Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

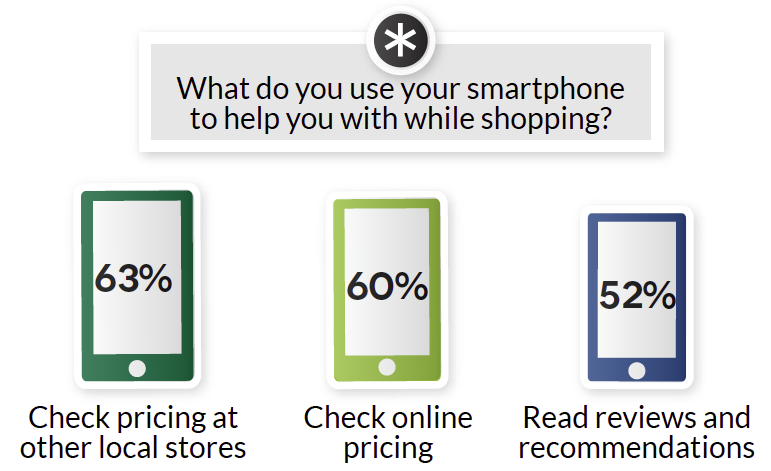

With so much riding on Black Friday (or, as many in the industry are calling it, the month of November), the winter storms forecast for the eastern half of the US this weekend has some industry watchers nervous. According to BDO USA, a business consulting firm, nearly two-thirds of the 100 retailing chief marketing officers it interviewed expect the overall level of their holiday discounts and promotions to be higher than last year, and 67% said that in-store deals would be their chief tactic for getting consumers into the stores early. Despite the preponderance of retailers’ early efforts to lure them into the stores and online (i.e., free shipping, extended store hours and deep discounting), consumers are still restrained. Bad weather is just one more thing that might keep them at bay. Then again, if people stay at home, some of those holiday dollars are likely to shift to online. As we report in our Weather Analytics section, this weekend’s storms will prod purchases of gloves, scarves and coats—not to mention shovels and snowblowers—though demand is likely to trail off as warmer temps return early next week, just in time for the four-day Thanksgiving/Black Friday spending spree. Meanwhile, another survey shows that the smartphone has emerged as Santa’s favorite helper this holiday. According to CFI Group and eBay Enterprises, 70% of people polled said they made a purchase with their mobile devices in the past six months, up from 59% in 2013—and also plan to make even more smartphone purchases in 2015. Interestingly, a full 54% of them say they use both mobile commerce sites and apps on their smartphones, but that they prefer mobile websites over apps by a margin of more than 2:1. The survey also suggests that retailers have to do more to fully capitalize on this huge opportunity by improving cross-channel functionality and customer engagement. In any event, retailers should be prepared for full-throttle digital engagement this holiday.

Source: CFI Group and eBay Enterprise Holiday Report, November 2014

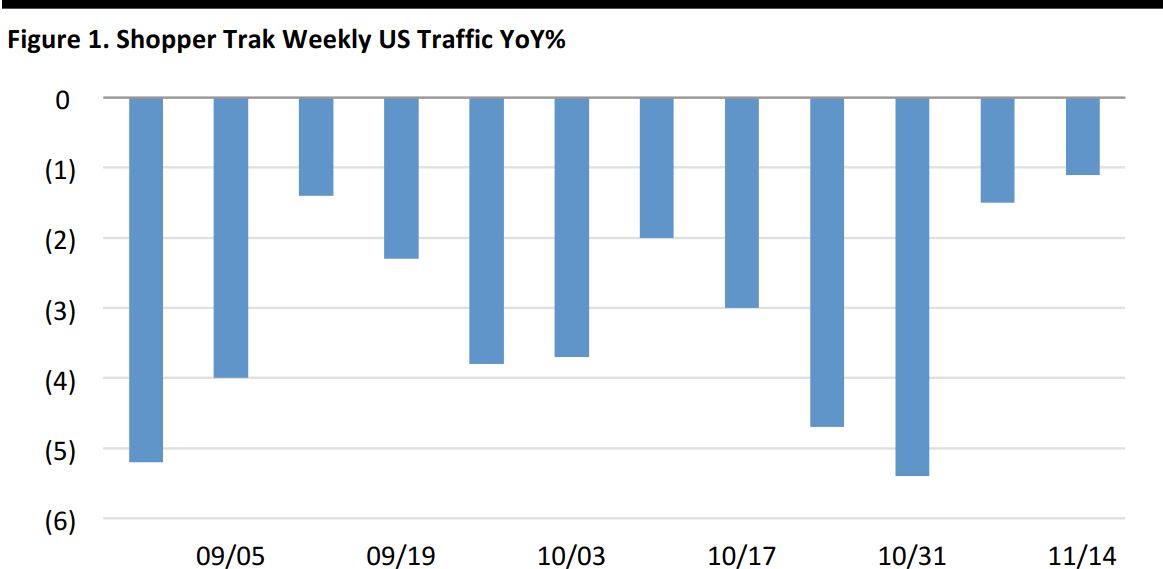

US WEEKLY TRAFFIC AND SALES INDICES

Through November 14, 2014 Source: ShopperTrak

- US store traffic fell 1.1% YoY for the week ended Nov. 14, the smallest decline since December 2013 and an improvement from the prior week’s 1.5% drop

- November is on track for the best monthly traffic showing since August 2012

- Apparel store traffic fell just 50 basis points (bps), also the best performance since December 2013; electronics store sales rose by high-single digits

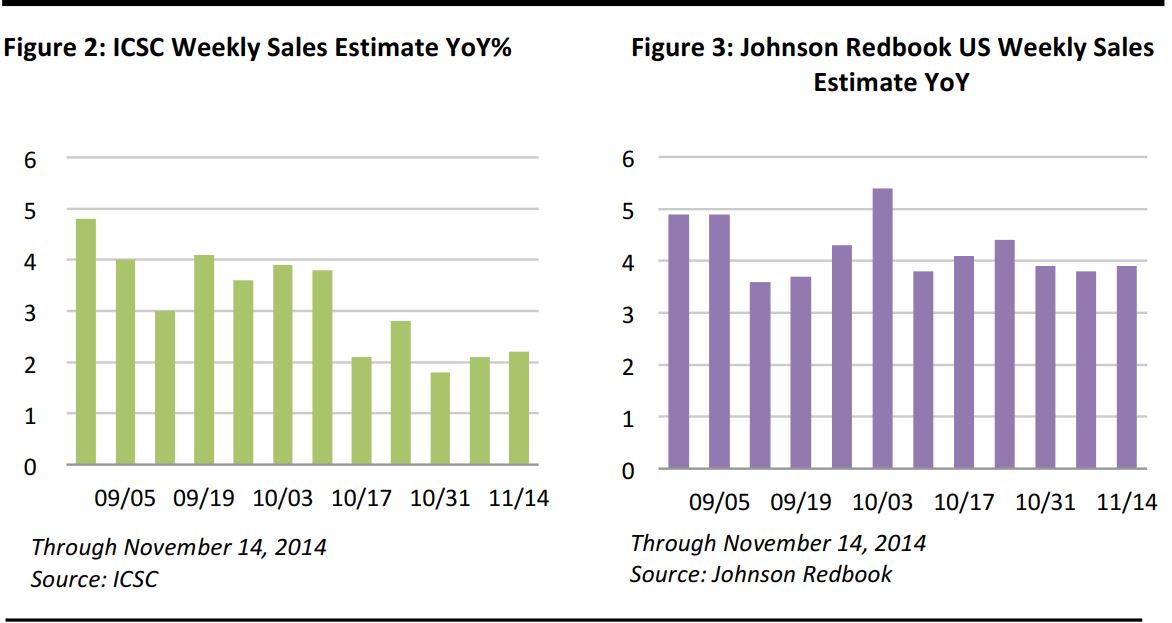

Note: The differences between the two index results reflect differences in coverage and methodology. The ICSC-Goldman Sachs index is a statistically derived estimate of industry sales that is weighted by sales volume. Redbook’s index encompasses 13 retailers, spanning specialty apparel, department stores and discounters.

- According to ICSC, discounters and electronics stores helped US retail sales increase 2.2% YoY for the week ended Nov. 14; apparel sales remained weak, although online apparel stores delivered their strongest sales gain of the year

- Johnson Redbook data showed a 3.9% YoY gain for the same week; discount stores strongly outperformed (up 4.5%), while department stores lagged (up 2.8%)

US RETAIL HEADLINES OF THE WEEK

(OB: HM B) Returns to Double-Digit Sales Growth in October (November 17). Swedish company H&M reported a 14% sales gain in October YoY, ahead of a 10% consensus projection and rebounding from the 8% gain in September. The company also announced its intention to launch new online markets of Belgium, Bulgaria, Czech Republic, Hungary, Poland, Portugal, Romania and Slovakia in 2015, and plans store openings in the new markets of India, Peru, South Africa and Taiwan. HM B shares closed up 2.5% on the announcement. Company press releases

(OB: HM B) Returns to Double-Digit Sales Growth in October (November 17). Swedish company H&M reported a 14% sales gain in October YoY, ahead of a 10% consensus projection and rebounding from the 8% gain in September. The company also announced its intention to launch new online markets of Belgium, Bulgaria, Czech Republic, Hungary, Poland, Portugal, Romania and Slovakia in 2015, and plans store openings in the new markets of India, Peru, South Africa and Taiwan. HM B shares closed up 2.5% on the announcement. Company press releases

(HD) 3Q Beats Expectations; Glad Tidings for 4Q (November 18). Consensus-beating 3Q results were driven by a 5.2% pickup in global comp-store sales, including an impressive 5.8% comp increase at its US stores. Online sales grew 40%, and both traffic and average ticket rose (+3.2% and +2.3%, respectively). All merchandising departments contributed to the results, with millwork, tools, bath and kitchen, indoor garden, lumber and plumbing posting above-company-average sales. Resurgent growth in the professional-contractor business was anchored by the largest professional (about 30% of pro sales), whose typical spend is two times the company average. SG&A cost controls pushed up the operating margin 60 bps.

The retailer continued to return cash to shareholders via dividends and stock buybacks (with the latter totaling $5.7 billion so far this year, and another $1.3 billion slated for the 4Q). Inventory turns were flat YoY, at 4.7 times, and merchandise inventory rose 5.8%, mostly reflecting the intentional addition of a day of back-stock in anticipation of potential supply-chain disruptions. However, management said that it has been able to land all of its Black Friday freight. The retailer reiterated its full-year guidance for a 21% EPS gain (to $4.54), and 4.8% revenue growth, including anticipated expenses related to its September customer-data breach. Investors were disappointed that the company didn’t raise guidance, leading to a 2.1% drop in HD shares for the day. Company report and conference call

(HD) 3Q Beats Expectations; Glad Tidings for 4Q (November 18). Consensus-beating 3Q results were driven by a 5.2% pickup in global comp-store sales, including an impressive 5.8% comp increase at its US stores. Online sales grew 40%, and both traffic and average ticket rose (+3.2% and +2.3%, respectively). All merchandising departments contributed to the results, with millwork, tools, bath and kitchen, indoor garden, lumber and plumbing posting above-company-average sales. Resurgent growth in the professional-contractor business was anchored by the largest professional (about 30% of pro sales), whose typical spend is two times the company average. SG&A cost controls pushed up the operating margin 60 bps.

The retailer continued to return cash to shareholders via dividends and stock buybacks (with the latter totaling $5.7 billion so far this year, and another $1.3 billion slated for the 4Q). Inventory turns were flat YoY, at 4.7 times, and merchandise inventory rose 5.8%, mostly reflecting the intentional addition of a day of back-stock in anticipation of potential supply-chain disruptions. However, management said that it has been able to land all of its Black Friday freight. The retailer reiterated its full-year guidance for a 21% EPS gain (to $4.54), and 4.8% revenue growth, including anticipated expenses related to its September customer-data breach. Investors were disappointed that the company didn’t raise guidance, leading to a 2.1% drop in HD shares for the day. Company report and conference call

(TGT) Exceeds Comp Guidance in 3Q (November 19). The retailer posted 3Q US +1.2% comp, surpassing guidance for flat to a 1% gain, matching the best performance in two years.Comps were positive for all three months reflected a 1.6% gain in average ticket offset by a decline in items per basket and a traffic decline. Digital sales rose +30%, driven by a 50% increment from in mobile traffic and improved conversion. Since Target introduced Store Pickup in late 2013, orders have averaged ~15% of digital traffic, with more than 80% of orders are ready within an hour. On the 3Q call, management articulated its growth plan: 1) channel agnostic growth drive by customer preferences; 2) segment and focus on signature categories that Target should be known for—babies, kids, wellness and style; 3) localization and personalization, reflecting local tastes and preferences; and 4) expense optimization and ongoing cost savings efforts. Guidance for 4Q is for a US comp gain of ~2%, and MTD sales are ahead of the forecast. TGT shares closed up 7.4%. Company press release and conference call

(TGT) Exceeds Comp Guidance in 3Q (November 19). The retailer posted 3Q US +1.2% comp, surpassing guidance for flat to a 1% gain, matching the best performance in two years.Comps were positive for all three months reflected a 1.6% gain in average ticket offset by a decline in items per basket and a traffic decline. Digital sales rose +30%, driven by a 50% increment from in mobile traffic and improved conversion. Since Target introduced Store Pickup in late 2013, orders have averaged ~15% of digital traffic, with more than 80% of orders are ready within an hour. On the 3Q call, management articulated its growth plan: 1) channel agnostic growth drive by customer preferences; 2) segment and focus on signature categories that Target should be known for—babies, kids, wellness and style; 3) localization and personalization, reflecting local tastes and preferences; and 4) expense optimization and ongoing cost savings efforts. Guidance for 4Q is for a US comp gain of ~2%, and MTD sales are ahead of the forecast. TGT shares closed up 7.4%. Company press release and conference call

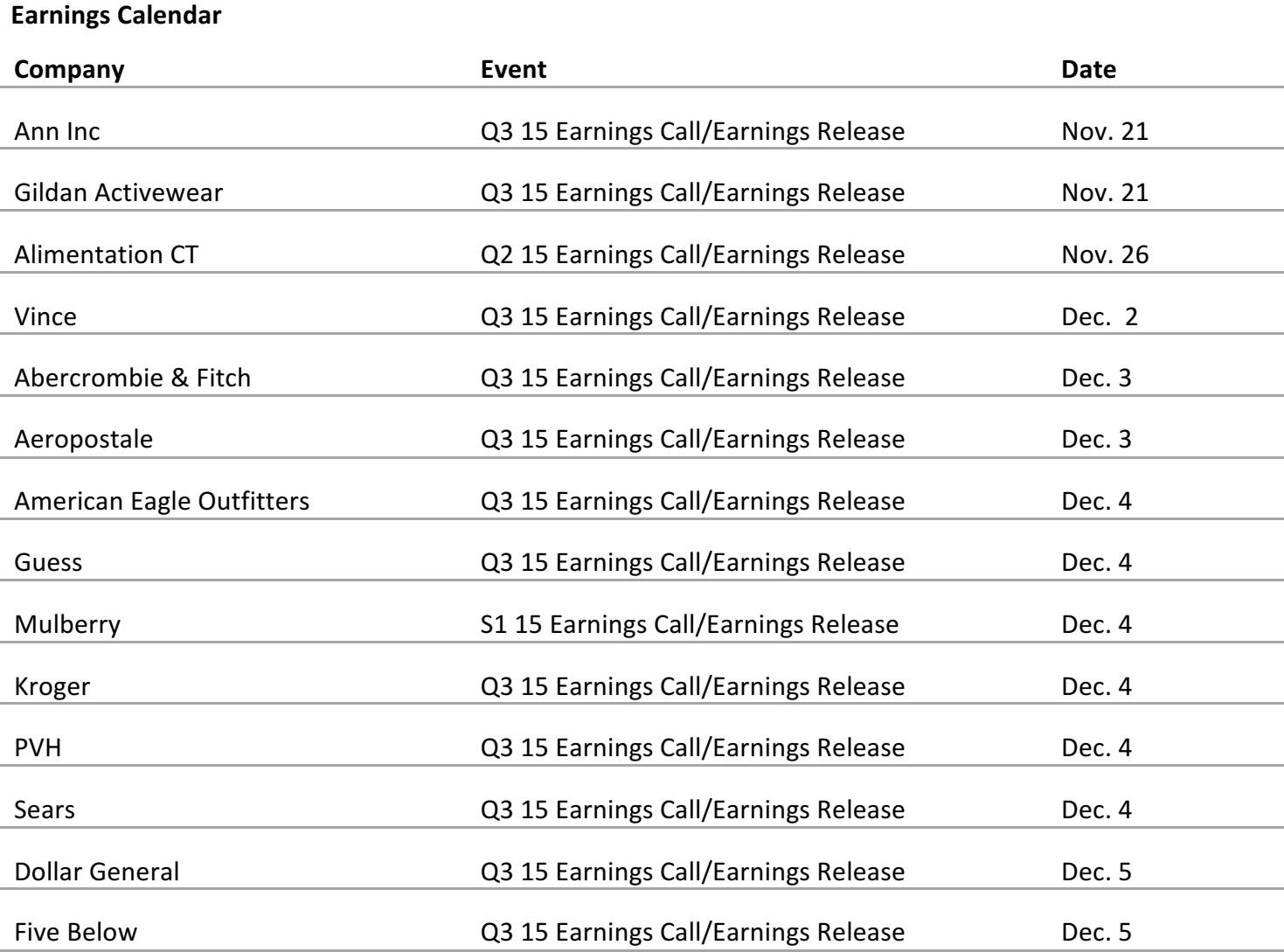

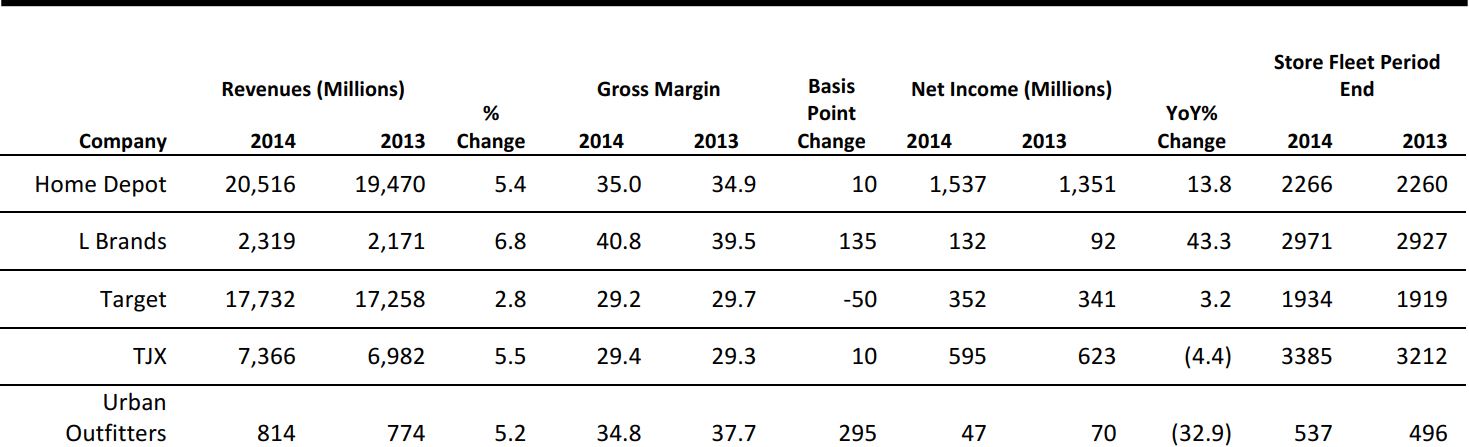

Selected Retail Company Earnings Results

Source: company reports US Regular Gasoline Prices

Source: US Energy Information Administration

FEATURE OF THE WEEK: West Coast Shipping Delays Worry Retailer

Equipment shortages, rail issues and ongoing labor negotiations are slowing shipments from the ports of Los Angeles and Long Beach in California and Tacoma in Washington. The delays could affect retailers’ ability to keep products on the shelves this holiday season. Some carriers are considering levying port-congestion surcharges. According to Bloomberg, shipments through the two California ports rose 3.1% in Q3, versus the 4.3% recorded a year ago.

The California ports are of key strategic importance to the US economy and to retailing, since together they handle about 40% of US imports from Asia. According to global trade research firm Panjiva, Target, Costco Wholesale, Home Depot, Samsung Electronics, and Kmart were the top five importers by weight at the Los Angeles and Long Beach ports.

Negotiations among the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association have been ongoing since the union’s six-year contract expired on July 1. Some retailers have diverted shipments to West-Coast Canadian or US East-Coast and Gulf ports. Specifically, Home Depot mentioned that it had created contingency plans in the event of a shipping disruption. Alongside the labor negotiations, there have been allegations that the unionized workers have been slowing shipment volume in order to gain negotiating leverage and reports of picketing and other labor disruptions. There are also reports of backups in Tacoma, Washington, which is a major transit port for perishable products such as apples, potatoes, and Christmas trees, which are shipped to Asia, Canada, and Mexico. Orders for more than 12,000 trees from Asia have been canceled, and 2,200 trees awaiting shipment to Hong Kong for two weeks will need to be discarded.

With the approaching holidays, these delays come at a critical time for retailers, who have been keeping inventories lean following the 2008 global financial crisis. S&P 500 companies grew inventories at 86% the rate of sales growth in Q3, on average, according to Bloomberg. The capacity backup at the port means that there is little excess capacity to buffer fluctuations in shipments. Storage space at several Los Angeles container terminals is 90% full, as shipments have backed up waiting to be shipped by truck to retail customers.

Large retailers such as Macy’s have already experienced some delays in being able to put products on the shelves, and CEO Terry Lundgren estimates that every day of a dock slowdown could reduce US GDP by $1.9 billion. Macy’s and the National Retail Federation (NRF), along with Walmart are asking for help from the White House in moving the contract negotiations forward. One consultant said that the port slowdown could affect the bulk of Christmas retailing, including retailers’ ability to replenish inventories of hot products during the holiday season.

Equipment shortages, rail issues and ongoing labor negotiations are slowing shipments from the ports of Los Angeles and Long Beach in California and Tacoma in Washington. The delays could affect retailers’ ability to keep products on the shelves this holiday season. Some carriers are considering levying port-congestion surcharges. According to Bloomberg, shipments through the two California ports rose 3.1% in Q3, versus the 4.3% recorded a year ago.

The California ports are of key strategic importance to the US economy and to retailing, since together they handle about 40% of US imports from Asia. According to global trade research firm Panjiva, Target, Costco Wholesale, Home Depot, Samsung Electronics, and Kmart were the top five importers by weight at the Los Angeles and Long Beach ports.

Negotiations among the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association have been ongoing since the union’s six-year contract expired on July 1. Some retailers have diverted shipments to West-Coast Canadian or US East-Coast and Gulf ports. Specifically, Home Depot mentioned that it had created contingency plans in the event of a shipping disruption. Alongside the labor negotiations, there have been allegations that the unionized workers have been slowing shipment volume in order to gain negotiating leverage and reports of picketing and other labor disruptions. There are also reports of backups in Tacoma, Washington, which is a major transit port for perishable products such as apples, potatoes, and Christmas trees, which are shipped to Asia, Canada, and Mexico. Orders for more than 12,000 trees from Asia have been canceled, and 2,200 trees awaiting shipment to Hong Kong for two weeks will need to be discarded.

With the approaching holidays, these delays come at a critical time for retailers, who have been keeping inventories lean following the 2008 global financial crisis. S&P 500 companies grew inventories at 86% the rate of sales growth in Q3, on average, according to Bloomberg. The capacity backup at the port means that there is little excess capacity to buffer fluctuations in shipments. Storage space at several Los Angeles container terminals is 90% full, as shipments have backed up waiting to be shipped by truck to retail customers.

Large retailers such as Macy’s have already experienced some delays in being able to put products on the shelves, and CEO Terry Lundgren estimates that every day of a dock slowdown could reduce US GDP by $1.9 billion. Macy’s and the National Retail Federation (NRF), along with Walmart are asking for help from the White House in moving the contract negotiations forward. One consultant said that the port slowdown could affect the bulk of Christmas retailing, including retailers’ ability to replenish inventories of hot products during the holiday season.

Chassis Shortages

There are several causes for the shipping backup, including chassis shortages, delays in the rail network, and poor communication between terminals and truckers during a strong increase in shipping volume. The chassis shortage arises from shipping lines’ having sold their equipment to leasing companies and pool operators, and the new owners have not deployed the chassis as efficiently to the marine terminals where they are needed. This has resulted in turnaround times rising to 3.5 to 5 hours in the Los Angeles/Long Beach harbor, versus 2.5 hours in other locations. Previously, for every chassis there was a container. Today, the shipping lines have divested most of their own chassis, and the number of available chassis at a terminal can vary from a few to the thousands. If a chassis not available, then the driver must wait.Rail Mismatch

There are also shipping issues at the container-rail interface, which have persisted for US and Canadian shippers since the cold winter of 2012. As of this July, railroads faced delays of two days in providing engines and railcars to the harbor, despite Los Angeles/Long Beach ports each having on-dock loading capability.Surge in Cargo Volume

Shipping volumes were on an upswing until the union contract negotiations began, with containerized imports up in May up 6% YoY.Resolution on the Horizon?

Last week, representatives from the NRF, the National Association of Manufacturers, the Toy Industry Association, and the Consumer Electronics Association met with White House officials to request that a federal negotiator intervene in the labor negotiation. Officials at the Port of Los Angeles are hopeful that an agreement can be reached within weeks.CHINA HEADLINES OF THE WEEK

China Consumer Retail Sales Rise Double-Digits in October (November 13). According to the China National Bureau of Statistics (NBS), total nominal retail sales of consumer goods reached 2.4 trillion yuan in October 2014, up 11.5% YoY, of which retail sales of companies above a designated size were 1,174.5 billion yuan, up by 8.3% YoY. Online sales above a designated size rose 55.6% YoY, reaching 330.7 billion yuan between January and October. National Bureau of Statistics Greater Support for E-Commerce Development (November 16). The General Office of the State Council recently issued the Opinions on Promoting the Development of Domestic Trade and Distribution Sector, which included supportive measures to foster the development of the domestic trade/distribution sector. The Opinions emphasize the importance of promoting and better regulating e-commerce development. Major tasks include supporting the development of e-commerce in smaller cities and rural areas, promoting the use of “big data” across public information platforms, encouraging online and offline integration, ensuring fair competition between banks and third-party payment companies and encouraging payment innovation. The Opinions also highlight the importance of accelerating the development of logistics and express delivery sector, and promoting franchise operations.

Efforts will also be made by the authorities to improve business environment for commercial enterprises and logistics companies. Major tasks include streamlining the administrative approval procedures and easing the tax burdens of enterprises, creating an environment for fair competition, strengthening law enforcement, and speeding up the establishment of a sound credit rating system. The General Office of the State Council

Domestic Trade and Distribution Sector, which included supportive measures to foster the development of the domestic trade/distribution sector. The Opinions emphasize the importance of promoting and better regulating e-commerce development. Major tasks include supporting the development of e-commerce in smaller cities and rural areas, promoting the use of “big data” across public information platforms, encouraging online and offline integration, ensuring fair competition between banks and third-party payment companies and encouraging payment innovation. The Opinions also highlight the importance of accelerating the development of logistics and express delivery sector, and promoting franchise operations.

Efforts will also be made by the authorities to improve business environment for commercial enterprises and logistics companies. Major tasks include streamlining the administrative approval procedures and easing the tax burdens of enterprises, creating an environment for fair competition, strengthening law enforcement, and speeding up the establishment of a sound credit rating system. The General Office of the State Council

Opens Shanghai Store (November 19).

US fashion designer Tory Burch opened a flagship store on the prime Nanjing Road west in Shanghai on October 2014. The store is the brand’s 10th store in China, but it is the first store in Shanghai and the largest one in Asia. Products sold at the store range from ready-to-wear and homewares, and the store features a private VIP suite. Insideretail

Opens Shanghai Store (November 19).

US fashion designer Tory Burch opened a flagship store on the prime Nanjing Road west in Shanghai on October 2014. The store is the brand’s 10th store in China, but it is the first store in Shanghai and the largest one in Asia. Products sold at the store range from ready-to-wear and homewares, and the store features a private VIP suite. Insideretail

Alibaba Extends AliPay and Taobao to Australian Merchants (November 18). Alibaba announced the extension of its services of Alipay, the biggest third-party payment platform in China, and Taobao, the largest C2C platform in China, to the Australian market. Alipay Australia will work with a joint venture partner, Paybang, to help local businesses expand in China and to facilitate cross-border trade between the two countries. Meanwhile, Taobao’s Australian platform will allow merchants to sell Australian goods, especially food and agricultural products, to Chinese consumers. Alibaba also announced to work with Australia Post to sell Alipay prepaid cards at 4,400 retail outlets to Aussie shoppers to purchase on Tmall and Taobao. Tech in Asia

Alibaba Extends AliPay and Taobao to Australian Merchants (November 18). Alibaba announced the extension of its services of Alipay, the biggest third-party payment platform in China, and Taobao, the largest C2C platform in China, to the Australian market. Alipay Australia will work with a joint venture partner, Paybang, to help local businesses expand in China and to facilitate cross-border trade between the two countries. Meanwhile, Taobao’s Australian platform will allow merchants to sell Australian goods, especially food and agricultural products, to Chinese consumers. Alibaba also announced to work with Australia Post to sell Alipay prepaid cards at 4,400 retail outlets to Aussie shoppers to purchase on Tmall and Taobao. Tech in Asia

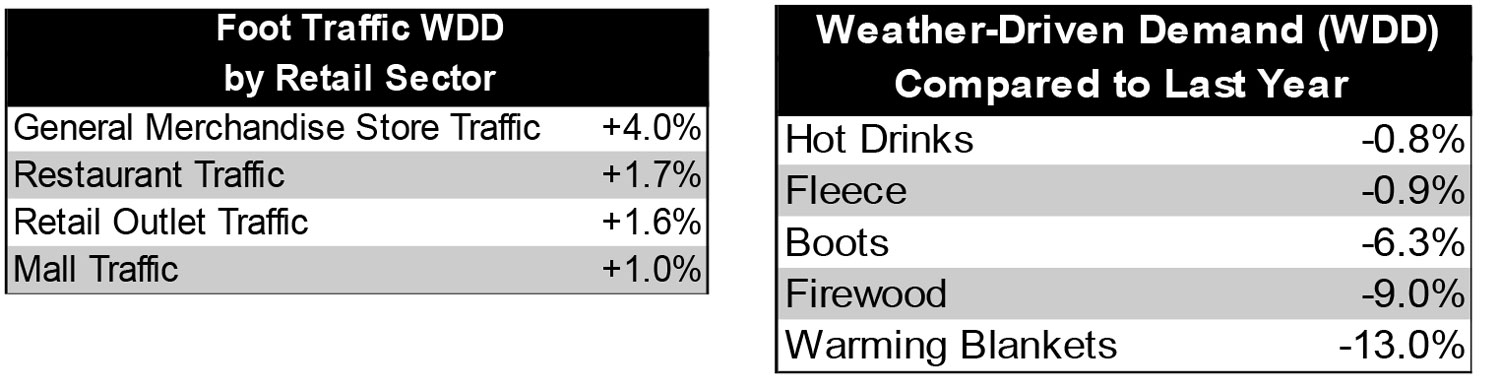

US WEATHER ANALYTICS: Week of Nov. 24 – 30

US WEATHER ANALYTICS: Week of Nov. 24 – 30

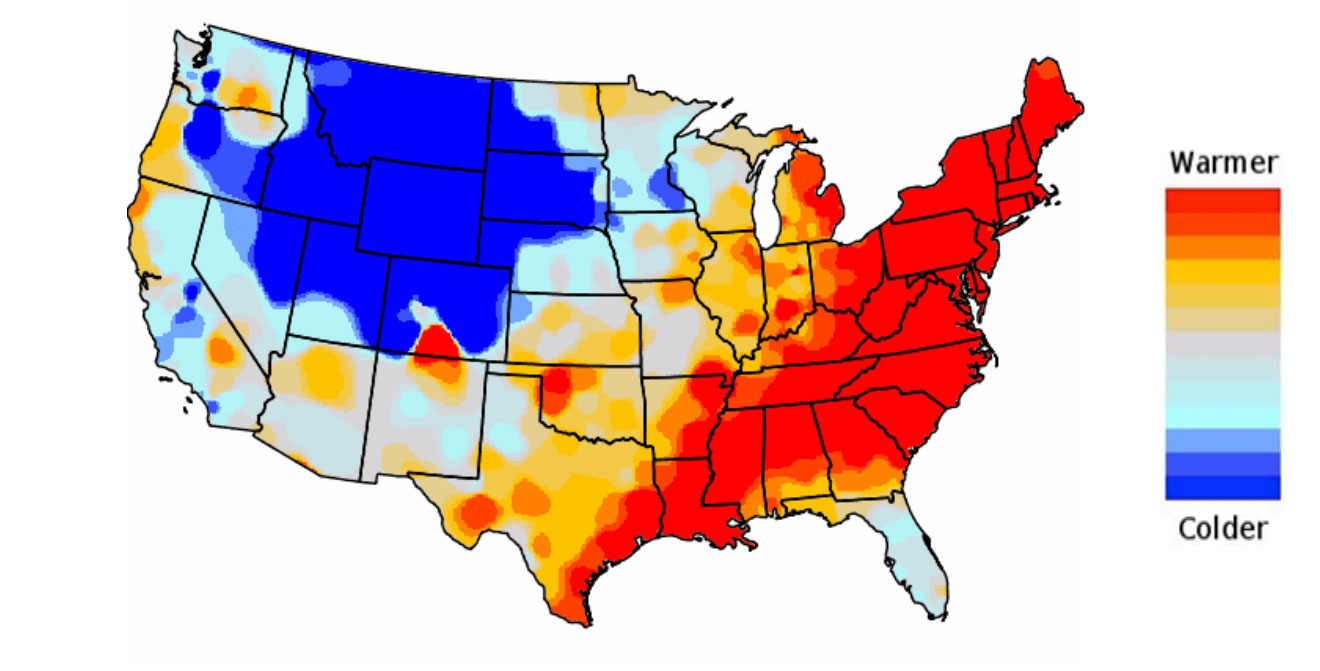

Mild Temps in the Forecast for Thanksgiving Weekend

Warmer Temperatures to Break the Icy Grip. After enduring one of the coldest November arctic surges in recent memory, the very cold temperatures of the past week will retreat and be replaced by a warmer trend. Against a cold week last year, this should slow the strong seasonal demand of the past two weeks. November to End on a Stormy Note. A large system will push through the West early in the week, bringing a good soaking to California and the West Coast, as well as some mountain snow. As this system pushes east into the Plains and Midwest, expect heavy rain in the South. Anticipate a measurable swath of snow from the Central Plains through the Upper Midwest into eastern Canada. Drier Weather for Most over the Holiday Weekend. While Thanksgiving travelers may have to deal with inclement weather early in the week, it should push out by Turkey Day, providing dry weather for Black Friday bargain hunters. While warmer temperatures versus last year’s holiday may shift purchasing away from seasonal items, the weather impact on retail traffic overall should be minimal. The Southern Plains may be faced with inclement weather during the holiday. The Tropics Whimper to a Close. The 2014 Atlantic tropical season officially ends at the end of the month and will close as another rather quiet season.Thanksgiving / Black Friday Week Weather Outlook

(Average Temperature vs. Last Year)

Drier & Warmer Weather Supports Store Traffic but Cold-Weather Items Will Suffer

Based on the warmer year-over-year temperatures in the East and along the West Coast, weather will support foot traffic for most retail segments. Expect demand for cold-weather seasonal categories such as sweaters, jackets, gloves, blankets and heaters to lag last year.

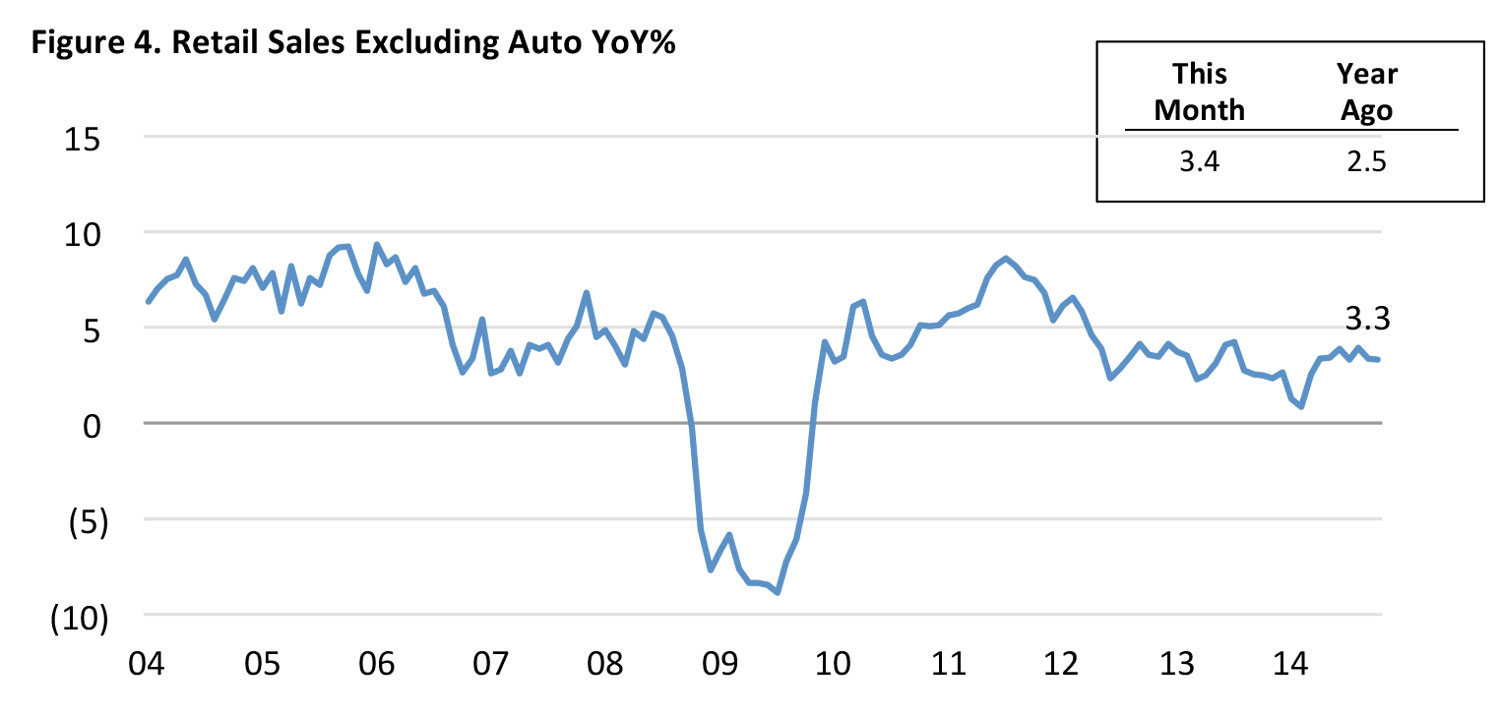

A FOCUS ON THE US RETAIL SALES

Through October 31, 2014

Seasonally adjusted

Source: US Department of Commerce

Through October 31, 2014

Seasonally adjusted

Source: US Department of Commerce

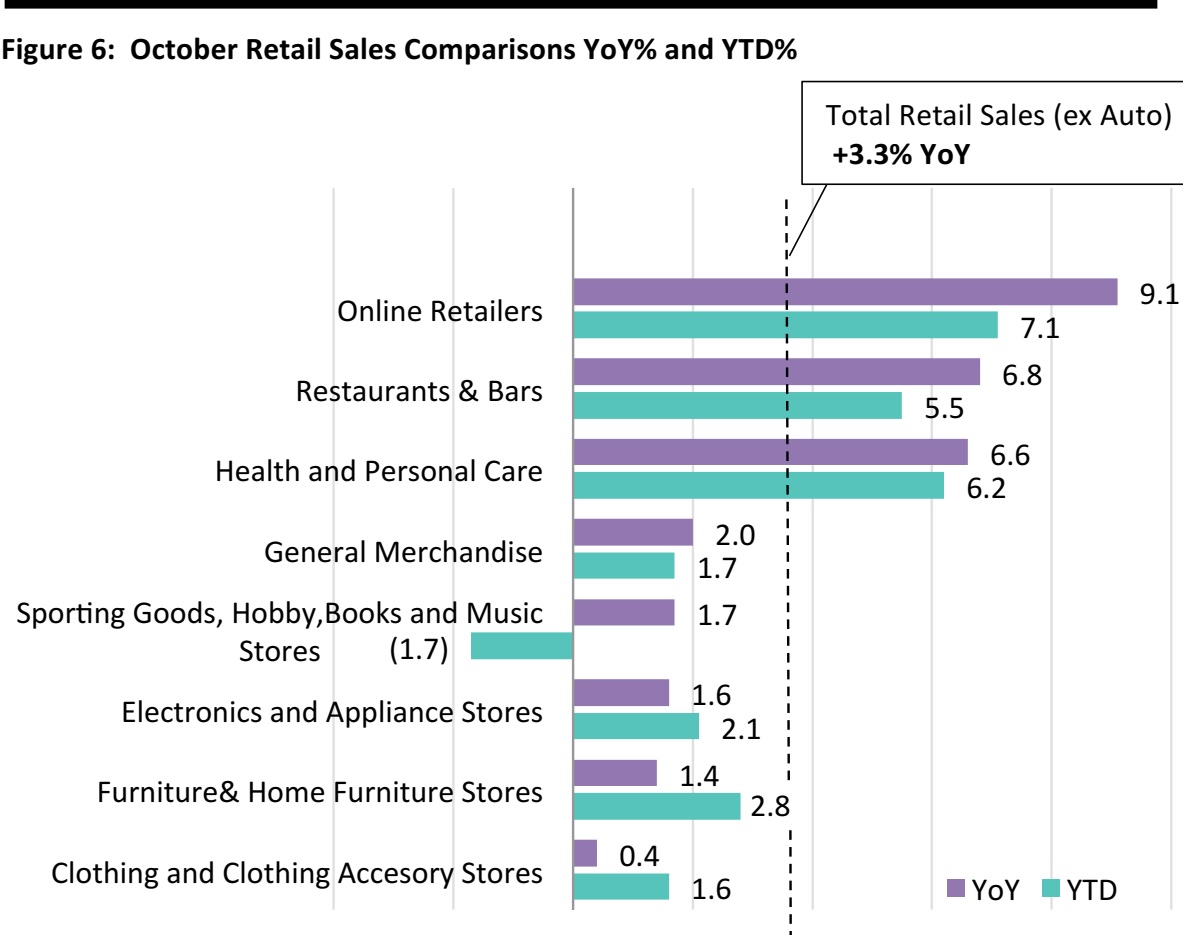

- Total US retail sales ex-auto increased 3.3% YoY in October, driven by a 9.1% gain in online sales

- YTD total US sales ex-auto rose 3.0%. With pump prices down 8% YoY in October, sales at gas stations declined 4.0%, reducing the 3.3% composite gain by an estimated 50 basis points

- Excluding the impact of lower gas prices, retail sales ex-auto would have risen ~3.8%

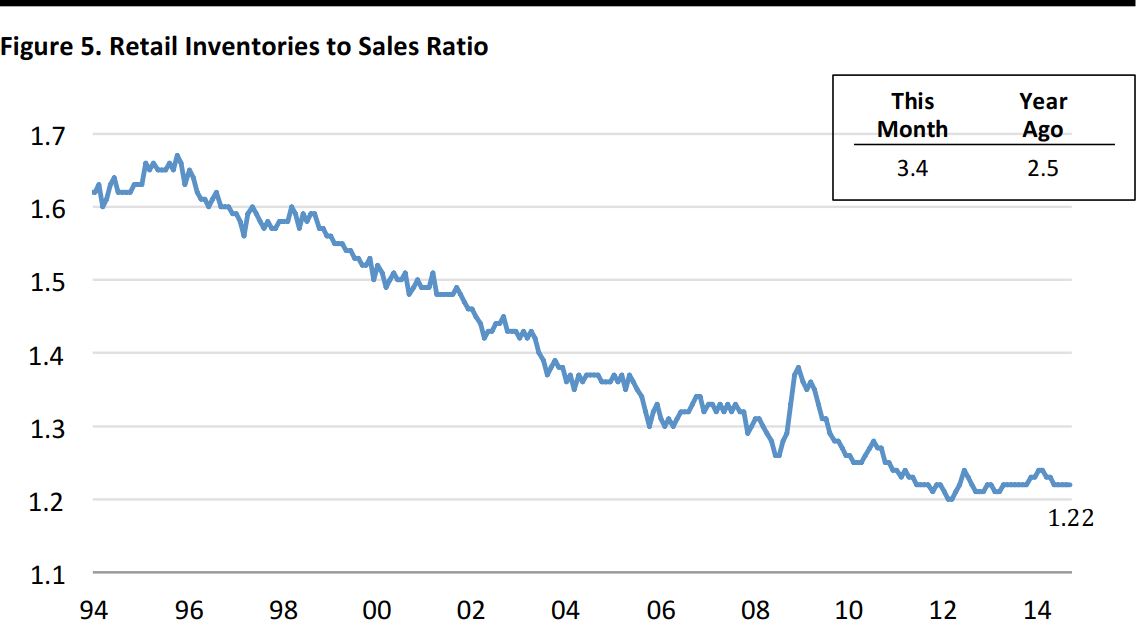

Through September 30, 2014 Seasonally adjusted; sales are ex-auto Source: US Department of Commerce

- Retail inventories/sales ratios remain extremely low going into the all-important holiday selling season, exacerbating the potential for out-of-stocks amid shipping delays at West Coast ports

Through October 31, 2014 YoY Seasonally adjusted; YTD unadjusted Source: US Department of Commerce

- Lower pump prices translated into more eating out, reflected in a 6.8% sales increase in restaurants and bars

- Clothing, electronic and furniture stores, as well as general merchants, trailed the 3.3% composite gain

- Despite the strength of various athletic wear stores, the 1.7% decline at sporting goods, hobby, books and music stores reflects the continued migration of media sales online, along with the growing penetration of ebooks

- Health and personal care stores continued to see vibrant growth, up 6.6% YoY and 6.2% YTD, by providing assortment, speed and convenience to time-constrained shoppers.

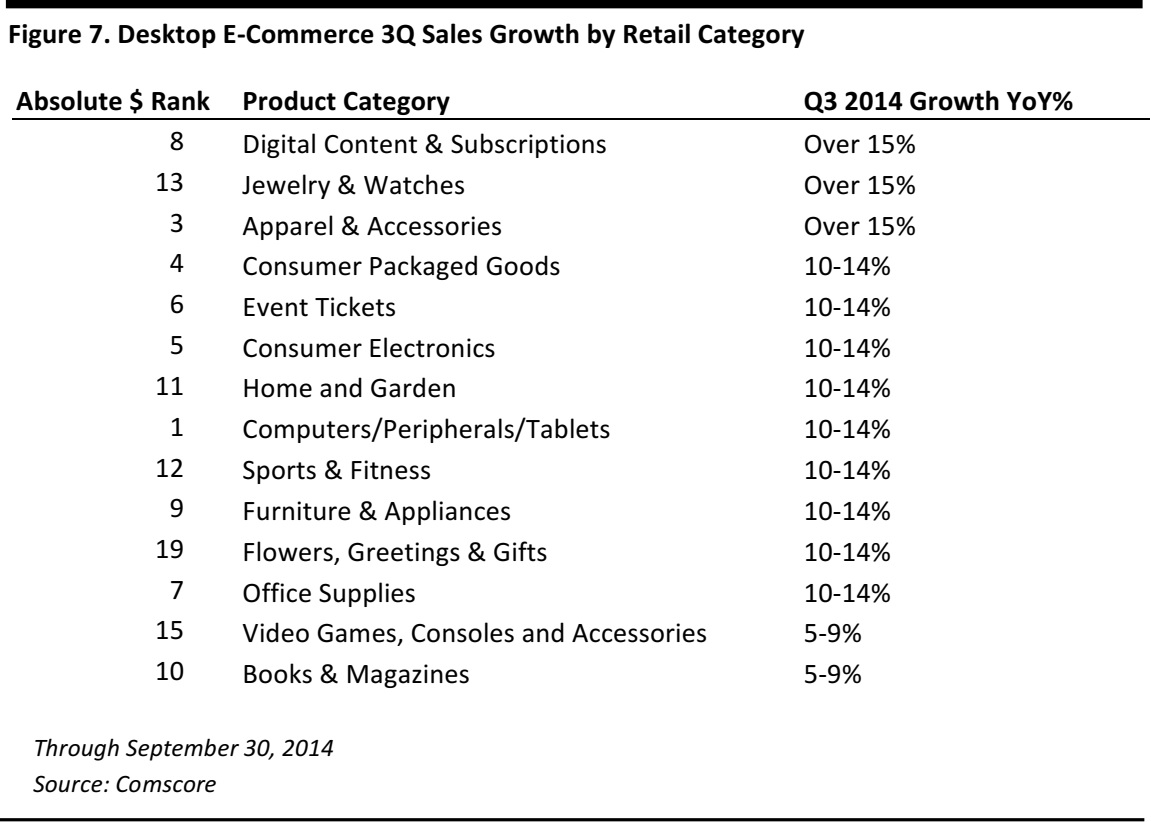

Through September 30, 2014 Source: Comscore

- Nearly all e-commerce categories showed double-digit growth YoY, including the largest overall category in dollars, computers/portable devices

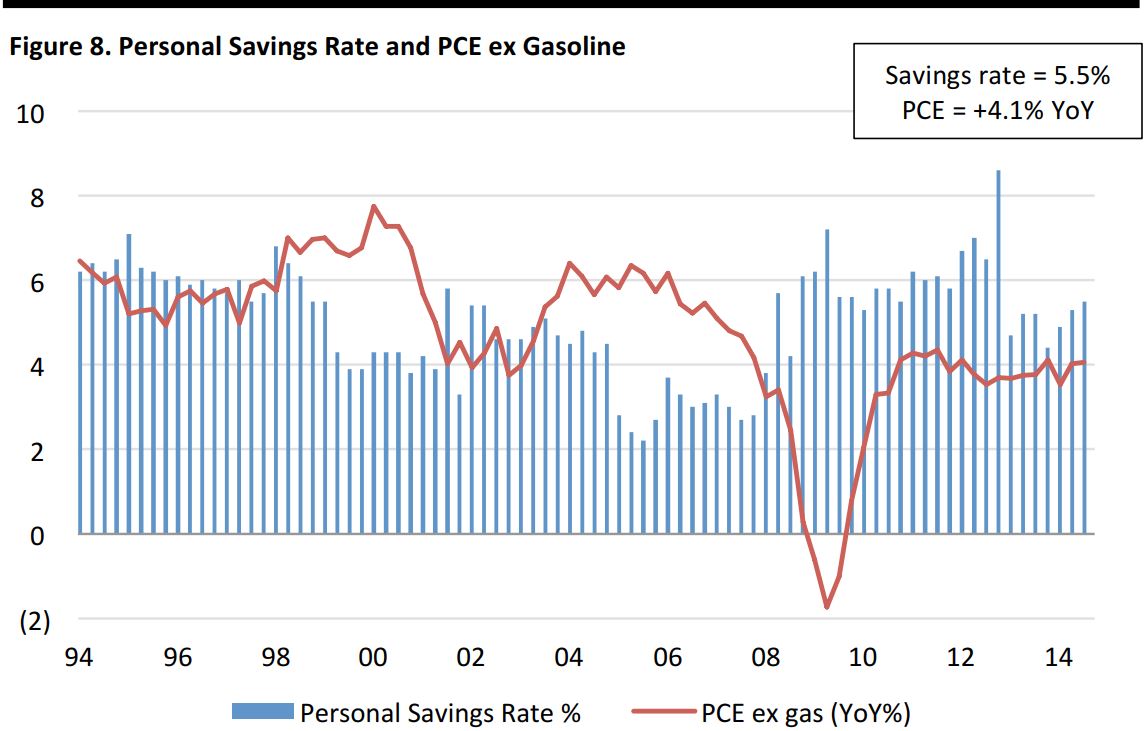

Through September 30, 2014 Source: US Bureau of Economic Analysis and Haver Analytics

- Consumer spending growth has been relatively flat for the past two years, while the savings rate has risen