FROM THE DESK OF DEBORAH WEINSWIG

This week, the Fung Global Retail & Technology team attended panel discussions, met leaders from several startups and saw interesting products on display at the Interactive segment of the 2016 South by Southwest (SXSW) festival in Austin, Texas. The festival focuses on the convergence of music, film and emerging technologies and runs for nine days every year. Below, we summarize some of the panel discussions we attended.

The panelists at the “Culture: The New Currency of Retail” discussion noted that although e-commerce receives a significant portion of our attention, it is still just a $340 billion market. Brick-and-mortar retail, by contrast, is a $4.7 trillion market. The panelists argued that retailers are not selling just products; rather, they are selling culture, which they referred to as “emotional ROI.”

“The $5 Trillion Question: What’s the Future of Retail?” addressed the outlook for the retail industry in 2025. Ultimately, retailers need to put their focus on the shopping experience, rather than on retail, the panelists concluded. They noted that shopping can be improved via the customer experience and personalization.

At the “Neiman Marcus Innovation Lab—The History, the Memory Mirror, and What’s Next” panel, a Neiman Marcus executive discussed the Memory Mirror, which takes lets customers take photographs while trying on clothes to see how they fit from all angles, and share the images with friends and family, too.

In a panel called “Future of Retail: Story and the New Paradigm,” Story founder Rachel Schechtman discussed her unique concept store. Story, which is supported by a sponsorship model, uses the retail space as a media channel; the store’s “editors” curate relevant content for customers.

This year’s SXSW also featured its own accelerator pitch competition, and nearly 100 startups pitched their businesses in the areas of enterprise and smart data, entertainment and content, health and wearables, the innovative world, payments and fintech, and virtual reality. Below are the winners in each of the six categories.

- Enterprise and Smart Data: Parknav provides real-time, on-street parking availability data to automotive, fleet, real estate and Internet companies.

- Entertainment and Content: PopUp Play offers a tablet that kids use inside the store to draw their creations. The company then prints a live version of their work and ships it to their home.

- Health and Wearables: MUrgency uses mobile technology and networks to make emergency medical responses available to anyone, anytime, anywhere, via a mobile phone or wearable.

- The Innovative World: Rorus makes the Filter Pack, the first comprehensive solution for carrying and instantly purifying drinking water; it removes both biological and chemical contaminants.

- Payments and Fintech: Chroma.fund is a blockchain-based exchange for trading stocks and bonds issued by early-stage companies.

- Virtual Reality: Splash is an iOS app that captures 360-degree video on a smartphone in seconds and enables users to share it on any social network as well as view it in virtual reality.

All kinds of wearable technologies were on display at SXSW. Items that caught our eye included the

Augmented Jacket, a smart and fashionable garment that includes navigational technology—feathers on the shoulder ruffle up when the wearer faces north; the

Fall, a garment that sheds its fabric panels over time to mimic falling leaves; and the

Vessel, a garment that can monitor the wearer’s actions and physical well-being, and change color depending on different physical conditions.

This is only a small taste of what was on display at SXSW 2016. Our team looks forward to reporting from other events throughout the year.

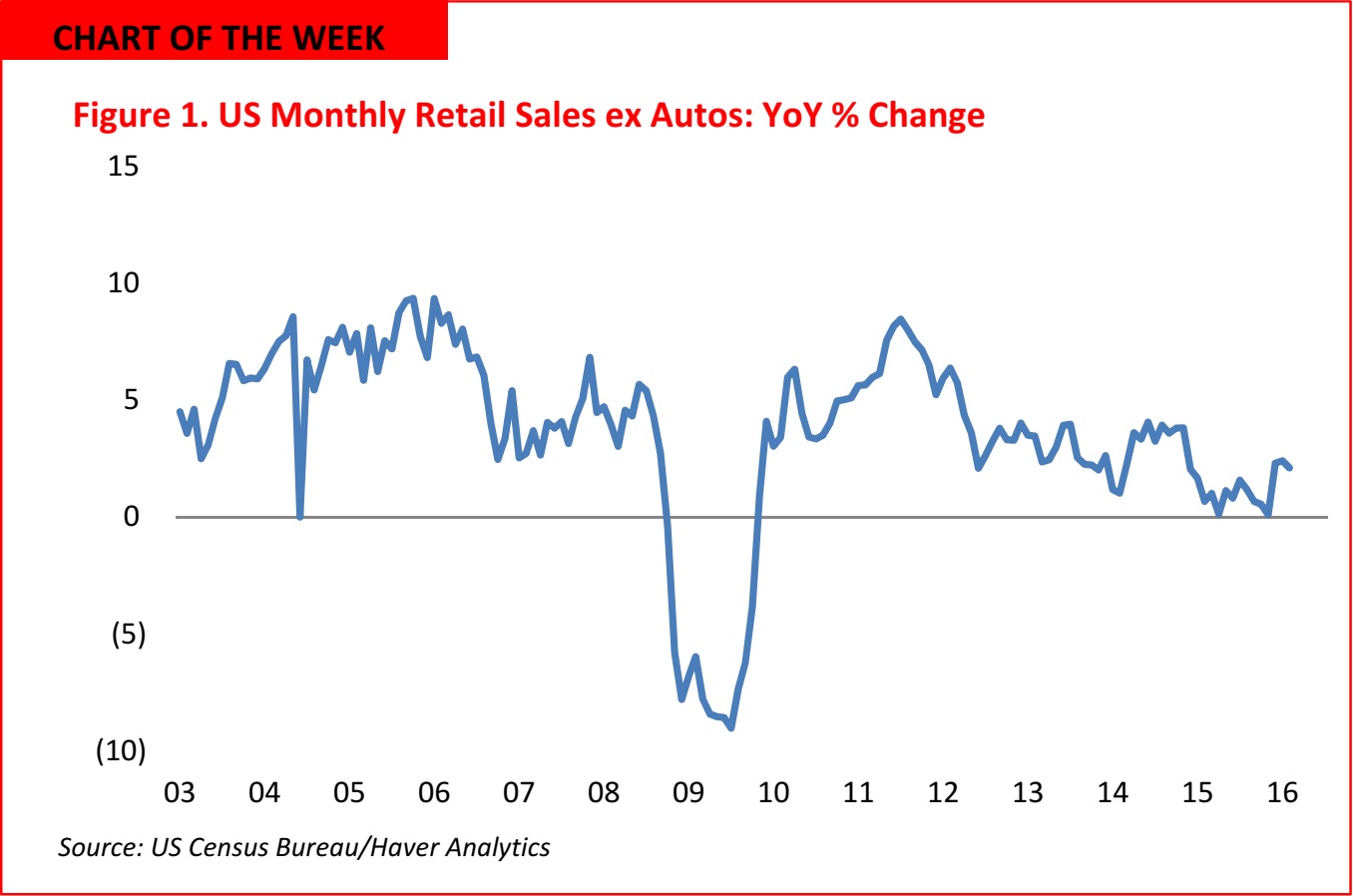

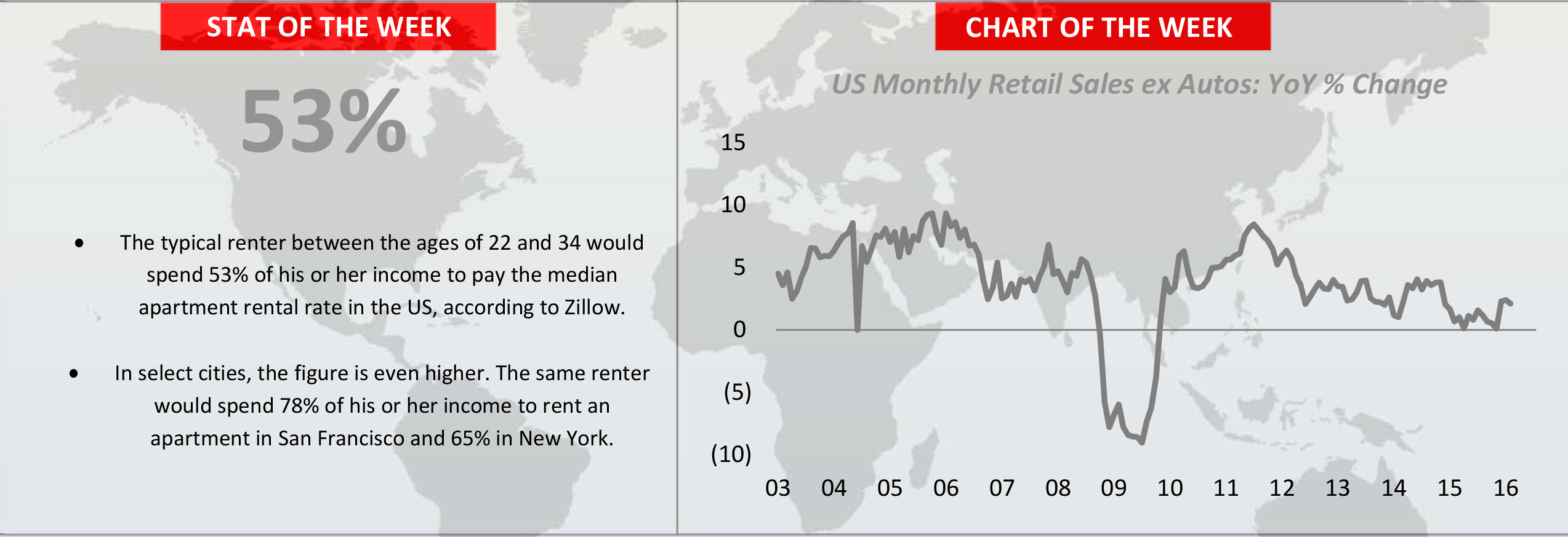

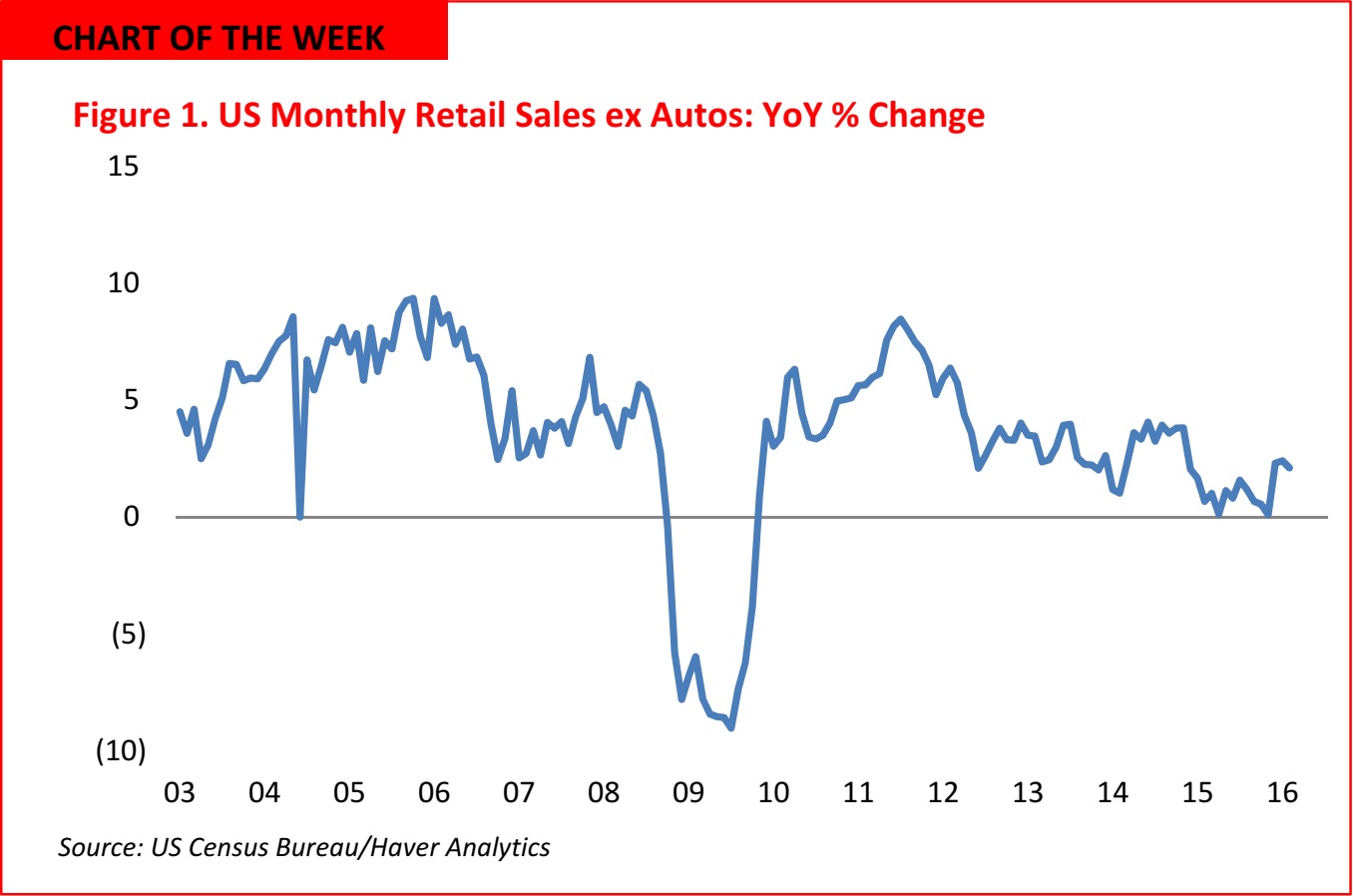

- US retail sales dipped in February 2016. Month over month, total retail sales and sales excluding autos both dropped by 0.1%. January’s sales figure was revised down sharply, to a 0.4% month-over-month decline versus a predicted increase of 0.2%. The February figures represented a continued decrease in retail sales since the beginning of 2016.

- Categories including motor vehicles, furniture, electronics, groceries and department stores dropped in February, although shoppers spent more on clothing and sporting goods. Consumers spent less on furniture and home goods for the second consecutive month. Grocery store sales declined, while restaurants and bars saw higher sales, indicating a greater consumer preference for dining out than for dining in.

- Following the release of the February retail data and the downward revision of the January figures, major investment banks downgraded their first-quarter US GDP forecast to around 2% from around 2.4%.

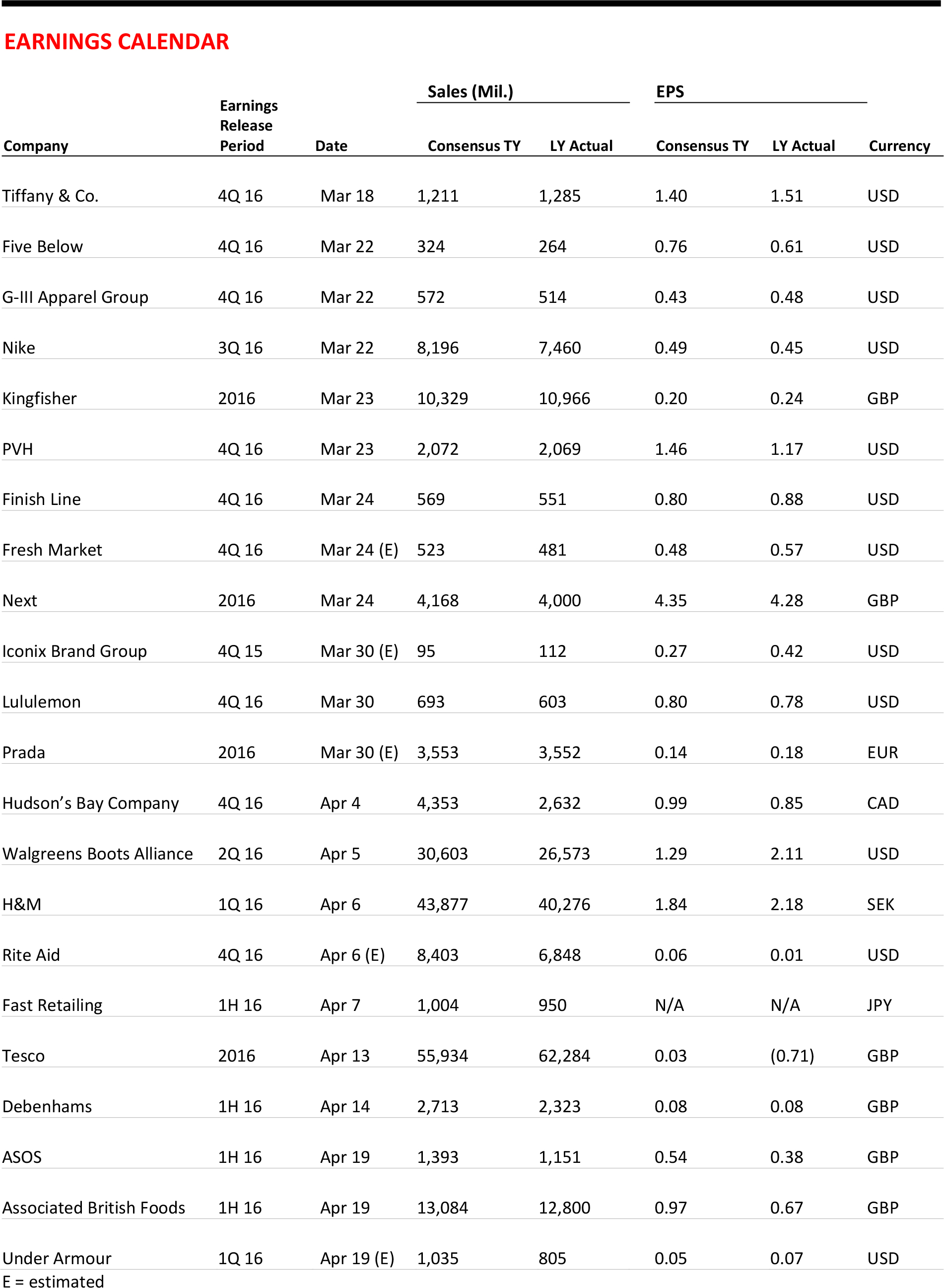

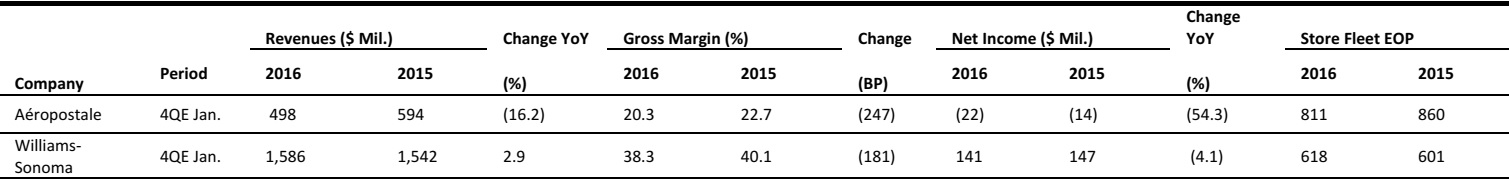

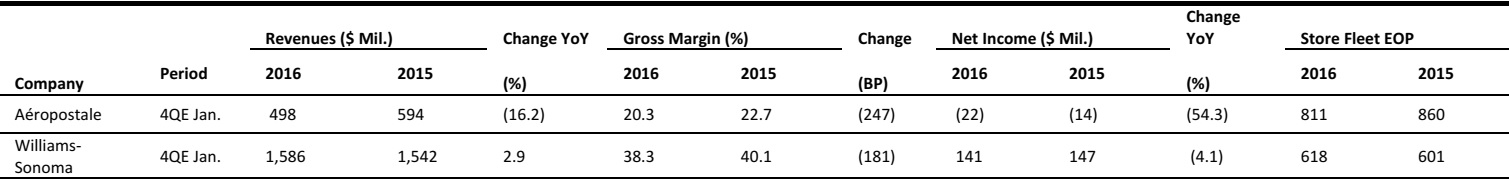

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Shops to Showrooms: Why Some Firms Are Opening Shops with No Stock

(March 12) The Economist

Shops to Showrooms: Why Some Firms Are Opening Shops with No Stock

(March 12) The Economist

- At the Bonobos shop on Fifth Avenue in Manhattan, shoppers can survey racks of clothes, try on shirts and trousers, and then decide which items to purchase. But they cannot actually buy any clothes in the store.

- Brick-and-mortar stores are in the throes of an identity crisis. The growing threat from online shopping has spurred some physical retailers to do more than just sell goods. That is why Bonobos outlets have no stock to sell; the idea is to divorce the purchase of a product from its distribution.

The North Face to Launch Insanely Smart, Watson-Powered Mobile Shopping App Next Month

(March 4) VentureBeat

The North Face to Launch Insanely Smart, Watson-Powered Mobile Shopping App Next Month

(March 4) VentureBeat

- Outdoor clothing retailer The North Face will launch a mobile app next month that lets users engage with the Watson supercomputer, which will help find the right item for them.

- It will be the first mobile retail app to use Watson. The app will allow a customer to speak to Watson by phone. The Watson-powered shopping assistant will engage the customer in a question-and-answer conversation in order to help figure out exactly what he or she needs.

Study Shows Staggering Fulfillment Costs for Omni-Channel Retailing

(March 14) Women’s Wear Daily

Study Shows Staggering Fulfillment Costs for Omni-Channel Retailing

(March 14) Women’s Wear Daily

- Nearly every top US retailer has invested in expanding its e-commerce offering. As a result, online sales have reached $201 billion in the US, according to eMarketer. But the investments made to achieve those sales erode profits.

- According to recent data from EKN Research working in partnership with Aptos, fulfillment costs alone take 18% of each dollar of sales to “satisfy today’s customer expectations of buy anywhere, pick up anywhere.” When the research firms applied that 18% to the $3.07 billion of estimated online sales from this past year’s Cyber Monday, they found that US retailers “would have spent $540 million on that one single day to get their products into customers’ hands.”

GM Offers Rentals to Lyft Drivers, Accelerating Challenge to Uber

(March 15) Bloomberg

GM Offers Rentals to Lyft Drivers, Accelerating Challenge to Uber

(March 15) Bloomberg

- General Motors is rolling out a program called Express Drive—starting in Chicago and expanding to Baltimore, Boston and Washington, DC—that lets Lyft drivers rent a Chevrolet Equinox sport utility vehicle for $99 a week. Renters also pay 40 cents a mile, but if the driver completes 40 rides in a week, the mileage is free, and if the total hits 65, then all fees are waived.

- The program is GM’s latest move to get a piece of the growing market of ride-sharing services. GM bought a 9% stake in Lyft for $500 million in January in order to compete with Uber, the nation’s largest ride-sharing service, and to develop a network of autonomous vehicles.

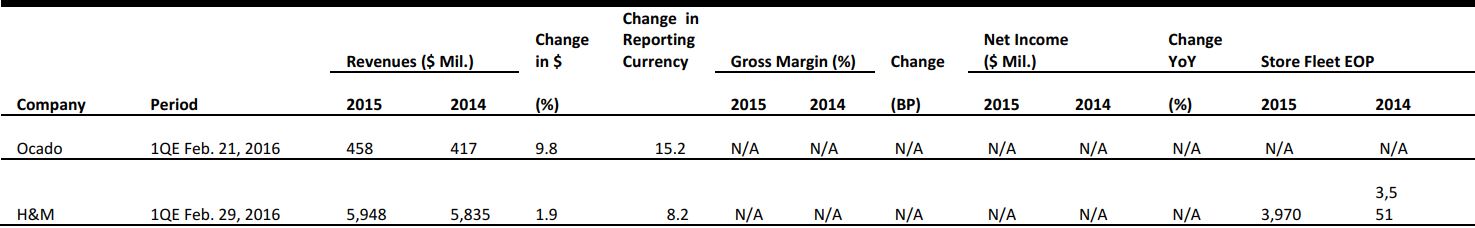

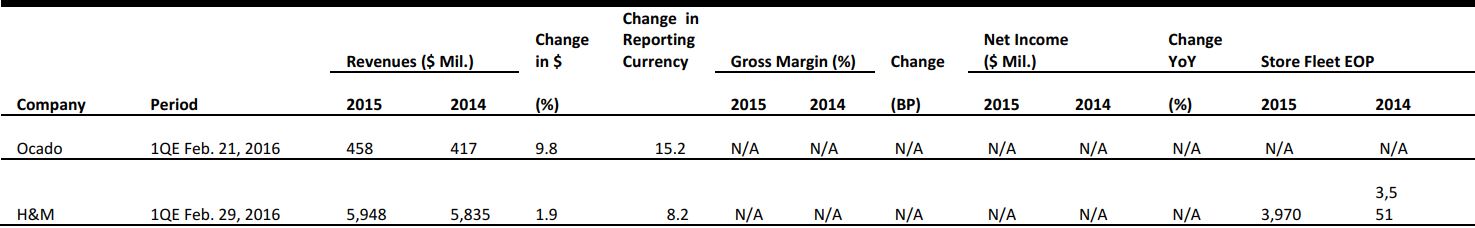

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Hudson’s Bay Company Plans to Expand Kaufhof in Benelux and Launch Saks Off 5th in Germany

(March 11) Dw.com

Hudson’s Bay Company Plans to Expand Kaufhof in Benelux and Launch Saks Off 5th in Germany

(March 11) Dw.com

- Canada’s Hudson’s Bay Company, which acquired Germany’s Galeria Kaufhof department store chain last year, plans to invest €1 billion (US$1.1 billion) in Galeria Kaufhof over the next five to seven years. The company has expressed interest in expanding into the Benelux countries, initially by opening a new department store in Luxembourg in 2018. Additionally, existing Galeria Kaufhof stores will be renovated and Hudson’s Bay will expand the Kaufhof online business.

- Hudson’s Bay is also reported to be aiming to open 40 new Saks Off 5th outlets in Germany. The launch would provide the first major competition to off-price segment leader TK Maxx in Europe.

Hotel Chocolat Plans to Float on the AIM

(March 13) FT.com and Retail‐week.com

Hotel Chocolat Plans to Float on the AIM

(March 13) FT.com and Retail‐week.com

- British chocolatier Hotel Chocolat this week revealed its intentions to float on London’s Alternative Investment Market (AIM). The estimated market value of the company would be £150 million.

- In the year ending June 2015, Hotel Chocolat reported £3 million in pretax profits. The retailer operates 81 stores in the UK, three in Denmark and one in Australia. Future growth plans include developing the company’s UK store network and investing in e-commerce, followed by potentially expanding further in the Scandinavian market in coming years.

Auchan’s Convenience Stores Outperform Hypermarkets in France

(March 14) Company press release

Auchan’s Convenience Stores Outperform Hypermarkets in France

(March 14) Company press release

- French retailer Auchan reported 1.5% year-over-year growth in consolidated revenue, to €54.2 billion, in 2015. Excluding fuel and exchange rate effects, revenues grew by 1.7%. Operating profit from continuing operations increased by 5.5%, to €1,181 million. Adjusted net profit grew by 10.5%.

- Central and Eastern Europe and Asia performed the best, while the retailer faced “some difficulty” in France and Italy. Revenue fell by 2.7% in France, where Auchan’s convenience stores performed better than its hypermarkets. In the eurozone excluding France, sales fell by 4.1%, driven by declines in revenues in Italy. The top line was supported by 9.0% growth in Eastern Europe and by 5.1% growth in Asia, at constant exchange rates.

Sainsbury’s Sees First Positive Underlying Sales Growth in More than Two Years

(March 15) Company press release

Sainsbury’s Sees First Positive Underlying Sales Growth in More than Two Years

(March 15) Company press release

- In the nine weeks through March 12, British grocery retailer Sainsbury’s grew comparable sales excluding fuel by 0.1%. Total retail sales excluding fuel were up 1.2%. Online grocery sales rose by nearly 14%. The company said clothing and entertainment performed particularly well, with both categories delivering growth of more than 10% during the period.

- This was Sainsbury’s first quarter of positive comparable sales growth in more than two years. CEO Mike Coupe said that the retailer had reduced its promotional participation, as customers have found multibuy offers confusing, and had focused on investing in its portfolio of 3,000 own-branded products.

Strong Sales Growth Continues for Online Grocer Ocado

(March 15) Press release

Strong Sales Growth Continues for Online Grocer Ocado

(March 15) Press release

- British online grocer Ocado reported a 13.8% year-over-year increase in gross retail sales for the 12 weeks ending February 21. Total gross sales, which include revenues from its agreement with Morrisons, were up 15.3%. Online orders grew by 16.9% and, for the first time, the company shipped more than 250,000 orders in a single week.

- Ocado’s average order size declined by 2.9%, and CEO Tim Steiner admitted that the retail environment remains challenging. However, he believes Ocado’s growth will continue to outpace that of the online grocery market. There was no news on Ocado’s long-anticipated deal to license its technology to international retailers.

ASIA TECH HEADLINES

Uber Hopes to Catch a Break as China Frames Ride-Hailing Regulations

(March 15) TechinAsia

Uber Hopes to Catch a Break as China Frames Ride-Hailing Regulations

(March 15) TechinAsia

- China is beginning to draft laws to regulate ride-hailing services. Chinese Minister of Transport Yang Chuantang told reporters that “online ride-hailing services have been a good experience for consumers, and welcomed by some passengers. So our solution is to provide a legal way.”

- The new legislation may be similar to regulations enacted in Shanghai in October; these legalized private cars being used with online services by giving drivers an “Internet car-booking license.” The laws required companies to train, certify and insure the drivers on their platforms.

Alibaba-Backed Logistics Firm Cainiao Lands Funding at a Reported $7.7 Billion Valuation

(March 14) TechCrunch

Alibaba-Backed Logistics Firm Cainiao Lands Funding at a Reported $7.7 Billion Valuation

(March 14) TechCrunch

- Cainiao, a three-year-old, Alibaba-backed logistics firm, has confirmed its first external funding round from Temasek and GIC in Singapore, Khazanah Nasional in Malaysia, and Primavera Capital in China.

- The company claims to have 128 warehouses and 180,000 express delivery stations in China that allow it to offer same-day delivery in seven Chinese cities and next-day delivery in a further 90. Cainiao handled 278 million packages from the Singles’ Day shopping sale alone in 2014.

Defeated Go World Champion Beats DeepMind AI in Penultimate Match

(March 14) TechCrunch

Defeated Go World Champion Beats DeepMind AI in Penultimate Match

(March 14) TechCrunch

- DeepMind’s AlphaGo combines two artificial intelligence (AI) techniques in its quest to master the hugely complex game of Go—deep learning and Monte Carlo Tree Search—which allow it to simulate millions of games, glean the outcomes and learn from those to generalize a game strategy. AlphaGo is in the middle of a five-match series with Go world champion Lee Sedol, and Sedol has won one match so far.

- DeepMind founder Demis Hassabis tweeted that the machine’s loss was due to Sedol’s ingenuity in move 78, pressurizing AlphaGo into making a fatal mistake.

This Singaporean Startup Is Building a Fitbit for Your Brain, and It Needs Your Help

(March 11) TechinAsia

This Singaporean Startup Is Building a Fitbit for Your Brain, and It Needs Your Help

(March 11) TechinAsia

- Singaporean startup Neeuro has come up with a headband with electroencephalogram (EEG) capabilities called the Neeuro SenzeBand. The device is basically a Fitbit that can read brain waves.

- The headband pairs with the Neeuro Memorie mobile app, which contains a number of games designed with the help of neuroscientists that can train users’ brains in functions such as memory, attention, spatial skills, multitasking and decision making.

China’s State VC Fund Now Has US$336 Billion to Throw at Startups

(March 11) TechinAsia

China’s State VC Fund Now Has US$336 Billion to Throw at Startups

(March 11) TechinAsia

- China’s state venture capital fund had US$336.4 billion at the end of 2015. It is not actually a single fund, but is made up of government guidance funds, consisting of local and central agencies. According to Bloomberg, there are now 780 such funds across China.

- The flood of government cash raises fears that China’s heated tech industry may be ready to burst. Billion-dollar investments into a single startup—Didi Kuaidi’s US$3 billion series E round in September, for example—are becoming increasingly common.

LATAM RETAIL HEADLINES

Mall Operator Grows in Brazil, Unfazed by Protests and Graft

(March 14) Bloomberg Business

Mall Operator Grows in Brazil, Unfazed by Protests and Graft

(March 14) Bloomberg Business

- Gazit-Globe, a commercial real estate company worth nearly $21 billion with ties to more than 20 countries, is planning to extend its business in Brazil despite the severe recession and political unrest in the country. Gazit expects Brazil’s strong democracy to prevail and sift out corruption.

- Gazit plans to invest $1 billion in 2016 to expand shopping centers in São Paulo and other major cities around the world. The company believes its model, centered on supermarkets in growing cities, will weather the economic downturn, as people always buy groceries, despite macroeconomic conditions.

Femsa Follows Mexican Billionaire Carlos Slim in Euro Debt Debut

(March 14) Bloomberg Business

Femsa Follows Mexican Billionaire Carlos Slim in Euro Debt Debut

(March 14) Bloomberg Business

- Femsa, owner of the largest convenience-store chain in Latin America, sold €1 billion in seven-year bonds for the first time this week, joining other Mexican borrowers as the European Central Bank buys investment-grade company debt.

- This is the first debt sale in euros by Femsa. Fitch Ratings ranked the bonds A, and analysts from Cantor Fitzgerald said that this is good timing for Femsa, as the company is fundamentally sound.

The Gold Medal for Questionable Spending Goes to Olympic Sportswear Sponsors

(March 14) Bloomberg Business

The Gold Medal for Questionable Spending Goes to Olympic Sportswear Sponsors

(March 14) Bloomberg Business

- Bloomberg found that the amount sportswear companies spend on marketing for the Olympic Games does not translate into higher sales gains. The firm’s research found that operating expenses during Olympic quarters outpaced sales gains in previous years, with an average 12.2% increase; some companies, including Nike, have actually seen a negative return.

- Adidas passed on the official sponsorship for the games in Rio after spending lavishly on the London Olympics in 2012.

Brazil’s Retail Sales Drop More than Expected in January

(March 10) Bloomberg Business

Brazil’s Retail Sales Drop More than Expected in January

(March 10) Bloomberg Business

- Brazil’s retail sales fell by twice as much as was forecasted in January in the face of increasingly difficult macroeconomic conditions. Sales fell by 1.5% in January, following a 2.7% drop in December. The January forecast was for a decline of 0.7%.

- Food, beverage and tobacco sales at hypermarkets and supermarkets were down 0.9% in January from December. Consumer inflation is currently above 10% in Brazil.

AT&T, Starwood, Marriott Poised to Complete Cuba Deals

(March 11) The Wall Street Journal

AT&T, Starwood, Marriott Poised to Complete Cuba Deals

(March 11) The Wall Street Journal

- Three major US corporations are pushing to close deals with the Cuban government to start doing business in the first high-profile exchanges with Cuba after more than 50 years of Cold War enmity with the US.

- The Starwood and Marriott partnerships will encourage tourism to Cuba, as the country’s current hotel stock is insufficient to meet demand, while AT&T will offer roaming service on the island. The negotiations are expected to close before President Obama makes his historic visit to Cuba on March 20.

GM Offers Rentals to Lyft Drivers, Accelerating Challenge to Uber

(March 15) Bloomberg

GM Offers Rentals to Lyft Drivers, Accelerating Challenge to Uber

(March 15) Bloomberg

Mall Operator Grows in Brazil, Unfazed by Protests and Graft

(March 14) Bloomberg Business

Mall Operator Grows in Brazil, Unfazed by Protests and Graft

(March 14) Bloomberg Business

AT&T, Starwood, Marriott Poised to Complete Cuba Deals

(March 11) The Wall Street Journal

AT&T, Starwood, Marriott Poised to Complete Cuba Deals

(March 11) The Wall Street Journal