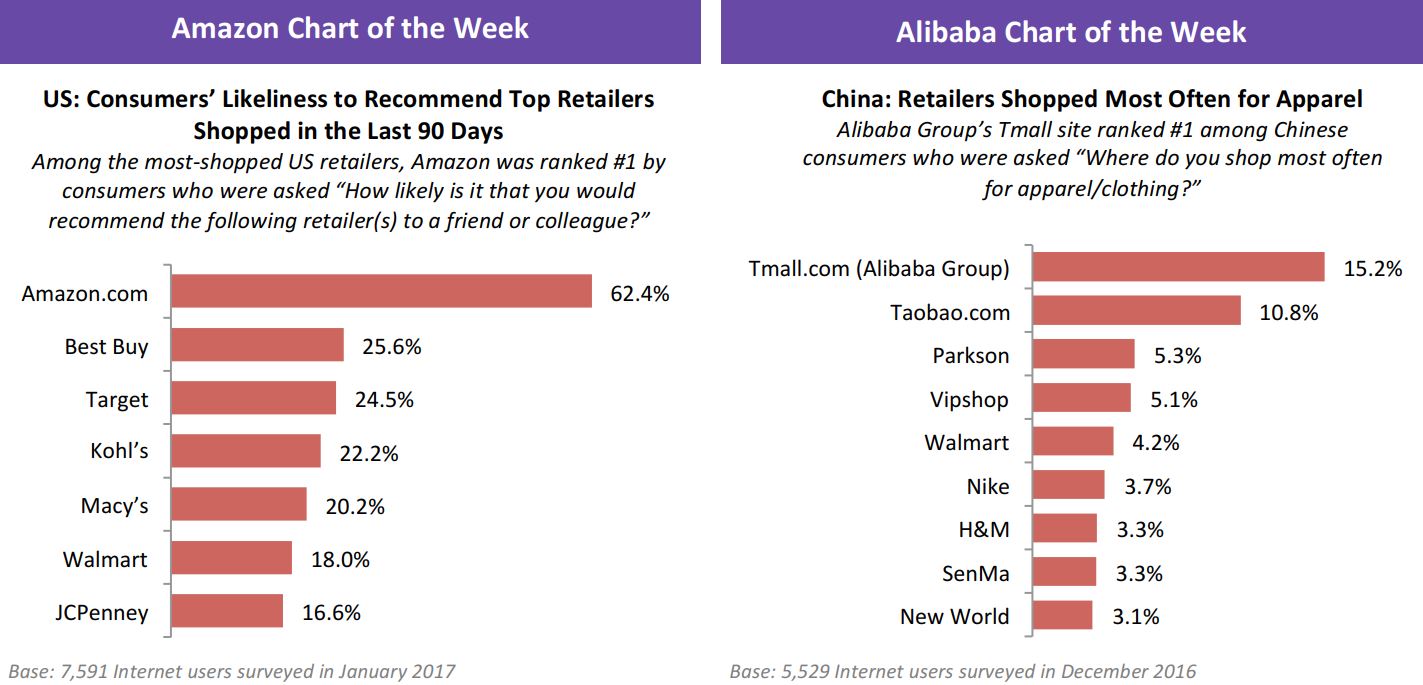

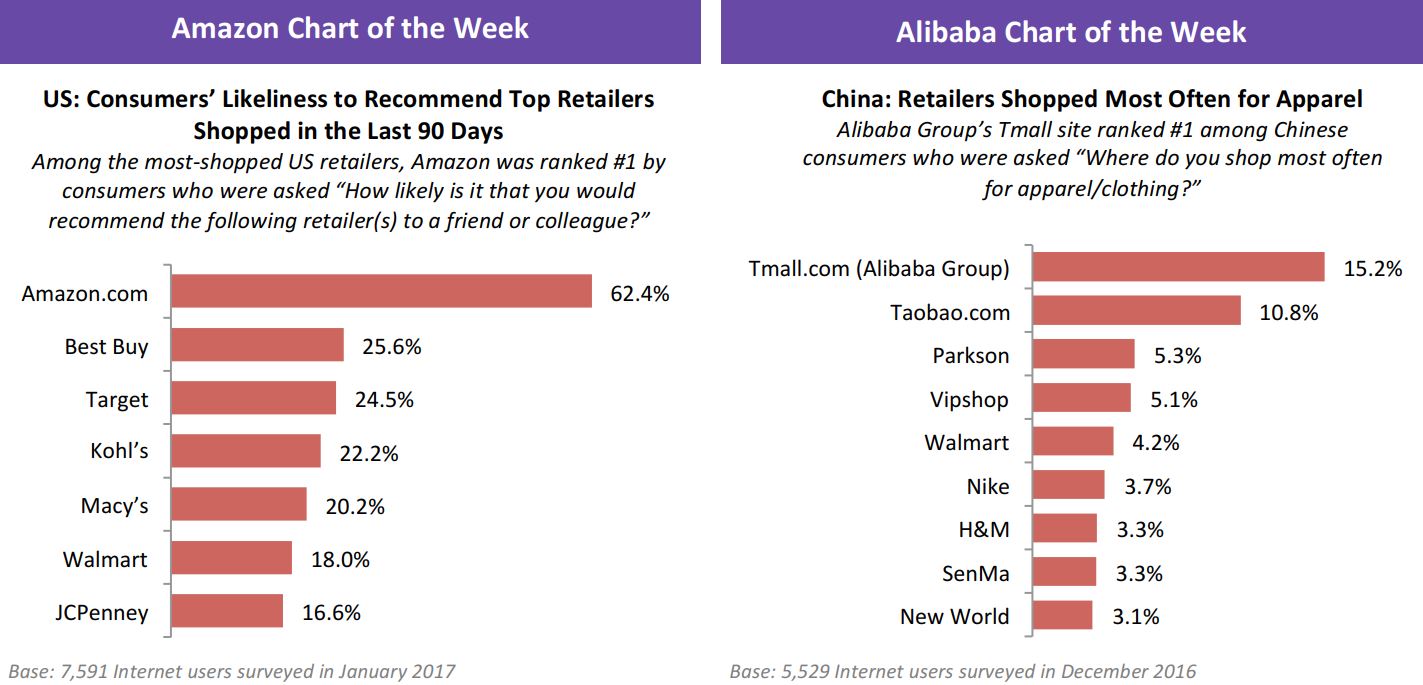

Source: Prosper Insights & Analytics

From the Desk of Deborah Weinswig

The $2.5 Billion Grab for Department Store Sales

Last week, JCPenney became the latest big US department store name to announce a round of store closures. The company said it will shutter 130–140 stores as well as two distribution centers over the next few months in a move to “align the company’s brick-and-mortar presence with its omnichannel network.” JCPenney’s announcement echoes an earlier one by Macy’s, which said in August 2016 that it intended to close 100 stores. Sears and Kmart continue to close stores, too. Sears Holdings announced in January this year that it would close 42 Sears stores and 108 Kmart stores.

Below, we summarize the revenues that rival retailers will have an opportunity to mop up as a consequence of these closures.

JCPenney

JCPenney emphasized that the locations it will close are lower-sales stores, specifying that the 130–140 stores set to be closed accounted for less than 5% of total company sales, despite representing 13%–14% of its current store portfolio. Based on an average 135 store closures (the midpoint of the announced range of closures), we estimate that stores set to close generated approximately $600 million in combined sales in the year ended January 2017.

If we assume JCPenney can hold on to approximately 20% of these sales by shifting them to nearby stores or its website, the dollar value of sales freed up to rivals comes down to

$482 million.

Macy’s

Macy’s put a clear dollar figure on the revenues it expects to lose to rivals when it closes 100 stores: the company estimates it will take a

$1 billion hit to sales after adjusting for sales retained at other

Macy’s stores and on Macys.com. The company did not provide a gross figure excluding retained sales, but said it retained between 10% and 45% of sales from previous closures.

This billion-dollar total equates to $10 million in sales for each store that will close. Given that the average Macy’s store turned over $30 million in the year ended January 2017, it is clear that the retailer is closing outlets that are underperforming at the top line.

Sears and Kmart

When Sears Holdings announced its latest round of closures across the Sears and Kmart banners, it stated that the 150 stores set to close generated around $1.2 billion in total sales in the past 12 months.

As at JCPenney and Macy’s, the stores being closed are low-sales stores: we estimate that this $1.2 billion total is approximately one-third less than the total sales that 108

average Sears stores and 42

average Kmart stores generated in the year ended January 2017.

If the company can retain 15% of these stores’ sales, the total value of sales freed up to rivals will be about $1.02 billion (we assume Sears and Kmart will see lower retention rates than JCPenney will based on shopper preference data from our research partner, Prosper Insights & Analytics). We estimate the total sales opportunity for rivals will be split as roughly $418 million from Sears and $602 million from Kmart.

In Short, a $2.5 Billion Opportunity for Rivals

So, what is our estimated total? Our basic math works out as $482 million + $1 billion + $1.02 billion, suggesting that rivals will mop up some $2.5 billion in extra sales once JCPenney, Macy’s, Sears and Kmart have completed all the store closures they have already announced. That estimate is based on our own assumptions regarding sales retention rates as well as on those by the retailers themselves.

The subject of US store closures is one that we watch closely and one that we will continue to cover in our reports tracking the changing retail landscape.

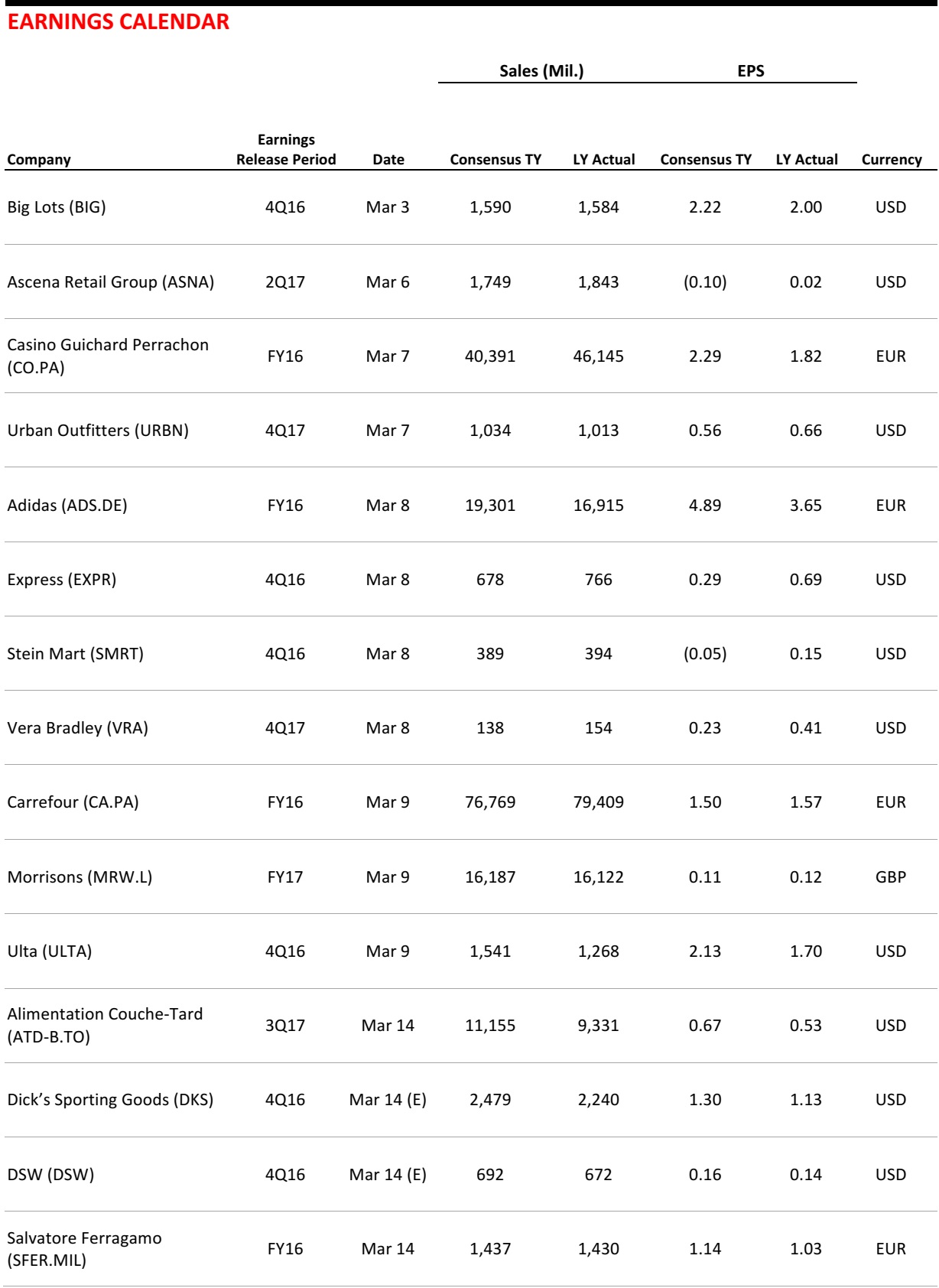

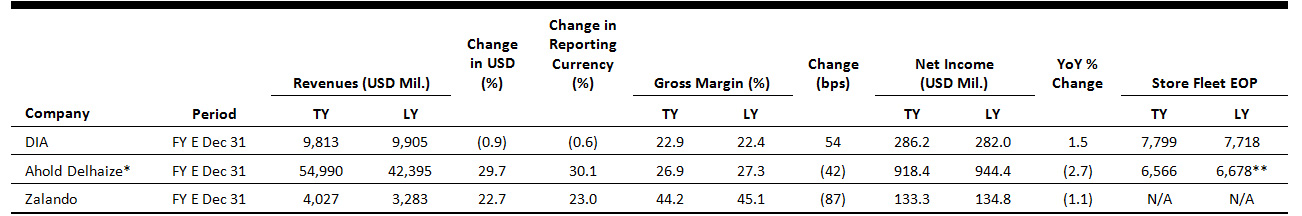

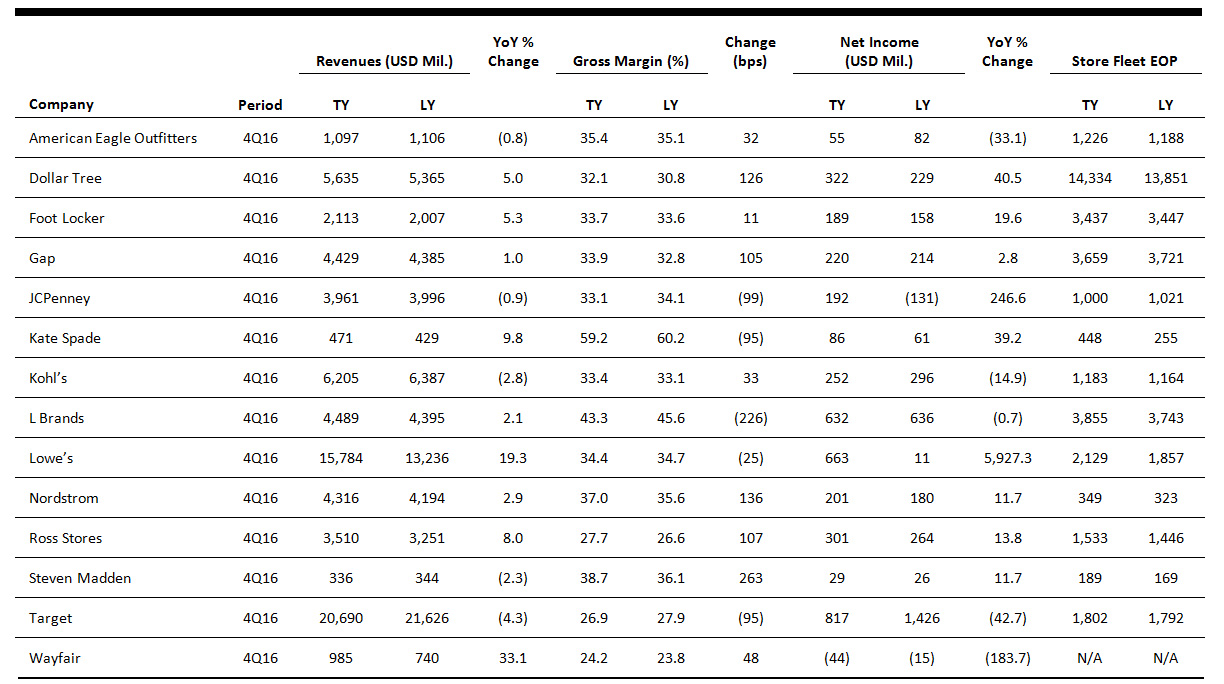

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Retail Cyberattacks Down in Fourth Quarter

(February 28) JOC.com

Retail Cyberattacks Down in Fourth Quarter

(February 28) JOC.com

- According to a new report from content delivery network and web security firm Akamai Technologies, cyberattacks against retailers were on the decline in the fourth quarter of 2016. However, that does not mean retailers were free from major security events during the holiday season.

- Akamai analyzed web security data between November 22 and 29, the days surrounding Thanksgiving, which was the start of the holiday shopping season in the US and, likewise, the peak time for criminal activity online. The firm found that web app attacks declined by 19% year over year in the fourth quarter.

Number of Distressed US Retailers at Highest Level Since Great Recession

(February 28) MarketWatch.com

Number of Distressed US Retailers at Highest Level Since Great Recession

(February 28) MarketWatch.com

- According to Moody’s Investors Service, the number of US retailers ranked at the most-distressed level of the credit-rating spectrum has more than tripled since the Great Recession of 2008–2009 and is heading toward record levels in the next five years.

- The rating agency is the latest to weigh in on the state of the sector. In its retail and apparel portfolio, 19 companies, or 14% of the total, are now trading at Caa/Ca. That is deep into speculative, or “junk,” territory, and the percentage is close to the 16% that were considered distressed during the 2008–2009 period.

US Retailers Destock and Restock Faster, Boosting Freight

(February 24) JOC.com

US Retailers Destock and Restock Faster, Boosting Freight

(February 24) JOC.com

- Evidence that inventory destocking is at least partially responsible for the recent surge in US imports and rising domestic freight volumes is showing up in retailers’ earnings reports. Several store chains have claimed that their reduced stockpiles helped boost pricing and profit in late 2016.

- But transportation executives say destocking is far from even across the retail sector, let alone in other industries. Although some are enjoying an earlier-than-usual uptick in freight demand in the first quarter, others are still waiting for an event big enough to jog the demand dial. The largest US retailer, Walmart, reported a big reduction in US inventories this week, both across the company and on a comparable store basis.

JCPenney to Close up to 140 stores, Offer Buyouts

(February 24) USA Today

JCPenney to Close up to 140 stores, Offer Buyouts

(February 24) USA Today

- JCPenney plans to close 130–140 stores and offer buyouts to 6,000 workers as the department-store industry sags in competition with online sellers and nimble niche retailers. The company said that it would shutter 13%–14% of its locations and introduce new goods and services aimed at the shifting preferences of its customer base.

- The cuts come amid mounting challenges for once-stalwart department store chains such as Macy’s and Sears, which are also aggressively closing stores in order to shed costs as shoppers flock to alternatives. Macy’s recently announced plans to close 100 of its 675 full-line stores. Sears said it plans to close 150 stores, including 108 Kmart locations.

An Overwhelming Number of Retailers Are Losing Money Chasing Amazon

(February 22) CNBC.com

An Overwhelming Number of Retailers Are Losing Money Chasing Amazon

(February 22) CNBC.com

- Brick-and-mortar retailers are becoming more competitive online by providing tighter delivery windows and offering the option to pick up digital orders in-store.

- There is only one problem: as they invest billions of dollars to close the gap with Amazon, the overwhelming majority of traditional retailers still have not figured out how to profitably fill orders that incorporate both the web and the store. According to a new report by JDA Software and PwC, only 10% of 350 global retailers surveyed are making money fulfilling these types of orders.

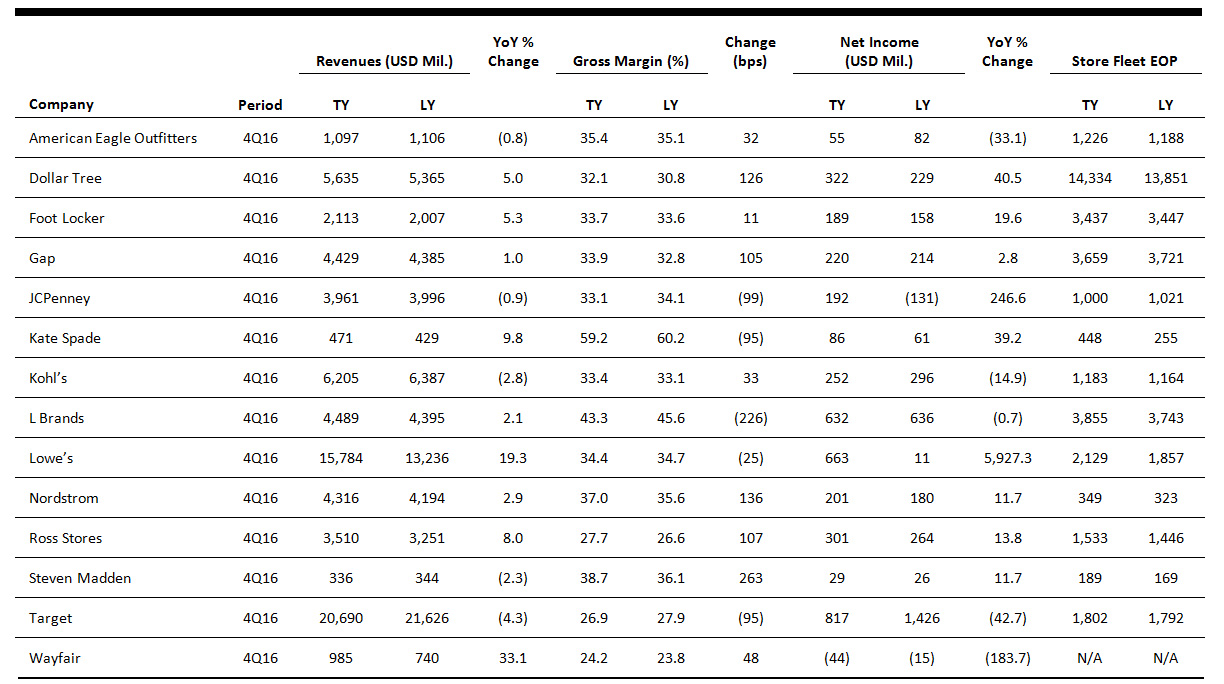

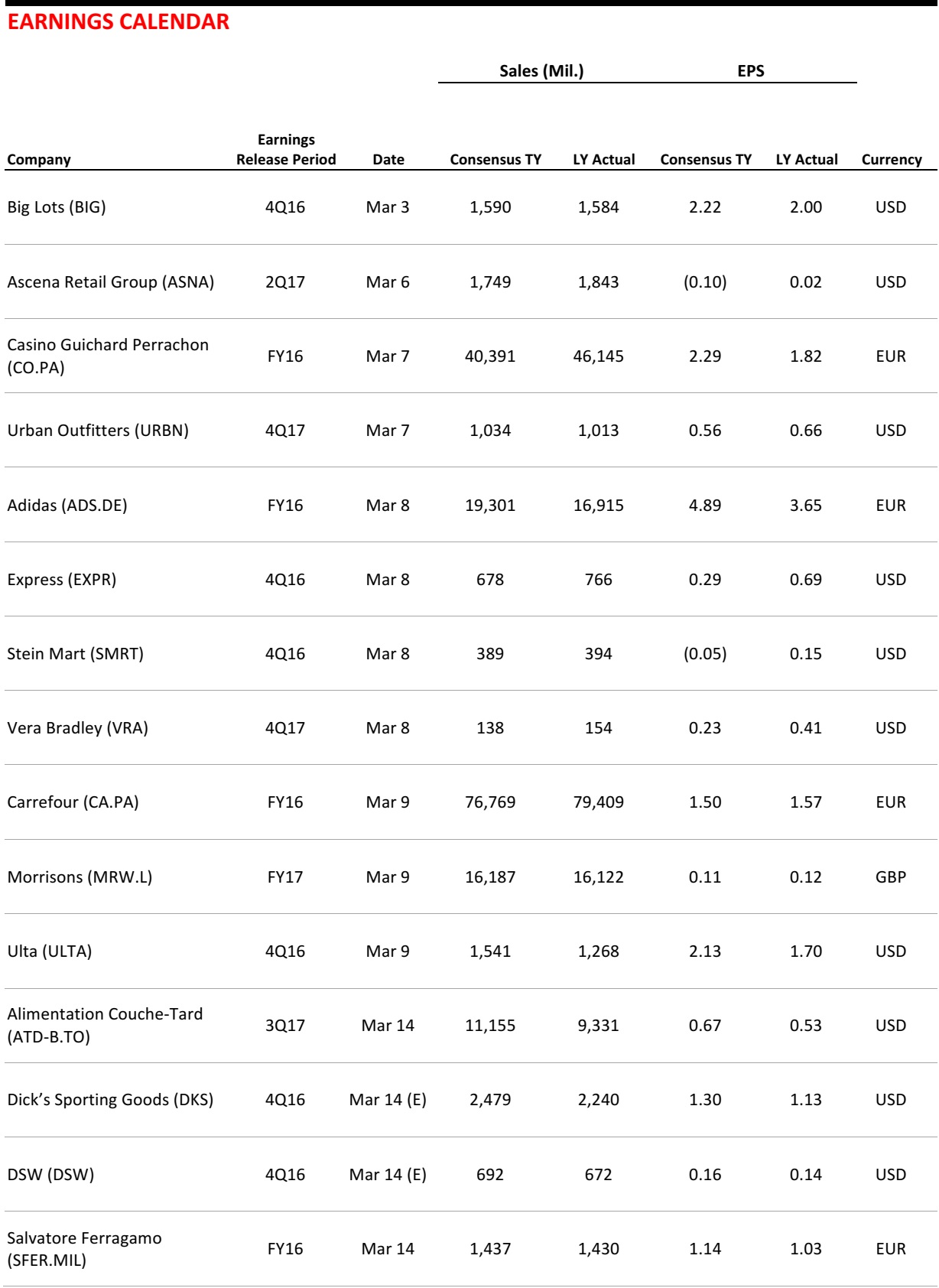

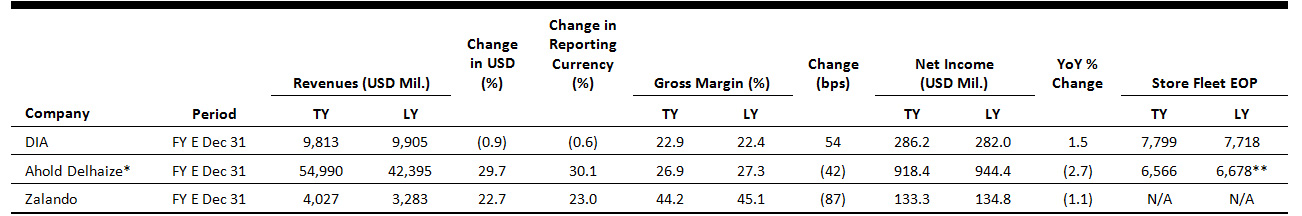

EUROPE RETAIL EARNINGS

*The merger between Dutch grocer Ahold and Belgian supermarket group Delhaize to form Ahold Delhaize came into effect on July 24, 2016. All data above are prepared on an IFRS basis and do not represent the group pro forma. The data represent the former Ahold company for the full year plus the former Delhaize company postmerger, from July 24, 2016.

**As of date of merger, July 24, 2016

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

Tesco to Cut 1,700 Convenience Store Deputy Manager Roles

(February 27) Company press release

Tesco to Cut 1,700 Convenience Store Deputy Manager Roles

(February 27) Company press release

- The UK’s biggest grocery retailer, Tesco, announced that it plans to cut at least 1,700 deputy manager roles across its 1,800 Express convenience stores. The company will create 3,300 shift leader roles, which pay lower salaries, in place of the deputy manager roles.

- Tesco added that it will financially support affected staff that take on shift leader roles. This news comes just weeks after rival grocer Waitrose revealed that it is cutting some 500 jobs and just days after John Lewis said that it is eliminating nearly 400 roles in order to simplify company structures.

Lidl Unveils New Concept Store in France

(February 28) ESMMagazine.com

Lidl Unveils New Concept Store in France

(February 28) ESMMagazine.com

- German discount grocer Lidl has unveiled a new concept store called Loft in Calais, France, where it already has two stores. Loft features wider aisles and more than 1,600 products. The store’s heat-reduction and waste-recycling processes make it environmentally friendly.

- Lidl will test a new concept in the store every Sunday in order to assess consumer demand and said that it has hired a team of students to help with the trials.

Regulator Fines 19 Web Shops in France for Misleading Promotions

(February 24) RetailDetail.eu

Regulator Fines 19 Web Shops in France for Misleading Promotions

(February 24) RetailDetail.eu

- France’s consumer affairs regulator has fined 19 web shops, including those belonging to Zalando, H&M and Amazon, a total of €2.4 million (US$2.5 million). The regulatory body claims that the retailers published misleading promotions on their sites, in some instances increasing prices before offering discounts to make products appear cheaper.

- Amazon, Comptoir des Cotonnieres and Zalando have paid their fines, while H&M, GrosBill Gerard Darel and others have rebuffed the claims. The regulator said that it has been investigating such noncompliant actions over the past few months and that it will continue to watch for malpractice in French online retail.

Boohoo.com Upgrades FY17 Expectations

(February 28) Company press release

Boohoo.com Upgrades FY17 Expectations

(February 28) Company press release

- UK fashion pure play Boohoo.com announced that it expects FY17 revenue growth to come in at around 50%, up from previous guidance of 46%–48%. The company said it expects to deliver an adjusted EBITDA margin at the top end of its previously guided range of 11%–12% for the year ended February 28.

- Boohoo.com also announced that it had completed the acquisition of US retailer Nasty Gal for $20 million, and that it will be consolidated beginning March 1, 2017.

Jones Bootmaker Up for Sale

(February 28) Retail-Week.com

Jones Bootmaker Up for Sale

(February 28) Retail-Week.com

- British footwear retailer Jones Bootmaker has been put up for sale by its owner, turnaround specialist Alteri Investors, which bought the company two years ago.

- Alteri is reported to have invested in new product ranges, a new head office and an improved website for the retailer. In 2016, Alteri put Jones Bootmaker’s sister footwear chain, Brantano, through a prepack administration.

ASIA TECH HEADLINES

Foxconn Is Taking over SoftBank’s Investment Fund in Asia

(February 27) TechCrunch.com

Foxconn Is Taking over SoftBank’s Investment Fund in Asia

(February 27) TechCrunch.com

- Foxconn is taking over SoftBank’s Asia-based tech investment fund. The manufacturing giant, which is responsible for producing Apple’s iPhone and many other tech products, has agreed to buy a majority 54.5% stake in SoftBank Asia Capital in exchange for $600 million.

- The establishment of this joint venture is in line with Foxconn’s overall investment strategy and will enable the company to explore and tap new investment opportunities that will drive its sustainable business development.

Samsung Unveils Two New Tablet Computers

(February 26) The Wall Street Journal

Samsung Unveils Two New Tablet Computers

(February 26) The Wall Street Journal

- At an event in Barcelona this week, South Korean technology giant Samsung introduced two new tablet computers and also offered a glimpse of how it plans to move past last year’s massive Galaxy Note 7 smartphone recall.

- Despite the company’s announcement, the aura of the Galaxy Note 7 battery-fire fiasco hung over the annual Barcelona event, where Samsung has typically released the latest iteration in its flagship Galaxy S smartphone series.

China’s Huawei Battles to Own the Next Generation of Wireless Technology

(February 26) The Wall Street Journal

China’s Huawei Battles to Own the Next Generation of Wireless Technology

(February 26) The Wall Street Journal

- To develop 5G technology, China’s Huawei deploys an R&D staff of 80,000, challenging Europe’s dominance. That could give Huawei a sizable edge at a time when all suppliers have set their sights on 5G, which promises to be a wellspring of revenue by enabling smoother and faster interaction between connected objects.

- Huawei has expanded rapidly in recent years in much of the world, even as its mainstay telecom-gear business has been effectively shut out of the US market. The company has already overtaken Sweden’s Ericsson as the world’s largest supplier of wireless equipment by revenue.

Baidu Says Worst of Advertising Scandal in the Past

(February 24) Financial Times

Baidu Says Worst of Advertising Scandal in the Past

(February 24) Financial Times

- Chinese search engine company Baidu narrowly missed revenue expectations in the final quarter of last year as it worked to reassure investors that the worst of an advertising scandal was behind it. The scandal involved a young man who died after buying an experimental cancer treatment advertised on Baidu.com. Shares rose slightly during after-hours trading in New York last Thursday.

- Baidu is China’s third-biggest Internet company, and it is facing stiff competition as it tries to entice advertisers. Rivals Tencent and Alibaba are proving savvy at attracting mobile app time and valuable user information via their respective social messaging app and online marketplace.

LATAM RETAIL AND TECH HEADLINES

Brazil Retailer GPA Reports Quarterly Loss, Missing Forecasts

(February 24) Reuters.com

Brazil Retailer GPA Reports Quarterly Loss, Missing Forecasts

(February 24) Reuters.com

- GPA, Brazil’s biggest retailer, reported a fourth-quarter net loss of R$29 million (US$9 million) last Friday, missing forecasts for its first profit in seven quarters due to weak supermarket sales and a hefty tax provision.

- The gross profit margin of GPA’s food retail division slipped 2.1 percentage points, to 26.9%, on deeper discounts designed to keep sales growing at the company’s supermarkets and hypermarkets during Brazil’s worst recession in generations.

Mexico Retail Sales Fall by Most in Three Years in December

(February 24) Reuters.com

Mexico Retail Sales Fall by Most in Three Years in December

(February 24) Reuters.com

- Mexican retail sales posted their biggest month-over-month drop in nearly three years in December, official data from the Mexican national statistics agency showed. Retail sales fell by 1.4% in December from November, the biggest drop since January 2014.

- Year over year, sales grew by 9.0% in December. The figure was lower than November’s 11.2%, but higher than December 2015’s 3.4%, indicating a relatively strong 2016 calendar year for the Mexican retail market.

Disburze and Banco Rendimento Introduce New B2B Service to Brazil

(February 28) Finextra.com

Disburze and Banco Rendimento Introduce New B2B Service to Brazil

(February 28) Finextra.com

- Disburze, a paytech company based in New York City that is rewiring how business payments are made, and Banco Rendimento, one of the leading institutions in foreign exchange operations in Brazil, announced the launch of a new business-to-business service in Brazil.

- The new service enables businesses to seamlessly settle invoices in Brazilian reais. Disburze also aims to allow Brazil-based businesses to move funds out of Brazil and into its growing payment network around the world in the future.

Walmart’s 2016 Review in Latin America

(February 21) RetailAnalysis.igd.com

Walmart’s 2016 Review in Latin America

(February 21) RetailAnalysis.igd.com

- Walmex continues to lead in the Mexican market, with a variety of formats delivering sales growth ahead of the market. In 2016 overall, total Mexico same-store sales growth came in at 8.0%, with growth in the fourth quarter up a creditable 7.9%.

- Walmart has placed much focus on reenergizing its operations in Brazil, using a combination of store closures and store refurbishments to help create a store network that appears better equipped to succeed in the longer term.

US Retailers Destock and Restock Faster, Boosting Freight

(February 24) JOC.com

US Retailers Destock and Restock Faster, Boosting Freight

(February 24) JOC.com

Foxconn Is Taking over SoftBank’s Investment Fund in Asia

(February 27) TechCrunch.com

Foxconn Is Taking over SoftBank’s Investment Fund in Asia

(February 27) TechCrunch.com