FROM THE DESK OF DEBORAH WEINSWIG

We attended a breakfast presentation hosted by the Retail Marketing Society featuring Allen Questrom, former Chairman and CEO of a number of US retailers, including Neiman Marcus, Federated Department Stores (Macy’s) and JCPenney. Here are some of our key takeaways from the hour-plus we spent with this industry titan:

Issues Plaguing Retail Today; Retail Is Not Dead

Questrom noted that retail is a unique industry, one that is constantly changing. Management teams have to be paranoid in order to succeed, he said, because one day’s success is not indicative of what will come the next day. Things are going to be different each day, and one has to constantly focus on managing the changes and doing better. Retailers need to deal with the new reality and not be stuck on how the retail business operated in the past, he said.

On a broader level, Questrom believes the US is “overstored.” Growth has accelerated in the last 10 years, with Walmart and the TJX Companies having added a significant number of new stores even as the department store segment has consolidated. In the US, there are 23 square feet of retail space per person compared to about 10 square feet in Canada and roughly 7 square feet in London. The result of having too many stores is having too much merchandise to fill all the stores, which results in markdowns. In addition, there are too many malls and shopping centers, Questrom noted.

Anatomy of a Turnaround

Questrom has a track record of implementing successful turnarounds at the companies he has led during his career, and he shared some insights into what he believes is necessary to succeed in such situations. First and foremost, he made an effort to talk to many people at the company he was joining, from senior executives to junior-level employees, to gain an insider’s understanding of the company’s culture and inner workings on a day-to-day basis. According to Questrom, a strategy has to be focused and well communicated, and then adopted by team members. Once leadership achieves “buy-in,” the company must adhere to the strategy in order to keep the turnaround on track. He said another thing that helps drive successful turnarounds is making all employees feel like they are instrumental in making the company successful.

Ron Johnson–Era Case Study: You Cannot “Fire” Your Customer

While Questrom got to know embattled former JCPenney CEO Ron Johnson only at the end of Johnson’s tenure, he shared that he believes Johnson is very smart, had “good ideas” and is very creative. That said, Questrom thinks that Johnson’s ideas could have been implemented more effectively had they gone through testing in a particular region or in individual stores in order to gauge customers’ reactions before being rolled out, untested, to the entire fleet of stores.

The State of the Retail Industry

Questrom also discussed the millennial shopper. In his view, millennials are generally more value conscious, particularly because more of them are attending college and bearing the high costs that come along with that. He said that roughly 35% of college-aged students attend college now versus closer to 11% in his own time.

Despite the challenges traditional retail is facing, there are pockets of strength, he said, and fast fashion is one of them. Zara, for example, is growing, and it has high traffic in its stores: the chain sees 17 visits per year per customer, on average, versus four per year for traditional retailers. Questrom noted that fast-fashion retailers turn their merchandise much more quickly and offer new merchandise twice a week.

An Industry Undergoing Tremendous Change

While there is tremendous uncertainty in retail today, one thing remains very clear: the balance of power has shifted from the purveyor of the goods to the buyer. Consumers now dictate how, when and where they want to shop. This power shift is presenting the single greatest threat to traditional brick-and-mortar retail. Yet it also presents a tremendous opportunity for those forward-thinking merchants that understand its unavoidable consequences and are looking to not only implement technologies that reduce costs and protect margins, but also to grow their businesses by offering new services and experiences to customers.

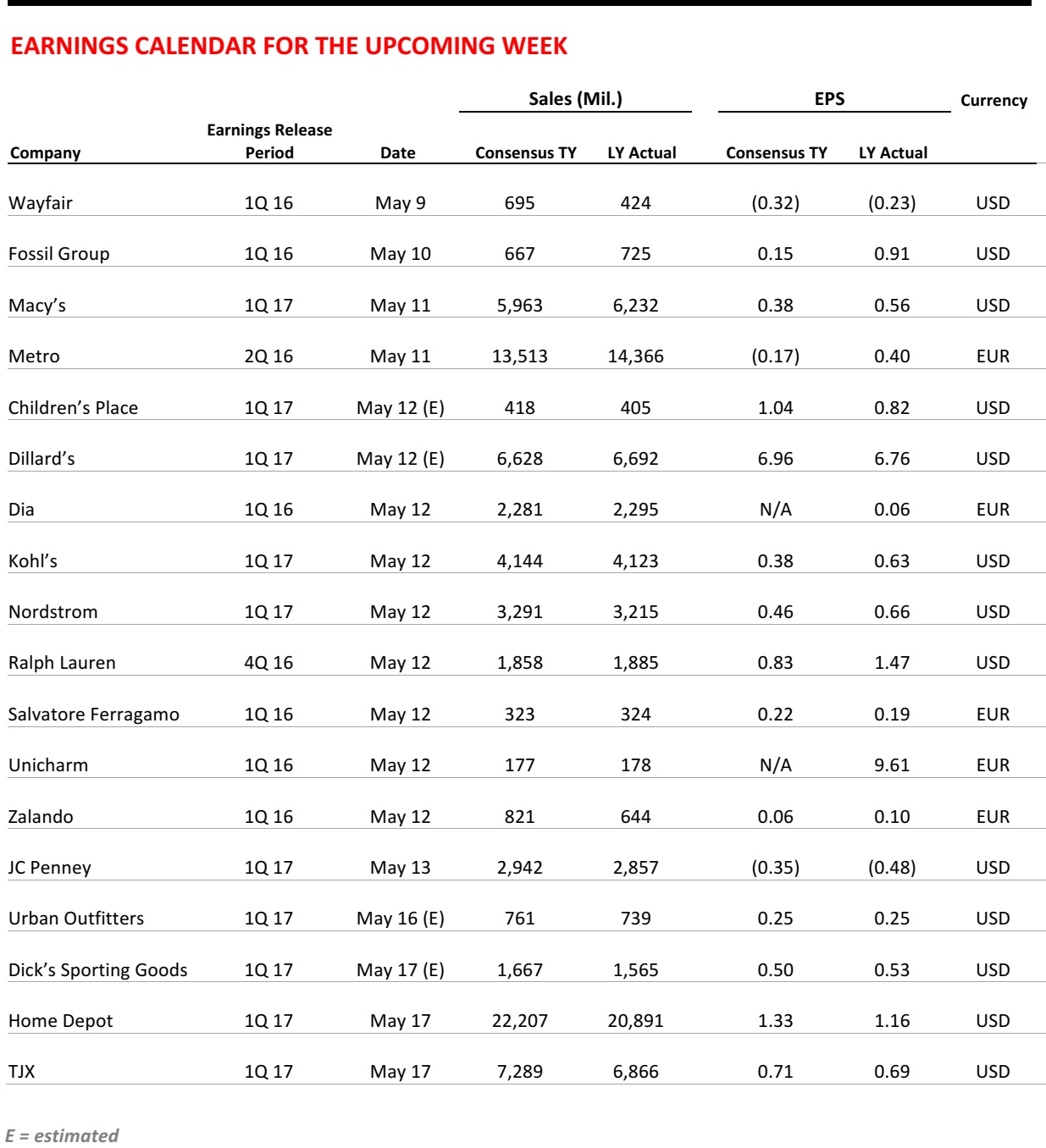

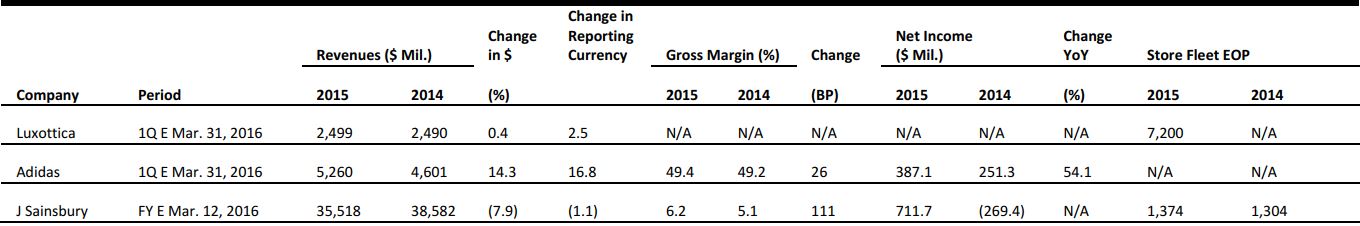

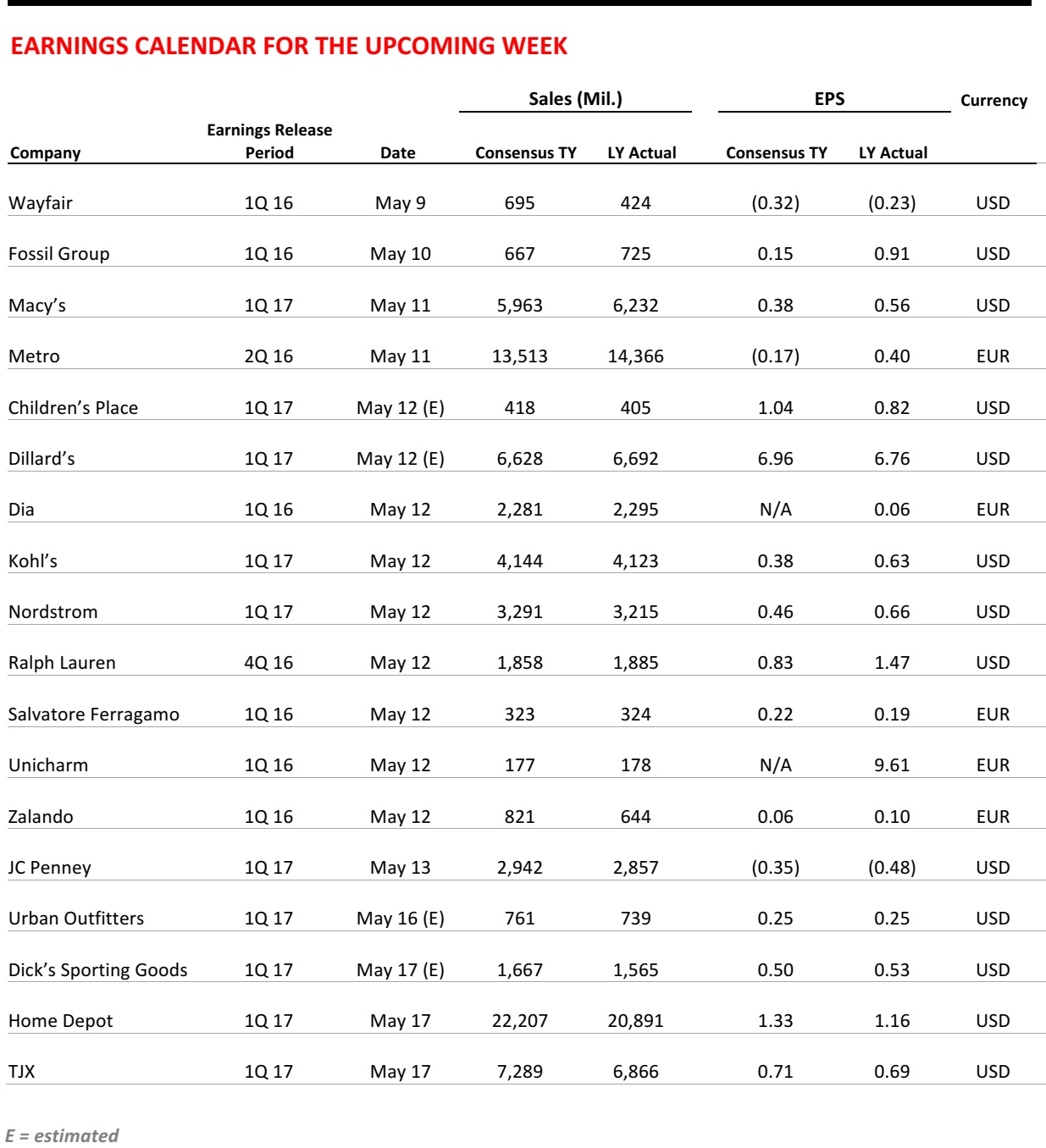

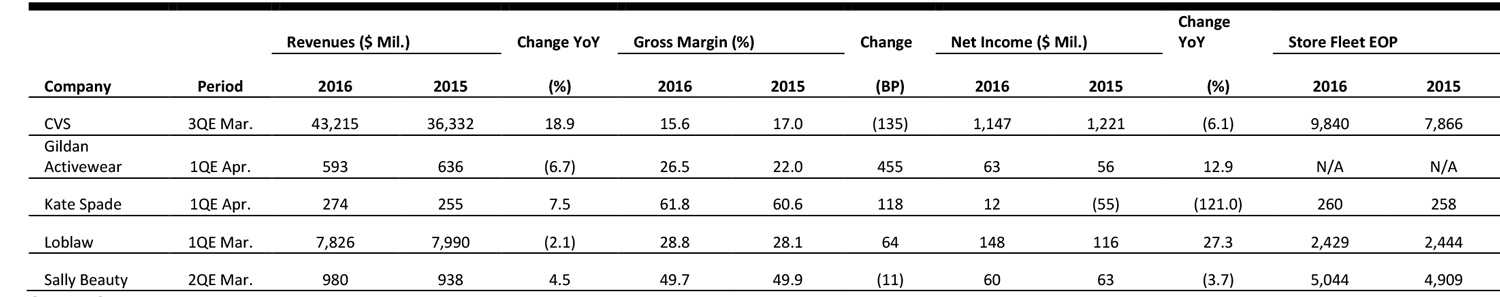

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Uber Offers to Get Merchants to Pay for Your Ride

(May 3) TechCrunch

Uber Offers to Get Merchants to Pay for Your Ride

(May 3) TechCrunch

- Uber is turning into a platform for external commerce promotions, rewarding users with special offers. The ride-sharing pioneer hopes that providing deals and discounts will help increase customer loyalty.

- The idea is that Uber riders will be able to get money off their next ride when they shop at select merchants using their Uber-linked credit card. Referral fees from merchants may eventually boost Uber’s profit per ride.

Online Sales Will Surpass $530 Billion by 2020

(May 2) Internet Retailer

Online Sales Will Surpass $530 Billion by 2020

(May 2) Internet Retailer

- According to a new report from Forrester Research, US shoppers will spend more than $530.6 billion online by 2020. The figure is 56.9% higher than Forrester’s 2015 estimate of $338.1 billion and 42.4% higher than its 2016 estimate of $372.5 billion.

- Amazon’s retail business represented 60% of all US online sales growth last year. Growth factors included a stronger economy, retailers gaining more repeat business from customers and a strong omni-channel push.

How Social Influencers Are Disrupting M-Commerce in Industries Besides Retail

(May 3) Luxury Daily

How Social Influencers Are Disrupting M-Commerce in Industries Besides Retail

(May 3) Luxury Daily

- Advertising partnerships with social influencers have benefited retailers, but other industries are beginning to catch on to the trend, too. Michael Becker, Managing Partner at mCordis, says that industries with high-value products and services—such as entertainment, real estate, restaurants, automotive and travel—could especially benefit from social influencer marketing.

- The social influencer strategy works best when it is not overly orchestrated by the brand, allowing the influencer’s experience and insight to guide the advertisement. And while social media users know that these posts are paid ads, the unique and complementary context results in a more positive reception.

Fashion Site Fynd Uses Machine Learning to Create a “Personal Shopper”

(May 3) Women’s Wear Daily

Fashion Site Fynd Uses Machine Learning to Create a “Personal Shopper”

(May 3) Women’s Wear Daily

- Fashion discovery search engine Fynd combines social media algorithms and machine learning to offer a virtual personal shopping experience. The site is designed to be an intuitive concierge service that makes the online shopping experience joyful and functional.

- Users find what they are looking for by entering a description in plain English or by liking certain items. Fynd’s search engine then goes into “robot mode” in order to curate and suggest products for individual users. As users “like” more items, and Fynd learns more about them, the search recommendations become deeper and richer.

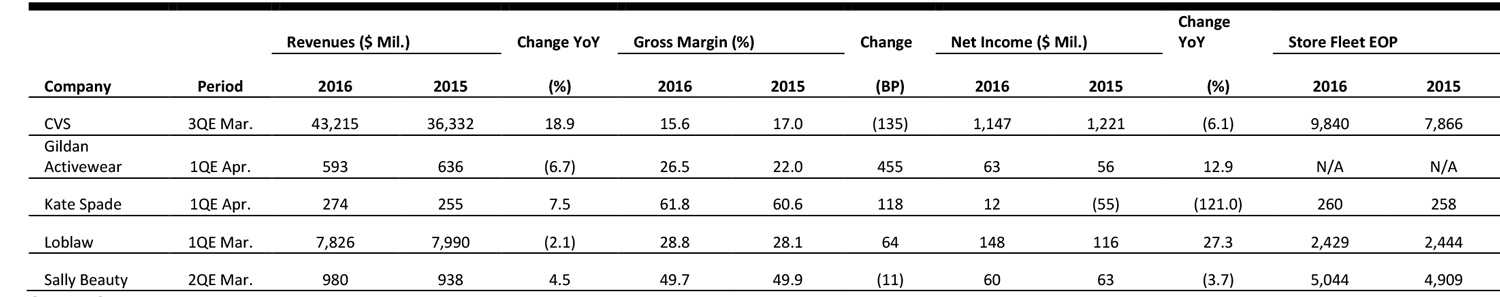

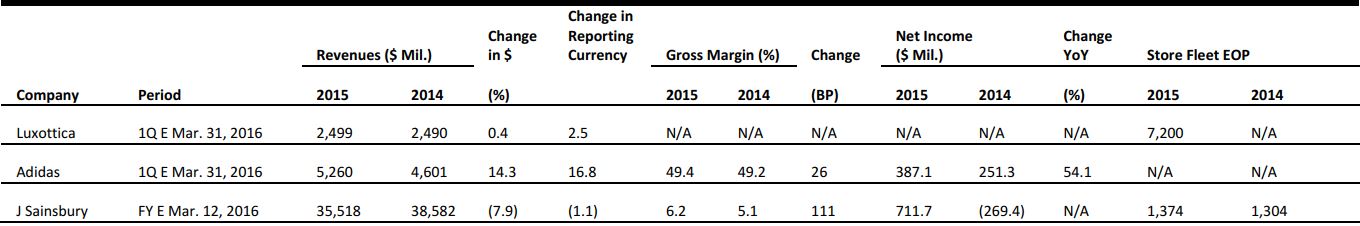

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

Hugo Boss Posts 4% Decline in Group Sales in 1Q16

(May 3) Company press release

Hugo Boss Posts 4% Decline in Group Sales in 1Q16

(May 3) Company press release

- German luxury fashion house Hugo Boss posted a year-over-year decline of 4% in net sales in 1Q16; sales totaled €642.6 million (US$707.3 million). Year over year, the company’s gross profit margin fell by 140 basis points and its operating margin fell by 700 basis points. Net income plunged by 49% year over year, to €38.5 million (US$42.4 million).

- In the quarter, sales fell by 16% in the US and by 11% in China, year over year at constant currency. Adding to the overall decline in profits were increased discounting, particularly in the US; negative effects from stock write-downs in Asia; and price adjustments of about 20% to the spring collection in China (to match European levels).

ASOS and Wayra Launch Fashion Tech Accelerator

(May 3) Wayra.co.uk

ASOS and Wayra Launch Fashion Tech Accelerator

(May 3) Wayra.co.uk

- British fashion Internet pure play ASOS has launched a new fashion accelerator program in partnership with Wayra, the startup accelerator of Spanish telecom company Telefónica. The program is expected to last for eight months and will be conducted at Wayra’s London office.

- The accelerator is seeking “mature startups with a proven track record of developing technologies, products and services” in the field of fashion, as it hopes to complement ASOS’s existing online fashion business model. The program will offer up to £34,000 (US$47,437) in funding.

Groupe Casino Completes Sale of Big C Vietnam for €1 Billion

(April 29) Company press release

Groupe Casino Completes Sale of Big C Vietnam for €1 Billion

(April 29) Company press release

- French retailer Groupe Casino announced that on April 29, 2016, it completed the sale of Big C Vietnam to Thailand’s Central Group for €1 billion (US$1.10 billion).

- Big C Vietnam’s retail network includes 43 stores and 30 malls, and the company generated turnover of €586 million (US$645 million) in 2015. Casino expects to receive €920 million (US$1.01 billion) from the proceeds of the sale. Combined with the sale of Big C Thailand, the sale of the Vietnam network allows for a €4.2 billion (US$4.6 billion) deleveraging of the group.

Topshop Launches Innovation Program Called Top Pitch

(April 27) WWD.com

Topshop Launches Innovation Program Called Top Pitch

(April 27) WWD.com

- British fashion retailer Topshop has launched an innovation program called Top Pitch for emerging technology companies. It is running the program in partnership with tech investment company L Marks and is looking for firms that develop fashionable wearables and smart accessories.

- Startups have until May 22 to apply for the program, after which the short-listed entrants will participate in a four-week mentorship program under the guidance of industry experts. The chosen startups will present their products to Topshop owner Sir Philip Green, and the winning company will have its innovation produced for Topshop.

Tado Raises €23 Million to Grow Smart Thermostat and AC Control Business

(April 26) TechCrunch.com

Tado Raises €23 Million to Grow Smart Thermostat and AC Control Business

(April 26) TechCrunch.com

- German smart technology company Tado has raised a further €23 million (US$25.3 million) to support its international expansion and develop its smart thermostat and AC control business. Its total funding to date is US$56.29 million, comprising four rounds and seven investors, according to TechCrunch’s database.

- Users can control Tado’s smart thermostat from an app on their smartphone, and the device uses the geolocation feature on the app to know when to switch on and off. CEO and Co-founder Christian Deilmann says that this feature differentiates Tado’s products from competitors.

ASIA TECH HEADLINES

Grab Follows Go-Jek into Food Delivery

(May 3) TechinAsia

Grab Follows Go-Jek into Food Delivery

(May 3) TechinAsia

- Grab, a Malaysian on-demand transportation company, is diversifying its services with the introduction of GrabFood in Indonesia. Currently, operating hours are from 11 am to 2 pm only, and the service is offerred only in Jakarta’s central business district.

- Users will be charged a delivery fee of US$1.52, although the service is currently running a promotion, charging only US$0.76. Competitor Go-Jek charges US$1.14 for delivery from non-partner restaurants, and US$0.38 for delivery from partner restauarants.

Baidu’s Health Problem Goes Way Deeper than a Dead College Student

(May 3) TechinAsia

Baidu’s Health Problem Goes Way Deeper than a Dead College Student

(May 3) TechinAsia

- A 21-year-old cancer patient died last month after a treatment he got at a hospital he found on Baidu failed to work. In a post written before his death, the student said he was misled about the efficacy of the treatment and that Baidu was partly to blame, as he had found the information via a Baidu search.

- Concerns about medical advertisements on Baidu leading people to less-than-ideal treatments have bubbled up from time to time for at least the last decade. As early as 2008, the company was criticized on state television for allowing paid search results for treatments that might not be beneficial to patients.

Australian Entrepreneur Craig Wright Claims He Invented Bitcoin

(May 2) ZDNet

Australian Entrepreneur Craig Wright Claims He Invented Bitcoin

(May 2) ZDNet

- Australian entrepreneur Craig Wright claimed to the BBC, The Economist and GQ that he created the bitcoin cryptocurrency. Core members of the bitcoin development team and community are said to have confirmed his identity.

- The founder of bitcoin has been attached to the pseudonym Satoshi Nakamoto, but no one had previously claimed the identity. Wright explained on his website that he believes his move will help remove the fear surrounding bitcoin and the blockchain, and help unlock the remarkable potential of both.

China Isn’t that Interested in Autonomous Vehicles

(May 2) ZDNet

China Isn’t that Interested in Autonomous Vehicles

(May 2) ZDNet

- According to a recent survey from J.D. Power and Tencent Auto, only 9% of 5,000 Chinese consumers polled said they feel very positive about the prospect of unmanned mobility. By contrast, nearly twice as many US consumers reported positive responses to autonomous vehicles.

- Geoff Broderick, GM of Asia-Pacific Automotive Operations for J.D. Power, explained that driving in China is still a novelty, and that it serves as a kind of socioeconomic status symbol, much like it did in the US in the 1950s.

Xiaomi Confirms It Has Plans for VR and Drones, but No Cars

(April 29) TechinAsia

Xiaomi Confirms It Has Plans for VR and Drones, but No Cars

(April 29) TechinAsia

- According to Xiaomi Co-founder and VP Liu De, the long-rumored Xiaomi smart car is not happening, but the company does have plans to release virtual reality and augmented reality products and drones.

- Liu confirmed that the company is working on an aerial drone, but said it is not yet ready, unlike “Xiaomi VR,” which will probably be launched by the end of 2016.

LATAM RETAIL HEADLINES

China COSCO Wins Draw for First Transit Through Expanded Panama Canal

(May 2) WWD.com

China COSCO Wins Draw for First Transit Through Expanded Panama Canal

(May 2) WWD.com

- China COSCO will send the first ship through the expanded Panama Canal during the inauguration event on June 26. The vessel Andronikos will be making the trip; it has a capacity of 9,400 20-foot-equivalent units, and is 27.06 feet in beam and 984.19 feet in length.

- An additional 100 Neopanamax ships, the largest vessels that will travel through the newly expanded canal, have made reservations to pass through the new locks.

Soda Sales in Mexico Rise Despite Tax

(May 3) WSJ.com

Soda Sales in Mexico Rise Despite Tax

(May 3) WSJ.com

- Soda sales continue to climb in Mexico, despite the tax of roughly 10% that was placed on sodas two years ago in an attempt to cap rates of obesity and diabetes. Mexico has the highest per-capita soda consumption in the world.

- Coca-Cola Femsa, the country’s largest Coke bottler, said Mexican soda volumes rose by 5.5% in the first quarter from a year earlier. The tax of one peso per liter has raised more than $2 billion in government revenue since January 2014.

Mexican Regulators Put Conditions on Delta-Aeromexico Transaction

(May 2) WSJ.com

Mexican Regulators Put Conditions on Delta-Aeromexico Transaction

(May 2) WSJ.com

- Mexican antitrust regulators said they have approved an enhanced partnership between Delta Airlines and Aeromexico under the condition that the two give up certain takeoff and landing slots at Mexico City’s international airport and that they eliminate duplicate cross-border routes.

- The joint venture comes after the recent ratification of a more liberal air treaty between the US and Mexico.

Facebook’s WhatsApp Blocked Again in Brazil over Data Dispute

(May 2) Bloomberg

Facebook’s WhatsApp Blocked Again in Brazil over Data Dispute

(May 2) Bloomberg

- Facebook’s WhatsApp messaging app was blocked in Brazil for the second time in less than six months due to failure to comply with an order to turn over data meant for use in a criminal investigation. Judge Marcel Montalvao ordered companies to block WhatsApp for 72 hours.

- The end result cost WhatsApp US$143,000 per day in one of its largest markets in the world.

Under Armour Set to Open 50 New Stores in Latin America Through 2020

(April 29) América Retail

Under Armour Set to Open 50 New Stores in Latin America Through 2020

(April 29) América Retail

- Under Armour announced its intention to open 50 new stores across Latin America by 2020. The company already operates 12 stores in the region. The most recent store opening in the region was in Bolivia, and an additional three stores are set to open in the country.

- The company also currently operates in Chile, Peru, Brazil, Colombia and Uruguay, and it has distributors in Argentina.

We attended a breakfast presentation hosted by the Retail Marketing Society featuring Allen Questrom, former Chairman and CEO of a number of US retailers, including Neiman Marcus, Federated Department Stores (Macy’s) and JCPenney. Here are some of our key takeaways from the hour-plus we spent with this industry titan:

We attended a breakfast presentation hosted by the Retail Marketing Society featuring Allen Questrom, former Chairman and CEO of a number of US retailers, including Neiman Marcus, Federated Department Stores (Macy’s) and JCPenney. Here are some of our key takeaways from the hour-plus we spent with this industry titan:

Uber Offers to Get Merchants to Pay for Your Ride

(May 3) TechCrunch

Uber Offers to Get Merchants to Pay for Your Ride

(May 3) TechCrunch

Australian Entrepreneur Craig Wright Claims He Invented Bitcoin

(May 2) ZDNet

Australian Entrepreneur Craig Wright Claims He Invented Bitcoin

(May 2) ZDNet

Under Armour Set to Open 50 New Stores in Latin America Through 2020

(April 29) América Retail

Under Armour Set to Open 50 New Stores in Latin America Through 2020

(April 29) América Retail