FROM THE DESK OF DEBORAH WEINSWIG

This week, we published a major, 50-page report titled

The Silver Wave: Understanding the Aging Consumer, which looks at the substantial demographic changes that countries, sectors and companies will face in the years ahead. In the report, we note that the group that includes those aged 65 and over will grow from 8% of the world’s population in 2015 to 10% in 2025 to 13% in 2035. In North America, the proportions will be higher still: silvers will grow from 15% of the population in 2015 to 19% in 2025 to 22% in 2035. Globally, the 65-and-older group will account for over one-third of total population growth through 2035, with the oldest subgroup—made up of those 85 and older—growing the fastest.

One of the main themes of our report is how the senior population will likely reshape the retail landscape in the coming years.

Silvers Reshaping Retail

We see seniors’ need for assistance and their demand for convenience driving two structural changes in the retail sector: they will do more shopping closer to home, typically at smaller stores, and they will increasingly take advantage of e-commerce home delivery.

Convenience stores and local grocery stores cater well to the smaller-basket shopping of older consumers. Silvers have smaller households and smaller appetites generally, which means they typically have less need to travel farther to stock up at large grocery superstores. Also, shoppers who are less physically able or have difficulty with mobility find the relative accessibility of local stores and the navigability of smaller stores appealing. It is no coincidence that Japan, which is well ahead of most countries in terms of the aging of its population, has a major convenience store sector. And silvers’ demand for proximity shopping may spread beyond grocery into nonfood categories such as health and beauty.

At the same time, we think seniors will become a more important consumer segment for e-commerce that is based on home delivery. E-commerce can overcome the mobility barriers—difficulty in traveling to a store, walking around it and reaching items on shelves, and bringing items home—that could otherwise prevent some silvers from shopping. In addition, many baby boomers who are retiring now or who will be soon will carry into retirement a familiarity with shopping online. For online grocery retailers, the challenge will be to square silvers’ smaller grocery basket sizes with the higher cost base of home delivery.

Big Stores Face a “Demographic Squeeze”

The story of silvers is not a relentlessly optimistic one for retailers: the aging society poses threats to established firms. In particular, silvers’ demand for smaller, more-local stores means they may turn away from large-store retailers, especially in everyday categories such as grocery.

Superstores filled to the brim with general merchandise are already threatened by the continued rise of e-commerce, which has stolen their USP of broad choice and low prices. Now, they face the prospect of demographic change channeling growth to local outlets.

Meanwhile, other demographics are changing the retail landscape, too. Millennials, for instance, also look to be purchasing more locally and on an as-needed basis, and they are buying more online, which presents additional challenges to big-store formats. Faced with this “demographic squeeze,” superstore retailers may need to consider diversifying their formats in order to tap growth—and they will almost certainly have to work harder to pull shoppers into their stores.

- You can find our recent report, The Silver Wave: Understanding the Aging Consumer, and others at www.fbicgroup.com.

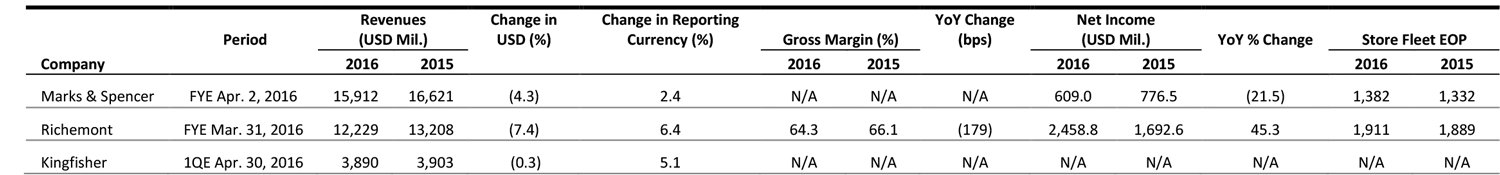

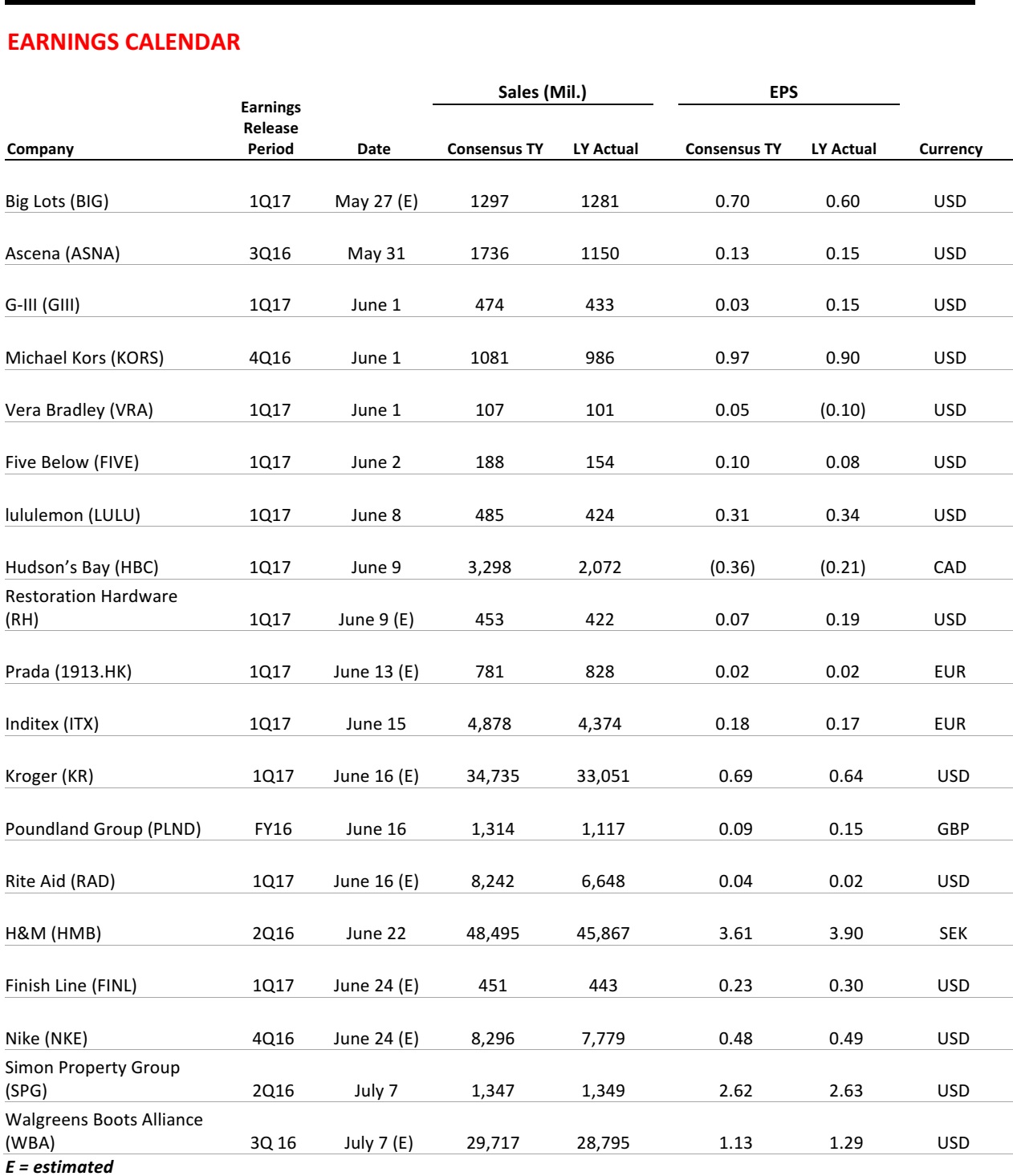

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Online Retailers Should Care More About the Post-Purchase Experience

(May 24) Harvard Business Review

Online Retailers Should Care More About the Post-Purchase Experience

(May 24) Harvard Business Review

- According to an article in the Harvard Business Review, retailers must remember the shopping experience is not over when online customers click the “buy” button. Shoppers expect a seamless experience, and there is an “experience gap” as they wait for their product to arrive. That is a key time for retailers to provide a positive experience and deepen their relationship with customers.

- Although it costs at least five times as much to acquire a new customer as it does to keep an existing one, only 16% of retailers are focused on customer retention. It is important for retailers to create a consistent customer experience and personalize the online shopping experience in order to keep customers coming back.

Fovo Wants Women to Shop Online by Shape, Not Size

(May 23) Glossy

Fovo Wants Women to Shop Online by Shape, Not Size

(May 23) Glossy

- Fovo is a personalized e-commerce marketplace that tailors product pages according to the shape of the shopper’s body. The site uses a personal style algorithm that takes into account the shopper’s information, and then generates a product assortment, styling tips and other content.

- Hoping to join the body positivity movement that is prominent across social media, the Fovo site avoids labels like “plus size.” The site also offers an open forum where customers can share reviews, photos and thoughts on products on the site.

Google Has a Wild Idea for Customizable Smartphones

(May 20) Tech Insider

Google Has a Wild Idea for Customizable Smartphones

(May 20) Tech Insider

- The idea behind Google’s Project Ara is for smartphones to have parts, such as the camera, battery and even the screen, that can be switched out. Reportedly, developer editions will be available at the end of the year and the finished consumer version should be complete by 2017.

- Consumers will be able to not only customize their phones, but also update only certain parts of them (for example, the camera) when a newer version comes out, allowing them to keep the phone itself longer.

Alexander Wang Takes See-Now, Buy-Now Approach to Resort 2017

(May 25) Women’s Wear Daily

Alexander Wang Takes See-Now, Buy-Now Approach to Resort 2017

(May 25) Women’s Wear Daily

- Like others in the fashion industry, designer Alexander Wang is adopting a strategy of shortening the timeline between showing a collection and getting it in stores. Wang has already dabbled with this strategy with his T by Alexander Wang collection, releasing images of the clothes only once they had been delivered to stores.

- Wang will show a selection of his Resort 2017 collection during his spring 2017 runway show in September. The Resort images will be unavailable to the public until the collection reaches stores in November.

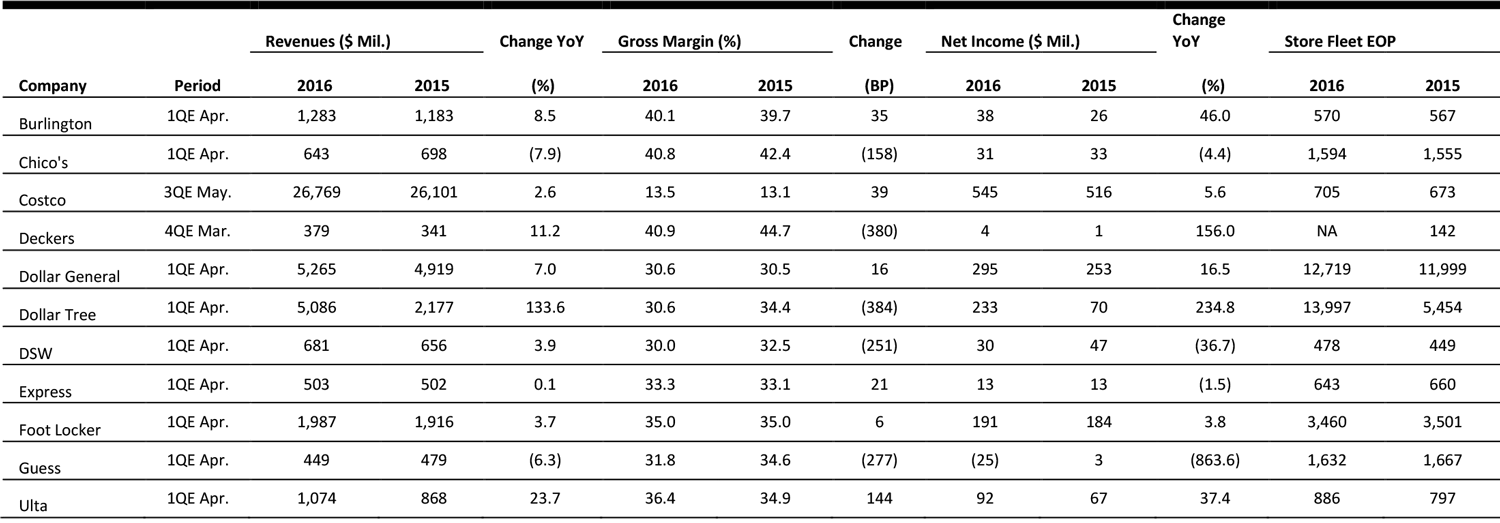

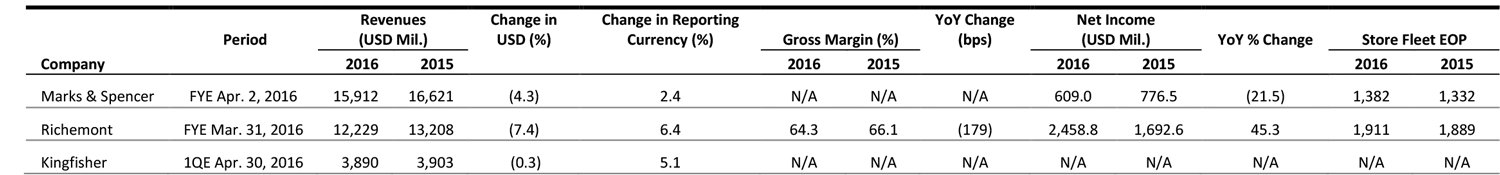

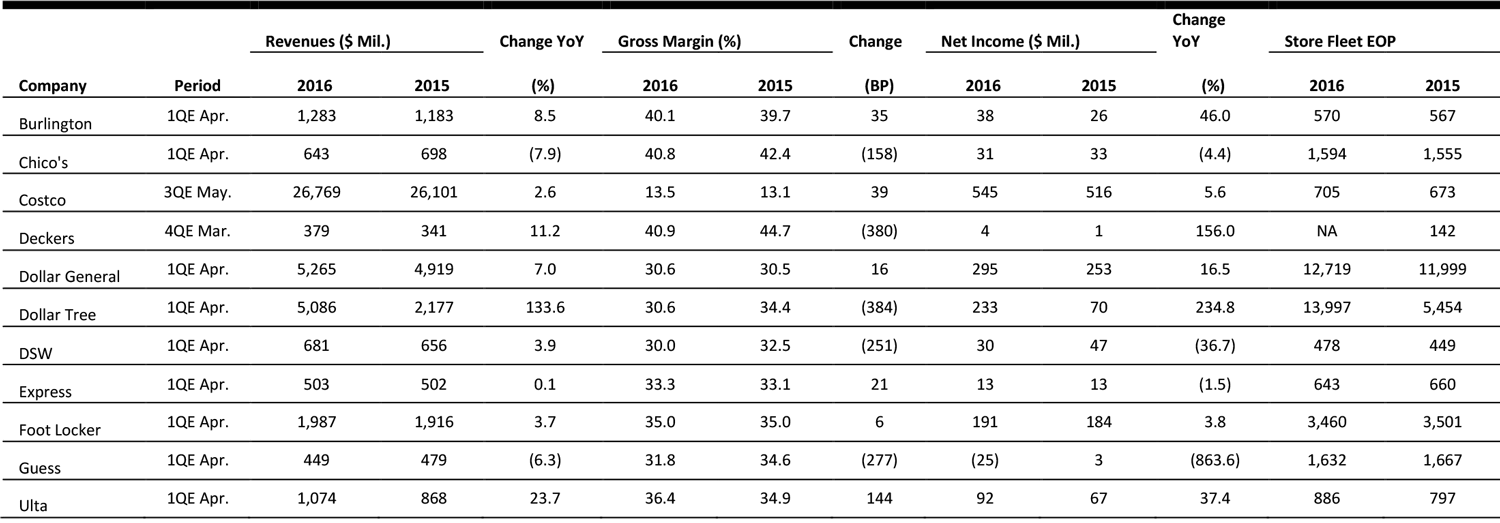

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

El Corte Inglés to Provide Samsung Pay Option

(May 24) Esmmagazine.com

El Corte Inglés to Provide Samsung Pay Option

(May 24) Esmmagazine.com

- Spanish retailer El Corte Inglés has announced that it will provide its 11 million customers with the option to make payments through Samsung Pay. This will make the company the first issuer of customer-payment cards in Spain to offer the option of mobile payments.

- As the El Corte Inglés store card will be integrated into the Samsung Pay app, users will only need to open the mobile app and identify themselves through a fingerprint sensor at the point-of-sale terminal to pay for their purchases.

Kingfisher Delivers Strong 1Q Performance

(May 24) Company press release

Kingfisher Delivers Strong 1Q Performance

(May 24) Company press release

- Kingfisher, the owner of DIY chains B&Q, Castorama and Brico Dépôt, posted a 5.1% sales increase in the first quarter, in reported currency. At constant currency, sales increased by 2.3%, with Screwfix showing the strongest growth in terms of business segments, at 23.5%, and Poland showing the strongest growth in terms of regions, at 12.6%.

- Comps grew by 3.6% at constant currency; the group’s UK and Ireland segment posted a comp increase of 6.2%, while France and the other international regions saw comps grow by 0.2% and 4.7%, respectively. In terms of businesses, Screwfix’s comps grew by 16.2%, B&Q’s by 3.6% and Brico Dépôt’s by 1.5%, while Castorama’s dropped by 0.9%, at constant currency.

Joules Valued at £140 Million Ahead of AIM Float

(May 23) Company press release

Joules Valued at £140 Million Ahead of AIM Float

(May 23) Company press release

- British homeware and clothing brand Joules was valued at £140 million (US$208 million) ahead of its listing on London’s Alternative Investment Market (AIM) on May 26, 2016. The brand, known for its country-inspired fashion, hopes to raise £77.5 million (US$115 million) through the IPO, which is priced at 160 pence (US$2.37) per share.

- Currently, Joules operates 98 shops in the UK. The company intends to use the proceeds of the listing to expand further, with a target of opening 10 to 12 new stores annually.

Richemont Reports Full-Year Sales Growth of 6%

(May 20) Company press release

Richemont Reports Full-Year Sales Growth of 6%

(May 20) Company press release

- Swiss luxury group Richemont reported FY16 sales of €11,076 million (US$12,229 million), up 6%. At constant currency, sales decreased by 1%. Net profit for the year grew by 67%, to €2,227 million (US$2,459 million), primarily due to a post-tax gain of €639 million (US$765 million) from the merger between its Net-A-Porter subsidiary and the Yoox Group.

- Japan saw the strongest sales growth, of 20%, at constant currency. Europe saw sales rise by 10%, and the Middle East and Africa region saw sales grow by 2%. Sales in the Americas and Asia-Pacific regions fell by 1% and 13%, respectively. The company anticipates no “meaningful improvement” in trading in the near term, but will prioritize cash-flow generation and continue investing in its jewelry business.

BNP Paribas and Carrefour Test New Mobile Application

(May 20) Eprretailnews.com

BNP Paribas and Carrefour Test New Mobile Application

(May 20) Eprretailnews.com

- French retail giant Carrefour and BNP Paribas are testing new technology which will combine payment functions with the retailer’s loyalty and couponing services in one application. By using only a PIN, customers can make payments at physical stores and online, irrespective of the bank they use, and still obtain their loyalty benefits from Carrefour.

- The technology will initially be tested in a range of Carrefour store formats in the Greater Paris region, and the retailer will mull a wider rollout based on the results of the test.

ASIA TECH HEADLINES

Hong Kong Startup Gets Series A to Ease Logistics Pains in Emerging Markets

(May 23) TechinAsia

Hong Kong Startup Gets Series A to Ease Logistics Pains in Emerging Markets

(May 23) TechinAsia

- OpenPort, a Hong Kong–based startup that builds logistics software solutions for emerging markets, conducted a study with consulting firm Roland Berger, and found that shipping and logistics costs amount to 26% of GDP in Indonesia, 18% in China, and 14% in Malaysia and India.

- Countries such as Indonesia and China are affected by supply chain inefficiencies that drive prices up. OpenPort seeks to cut down inefficiencies and increase visibility along the supply chain, and it is focusing particular attention on Indonesia.

Yet Another Chinese P2P Lending Firm Under Investigation

(May 23) TechinAsia

Yet Another Chinese P2P Lending Firm Under Investigation

(May 23) TechinAsia

- Chinese P2P lending firm eSuDai has officially confirmed that its offices were raided by local finance authorities last Friday, and that police have been interviewing employees. The company’s website was also down, at least temporarily.

- eSuDai is one of China’s older P2P lending sites, having been founded in 2010, and it claims to have handled a total transaction volume in excess of US$1 billion. It is unclear whether the raid was prompted by fraud on the company’s part or if it was part of the routine for P2P lending firms going forward.

China’s Tencent Seeks to Buy Majority Stake in Clash of Clans Maker Supercell

(May 23) The Wall Street Journal

China’s Tencent Seeks to Buy Majority Stake in Clash of Clans Maker Supercell

(May 23) The Wall Street Journal

- China’s Tencent is in talks with SoftBank to buy the Japanese telecom giant’s majority stake in Supercell Oy, the Finland-based maker of some of the world’s most popular mobile games, according to people briefed on the discussions.

- SoftBank bought a 51% stake in Supercell for US$1.53 billion in 2013, and raised its stake to 73% in 2015, without disclosing how much it paid for the additional stake. A person familiar with both transactions said Supercell was valued at roughly US$5.25 billion last year. SoftBank is also Alibaba’s largest shareholder.

Alibaba Offers a VR Girlfriend or Boyfriend for China’s Online Valentine’s Day

(May 23) TechinAsia

Alibaba Offers a VR Girlfriend or Boyfriend for China’s Online Valentine’s Day

(May 23) TechinAsia

- Users of the Taobao mobile app who have a virtual-reality (VR) headset can scan a code through the app to be transported to an event page where they can opt for a virtual boyfriend or girlfriend experience in a 180-degree VR. In the video, the virtual sweetheart will do things such as tell the user to get up, joke around with the user and cook breakfast for him or her.

- The promotion, which coincided with China’s “online Valentine’s Day” on May 20, was designed to attract consumers to Alibaba’s new VR video player, which links with the Taobao mobile app and allows users to save products, make purchases and follow shops within VR.

Uber’s Food Delivery Service to Launch in Singapore Soon

(May 21) TechinAsia

Uber’s Food Delivery Service to Launch in Singapore Soon

(May 21) TechinAsia

- Uber is about to launch UberEats, its food delivery service, in Singapore. Without revealing a launch date, Uber announced the launch via email to customers and on Twitter. The service was previously available in only 14 cities in the US, Australia, Canada and France; Singapore would be the first Asian city where the service is offered.

- UberEats, which has an app separate from the main Uber app, will be competing against Foodpanda and Deliveroo in Singapore.

LATAM RETAIL HEADLINES

Cuba Legalizes Small and Medium Private Businesses

(May 25) BBC.com

Cuba Legalizes Small and Medium Private Businesses

(May 25) BBC.com

- Cuba’s government announced that it has decided to slowly legalize small and medium-sized private businesses, in a continuation of reforms implemented by President Raúl Castro that are meant to stimulate the country’s stagnant economy.

- The government has yet to specify what this new status for “private businesses of medium, small and micro size” will entail, although the announcement is a positive sign for those who are self-employed and looking to employ other workers.

Tech in Brazil Is Booming Despite the Country’s Political Troubles

(May 25) TechCrunch.com

Tech in Brazil Is Booming Despite the Country’s Political Troubles

(May 25) TechCrunch.com

- Despite Brazil’s plunging GDP, which contracted by 4% in 2015, the country’s tech industry has continued its forward march, growing by 20% from 2014 to 2015. Venture investments in Latin America have also continued to grow, reaching US$594 million in 2015, up from US$387 in 2012, and 63% of these venture capital dollars went to Brazil.

- Even as tech continues to grow in the country, many companies that were flourishing five years ago were not strong enough to make it, as they had banked on the emergence of Brazil’s middle class, which has dwindled rather than grown.

Mexican Economy Picked Up Speed in the First Quarter

(May 20) WSJ.com

Mexican Economy Picked Up Speed in the First Quarter

(May 20) WSJ.com

- Mexican economic growth accelerated in the first quarter, with increases from industrial output, services and agricultural production. GDP grew by 0.8%, adjusted seasonally, from the fourth quarter, or by an annualized rate of 3.3%.

- According to Deputy Finance Minister Fernando Aportela, “The main driver of growth in the Mexican economy is the domestic market, above all investment and consumption.” The Finance Ministry lowered this year’s growth estimate to 2.2%–3.2% from 2.6%–3.6% previously, due to slow global and US growth.

Panama Canal Fever Sweeps the Globe Again as New Era in Trade Nears

(May 24) Bloomberg

Panama Canal Fever Sweeps the Globe Again as New Era in Trade Nears

(May 24) Bloomberg

- The debut of the expanded Panama Canal locks in June will more than double the isthmus’s capacity for carrying cargo and will allow the canal to accommodate much larger tankers. The debut coincides with a surge in US natural gas production, and the canal’s new, deeper channels will be able to accommodate the huge tankers that usually transport liquefied natural gas.

- The growth of the Panama Canal has triggered ports in the US, Caribbean and South America to expand in order to accommodate the greater influx of ships and compete for share of the traffic boom.

This week, we published a major, 50-page report titled The Silver Wave: Understanding the Aging Consumer, which looks at the substantial demographic changes that countries, sectors and companies will face in the years ahead. In the report, we note that the group that includes those aged 65 and over will grow from 8% of the world’s population in 2015 to 10% in 2025 to 13% in 2035. In North America, the proportions will be higher still: silvers will grow from 15% of the population in 2015 to 19% in 2025 to 22% in 2035. Globally, the 65-and-older group will account for over one-third of total population growth through 2035, with the oldest subgroup—made up of those 85 and older—growing the fastest.

One of the main themes of our report is how the senior population will likely reshape the retail landscape in the coming years.

This week, we published a major, 50-page report titled The Silver Wave: Understanding the Aging Consumer, which looks at the substantial demographic changes that countries, sectors and companies will face in the years ahead. In the report, we note that the group that includes those aged 65 and over will grow from 8% of the world’s population in 2015 to 10% in 2025 to 13% in 2035. In North America, the proportions will be higher still: silvers will grow from 15% of the population in 2015 to 19% in 2025 to 22% in 2035. Globally, the 65-and-older group will account for over one-third of total population growth through 2035, with the oldest subgroup—made up of those 85 and older—growing the fastest.

One of the main themes of our report is how the senior population will likely reshape the retail landscape in the coming years.

Fovo Wants Women to Shop Online by Shape, Not Size

(May 23) Glossy

Fovo Wants Women to Shop Online by Shape, Not Size

(May 23) Glossy