FROM THE DESK OF DEBORAH WEINSWIG

By far the biggest event in retail this week was the celebration on November 11 of Singles Day, a Chinese holiday devoted to “selving” —or buying for oneself. The idea seems destined to spread to other countries. The final Singles Day tally of merchandise flowing through the Alibaba marketplace was $9.3 billion, oneHfifth of all US retail sales for the fourth-day Thanksgiving weekend last year. Chinese consumers are proving their buying power!

Meanwhile, in the US, retailers are bracing for fierce competition weeks before their own busiest shopping day of the year. Hunting for rockHbottom prices has long been a Black Friday tradition, but the emphasis on promotional pricing has risen to new heights since the recession, fueled by consumers’ relentless search for deep discounts. And deals already abound, as do offers of free holiday shipping. Walmart lowered prices on 20,000 items in November and expects the majority of those cuts to remain in place through the holiday season. Target launched a Black Friday preHsale campaign this past Monday—joining Amazon.com, Staples and several other retailers in making their Thanksgiving weekend deals to customers earlier this year.

We think this could end up being the most aggressively promotional holiday in recent memory. Along with falling pump prices, more people working and rising consumer

confidence in the economy, this is just one more reason why we’ve become increasingly confident that US holiday sales growth can come in at the high end of our 3%H5% forecast range. We will keep you posted.

US RETAIL HEADLINES

Quote of the Week: “It used to be called Black Friday, then it became Thursday, now it’s a week long,” said Walmart US chief merchant Duncan MacNaughton. “Maybe'we'should'

just call it November.”

Through October 31, 2014

Source: First Data

Through October 31, 2014

Source: First Data

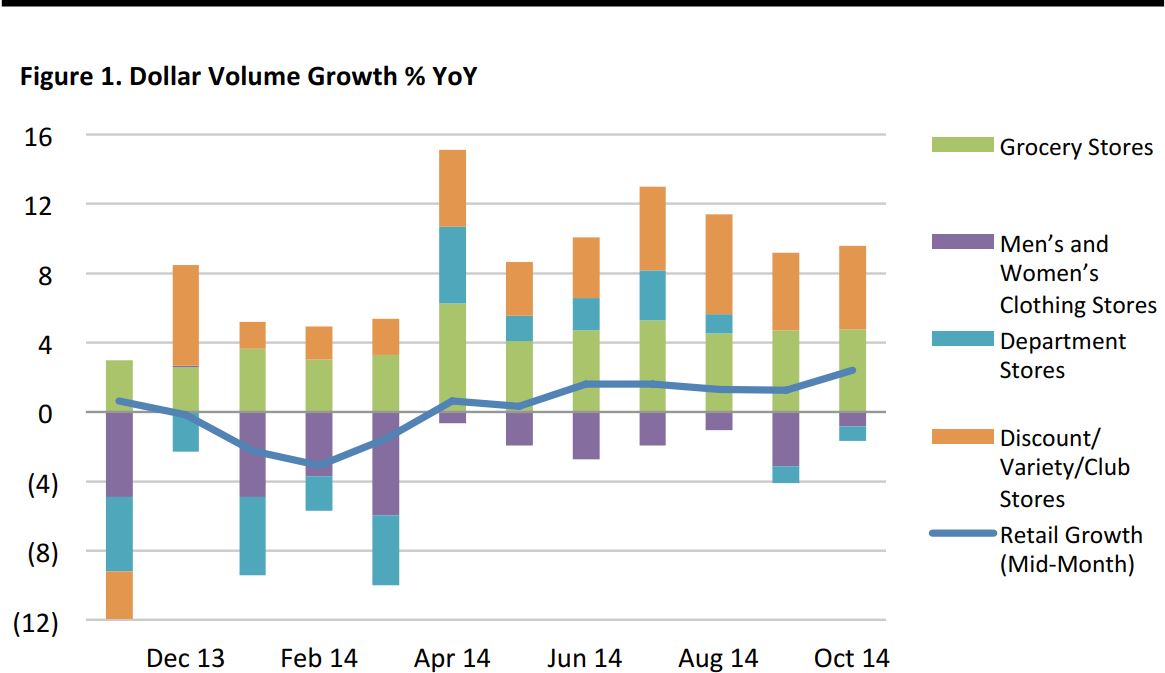

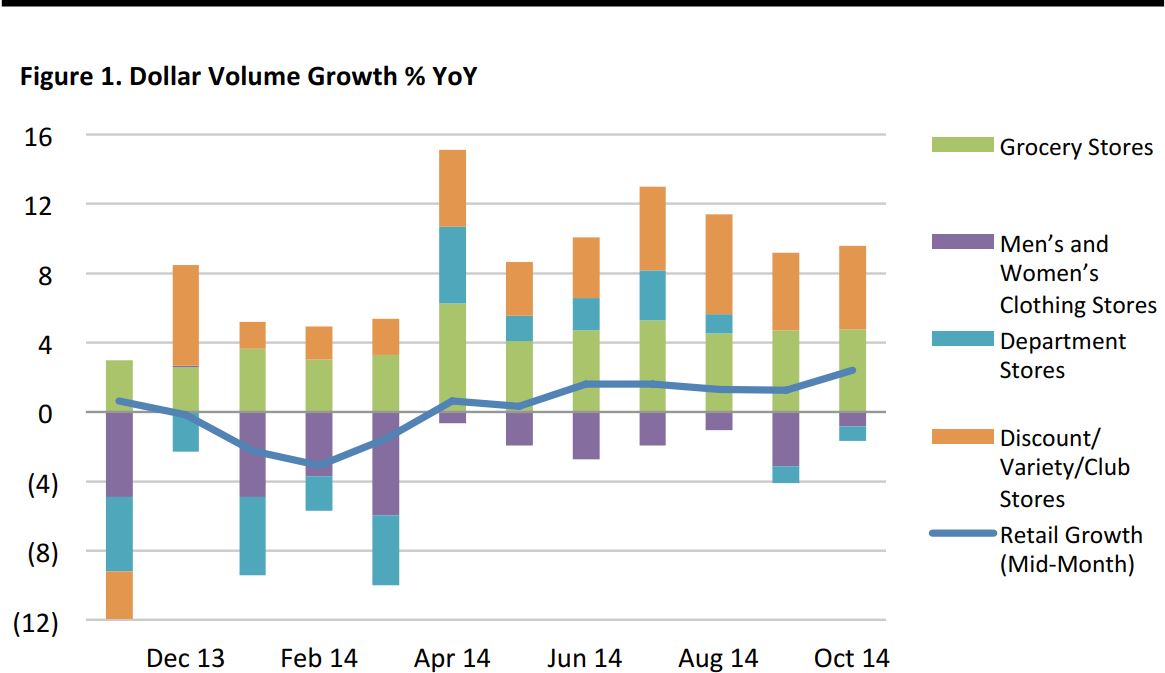

- POS sameHstore retail sales increased a total of 2.4% in October, beating the preliminary reading by 20 bps

- With the subgroups, discount stores continue to lead. Clothing stores and department stores still suffer but had a marginal improvement over previous month

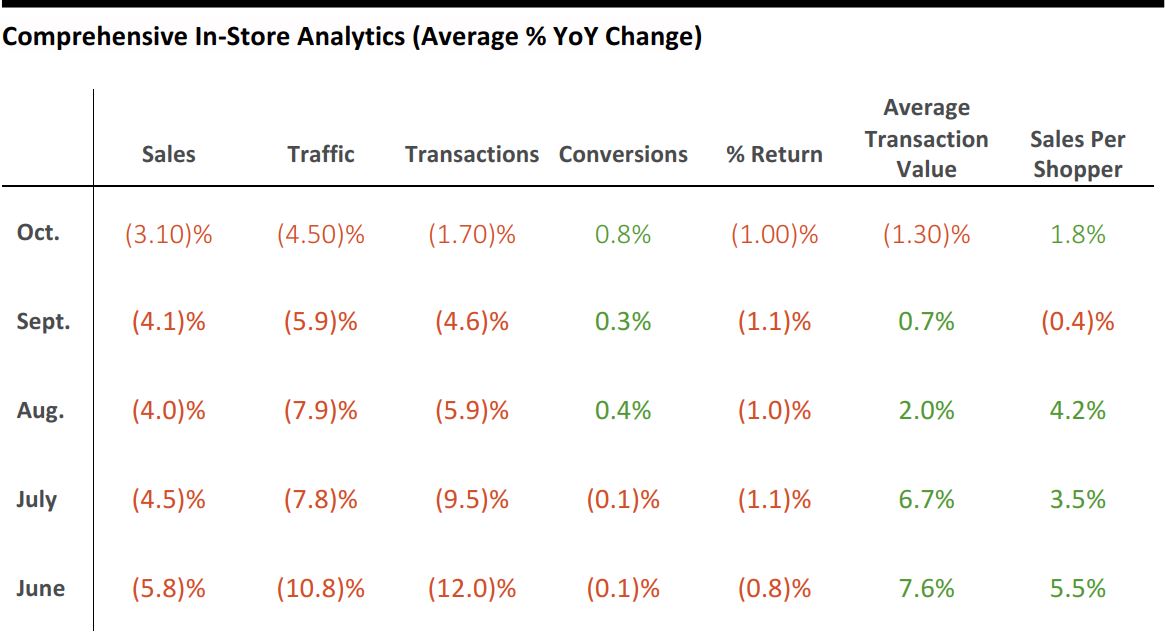

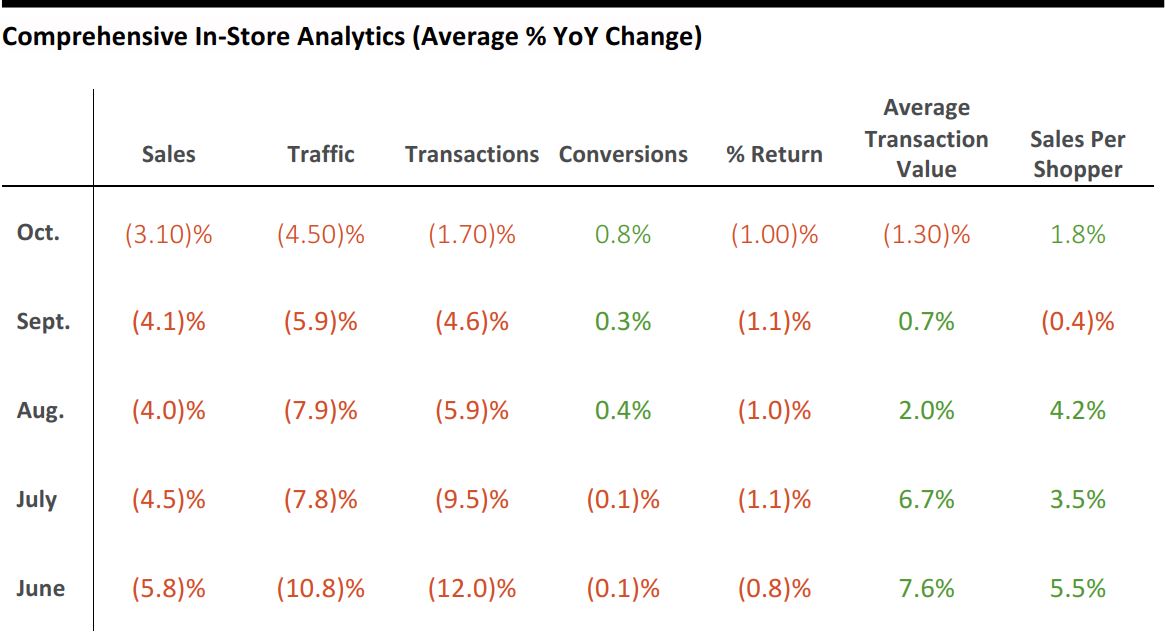

RetailNext reported that in-store sales declined 3.1% YoY, as a (-4.5%) drop in store traffic was offset by a +0.8% gain in the conversion of traffic into sales. On the plus side, the weakening trend in monthly sales has diminished, compared with (-4.1%) in September and (-5.8%) in June. Average transaction value (ATV) turned negative for the first time this year, at (-1.3%), reflecting price deflation in a number of product categories, and the prevailing level of promotions and product-mix changes (for example, as preferences shift from $59 jeans to $29 yoga pants). Conversion has been a positive metric for the past three months, suggesting improved “clienteleing”, better in-store service levels and a growing willingness among consumer to buy

when they come to the store.

Holiday promotions drive store traffic. In terms of highs and lows for the month, the Saturday before Columbus Day (October 11) experienced the highest traffic and transactions, while conversion hit its peak on October 30, as shoppers prepared for Halloween with purchases of candy, costumes and decorations. By region, YoY traffic comparisons were the softest in the northeast (-7.5%) and strongest in on the West Coast (-1.4%); ATV was weakest in the northeast as well, at (-4.0%), but was offset by a 1.3% pickup in conversion, which compares favorably with the 0.8% national reading.

As of November 7, 2014

Source: RetailNext

American Eagle Outfitters (AEO) Lifts 3Q Earnings Guidance (November 12).The company raised its 3Q EPS guidance to $0.22 from its previous $0.17─$0.19 estimate range and last year's $0.19, reflecting fewer markdowns and lower expenses. Revenues for the period fell modestly, on a -5% comp-store sales decline. American Eagle is making progress reducing promotional activity despite the highly promotional retail environment, and Q3 inventories are down as planned. The company said that it was cautious on the outlook for holiday given the ongoing weakness in mall traffic. Restructuring activities should strengthen profitability metrics restructuring and impairment charges are estimated at $0.17 per share for Q3, versus 0.06 in the same period last year. AEO shares closed up 10.3% on the announcement.

Company press release

Abercrombie & Fitch (ANF) Preannounces Q3 Sales Along with Business Update (November 7).Continued weak store traffic was the primary contributor to Abercrombie's negative comps, which were down (-7%) in the US and (-15%)internationally.The company mentioned that the decline in heavily logoed product also weighed on Q3 sales.Total direct-to-consumer (e-commerce) sales rose 8% and consolidated sales decreased (-12%), to $911 million.Europe was particularly weak and shows signs of further slowing. Modest gross margin erosion, reflecting the highly promotional and challenging environment, will be partially offset by continued expense reductions.Inventory at cost is down (-20%) entering Q4. Excluding expected impairment charges, management projected that non-GAAP EPS could come in at the $0.40−$0.42 range. Abercrombie reports Q3 results on December 3. ANF shares closed down (-16.6%) on the day.

Company press release

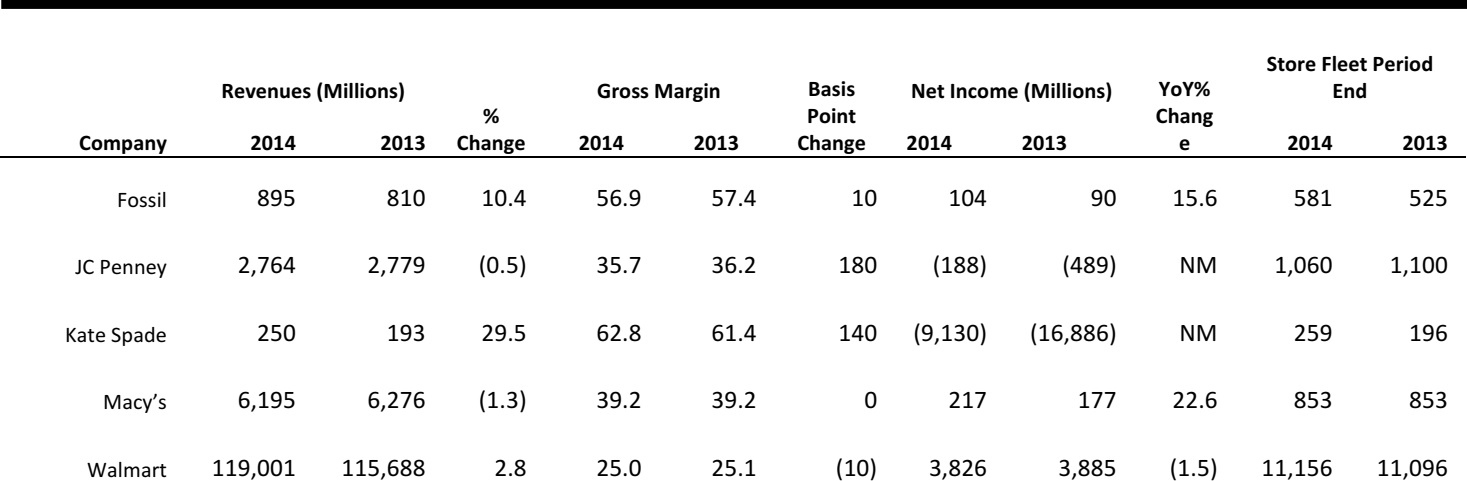

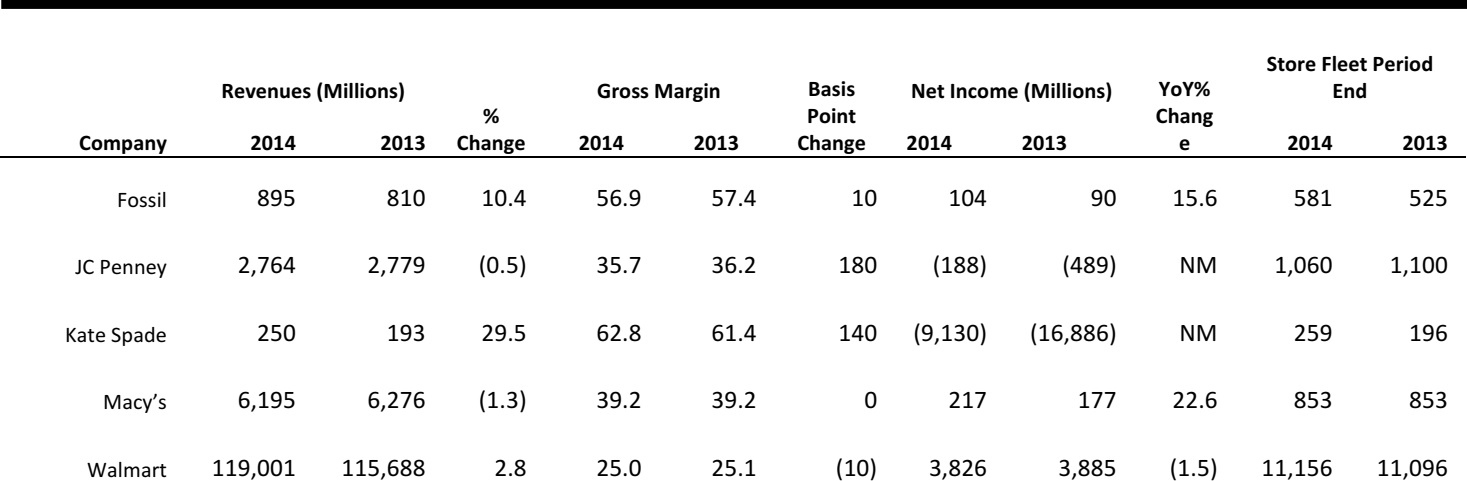

JC Penney (JCP) Posts Flat Sales, Mixed Guidance (November 12). The company reported flat Q3 revenues of $2.76 billion, attributing the sluggishness to unseasonably warm weather. Gross margins improved 710 bps YoY in the period. Inventory was $3.4 billion, down 10.4% YoY. For 4Q, management expects comp sales to rise 2%-4% and for gross margins to improve by 500L600 bps, offset by higher SG&A expenses. However, the company also reduced 2014 comp sales growth guidance to 3.5%-4.5% range, down from its previous “mid-single digits” estimate. It also now sees gross margins improving by 500-600 bps YoY, versus its previous “up significantly” guidance. JCP shares opened on November 13 down 9.92%.

Company reports

Kate Spade & Company (KATE) Raises 3Q Profitability and Revenue Guidance (November 6). The company reported Q3 revenues of $250 million, up 30% YoY. Domestic and international store openings increased average retail square footage by 47% and 34%, respectively. Sales were $1,507 per sq. ft. during the past 12 months. Inventory increased 56% YoY. However, management commented that inventory increased in line with revenue growth, adjusted for the timing of the July 4 holiday and the Kate Spade Saturday, and that inventory is now much cleaner. The company still plans to open about 80 new stores this year, versus 169 stores at the end of last year. KATE shares closed up 17.9% for the day.

Company press release and our estimates

Macy’s (M) Lowers FY2014 Sales and Profit'Outlooks (November 12). In tandem with its Q3 earnings release, Macy’s revised its 2014 EPS guidance to a range of $4.25─$4.35,down from its previous $4.40─$4.50 estimate range. Comp guidance was reduced as well, to a 1.2%─1.5% range, from a 2%─2.5% range. Guidance for Q4 comps spans 2% to 3%. Despite its 1.3% sales decline, Macy’s noted$its strongest businesses were handbags, fragrances, active and millennial apparel. Men’s business also strengthened, but kid’s disappointed post-Back to School. Weak categories were home, women’s shoes, cosmetics and non-millennial women’s apparel. The impact of positive economic factors, such as lower energy prices, a healthier job market and stronger financial markets, is being offset by the shift in consumer preference towards categories not offered at Macy’s that is, autos, healthcare, electronics and home improvement, clouding Macy’s Q4 outlook. Macy’s shares closed up 5.1% on the day.

Company press release and conference call

Walmart (WMT) Returns to Comp-Store Sales Growth in 3Q; Lowers Full-Year Guidance (November 13). The company reported EPS from continuing operations of $1.15 (versus $1.14 last year), on a 2.8% consolidated revenue increase, to $118.1 billion. The results were driven by comp-store sales gains of +0.5% at the chain’s US stores, +5.5% at its Neighborhood Market format, +0.4 at Sam’s Club (excluding fuel), along with a 1.7% gain in international sales. Bolstered by the chain’s recent investments in its website, mobile platform and related acquisitions, global e-commerce sales climbed 21%, adding 0.2 percentage points to the retailer’s comp-store sales growth. Walmart plans to spend $1.2−$1.5 billion on e-commerce investments in its next fiscal year. Operating profits for the quarter decreased (-0.7%), to $6.3 billion, attributable to a (-1.2%) drop in the Walmart US segment, partially offset by 3.7% growth in the international segment and a strong 12% gain at Sam’s Club.

Management reduced its full-year EPS guidance from a range of $4.90−$5.5 to a range of! $4.92−$5.02. This would result in growth of 1.4%-3.5% versus fiscal 2014. For 4Q 2014, Walmart forecasts EPS of $1.46−$1.56, and flat to a 1% increase in comp sales at Walmart’s US stores and a flat to 2% increase in Sam’s Club comp sales. Last year, Walmart reported 4Q EPS of $1.34, which included $0.26 in nonrecurring items. WMT shares rose 2% in reaction to the earnings news.

Company press release

Selected Retail Company Earnings Results

Source: company reports

US and China Agree to Expand Information Technology Agreement (November 10). The US and China agreed to expand the scope of the Information Technology Agreement (ITA), a global trade agreement, to include certain semiconductors, medical devices, Global Positioning System (GPS) devices, and other newer products. Trade organizations and industry groups hailed the updated agreement as creating jobs, reducing prices for consumers, and as beneficial to the global semiconductor industry. Economists and advocates of free markets dislike tariffs, saying that tariffs raise prices, thereby reducing demand as well as hurting consumers and employment levels. The value of updated agreement covers a range of $1 trillion to $1.4 trillion worth of products, depending on the source, expanding the $4 trillion of products already covered by the previous ITA. The most recent round of negotiations has been taking place for over a year and reached a breakthrough alongside the AsiaLPacific Economic Cooperation (APEC) leaders' meeting in Beijing. Final, multilateral negotiations are expected to begin in Geneva in December.

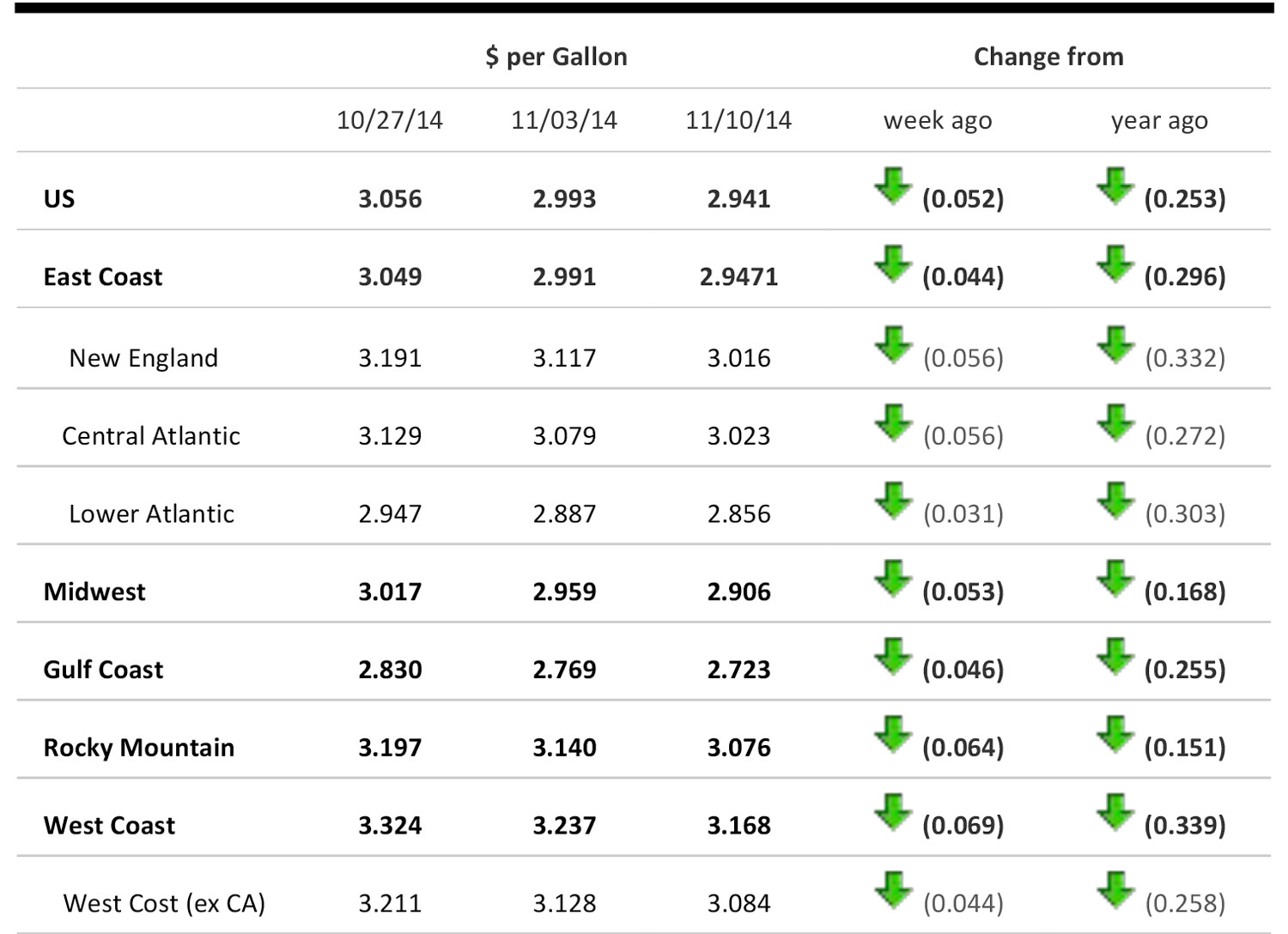

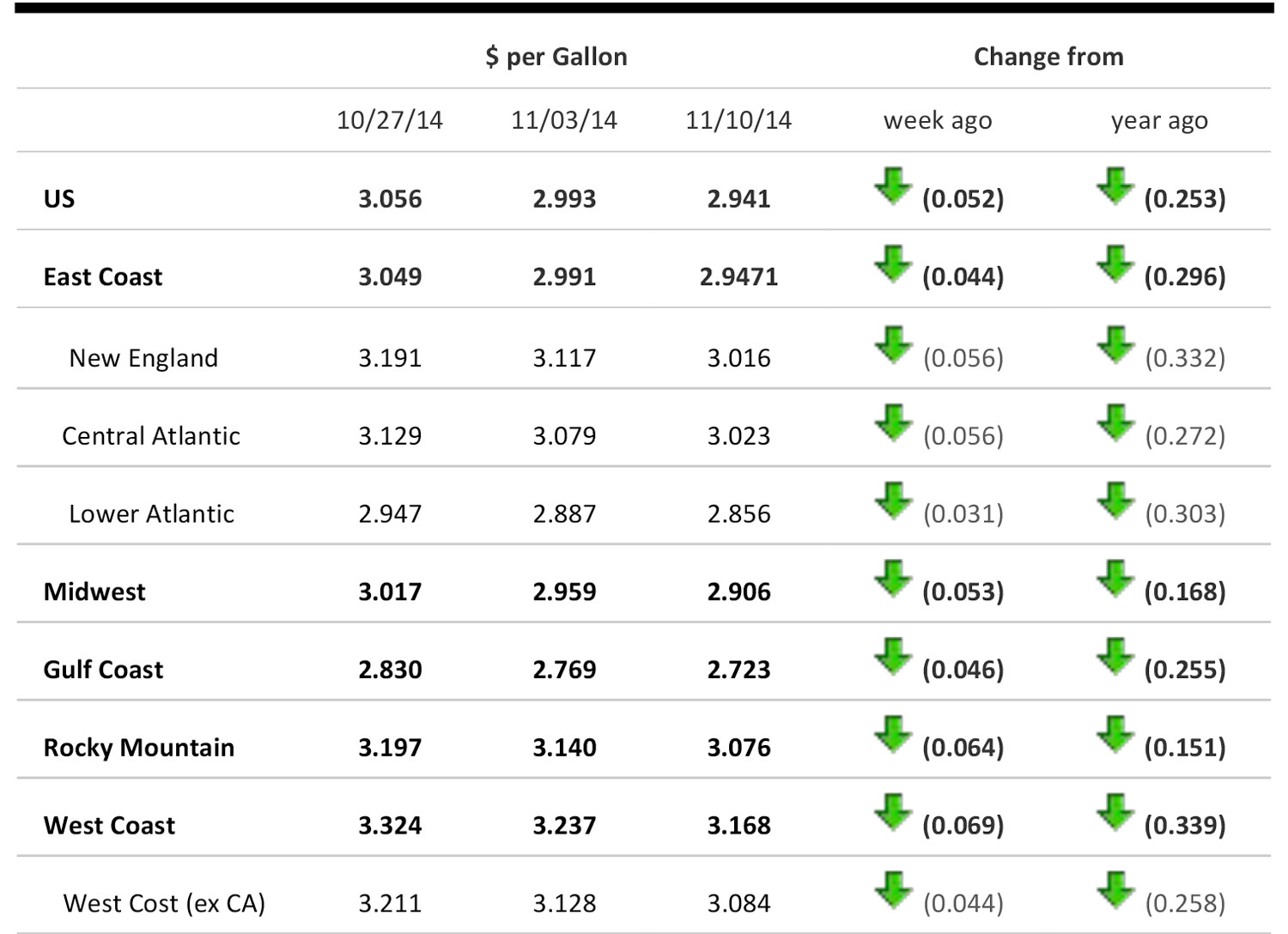

US Regular Gasoline Prices

Source: US Energy Information Administration

CHINA HEADLINES OF THE WEEK

Singles Day Clears US$9.3 Billion (November 12)

Singles Day Clears US$9.3 Billion (November 12). The total volume of merchandise flowing through Alibaba’s e-commerce marketplace on Singles Day reached US$9.3 billion (57.1 billion yuan) this year, up 60% from last year’s US$5.8 billion. This year, mobile sales totaled more than US$4 billion (24.3 billion yuan), or 42% of the total. More than 27,000 brands and merchants participated in the event, including international retailers such as Costco, Zara, American Eagle Outfitters, ASOS, Muji, Desigual and North Face. Xiaomi, the upstart Chinese smartphone maker, reportedly hit US$163 million (1 billion yuan) in sales by noon, becoming the first store on Tmall, Alibaba’s B2C platform, to break the 1 billion yuan mark in the history of Singles Day.

International Business Times

Amazon Overseas and Suning USA Launch in China (November 11)

Amazon Overseas and Suning USA Launch in China (November 11). Amazon China has officially launched Amazon Overseas, which will allow Amazon China customers to browse and purchase products available at the US Amazon store from within an all-Chinese user interface. The products available on Amazon Overseas included baby and kids’ stuff, toys, clothing, shoes, sports equipment, beauty products, and health products. Earlier in August, Amazon signed a memorandum of cooperation with China (Shanghai) Pilot Free Trade Zone and Shanghai Information Investment to facilitate cross-border e-commerce development. Separately, Suning Commerce Group Co, China's biggest electronic appliance retailer, has also rolled out its new US online shopping platform on 11 November, offering US products to Chinese consumers and providing direct shipping.

(Tech in Asia)

Borderfree Brings Top US Retailers to Chinese Shoppers with Alipay (November 10). Borderfree, a market leader in international cross-border ecommerce, announced its collaboration with Alipay, China’s leading e-payments service provider, to launch five iconic American retailers on a new pilot program that leverages Alipay ePass to help US brands reach online shoppers in China. The program will be available throughout the holiday season.The five retailers include Saks Fifth Avenue, Bloomingdale’s, Macy’s, Ann Taylor and Aéropostale.

Businesswire Galeries Lafayette (China) Reports 1H14 Loss (November 11). Galeries Lafayette (China) Limited, a 50/50 joint-venture (JV) between Galeries Lafayette and I.T Limited, recorded a net loss of US$2.58 million (HK$20.0 million) for the first six months of 2014 (ended August), versus US$1.38 million for the same period a year ago. The company attributed the results to the currently difficult retail environment. On November 10, Galeries Lafayette appointed Paul Burke as the new chief executive officer for the China market. The company opened its first Chinese store in Beijing last year. With 500 stores-inLstore, the Beijing Galeries Lafayette department store is only second in size to the company’s flagship store in Paris. It currently has 64 outlets, five of which are outside France, with sites in Jakarta, Berlin, Casablanca, Dubai and Beijing.

Winshang and China Retail News

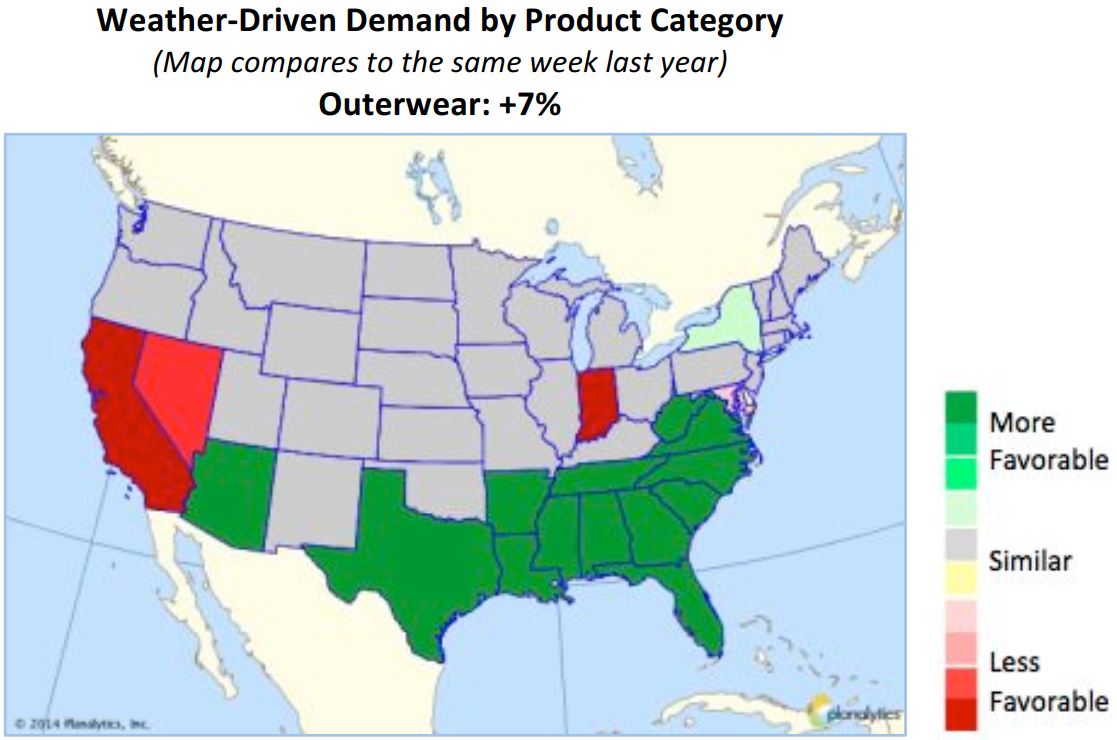

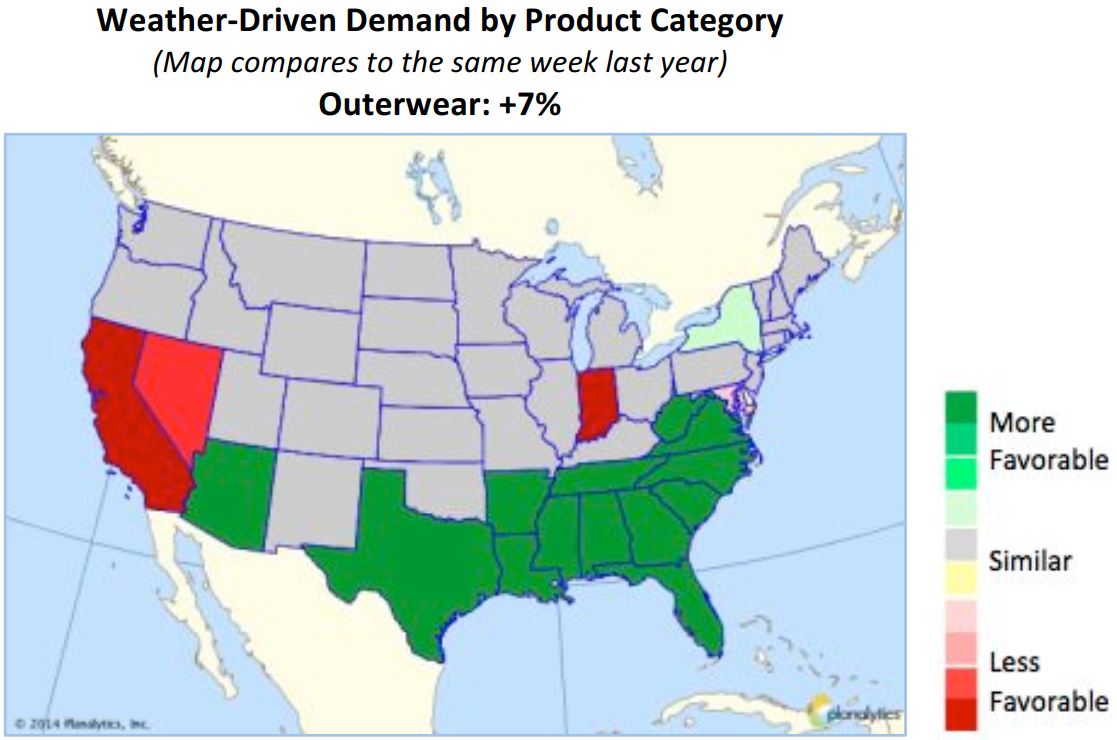

US WEATHER ANALYTICS

What to Expect for the Week of Nov. 16 ─ 22

What to Expect for the Week of Nov. 16 ─ 22

Baby, It’s Cold Outside:

Good News for Seasonal Items and Snow Removal Products

- Starting the Week with Cold Temperatures. The frigid air mass will continue across all of North America for the beginning of the week. A warming trend will develop along the West Coast by the middle of the week then expand eastward into the Plains. For the week as a whole, the western half of the continent will experience warmer weather than last year, while temperatures across the east will be below last year’s. Expect strong yearLoverLyear demand surges for cold weather apparel and consumables.

- Snow for the Northeast. An area of light rain will ride up the East Coast early in the week. Temperatures will be cold enough that some wet snow may mix in from the MidLAtlantic to coastal New England. A low pressure center will develop over the Great Lakes on Tuesday and quickly lift northeast to the Maritimes, generating

another round of snow.

- Cold, Rain, and Snow to Drive Seasonal Purchasing in Major Eastern Markets. Regardless of the exact path of the storm, the threat of snowfall in major markets will increase media attention and drive consumer purchasing of winterLrelated items. Precipitation in the Northeast is not expected to begin until late in the weekend and extend into early next week.

- Consumers Brace for Winter. Early in the weekend, conditions will be favorable for store foot traffic, providing customers the opportunity to get out and purchase need based items. Businesses with cold weather categories in these markets should prepare for increased demand for snow removal items as well as boots, gloves, jackets, and sweaters. The cold temperatures will also increase demand for consumables such as soup and hot drinks. As the holiday shopping season is ramping up, the threat of cold and snow will serve to get consumers into a “winter” mindset.

Source: Planalytics

A FOCUS ON THE US RENTAL SOCIETY: A LEGACY OF THE HOUSING BUST

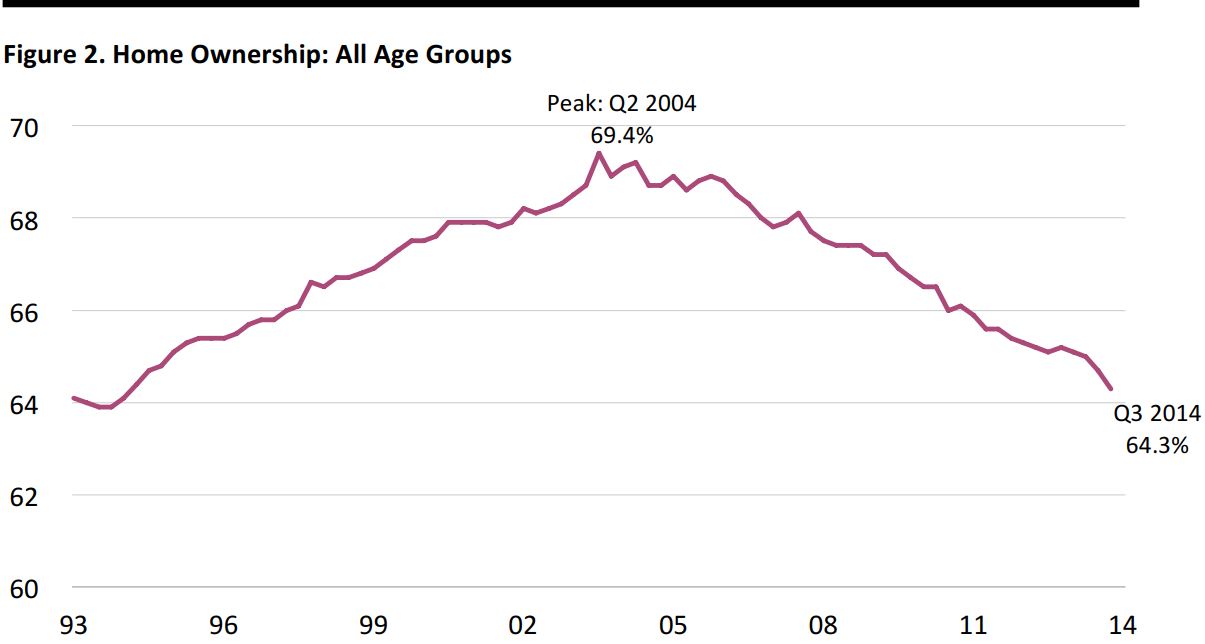

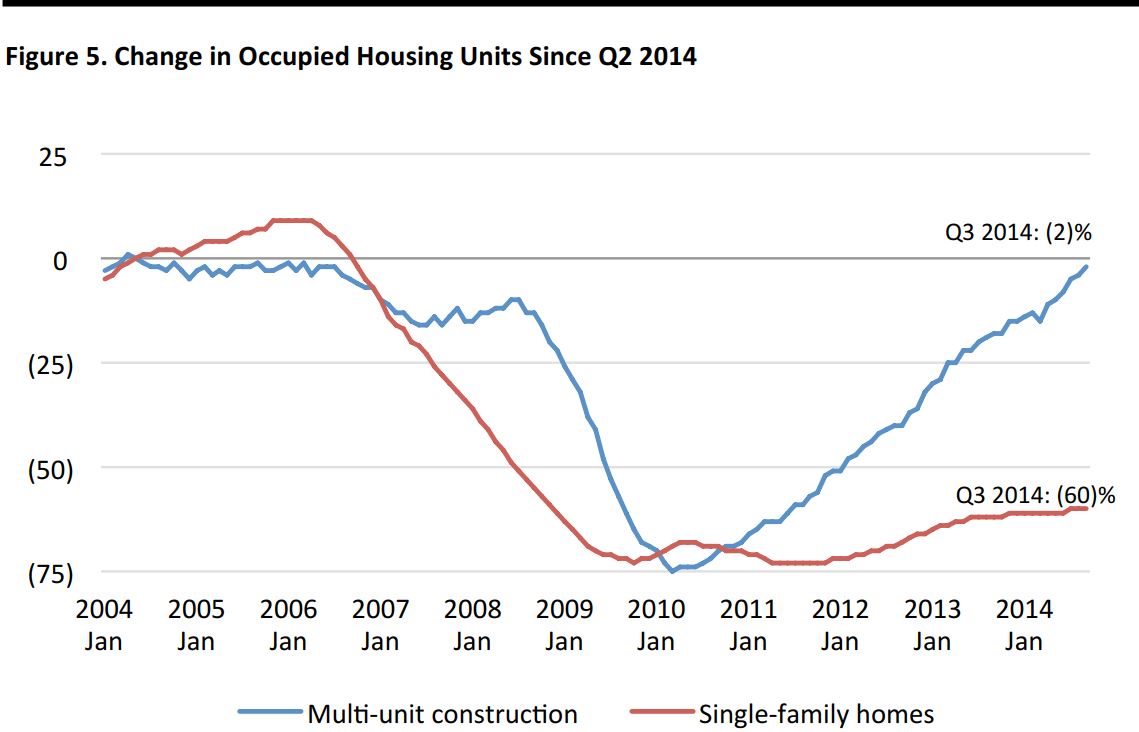

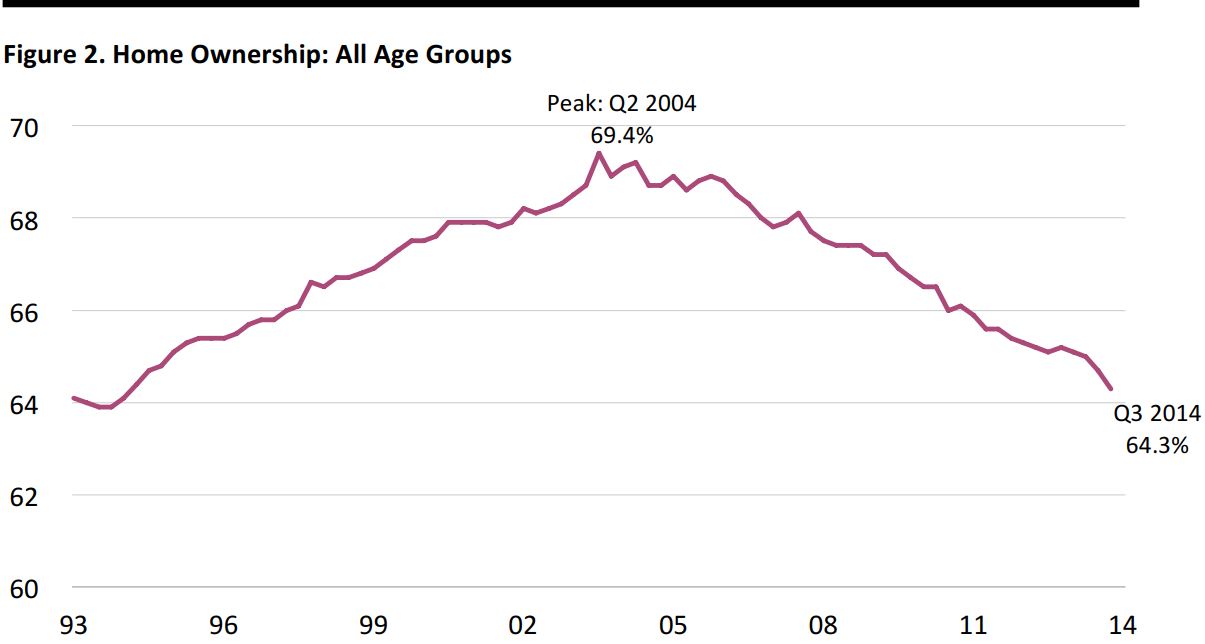

Through September 30, 2014

Source: US Census Bureau and Haver Analytics

- Though the US housing market is recovering, the homeownership rate—or the percentage of homes and apartments that are owned by the occupant rather than rented—continues to decline

- The share of Americans who own their home fell to 64.3% in 3Q 2014, the lowest level since 1994

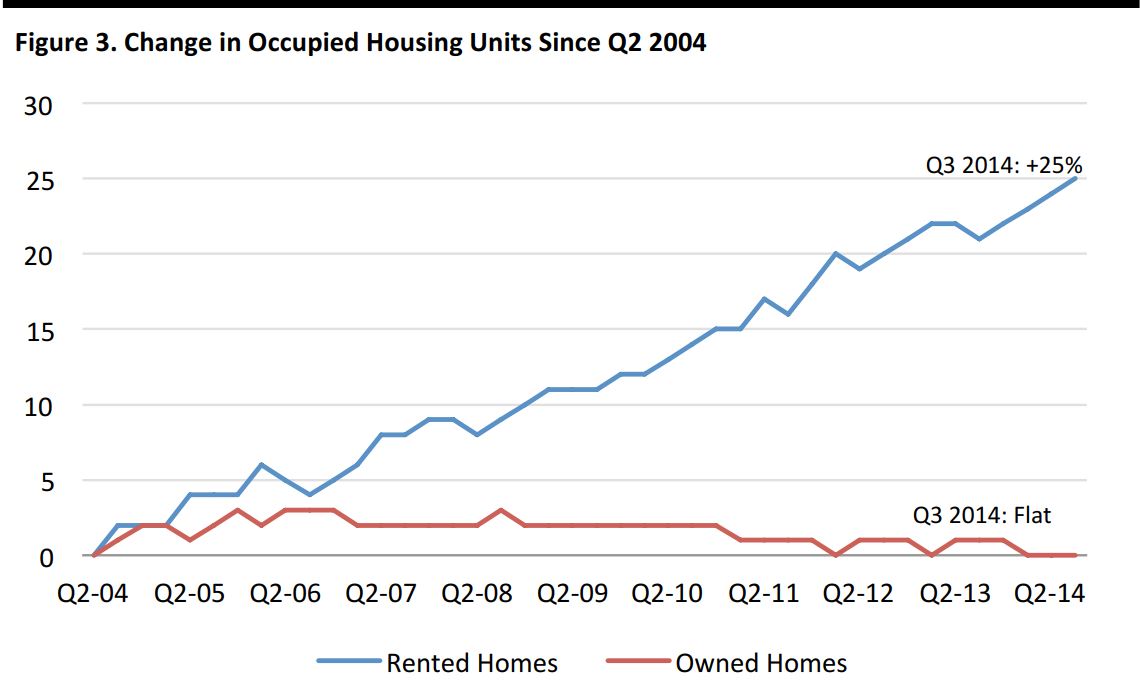

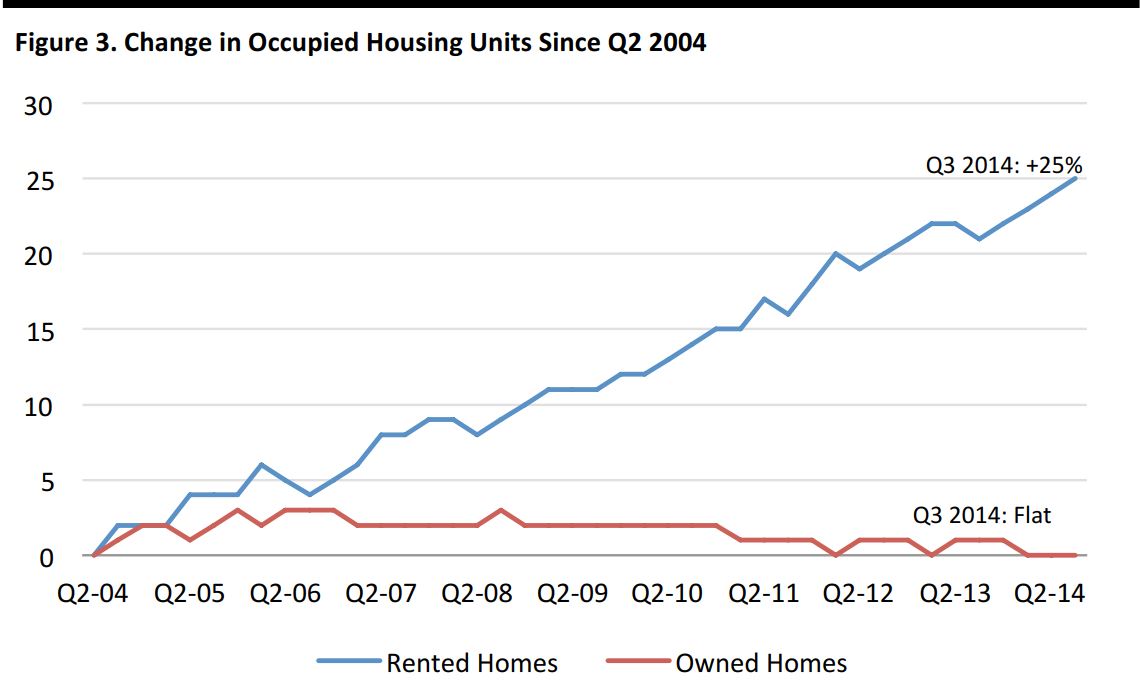

Through September 30, 2014

Source: US Census Bureau and Haver Analytics

- Since 2004, the number of homes occupied by renters has risen by almost 25%

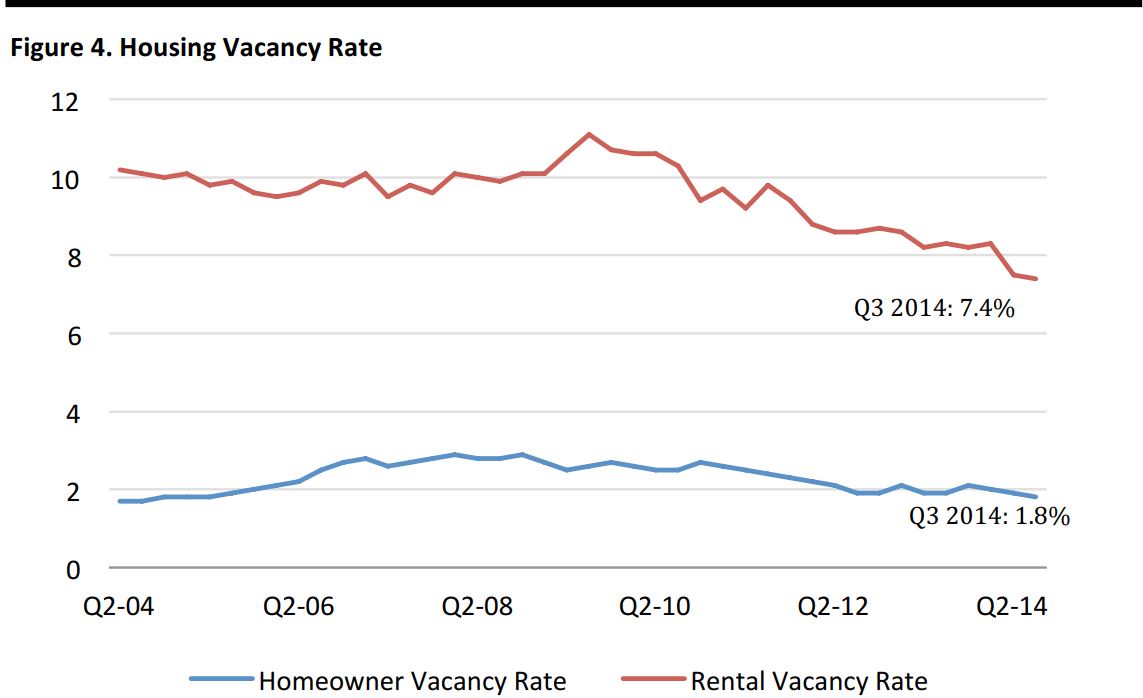

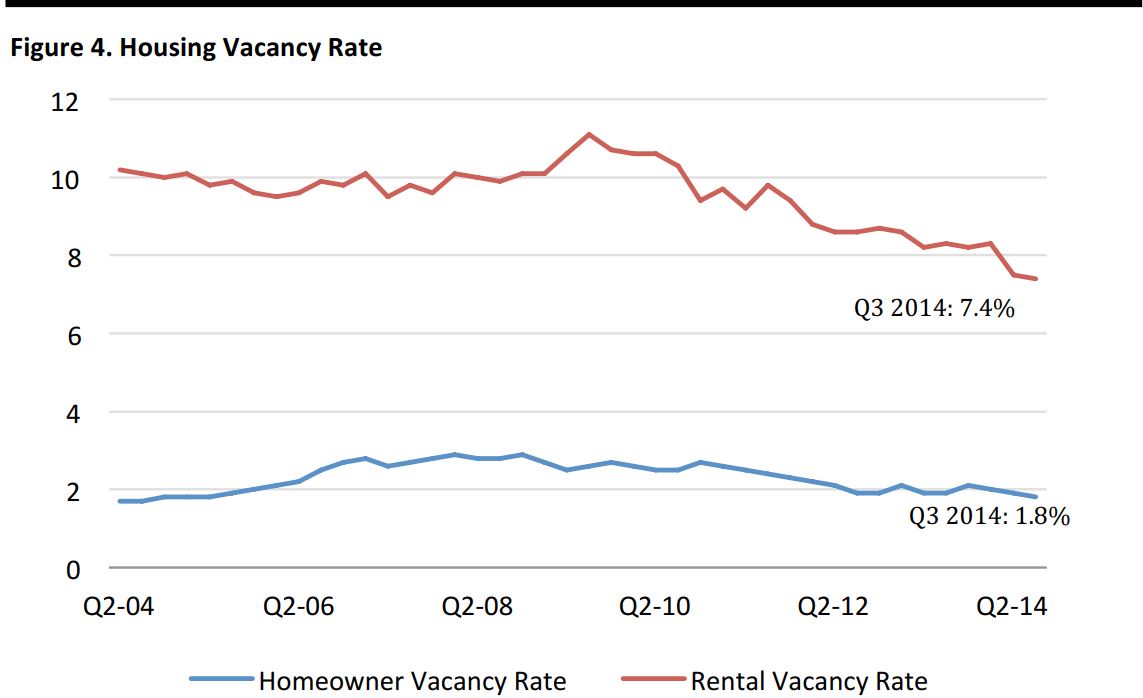

Through September 30, 2014

Source: US Census Bureau and Haver Analytics

Vacancies Remain High

- Though down since the 2009 financial crisis, the combined rate of homeowner and rental vacancies is still higher than they were before the recession began

- The vacancy overhang continues to weigh on single-family starts

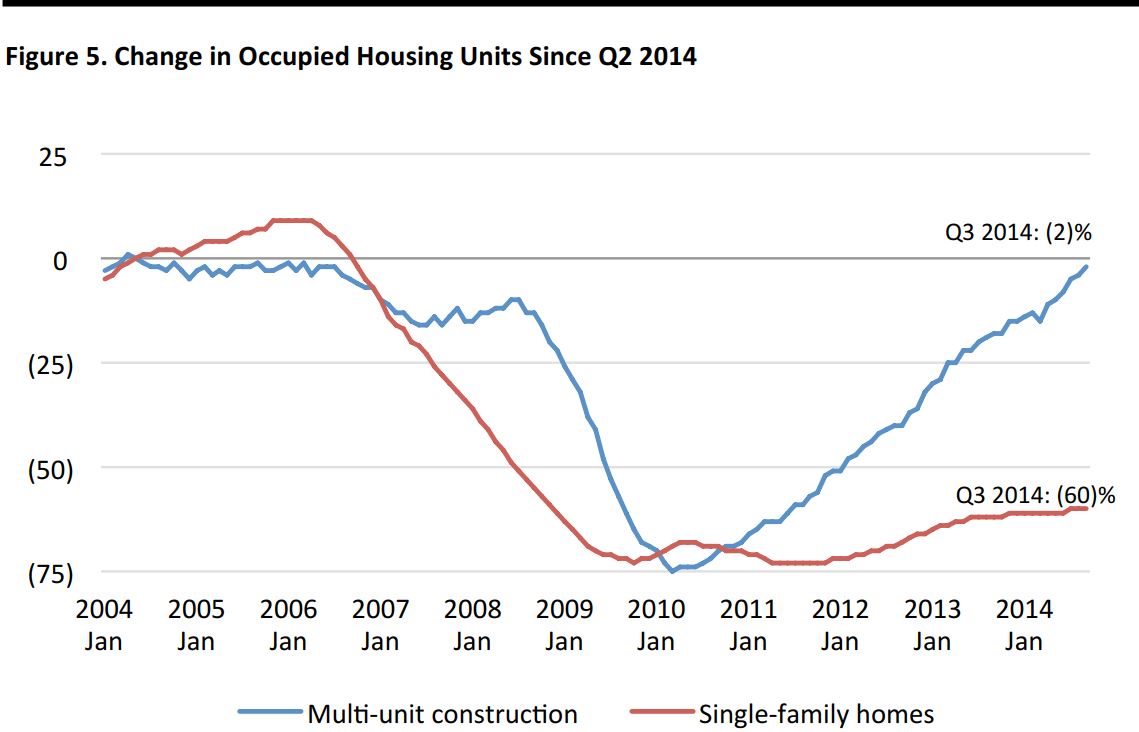

Through September 30, 2014

Source: US Census Bureau and Haver Analytics

Multifamily Construction Has Bounced Back; Single-Family Lags

- •s more families rent, the number of apartments built has recovered to pre-recession levels, while single-family starts remain subdued

- Over the past 12 months, multifamily building has accounted for more than twice the levels reached in early 2006, when it accounted for less than 17% of new residences constructed

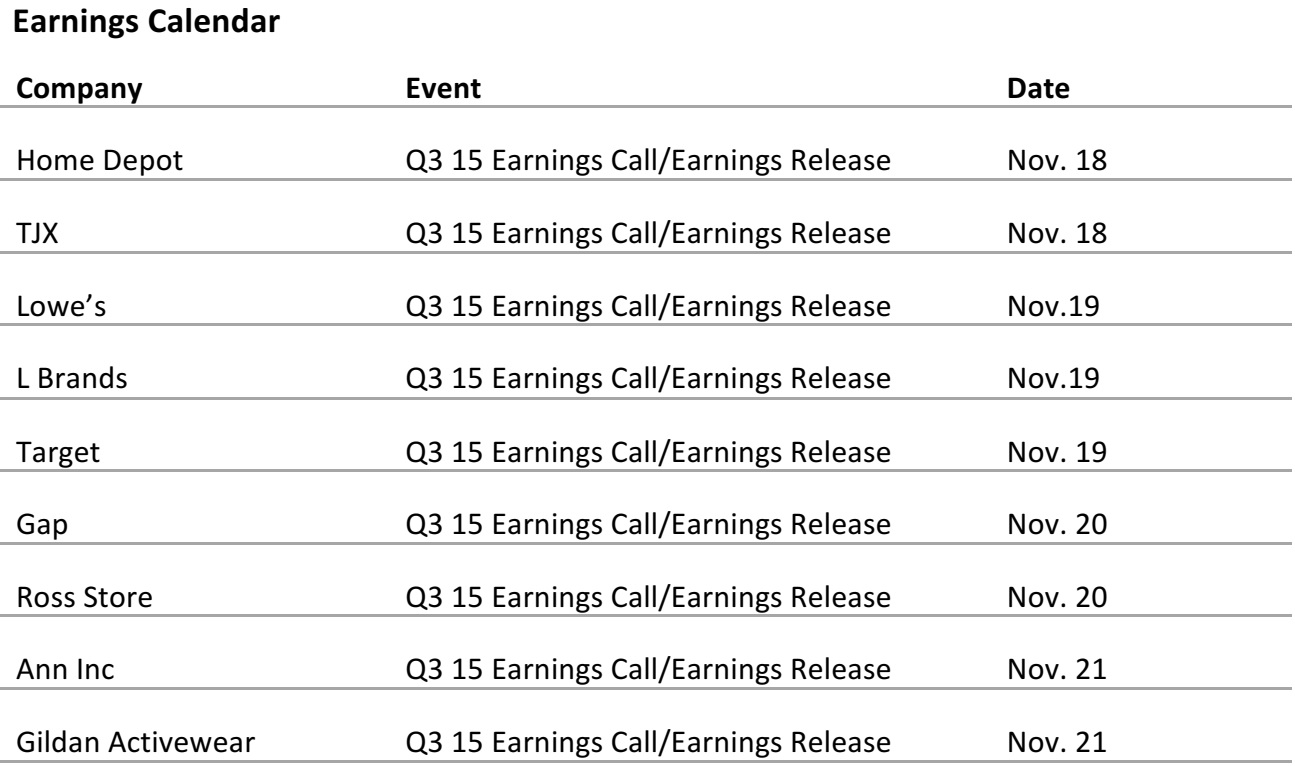

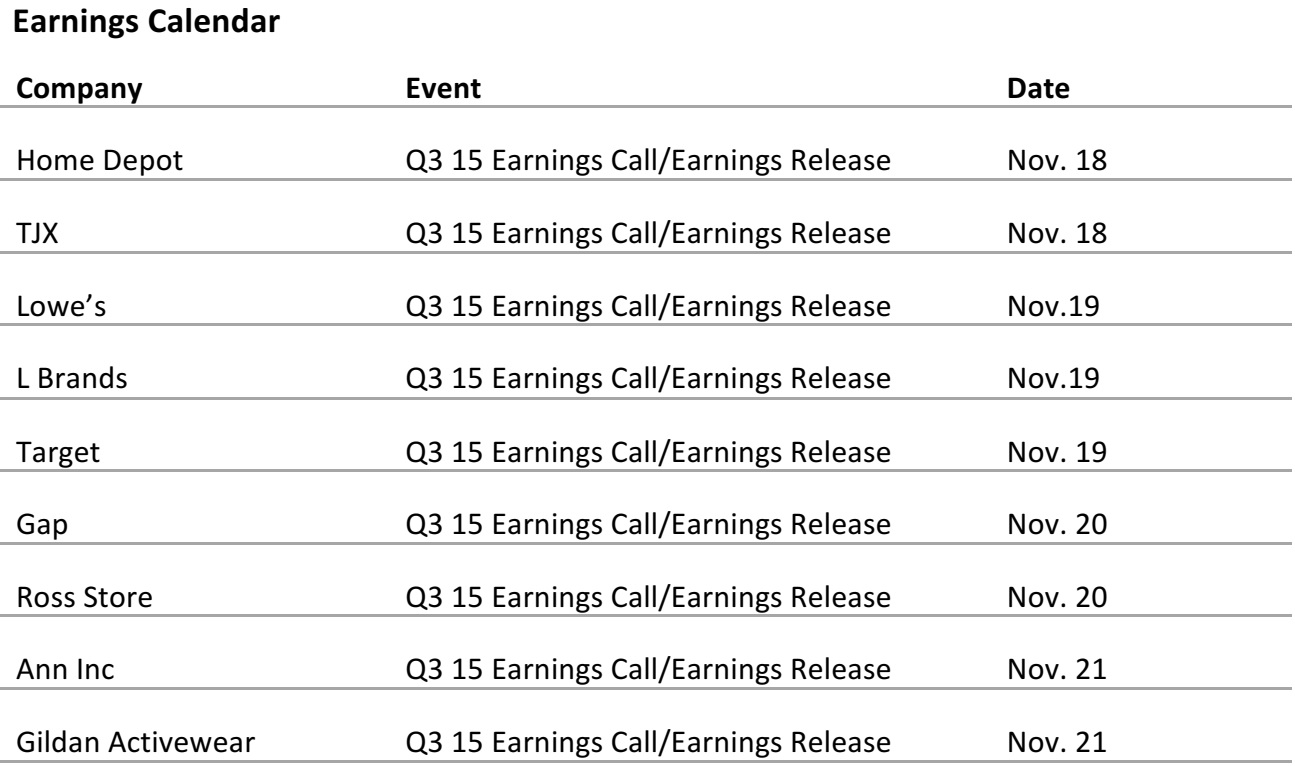

UPCOMING EVENTS

Through October 31, 2014

Source: First Data

Through October 31, 2014

Source: First Data

Singles Day Clears US$9.3 Billion (November 12). The total volume of merchandise flowing through Alibaba’s e-commerce marketplace on Singles Day reached US$9.3 billion (57.1 billion yuan) this year, up 60% from last year’s US$5.8 billion. This year, mobile sales totaled more than US$4 billion (24.3 billion yuan), or 42% of the total. More than 27,000 brands and merchants participated in the event, including international retailers such as Costco, Zara, American Eagle Outfitters, ASOS, Muji, Desigual and North Face. Xiaomi, the upstart Chinese smartphone maker, reportedly hit US$163 million (1 billion yuan) in sales by noon, becoming the first store on Tmall, Alibaba’s B2C platform, to break the 1 billion yuan mark in the history of Singles Day. International Business Times

Singles Day Clears US$9.3 Billion (November 12). The total volume of merchandise flowing through Alibaba’s e-commerce marketplace on Singles Day reached US$9.3 billion (57.1 billion yuan) this year, up 60% from last year’s US$5.8 billion. This year, mobile sales totaled more than US$4 billion (24.3 billion yuan), or 42% of the total. More than 27,000 brands and merchants participated in the event, including international retailers such as Costco, Zara, American Eagle Outfitters, ASOS, Muji, Desigual and North Face. Xiaomi, the upstart Chinese smartphone maker, reportedly hit US$163 million (1 billion yuan) in sales by noon, becoming the first store on Tmall, Alibaba’s B2C platform, to break the 1 billion yuan mark in the history of Singles Day. International Business Times

What to Expect for the Week of Nov. 16 ─ 22

What to Expect for the Week of Nov. 16 ─ 22