FROM THE DESK OF DEBORAH WEINSWIG

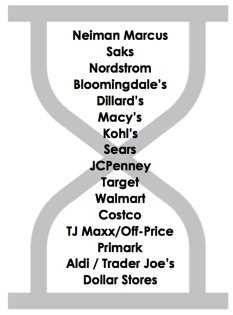

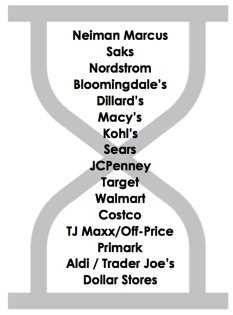

We have for several years pointed to our Weinswig Hourglass Model as an illustration of where outperformance and underperformance are to be found in retail. We think the model is still relevant—and not simply because budget retailers, from Aldi to Primark, have seen sustained growth. At the top end of the hourglass, luxury has recently faced a squeeze, but that is not the only segment at the upper end of the market.

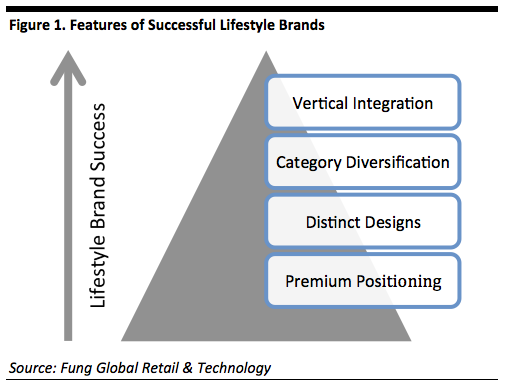

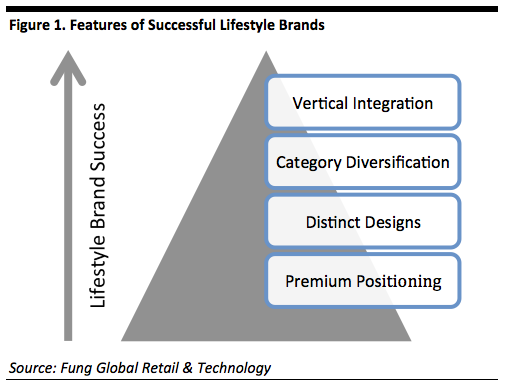

We see another segment of the upper consumer market as one that continues to outperform: lifestyle brands. We define “lifestyle brands” as those combining several characteristics:

- They have a premium, aspirational brand identity that suggests a certain quality of lifestyle. They are often younger brands than heritage luxury brands.

- They offer products with distinct design characteristics: they are brands that can often be recognized by their design and that many customers like to be seen owning.

- Many of the most successful lifestyle brands have expanded beyond their core, original category: for instance, Ted Baker has moved into electronics.

- A further feature of the biggest, most successful lifestyle brands is vertical integration: they operate their own monobrand stores as well as wholesaling through third-party retailers—so they are not just brands; they are retailers. By controlling the retail experience more tightly, this vertical integration provides a further means through which to build the brand.

Prime examples of lifestyle brands include Apple, Ted Baker, Lululemon, Sweaty Betty, Under Armour, Cath Kidston, Fitbit and Joseph Joseph. Brands such as these have been among the stronger performers in recent years, with double-digit compound annual growth in revenues.

The recently reported FY2016 results from Ted Baker point to this outperformance: the company grew revenues by 17.7% profit before tax by 20.3% and EPS by 22.7% in the year through January. This was just the latest impressive set of numbers from this and other lifestyle brands.

We also view the much-documented growth in athleisure apparel as one element of this growing lifestyle segment: the trend is arguably driven by consumers wanting to be seen to be enjoying a lifestyle that is both casual and sporty. Lululemon Athletica is set to announce 4Q and FY15 earnings on March 30, and consensus estimates call for full-year revenue to increase 14%.

This surging demand for lifestyle brands is not incompatible with the budget boom that has marked retail, for two reasons. First, parts of the customer base of each will be distinct—i.e., the customer overlap will be limited. Second, even where there is overlap, we see both segments gaining from mix-and-match shopping: more consumers appear happy to save by shopping at budget channels and treat themselves with purchases of lifestyle brands.

So, we think there are core opportunities to grow lifestyle brands this year and in the coming years:

- Big, established lifestyle brands can continue to diversify into adjacent product categories.

- There is space for new lifestyle brands to emerge in categories such as homewares and home furnishings. Tech and apparel look to be the categories that currently have the heaviest presence of lifestyle brands, mainly because these are highly visible categories, where consumers can “display” their brand purchases.

- There are opportunities to truly bring the “lifestyle” into lifestyle brands through diversification into services, including by licensing brands to third-party service providers.

Under Armour gyms, Lululemon yoga classes, and Fitbit training programs are the kind of services we see as helping to create truly 360-degree lifestyle brands.

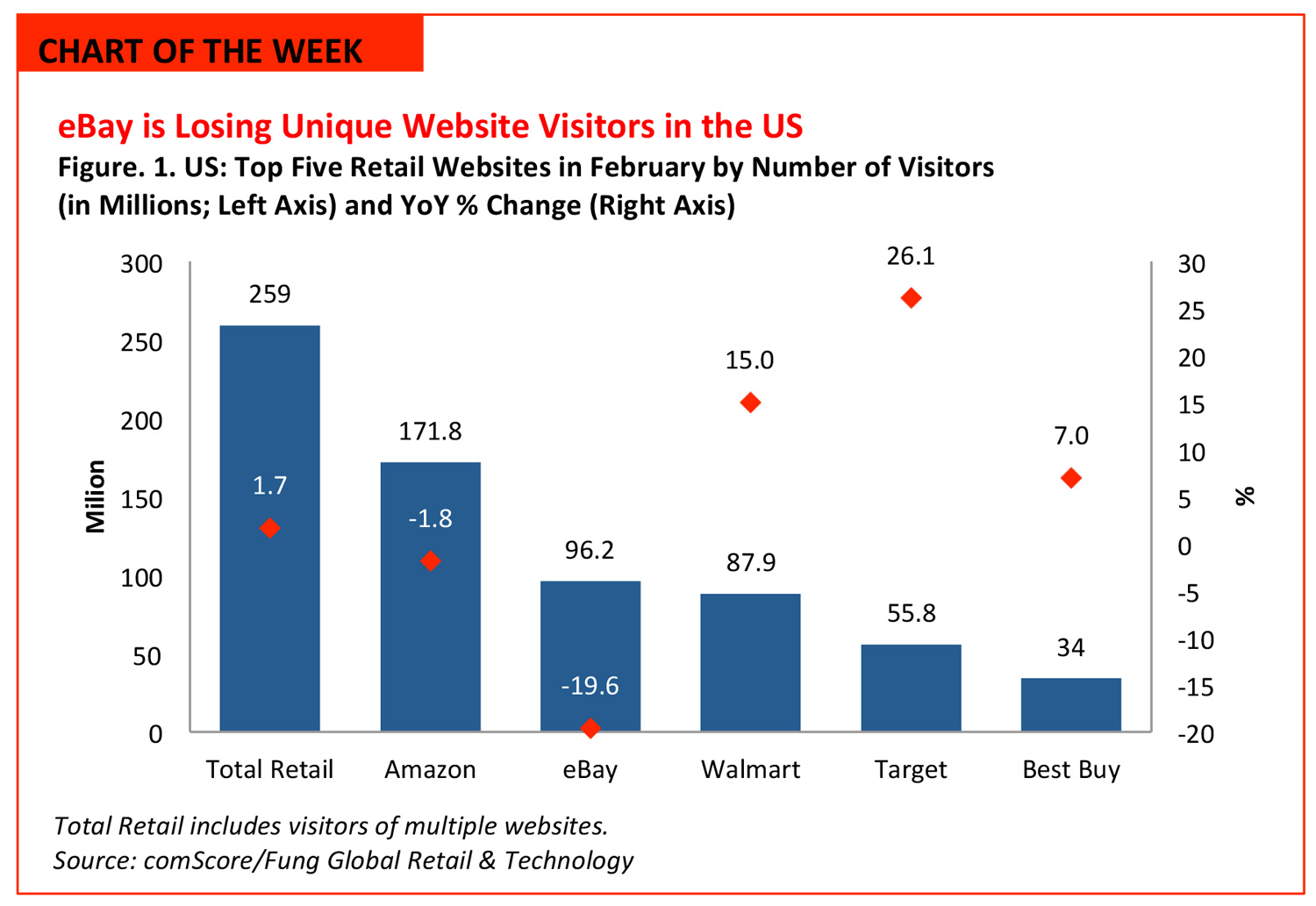

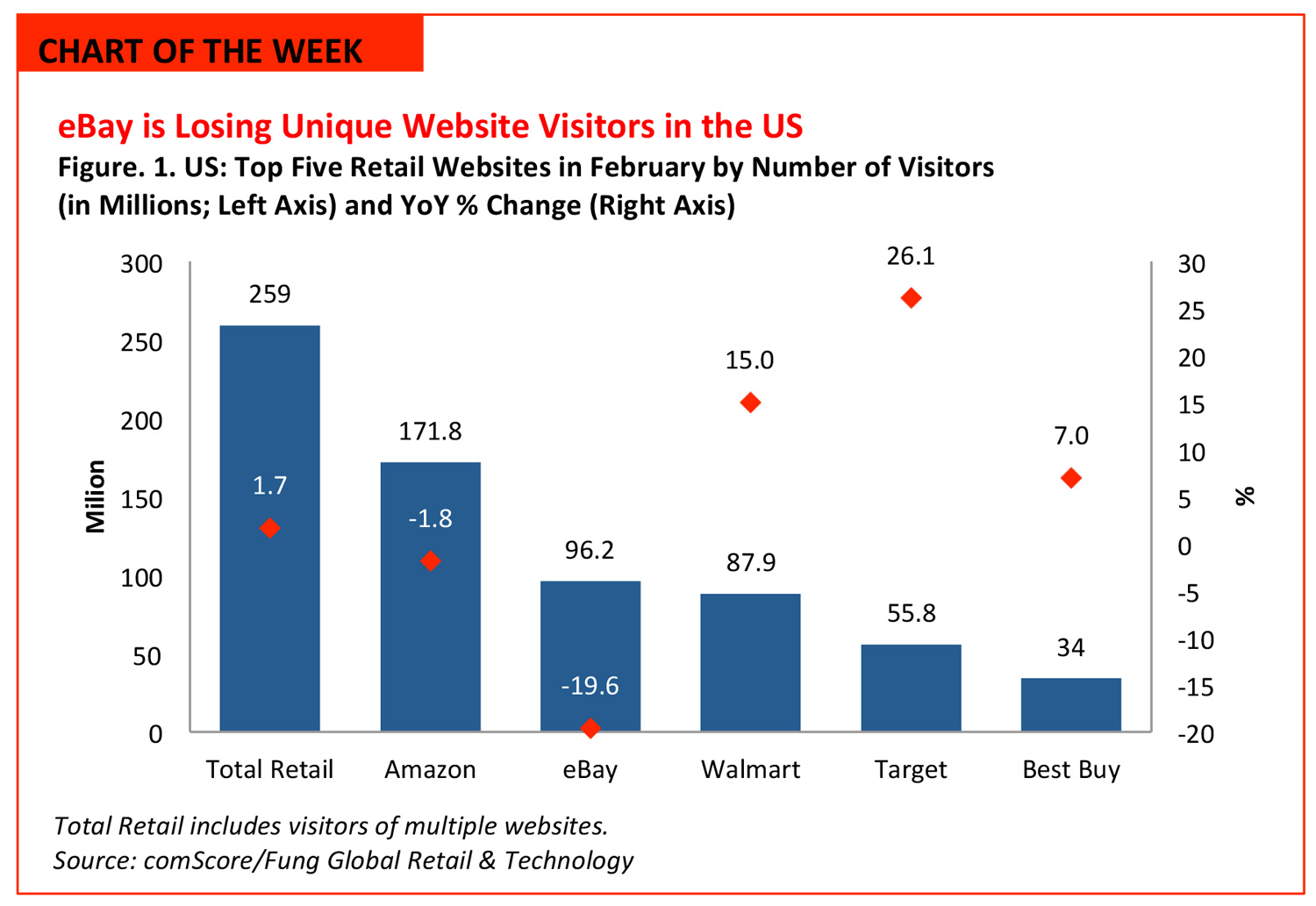

- Total US desktop e-commerce sales (excluding travel, auctions and event tickets) were up by 7.1% year over year in February, according to comScore. During the same period, total unique visitors to all retail websites grew by 1.7%.

- Amazon with 171.8 million unique US visitors on its website in February was the the most visited retail website, well ahead of eBay’s 96.2 million and Walmart’s 87.9 million unique US visitors that month.

- eBay’s US visitor numbers have declined significantly and the company is now working to revitalize its core marketplace business. Both Walmart and Target have enjoyed double-digit growth rates in the numbers of visitors on their websites. For more information, please refer to our report, Feb 2016 US E-Commerce Briefing.

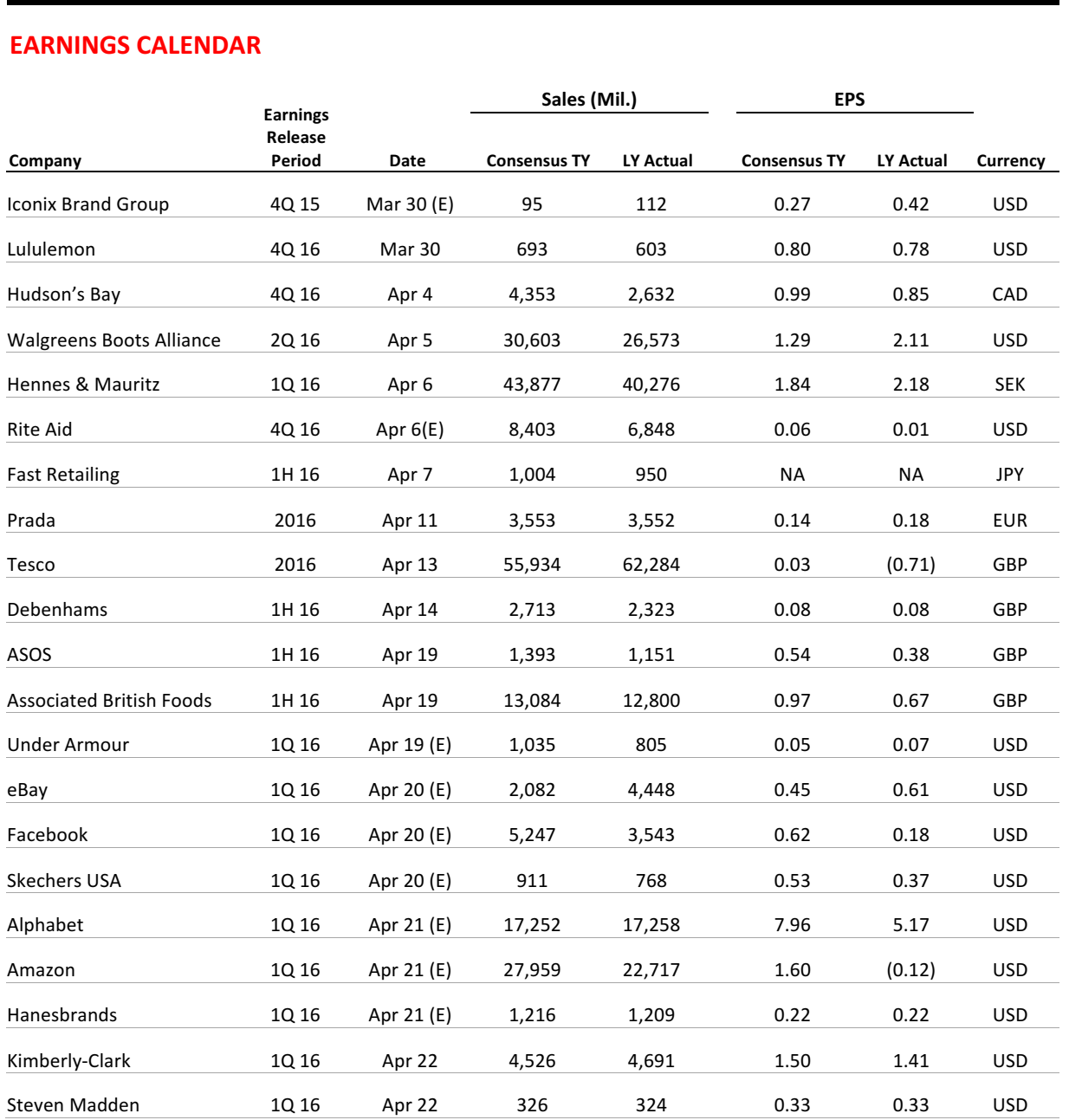

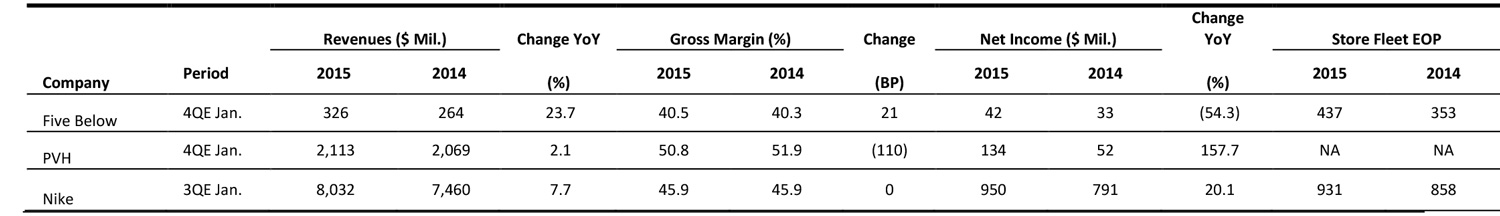

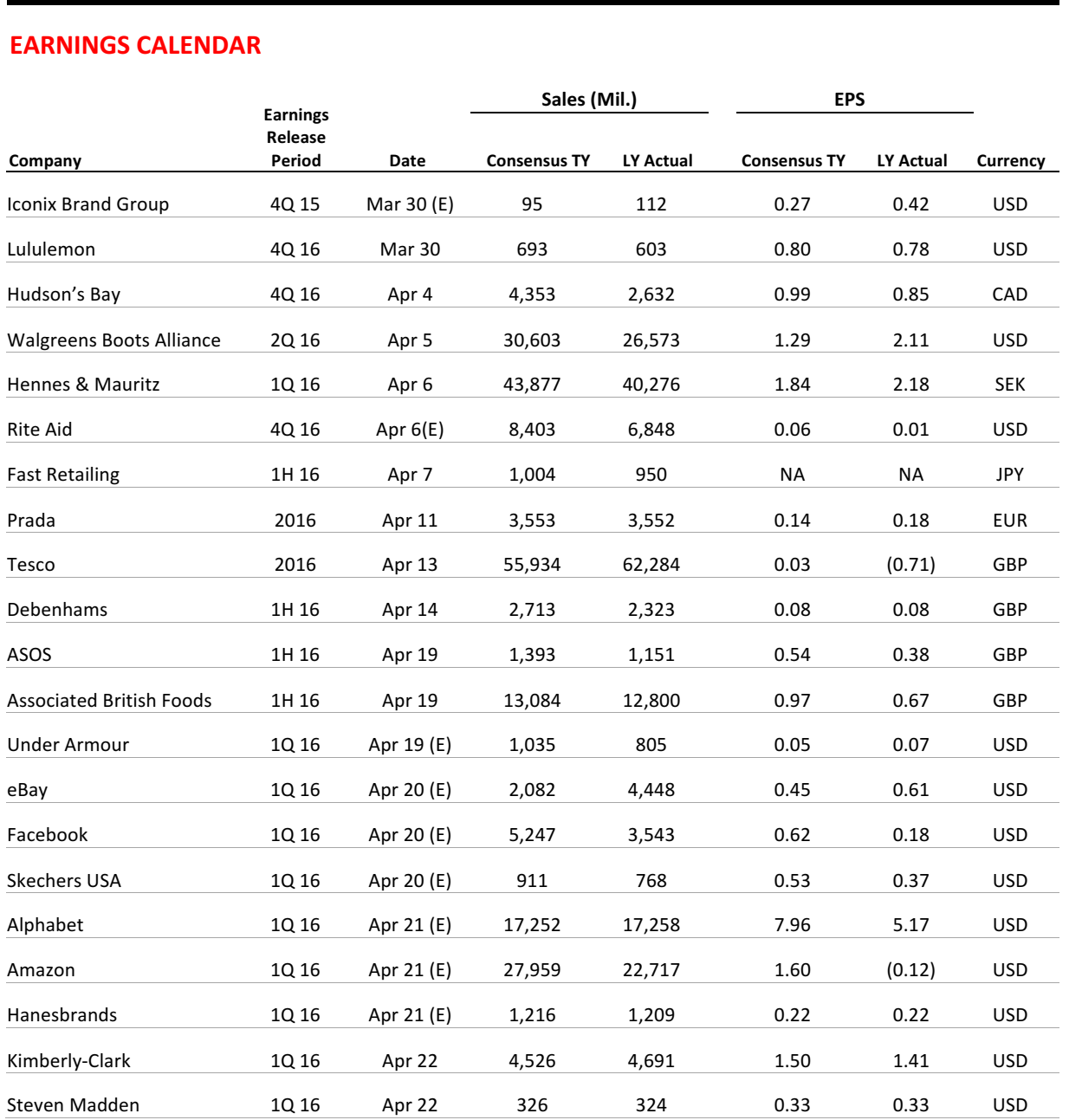

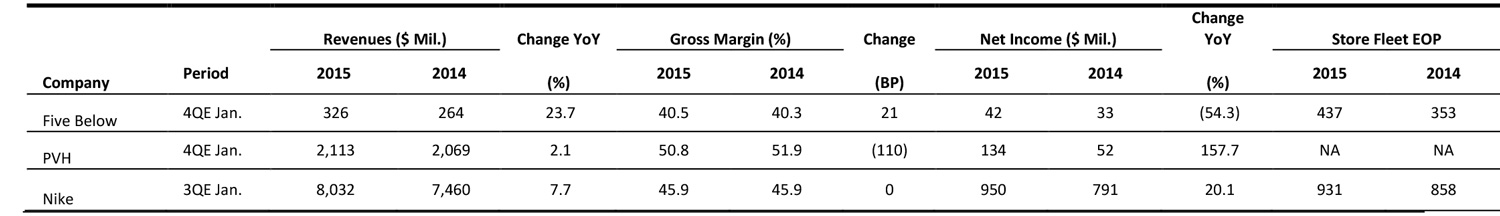

US RETAIL EARNINGS

Source: Company reports

Source: Company reports

US RETAIL HEADLINES

Micharel Kors to Enter Wearable Market

(March 23) BBC News

- Fashion brand Michael Kors announced its foray into the wearable industry at Baselworld 2016. The first item in the new wearable technology accessories line is the Michael Kors Access smartwatch which is powered by Google’s Android Wear platform.

- The touchscreen display includes social media updates, text and email alerts, app notifications and built-in fitness tracking as well as Google’s Smart Help and voice-activation. The Michael Kors Access starts at $395 and will be available fall of 2016.

Starbucks Expands Customer Rewards Program

(March 23) Wall Street Journal

Starbucks Expands Customer Rewards Program

(March 23) Wall Street Journal

- Starbucks is rolling out a program were customers using a branded prepaid Visa card will be able to earn points for free coffee and other perks. The Starbucks prepaid card can be used at any retailer that accepts Visa cards.

- The Starbucks card, which is expected to be available by the end of the year, will give card holders “stars” to be then redeemed at Starbucks cafes. The coffee chain has also teamed up with music-streaming service Spotify and ride-sharing service Lyft to allow those customers to get rewards points that can be redeemed at Starbucks.

Nike Woos Lead Designer Away from Under Armour

(March 22) Quartz

Nike Woos Lead Designer Away from Under Armour

(March 22) Quartz

- Nike has reportedly hired top designer Dave Dombrow away from rival Under Armour. As UA senior vice president of design, Dombrow is credited with the creation of the Stephen Curry sneaker line, which increased footwear sales by 94.5% over the previous year in its fourth quarter. Earlier this year, Morgan Stanley projected that Curry’s line would overtake LeBron James in U.S. sales by the end of this year, reaching $160 million.

- Dombrow is under a non-compete agreement that wouldn’t let him start work for Nike until 2017. His new company’s most popular sneaker line by a wide margin is that of LeBron James.

Apple Unveils Smaller-Screened iPhones, to Expand Apple Pay

(March 21) Bloomberg News

Apple Unveils Smaller-Screened iPhones, to Expand Apple Pay

(March 21) Bloomberg News

- Apple unveiled a new, smaller iPhone that will start at $399, seeking to jump-start sales of its flagship product by enticing users to upgrade, especially in high-growth markets such as China and India.

- The iPhone SE has a 4-inch-screen and incorporates the faster A9 processor that also runs the larger iPhone 6S phones. The iPhone SE will start to ship March 31. The company also announced that it is cutting the price of the cheapest Apple Watch to $299 from $349.

- Apple also announced that it will expand Apple Pay to mobile websites by the end of the year, just in time for the holiday rush. Users will access the service using Safari on iPhones and iPads with Apple TouchID.

Rent the Runway Adds Subcription Service

(March 23) The Washington Post

Rent the Runway Adds Subcription Service

(March 23) The Washington Post

- Rent the Runway launched an application and subscription service this week called Unlimited, which lets users borrow three items of office-suitable clothing at a time for a monthly fee of $139. Chief Executive Jennifer Hyman said customers were seeking outfits more suitable for where they spend most of their time, in the office.

- Unlimited is focused on offering everyday clothes such as tops, blazers and skirts, a change from Rent the Runway’s tradition business of more special-occasion outfits. Unlimited is attractive from a logistics standpoint; previously the company faced time pressure and concentration for special occasion events which tend to be on Friday or Saturday nights. The company will face a crowded subscription apparel market, with businesses such as Trunk Club and StitchFix already dropping regular wardrobe additions on customers’ doorsteps.

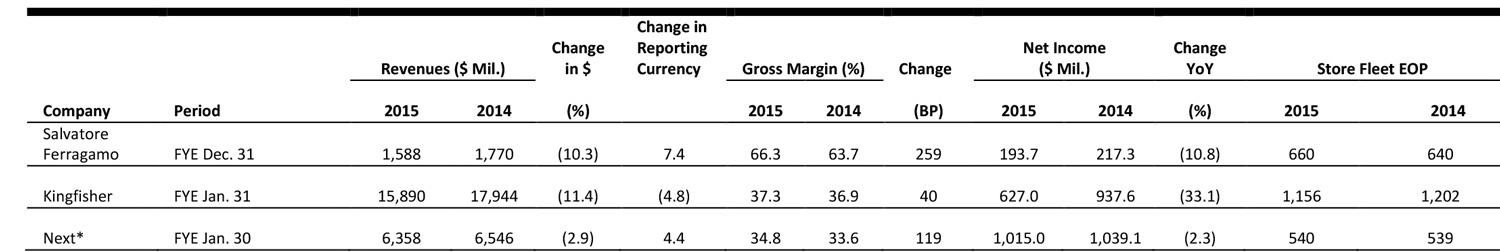

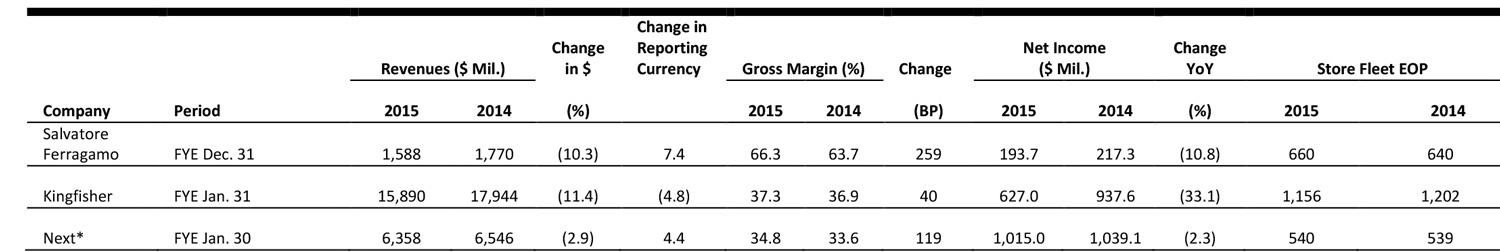

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Tesco Introduces Value Own-Label Ranges, Intensifies War With Discount Grocers

(March 21) retail-week.com

Tesco Introduces Value Own-Label Ranges, Intensifies War With Discount Grocers

(March 21) retail-week.com

- British grocer Tesco has launched an assortment of new budget own-label brands in fresh foods, to compete with hard-discount rivals Aldi and Lidl. The launch covers 76 fresh produce, meat and poultry products under seven new brand names and will reportedly replace Tesco’s existing Everyday Value range in fresh foods.

- The new color-coded packaging uses farm names, such as Nightingale, Redmere, Suntrail and Rosedene Farms for salad, vegetables and fruit, and Woodside, Boswell and Willow Farms for meat and poultry. It is understood that the prices of all products will remain consistent across Tesco’s supermarkets and convenience stores.

Zalando Experiments With Delivery From Stores

(March 21) drapersonline.com

Zalando Experiments With Delivery From Stores

(March 21) drapersonline.com

- Germany-based ecommerce pureplay Zalando, last week delivered its first parcel from a store, in a move to become the platform that connects its brands and its customers. Through its logistics network, Zalando collected and delivered a purchase from Bodycheck, a lifestyle store in Berlin on March 17.

- The online retailer is also testing GPS technology for deliveries to and collecting returns directly from customers, in Amsterdam and Cologne. Apart from improving its logistics and payment solutions, Zalando has been investing heavily in other technology, including the launch of its new “shopping inspiration” app called Fleek.

Eroski’s Recently-Launched App Receives Positive Responses

(March 21) ecommercenews.eu

Eroski’s Recently-Launched App Receives Positive Responses

(March 21) ecommercenews.eu

- Eroski, the Spanish supermarket chain, launched two mobile applications in mid-February which have reached a milestone of 100,000 downloads. The first app, called Eroski Super, allows customers to complete a weekly online purchase in 15 minutes. The orders can be made up to three weeks in advance, and the prepared food is cooked on the day of the delivery to ensure maximum freshness.

- The second app, called Eroski App, is aimed at the retailer’s 2.7 million loyalty club customers. Through the app, customers can avail of lower prices, travel club points and other offers that are exclusive to the club members. Eroski expects 10% of its online sales to be made through the app this year.

Sainsbury’s Emerges Victor In Takeover Race For Home Retail Group

(March 18) theguardian.com

Sainsbury’s Emerges Victor In Takeover Race For Home Retail Group

(March 18) theguardian.com

- Sainsbury’s this week confirmed its bid for Argos-owner Home Retail Growup, after South African retail group Steinhoff pulled out of the takeover race. The British grocer tabled its £1.4 billion ($1.9 billion) bid roughly half an hour before the 5 p.m. deadline set by the Takeover Panel, on March 18.

- Sainsbury’s bid is unchanged from its previous proposal, which perhaps disappointed Home Retail’s shareholders who were hoping that a competing bid from Steinhoff could have resulted in a higher offer. Steinhoff confirmed this week that it had agreed to buy French electronics retailer Darty, which French peer Fnac had planned to acquire.

Mango Unveils Low-priced Collection Aimed At Younger Shoppers

(March 18) retailgazette.co.uk

Mango Unveils Low-priced Collection Aimed At Younger Shoppers

(March 18) retailgazette.co.uk

- Spanish fashion retail brand Mango has launched a new, low-priced collection of casualwear, called #NewPrices, aimed at younger shoppers. The new collection is at least 15% cheaper than Mango’s existing products and is available online and in stores.

- The launch of #NewPrices follows Mango’s decision in January to shift its focus toward fast fashion. The brand, which has been inspired from music events like Coachella, will soon release a lookbook to market its launch further.

ASIA TECH HEADLINES

Japan Companies Seeking to Shield Cars from Hacking

(March 22) Nikkei Asian Review

Japan Companies Seeking to Shield Cars from Hacking

(March 22) Nikkei Asian Review

- Panasonic has developed a device to monitor signals sent between electronic control units inside a car via an internal communications network based on the widely used Controller Access Network protocol. Unauthorized signals are detected and canceled out.

- Ritsumeikan University professor Takeshi Fujino and Mitsubishi Electric have jointly developed security technology that prevents the theft of digital keys for decrypting automotive network signals. The unique characteristics of signals for each semiconductor element are used as keys.

This Test Prep Startup Just Got US$75 Million in India’s Largest Edtech Round Yet

(March 22) TechinAsia

This Test Prep Startup Just Got US$75 Million in India’s Largest Edtech Round Yet

(March 22) TechinAsia

- Originally helping students in India prepare for tests like the GMAT and the GRE, Byju realized the power of the smartphone, and he decided to take his services online, but with a focus on students between primary school and high school.

- Byju Raveendran’s latest round in funding, US$75 million, is not only is the biggest edtech fundraise in India’s history, larger than the funding raised by the top ten-highest funded edtech startups in 2015 combined.

Indian Ride-Hailing App Ola Acquires Mobile Payment Startup Qarth to Expand Ola Money

(March 21) TechCrunch

Indian Ride-Hailing App Ola Acquires Mobile Payment Startup Qarth to Expand Ola Money

(March 21) TechCrunch

- After launching a standalone app for Ola Money in November last year, Indian transportation app Ola has made an acquisition to expand its mobile wallet and payments business: the company has acquired Qarth, a startup that has developed a mobile payments app called X-Pay.

- Ola Money was launched since credit and debit cards are not that ubiquitous. Users were keeping more money in their Ola Money wallets more than what they were spending on rides alone, Ola expanded the service beyond simply rides on its own network.

Grab, Uber’s Biggest Rival in Southeast Asia, Signs Deal with Conglomerate Lippo Group

(March 21) TechCrunch

Grab, Uber’s Biggest Rival in Southeast Asia, Signs Deal with Conglomerate Lippo Group

(March 21) TechCrunch

- Known for its real-estate holdings across Asia, Lippo Group is also making forays into tech businesses. Last year it launched and poured $500 million in MatahariMall, the largest known e-commerce investment in Indonesia so far, targeting sales of $1 billion within two or three years of its launch.

- Grab will provide logistic services for MatahariMall. Grabm which is backed by investors like Didi Kuaidi (China’s largest ride app), GGV Capital, and SoftBank, is reportedly valued at more than $1 billion. Its rivals include Uber and Indonesia-based Go-Jek.

Singapore-based Smart Street Lighting Startup to List on ASX; $5.7M Committed by Investors

(March 18) TechinAsia

Singapore-based Smart Street Lighting Startup to List on ASX; $5.7M Committed by Investors

(March 18) TechinAsia

- GridComm, a Singapore-based startup that builds energy-and-cost-saving ‘smart’ lighting grids, announced that it is completing a backdoor listing bid on the Australian Securities Exchange (AXS).

- Built on top of existing lighting grids, GridComm connects street lights into a network that can be monitored with software. This allows administrators to monitor usage, dim the lights, and save electrical costs. It is deployed in three Indonesian cities and four Chinese cities, with trials ongoing in Singapore, Spain, Russia and Macau.

LATAM RETAIL HEADLINES

U.S. Labor Department Cites Labor Concerns in Peru’s Textile, Apparel Sectors

(March 21) WWD

U.S. Labor Department Cites Labor Concerns in Peru’s Textile, Apparel Sectors

(March 21) WWD

- The U.S. Department of Labor issued a report outlining concerns about workers’ rights in both Peru’s textile and apparel industries. Laborers in Peru, according to the report, do not have the freedom of association and inadequate labor law enforcement.

- Peru and the U.S. have signed a free trade agreement, thus these infringements on workers’ right do not meet the obligations of the Peruvian government. The U.S. government has recommended that the Peruvian government adopt and implement measures to ensure that workers’ rights are recognized and that unionization does not threaten employment, even in the circumstance of short-term contracts.

Honda Postpones New Brazil Plant Until Local Economy Recovers

(March 23) Bloomberg

Honda Postpones New Brazil Plant Until Local Economy Recovers

(March 23) Bloomberg

- The Japanese carmaker has postponed plans to open a plant in Brazil until it sees signs of improvement in the economy. Honda has already invested $250 million in the factory in order to double production capacity in Brazil, though the company is halting construction and hiring until Brazil’s macroeconomic conditions turn around.

- Honda expects sales to decrease 18% this year due to the deepening recession and the company’s upgraded Civic, which comes with a steeper price. Honda has not let any workers go in its existing plant, thus far.

Ecommerce in Brazil Gets More Mobile

(March 18) eMarketer

Ecommerce in Brazil Gets More Mobile

(March 18) eMarketer

- The portion of digital purchases made on mobile phones is increasingly rapidly in Brazil. The share of retail ecommerce orders in Brazil made via mobile devices reached 14.3% in December of 2015, which is up 4.2% from June. This figure does not include sales made via apps.

- In Q415, m-commerce accounted for 18.6% of all e-commerce, which is up from 10.0% in Q414. Brazilians have indicated that they are equally as happy to complete an online purchase no matter what the device.

GE Seeks to Sell Power, Medical Equipment to Cuban Government

(March 21) Wall Street Journal

GE Seeks to Sell Power, Medical Equipment to Cuban Government

(March 21) Wall Street Journal

- General Electric has signed memoranda of understanding with the Cuban government in order to express mutual interest in business opportunities between the company and Cuba. Any and all commercial activity must adhere to U.S. policy and licensing requirements.

- GE is particularly interested in the electric power business in Cuba, where the company could provide its heavy-duty gas turbines for power plants. This would serve as a huge upgrade for the outdated oil-fueled power stations in Cuba.

We have for several years pointed to our Weinswig Hourglass Model as an illustration of where outperformance and underperformance are to be found in retail. We think the model is still relevant—and not simply because budget retailers, from Aldi to Primark, have seen sustained growth. At the top end of the hourglass, luxury has recently faced a squeeze, but that is not the only segment at the upper end of the market.

We see another segment of the upper consumer market as one that continues to outperform: lifestyle brands. We define “lifestyle brands” as those combining several characteristics:

We have for several years pointed to our Weinswig Hourglass Model as an illustration of where outperformance and underperformance are to be found in retail. We think the model is still relevant—and not simply because budget retailers, from Aldi to Primark, have seen sustained growth. At the top end of the hourglass, luxury has recently faced a squeeze, but that is not the only segment at the upper end of the market.

We see another segment of the upper consumer market as one that continues to outperform: lifestyle brands. We define “lifestyle brands” as those combining several characteristics:

Prime examples of lifestyle brands include Apple, Ted Baker, Lululemon, Sweaty Betty, Under Armour, Cath Kidston, Fitbit and Joseph Joseph. Brands such as these have been among the stronger performers in recent years, with double-digit compound annual growth in revenues.

The recently reported FY2016 results from Ted Baker point to this outperformance: the company grew revenues by 17.7% profit before tax by 20.3% and EPS by 22.7% in the year through January. This was just the latest impressive set of numbers from this and other lifestyle brands.

We also view the much-documented growth in athleisure apparel as one element of this growing lifestyle segment: the trend is arguably driven by consumers wanting to be seen to be enjoying a lifestyle that is both casual and sporty. Lululemon Athletica is set to announce 4Q and FY15 earnings on March 30, and consensus estimates call for full-year revenue to increase 14%.

This surging demand for lifestyle brands is not incompatible with the budget boom that has marked retail, for two reasons. First, parts of the customer base of each will be distinct—i.e., the customer overlap will be limited. Second, even where there is overlap, we see both segments gaining from mix-and-match shopping: more consumers appear happy to save by shopping at budget channels and treat themselves with purchases of lifestyle brands.

So, we think there are core opportunities to grow lifestyle brands this year and in the coming years:

Prime examples of lifestyle brands include Apple, Ted Baker, Lululemon, Sweaty Betty, Under Armour, Cath Kidston, Fitbit and Joseph Joseph. Brands such as these have been among the stronger performers in recent years, with double-digit compound annual growth in revenues.

The recently reported FY2016 results from Ted Baker point to this outperformance: the company grew revenues by 17.7% profit before tax by 20.3% and EPS by 22.7% in the year through January. This was just the latest impressive set of numbers from this and other lifestyle brands.

We also view the much-documented growth in athleisure apparel as one element of this growing lifestyle segment: the trend is arguably driven by consumers wanting to be seen to be enjoying a lifestyle that is both casual and sporty. Lululemon Athletica is set to announce 4Q and FY15 earnings on March 30, and consensus estimates call for full-year revenue to increase 14%.

This surging demand for lifestyle brands is not incompatible with the budget boom that has marked retail, for two reasons. First, parts of the customer base of each will be distinct—i.e., the customer overlap will be limited. Second, even where there is overlap, we see both segments gaining from mix-and-match shopping: more consumers appear happy to save by shopping at budget channels and treat themselves with purchases of lifestyle brands.

So, we think there are core opportunities to grow lifestyle brands this year and in the coming years:

Source: Company reports

Source: Company reports Rent the Runway Adds Subcription Service

(March 23) The Washington Post

Rent the Runway Adds Subcription Service

(March 23) The Washington Post