From the Desk of Deborah Weinswig

Retail Revolutions Emanating from Shoptalk

This week, the Fung Global Retail & Technology team attended the second annual Shoptalk conference in Las Vegas. The organizers described it as “the nextgen commerce event” and expected more than 5,000 attendees from more than 40 countries. Those at the conference are exploring disruption in the retail industry ranging from new technologies and business models to changes in consumer preferences and expectations, particularly with regard to how consumers discover, shop and buy.

Day One Takeaways

On the first day of Shoptalk 2017, Deborah Weinswig emceed a startup pitch competition in which 15 innovative early-stage companies vied for two cash prizes of $25,000 each, based on their pitches before a panel of three distinguished judges and an audience. The judges selected one winner and the audience the other. The winners were:

- Returnly, a B2B fintech platform that streamlines the returns experience by offering shoppers instant returns (judges’ selection).

- Myagi, a mobile- and web-based training platform that connects retailers and brands with their sales associates (audience’s selection).

Day Two Takeaways

On the second day of the conference, the main topics of discussion were e-commerce, technology and innovation.

E-commerce companies Amazon and eBay shared their efforts to improve fulfillment speed. Amazon pointed out that instant fulfillment, such as two-hour delivery, could become the norm for e-commerce in the future.

Many retailers are rethinking technologies that can help them run stores more efficiently and engage customers. Lowe’s, for example, is creating a more efficient and engaging shopping experience by introducing autonomous robots at 11 of its retail stores.

Walmart’s e-commerce arm announced the launch of a technology startup incubator in Silicon Valley designed to help identify changes that will reshape the retail experience. Dubbed Store No. 8, the incubator will house startups that are wholly owned by Walmart but run independently.

Day Three Takeaways

On the third day of the conference, the discussion centered on customer lifestyles, physical store environments and the restructuring of retailers’ organizations.

An environmentally conscious and healthy lifestyle has become essential to millennials, and they seek to buy consumer products that are in line with their values. At Shoptalk, there were several emerging companies in the fashion, food and pet sectors that offer such products.

Retailers are breaking up silos in their organizations in order to better serve their customers seamlessly, both online and offline. The CEO of Kohl’s shared the company’s efforts to create a one-view merchandising team that oversees both channels.

Digitally native companies such as Bonobos, Birchbox and Away have moved away from an online-only approach and have started to embrace physical stores, pop-up locations and showrooms so that consumers can engage with their products in person.

Retailers such Target and West Elm are creating new physical environments that enable consumers to interact with their products in a more immersive way.

Please click on the links to read our full coverage of

Day One,

Day Two and

Day Three at Shoptalk.

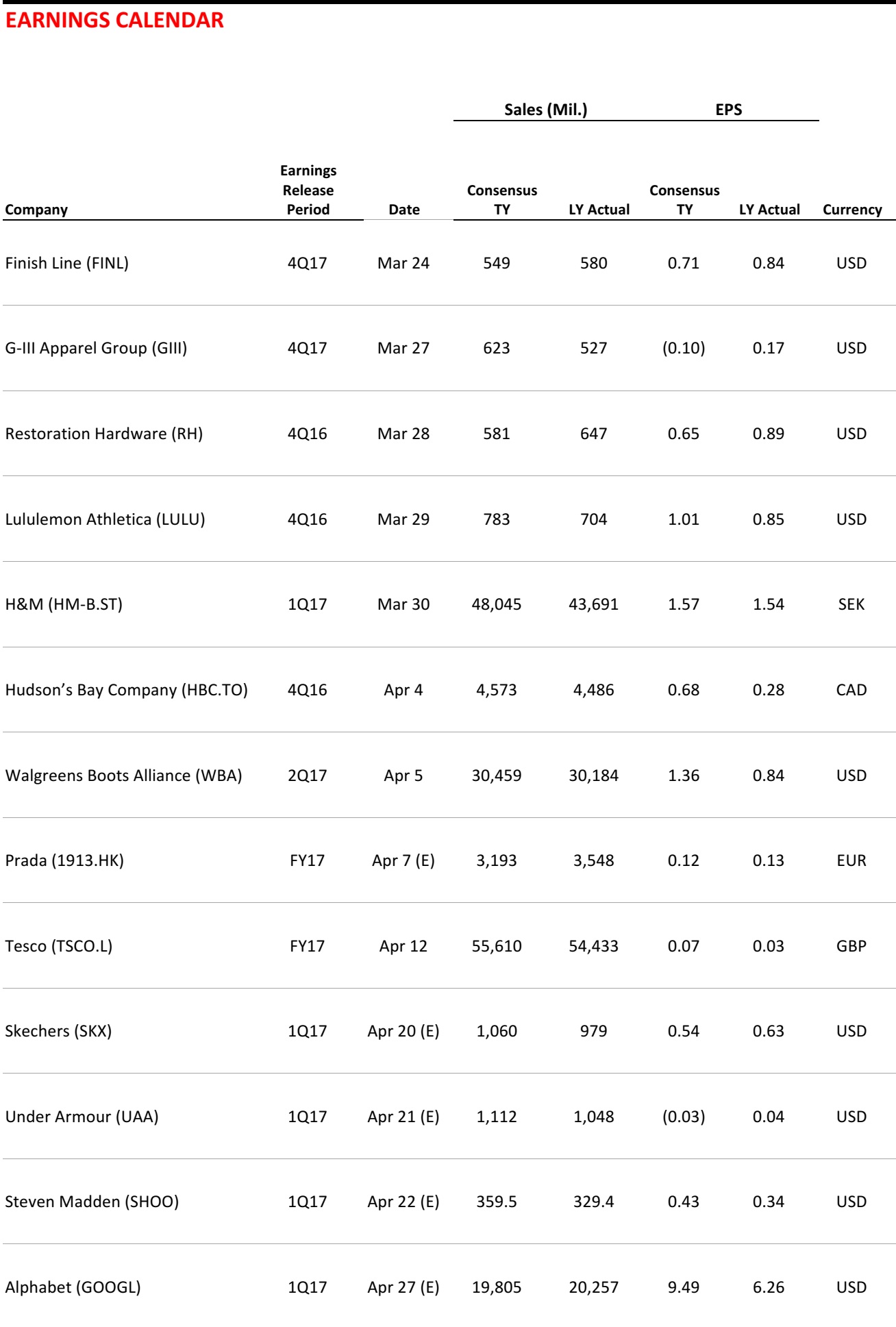

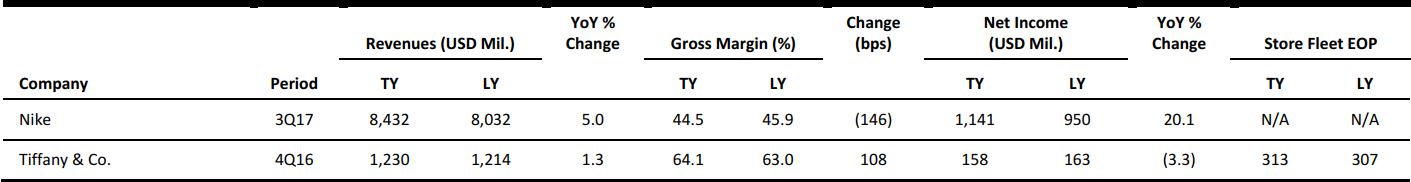

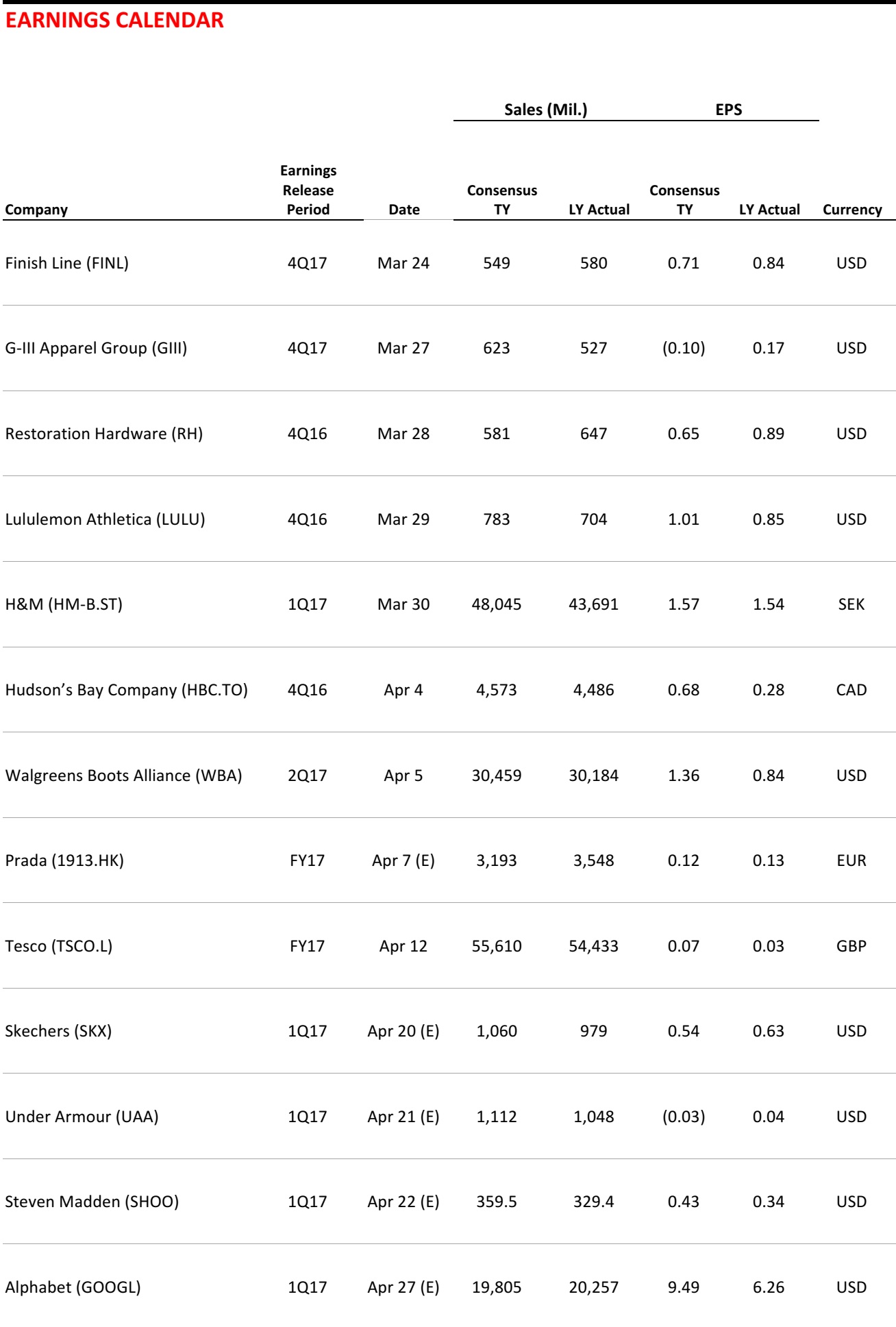

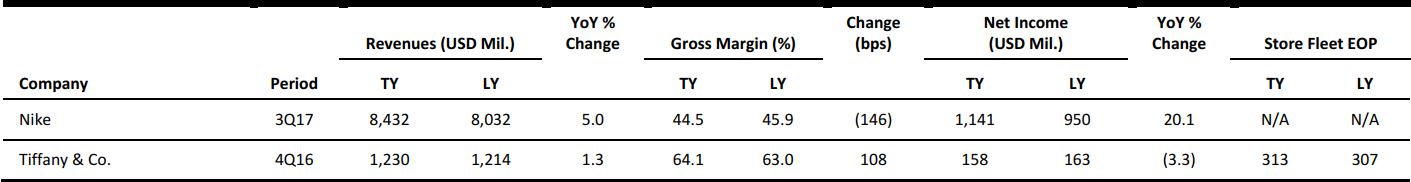

US RETAIL EARNINGS

US RETAIL EARNINGS

Source: Company reports

Source: Company reports

US RETAIL & TECH HEADLINES

Sears, an Icon of US Retail, May Shut Its Doors

(March 22) CBS MoneyWatch

Sears, an Icon of US Retail, May Shut Its Doors

(March 22) CBS MoneyWatch

- Sears, an icon of American retail dating to the 19th century, is in danger of having to close its doors. The company said late Tuesday in a regulatory filing that there is “substantial doubt” it can remain in business.

- According to its most recent quarterly earnings report, Sears lost more than $2 billion last year. Adjusted for onetime charges, its loss was $887 million. The company has lost a total of $9 billion over the past eight years and has total liabilities of more than $13 billion. It has not turned a profit since 2011, according to Reuters.

Border Adjustment Tax Could Crush Millions of Businesses, Retailers Fear

(March 21) CNBC.com

Border Adjustment Tax Could Crush Millions of Businesses, Retailers Fear

(March 21) CNBC.com

- Amid the battle over tax reform, some small businesses that import goods are focused on a key proposal in the House Republican blueprint, the border adjustment tax, which levies a 20% tax on imports. Certain retailers who rely on getting their goods from overseas are dreading the possible repercussions.

- Economists in support of the proposal argue that the dollar will strengthen to offset costs to retailers, meaning consumers will not be hit with higher taxes in stores. One of the most outspoken critics of the proposal has been the National Retail Federation, the world’s largest retail trade organization, which warns that the tax would “crush” small retailers.

Grocery Shopping Is About to Change Dramatically

(March 21) Forbes.com

Grocery Shopping Is About to Change Dramatically

(March 21) Forbes.com

- The shift to healthier eating has already changed grocery retail. There is more emphasis on fresh foods, prepared foods, organics and foods considered “free from” artificial flavors or ingredients. This move to cleaner eating has migrated from certain geographic and demographic pockets and taken off throughout America.

- Retailers from Kroger to Walmart and Aldi have increased their offerings in these categories, driving prices down and increasing US consumers’ access to healthy foods. But this kind of repositioning among grocers will result in more consolidation, particularly among the remaining independent and regional retailers.

Retail Store “Bubble” Has Burst and CEOs Search for Answers

(March 18) The Wall Street Journal

Retail Store “Bubble” Has Burst and CEOs Search for Answers

(March 18) The Wall Street Journal

- US retailers are looking for ways to deal with a problem that has no simple fix: too many stores. Once considered a competitive advantage, large store footprints have now become a burden for many chains as more shopping moves online.

- Declining foot traffic and falling profit margins have forced many chains to scale back. The Limited, RadioShack owner General Wireless Operations and Gander Mountain have filed for bankruptcy protection this year, and department store operators, including Macy’s, Sears and JCPenney, are closing hundreds of locations.

High and Low-End Shops Defy US Retail Gloom

(March 16) Financial Times

High and Low-End Shops Defy US Retail Gloom

(March 16) Financial Times

- The missing middle class was on display last week as retail earnings showed growth at both the high and low ends of the shopping spectrum. Williams-Sonoma beat earnings estimates, and discount retailer Dollar General beat estimates for sales growth.

- Both retailers performed well during the holiday shopping season. Williams-Sonoma CEO Laura Alber said it was “one of the best” for the company, which has been hit by slower consumer spending and rising competition, forcing it to repeatedly trim the top end of its full-year sales and earnings forecasts in recent quarters.

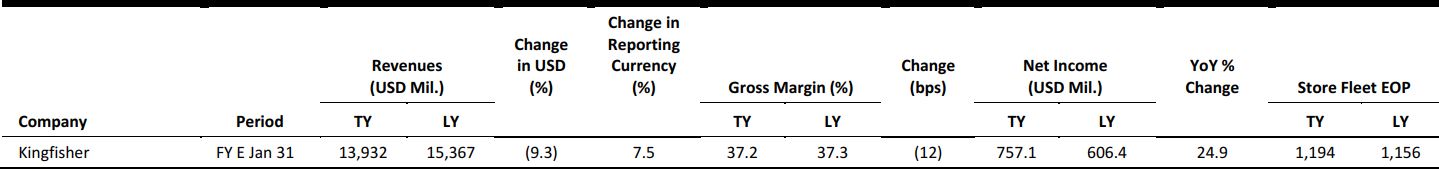

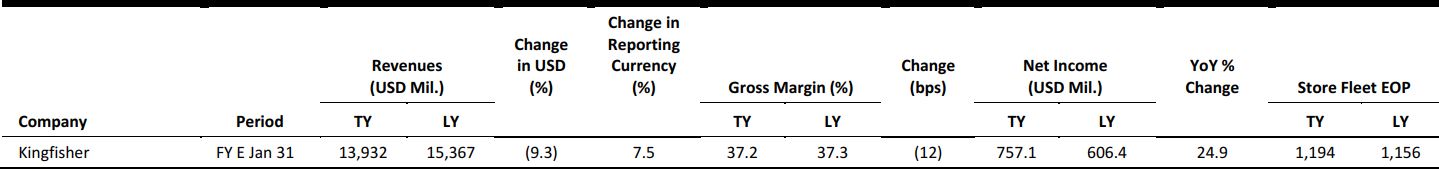

EUROPE RETAIL EARNINGS

Source: Company reports

Source: Company reports

EUROPE RETAIL HEADLINES

UK Retail Footfall Falls by 1% in February

(March 20) Press release

UK Retail Footfall Falls by 1% in February

(March 20) Press release

- Total retail footfall in the UK fell by 1% year over year in February, according to the latest data from the British Retail Consortium and Springboard. The rate was below the three-month average of (0.8)%.

- Footfall in retail parks and shopping centers declined by 1.6% and 2.6%, respectively. High-street stores saw footfall increase slightly, by 0.1%, in February.

The White Company Considers US Expansion with First Store in New York

(March 20) RetailGazette.co.uk

The White Company Considers US Expansion with First Store in New York

(March 20) RetailGazette.co.uk

- British fashion, furniture and lifestyle retailer The White Company is set to open its first store in the US this summer, on Fifth Avenue in New York City. The retailer will open additional stores across New York State, New Jersey and Connecticut.

- The White Company already has an online presence in the US and news of the expansion follows the retailer’s recent reporting of “significant growth” in its American e-commerce business.

Buyout Funds Line Up Bids for The Body Shop amid Pricing Challenges

(March 20) UK.Reuters.com

Buyout Funds Line Up Bids for The Body Shop amid Pricing Challenges

(March 20) UK.Reuters.com

- Initial bids to acquire The Body Shop from L’Oréal suggest that the beauty major may earn less than it had expected from the auction.

- Earlier this month, L’Oréal valued The Body Shop at close to €1 billion (US$1.1 billion), but most investors have valued the company at less than €700 million (US$756.6 million). The ethical beauty products retailer has recently been challenged by weakening sales and profits.

Tesco to Appoint Two New Executives as International Chief Departs

(March 20) Company press release

Tesco to Appoint Two New Executives as International Chief Departs

(March 20) Company press release

- Trevor Masters, CEO of Tesco International, is set to leave the company after nearly 40 years. He will be replaced by two executives.

- Tesco said that the two new roles, based in Asia and Central Europe, would “give greater focus to the two parts of [its] international business.”

Belgium’s Colruyt Group Launches Single Loyalty Card for Every Store

(March 20) RetailDetail.eu

Belgium’s Colruyt Group Launches Single Loyalty Card for Every Store

(March 20) RetailDetail.eu

- Belgian grocery retailer Colruyt Group will introduce a single loyalty card and app on April 4 to replace the existing distinct loyalty cards and apps it provides for shoppers at each of its store banners.

- The new loyalty card and app, called Xtra, will be used by nearly 4 million customers at its 600 stores, websites and pickup locations in Belgium and Luxembourg.

South Korea’s Netmarble Seeks to Raise Up to $2.4 Billion with IPO

(March 20) Financial Times

South Korea’s Netmarble Seeks to Raise Up to $2.4 Billion with IPO

(March 20) Financial Times

- Netmarble Games, the world’s third-largest maker of mobile games, is seeking to raise up to KRW 2.7 trillion (US$2.4 billion) in an IPO as it looks to fund aggressive global expansion in a highly competitive market.

- The company, which is Asia’s fastest-growing mobile games company, has found success in the region with its role-playing mobile games featuring Marvel characters. Sales jumped 40%, to KRW 1.5 trillion (US$1.3 billion), last year, while net profit rose by 24%, propelled by popular mobile games such as Seven Knights, Everybody’s Marble and Marvel: Future Fight.

Samsung’s S8 Gets Its Own Artificial Intelligence (AI) Assistant to Challenge Apple’s Siri

(March 20) Bloomberg.com

Samsung’s S8 Gets Its Own Artificial Intelligence (AI) Assistant to Challenge Apple’s Siri

(March 20) Bloomberg.com

- Samsung Electronics’ upcoming Galaxy S8 will feature a Siri-like digital assistant that studies user activity to offer helpful tips and information as Samsung seeks to challenge rivals such as Apple in mobile AI.

- The Galaxy S8 is to be unveiled later this month. It sports a side button that can activate a digital assistant called Bixby. Digital assistants have become popular in recent years as Silicon Valley has sought to embed AI deeper into a plethora of devices.

Flipkart to Raise $1 Billion, with Plans for $1 Billion More

(March 20) Bloomberg.com

Flipkart to Raise $1 Billion, with Plans for $1 Billion More

(March 20) Bloomberg.com

- Flipkart has completed a $1 billion fundraising, and it aims to raise as much as $1 billion more over the next few months, according to people familiar with the matter. The funds would give India’s largest e-commerce company the capital to battle back against rising competition.

- The 10-year-old startup is fighting for its life against Amazon and other rivals looking for a piece of the fast-growing Indian market. The latest fundraising shows that investors believe Flipkart has a good chance of beating back competitors, despite the current environment being dismal for capital raising and Flipkart struggling with its own internal difficulties.

Alibaba-Backed Payments Startup Paytm Takes a Big Step into Canada

(March 16) Bloomberg.com

Alibaba-Backed Payments Startup Paytm Takes a Big Step into Canada

(March 16) Bloomberg.com

- Paytm, the Indian mobile payments startup backed by Alibaba Group, has begun its global expansion by launching a mobile bill and tax payment service in Canada. Paytm’s Canadian smartphone app lets users pay their phone, cable, Internet and utility bills as well as their insurance and property taxes.

- Paytm already runs a team of data scientists and engineers in Toronto who are focused on building payment and e-commerce technologies. Paytm Labs, the company’s research division, uses big data, AI and machine learning to build products.

LATAM RETAIL AND TECH HEADLINES

Carrefour to Speed Up Convenience Expansion in Brazil

(March 15) RetailAnalysis.igd.com

Carrefour to Speed Up Convenience Expansion in Brazil

(March 15) RetailAnalysis.igd.com

- French multinational retailer Carrefour plans to open 70 Express convenience stores in Brazil in 2017. Carrefour already has around 70 convenience stores in São Paulo. It is planning an IPO in Brazil this year and will use some of the money raised to fund expansion.

- Carrefour launched the convenience format in Brazil in 2014, and it has grown rapidly. Overall sales from the Express format account for less than 1% of Brazilian sales, but analysts believe there is great opportunity for growth. Expansion to other parts of Brazil is possible in the longer term.

Capgemini to Launch Innovation Center in Brazil

(March 20) ZDNet.com

Capgemini to Launch Innovation Center in Brazil

(March 20) ZDNet.com

- IT outsourcing and consultancy firm Capgemini is set to launch a new innovation center focused on the development of digital and cloud services for Brazilian clients. The site will be based in São Paulo and will initially employ 120 professionals. The company has 10 other excellence centers worldwide.

- The innovation center—which is the company’s first in Latin America—is part of Capgemini’s plans for increased investment in Brazil. The center will be working on digital transformation projects and will be supported by a dedicated São Paulo–based data center that was announced last year.

Social Startup Beek Eyes Latin America E-Commerce Future

(March 15) Pymnts.com

Social Startup Beek Eyes Latin America E-Commerce Future

(March 15) Pymnts.com

- Mexico City–based Beek is an early-stage tech startup that has built a social network for readers. Beek is popular in Latin America and currently reports about 250,000 monthly active users. It allows users to recommend, rate and review books using emoji and to access reviews of others on its mobile app, website and YouTube.

- The company hopes to eventually be able to integrate with book lists on Amazon, iBooks or Google Play Books. These integration plans are just the beginning for Beek. The company seeks to grow its presence as a source of user-generated online reviews across Latin America.

Walmart Boosts Investment in Mexican Market

(March 17) AndNowUKnow.com

Walmart Boosts Investment in Mexican Market

(March 17) AndNowUKnow.com

- Walmart’s Mexican subsidiary, Walmex, announced that it plans to sizably increase its capital expenditures. Walmex will invest in new store openings and remodels and in efforts to bolster the company’s logistics and online presence in the region.

- The company is planning to pour MXN 17 billion (US$863 million) into Mexico this year—up 19% from 2016. The investment is part of an ongoing, 10-year plan to double annual sales from 2014 to 2024. Walmex sales grew by 12% last year, to around $27 billion. The company currently operates 3,029 stores in the region—including 735 in Central America.

US RETAIL EARNINGS

US RETAIL EARNINGS Source: Company reports

Source: Company reports Border Adjustment Tax Could Crush Millions of Businesses, Retailers Fear

(March 21) CNBC.com

Border Adjustment Tax Could Crush Millions of Businesses, Retailers Fear

(March 21) CNBC.com

Source: Company reports

Source: Company reports Social Startup Beek Eyes Latin America E-Commerce Future

(March 15) Pymnts.com

Social Startup Beek Eyes Latin America E-Commerce Future

(March 15) Pymnts.com