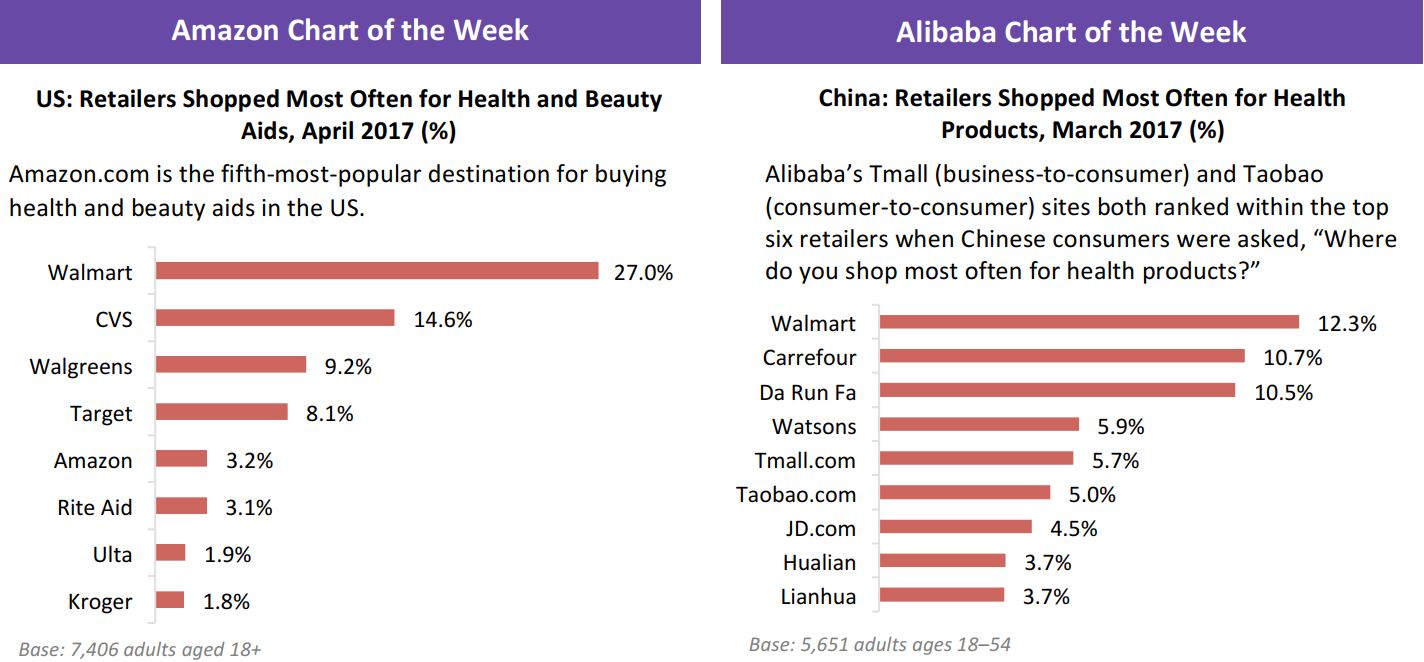

Source: Prosper Insights & Analytics

From the Desk of Deborah Weinswig

Aussies, Get Ready for Amazon!

Australia is next on the list to get the Amazon treatment. The online giant has finally confirmed long-standing rumors that it will launch a full offering in the Australian market, although it has not specified when. In March and April 2017, the company was reportedly scouting for its first distribution center in the country, which could suggest a launch by mid-2018.

Our forthcoming

Deep Dive report looks at Amazon Australia in detail. And in this week’s note, we wrap up some of our conclusions on the likely impact of the company’s entry into the Australian market.

How Big Could Amazon Australia Get?

We estimate that Amazon Australia could generate total merchandise sales of just over A$4 billion in 2021, rising to around A$10 billion in 2026. Our figures include sales by third-party marketplace sellers on Amazon. This would see Amazon enjoying an approximate 20% share of Australian Internet sales by 2026.

Amazon already generated total Australia and New Zealand sales of around A$1.9 billion in 2016 through its overseas sites, including non-Amazon-branded sites such as Book Depository. This gave it an Internet market share of more than 8% in the region, according to Euromonitor International.

What Are the Opportunities for Amazon?

First, we see an opportunity for Amazon to grow an Australian e-commerce market that is immature: last year, only about 7.6% of Australian retail sales were made online, versus 10.5% in the US and 14.7% in the UK, according to our analysis of data from National Australia Bank, the Australian Bureau of Statistics, Euromonitor and the UK Office for National Statistics. Second, we think Amazon can consolidate the highly fragmented Australian online channel: in 2016, the top 10 e-commerce retailers accounted for just 35% of Internet sales in Australia and New Zealand, versus 62% in the US and 66% in the UK, according to our analysis of Euromonitor data.

What Are the Threats to Rivals?

We see the following potential threats to incumbent retailers from Amazon:

- Electronics tends to be among the first categories to migrate online, and we expect Amazon to use this category to build scale in its Australian business in the short term. This poses a threat to incumbent electronics specialist chains as well as to some competing Internet-only retailers.

- Longer term, Amazon is likely to encourage higher rates of online shopping in categories such as apparel, beauty and food. This will increase competitive pressures for undifferentiated specialists, particularly those that focus on the kind of third-party brands that Amazon will likely sell.

- With its unique selling points of choice and convenience, Amazon threatens to steal sales from those multicategory retailers that have built their businesses on similar competitive advantages, including department stores and other general-merchandise retailers.

- Finally, Amazon poses a threat to margins, too. The retailer is expected to price aggressively, which will pressure incumbents to lower their own prices. Additionally, any accelerated migration of sales to the inherently less profitable online channel will dent profits across the retail sector. Plus, there will be added pressure on competing retailers to subsidize shipping for online purchases, given Amazon’s free shipping options and Prime membership offering.

In short, Amazon’s impact on Australia’s retail sector is likely to be substantial, and incumbent retailers will need to be ready to face the challenges with competitive pricing, multichannel convenience and, most importantly, differentiation. Our full report on Amazon’s move into Australia will be published soon on

FungGlobalRetailTech.com.

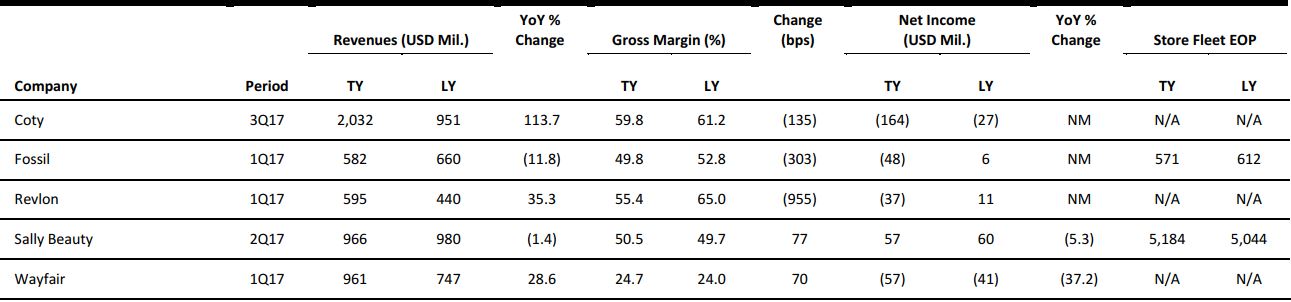

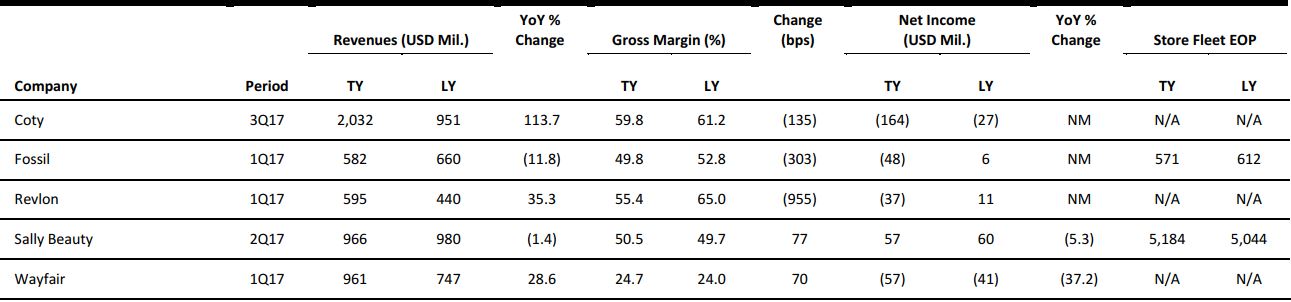

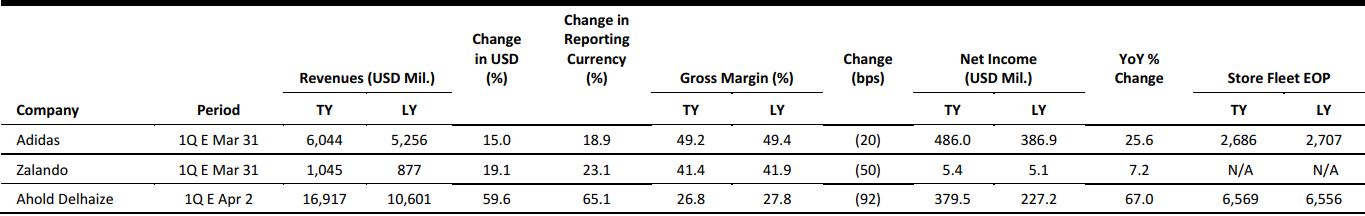

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Amazon Goes North, Forcing Canada’s Retailers Out of Hibernation

(May 10) Bloomberg.com

Amazon Goes North, Forcing Canada’s Retailers Out of Hibernation

(May 10) Bloomberg.com

- Canadian retailers are getting serious about selling stuff over the Internet. You can thank Amazon.com for that. After years in which e-commerce seemed like an afterthought for many Canadian stores, more and more retailers are making the pricey investments in online shopping platforms that are needed to attend to a vast and sparsely populated country.

- As Amazon steadily ramps up its own operations in Canada, local rivals are scrambling to avoid the same fate that doomed many of their counterparts south of the border.

Sears CEO: “We’re Fighting…to Change the Way People Do Business with Us”

(May 10) ChicagoTribune.com

Sears CEO: “We’re Fighting…to Change the Way People Do Business with Us”

(May 10) ChicagoTribune.com

- After the sixth consecutive year of losses and several rounds of store closings, Sears Holdings Chairman and CEO Edward Lampert says he is still committed to reversing the department store chain’s slide by turning Sears into a 21st-century merchant focused on catering to its best customers.

- In an interview Tuesday, Lampert acknowledged the company’s struggles and admitted that the turnaround is taking longer than expected. But he also complained about media coverage speculating on a possible bankruptcy, saying it is undermining the company’s efforts and has made it tougher for Sears and Kmart to work with suppliers.

Abercrombie & Fitch Fields Takeover Interest

(May 10) Reuters.com

Abercrombie & Fitch Fields Takeover Interest

(May 10) Reuters.com

- US teen apparel retailer Abercrombie & Fitch is working with an investment bank to field takeover interest from other retailers, people familiar with the situation said on Tuesday.

- The company has hired investment bank Perella Weinberg Partners to handle the takeover approaches, the two sources said, asking not to be identified because the matter is confidential. There is no certainty that any deal will occur, the sources added.

Amazon Fires Back at Walmart by Slashing Free-Shipping Threshold to $25

(May 9) CNBC.com

Amazon Fires Back at Walmart by Slashing Free-Shipping Threshold to $25

(May 9) CNBC.com

- Adding to the e-commerce battle among retailers to woo customers over with special deals, Amazon is now making it even easier, and $10 cheaper, for shoppers to qualify for free shipping.

- In February, Amazon reduced its minimum order amount required to qualify for free shipping to $35 from $49 for non-Prime members, price tracker BestBlackFriday.com first reported. Amazon’s website now reads that, for eligible items, online orders of $25 or more will qualify for free shipping.

Target’s Next-Day Delivery: Fast Enough to Counter Amazon, Walmart?

(May 9) Investor’s Business Daily

Target’s Next-Day Delivery: Fast Enough to Counter Amazon, Walmart?

(May 9) Investor’s Business Daily

- Target plans to test a next-day home-delivery service that sends “essentials” such as ground coffee and laundry detergent to customers’ doorsteps. But whether that will be enough to catch up with Walmart’s and Amazon’s advancements in the delivery space is uncertain.

- The Target Restock pilot service, which rolls out this summer in the Minneapolis area for REDcard users, will offer delivery for “thousands of household essentials” for an unspecified flat fee. Competition is fiercer than ever, though, as Amazon just reduced its free-shipping minimum to $25

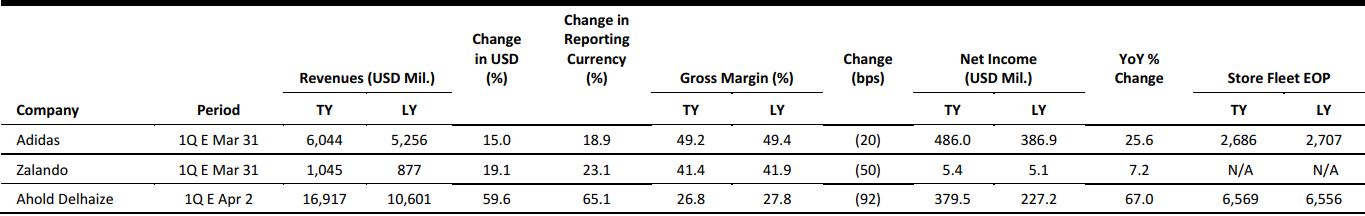

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Britain’s Grocery Market Grows by 3.7%

(May 3) Press release

Britain’s Grocery Market Grows by 3.7%

(May 3) Press release

- The UK grocery market grew by 3.7% in the 12 weeks ended April 23, according to new data from market research firm Kantar Worldpanel. The growth rate was the fastest seen since September 2013 and was supported by an increase in inflation to 2.6%. Strong Easter holiday sales contributed to the market’s growth.

- Tesco grew sales by 1.9%, Sainsbury’s by 1.7%, Asda by 0.8% and Morrisons by 2.2% over the period, while Aldi grew sales by 18.3% and Lidl by 17.8%. “All 10 major retailers are in growth for the first time in three and a half years,” noted Fraser McKevitt, Kantar Worldpanel’s Head of Retail and Consumer Insight.

House of Fraser Buys Defunct Brand Issa

(May 8) DrapersOnline.com

House of Fraser Buys Defunct Brand Issa

(May 8) DrapersOnline.com

- British department store House of Fraser bought the rights to premium British fashion label Issa for an undisclosed sum.

- Maria Hollins, Executive Director for Buying and Design at House of Fraser, said, “The design and buying team have worked extremely hard over the last 10 months to develop a range that was true to the Issa brand, by keeping the luxury element of the clothing yet offering a modern twist.”

Marks & Spencer Announces Appointment of New Chairman

(May 5) Company press release

Marks & Spencer Announces Appointment of New Chairman

(May 5) Company press release

- British retailer Marks & Spencer announced the appointment of former Asda CEO Archie Norman as Non-Executive Chairman, effective September 1, 2017.

- Norman said that he is “looking forward to taking on the role of the Chairmanship of Marks & Spencer as the business under Steve Rowe’s leadership faces into the considerable challenges ahead in a rapidly changing retail landscape.”

Spar International to Open 50 Stores in Ukraine (May 3) Company press release

(May 3) Company press release

- Dutch retail chain Spar International and conglomerate VolWest Group announced plans to open 50 Spar stores in Ukraine over the next three years.

- Serhiy Shavlukhevich, Managing Director of Spar Ukraine, said, “We are delighted to be embarking on this exciting expansion with Spar International. These expansion plans are a key part of our broader strategic plans for future growth and development.”

Second Round of Body Shop Bidders Announced

(May 8) Cityam.com

Second Round of Body Shop Bidders Announced

(May 8) Cityam.com

- British cosmetics retailer The Body Shop, which was put up for sale with a price tag of about £850 million (US$1.1 billion) by owner L’Oréal, has decided which offers will make it into the second round of bidding.

- The parties that have been connected to the sale include private equity firms Investindustrial, CVC Capital Partners, South Korea’s CJ Group and Advent International.

Late Easter Boosts Retail Sales in April

(May 9) Retail-Week.com

Late Easter Boosts Retail Sales in April

(May 9) Retail-Week.com

- UK retail sales increased by 5.6% year over year in April, according to the latest British Retail Consortium-KPMG Retail Sales Monitor report.

- KPMG’s UK Head of Retail, Paul Martin, attributed much of the increase to the later Easter and commented that the April sales uplift was “a brief period of respite for retailers following a relentless start to the year.”

ASIA TECH HEADLINES

Singapore-Based Startup Garena Raises $550 Million Ahead of US IPO

(May 8) FT.com

Singapore-Based Startup Garena Raises $550 Million Ahead of US IPO

(May 8) FT.com

- Garena, Southeast Asia’s most valuable technology startup, has raised $550 million, including investment from the son of Indonesia’s wealthiest tycoon, as the business prepares for a listing in the US.

- The Singapore-based online games and e-commerce business is battling to be the dominant technology platform in the region, in the face of stiff competition from ride-sharing apps such as Grab and Alibaba-backed e-commerce operator Lazada.

Toshiba Escalates Dispute with Western Digital

(May 9) FT.com

Toshiba Escalates Dispute with Western Digital

(May 9) FT.com

- Toshiba has swung to the offensive in its legal dispute with Western Digital, warning the US chipmaker to stop interfering in the estimated $20 billion sale of its memory chip business—a deal critical to the future of the Japanese conglomerate.

- The sale of Toshiba’s highly profitable NAND chipmaking business is at the heart of efforts to shore up the finances of a group that has been hit by massive write-downs on its nuclear business. The prospective sale of one of the Toshiba “crown jewels” has drawn bids from consortiums combining industrial and private equity players from around the world.

China’s Alipay Grabs Slice of US Market with First Data Deal

(May 9) Bloomberg.com

China’s Alipay Grabs Slice of US Market with First Data Deal

(May 9) Bloomberg.com

- Alipay, owned by Jack Ma’s Ant Financial, reached a deal that will let its users shop at 4 million US merchants served by payments processor First Data. The rollout will begin with businesses that use First Data’s Clover products.

- Alipay and Tencent’s WeChat Pay dominate the mobile-payments market in China, with a combined 90% share. Alipay now wants to leverage the millions of Chinese customers who travel abroad by offering them services wherever they go.

JD.com Posts First Profit as Chinese Online Shopping Surges

(May 8) Bloomberg.com

JD.com Posts First Profit as Chinese Online Shopping Surges

(May 8) Bloomberg.com

- JD.com, China’s largest e-commerce company after Alibaba, has benefited from the rise of online shopping in a country with patchy retail infrastructure. JD, which bought Walmart’s Yihaodian local shopping platform in 2016, reported net income of ¥239 million (US$35 million) for the three months ended March, its first time in the black since listing in 2014.

- JD said a plan to spin off its online payments and finance division in a multibillion-dollar deal may close this quarter. That deal would raise cash to bankroll the warehouses and drone delivery networks JD is building to become one of Asia’s dominant e-commerce players. Yet that race to build logistics networks and attract customers could still weigh on margins in 2017.

LATAM RETAIL AND TECH HEADLINES

Cornershop, a Grocery Delivery App in Chile and Mexico, Raises $21 Million

(May 8) TechCrunch.com

Cornershop, a Grocery Delivery App in Chile and Mexico, Raises $21 Million

(May 8) TechCrunch.com

- Cornershop, a grocery-delivery app that operates in Chile and Mexico, raised $21 million in a financing round led by Accel. Cornershop is starting to expand in that market, and potentially get ahead of competitors such as Instacart, which just raised a massive round at a $3.4 billion valuation.

- Cornershop works with shoppers to track down products in stores and then deliver them in 90 minutes or less. Instacart’s recent growth is another positive indication that we are reaching an inflection point in the shift of consumer dollars online across large international markets.

Starbucks Expands Caribbean Presence with First Store in Jamaica

(May 4) EPRRetailNews.com

Starbucks Expands Caribbean Presence with First Store in Jamaica

(May 4) EPRRetailNews.com

- Starbucks announced that it has entered a geographic licensing agreement with Caribbean Coffee Traders, a consortium led by Margaritaville Caribbean Group, a leading restaurant management and franchise operator in the Caribbean.

- The agreement grants Caribbean Coffee Traders the exclusive rights to own and operate Starbucks stores in Jamaica, which will be Starbucks 17th market in the Latin America and Caribbean region. The first store is slated to open in Montego Bay.

Brazil’s BR Malls Plans $536 Million Offering

(May 5) Reuters.com

Brazil’s BR Malls Plans $536 Million Offering

(May 5) Reuters.com

- Rio de Janeiro-based BR Malls has hired the investment-banking units of Banco Bradesco, Itaú Unibanco, JPMorgan Chase, Banco Santander Brasil and Morgan Stanley to sell R$1.7 billion (US$536 million) worth of new shares in an offering as early as next week.

- The move comes as several mall companies raise cash to buy cash-strapped rivals or undertake new projects amid domestic borrowing costs that are approaching single-digit levels. Commercial real estate firms benefit from lower interest rates, which make their projects and investments more profitable over time.

Xiaomi Debuts New Smartphone Line in Mexico in Push for Overseas Growth

(May 10) South China Morning Post

Xiaomi Debuts New Smartphone Line in Mexico in Push for Overseas Growth

(May 10) South China Morning Post

- As it looks beyond its home market for growth, Chinese smartphone maker Xiaomi is doubling down on Latin America by debuting a new product line in Mexico. The move will enable Xiaomi to bring more of its smartphones to the Latin America region.

- Xiaomi has already launched the budget-priced Redmi 4X and Redmi Note 4X phones in China. The official product-line launch in Mexico, which comes within two weeks of its debut in Russia, marks the firm’s latest push in overseas expansion.

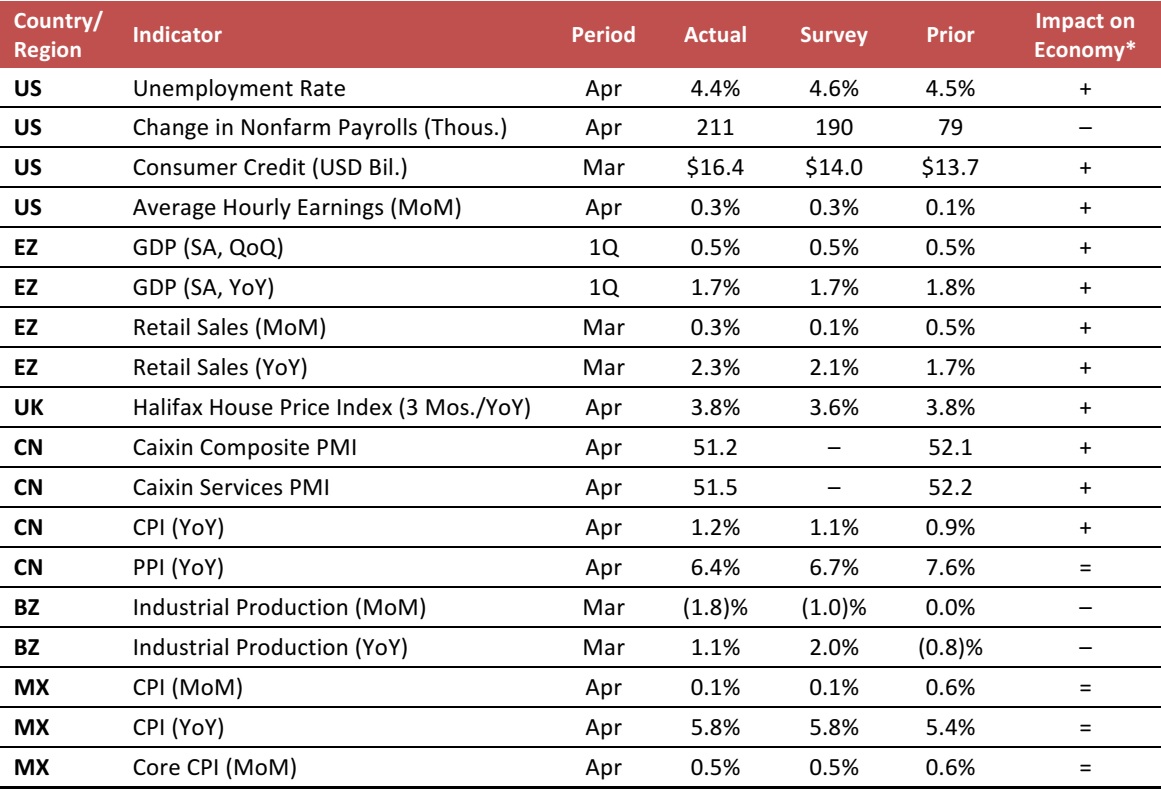

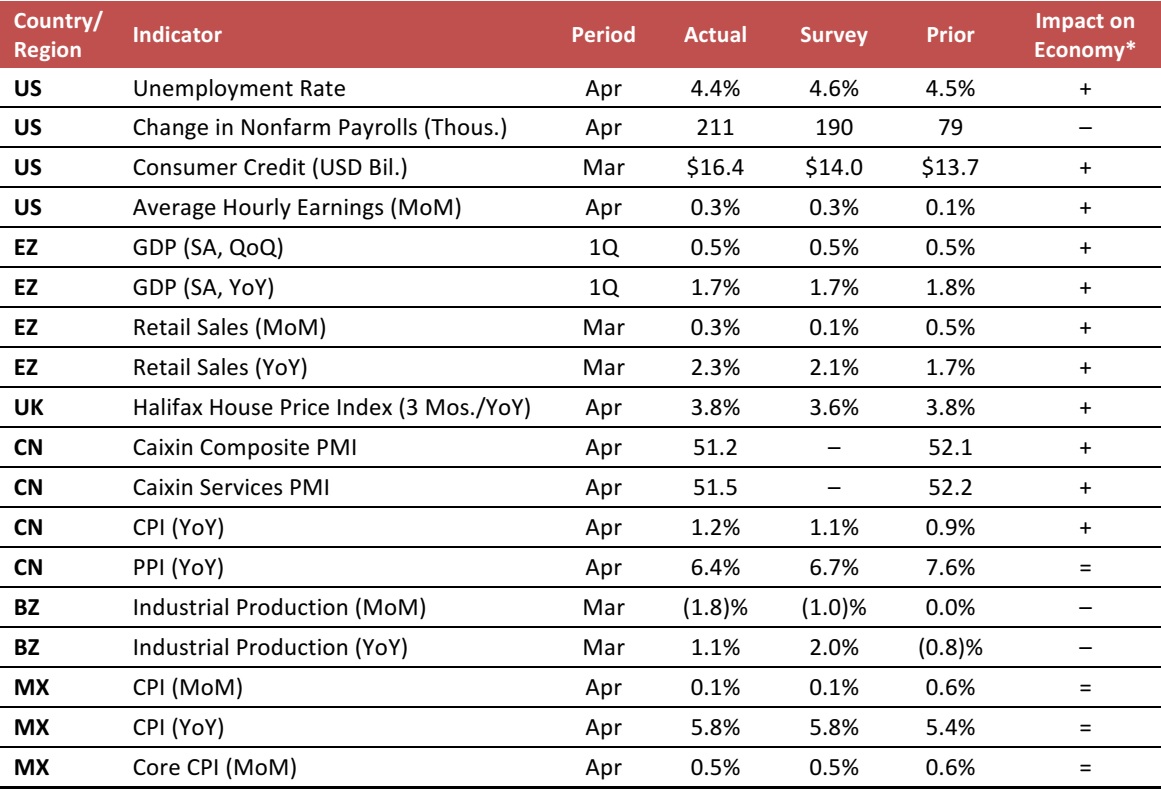

MACRO UPDATE

Key points from global macro indicators released May 3–10, 2017:

- US: In April, the US unemployment rate edged down further, to 4.4%, which was below the consensus estimate. Nonfarm payrolls increased by more than expected. An increase in consumer credit in March signals higher consumer spending.

- Europe: In the first quarter, eurozone GDP growth edged down year over year, but was in line with the consensus estimate. Retail sales in the eurozone were stronger than expected in March. In the UK, home prices continued to moderate higher in April.

- Asia-Pacific: In China, the Caixin Composite and Services Purchasing Managers’ Indexes (PMIs) stayed above the expansion threshold of 50.0 in April. China’s Consumer Price Index (CPI) edged higher in April, while growth in the Producer Price Index (PPI) slowed.

- Latin America: In Brazil, industrial production showed negative growth month over month in March. In Mexico, the CPI was in line with the consensus estimate in April.

* Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Federal Reserve/Markit/Halifax/Eurostat/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística (IBGE)/Instituto Nacional de Estadística y Geografía (INEGI)/Fung Global Retail & Technology