Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

Barely a week goes by without someone asking us about grocery discounters Aldi and Lidl, and what their impact will be on their newer markets, such as the US. We have a whole report coming out on these retailers very shortly, but we thought it would be a good idea to summarize what these discounters’ effect has been on other markets.

Our principal message is that in markets where shoppers have switched en masse to discounters, major nondiscount grocers have been hit with smaller basket sizes and lower margins

Barely a week goes by without someone asking us about grocery discounters Aldi and Lidl, and what their impact will be on their newer markets, such as the US. We have a whole report coming out on these retailers very shortly, but we thought it would be a good idea to summarize what these discounters’ effect has been on other markets.

Our principal message is that in markets where shoppers have switched en masse to discounters, major nondiscount grocers have been hit with smaller basket sizes and lower margins

1 Price Cuts, Not Premium Stores, Help Nondiscounters Fight Back

As consumers in the UK and France prioritized low prices, the countries’ respective market leaders, Tesco and Carrefour, sought to revive the performance of their flailing superstore formats with fancy renovations. At Tesco, this involved wooden-themed store refits and the addition of aspirational cafés and restaurants. Carrefour launched a flashy, zoned “Planet” store format that incorporated services such as hairdressers. Both conversion programs were abandoned after the CEOs who devised them were ousted—and both retailers have slowed or reversed loss of market share by focusing instead on lower prices. So, lesson one is: Do not be distracted from the main reason shoppers are switching—which is price. Lesson two is: Do not wait too long to make this price investment.2 Prepare for Lower Margins

Serious price investment will drive down operating margins. And, if this comes on top of falling volumes, retailers will experience a double hit to profits. But that is the price some retailers will have to pay in order to regain top-line momentum. In the UK, operating margins for the three big public grocers have slumped. For instance, second-place Sainsbury’s saw its margins fall steadily from 4.0% in fiscal year 2012 to 2.9% in fiscal year 2015, while margins at rival Morrisons plunged from 5.6% to 1.7% over the same period. As a result, many analysts and commentators in the UK no longer know what a “normal” margin is for grocery retailing. Until the threats have been fought off, uncertainty will remain the new normal.3 Expect Fragmentation of Grocery Shopping

Where discounters gain ground, we expect to see a fragmentation of grocery spend as consumers split their shopping among channels. The limited choice at discount stores means that they steal share of basket more than they steal shopper numbers. For example, customers who shop at Aldi and Lidl typically need to make another trip to a regular store to buy the products and brands they cannot get at the discounters. The result in markets such as the UK is that consumers appear to be increasingly mixing channels—discount, convenience and superstore as well as online—and we are likely to see this in other countries where discounters gain ground. This fragmentation is a threat to those nondiscount retailers that have built businesses on serving large-basket customers, and could dent the profitability of big-box retailers.4 Online Grocery Is an Opportunity to Fight Back

Online grocery shopping is one element in the switch away from traditional big-box stores in countries such as the UK. But the no-frills model of Aldi and Lidl fits poorly with Internet grocery retailing due to the high costs involved in this added-value service. So, sustained growth in demand for online grocery is a threat to discount stores and an opportunity for nondiscounters to gain a competitive advantage. Not all attempts at differentiation work. As we have already discussed, differentiation through more premium stores looks unlikely to succeed. But differentiation through e-grocery is more promising, due to the convenience provided by this service—a convenience that discounters are very unlikely to provide. In short, convenience is the discounters’ biggest weakness, given the compromises people have to make when they are shopping the discount stores. So, there is no certainty that discounters will make headway with shoppers who prioritize convenience. For more on this subject, look for our forthcoming report, European Grocery Discounters.

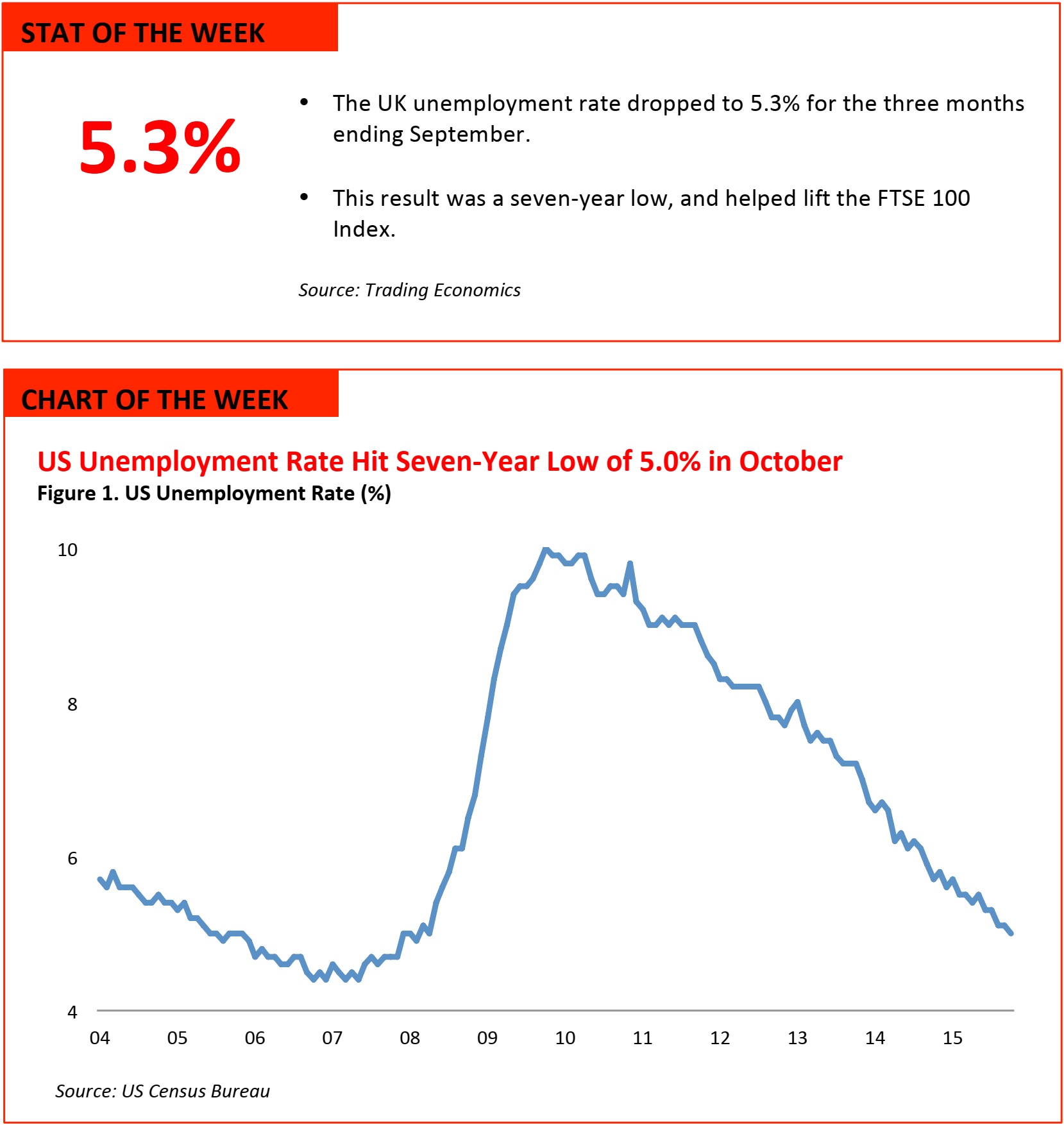

Source: US Census Bureau

- The US unemployment rate fell to 5% in October, down slightly from 5.1% in September. The reading was the lowest since April 2008. During the month, 271,000 jobs were added to the nonfarm payrolls. The combined job gains in August and September were revised up.

- Average hourly earnings of private-sector workers rose in October, to $25.20, up 2.5% from the same month a year ago. The wage growth was higher than the 2% average seen over the last six years.

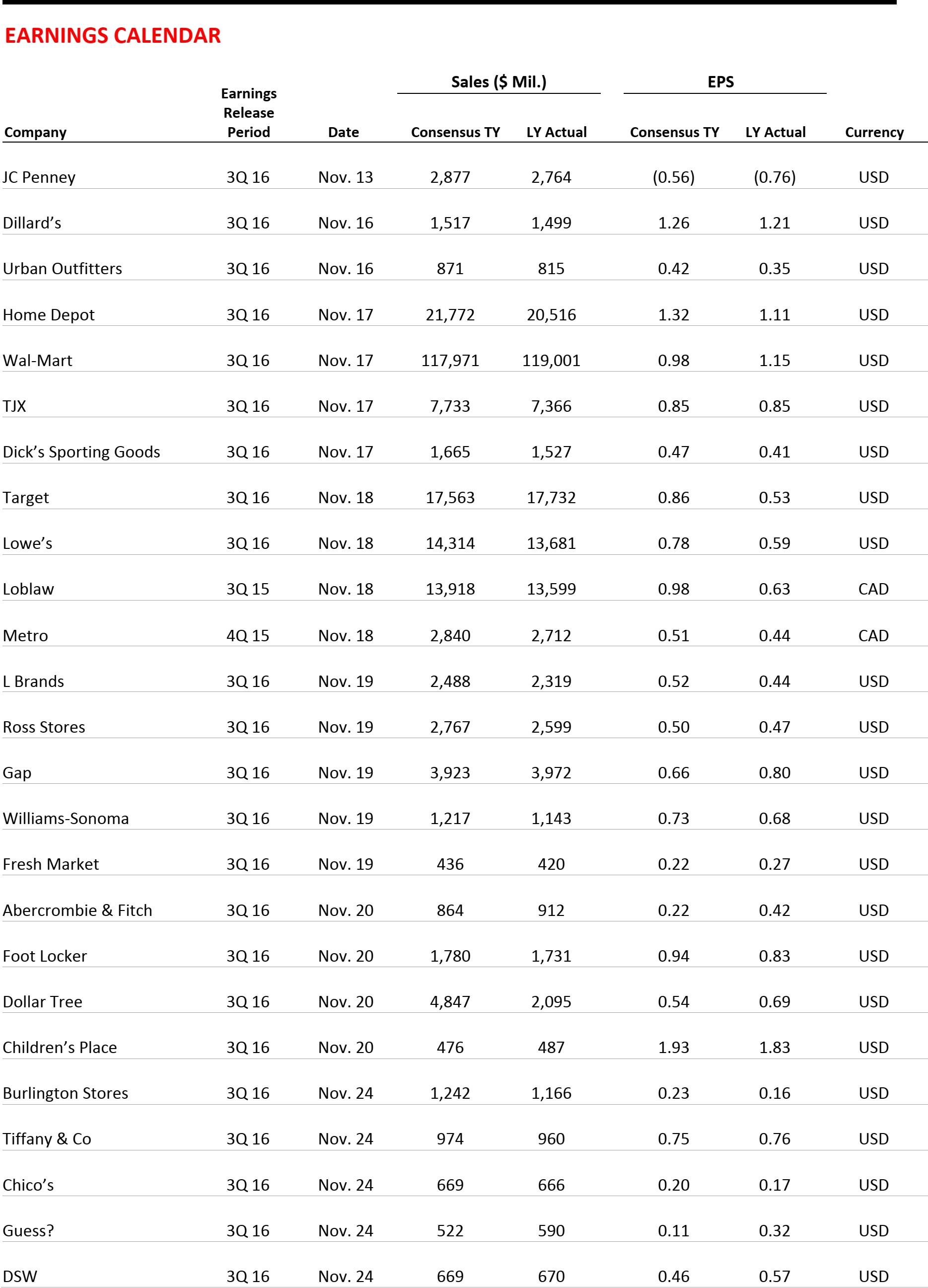

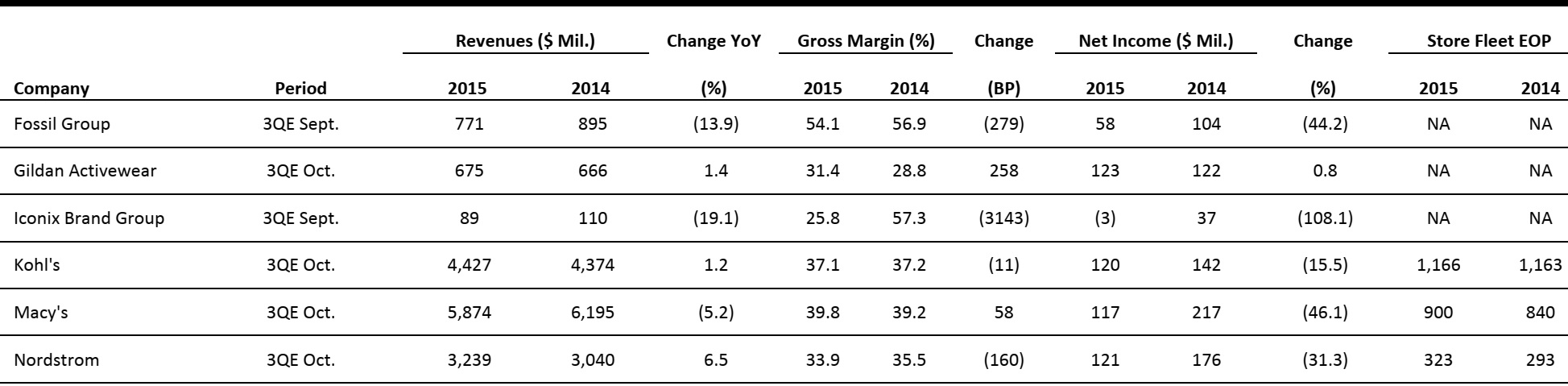

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- In addition to ordering items from Amazon and local grocery stores, Prime Now members in Los Angeles can now order from local restaurants as well. Orders are delivered within an hour.

- From the Prime Now mobile app, consumers can view participating restaurants, and watch in real time as a delivery driver travels from the restaurant to their delivery address.

- Kohl’s announced that it will collaborate with designer Reed Krakoff on items that include handbags and apparel. This is Krakoff’s first retail partnership.

- “The REED collection is inspired by iconic looks, with the emphasis on craftsmanship and quality synonymous with Reed Krakoff,” said Michelle Gass, Kohl’s chief merchandising and customer officer.

- Kroger will acquire grocer Roundy’s for $178 million in order to gain market share in the Midwest. Roundy’s currently owns approximately 150 stores in Wisconsin and Illinois.

- Kroger will pay $3.60 per share, or a 61% premium over the Tuesday closing price of $2.18 per share. The deal is expected to close by the end of this year.

- Spanish fashion brand Mango will not renew its partnership agreement with JCPenney. The company is also closing the 450 concession outlets that it had opened in US JCPenney stores over the five years of the contract.

- The stores will close in February, after which Mango will operate only seven stand-alone stores in the US. The company is looking into opening stores in key markets such as New York and Miami.

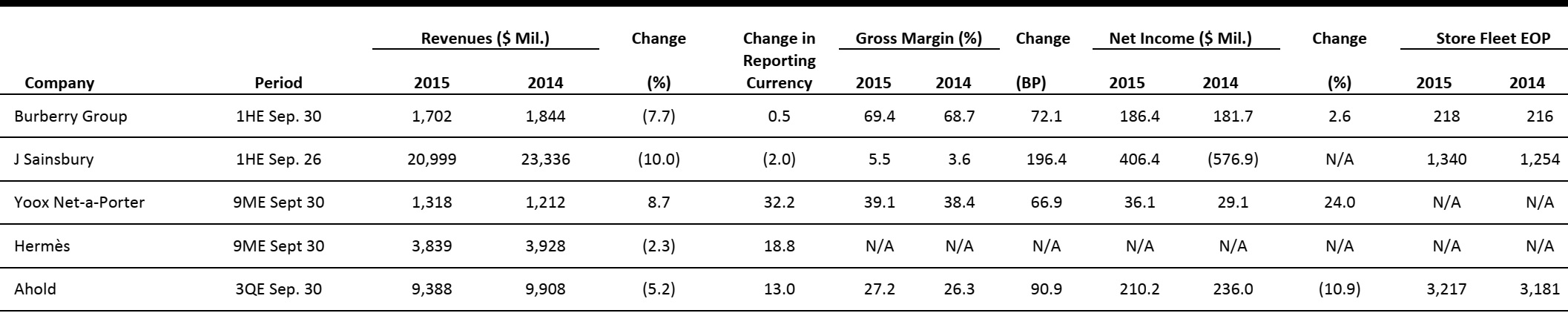

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

- Amazon has launched its one-hour delivery service, Prime Now, in Italy. Customers with a Prime membership can now have products delivered the same day for free or opt to have goods delivered within an hour for €6.90 (US$7.70). Italy is the second country in Europe, after the UK, where Amazon is providing the one-hour delivery service.

- Currently, Amazon offers the service in Milan and surrounding areas for a minimum order of €19 (US$21). Amazon Italy launched a same-day delivery service for food in July.

- German athletic and casual clothing company Puma posted total sales growth of 8.4% at actual rates and 3.1% in constant currency in the third quarter of 2015. Growth was driven by sales in the Americas (up 10.7%) and the Asia-Pacific region (up 5%), while EMEA sales declined by 3.6%.

- Footwear is Puma’s best-selling product category, accounting for 44.7% of sales in the third quarter. Currency-adjusted footwear sales rose by 3.5%. Shoes designed by Rihanna were extremely successful, and many retailers sold out of the collection within hours or days.

- Spanish fashion company Mango is ending its partnership with American retailer JCPenney. Mango will discontinue selling its clothing in 450 JCPenney stores in the US next year, leaving only seven stand-alone stores in the country.

- Mango has decided not to renew its five-year deal with JCPenney, where the shop-in-shops constituted only 0.5% of Mango’s global sales. The company hopes to expand its presence in the US with stand-alone stores.

- Danish jewelry manufacturer and retailer Pandora posted total sales growth of 28% in local currency and 37.5% in adjusted currency in the third quarter of 2015. Growth was strongest in the Asia-Pacific region (at 74.8%), followed by Europe (at 40.7%) and the Americas (at 22.7%).

- Total quarterly group sales were DKK 3,911 million (US$582 million). The total number of branded Pandora stores was 5,874, up by 711 from the third quarter of 2014. In Europe, the number of branded stores increased by 501, to a total of 3,236. In the Americas, the number of branded stores increased by 164, to a total of 2,067, while store numbers in the Asia-Pacific region increased by 46, to a total of 570.

- British fashion retailer New Look saw comparable sales increase by 5.9% in the six months ending September 26, to £756 million (US$1,188 million). Underlying operating profit grew by 10.9%, to £94.8 million (US$149 million), and adjusted profit before tax rose by 40.6%, to £39.5 million (US$62 million). New Look brand sales increased by 4.9%, sales in the UK grew by 4.7%, the company’s own website sales grew by 37.9% and third party e-commerce sales grew by 47.2%.

- New Look successfully launched its first stand-alone menswear stores, and said the category is performing well. The retailer also benefited from more normal weather in comparison to last year. New Look has been expanding internationally, particularly in China, where it is planning to grow from 52 stores in the half year to 85 by March 2016.

ASIA TECH HEADLINES

- In China, November 11 is Singles’ Day, the craziest day in China’s huge e-commerce market, which is estimated to account for about US$670 billion in spending in 2015.

- The anti-Valentine’s Day dates to the mid-1990s, when it was started among university students in China. In 2009, Alibaba leaped on the bandwagon to create an online sales day on its Taobao marketplace. Now, almost every e-commerce site participates in the 24-hour online shopping extravaganza.

- MIT announced that it will open an “innovation node” in Hong Kong next summer. The center will be a startup incubator of sorts, which MIT said will combine “resources and talent…to help students learn how to move ideas more rapidly from lab to market.”

- The idea is to facilitate a way for MIT and Hong Kong students to collaborate physically or virtually in order to drive ideas toward commercialization. For example, medical devices, sensors and robotics being prototyped on the MIT campus or at the node could be tested in Boston or Hong Kong, and then manufactured in small quantities in Shenzhen.

- Besides tracking a wearer’s sleep and steps, Xiaomi’s Mi Band Pulse can track heart rate, too, a function not offered by its predecessor. The new device will work with both Android (4.4 or later) and iOS (iPhone 4S/ iOS 7.0 upward).

- The Mi Band Pulse is priced low, at ¥99 (US$15). It will be sold only in China initially, as part of the country’s massive November 11 Singles’ Day online shopping event.

- Alibaba will acquire the remaining shares of China’s popular online video site, Youku Tudou, in an all-cash transaction estimated to be worth US$3.7 billion.

- The merger will give Alibaba access to more than 580 million online video users a month, further bolstering its presence in the Chinese digital media market

- A Hong Kong startup is applying Uber-style ride sharing to umbrellas: Umbrella Here is a small, donut-shaped device that sits on top of an umbrella. The umbrella’s owner can use an app to make the device light up, indicating that strangers are welcome to share the umbrella.

- The app also works as a social network, allowing users to stay in touch with those with whom they have shared their umbrella.

LATAM RETAIL HEADLINES

- Despite the economic slowdown in Brazil, salaries are up 8%–10%.

- In Brazil, all employees are represented by a sector and/or industry union, which negotiates an annual salary increase with the association that represents the employers of that industry, resulting in annual salary increases for all employees.

- Carlos Slim’s Grupo Sanborns saw a 44% increase in same-store sales at its electronics and music stores, largely thanks to the popularity of Apple Watches and iPhones.

- Broker Itau raised its same-store-sales growth estimate for the year to 36% from 9%.

- Retail same-store sales increased by 6.2% in the first nine months of 2015, after being flattish in 2014, according to retailer industry group ANTAD.

- Drivers include strong remittances from the US, the success of economic reforms and an increase in the number of people in formal employment rather than in low-productivity jobs in small firms.

- Walmart will open its first Walmart Super Center in Nicaragua on December 10, just in time for holiday shopping.

- The store will have total space of 5,800 square meters (62,431 square feet), at a total investment of US$17 million.

- In the third quarter, Falabella’s revenues increased by 12.7%, to CLP 2 trillion (US$2.9 billion), and net income grew by 16.2%.

- Growth was generated by a 6.5% increase in sales area, driven in part by supermarket store openings, and by same-store-sales growth at Falabella and Sodimac in Chile, as well as by a 14.3% increase in loan growth.