From the Desk of Deborah Weinswig

Lidl US Update

If there is one topic we are frequently asked about, it is Lidl’s entry into the US market. The German grocery discounter will open its first 20 US stores this summer, in three states in the East: North Carolina, South Carolina and Virginia. We will shortly publish a full update on Lidl’s expansion into the US. In this week’s note, we wrap up some key findings from our research so far.

Lidl: Where and What?

Lidl plans to open locations in more states than just the three chosen for its initial tranche of stores. When we checked its website on March 22, the company was hiring for store-based roles in a total of 38 towns in eight eastern states: Delaware, Georgia, Maryland, New Jersey and Pennsylvania as well as North Carolina, South Carolina and Virginia.

Lidl will operate bigger stores in the US than it does in Europe. Its stores will typically have 21,000 square feet of selling space, according to a

Washington Post interview with Brendan Proctor, Lidl’s US CEO. That is roughly double its average store size globally and more than double the size of rival discounter Aldi’s typical US store, which is approximately 10,000 square feet.

Lidl is a limited-line discounter that relies on economies such as narrow choice and a strong private-label focus to enable it to offer low prices. Given this model, and the fact that the retailer will likely not have benefits of scale in the US market for some time, Lidl looks to have limited opportunity to offer substantially higher-than-average product counts in private-label packaged goods. So, how will Lidl use all that extra space in its American stores?

First, we expect Lidl’s stores in the US to include enhanced fresh food sections. The stores will almost certainly have fresh bakery departments, and we expect substantial fresh produce departments, too. We have seen a greater focus on fresh foods in other nontraditional markets, such as the UK. Second, general merchandise will be in the mix. Lidl’s European stores include fast-changing selections of nongrocery ranges, from DIY goods to apparel. In the

Washington Post interview, Proctor confirmed that Lidl’s US stores would include a “large section” dedicated to these ranges. Third, a greater number of third-party brands is a possibility, although we have yet to see which major grocery brands will appear on Lidl’s shelves.

Who Will Shop at Lidl?

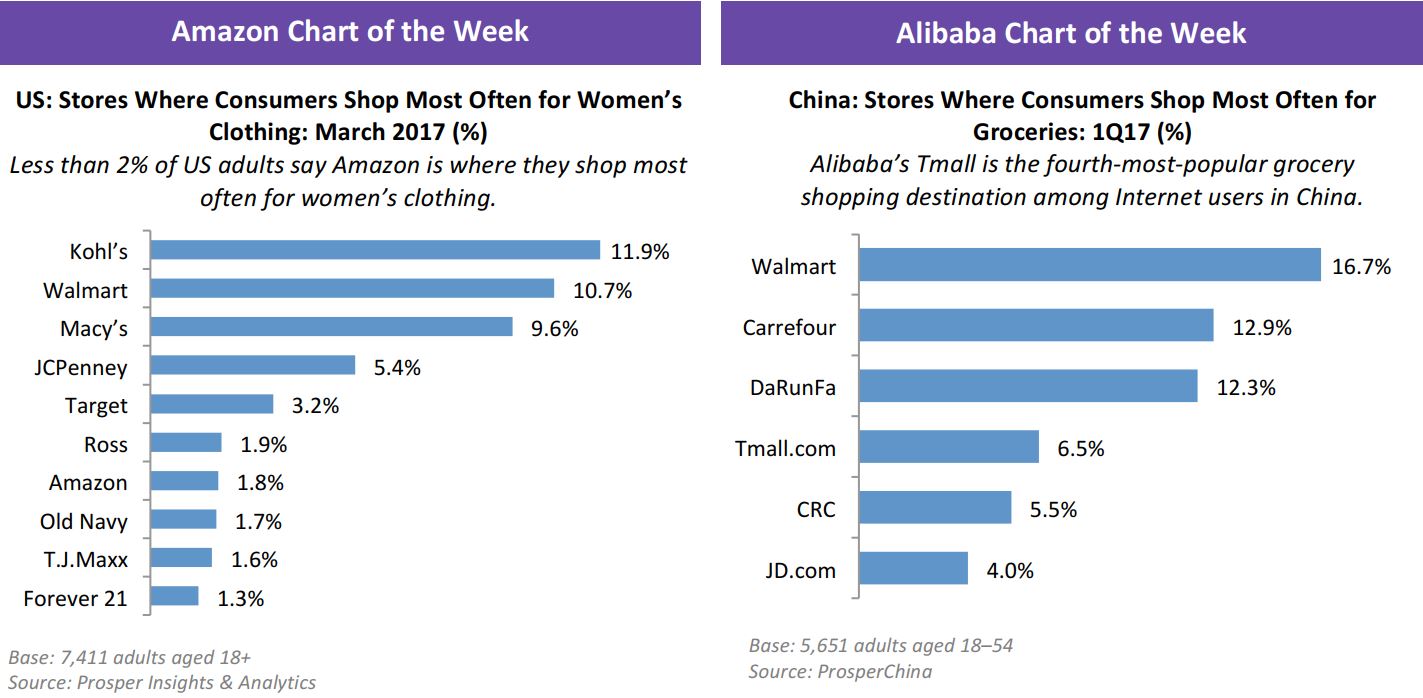

We think the best way to understand who will shop at Lidl is to look at who shops at Aldi in the US, given the similarity between the companies and their comparable focus on eastern states. For this, we turn to consumer survey data from our research partner, Prosper Insights & Analytics.

In terms of crossover between shoppers at Aldi and shoppers at other major grocery rivals, the biggest overlap is with Kroger: according to survey data from Prosper, as of August 2016, nearly 24% of Kroger grocery shoppers had shopped at Aldi in the previous 90 days. That rate was 20% among Sam’s Club shoppers, 17% among Walmart grocery shoppers and just 10% among Costco shoppers.

Looking at demographics, frequency of shopping at Aldi US tends to increase with age: among those surveyed by Prosper in August 2016, some 16% of millennials, 19% of Gen Xers and 21% of baby boomers had shopped at Aldi in the past 90 days.

While we think these data are a good ballpark guide, much will depend on Lidl’s final US proposition and how the company uses the extra space in its stores. We will offer a more detailed analysis in our forthcoming report on Lidl’s US market entry. Keep an eye out for it at FungGlobalRetailTech.com.

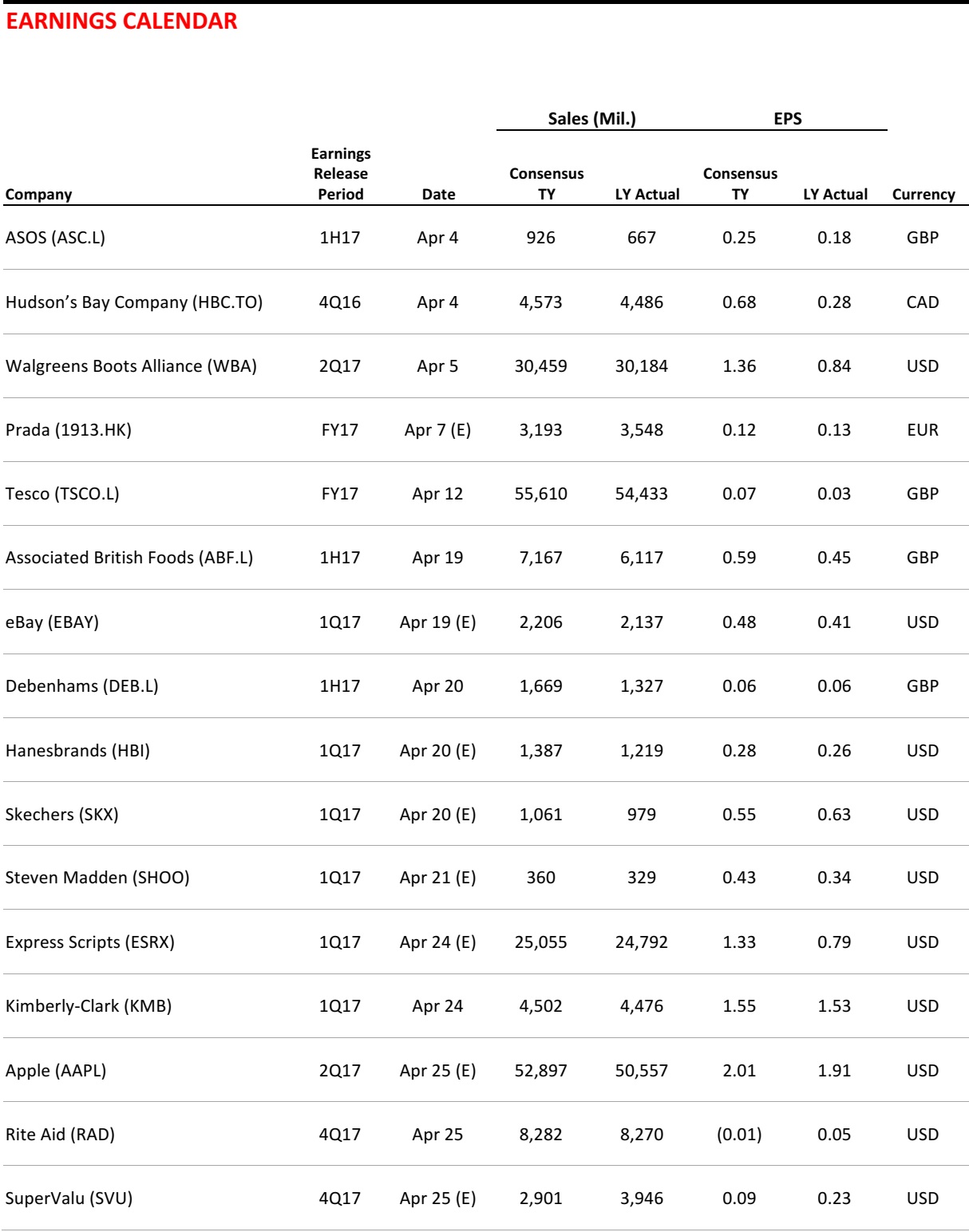

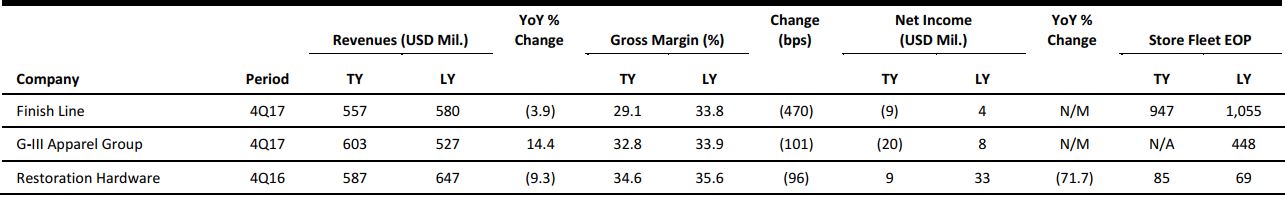

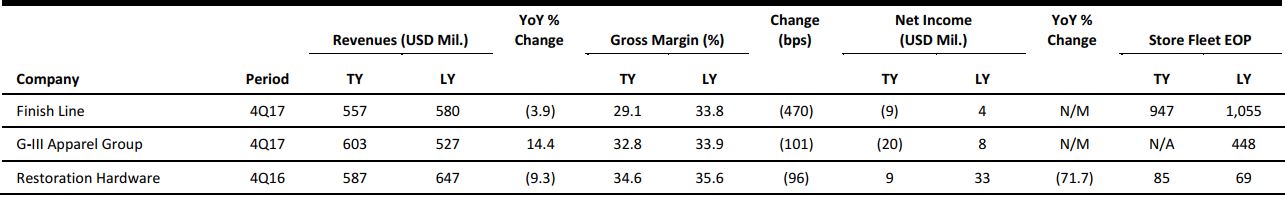

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

US: Consumer Confidence Is Going Gangbusters

(March 29) FXStreet.com

US: Consumer Confidence Is Going Gangbusters

(March 29) FXStreet.com

- According to the Australia and New Zealand Banking Group (ANZ), US consumer confidence is going gangbusters, as The Conference Board’s consumer confidence index for March spiked to 125.6 versus an expected reading of 114. The takes on the present and future situations were both up by around 10 points.

- The research team at ANZ reported that “the headline reading is the highest since late 2000. The labor differential rose to 12.2 from 7.0, moving through its 2007 peak, with the proportion of people reporting jobs are ‘plentiful’ seeing its biggest monthly gain in 43 years, while the proportion saying they are ‘hard to get’ continued its downward trend. The Fed will be watching closely to see if confidence translates into spending, with reports of tough times in US retail.”

Moody’s Sees Improved Profits for US Supermarkets

(March 28) FoodBusinessNews.net

Moody’s Sees Improved Profits for US Supermarkets

(March 28) FoodBusinessNews.net

- Operating profits at US supermarkets are expected to increase at a “fairly healthy rate” in 2017 after a disappointing 2016, according to a new report from Moody’s Investors Service. The sector’s profitability was adversely affected in 2016 by an unprecedented level of deflation, but, as downward pressure on prices wanes, things are expected to accelerate in the latter half of 2017, Moody’s said.

- “We expect the US supermarket sector’s operating profits to grow about 8% in 2017, compared with an approximate 5% drop last year,” said Mickey Chadha, an analyst with Moody’s. “As deflation subsides, growth will be skewed toward the second half of the year, driven by improvement at Albertsons, The Kroger Company and Whole Foods Market.”

Fraud Costs Foreign E-Commerce Retailers 22% More than US Brands

(March 24) RetailTouchPoints.com

Fraud Costs Foreign E-Commerce Retailers 22% More than US Brands

(March 24) RetailTouchPoints.com

- EMV payment regulations, which mandate the use of chip cards at the point of sale, have been effective in mitigating fraud for in-person “card present” transactions worldwide. Unfortunately, fraudsters have migrated to less-protected targets, particularly the “card not present” transactions that dominate e-commerce.

- Non-US retailers are particularly vulnerable, and non-US retailers with an e-commerce operation have the highest fraud-related costs as a percentage of annual revenue, with charges that are 22% higher than those of US retailers, according to a study from LexisNexis. These merchants’ overall fraud costs are 85% higher than those of their brick-and-mortar-only counterparts.

US Retail Sales Showed Weaker Improvement in February

(March 23) MarketRealist.com

US Retail Sales Showed Weaker Improvement in February

(March 23) MarketRealist.com

- According to US Census Bureau data, US retail sales rose by 0.1% in February, below the market’s expectation of a 0.3% increase. Sales rose by 0.4% in January. The February increase was the lowest since September 2016.

- Some US retail sales segments provided positive returns, while others provided weaker figures. Weaker retail sales were mainly the result of weak improvement in motor vehicle sales. Core retail sales, which most closely reflect the performance of the consumer-spending segment of GDP, rose by 0.1% in February, compared with 0.6% in January.

The Robots Are Coming: 38% of US Jobs Soon To Be Automated

(March 24) NewsFactor.com

The Robots Are Coming: 38% of US Jobs Soon To Be Automated

(March 24) NewsFactor.com

- Up to 38% of jobs in the US are at high risk of being eliminated due to advances in automation, according to a new report by consulting firm PwC. The risk is highest in sectors such as transportation and storage (56%), manufacturing (46%), and wholesale and retail (44%), while it is lower in sectors such as health and social work (17%), according to the study.

- “These estimates are based on an algorithm linking automatability to the characteristics of the tasks involved in different jobs as well as those of the workers doing them (e.g., the education and training levels required),” PwC said in the report. The estimates are based on anticipated technological advancements in artificial intelligence and robotics between now and the early 2030s.

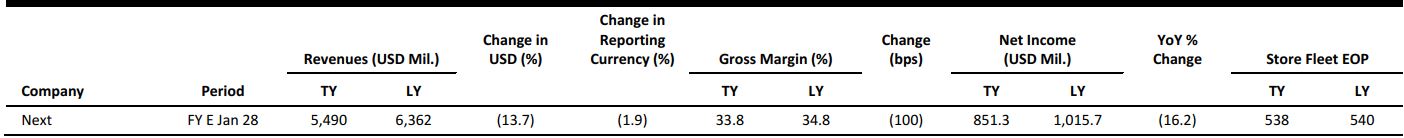

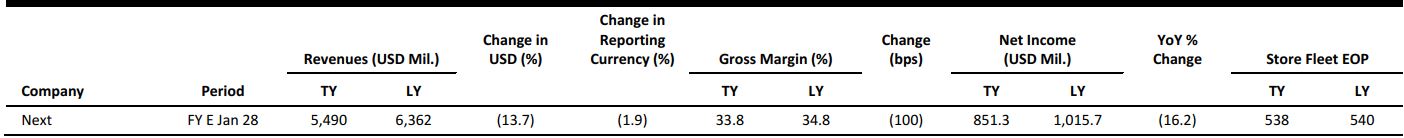

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Ahold Delhaize Updates on Divestment Strategy for Belgium

(March 23) Company press release

Ahold Delhaize Updates on Divestment Strategy for Belgium

(March 23) Company press release

- Ahold Delhaize announced that its Belgian subsidiaries have reached agreements to divest four stores and one store-development project in Belgium in order to comply with Belgian Competition Authority conditions on its 2016 merger.

- The international food retail group says it is uniquely positioned to serve the Belgian market and is “convinced of the outcome of this journey and [that] there is opportunity for growth in Belgium.”

Brantano Files for Bankruptcy

(March 24) RetailDetail.eu

Brantano Files for Bankruptcy

(March 24) RetailDetail.eu

- British shoe chain Brantano, owned by Alteri, has filed for bankruptcy after having relaunched only last year. Reportedly, the weaker pound was detrimental to the chain, as were evolving consumer behavior and changes in the UK retail landscape.

- Last weekend, Brantano’s sister footwear chain, Jones Bootmaker, was sold to investment firm Endless under a “pre-pack” administration.

New Look Owner Cancels London Listing Ahead of Brexit

(March 27) RetailGazette.co.uk

New Look Owner Cancels London Listing Ahead of Brexit

(March 27) RetailGazette.co.uk

- New Look’s owner, Brait, has announced it has withdrawn plans to be listed on the London Stock Exchange “in light of the uncertainty” brought about by Brexit.

- The South African-owned company announced its intentions to move onto the London Stock Exchange last year. Brait stated that, although it is still convinced of the long-term benefits of a transfer, due to the timing and form of Brexit, the board will not proceed at this time.

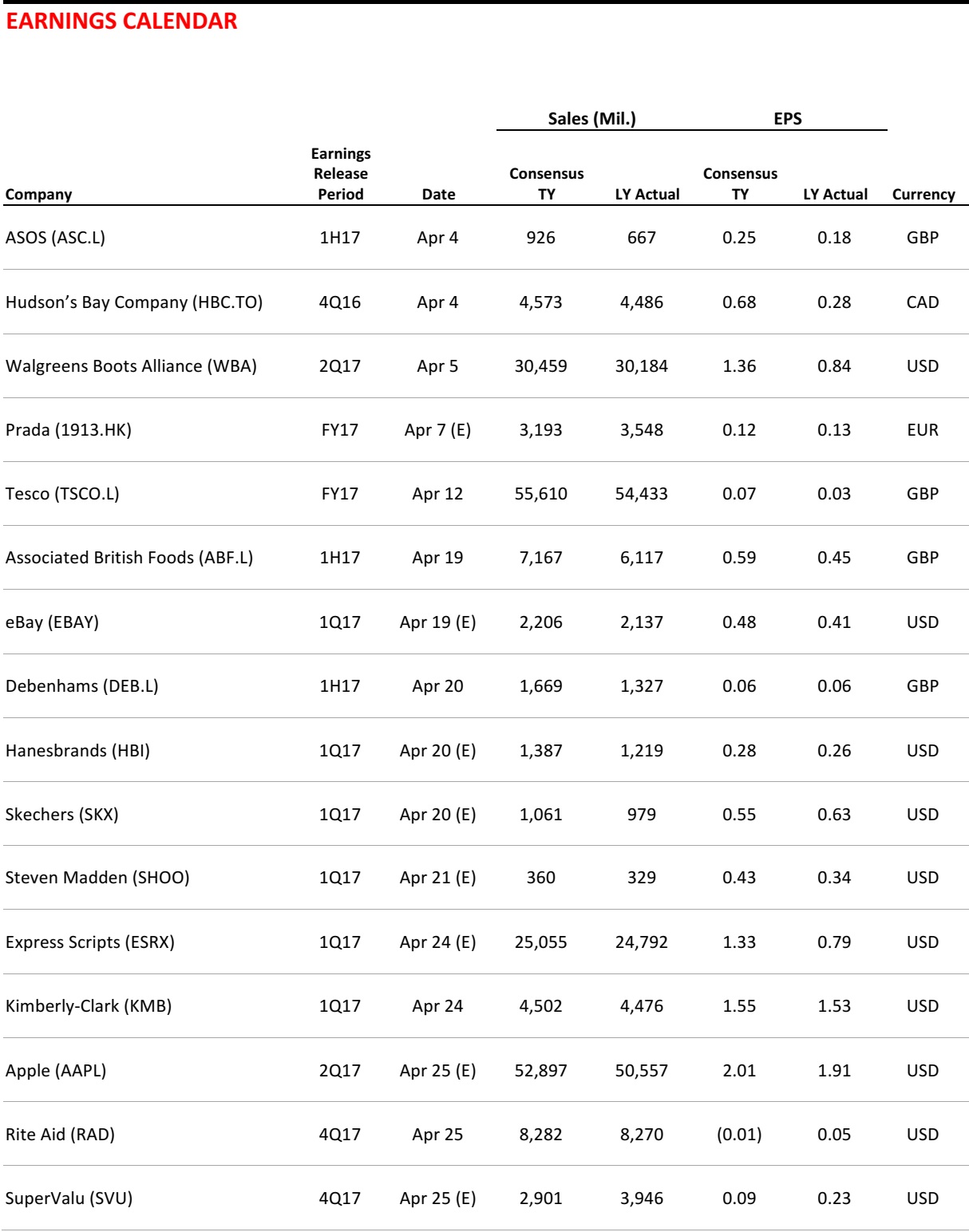

Next Is “Extremely Cautious” About the Year Ahead

(March 23) Company press release

Next Is “Extremely Cautious” About the Year Ahead

(March 23) Company press release

- British clothing retailer Next has reported its first drop in profit since 2009 and the company says it “remains extremely cautious about the outlook for the year ahead.”

- The retailer’s caution is based on potential threats in the clothing sector, a sectorial shift away from clothing spending, inflation due to the devaluation of the pound and weaker growth in real income.

German Firms Fear Disruption from New Technologies

(March 26) UK.Reuters.com

German Firms Fear Disruption from New Technologies

(March 26) UK.Reuters.com

- German business morale was high in February, but the Ifo Institute for Economic Research reported that many German companies doubt that the good conditions in the economy will last.

- Ifo President Clemens Fuest told the German newspaper Südkurier that digitalization and new technologies such as electric cars will lead to “structural upheaval” and disrupt the current business conditions.

Tesco Faces £235 Million Hit over Accounting Scandal

(March 28) News.Sky.com

Tesco Faces £235 Million Hit over Accounting Scandal

(March 28) News.Sky.com

- The UK’s biggest retailer, Tesco, will take a charge of £235 million (US$293 million) in relation to a 2014 financial reporting scandal that saw it exaggerate its profits by more than £300 million (US$373 million).

- Tesco said the total includes a fine of £129 million (US$161 million) to avoid prosecution, an estimated £85 million (US$106 million) in compensation for investors and the unspecified costs of an investigation by the UK’s Serious Fraud Office.

ASIA TECH HEADLINES

Didi Chuxing Weighing $6 Billion SoftBank-Backed Funding

(March 28) Bloomberg.com

Didi Chuxing Weighing $6 Billion SoftBank-Backed Funding

(March 28) Bloomberg.com

- Chinese ride-sharing giant Didi Chuxing is weighing whether to take a $6 billion investment backed by SoftBank that could dilute existing backers such as Apple. If the deal goes through, the funding will be the single largest on record for a Chinese technology startup.

- Didi, which amassed $10 billion of cash and equivalents last year, will need to decide whether it will take the additional funds as it locks horns with Uber and Alphabet in the development of driverless technology.

Toyota and NTT to Collaborate on Connected-Car Tech, Including AI

(March 27) TechCrunch.com

Toyota and NTT to Collaborate on Connected-Car Tech, Including AI

(March 27) TechCrunch.com

- Toyota and NTT are teaming up to work on research and development of connected vehicle technology. Through the partnership, the two companies will share tech and expertise, and create big data research projects using vehicle information collected from Toyota’s fleet of connected cars.

- Both automakers and wireless carriers are looking to maximize the amount of data they can get from their customers as vehicles become increasingly connected.

China’s Largest Chipmaker Secures $22 Billion To Expand Globally

(March 28) Bloomberg.com

China’s Largest Chipmaker Secures $22 Billion To Expand Globally

(March 28) Bloomberg.com

- Tsinghua Unigroup has clinched as much as ¥150 billion (US$22 billion) of financing from two Chinese government-backed investors, amassing a pool of funds to pursue acquisitions and build a world-class semiconductor industry.

- The state-linked chipmaker will receive a total of ¥100 billion (US$15 billion) from China Development Bank, a policy lender overseen by the country’s cabinet, in the years until 2020. It will get another ¥50 billion (US$7 billion) from a national chip fund that was set up in 2014 to drive advances in domestic semiconductors.

LATAM RETAIL AND TECH HEADLINES

Waze Carpool to Launch in Brazil

(March 27) ZDNet.com

Waze Carpool to Launch in Brazil

(March 27) ZDNet.com

- Traffic and navigation app Waze will be launching its ride-sharing product in Brazil, parent company Google announced last week. The exact launch date for Waze Carpool in the country is yet to be confirmed, but the service is expected to be up and running by September.

- Waze Carpool connects drivers and passengers from the same local user network with similar routes by analyzing their home and work addresses. According to Waze, Brazil is its second-largest market and the ride-sharing tool will help locals save money and time, while reducing the number of vehicles on the road.

PC Sales Decrease in Brazil

(March 22) ZDNet.com

PC Sales Decrease in Brazil

(March 22) ZDNet.com

- The Brazilian PC market saw a considerable shift in 2016, with 4.5 million items sold and a 31.7% drop in sales versus the prior year. Of that total, 3 million units were sold to consumers, while the remainder was purchased by corporate buyers.

- With the continued decline of the local PC market, manufacturers are also earning less: the whole market generated R$10.9 million (US$3.5 million) in 2016, down from R$15.3 million (US$4.9 million) in 2015. This was due mainly to price increases caused by the rise of the US dollar against the Brazilian real.

Brazilian Retailer GPA Plans $384 Million in Capital Spending this Year

(March27) Reuters.com

Brazilian Retailer GPA Plans $384 Million in Capital Spending this Year

(March27) Reuters.com

- GPA, Brazil’s largest diversified retailer, announced in a recent securities filing that it plans to invest as much as R$1.2 billion (US$384 million) this year to bolster growth in its supermarket and cash-and-carry divisions and real estate.

- The GPA board said it would propose that shareholders approve this year’s budget for capital spending, which would earmark R$539 million (US$172 million) for multiple retailing formats and R$596 million (US$190 million) for the chain’s Assaí cash-and-carry operation.

Mexico Retail Sales Fall in January for Second Month in a Row

(March 24) Reuters.com

Mexico Retail Sales Fall in January for Second Month in a Row

(March 24) Reuters.com

- Mexican retail sales fell by 1.1% in January from December, dropping for the second month in a row, the Mexican national statistics agency said. Sales were up 4.9% year over year in January.

- Consumer confidence in Latin America’s second-biggest economy sank to a record low in January following a big gasoline price hike and the peso’s fall to a record low. The decline reflects consumers’ concerns over the potential collapse of Mexico’s free trade deal with the US.

Brantano Files for Bankruptcy

(March 24) RetailDetail.eu

Brantano Files for Bankruptcy

(March 24) RetailDetail.eu

Toyota and NTT to Collaborate on Connected-Car Tech, Including AI

(March 27) TechCrunch.com

Toyota and NTT to Collaborate on Connected-Car Tech, Including AI

(March 27) TechCrunch.com