FROM THE DESK OF DEBORAH WEINSWIG

Reviewing Singles’ Day 2016

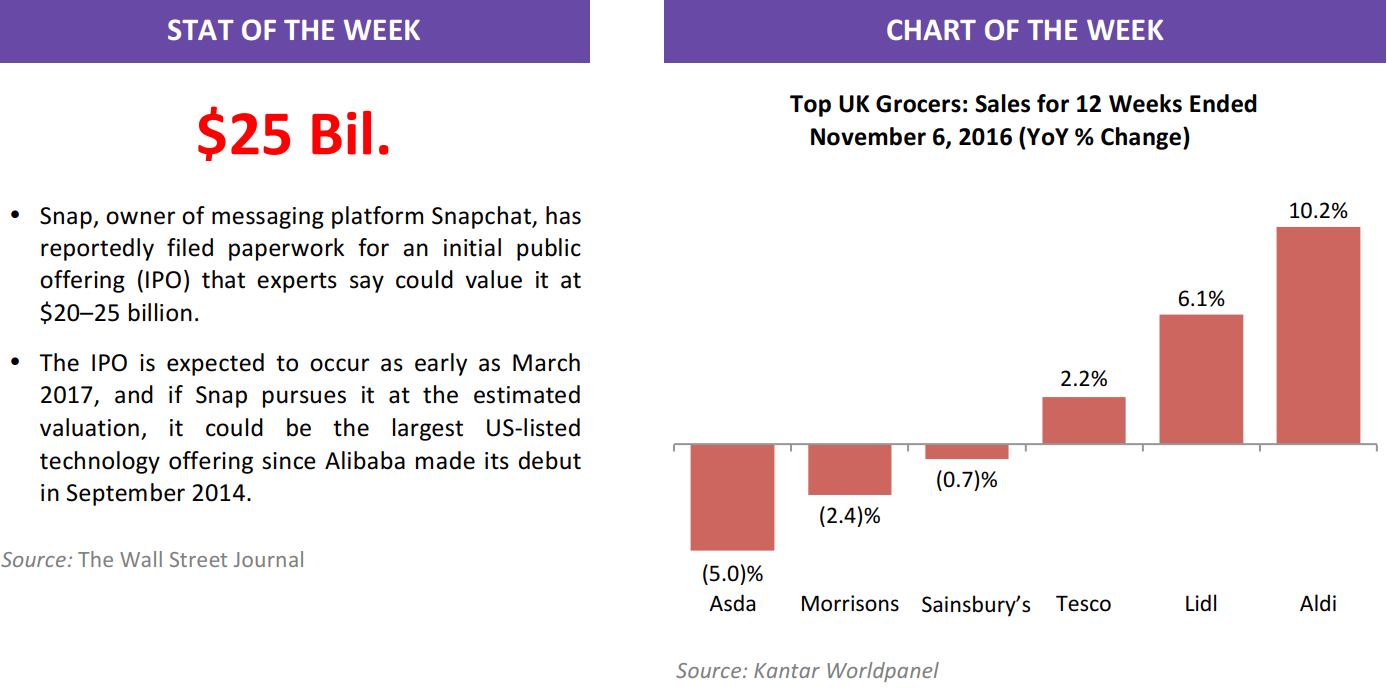

This year, the Singles’ Day shopping event received more media coverage, saw greater participation and generated higher sales than ever before. Here, we recap the event and consider how Alibaba has developed this shopping festival in a way that differentiates it from conventional retail events.

Singles’ Day 2016 in Numbers

Here are some top-line numbers on Singles’ Day that were released by Alibaba:

- The value of all purchases settled through the Alipay payment service on November 11, 2016, was up 32% year over year, to ¥121 billion (US$17.8 billion), making Singles’ Day substantially bigger than Black Friday or Cyber Monday in the US.

- Alibaba Cloud processed 175,000 orders per second at the peak.

- Alipay processed more than 1 billion payments.

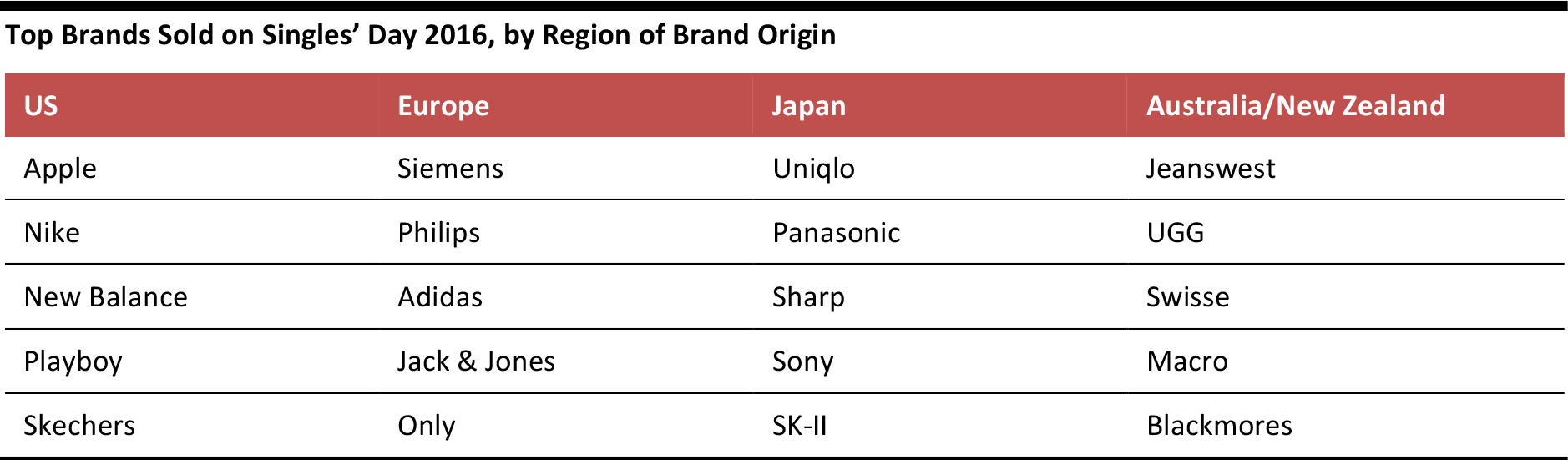

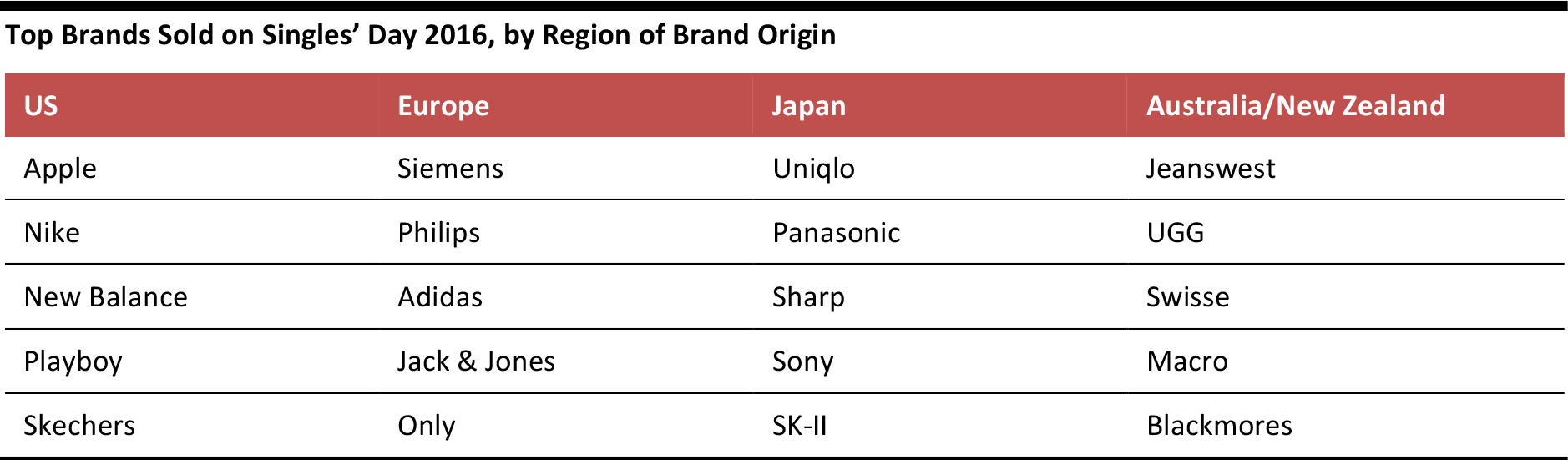

- Some 37% of shoppers bought from international brands or merchants.

Source: Alibaba

All About the Experience

Singles’ Day is distinguished not just by its scale, but by the experience that Alibaba builds around the event. This year was more spectacular and interactive than ever.

Alibaba hosted a two-day Global Shopping Festival celebration in Shenzhen, China, on November 10 and 11. The event included Alibaba’s executive briefing, an influencer panel and a gala celebration. David Beckham, OneRepublic and Kobe Bryant were among the star guests at the gala, and we were there to witness the spectacle. The event was televised across multiple platforms in China, and viewers were able to buy showcased collections and win the outfits worn by celebrities.

Alibaba also brought virtual reality to Singles’ Day this year, through its Buy+ virtual reality shopping experience on its mobile app. And its Tmall platform offered a Pokémon Go–style augmented-reality mobile game featuring a cat mascot that led shoppers to Tmall merchants’ physical stores.

Online shopping in countries other than China is becoming ever more about price—and shopping events, such as Black Friday in the US, also tend to be price-focused. In contrast, Alibaba’s Singles’ Day is increasingly putting the emphasis on experience and “retailtainment.”

As Daniel Zhang, CEO of Alibaba Group, said, Singles’ Day 2016 was “a preview of the future of retail,” blending “entertainment, commerce and interactive engagement.” Although shopping online is often considered a chore in the US, it has become akin to a sport in China.

- You can find our series of reports on Singles’ Day 2016 on FungGlobalRetailTech.com.

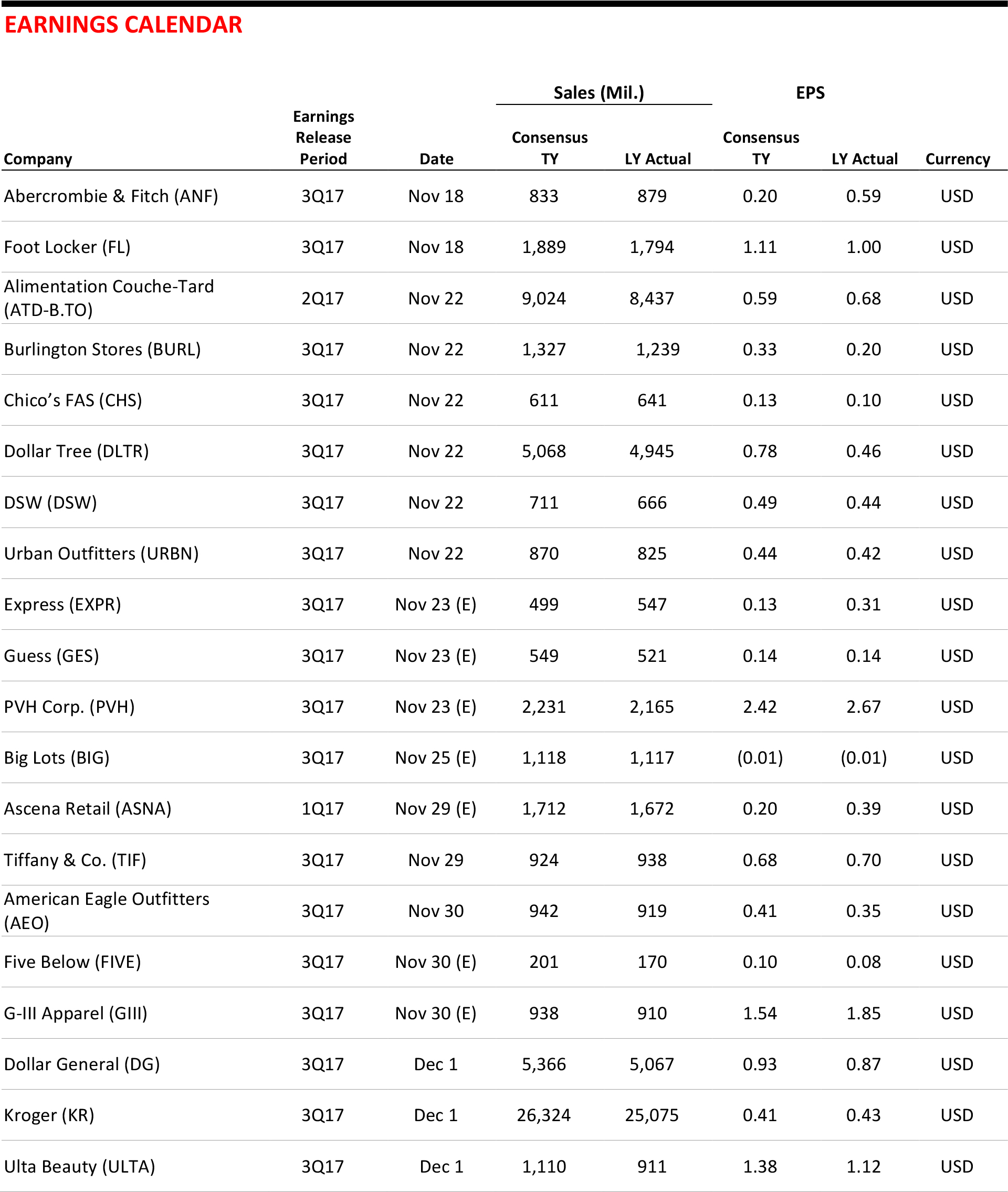

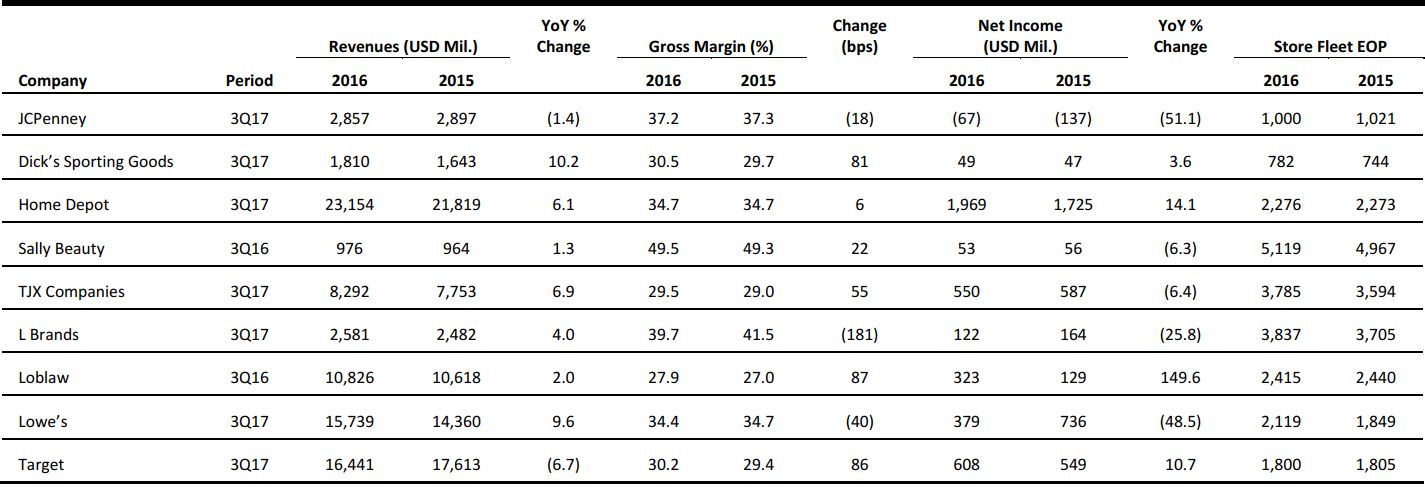

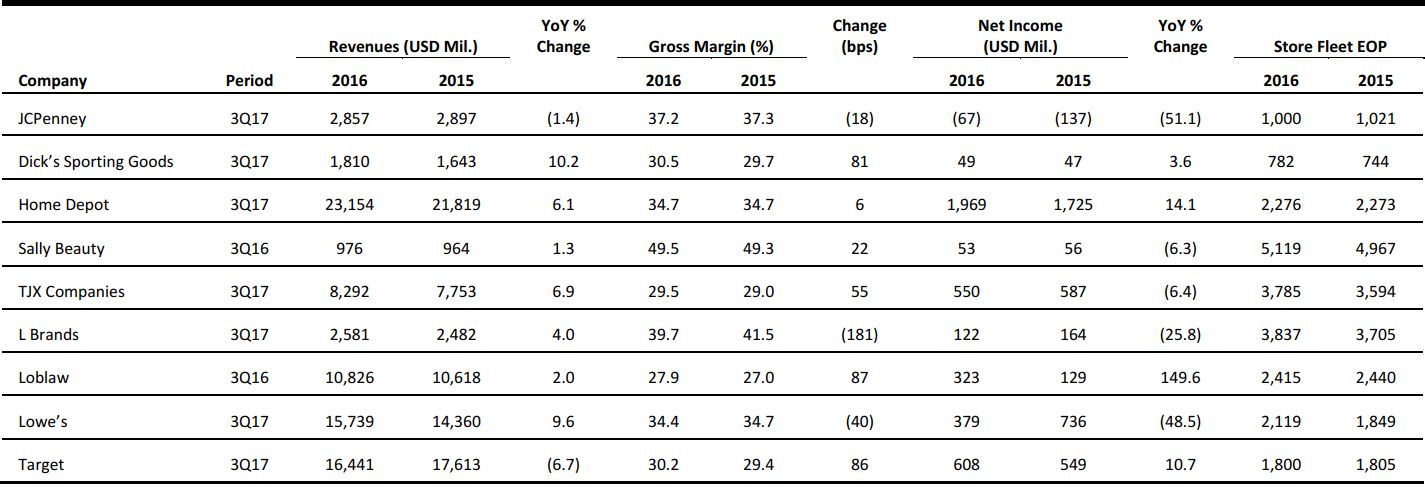

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Fifth Avenue Retailers Feel Pain, with No End in Sight

(November 15) Women’s Wear Daily

Fifth Avenue Retailers Feel Pain, with No End in Sight

(November 15) Women’s Wear Daily

- In New York City, Fifth Avenue’s famous retail climate is being disrupted by security for President-elect Donald Trump. Barricades block the entrance to Trump Tower between 56th and 57th Streets, restricting pedestrian traffic and ultimately impacting shopping in the neighboring stores. The Secret Service is reportedly in negotiations with the New York Police Department regarding security and possibly prohibiting vehicular traffic on Fifth Avenue while Trump is in town.

- Tom Cusick, President of the Fifth Avenue Business Improvement District, estimates that retailers on Fifth Avenue have already lost millions, and possibly tens of millions, of dollars due to security and anti-Trump protests on Fifth Avenue.

Shoppers Ramp Up Spending Ahead of Key Holiday Shopping Season

(November 15) The Wall Street Journal

Shoppers Ramp Up Spending Ahead of Key Holiday Shopping Season

(November 15) The Wall Street Journal

- Shoppers are spending more on home improvement projects, sporting goods and off-price apparel leading into the holiday shopping season. The US Department of Commerce reported that total retail sales rose by 0.8% in October, suggesting a healthy profile for the US retail industry ahead of the unofficial kickoff to the holiday shopping season, Black Friday.

- Retailers are racing to promote their holiday sales after delaying their marketing efforts due to the presidential election. The National Retail Federation estimates that holiday sales will increase by 3.6% over last year.

How Walgreens Plans to Use Pinterest to Drive Holiday Sales

(November 14) Internet Retailer

How Walgreens Plans to Use Pinterest to Drive Holiday Sales

(November 14) Internet Retailer

- This holiday season, Walgreens wants to be a “primary destination for secondary gifts” such as those given to coworkers or the mail carrier. To promote this initiative, Walgreens is launching its first video ad campaign on Pinterest.

- Running through mid-December, the video will highlight the types of “secondary gifts” shoppers can find at Walgreens, such as action figures, candles and wine. Pinterest launched Promoted Videos in August, with video ads timed to play at the same pace at which users scroll down their feed; video ads on Facebook and Twitter automatically play at a constant rate.

Nearly 40% of JCP.com Orders Are Picked Up in Stores

(November 15) Internet Retailer

Nearly 40% of JCP.com Orders Are Picked Up in Stores

(November 15) Internet Retailer

- JCPenney reported that its customers picked up nearly 40% of online orders at a local store in the third quarter, ended October 29. For comparison, Kohl’s announced earlier this week that 5%–6% of its online orders were picked up in stores. In-store pickup accounts for 15% of Target’s online orders.

- In a survey, 73% of those who had picked up an online order in a store said they did so to avoid shipping fees, and 32% said they did so because it was more convenient. JCPenney says that 40% of these customers end up buying more while in the store to pick up their online order.

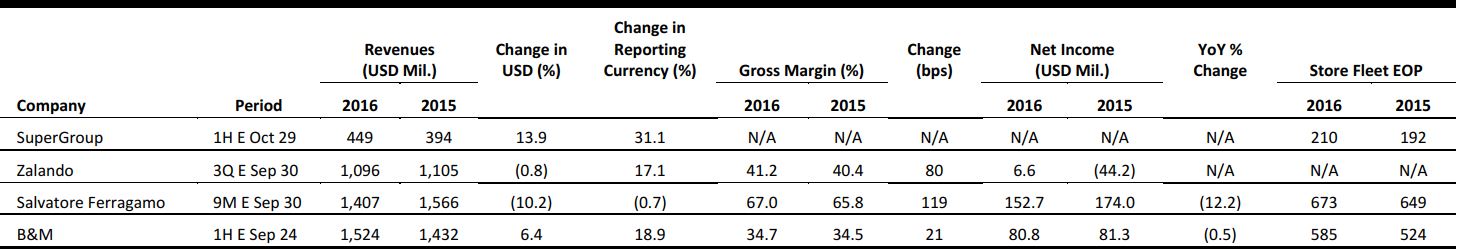

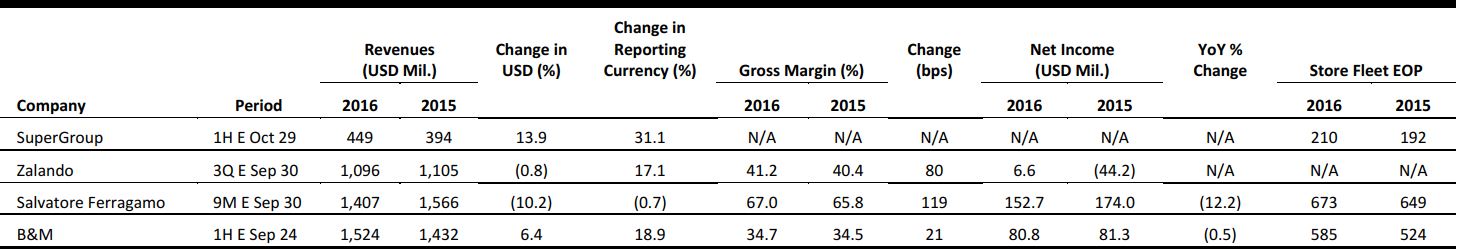

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

Printemps Implements Chinese Mobile Pay to Draw France’s Major Shopping Audience

(November 10) LuxuryDaily.com

Printemps Implements Chinese Mobile Pay to Draw France’s Major Shopping Audience

(November 10) LuxuryDaily.com

- French department store Printemps is introducing mobile payment service Alipay to draw more Chinese customers into its stores. Chief Marketing Officer Annalisa Loustau noted that “Chinese tourists are an important target clientele for Printemps.”

- Printemps stated that users can receive information on promotions—as well as notifications and commentary—through Alipay’s Global Lifestyle Platform marketing solution even before they arrive in Paris, to better prepare them to shop. The retailer expects to roll out Alipay to 18 stores by the end of the year.

Aldi to Enter China and Use Australia as Springboard

(November 13) Smh.com.au

Aldi to Enter China and Use Australia as Springboard

(November 13) Smh.com.au

- German supermarket group Aldi is set to enter China and to use Australia as a springboard to sell to Asia more broadly. In the first half of 2017, Aldi plans to sell groceries and wine online in China and also to set up physical stores in the country.

- A company spokesperson stated that Aldi’s site will sell “nonchilled” groceries and wine, and that a large proportion of the products will be sourced from Aldi’s existing suppliers in Australia. The spokesperson added that Aldi will begin “selling a carefully selected range of everyday grocery items” online in the second half of 2017.

Danish Retailer Bestseller Acquires Miinto

(November 14) Ecommercenews.eu

Danish Retailer Bestseller Acquires Miinto

(November 14) Ecommercenews.eu

- Family-owned Danish retailer Bestseller has acquired Miinto, an online platform for fashion brands from over 1,000 retailers. Bestseller is reportedly investing “a double-digit-million euro” sum in Miinto, but neither firm revealed details of the amount.

- Anders Holch Povlsen, the owner of Bestseller, already holds significant shares in many European online retailers, such as Zalando, Nemlig, Whiteaway Group, Stylepit and ASOS. The investment in Miinto is intended to build awareness of the online platform and create new digital applications.

October Footfall in UK Stores Falls by 0.4% Year over Year

(November 14) British Retail Consortium

October Footfall in UK Stores Falls by 0.4% Year over Year

(November 14) British Retail Consortium

- October footfall in UK stores was 0.4% lower than in the same month in 2015, but was in line with the three-month average rate, according to the latest Footfall and Vacancies Monitor, published by the British Retail Consortium and Springboard.

- Retail parks were the biggest winners in the retail sector, with footfall up 1.1%. Shopping centers were the biggest losers, with footfall down 1.8%, representing the ninth consecutive monthly decline. Footfall at high-street stores fell by 0.4%...

Auchan Tests Grocery-Carrying Robots

(November 14) RetailDetail.eu

Auchan Tests Grocery-Carrying Robots

(November 14) RetailDetail.eu

- French retailer Auchan is set to test a robot that can carry groceries for customers as they shop. The grocery-carrying robot is called WiiGO, and the first one will be trialed at a store near Lille for a month. Based on the results, the trial will be expanded to other stores.

- A camera on the robot identifies the customer it is carrying groceries for, and follows the user at a distance of 1.5 meters. WiiGO is also expected to help with the checkout process, and Auchan plans to modify its tills to work with the robot.

ASIA TECH HEADLINES

China’s Alipay Saw a Record 1 Billion Transactions on Singles’ Day

(November 14) TechinAsia

China’s Alipay Saw a Record 1 Billion Transactions on Singles’ Day

(November 14) TechinAsia

- Popular mobile wallet app Alipay saw 1.05 billion transactions on November 11, Singles’ Day. The number represented a 48% increase over the same day last year.

- According to data from Alibaba spin-off company Ant Financial, which runs Alipay, the app was seeing 120,000 transactions per second at its peak on Singles’ Day.

JD.com Delivered by Drone to Rural China

(November 14) Fortune

JD.com Delivered by Drone to Rural China

(November 14) Fortune

- com successfully obtained clearance from the Chinese government for a drone delivery initiative and employed a fleet of 30 drones that can deliver packages weighing 5–15 kilograms for a distance of up to 50 kilometers.

- The company began the service with the goal of speeding up delivery to locations in rural China, and plans to have more than 100 routes available and in operation by the end of 2017.

Samsung to Acquire Car Tech Company Harman for US$8 Billion

(November 14) Reuters

Samsung to Acquire Car Tech Company Harman for US$8 Billion

(November 14) Reuters

- Samsung Electronics has agreed to buy Harman International for US$8 billion. With the purchase, Samsung looks to break into the high-barrier automotive industry—a strategic shift for the electronics company.

- Harman manufactures products for more than 30 million vehicles made by automakers such as BMW, Toyota Motor and Volkswagen. Its products include infotainment, telematics, connected safety and security services.

India’s Zefo Raises US$6 Million to Develop Its Business

(November 15) e27.co

India’s Zefo Raises US$6 Million to Develop Its Business

(November 15) e27.co

- India’s Zefo, an online marketplace specializing in secondhand and factory-second furniture and appliances, has raised INR 40 crore (US$6 million) to expand its existing business.

- The company will use the funds to extend its reach in existing categories, diversify into new geographies and categories, invest in technology and build its talent pool.

LATAM RETAIL HEADLINES

Bal Harbour Shops Said Eyeing Panama’s Soho Mall

(November 11) WWD.com

Bal Harbour Shops Said Eyeing Panama’s Soho Mall

(November 11) WWD.com

- Miami-based luxury mall operator Bal Harbour Shops could offer roughly $350 million for Panama’s Soho Mall, which is failing following a US money-laundering probe against the mall’s owner, Abdul Waked.

- Bal Harbour Shops is expected to join several other bidders from Panama, Brazil and the US. The assets include the 100-store Soho Mall, which is home to the likes of Salvatore Ferragamo and Louis Vuitton, and three high-end office towers, two of which were being built to host Central America’s first Ritz Carlton and a casino by Spain’s Egasa.

Nestlé Mexico CEO Considers New Export Plans

(November 14) Bloomberg

Nestlé Mexico CEO Considers New Export Plans

(November 14) Bloomberg

- Nestlé’s chief in Mexico said the company is looking into the possibility of adjusting its supply chains and export strategies should US President-elect Donald Trump impose new taxes on products made in Mexico.

- The Swiss food company could buy from elsewhere in Latin America or focus its exports on nations other than the US to avoid an increase in duties. Nestlé is pushing forward with a $1 billion investment, already about 80% complete, to expand production and distribution in Mexico.

Roll Over Miami, Argentina Has Found a New Shopper’s Paradise

(November 11) Bloomberg

Roll Over Miami, Argentina Has Found a New Shopper’s Paradise

(November 11) Bloomberg

- Argentinian President Mauricio Macri has introduced policies that have unleashed a retail sales boom; unfortunately, those sales are going to Chile. Since Macri removed exchange controls in December, Argentinians have begun crossing the border in masses to seek bargains in Chile.

- This is good news for Chile, whose three years of sluggish economic growth have weighed on retail sales. In Chile, goods that depend on domestic demand, such as furniture, have seen sales decline, while goods popular with foreigners, including computers and mobile phones, have seen sales jump.

Mexico’s Retail Sales up 11.4% Year over Year in October

(November 14) EMIS

Mexico’s Retail Sales up 11.4% Year over Year in October

(November 14) EMIS

- The retail sector in Mexico grew by 11.4% year over year in October, reaching $62.94 million, according to the Mexican Retailers’ Association. Local same-store sales grew by 7.7% year over year, while supermarket sales grew by 8.7%, a 4.8% increase compared with September.

- Department store sales slowed in October, increasing by 6.3% compared with 7.9% in September. The victory of US President-elect Donald Trump is expected to have a negative impact on the retail industry in Mexico.

Singles’ Day is distinguished not just by its scale, but by the experience that Alibaba builds around the event. This year was more spectacular and interactive than ever.

Alibaba hosted a two-day Global Shopping Festival celebration in Shenzhen, China, on November 10 and 11. The event included Alibaba’s executive briefing, an influencer panel and a gala celebration. David Beckham, OneRepublic and Kobe Bryant were among the star guests at the gala, and we were there to witness the spectacle. The event was televised across multiple platforms in China, and viewers were able to buy showcased collections and win the outfits worn by celebrities.

Alibaba also brought virtual reality to Singles’ Day this year, through its Buy+ virtual reality shopping experience on its mobile app. And its Tmall platform offered a Pokémon Go–style augmented-reality mobile game featuring a cat mascot that led shoppers to Tmall merchants’ physical stores.

Online shopping in countries other than China is becoming ever more about price—and shopping events, such as Black Friday in the US, also tend to be price-focused. In contrast, Alibaba’s Singles’ Day is increasingly putting the emphasis on experience and “retailtainment.”

As Daniel Zhang, CEO of Alibaba Group, said, Singles’ Day 2016 was “a preview of the future of retail,” blending “entertainment, commerce and interactive engagement.” Although shopping online is often considered a chore in the US, it has become akin to a sport in China.

Singles’ Day is distinguished not just by its scale, but by the experience that Alibaba builds around the event. This year was more spectacular and interactive than ever.

Alibaba hosted a two-day Global Shopping Festival celebration in Shenzhen, China, on November 10 and 11. The event included Alibaba’s executive briefing, an influencer panel and a gala celebration. David Beckham, OneRepublic and Kobe Bryant were among the star guests at the gala, and we were there to witness the spectacle. The event was televised across multiple platforms in China, and viewers were able to buy showcased collections and win the outfits worn by celebrities.

Alibaba also brought virtual reality to Singles’ Day this year, through its Buy+ virtual reality shopping experience on its mobile app. And its Tmall platform offered a Pokémon Go–style augmented-reality mobile game featuring a cat mascot that led shoppers to Tmall merchants’ physical stores.

Online shopping in countries other than China is becoming ever more about price—and shopping events, such as Black Friday in the US, also tend to be price-focused. In contrast, Alibaba’s Singles’ Day is increasingly putting the emphasis on experience and “retailtainment.”

As Daniel Zhang, CEO of Alibaba Group, said, Singles’ Day 2016 was “a preview of the future of retail,” blending “entertainment, commerce and interactive engagement.” Although shopping online is often considered a chore in the US, it has become akin to a sport in China.

Shoppers Ramp Up Spending Ahead of Key Holiday Shopping Season

(November 15) The Wall Street Journal

Shoppers Ramp Up Spending Ahead of Key Holiday Shopping Season

(November 15) The Wall Street Journal

Danish Retailer Bestseller Acquires Miinto

(November 14) Ecommercenews.eu

Danish Retailer Bestseller Acquires Miinto

(November 14) Ecommercenews.eu