Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

Signs of Uber’s influence are everywhere these days, but particularly in the world of logistics. Take, for instance, the case of Cargomatic, a Web-based startup whose “Uber-style” on-demand service has emerged as a creative solution to the massive congestion problems still plaguing the US West Coast ports. Cargomatic connects qualified drivers with extra space on their trucks with local businesses that are signed up with the program. Using a smartphone-based app, the truck driver accepts the order, shows up to the terminal (no appointment necessary) and is given the first container off the top of the Cargomatic pile. The driver then logs the pickup in the Cargomatic app, which provides instructions on where to bring the container. A Wall Street Journal article noted that Cargomatic’s involvement, though limited, proved to be “a rare instance where the port’s productivity increased amid the labor strife.” The average turnaround time for Cargomatic truck drivers was 35 minutes, roughly half the time it usually takes for standard systems. As they struggle to eliminate the cargo backlog, will shippers, terminal companies and trucking companies embrace the efficiency improvements of the Uber-style model? Integrating the order-fulfillment process into one set of inventory and assets has become something of a holy grail for retailers. Amazon certainly appears to be the most fixated on replicating an Uber-like experience for its customers, with its recent launched of Prime Now one-hour service in Manhattan. Asia is far ahead of the US when it comes to in-a-pinch logistics and delivery. Uber recently launched UberCargo in Hong Kong, but the busy city-state already has two thriving “Uber for logistics” startups—Lalamove (also known as EasyVan) and rival GoGoVan, which provide peer-to-peer apps that connect van drivers with consumers or businesses who need their stuff shipped quickly, bypassing the inefficient call centers used by traditional van-rental-service companies. Both startups have big expansion plans for the rest of Asia. As smartphone app-enabled consumers become ever-more accustomed to Uber-like experiences, we expect retailers of all stripes to increasingly look to the Uber model for ways to deliver instant gratification to customers. Its influence should continue to grow over the coming year.

US MACROECONOMIC UPDATE

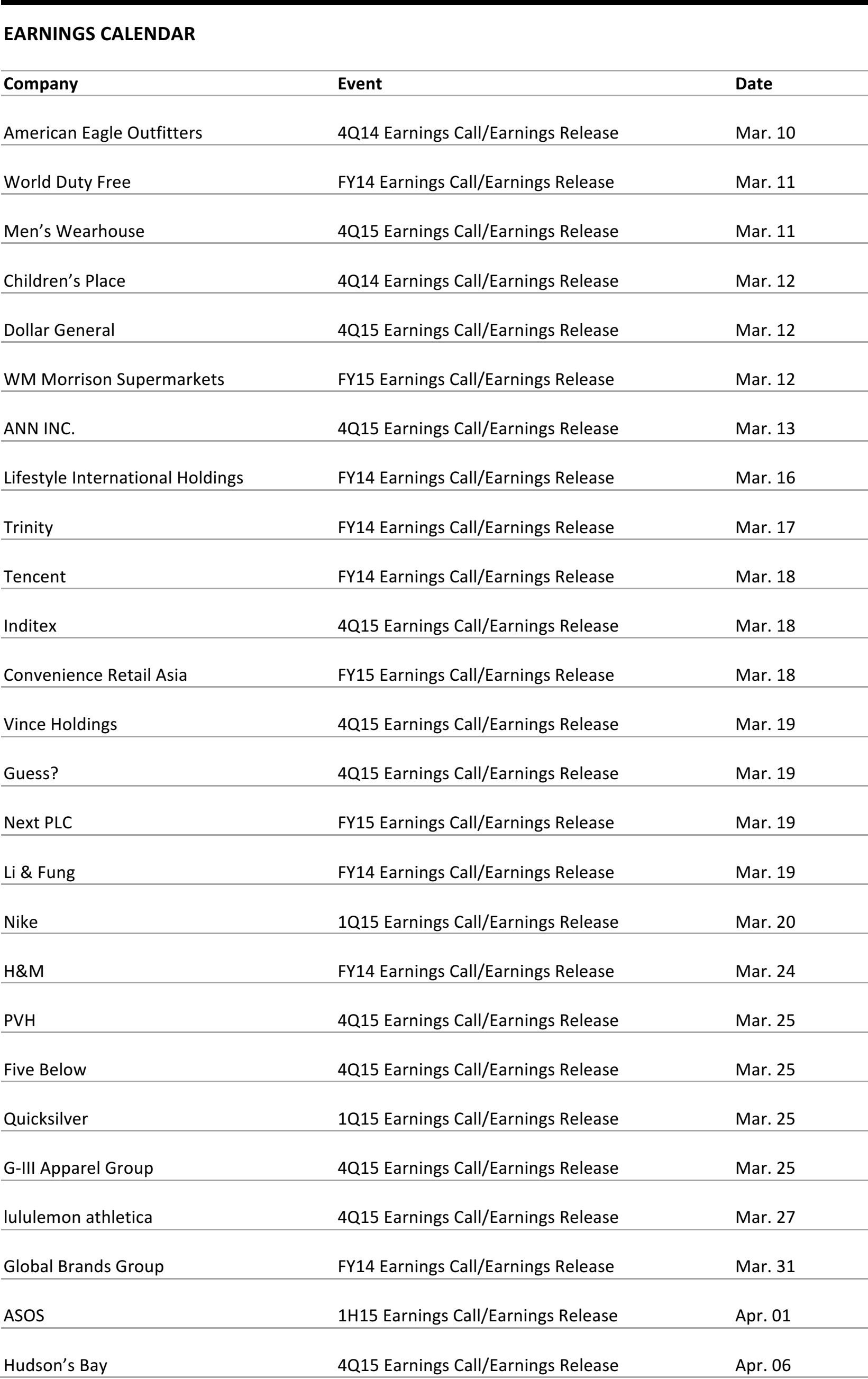

January Personal Consumption Expenditure (PCE) Growth Consistent with December 2014 Rate

Through January 31, 2015 Seasonally adjusted Source: Bureau of Economic Analysis

- US PCE grew at a 3.6% YoY rate in January, consistent with December 2014’s growth rate.

- Durables set the pace, accelerating from December’s 5.9% rate to a 6.8% YoY rate in January driven by a 9.6% gain in auto sales.

- Women’s and girls’ clothing outpaced the 3.8% growth rate for the clothing and footwear category, 4.5% YoY in January.

- Nondurables was an underperforming sector in January, posting a 0.8% YoY decrease in spending.

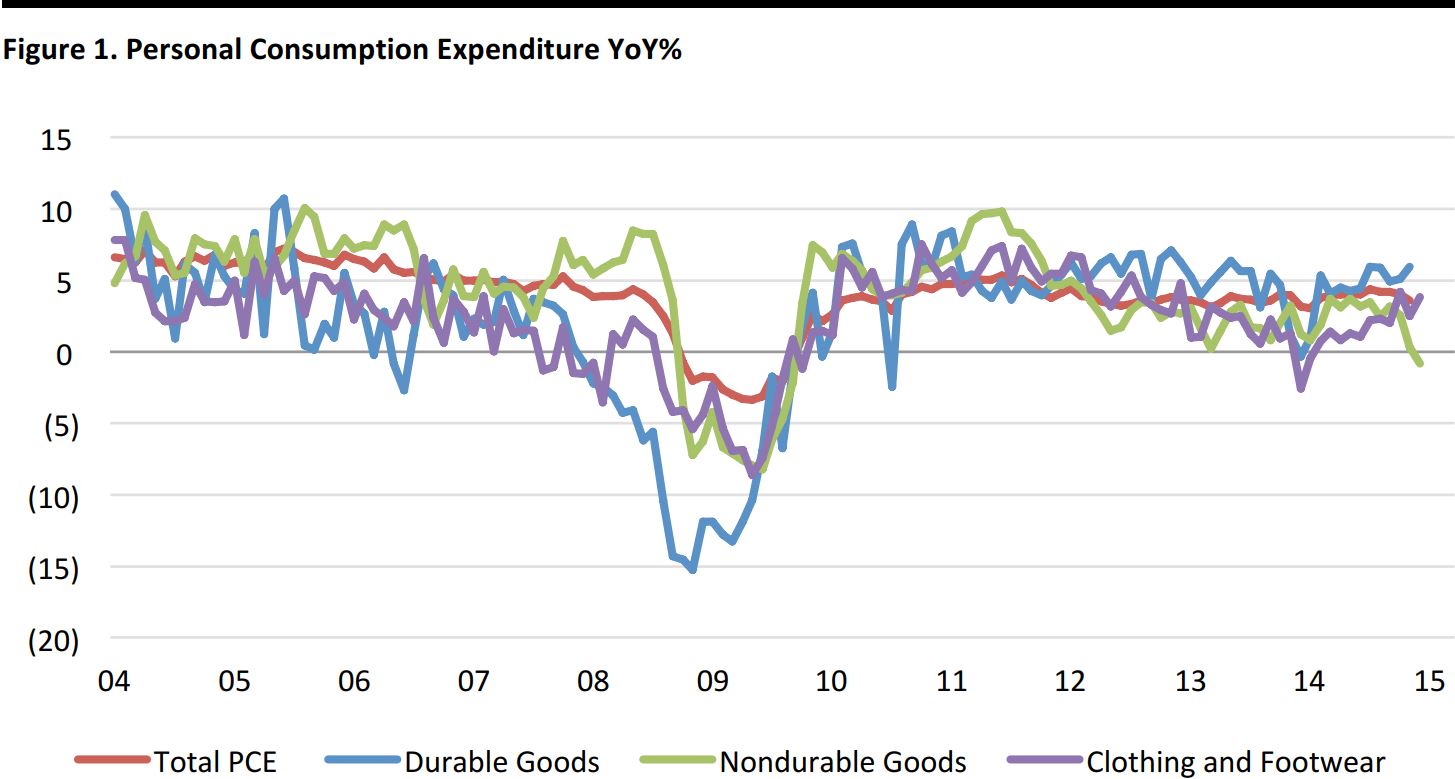

US RETAIL TRAFFIC

US Store Traffic Continues to Decline the Final Week of February

Through February 28 Source: ShopperTrak

- US store traffic fell 7.7% YoY in the final week of February, bringing the month’s slide to 6.3%.

- Traffic at electronics retailers slid precipitously at a 15.3% rate.

- Apparel stores suffered a YoY traffic decline in the final week of February, down 4.4%..

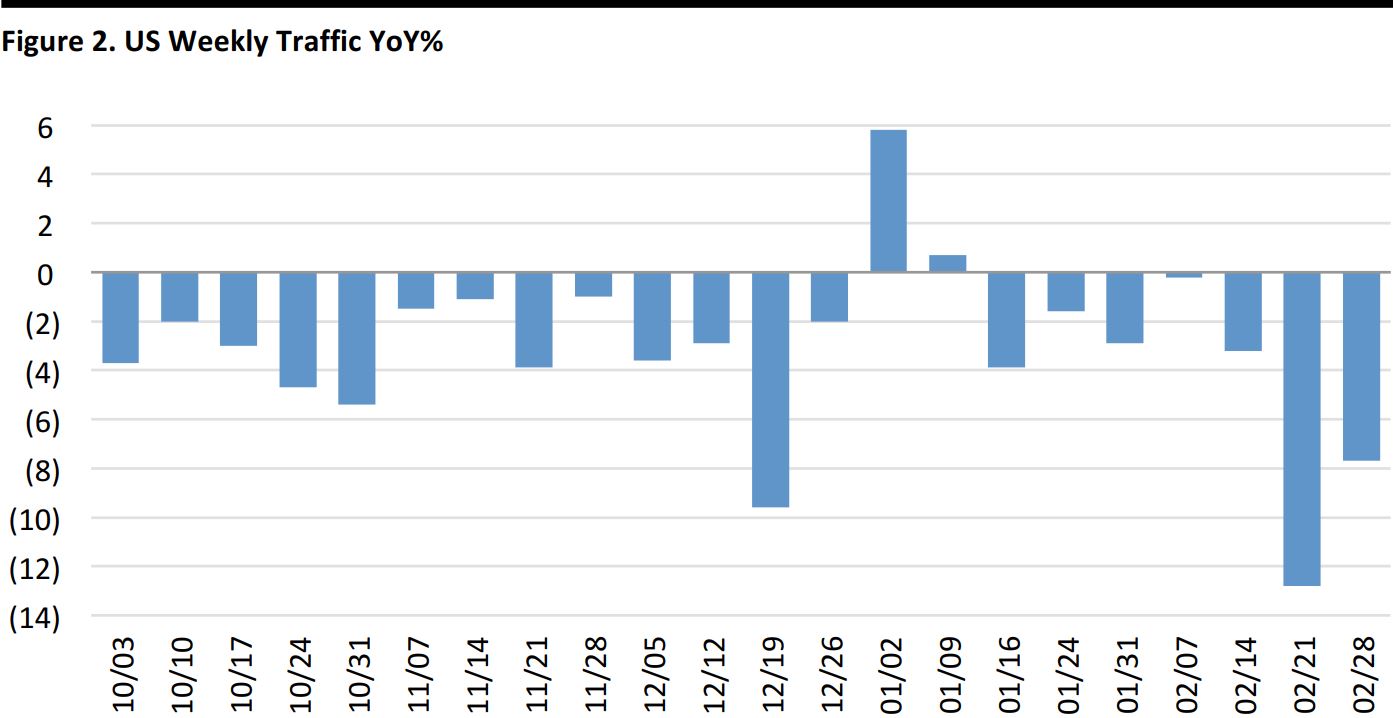

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

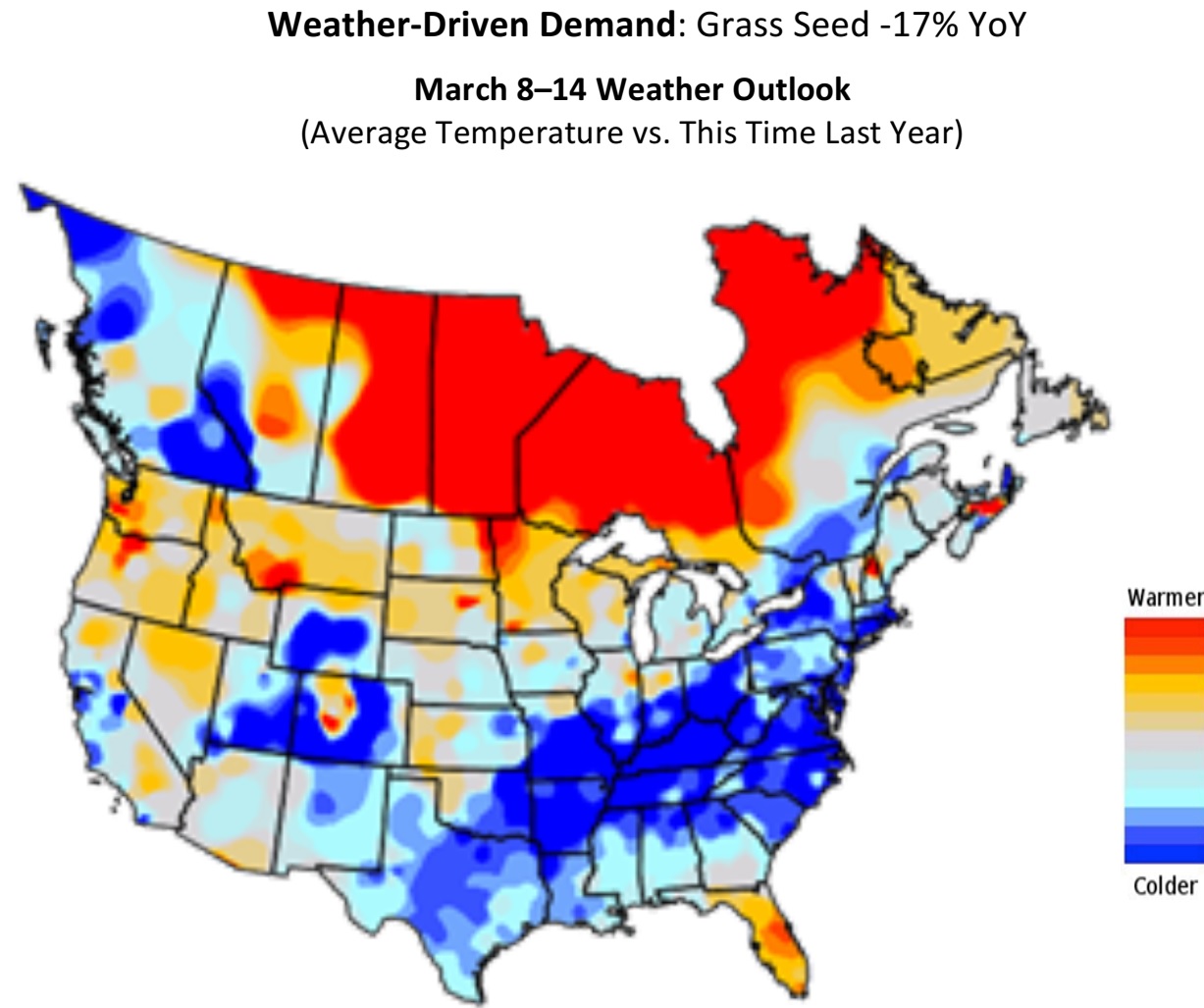

US WEATHER ANALYTICS: Week of March 8–14

Week 2 of March Will Start on a Warmer Note than It Did Last Year

- Mild in the Middle. The greatest warmth versus normal and a year ago will be found across central areas of the Canadian Prairies down through the Central Plains. Showers and storms will break out across the Plains during the second half of the week.

- Warm, but Wetter Across the West. Temperatures in the Western US will climb back above normal, although they will remain similar to a year ago. More rain and mountain snow are on the way. The rain and milder temperatures will spread out into the Plains by the middle of the week, driving demand for rain gear.

- No Spring for the East Next Week. The latest surge of cold air will drop into the eastern US and decide to stick around a bit, pushing the trend back to colder than a year ago. The good news is that most of the East will be relatively dry, giving consumers a much needed break from wintry precipitation and supporting foot traffic in most shopping destinations.

Source: Planalytics

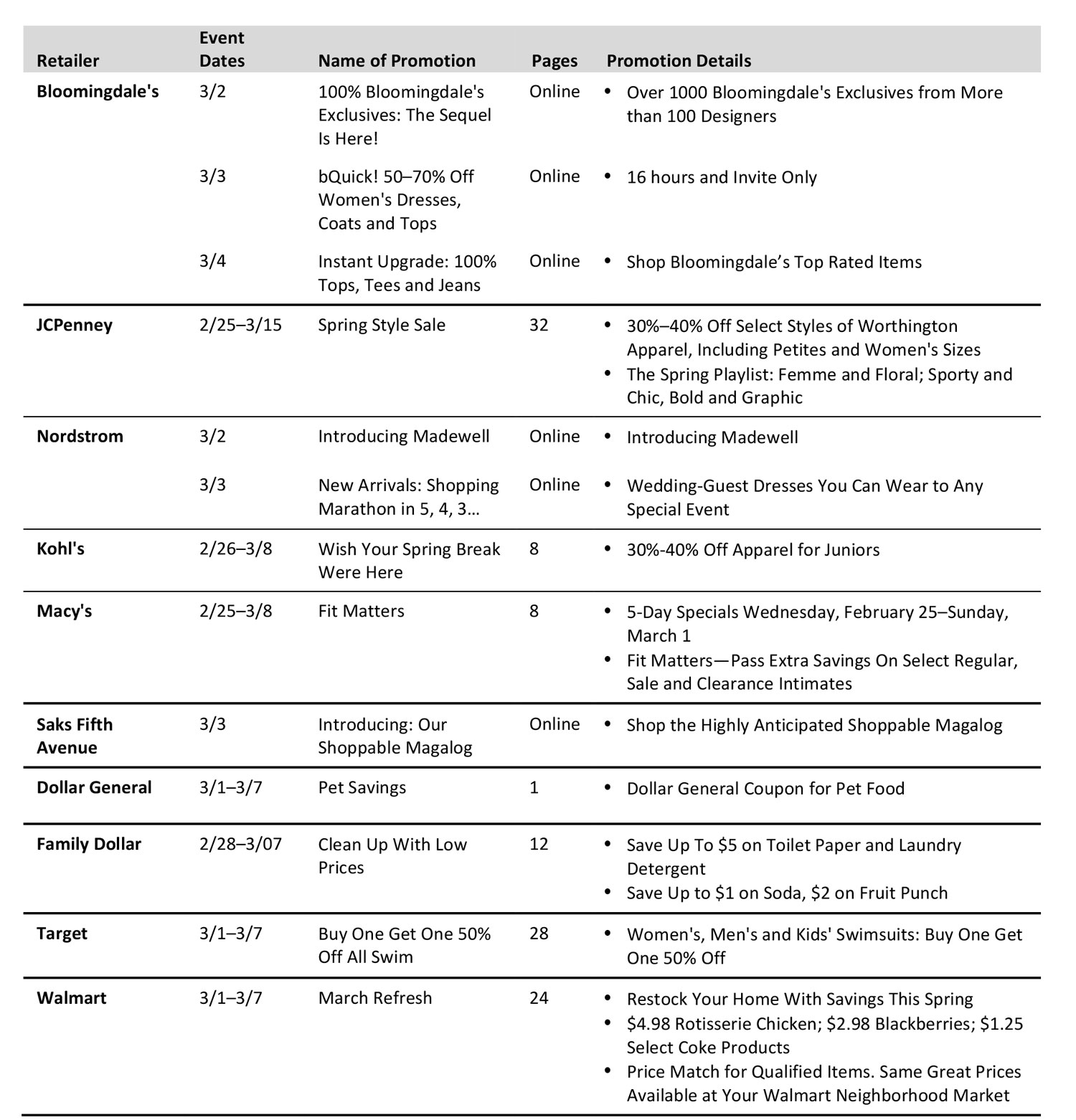

US PROMO HIGHLIGHTS

- Saks Fifth Avenue introduced the first edition of its “shoppable magalog,” a digital catalog for its women’s and men’s collections.

- Department stores started their spring campaigns: JCPenney presented its Spring Playlist for women of all sizes, including petites and women’s sizes; Kohl’s promotion focused on juniors and their Spring-Break styles.

- Macy’s featured the “Ultimate Wardrobe Sale” during the same week as in 2014. This year the department store switched to sales on intimates items.

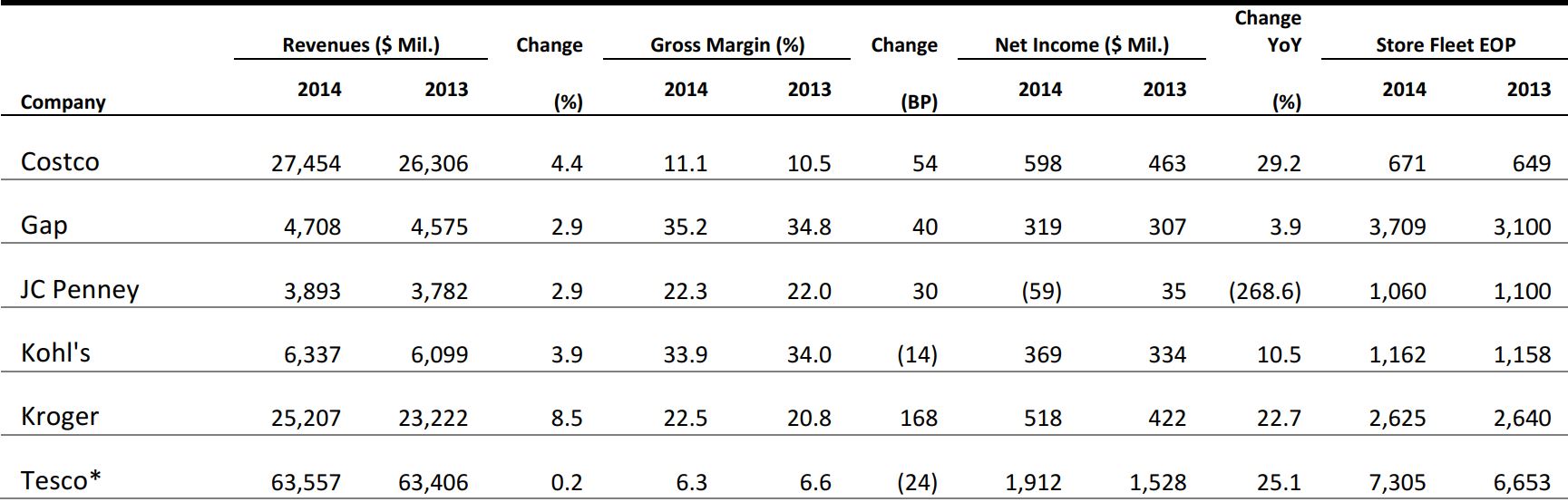

RETAIL EARNINGS

Source: Company reports *Tesco reports in GBP, net income from continuing operations

US RETAIL HEADLINES

- In tandem with Kate Spade’s 4Q earnings release, the company announced it’s entering into four new licensing agreements to expand into furniture, bedding, bath, wallpaper, rugs and other household items. CEO Craig Leavitt commented, “The breadth of our home décor line will feature products at all access points in both pricing and distribution, from an $8 notebook to an $8,000 piece of furniture.”

- The company expects the home category to generate $100–$150 million in additional revenue in 2015. Kate Spade has proven success in the stationery and gifting business, up 180% YoY, and Kate Spade Tabletop, the #1 designer brand in tabletop and bridal registry, is growing at a 20% annual pace versus a 5% category decline.

- CEO Brian Cornell and his executive team met with members of the investment community and presented the retailer’s strategic plan to return to double-digit earnings per share (EPS) growth. Gross margin is expected to remain in the 29.5% area as the focus shifts to topline growth. Sales growth of approximately 3% beyond 2015 will be a function of a 1% comp, 40% digital growth and about 50 basis points from new stores. The four signature categories in which Target will invest are style, baby, kids and wellness, based on what’s most important to Target’s guests.

- Chief Merchandising Officer Kathee Tesija spoke about Target’s new core guest, the “demanding enthusiast,” who cares about wellness, style and value, and wants products with stories and backstories. Of Target shoppers, 75% start the purchase process with a mobile device, as the mobile device has become Target’s front door.

- February same-store sales came in at +6% vs. +4.9% consensus estimate; the Victoria's Secret comp was up 7%.

- The transition to the spring collection is going well. No mention of a negative impact from the West Coast port issue. An early Easter should have a meaningful impact on March comps.

ASIA TECH HEADLINES

- Last year, Masayoshi Son, founder and CEO of Japanese telecom giant Softbank, visited India and announced plans to pump US$10 billion into India’s “information revolution.” Two-thirds of the first billion went to Snapdeal, and nearly a quarter billion went to taxi app Ola to help it take on Uber.

- AdNear, a location-based advertising intelligence startup, picked Japanese venture capital (VC) firm Global Brain to raise US$19 million in Series B funding for help in entering the Japanese market.

- South Korea’s Samsung Electronics unveiled its latest Galaxy X smartphones, featuring a slim body made from aircraft-grade metal, in a bid to reclaim the throne of undisputed global smartphone leadership from Apple. Some technology publications described the phones as Samsung’s best-looking to date.

- Batteries in the new phones cannot be replaced, however they support wireless charging.

- A new mobile payment system will be launched in the US and South Korea in partnership with major US banks and credit card companies including Visa and MasterCard. It will allow users to make payments through magnetic strip-card readers.

- Qihoo CEO Zhou Hongyi says its smartphone, created in a joint venture with Coolpad last year, will come on the market this year and target Chinese students and recent grads, who change phones approximately every year and a half.

- Qihoo has an advantage over other tech firms and local startups, as it is already a household name in China.

Chinese Secondhand Car Platform Cheyipai Raises $110M in a Series D Round

(March 3) Tech in Asia

Chinese Secondhand Car Platform Cheyipai Raises $110M in a Series D Round

(March 3) Tech in Asia

- Cheyipai netted US$50 million in a series C round financing in February 2014, and raised another US$100 million in a series D round.

- Cheyipai is China’s largest online secondhand car trading platform, and it operates a number of services, like offline car inspection teams that check the quality of cars listed on the site. The company plans to expand and strengthen with this latest cash infusion.

Razelab Wins Tech in Asia Tour Jakarta 2015

(March 3) Tech in Asia

Razelab Wins Tech in Asia Tour Jakarta 2015

(March 3) Tech in Asia

- Razelab was among the five finalists selected from 50 participants who won the chance to pitch to a panel of judges. The company has developed a mobile application named “Light Me Up” that has the same function as a glow stick or bracelet, and can recognize the sound produced by a concert venue’s speaker system in order to change the color of a smartphone’s illumination.

- Razelab’s designers won free flights to and accommodation in Singapore, conference passes, and a startup booth at Tech in Asia Singapore

- New Singapore-based crowdfunding platform FundedHere will facilitate equity-based funding and venture debt for startups from as low as S$5,000. The platform will initially focus on Singapore and Southeast Asia.

- Andy Lim, who launched FundedHere, is a cofounder of local private equity group Tembusu Partners. In December Tembusu launched a US$100 million Singapore-based private equity media fund targeting China’s media and entertainment industries. Tembusu is working in partnership with NASDAQ-listed Bona Film and local media entrepreneur Calvin Cheng.

- President Barack Obama on Monday sharply criticized China’s plans for new rules on US tech companies, urging Beijing to change the policy if it wants to do business with the United States and saying he had raised the matter with President Xi Jinping.

- The new counterterrorism law would require technology firms to hand over encryption keys, the passcodes that help protect data, and install security “backdoors” in their systems to give Chinese authorities surveillance access.

- Alibaba announced on March 2 that it intends to set up a $318 million (NT$10 billion) not-for-profit fund to provide capital for young entrepreneurs from the island state in order to help them build their businesses.

- The proposed fund comes just a month after the company announced its plans to pump $129 million (HK$1 billion) into a not-for-profit foundation aimed at boosting entrepreneurship among Hong Kong’s younger population.

- The HTC Vive, to be released as part of a tie-in with Valve, a leading PC video games publisher, will be paired with wireless controllers and tracking technology to let wearers explore computer-generated environments by walking around their rooms.

- HTC said more than 70 sensors were built in to the machine, including a gyroscope, an accelerometer and a laser position sensor. The headset features can display video at 90 frames per second (fps)—an important consideration, as many developers believe frame rates lower than 60fps can cause nausea.

- Through an Android or iOS app, CallFixie users can specify the type of fix they’re looking for (plumbing or electric), enter in a description and photo of the issue, and request a handyman. Upon spotting the submission, interested repairmen can respond with a quote.

- “In Hong Kong, the tradespeople themselves are generally not well off. So they want to maximize the number of jobs they can do in a day,” Sarai, one of the cofounders said. “We’ve already seen in Hong Kong that once you put a job up, you’ll get a quote within two minutes.”

Xiaomi Launches GoPro-Style Camera

(March 2) ZDNet

Xiaomi Launches GoPro-Style Camera

(March 2) ZDNet

- Chinese technology company Xiaomi has launched a sports camera that is capable of shooting 1080-pixel videos at 60fps in 40-meter-deep water.

- The camera is the same size as the GoPro Hero 4, but comes with a much smaller price tag. The basic version of the Yi cam is priced at $64 (399 Yuan), while an advanced version with a convertible selfie pole costs an extra $16 (100 Yuan).

EUROPE/UK RETAIL HEADLINES

- QVC reported full-year German sales flat at US$970 million and UK sales up 11% to US$730 million in 2014. In local currencies, German sales were up “slightly” in the year, while UK revenues were up 6%, its parent company Liberty Interactive reported.

- German operations saw sales growth in the home category but declines in apparel and jewelry. In the UK, sales growth was driven by the jewelry and beauty categories.

- Fashion giant Topshop has opened its first Dutch store, a 15,000 sq. ft. outlet on Amsterdam’s Kalverstraat.

- The Arcadia-owned retailer had previously been present in Amsterdam through a concession in the De Bijenkorf department store.

- Upscale US grocer Whole Foods Market grew its UK sales by 24% to $143 million (£101 million) in the year to September 28, 2014, new accounts show. Its loss in the UK was almost halved to $11.4 million (£7.5 million) in the year.

- Sales were boosted by new stores in Richmond and Fulham, both in London. The new stores brought the UK total to nine.

- Consumer prices in the Eurozone currency bloc fell by 0.3% YoY in February 2015, an improvement from a 0.6% fall in January, according to flash estimates from Eurostat.

- Food, beverage and tobacco prices rose 0.5% YoY in February, with energy costs down 7.9%.

- The UK’s Marks & Spencer (M&S) this week unveiled fresh plans for expansion in China. The company is to focus on flagship stores in top-tier cities like Beijing and Guangzhou and will modernize its Shanghai flagship store. Five stores in the Shanghai region will close by August 2015, with M&S targeting shoppers in these areas online through its partnership with Tmall.

- In Hong Kong, M&S will expand its food-store portfolio at travel and city locations, and in Macao M&S will open a new 1,000 sq. m. store at The Venetian Mall in November 2015.

- An interview given by Dia’s chief corporate officer has ignited speculation that the Spanish discounter could enter the fiercely-competitive UK grocery market.

- Dia’s Amando Sánchez-Falcón said the company would consider entering the UK through a joint venture similar to that undertaken by Denmark’s Netto when it partnered with the UK’s Sainsbury’s. But Sánchez-Falcón said that he had not yet approached any potential joint-venture partners.

LATAM RETAIL HEADLINES

- Gazit-Globe is a multinational real estate company focused on the acquisition, development and redevelopment of supermarket-anchored shopping centers.

- Its Gazit Brasil subsidiary acquired the remaining 25% stake in Mais Shopping in São Paulo for $26 million (BRL$75 million).

- The acquisition marks Gazit’s fourth shopping center in São Paulo, with 238 stores and a gross leasable area (GLA) of approximately 143,000 sq. ft. (13,300 sq. m.)

- Mexico’s manufacturing purchasing manager’s index was 54.4 in February, down from 56.6 in January. Output softened slightly from a 25-month high in January.

- Job creation remained solid in February.

- The rate of input-cost acceleration was the highest since June 2012.

- Mexican home and clothing retailer Coppel plans to invest $167 million (MXN$2.5B) to acquire and remodel Viana’s retailing network.

- The renovation is expected to be completed by November 2015.

- Coppel also plans to hire an additional 1,300 workers.

- Brazil’s manufacturing purchasing manager’s index was 49.6 in February, down from 50.7 in January.

- New orders were down slightly, and the strength of the US dollar versus the Real reportedly pushed up prices.Manufacturers signaled a small increase in employment.

- Truckers’ roadblocks in Brazil are continuing in southern Brazil, despite a government crackdown.

- The two-week-old labor dispute has delayed grain deliveries, disrupted soybean harvests due to lack of fuel shipments, and forced some meat-processing plants to close.

- President Rousseff is expected to sign a bill reducing toll costs, waiving fines for overweight trucks, and building more rest stops on federal highways.

- Brazilian police and industry associations are cracking down on fake products such as champagne, cologne and cigarettes.

- Smuggling is increasingly attractive, with a 7.5% inflation forecast and taxes of up to 78% on some goods.

- Illegal cigarettes made in Paraguay generate losses of $1.55 billion a year and cost less than half the price of domestic cigarettes.

- Hamley’s is joining other British brands such as Thomas Pink and Hackett London in opening stores in Mexico. Moreover, luxury carmakers Lotus and McLaren are expected to open showrooms in Mexico City.

- Mexico is the UK’s fourth-largest export market and its second-largest trading partner in Latin America after Brazil.

- Luxottica plans to focus on brands, service, new channels and mergers and acquisitions to fuel future growth. Plans are to double sales to $23 billion (€15B) over the next 10 years.

- The company expects markets in Latin America to grow 16%–20% this year.

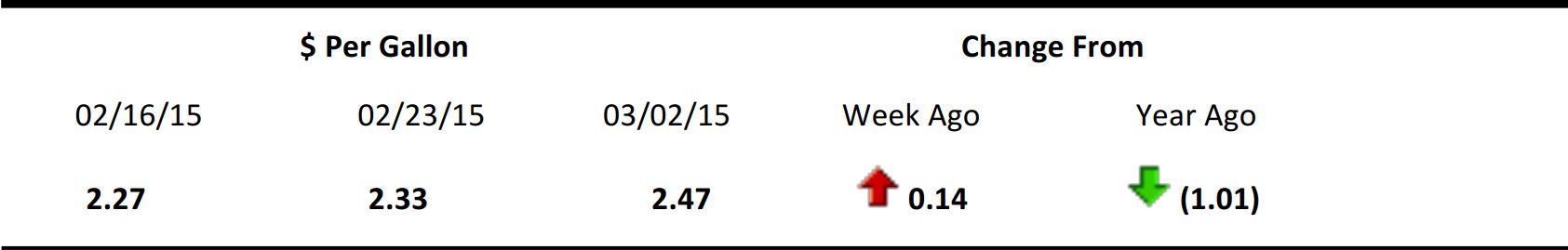

Earnings Calendar