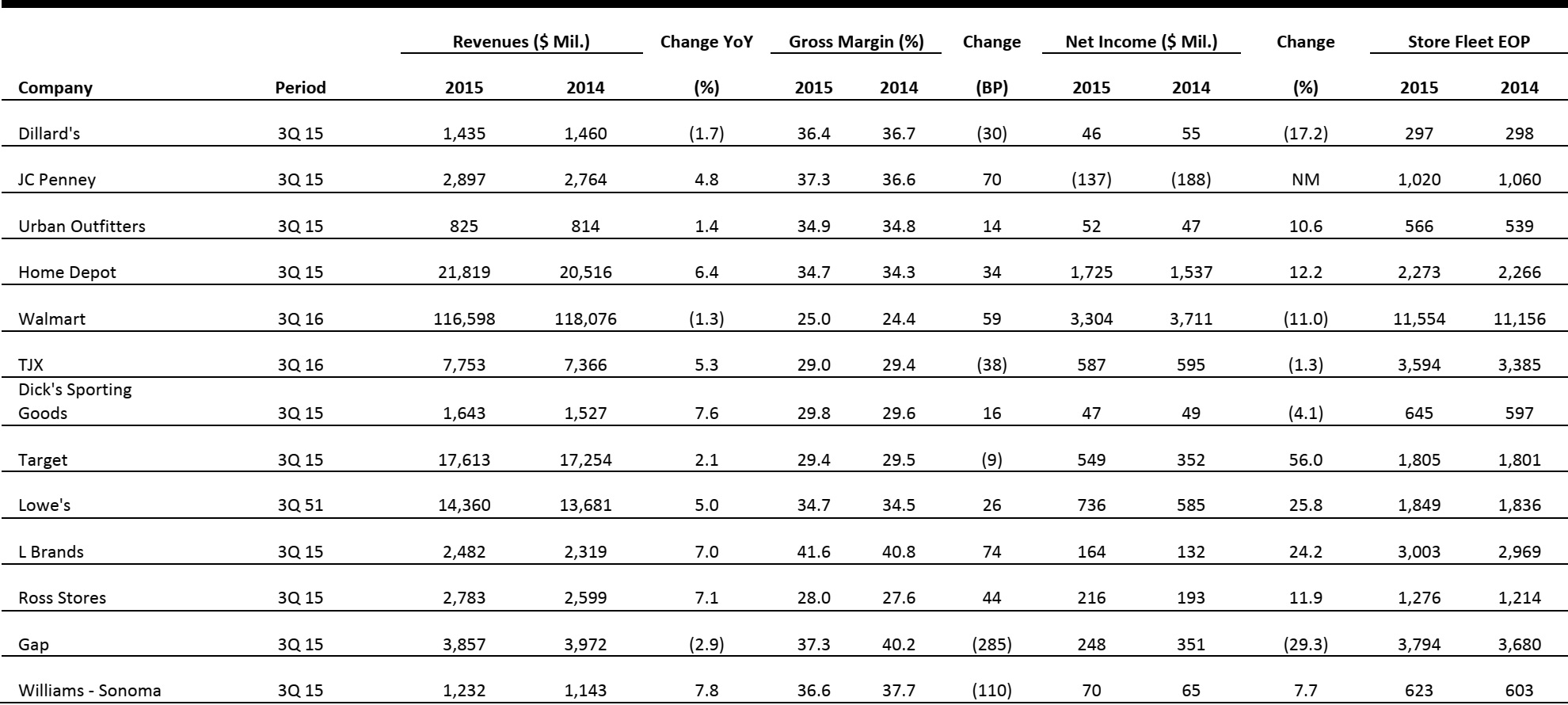

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Kohl’s Hires Walgreens E-Commerce Exec for New COO Post

(November 17) Fortune

Kohl’s Hires Walgreens E-Commerce Exec for New COO Post

(November 17) Fortune

- Kohl’s has named former Walgreens’ President of Digital and Chief Marketing Officer Sona Chawla as its first Chief Operating Officer, to oversee the integration of its digital and brick-and-mortar businesses. Kohl’s announced earlier this year that it would create the role and that the new COO would be a contender to eventually fill the CEO role.

- Chawla will also be in charge of store operations, logistics, supply chain and e-commerce. Kohl’s plans to lean more on tech to bolster a sales turnaround, with more personalized interaction with shoppers via a loyalty program and deeper data analytics. Last month, CEO Kevin Mansell told Fortune that Kohl’s will be launching a chain of smaller-format stores to cater to both urban shoppers and small markets. It is also opening more outlet stores, and all of these will require integration with Kohl’s tech systems.

Urban Outfitters Buys Pizza Chain Vetri Pizza

(November 16) The Wall Street Journal

Urban Outfitters Buys Pizza Chain Vetri Pizza

(November 16) The Wall Street Journal

- Retailer Urban Outfitters announced Monday that it will acquire Philadelphia’s Vetri Family group of restaurants from chef Marc Vetri. The deal covers five concepts, including Pizzeria Vetri, which has a second location in Austin, Texas, and two more outlets set to open in Washington, DC.

- Urban Outfitters has suffered from a slowdown in shopper traffic and, rather than ramping up online efforts, it is focusing on locations where economics are growing. Urban Outfitters Chief Development Officer Dave Ziel said, “Shoppers are increasingly spending their disposable income on food instead of retail.”

Saks Plans a Second Off 5th Outlet in NYC

(November 16) WWD.com

Saks Plans a Second Off 5th Outlet in NYC

(November 16) WWD.com

- Saks Fifth Avenue announced it will open a 47,333-square-foot Saks Off 5th store at Tower 57, an office tower at 125 East 57th Street. The off-price store is a mere two blocks away from the 59th street flagship of rival Bloomingdale’s. An Off 5th is also slated to open in lower Manhattan, just a few blocks from where a full-line Saks Fifth Avenue is opening next year. “Off-price is a major growth strategy for Saks Fifth Avenue,” said Gerald Storch, CEO of Hudson’s Bay Co., the parent of Saks Fifth Avenue and Saks Off 5th. “It’s growing faster than the retail industry.”

- The company will expand this concept internationally, opening up to eight stores in Canada and eventually expanding to Germany as well. Saks Off 5th will target more of a millennial shopper, and Hudson’s Bay made clear that the two stores have very little crossover in terms of shoppers. “Everybody shops everywhere, yet, when it comes to apparel buying, we see that Saks Off 5th customers tend to be distinct from the Saks luxury customers.”

Changes Help Target Hit the 3Q Bull’s-Eye

(November 16) Retailing Today

Changes Help Target Hit the 3Q Bull’s-Eye

(November 16) Retailing Today

- Target announced its third-quarter earnings on Wednesday, reporting that its digital channel grew sales by 20% and that the increase contributed 40 points, or 0.4%, to same-store-sales growth of 1.4%. Target has made clear that this may be its most omni-channel holiday season ever, with more services online and in-store, including two new “click-and-mortar” programs that are designed to add convenience and value for shoppers.

- One of the new programs allows guests to express their “love” for Target products and featured brands on its mobile website through heart icons. These hearts allows guests to bookmark items and receive personalized product recommendations. Target also updated its innovative Awesome Shop website by pulling user-generated content from Pinterest, to allow users to see what other Target customers are shopping for. Target’s net sales rose by 2.1%, to $17.6 billion, and the company raised its full-year earnings forecast for the second time in three months: it now expects earnings of $4.65 to $4.75 per share.

Kroger Agrees to Buy Milwaukee-Based Grocery Chain Roundy’s

(November 11) Company press release

Kroger Agrees to Buy Milwaukee-Based Grocery Chain Roundy’s

(November 11) Company press release

- Supermarket chain Kroger will acquire Roundy’s, paying $3.60 a share in cash—65% higher than Roundy’s closing share price—and assuming more than $600 million in Roundy’s debt, the companies announced on November 11. The deal is valued at about $800 million, including debt. The acquisition will add 151 stores to Kroger’s existing stable of 2,623 grocery stores nationwide, which is the most of any US supermarket.

- Kroger Chief Financial Officer Michael Schlotman said the deal will enable Kroger to learn from Roundy’s small but successful grocery chain, Mariano’s. Kroger has several hundred stores in urban locations that could benefit by adopting techniques similar to those used by Mariano’s. While Kroger expects to realize cost savings of approximately $40 million over time, the company plans to reinvest those cost savings in order to grow the business.

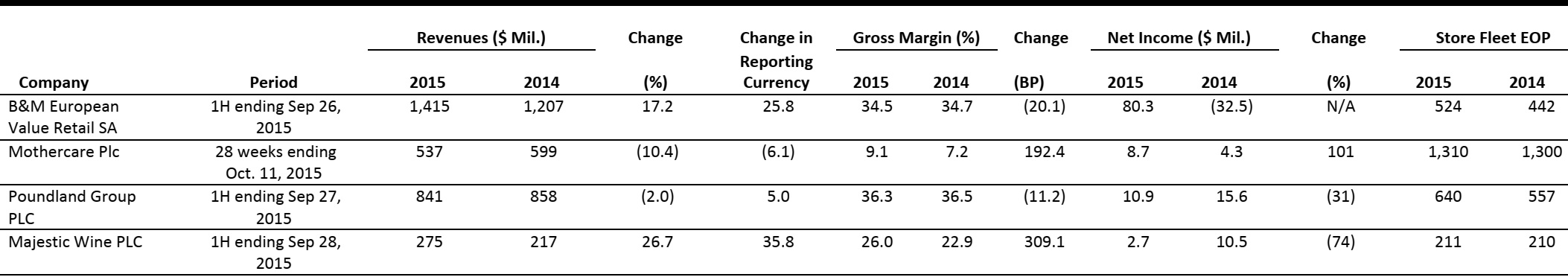

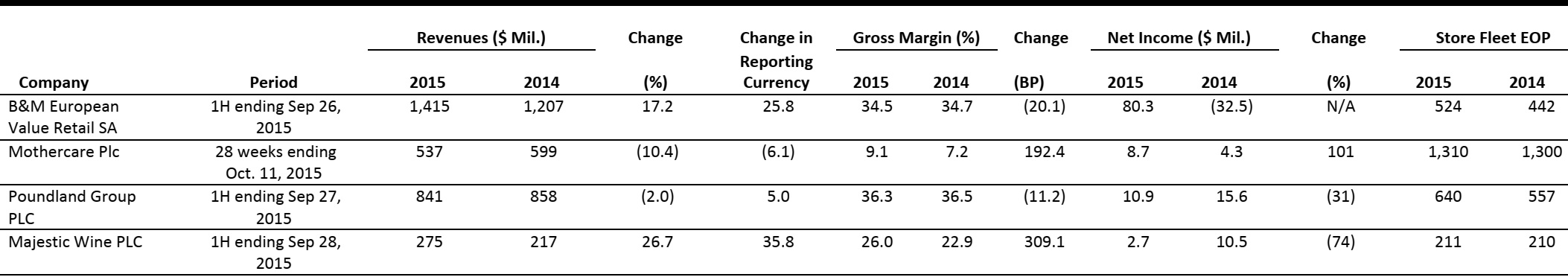

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Asda Launches Third-Party Click-and-Collect

(November 11) Company press release

Asda Launches Third-Party Click-and-Collect

(November 11) Company press release

- British grocery retailer Asda launched a new click-and-collect service on November 11. The service, called ToYou, allows customers to collect and return—at any Asda store—orders placed with third-party retailers. Online fashion retailer Missguided was the first third-party firm to sign up for the program.

- With ToYou, Asda aims to increase footfall in its network of 614 stores throughout the UK. The company predicts that the initiative could provide 40 million extra customer visits per year by 2019.

Zalando’s Annual Turnover Heads Toward €3 Billion

(November 12) Company press release

Zalando’s Annual Turnover Heads Toward €3 Billion

(November 12) Company press release

- Zalando, the German online fashion retailer, reached total turnover of €2.1 billion (US$2.3 billion) in the nine-month period ending September 30, equating to 34.9% year-over-year growth and amounting to almost the total turnover generated during the previous fiscal year.

- The company’s revenue in its third fiscal quarter grew by 42.2% year over year, to €713.1 million (US$793.1 million). According to the company, customer focus, including the provision of fast delivery and easy returns, is the key driver of its revenue growth.

Burberry’s Revenue Remains Unchanged Despite the Challenging Environment for Luxury

(November 12) Company press release

Burberry’s Revenue Remains Unchanged Despite the Challenging Environment for Luxury

(November 12) Company press release

- Burberry delivered flat sales of £1.1 billion (US$1.7 billion) in the first half of fiscal year 2016, and profit before tax was up 9% year over year, to £154.7 million (US$238.3 million), despite the challenging environment for the luxury sector, which has been particularly affected by the slowdown of the Chinese economy.

- Burberry CEO Christopher Bailey said that the robust profit performance despite the unfavorable luxury market is the result of the company’s decisive actions, including focusing on iconic products such as trench coats, improving and personalizing customer service even more, and using marketing resources more tactically.

Amazon Launches Prime Pantry in the UK

(November 13) IGD Retail Analysis

Amazon Launches Prime Pantry in the UK

(November 13) IGD Retail Analysis

- Amazon launched Prime Pantry in the UK on November 13. The service allows Amazon Prime customers to fill a 20 kg box with items chosen from a range of 4,000 everyday essentials—including groceries, household goods, health and beauty products, and baby items—and have them delivered for a flat £2.99 delivery fee (US$4.54). Amazon Prime Pantry is already available in the US and was launched outside the US for the first time in October 2015, in Germany.

- The launch in the UK is part of Amazon’s effort to increase Amazon Prime membership. In conjunction with the launch, the company offered customers the possibility to sign up for Amazon Prime at a discounted fee of £59 (US$88) instead of the usual £79 (US$120) for a limited time, in order to encourage new customers to join.

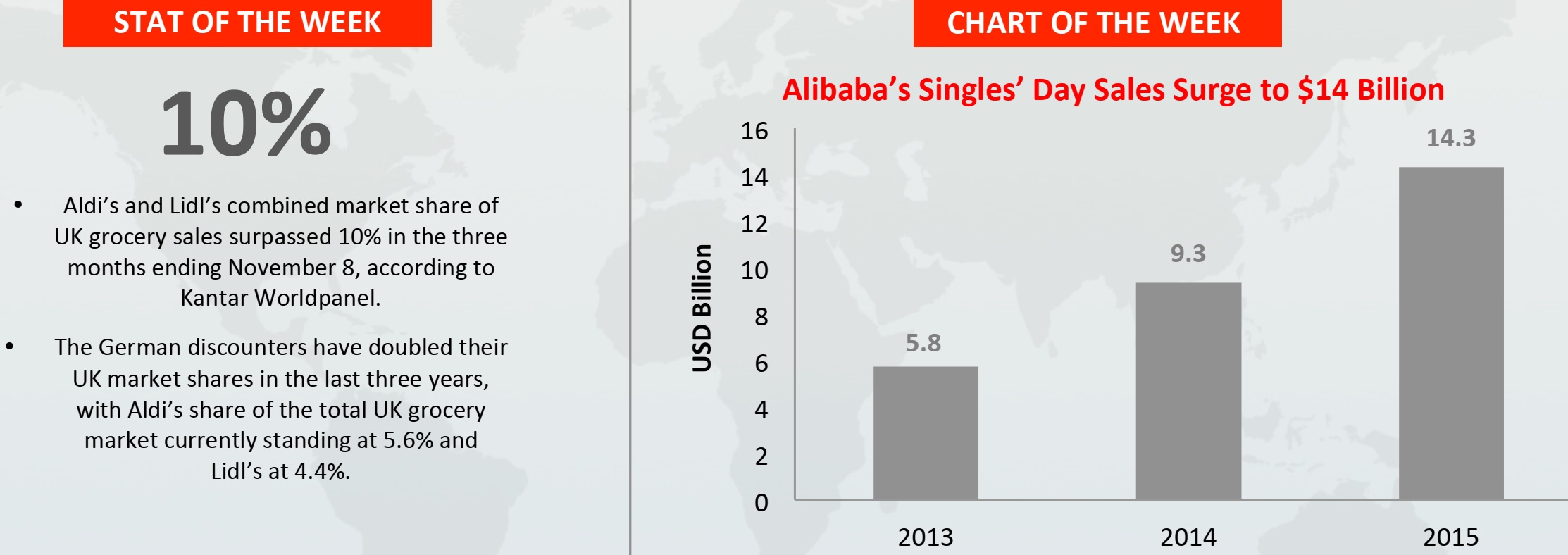

Aldi and Lidl Take 10% of UK Grocery Market

(November 17) Kantar Worldpanel

Aldi and Lidl Take 10% of UK Grocery Market

(November 17) Kantar Worldpanel

- The combined share of discounters Aldi and Lidl reached 10% of the UK grocery market, according to new figures from market share measurement service Kantar Worldpanel. The figures cover the 12 weeks ending November 8. By way of comparison, in 2012 the combined share of the two retailers was just 5% of the UK grocery market.

- Aldi and Lidl reached a market share of 5.6% and 4.4%, respectively, and increased their sales by 16.5% and 19.0% year over year, respectively, during the 12 weeks ending November 8. Kantar Worldpanel’s new data also shows that among the big four grocery multiples—Tesco, Asda, Sainsbury’s and Morrisons—only Sainsbury’s saw its share of the UK grocery market increase by 20 basis points year over year.

ASIA TECH HEADLINES

Apple SIM Now Available in Japan

(November 17) TechCrunch

Apple SIM Now Available in Japan

(November 17) TechCrunch

- Apple SIM, the SIM card that lets iPad users switch between participating carriers in different countries, has launched in Japan through a partnership with KDDI, the leading Japanese telecom.

- After signing a partnership with GigSky in June, Apple SIM now offers cellular data plans in 90 countries and territories, while previously it was limited to users in the US and UK.

E-Commerce One of Four Pillars in SingPost Restructuring

(November 17) e27.co

E-Commerce One of Four Pillars in SingPost Restructuring

(November 17) e27.co

- SingPost has undertaken an organizational restructuring following recent moves to strengthen its e-commerce logistics capabilities. Marcelo Wesseler, CEO of SingPost E-Commerce, will spearhead the development and growth of the group’s e-commerce business and operations, and relocate to the US.

- In October, SingPost acquired majority stakes in end-to-end e-commerce provider TradeGlobal and US-based e-commerce logistics provider Jagged Peak.

In India, Cash Back Is the New Black

(November 16) TechinAsia

In India, Cash Back Is the New Black

(November 16) TechinAsia

- Online cash back and coupons site CashKaro.com has secured a series A funding round worth approximately US$3.8 million from Bangalore-based Kalaari Capital, marking the first time a local venture capital firm has invested in a cash-back-oriented startup.

- CashKaro links its customers to over 1,000 partner retailers and helps them save on purchases. The “cash back” is a portion of the sale refunded into the customer’s mobile wallet, which can then be banked as mobile credit, or used to pay bills or buy other items on the site.

Apple to Power Singapore Operations with Renewable Energy

(November 16) Channel NewsAsia

Apple to Power Singapore Operations with Renewable Energy

(November 16) Channel NewsAsia

- Apple announced on November 15 that it has struck a deal to power all of its Singapore operations with renewable energy, the latest step in its efforts to turn its operations worldwide green.

- Solar energy developer Sunseap Group will provide Apple with 100% renewable electricity from its portfolio of solar energy systems built atop more than 800 buildings, making Apple the first company in Singapore to run exclusively on renewable energy.

Hot Japanese Printing Startup Expands to Southeast Asia with Local Investment

(November 14) TechinAsia

Hot Japanese Printing Startup Expands to Southeast Asia with Local Investment

(November 14) TechinAsia

- Raksul, one of the best-funded startups in Japan, with more than US$51 million raised to date, is expanding outside Japan. Founder and CEO Yasukane Matsumoto’s strategy is to invest in—and perhaps eventually acquire—local printing startups in other Asian markets.

- The e-commerce printing model is connecting users with local brick-and-mortar printing businesses, allowing them to shop around for the best price, place their order online and have the order shipped to their door. Raksul now has more than 100 printing partners in Japan, covering all 47 prefectures.

LATAM RETAIL HEADLINES

Survey: Brazilian Inflation Will Exceed 10% this Year

(November 16) The Wall Street Journal

Survey: Brazilian Inflation Will Exceed 10% this Year

(November 16) The Wall Street Journal

- Brazil’s inflation rate is expected to exceed 10% in 2015 and decelerate to a growth rate of 6.5% in 2016, according to the median forecast from a weekly survey of 100 economists and analysts

- The central bank’s 12-month inflation target is 4.5%, plus-or-minus two percentage points, and the current benchmark interest rate stands at 14.25%. According to the survey, Brazil’s GDP is expected to contract 3.1% this year and another 2.0% in 2016.

Decline in Retail Sales Could Aggravate Weak Brazilian Economy

(November 13) Bloomberg Intelligence

Decline in Retail Sales Could Aggravate Weak Brazilian Economy

(November 13) Bloomberg Intelligence

- Retail sales are expected to decline 4% in 2016, putting the retail-sales index at its lowest point since 2012, following a 2.2% increase in 2014

- There is also a lagged effect of retail sales and personal consumption driven by rising unemployment, leading to a forecast of a 2% decline in GDP in 2016

Mexico Plans 16-year Phase-out of Duties Following TPP

(November 12) WWD

Mexico Plans 16-year Phase-out of Duties Following TPP

(November 12) WWD

- Mexico plans to phase out its average of 25% duty on apparel imports, including women’s wear, pants, dresses and coats over 16 years after the Trans-Pacific Partnership (TPP) takes effect

- The long phase-out, which decrease duties by about 1.5% annually, is intended to insulate Mexico from of imports from other TPP members such as Vietnam and Malaysia

Brazilian Recession Cutting into Robust Beauty Market

(November 12) WWD

Brazilian Recession Cutting into Robust Beauty Market

(November 12) WWD

- Brazil’s recession could cause a slowdown in the growth rate in sales of beauty products, representing the slowest rate in 15 years, with one estimate of just 5%. Growth is already flat on a US dollar basis. Growth could be hurt further by an increase in the industrial IPI tax in July, which could cause fragrance, makeup and personal-care brands to raise prices by as much as 20%

- Last year, Brazil’s beauty industry experienced 11% growth to BRL $102 billion (US $26 billion)

Osklen Plans to Open 10 New Stores in US

(November 11) WWD

Osklen Plans to Open 10 New Stores in US

(November 11) WWD

- Brazilian beachwear brand Osklen plans to invest more than $5 million to open 10 new stores in the US by 2020, including a New York flagship and a store in Los Angeles within the next 12 months

- In Brazil, the brand is known for high-end unisex beachwear, footwear and apparel and the company operates 81 stores, including more than 50 that are directly owned. In 1H2015, gross revenues were BRL 578.5 million reals (US$152.0 million), down 3.3%, and EBITDA was BRL 4.2 million (US $1.6 million)

Established in Hong Kong in December 2014, Rumi Yoga Wear is an active lifestyle brand focusing on apparel that is ethically engineered and designed to make customers feel good. The brand utilizes high-performance and sustainable fibers such as recycled plastic bottles and upcycled coffee grinds in its garments. Founder Melissa Chu demonstrated the yoga pants, and introduced us to the soon-to-be-released sports bra, tank top and long-sleeve additions, as well as the upcoming men’s line.

Established in Hong Kong in December 2014, Rumi Yoga Wear is an active lifestyle brand focusing on apparel that is ethically engineered and designed to make customers feel good. The brand utilizes high-performance and sustainable fibers such as recycled plastic bottles and upcycled coffee grinds in its garments. Founder Melissa Chu demonstrated the yoga pants, and introduced us to the soon-to-be-released sports bra, tank top and long-sleeve additions, as well as the upcoming men’s line.

Survey: Brazilian Inflation Will Exceed 10% this Year

(November 16) The Wall Street Journal

Survey: Brazilian Inflation Will Exceed 10% this Year

(November 16) The Wall Street Journal

Decline in Retail Sales Could Aggravate Weak Brazilian Economy

(November 13) Bloomberg Intelligence

Decline in Retail Sales Could Aggravate Weak Brazilian Economy

(November 13) Bloomberg Intelligence

Mexico Plans 16-year Phase-out of Duties Following TPP

(November 12) WWD

Mexico Plans 16-year Phase-out of Duties Following TPP

(November 12) WWD

Brazilian Recession Cutting into Robust Beauty Market

(November 12) WWD

Brazilian Recession Cutting into Robust Beauty Market

(November 12) WWD