Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

This week, the Fung Global Retail & Technology team attended the inaugural Shoptalk conference, which took place over three days in Las Vegas. The organizers billed it as “the tech event for ne xtgen commerce” and more than 3,000 people attended, including C-suite executives, entrepreneurs and retail leaders from 20 countries. Each day featured keynote addresses from industry leaders, in addition to fireside chats, networking opportunities and panel discussions in several topical tracks.

Our team attended many of these events and actively participated in a number of them. We also published daily reports on the presentations and exhibitions during all three days of the conference.

Shoptalk kicked off on Monday with a keynote address from Hudson’s Bay Company CEO Jerry Storch, who reminded attendees that the vast majority of retail sales still occur in physical stores and that while the Internet is transformational, it is not transcendent.

A first-day panel discussion with representatives from Foot Locker, Kohl’s and Sephora touched on a number of retail basics, such as the need to focus on the customer, corporate culture and the major influence of mobile on retail transactions.

Also on Monday, in a conference track titled “Physical Retail Goes Digital,” we interviewed Nigel Oddy, CEO of House of Fraser. The British department store chain has stores across the UK and Ireland, and was acquired in 2014 by the Sanpower Group, a Chinese conglomerate. In our conversation, we discussed topics ranging from the benefits of launching an online business later than one’s competitors to Chinese consumers’ enthusiasm for all things British. Oddy also commented that House of Fraser’s relatively late entry into the digital world turned out to work to its advantage, as it enabled the company to operate a mobile business from the very beginning.

This week, the Fung Global Retail & Technology team attended the inaugural Shoptalk conference, which took place over three days in Las Vegas. The organizers billed it as “the tech event for ne xtgen commerce” and more than 3,000 people attended, including C-suite executives, entrepreneurs and retail leaders from 20 countries. Each day featured keynote addresses from industry leaders, in addition to fireside chats, networking opportunities and panel discussions in several topical tracks.

Our team attended many of these events and actively participated in a number of them. We also published daily reports on the presentations and exhibitions during all three days of the conference.

Shoptalk kicked off on Monday with a keynote address from Hudson’s Bay Company CEO Jerry Storch, who reminded attendees that the vast majority of retail sales still occur in physical stores and that while the Internet is transformational, it is not transcendent.

A first-day panel discussion with representatives from Foot Locker, Kohl’s and Sephora touched on a number of retail basics, such as the need to focus on the customer, corporate culture and the major influence of mobile on retail transactions.

Also on Monday, in a conference track titled “Physical Retail Goes Digital,” we interviewed Nigel Oddy, CEO of House of Fraser. The British department store chain has stores across the UK and Ireland, and was acquired in 2014 by the Sanpower Group, a Chinese conglomerate. In our conversation, we discussed topics ranging from the benefits of launching an online business later than one’s competitors to Chinese consumers’ enthusiasm for all things British. Oddy also commented that House of Fraser’s relatively late entry into the digital world turned out to work to its advantage, as it enabled the company to operate a mobile business from the very beginning.

On Tuesday, we heard some interesting remarks from executives at Birchbox and The Honest Company, as well as from a panel of venture-capital executives, which included one of our colleagues from Fung Capital. Birchbox’s representative outlined how the company had changed the way people shop online for beauty and grooming products, and explained why it later decided to change its business model and open physical stores. An executive from The Honest Company explained that, while the company has experienced success online, demand from large retailers prompted it to begin selling in stores as well. The venture capitalists discussed current private company valuations and at which stage of a company’s development they choose to invest. The panelists also discussed whether they are pure investors or also operators, and what resources they are able to provide to emerging companies.

Wednesday was the most dynamic day of the conference, and we gave a brief presentation on the current retail environment before emceeing a startup pitch competition. There were 15 participating startups, which we classified into four categories—new retail model, all channel, experiential retail or customer engagement—and each startup had three minutes to pitch plus three minutes of Q&A with the judges. Each startup was assessed on the retail challenge it is attempting to solve, and the two winners each received a prize of $25,000. Reaction Commerce, an open-source platform that offers e-commerce solutions for businesses, and Shopic, an app for expediting self-checkout, were the big winners.

We enjoyed attending and participating in the first-ever Shoptalk conference and look forward to attending and reporting from future

On Tuesday, we heard some interesting remarks from executives at Birchbox and The Honest Company, as well as from a panel of venture-capital executives, which included one of our colleagues from Fung Capital. Birchbox’s representative outlined how the company had changed the way people shop online for beauty and grooming products, and explained why it later decided to change its business model and open physical stores. An executive from The Honest Company explained that, while the company has experienced success online, demand from large retailers prompted it to begin selling in stores as well. The venture capitalists discussed current private company valuations and at which stage of a company’s development they choose to invest. The panelists also discussed whether they are pure investors or also operators, and what resources they are able to provide to emerging companies.

Wednesday was the most dynamic day of the conference, and we gave a brief presentation on the current retail environment before emceeing a startup pitch competition. There were 15 participating startups, which we classified into four categories—new retail model, all channel, experiential retail or customer engagement—and each startup had three minutes to pitch plus three minutes of Q&A with the judges. Each startup was assessed on the retail challenge it is attempting to solve, and the two winners each received a prize of $25,000. Reaction Commerce, an open-source platform that offers e-commerce solutions for businesses, and Shopic, an app for expediting self-checkout, were the big winners.

We enjoyed attending and participating in the first-ever Shoptalk conference and look forward to attending and reporting from future

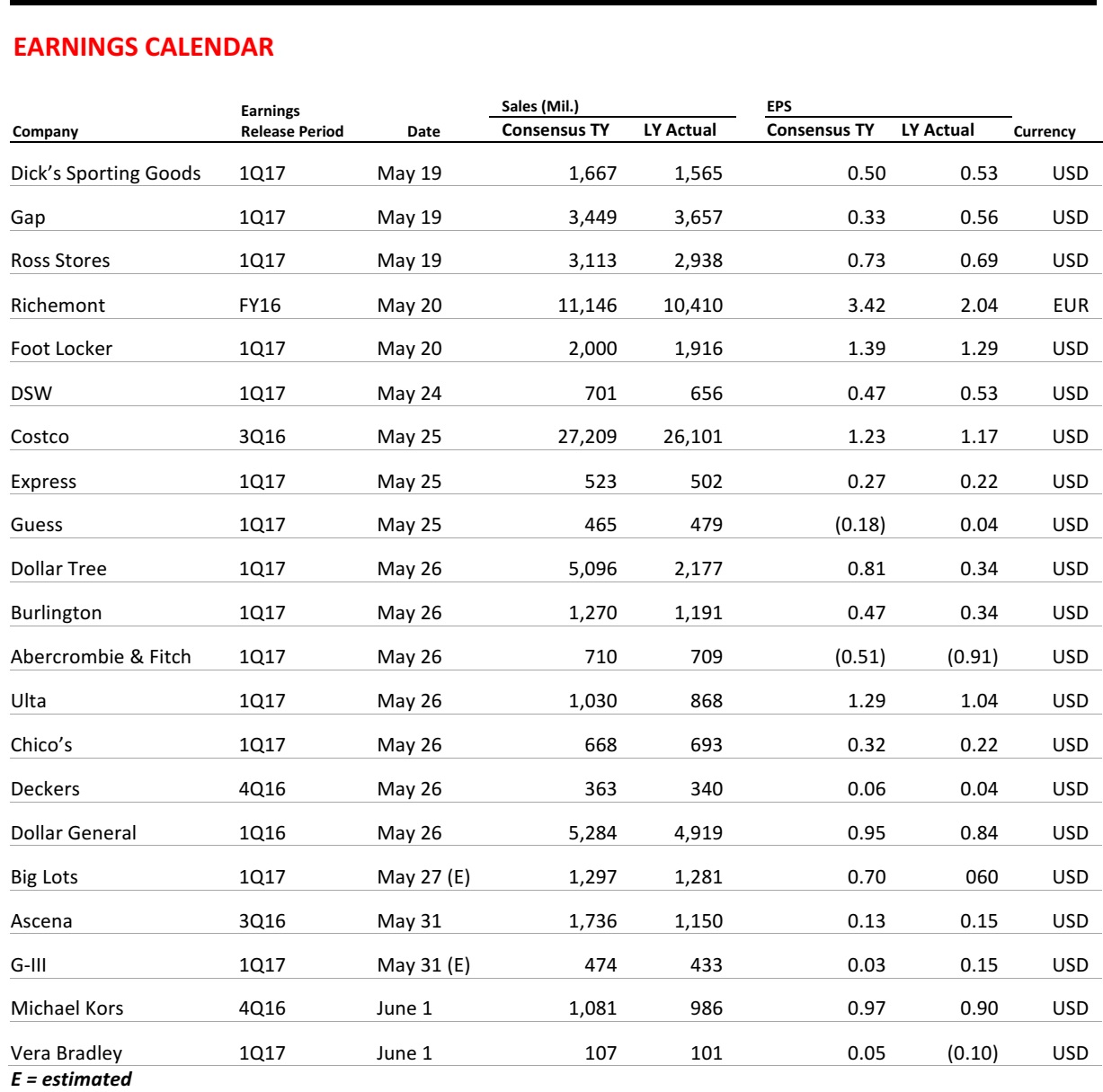

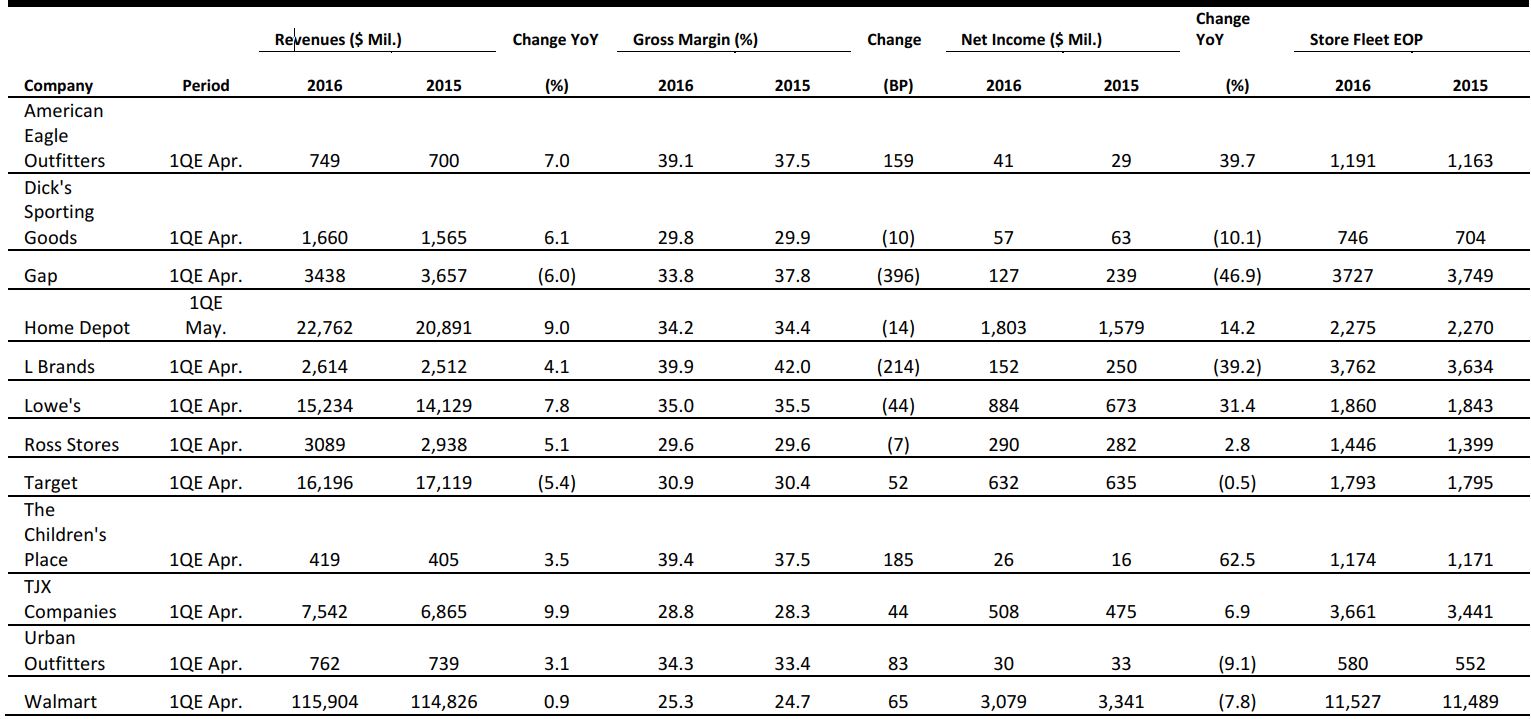

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- To keep up with the growth in mobile shopping, Google will begin to include ads in Google Images. The ads will appear next to related product photos, directing interested browsers to the retailer’s website. Google has been testing the ads with various brands for months.

- Google will also introduce local inventory features. According to the tech giant, searches for a store name, zip code or phrase such as “near me” have doubled in the past year. To capitalize on this growth, Google will increase the number of ways buyers can find out which products are in stock at local stores and also allow retailers to offer shoppers a buy-online, pick-up-in-store option.

- JackThreads is facing a problem that is an epidemic in retail: once you start discounting, it is difficult to go back to full-price. As the startup seeks to move away from flash sales and increase its revenues, it is testing out a try-on-at-home model.

- Shoppers can try on anything from the JackThreads site at home, make a decision to buy or return it within seven days, and pay after they have tried on the item. Delivery and returns are free. The company saw that shoppers who bought JackThreads brand clothing were more likely to order more frequently and spend more than other customers were. The goal of the new model is to get that clothing into the hands of shoppers more quickly.

- Subscription boxes present a variety of challenges, including logistics, inventory, shipping and presentation. Companies that offer them must manage to provide a positive retail experience through the mail and figure out how and where to store entirely new batches of products each month.

- Often, packaging is complex, including sturdy gift boxes, tissue paper and ribbon, all of which complicate the assembly process. And shipping has to be executed in three waves, so customers in one region of the country do not receive their boxes before customers elsewhere, which would spoil the surprise for those who got later deliveries.

- According to a new government survey, almost half of Internet users cite privacy and security concerns as reasons that stop them from taking basic actions online, including posting to social networks and buying things from websites.

- Two out of three respondents cited identity theft as one of their biggest concerns with the Internet, and 20% said they had personally experienced some form of identity theft, an online security breach or another similar problem in the past year. This trend could have a negative impact on banks, online retailers and the overall Internet economy.

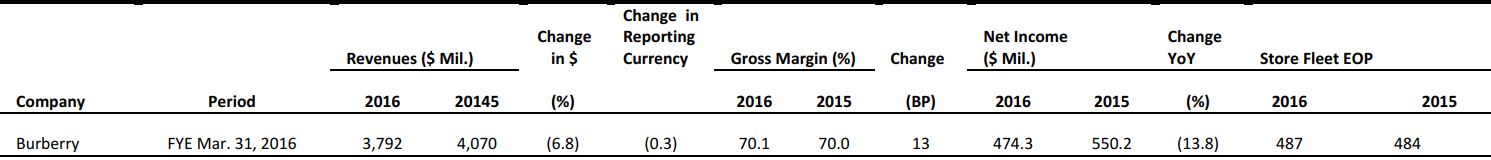

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

- In June, British grocer Tesco will close the stand-alone website of its F&F clothing range, Clothingattesco.com, to integrate it into its general merchandise website, Tesco Direct. The company said that the change will make the shopping experience simpler and easier for customers, as they will be able to buy general merchandise items and clothing from a single website.

- This move follows a slew of efforts undertaken by CEO Dave Lewis in the past year as he attempts to turn around Tesco from the loss it posted in fiscal year 2015. Eliminating the dedicated clothing website is likely to contribute to further cost savings at the retailer.

- French homewares retailer Maisons Du Monde is set to debut on the Euronext Paris stock exchange on May 27. The retailer said that the issue price will be finalized on the eve of the debut, within an indicative price range of €16.60–€22.25 (US$18.30–US$24.50) per share.

- Through the IPO, the retailer hopes to raise about €325–€385 million (US$358–US$424 million) and trade about 40% of its shares. The company hopes to reduce some of its debt through the new shares raised, according to it press statement.

- High-street shopper numbers in the UK declined by 4.6% year over year in April, according to the latest figures from the British Retail Consortium and Springboard. While traffic at shopping centers dropped by 0.7% during the period, it grew by 1.1% at retail parks. Overall, footfall declined by 2.4% compared to the same month last year.

- Springboard Marketing and Insights Director Diane Wehrle noted that “footfall during standard daytime trading hours…dropped by a greater degree than in other parts of the day.”

- Swedish fast-fashion chain H&M reported a year-over-year sales increase of 5% in April, including VAT and at constant currency. The retailer said that the cold spring temperatures, which continued into April in many of H&M’s major markets, affected sales of its transitional garments.

- H&M operated 4,035 stores on April 30, up from 3,610 on the same day in 2015. The retailer will announce its half-year results on June 22.

- Spanish supermarket group DIA posted net sales of €2,021 million (US$2,225 million) in the first quarter, up 8.9% at constant currency. Year-over-year sales in Spain and Portugal grew by 2.2% and 0.7%, respectively. Excluding calendar effects, DIA posted comps of 7.0%, which it said was the highest growth rate it had seen since its listing.

- The retailer’s adjusted EBIT decreased by 2.5% at constant currency, as it was adversely impacted by acquisitions and increased depreciations in Iberia. Net profit in the quarter fell by 3.0% at constant currency, to €38.7 million (US$42.6 million). The company’s CEO stated that “cash generation is a priority” for the group in 2016 and that it will “continue to invest sensibly in remodeling stores.”

ASIA TECH HEADLINES

- Alibaba Pictures, the film and television subsidiary of Alibaba Group, has raised a ¥7 billion (US$260 million) series A round of funding for its online ticketing platform, Taobao Movie. According to a filing with the Hong Kong Stock Exchange, the investment gives Taobao Movie a valuation of ¥13.7 billion (US$2.1 billion).

- Though Taobao Movie claims to cover 95% of the country’s total box office, Chinese market research firm BigData-Research says it is sharing less than half of the online movie ticketing market with Baidu-backed Nuomi, WePiao and Gewala.

- Didi Chuxing, China’s biggest ride-hailing company, is aiming for an IPO in New York next year, according to a report from Bloomberg. In a statement to TechCrunch, the company denied the Bloomberg report two and a half hours after it was published.

- Last Friday, Didi Chuxing announced its biggest-ever single investment, US$1 billion from Apple. The company’s valuation is estimated to be about US$26 billion, with Alibaba, Tencent, SoftBank and others on its investor list.

- Startup Mesitis announced that it has raised US$2.35 million from undisclosed investors, including senior corporate executives and entrepreneurs, for developing Canopy, an online service that aggregates financial data from many formats into an easy-to-view, highly visual form.

- According to company founder Tanmai Sharma, Canopy will convert the 1,000–3,000 pages of “raw data” a typical investor gets a year into “information,” typically in the form of a single chart or drawing, based on the subject the investor looks for.

This Cardboard Gadget Lets Your Phone Produce Holograms

(May 16) TechinAsia

This Cardboard Gadget Lets Your Phone Produce Holograms

(May 16) TechinAsia

- Hong Kong–based startup Project Holo is the maker of the Holo Cardboard, a smartphone-driven cardboard holographic display that one can use to “animate” small objects, such as toys or jewelry, for display purposes.

- The device combines a cardboard box, which forms the backdrop and holds the smartphone, and a transparent three-sided pyramid. The device will work with most smartphones with screens of 4–5.5 inches, and no new app is needed. It is currently in the middle of a crowdfunding campaign.

- Line is looking to expand its e-commerce lineup with a spin-off app called Line Man. The new service relies on green-jacketed scooter drivers to deliver takeaway meals, deliveries from local 7-Elevens and packages. The on-demand services is limited to Bangkok.

- The new Line Man app has partnered with two startups for its launch: Wongnai, Thailand’s top restaurant review app, provides the food listings for over 10,000 restaurants and street food vendors, while Lalamove, a Hong Kong–based startup that is an Uber-like service for motorbike couriers and truck drivers, provides the deliveries.

LATAM RETAIL HEADLINES

- Thousands of fashion retailers are teetering on the edge of bankruptcy and closing thousands of stores as Brazil’s recession deepens and consumers stop spending. The few signs, however minimal, of hope in Brazil include the attention that luxury and fashion brands are paying to the country.

- Rising unemployment and high inflation are likely to keep consumption down; thus, recovery is expected to be gradual, and retailers could remain under pressure until 2018.

- FEMSA, the Mexican convenience store leader, is planning to expand its presence in Chile with the purchase of the Big John chain of convenience stores. The secret deal is expected to close within the coming week.

- Big John is one of the largest convenience store chains in Chile, controlling 49% of the market, while OK Market controls the remainder.

- Lojas Renner has revised its plan for store openings, raising its goal from 408 stores to 450 by the end of 2021. The company currently operates 283 stores.

- The company’s board of directors also approved a plan to open Renner stores in Uruguay, and two stores are set to open in the country in the second half of 2017.

Mexico Is Heading for Recession, Forecaster Claims

(May 18) Financial Times

Mexico Is Heading for Recession, Forecaster Claims

(May 18) Financial Times

- Economic-forecasting agency World Economics predicts that Mexico is going to plunge into recession for the first time since 2009. While the Mexican economy is expected to grow by 2% in 2016, growth is slowing.

- According to a World Economics analyst, the agency has, at minimum, a head start of two to three months with regard to forecast visibility compared to official data, due to its sales managers’ indices, which have reported negative sales growth for the past three to four months.