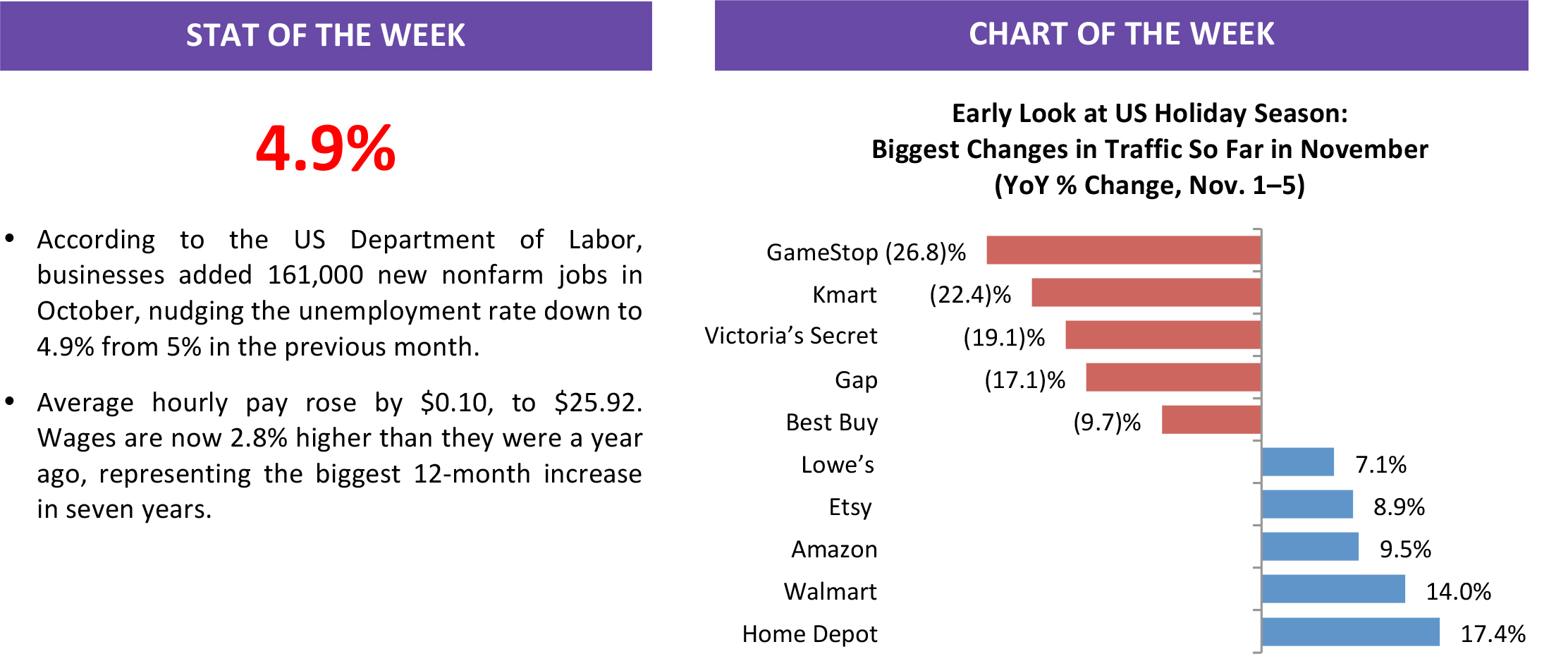

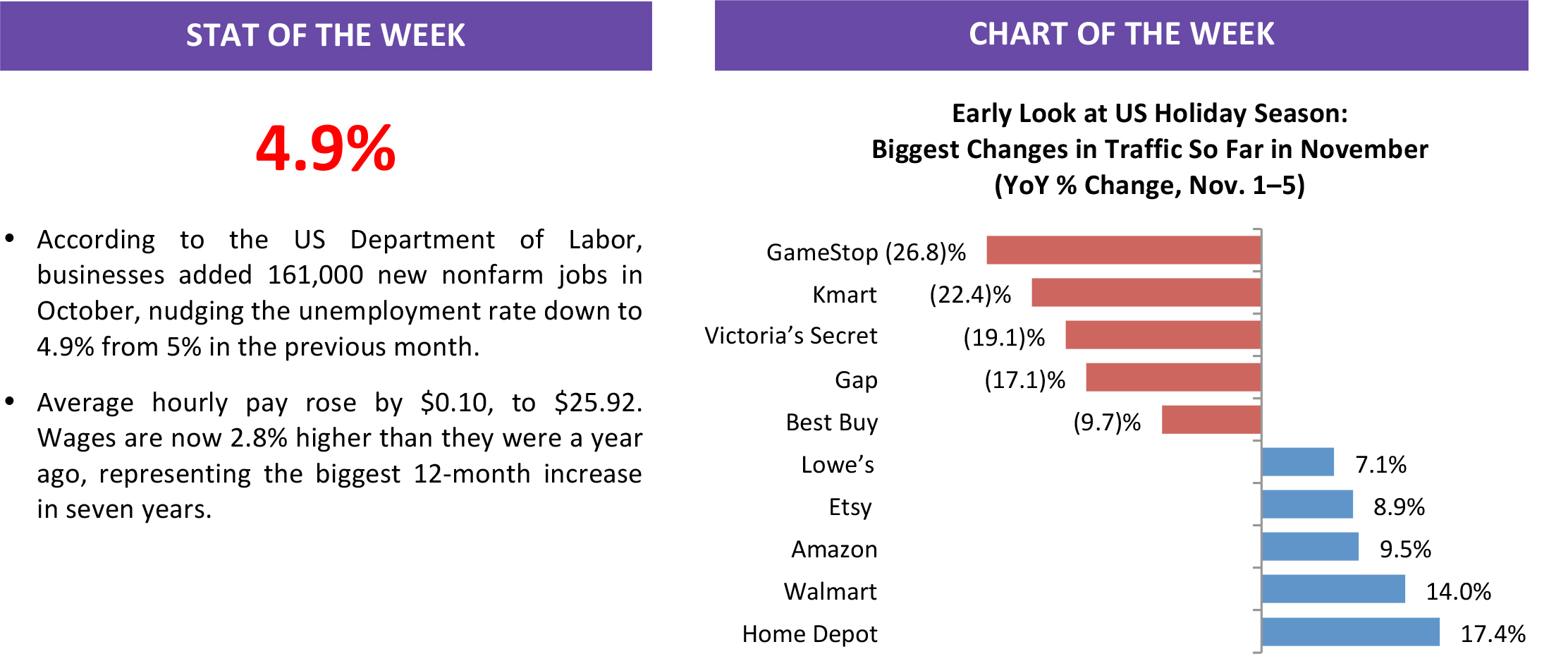

Source: US Department of Labor Source: SimilarWeb Data

FROM THE DESK OF DEBORAH WEINSWIG

Singles’ Day Is upon Us Again!

Now that the US election is finally behind us, consumers can refocus their energies toward what they do best—shopping. No longer can consumers point to preelection jitters as an excuse not to pull out their wallets. Fortunately for us, there is a global shopping holiday—Singles’ Day—upon us to help warm up consumers’ spending habits so they will be in shape for Black Friday and the rest of the holiday shopping season.

Singles’ Day is a secular holiday that falls on November 11 every year. The ones in the date—11/11—represent singletons, and the shopping day was created in China back in the 1990s as a way for bachelors at one university to celebrate—or commiserate over—their single status. Online marketplace giant Alibaba rebranded the day as a national shopping holiday in 2009, and it has now expanded into a global event. Singles’ Day has grown exponentially in China and around the world, generating a total gross marketplace value (GMV) of $14.3 billion last year. Fung Global Retail & Technology estimates that this year’s Singles’ Day GMV could grow by 40%, to reach $20 billion. In China, other online merchants have jumped on the Singles’ Day bandwagon, and e-commerce company JD.com and consumer-electronics merchant Suning are now big supporters of the shopping holiday.

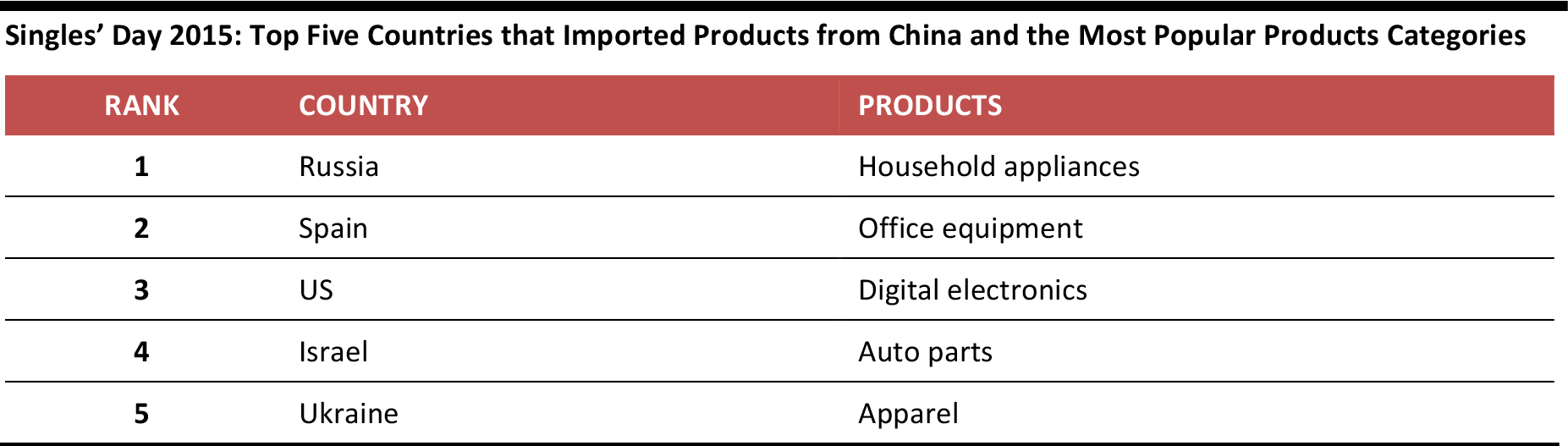

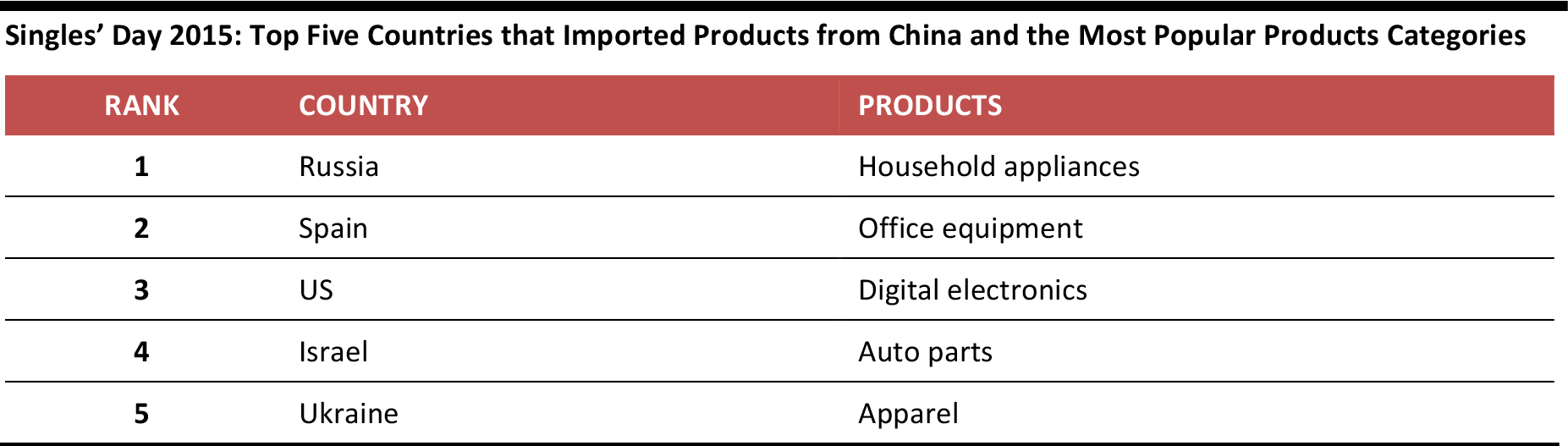

Although Singles’ Day was created in China, the event has grown into a global phenomenon. The table below shows the top five countries that imported products from China on Singles’ Day in 2015 and the most popular product categories, according to AliResearch.

Source: AliResearch

Although the US ranked third in AliResearch’s ranking of Singles’ Day imports, the shopping day is not yet a household word in America. Still, US consumers spent a respectable $1.35 billion on goods on Singles’ Day last year, up 10% year over year, according to a report from Adobe, which put the day in 24th place among the top US shopping days in 2015. The top-selling four products (by revenue) in the US were Nike Air Jordan shoes, the Sony PlayStation 4 gaming console, Samsung curved 4K TVs and Apple iPad Airs/Mini 2s.

Chinese e-tailers are planning to raise the already massive amount of publicity and celebration surrounding Singles’ Day even further this year. Last year, Alibaba threw a Singles’ Day celebration in Beijing (the site of its newly relocated headquarters), holding a four-hour variety show that was attended by international celebrities such as actor Daniel Craig (the most recent James Bond) and that featured a performance by

American Idol finalist Adam Lambert and an appearance by actor Kevin Spacey via YouTube. (Although Netflix is not available in China,

House of Cards—in which Spacey plays the lead role—is quite popular there.) This year’s celebration will be held in the heart of China’s Silicon Valley—Shenzhen—and Alibaba planned another four-hour gala on November 10, featuring singer Katy Perry (who ended up having to cancel at the last minute due to a family emergency), bands from South Korea and Taiwan, German soccer star Thomas Müller (a forward for the Bayern Munich team) and many other Chinese and international celebrities. Last year’s viewership of the TV gala was more than 100 million in China, and this year’s figure is likely to be even higher due to the presence of a global audience.

Fung Global Retail & Technology will be attending this year’s celebration in Shenzhen and will continue to report on this year’s Singles’ Day celebration as we proceed toward Black Friday and the holiday shopping season.

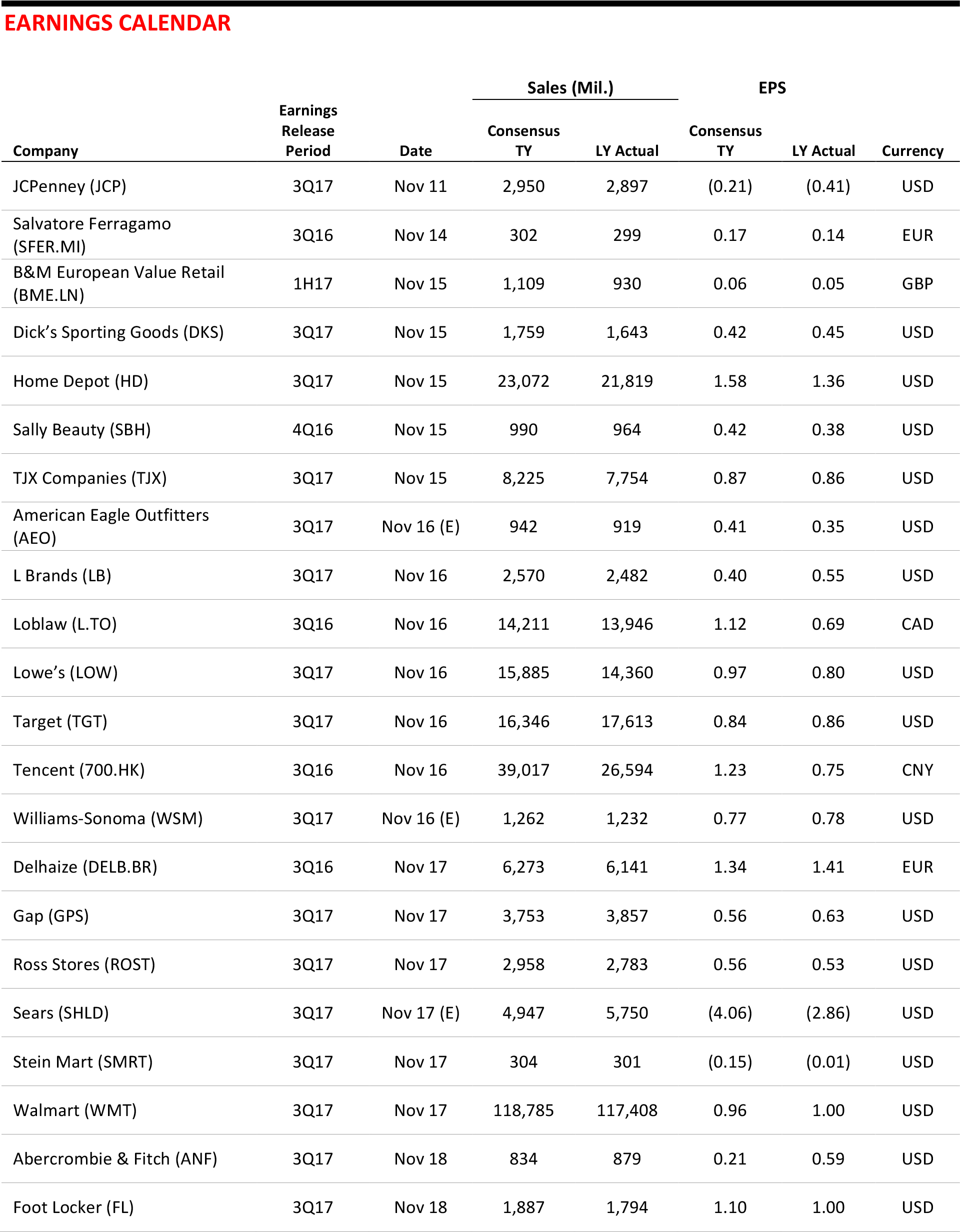

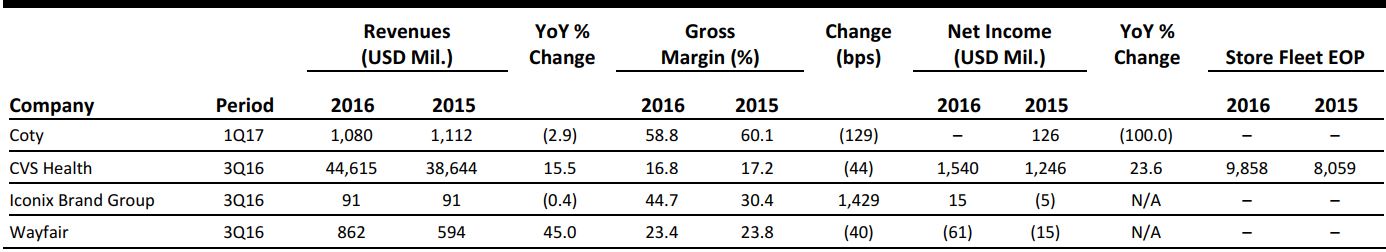

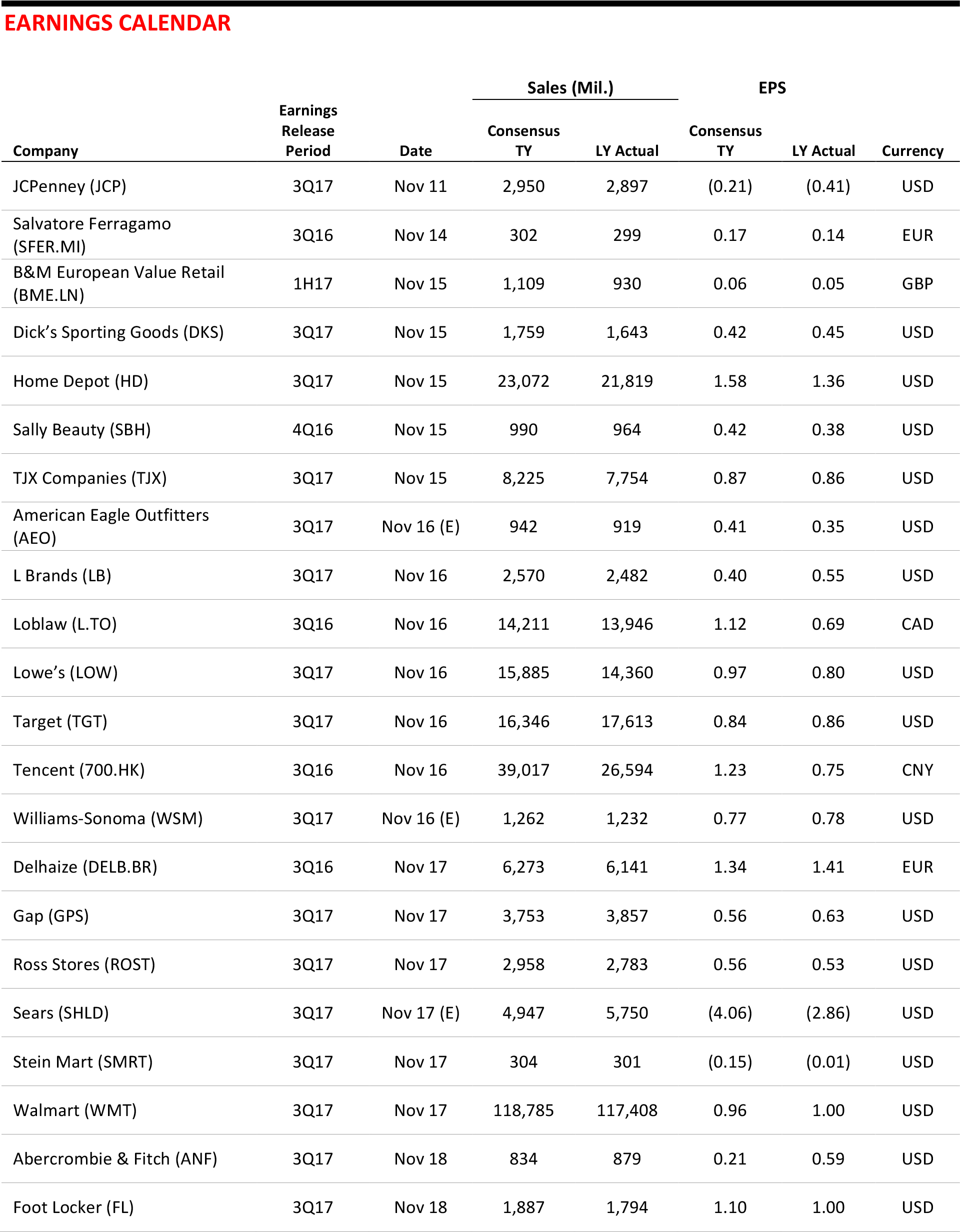

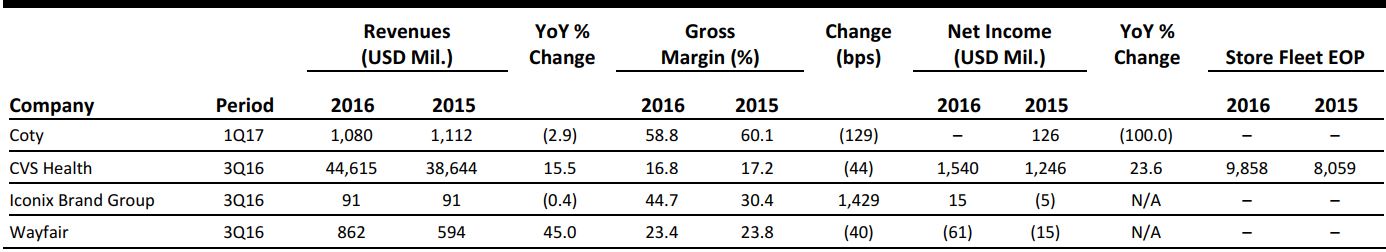

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

The Lowdown on Markdowns, as Holiday Selling Creeps In

(November 8) Women’s Wear Daily

The Lowdown on Markdowns, as Holiday Selling Creeps In

(November 8) Women’s Wear Daily

- As consumers begin their holiday shopping earlier, retailers are ramping up holiday promotions. Industry experts urge retailers not to panic yet over consumers remaining reluctant to splurge on apparel and accessories.

- However, many companies are finding that they have to sell goods for less; most are saying they are discounting at the same rate as a year ago. Data from Market Track show that prices of holiday products are 6% lower than last year as promotions continue to creep in.

High-Low Fashion Collaborations Are Not About the Customers

(November 7) Glossy

High-Low Fashion Collaborations Are Not About the Customers

(November 7) Glossy

- While collaborations between high-end designers and fast-fashion retailers may seem like democratized fashion, they actually further foster exclusivity. Furthermore, these collaborations disrupt both luxury and fast-fashion retailers and can hurt the designers’ brands, as fast fashion is often the antithesis of what they stand for.

- The Kenzo x H&M collection released this past Thursday caused shoppers to line up for the chance to grab a piece at retail price. Shoppers who did not succeed could buy the items secondhand on eBay, where the prices more than doubled.

American Retailers Are Still Trying to Transform Thanksgiving into a Shopping Holiday

(November 8) Business Insider

American Retailers Are Still Trying to Transform Thanksgiving into a Shopping Holiday

(November 8) Business Insider

- Despite suggestions that starting Black Friday sales on Thanksgiving Day does not make financial sense, several retailers are still sticking to the strategy. Sears, Macy’s, Toys “R” Us and Kohl’s will all kick off their Black Friday sales on Thanksgiving evening this year.

- It seems, however, that the movement to start Black Friday shopping on Thanksgiving has actually backfired. By extending the shopping event, Black Friday loses its distinction, and consumers opt to spread out, rather than concentrate, their spending leading up to the holidays.

Basics Abound: Amazon’s Apparel Business Up 5% in October

(November 7) Women’s Wear Daily

Basics Abound: Amazon’s Apparel Business Up 5% in October

(November 7) Women’s Wear Daily

- Amazon’s apparel sales grew by 5% in October year over year and by 85% month over month, according to One Click Retail. Growth in the men’s category was particularly strong. Halloween costumes accounted for an estimated $21 million in sales, representing a 27% month-over-month increase in apparel.

- Amazon’s traction in its apparel business is mostly in basics, as luxury retailers continue to distance themselves from the e-commerce giant. Functional staples such as Levi’s 501 Original Fit Jeans and Carhartt hoodies continue to prove popular on Amazon.

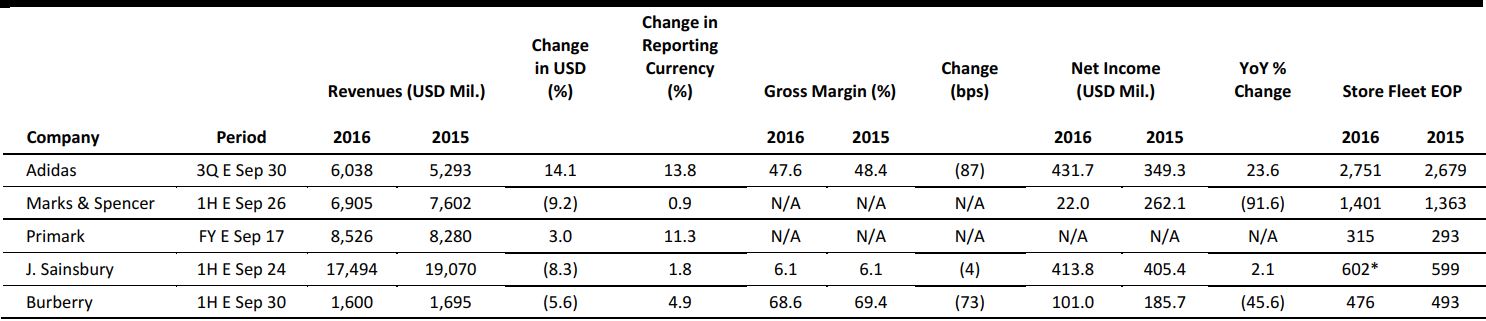

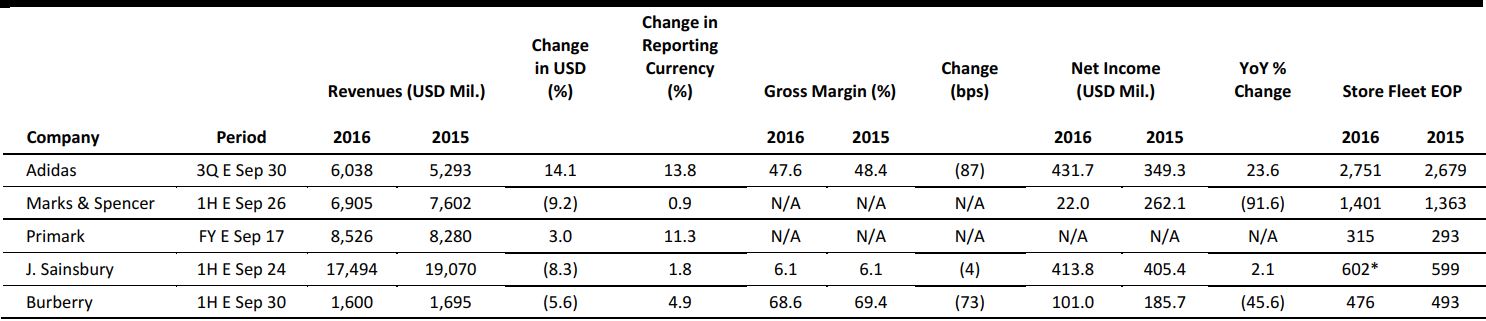

EUROPE RETAIL EARNINGS

*Excludes the 725 Argos stores that were acquired earlier in 2016

Source: Company reports

EUROPEAN RETAIL HEADLINES

Vente-Privée Acquires Polish Shopping Club Złote Wyprzedaże

(November 3) Ecommerce News Europe

Vente-Privée Acquires Polish Shopping Club Złote Wyprzedaże

(November 3) Ecommerce News Europe

- French flash-sale retailer Vente-Privée has acquired a majority stake in Złote Wyprzedaże, Poland’s biggest online shopping club. The Polish company offers deep discounts and flash sales on clothing and accessories.

- Vente-Privée noted that this is another strategic step forward in its expansion plans across Europe, and that Złote Wyprzedaże’s 3.5 million members will now have access to 6,000 international brands.

Richemont Reports 1H Sales Drop, Announces that CEO Will Step Down

(November 4) Company press release

Richemont Reports 1H Sales Drop, Announces that CEO Will Step Down

(November 4) Company press release

- French luxury group Richemont reported first-half 2016 sales of €5,086 million (US$5,616 million), down 13% year over year, which the company attributed to a decline in watch sales and an overall challenging international environment. Richemont’s net profit for the period tumbled 51%, to €540 million (US$596 million).

- The company announced that CEO Richard Lepeu will step down in March 2017 and that it will no longer appoint a CEO, but will be managed by the board instead, which is currently chaired by Johann Rupert.

Thousands of Tesco Bank Accounts Hacked

(November 7) Financial Times

Thousands of Tesco Bank Accounts Hacked

(November 7) Financial Times

- Tesco Bank reported on November 6 that many of its customers have had money taken from their accounts as a result of a cyber attack. It stated that it had blocked online transactions for some accounts to prevent further fraud.

- The company said that it has begun to process refunds to the affected accounts and that it is working with authorities and regulators to resolve the problem as soon as possible.

Ted Baker Set to Expand in India

(November 7) Drapers

Ted Baker Set to Expand in India

(November 7) Drapers

- British high-street brand Ted Baker has signed a partnership with Indian retailer Aditya Birla Fashion and Retail to expand in India. Aditya Birla operates more than 2,000 of its own stores in 375 cities and towns across India.

- While Ted Baker does not yet have a physical presence in India, it has been trading there through multibrand reseller The Collective since 2009.

Paperchase to Launch Stores in the US Next Year

(November 7) Retail Week

Paperchase to Launch Stores in the US Next Year

(November 7) Retail Week

- British stationery retailer Paperchase has confirmed that it is set to open its first stores in the US, starting off with two stores in Chicago. It already sells greeting cards through retailers Target and Staples, but currently has no stand-alone stores in the country.

- Paperchase was formerly owned by US bookstore chain Borders, which sold it for £20 million (US$24.8 million) in 2009. This year, Paperchase has already opened 23 new stores, nine of which are outside the UK.

ASIA TECH HEADLINES

Huawei to Launch IoT Startup Accelerator in Singapore

(November 7) e27.co

Huawei to Launch IoT Startup Accelerator in Singapore

(November 7) e27.co

- Chinese telecommunications electronics company Huawei has partnered with NUS Enterprise to launch an Internet-of-Things startup accelerator called i5Lab in Singapore. The program aims to help nurture participating startups’ customer discovery, business model development and agile engineering skills.

- The 10-week accelerator program will focus on smart verticals, including smart living, transportation and logistics. It will also focus on developing big data, virtual reality/augmented reality and natural language processing technologies.

WeChat Introduces Electronic Identity Card Feature

(November 7) Tech Wire Asia

WeChat Introduces Electronic Identity Card Feature

(November 7) Tech Wire Asia

- In a move aimed at developing itself into the only app people will ever need, WeChat, owned by Tencent, recently launched an electronic identity card feature in collaboration with Alipay. Tencent says that the system will utilize facial recognition technology to ensure the security of the identity cards.

- The feature could eliminate the need for citizens to carry a physical identity card around, and is currently being tested in Nanning.

Google-Accelerated Edtech Startup HarukaEdu Raises US$2.2 Million

(November 7) TechinAsia

Google-Accelerated Edtech Startup HarukaEdu Raises US$2.2 Million

(November 7) TechinAsia

- Indonesian online learning platform HarukaEdu announced that it has raised US$2.2 million in a funding round. The startup was one of eight firms from Indonesia selected to join the Google Launchpad accelerator program earlier this year.

- The edtech startup works with a number of Indonesian institutions to offer online classes, including both informal courses and certified university programs that lead to a degree.

Baidu Seeks Up to US$500 Million for Its Delivery Unit

(November 6) Bloomberg

Baidu Seeks Up to US$500 Million for Its Delivery Unit

(November 6) Bloomberg

- Baidu is seeking to raise up to US$500 million for its Waimai food delivery unit, which uses scooters to deliver everything from Starbucks coffee to sashimi. The company’s food delivery business is in a costly battle for customers with Alibaba and Tencent.

- Baidu has invested heavily in sectors outside its primary desktop search business as it tries to find new growth as users switch from desktops to mobile devices.

LATAM RETAIL HEADLINES

Uber Launches Its First Debit Card in Latin America, in Partnership with Bankaool

(November 4) CBS.com

Uber Launches Its First Debit Card in Latin America, in Partnership with Bankaool

(November 4) CBS.com

- Uber is partnering with Bankaool, the first Mexican online bank, and MasterCard on the Uber Bankaool Debit Card, an innovative solution that offers an alternative way to pay for rides using a mobile-banking app.

- This is the first debit card that the rideshare company has launched in Latin America, offering users who do not have credit cards or debit cards that function with e-commerce a new payment method option.

Trump’s Win Has Mexico’s Markets in Chaos

(November 9) Business Insider

Trump’s Win Has Mexico’s Markets in Chaos

(November 9) Business Insider

- The Mexican peso crashed by more than 13% to a record low in the wake of Donald Trump’s electoral victory in the US on Tuesday night. The Bank of Mexico held an emergency meeting to discuss the currency issues.

- Mexico’s stock market, the IPC, opened to a loss of more than 4% on Wednesday. While the IPC recovered a good portion of its losses, the volatility in the market is evidence of the nervousness in Mexico surrounding the Trump presidency.

Nike Opens First Kicks Lounge in Latin America

(November 4) Fashion Network

Nike Opens First Kicks Lounge in Latin America

(November 4) Fashion Network

- Nike has opened a space called the Kicks Lounge in the Costanera Center mall in Santiago, Chile. The 4,434-square-foot store on the fourth floor of the shopping center is the first Kicks Lounge in the region and the sixth in the world.

- Chile has become a hub in Latin America for sneaker culture, and the specialty store will offer exclusive Nike sneakers not found in other locations. The store’s areas include Nike ID, Sneakers Bar, The Vault, Nike ID VR Studio and the School of Sneakers.

São Paulo Fashion Week Restructures as Recession Bites

(November 8) WWD.com

São Paulo Fashion Week Restructures as Recession Bites

(November 8) WWD.com

- São Paulo Fashion Week’s sponsorship revenue and attendance levels fell sharply during its latest fall edition due to Brazil’s deep recession and the unavailability of the event’s usual location of the Bienal Pavilion due to an art fair.

- Sponsorship revenues declined by roughly 20%, to R$12 million (US$3.6 million, at current exchange), and attendance was expected to fall to 70,000 from 100,000 last year. The event currently has more sponsors than last year, but they are investing less than before.

American Retailers Are Still Trying to Transform Thanksgiving into a Shopping Holiday

(November 8) Business Insider

American Retailers Are Still Trying to Transform Thanksgiving into a Shopping Holiday

(November 8) Business Insider