Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

It’s been a glass-half-full kind of week. First-quarter earnings reports and economic releases reflect a consumer who is still on the sidelines. Wednesday’s GDP report revealed that US economic growth had slowed to a 0.2% annual pace in the first quarter, down from 2.2% growth in the fourth quarter of 2014 and 5% in the third quarter of 2014. A year ago, in the first quarter of 2014, economic activity actually contracted by 2.1% on an annualized basis with unusually harsh weather. This year, we had the benefit of an early Easter. In addition to a cautious consumer, bad weather, oil prices, West Coast port disruptions and the strength of the US dollar all contributed to the recent muted economic performance. A look at the Federal Open Market Committee’s (FOMC’s) minutes from its April 28–29 meeting is revealing. The FOMC judged that “economic growth slowed during the winter months, in part reflecting transitory factors.” The pace of job gains moderated, the unemployment rate remained steady and a number of labor market indicators suggested continued underutilization of labor resources. The real slowdown was in the business sector, where fixed investment declined by 3.4%, and—not surprisingly—in exports, which were down 7.2% as the US dollar’s rapid appreciation led to a deterioration in net trade. Meanwhile, growth in household spending slowed to 1.9% from 4.4% in the fourth quarter even as household real incomes rose strongly. Rather than spend their savings from lower gasoline prices, consumers chose to hold on to those dollars, lifting the personal savings rate to 5.5% (up from 4.6% in the fourth quarter). With consumer sentiment still at encouraging levels, we could see consumers open their purse strings in the summer months. We had encouraging news Thursday on the employment front, with jobless claims dropping to a 15-year low and a 2.6% annualized increase in the employment cost index. Private wages jumped 2.8% and nonfarm payrolls were up 2.2%. This is the virtuous cycle we’ve long been waiting for: more people working and wages improving—this is the stuff of dreams for economists and retailers! On the digital front, the Uber-fication of the fashion industry continues to gain traction, as evidenced by Rent the Runway’s addition of sportswear to its rental mix as it goes after more dressing occasions. Rent the Runway will add the category to its subscription business, where, for a fee of $99 a month, members can rent any three pieces of sportswear, dresses, outerwear and accessories. The company has more than 5 million members currently, and expects to rent out the retail equivalent of $1.35 billion in fashion goods in 2015. It’s adding this new service as well as another 15 appointment showroom locations (up from just five today), all of which puts a new spin on just-in-time dressing.

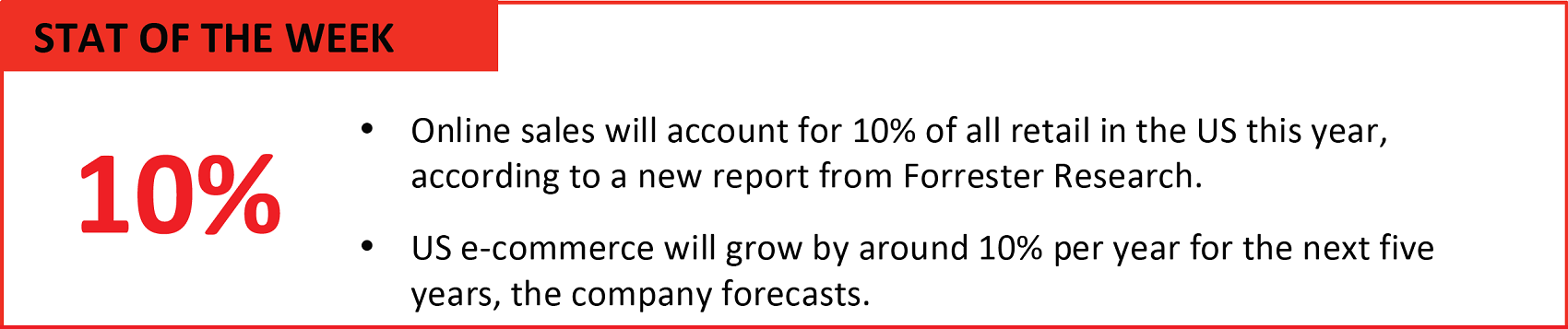

Source: Forrester Research

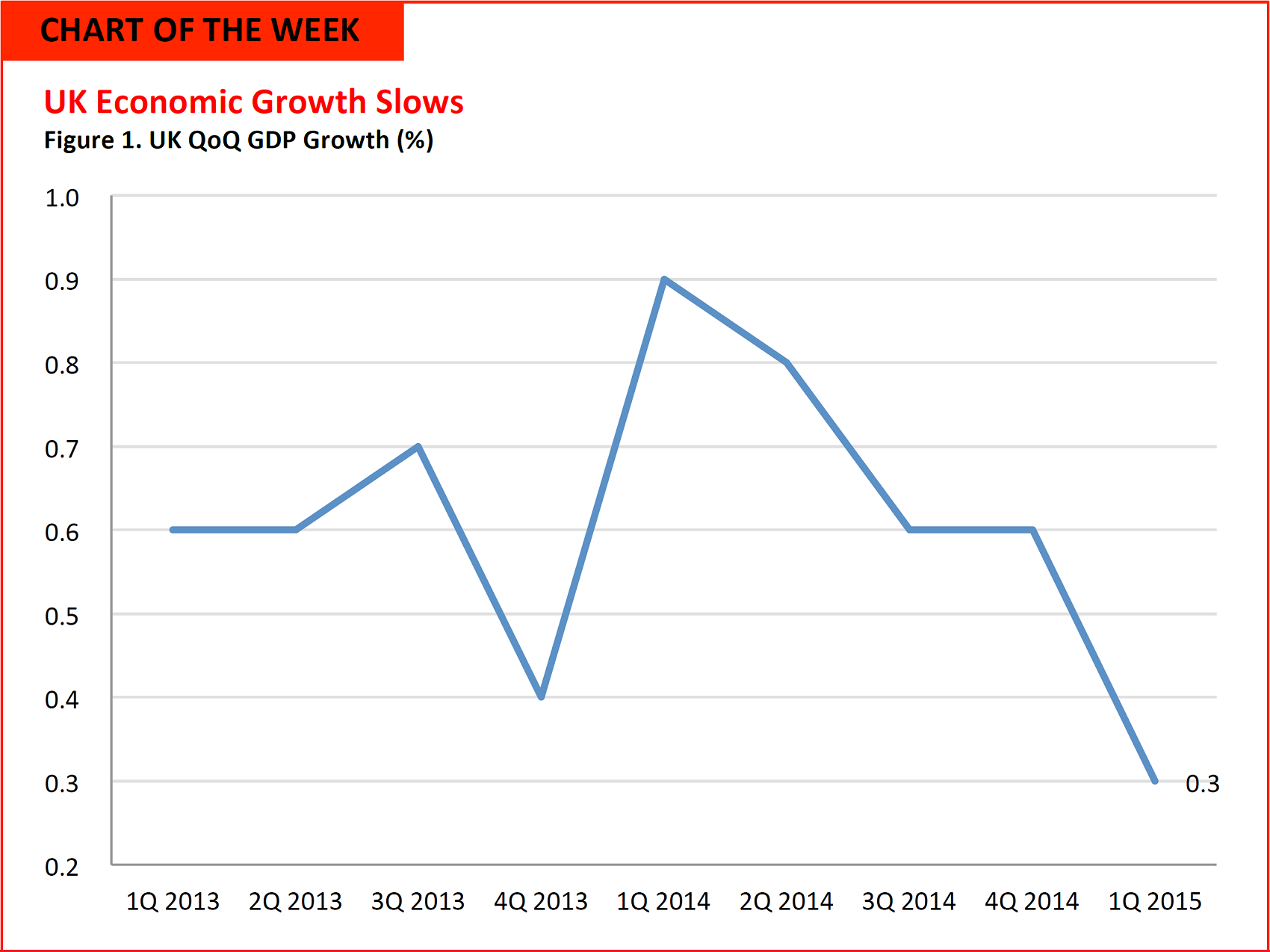

Source: Office for National Statistics

- UK economic growth slowed to just 0.3% in the first quarter of 2015, according to preliminary figures published this week, down from 0.6% growth in the previous two quarters.

- This was the lowest quarter-over-quarter growth since the fourth quarter of 2012. Growth was pulled down by a contraction in construction output.

- The slowing growth is a blow to the incumbent Conservative Party ahead of a general election scheduled for May 6.

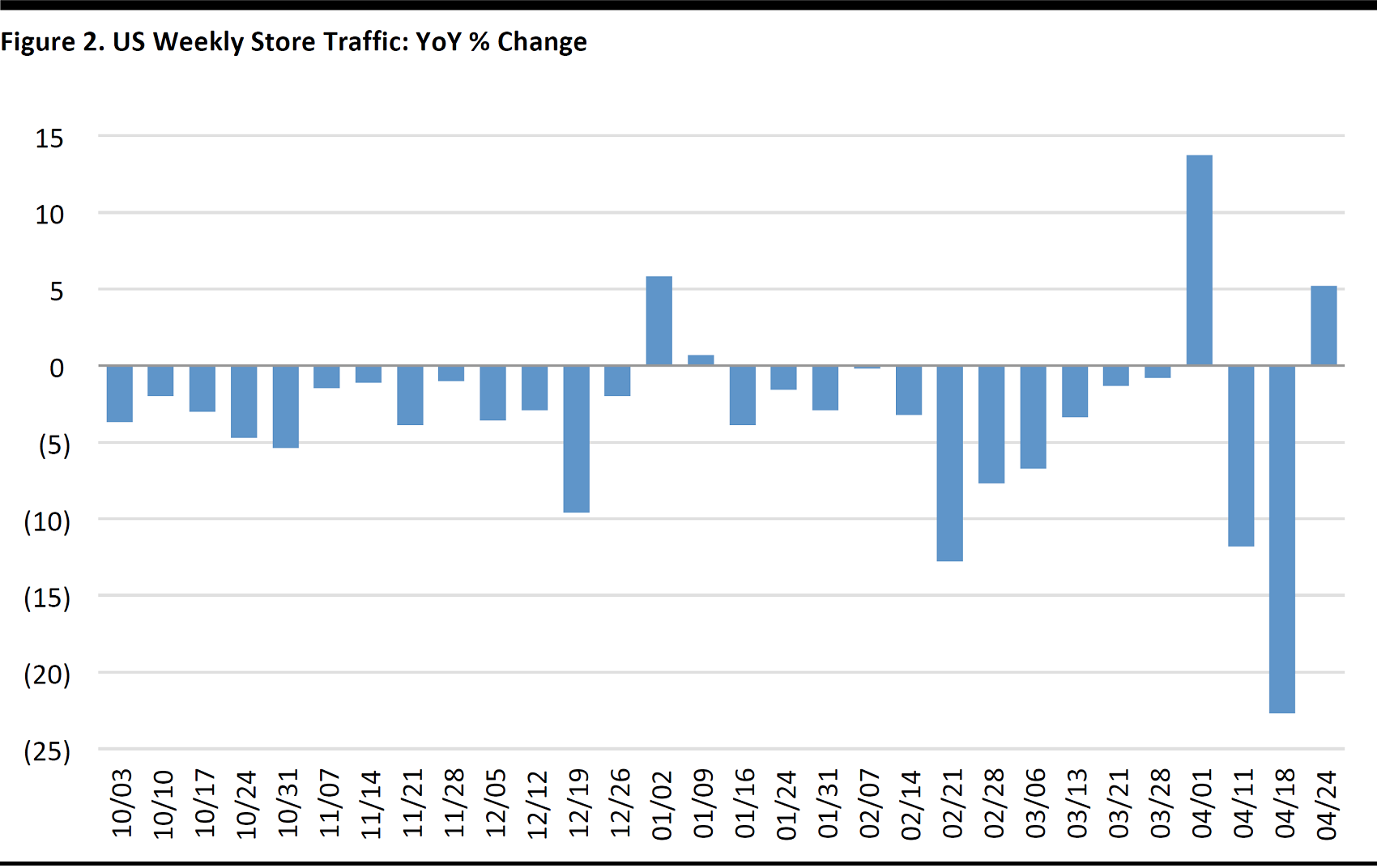

US RETAIL TRAFFIC

US Weekly Traffic Surged by 5.2%

Through April 24,2015 Source: ShopperTrak

- An extra selling day boosted US weekly store traffic by 5.2% year over year. Without the calendar effect, store traffic would have declined by 8.0%.

- Apparel store traffic rose by 2.9%, its sharpest decline in 10 months.

- Electronics store traffic rose by 79basis points, its first increase in 15 weeks.

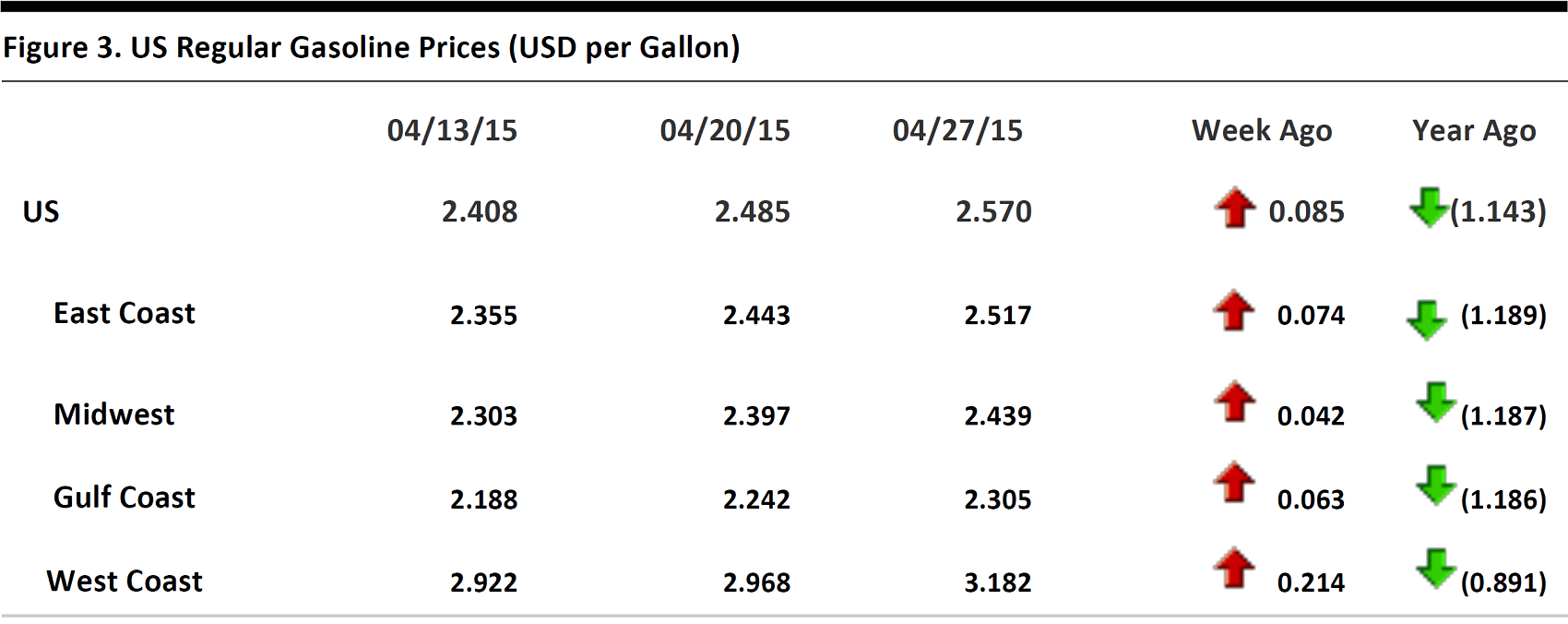

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

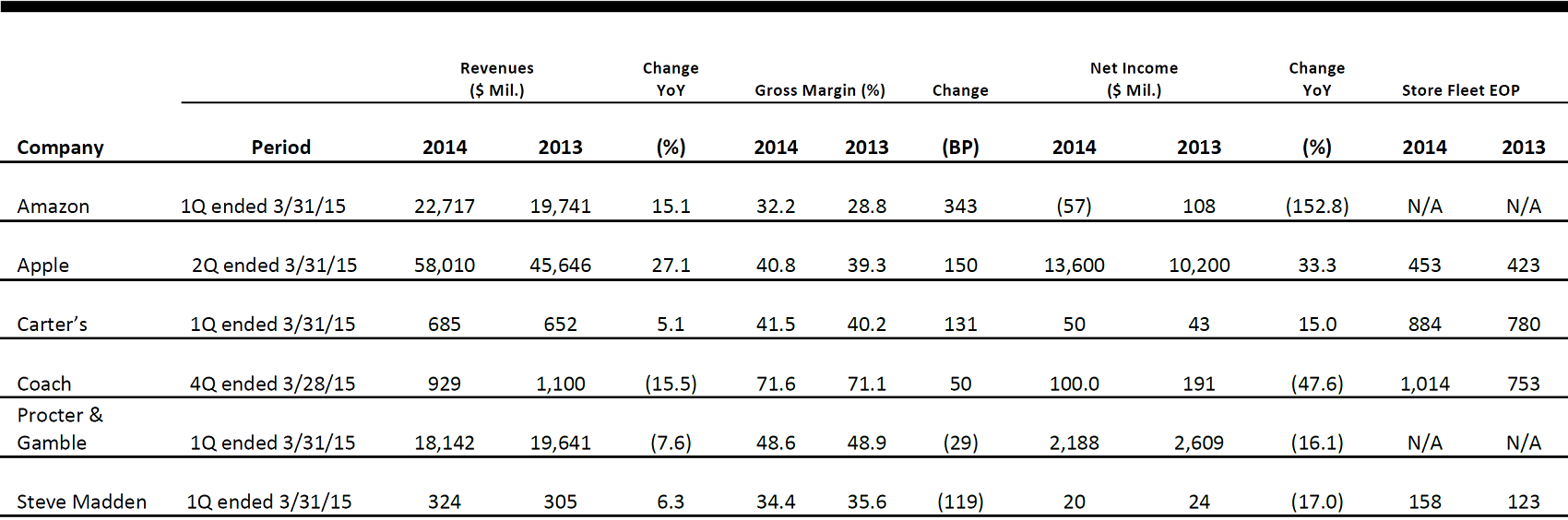

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- Kroger entered a new agreement with a joint venture partner, leading consumer science company dunnhumby. Under the agreement, Kroger will use dunnhumby’s analytics technology to build its customer insights and loyalty programs.

- Kroger will also absorb over 80% of dunnhumby’s 500 current US employees under a Kroger subsidiary called 84.51°.

- The new business began operation on April 27.

- Starting on April 30, Rent the Runway will offer expanded categories from brands such as Derek Lam, Nina Ricci, Carven and Opening Ceremony. The new categories include handbags, sunglasses and sportswear.

- In July, the company will launch a new, unlimited subscription program that allows shoppers to rent three items,excluding dresses, for $75 a month. For $99 a month, renters can add dresses to their subscription.

- Rent the Runway is looking for retail store space in Los Angeles, Houston and Boston. It’s aiming for a total of 15 stores, and currently operates four physical stores in the US.

- Walmart will increase its physical store presence in China by a third by 2017. Walmart CEO Doug McMillon disclosed this plan at a conference in Beijing. The company will also revamp its online business in China through Yihaodian.com and close some underperforming stores.

- The new stores will be opened in Shanghai, Shenzhen and Wuhan between 2015 and 2017.

- PayPal is extending its service to include online shopping carts. PayPal One Touch allows a secured checkout process with a single touch without requiring that the user enter log-in information. This functionality will help reduce the 68% rate of shopping cart abandonment that’s largely due to complicated checkout processes.

- PayPal’s single-touch service is only available on mobile devices; retail sites will have to be “PayPal-enabled.”

ASIA TECH HEADLINES

Apple Announced Strong 2Q Results in Asia, and Record-Breaking Numbers in China

(April 28) TechinAsia

Apple Announced Strong 2Q Results in Asia, and Record-Breaking Numbers in China

(April 28) TechinAsia

- Apple posted strong second-quarter results. Sales numbers were strong across the board, particularly in Asia. iPhone sales more than doubled during the second quarter in South Korea, Singapore, Taiwan and Vietnam.

- Apple CEO Tim Cook touched on the Apple Watch during the earnings call. He said that demand outstrips supply, but did not provide any specific sales numbers.

- According to new research by industry analyst firm Telsyte, the rising popularity of wearable technology in Australia hit domestic tablet sales in 2014, which declined by 20%.

- The decline in tablet sales was mainly due to the rising popularity of wearable devices, the release of the new iPhone6 and market saturation.

- Keru Cloud, a restaurant management software-as-a-service startup, has secured US$10.7 million in series B funding led by Baidu and three other venture capital companies.

- The startup aims to be an all-in-one solution for restaurants and other businesses to go digital.

- Taiwan-based music-streaming firm KKBox has invested in WalkieTicket, a ticket-vending startup. The deal makes KKBox WalkieTicket’s largest institutional shareholder.

- With the investment, KKBox can help drive ticket sales through traffic on its music-streaming app and draw on its user-listening-habit data to recommend upcoming events.

- With the Apple Watch going on sale around the world on April 25, Japan’s watchmakers are trying to stay ahead of demand by revamping their timepieces.

- Seiko says it will focus on its signature mechanical, sporty and solar-powered GPS watches, but it does not rule out the possibility of jumping into the smartwatch fray eventually.

- Sony’s shares were up 3% in early trading after the company raised its earnings guidance for the fiscal year that just ended. Sony now expects an operating profit of ¥68billion for the year ended March 31, which would beat market expectations of about ¥50 billion.

- The better-than-expected earnings were mainly driven by higher-than-expected sales of video games and digital cameras.

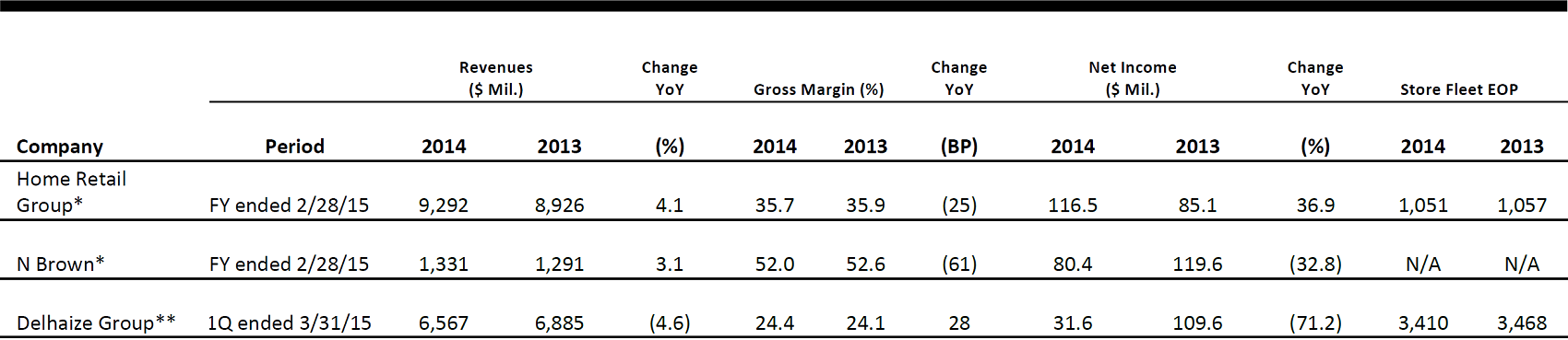

EUROPEAN RETAIL EARNINGS

*Converted from £ **Converted from € Source: Company reports

EUROPEAN RETAIL HEADLINES

- As of September this year, London Fashion Week will have a new home. The high-profile event, historically held at Somerset House, will now take place at the Brewer Street Car Park in the heart of London’s Soho.

- The British Fashion Council said the move will increase London Fashion Week’s footprint across the capital and mark the next stage in the evolution of the event.

- The new owners of BHS have revealed plans to expand its product mix by introducing new brands and product categories. The retailer is reportedly looking at an electrical department as well as an extended food offering.

- In addition, BHS will focus on overseas expansion and improving its online retailing. There are reportedly no more store closures planned.

- The Digital Labs team at Marks& Spencer has further developed its Cook with M&S app for use with the new Apple Watch. Cook gives customers access to seasonal recipes and enables them to create shopping lists with items that can be checked off as they move around the store.

- The objective of the update was to make the app a practical aid while cooking, and the team at Marks & Spencer has achieved this by including time notifications to alert users when ingredients need to be taken off the stove or out of the oven.

- Luxury brand Hermès reported a 19% increase in year-over-year sales for the first three months of the year, to €1.1billion (US$1.2billion). Even after removing currency effects (in this case, the weak Euro), there was still an increase of 8%—only 2% less than the Christmas quarter’s 10% comparable increase.

- This success has been largely attributed to the brand’s understated design, which appeals to Asian consumers, as reflected in the 9.6% currency-neutral sales in Asia. The Americas are proving a successful market, too, reporting the exact same 9.6% increase.

- UK home and general merchandise retailer Home Retail Group posted full-year sales that were up 0.8%, to £5.7 billion (US$9.3 billion), comps that were up 0.6% at general merchandise chain Argos and comps that were up 2.3% at do-it-yourself store Homebase.

- Total sales at Argos were up 1.1%, helped by new store openings, while total sales at Homebase were down 0.7% as the chain undertook a program of store closures. At the group level, lower costs fed into a 32% boost to pretax profit.

- British catalog retailer N Brown reported that full-year sales were down 0.1%, to £818 million (US$1.3 billion); operating profit was down 11.9%; and pretax profit was down 21.2%. N Brown owns catalog brands such as JD Williams, Simply Be and Jacamo.

- The company indicated that it had been a year of transition.It changed seasonal product and marketing “to better reflect consumer spending patterns” and modernized the business in terms of organization, capability, infrastructure and processes, all of which proved to be more disruptive than anticipated, N Brown’s CEO said.

- Belgium-domiciled grocery retailer Delhaize Group posted first-quarter sales that were up 15.8% to €5.8 billion (US$6.6 billion). Underlying operating profit was down 11.2% at constant exchange rates,and pretax profit slumped by 72.5% year over year, impacted by investments in price, promotions and marketing.

- Comps were up 2.5% in the US, down 2.8% in Belgium and down 0.8% in southeastern Europe.

- UK clothing specialist NEXT reported total sales growth of 4.1% for the first quarter. Retail sales were up 0.5%, and Directory sales (both online and through the catalog) were up 9.2%.

- Full-price sales climbed 3.2% in the quarter, with performance flattered by the early launch of a “New In” summer brochure, which coincided with warm spring weather.

LATAM RETAIL HEADLINES

- Wholesale, consumer and construction prices rose 1.17% month over month in April, according to the Getulio Vargas Foundation.

- Prices rose faster than the 1.11% increase forecasted by 28 economists who were surveyed by Bloomberg.

- This represents the fastest rate in 13 months, and comes ahead of an expected increase in interest rates by the central bank.

- UK- and Singapore-based fashion technology company Metail announced that it has signed a contract with Dafiti, the largest e-commerce business in Brazil.

- In a trial last year, Dafiti experienced a 30% increase in sales that involved Metail technology.

- Customers also spent 3.5 times longer on Dafiti’s website.

- Colombia’s central bank governor, Jose Dario Uribe, said he expects Colombia’s GDP growth to slow to 3%–3.6% this year due to the drop in the price of oil.

- The official growth forecast was 3.6%.

- The annual inflation rate accelerated to 4.56% in March, the second-highest rate in South America, after Brazil’s.

- In Costa Rica, Walmart launched a shopping cart that calculates physical activity.

- The sensors on the cart calculate steps taken, distance traveled and calories consumed.

- The project was intended to combat obesity and was conducted with a team of nutritionists for broadcast on Costa Rican TV.

- In Costa Rica, Walmart launched a shopping cart that calculates physical activity.

- The sensors on the cart calculate steps taken, distance traveled and calories consumed.

- The project was intended to combat obesity and was conducted with a team of nutritionists for broadcast on Costa Rican TV.

- Mexican retail sales grew by 5.6% year over year in February, which was ahead of estimates.

- Sales also increased by 0.5% month over month.

- The areas of highest growth were appliances, computers and interior decoration.