Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

Mobile commerce is gaining ground at lightning speed—and much faster than many of us expected. According to The New Digital Divide report from Deloitte, smartphones alone accounted for almost 20% of in-store sales in 2013, up from a mere 5% a year earlier. The professional services firm saw that percentage rising to 50% of in-store sales in 2014. Retailers are increasingly realizing the competitive value of a digitally integrated storefront. As we've said before, it's all about Internet connectivity. That was the impetus behind Gap’s rollout of free Wi-Fi in more than 1,000 of its stores last year (and its plans to take it chain-wide), which will allow shoppers access to the retailer’s mobile apps and websites. As mobile apps get more sophisticated, retailers will be increasingly integrating them with smart displays that can deliver interactive catalogs, manage loyalty and reward programs and distribute relevant content to customers, including product recommendations, coupons and social media. Augmented reality and 3-D applications are already taking fitting room customer service to a whole new level. As interfaces advance, stores may start employing holograms and responsive ambient intelligence technologies that can bring even greater personalization to the shopping experience. Which bring us to another thought: If connected storefronts are the future, how will mobile payments evolve? We can foresee a scenario in which the in-app model—whereby the newer payment options (such as Apple Pay, Google Pay and soon Samsung Pay) are built into retailers’ own apps—becomes dominant. As we see it, in-app is the only option that aligns the interests of merchant, customer and credit-card operator (bank). Digitally astute, “connected” retailers do not want to relinquish control of the “last millimeter” of engagement between their stores and their customers—that is, at the point of sale (POS), where they can gain access to valuable consumer data. Many customers want to use more convenient and secure payment systems, but also want to get personalized information and special deals on products from the retailers they trust. When it comes to in-store shopping, retailers’ own apps are likely to provide a more fulfilling experience than general solutions. Consider Staples, which was among the first US retailers to adopt Apple Pay after rolling out near-field-communications support at 1,400 locations last November: Apple Pay users now account for 30% of purchases made through the retailer's iOS app, according to FierceMobileIT. So, while Apple Pay and its closest rivals may disrupt the offline experience, their biggest impact may well be in-app and on the mobile Web.

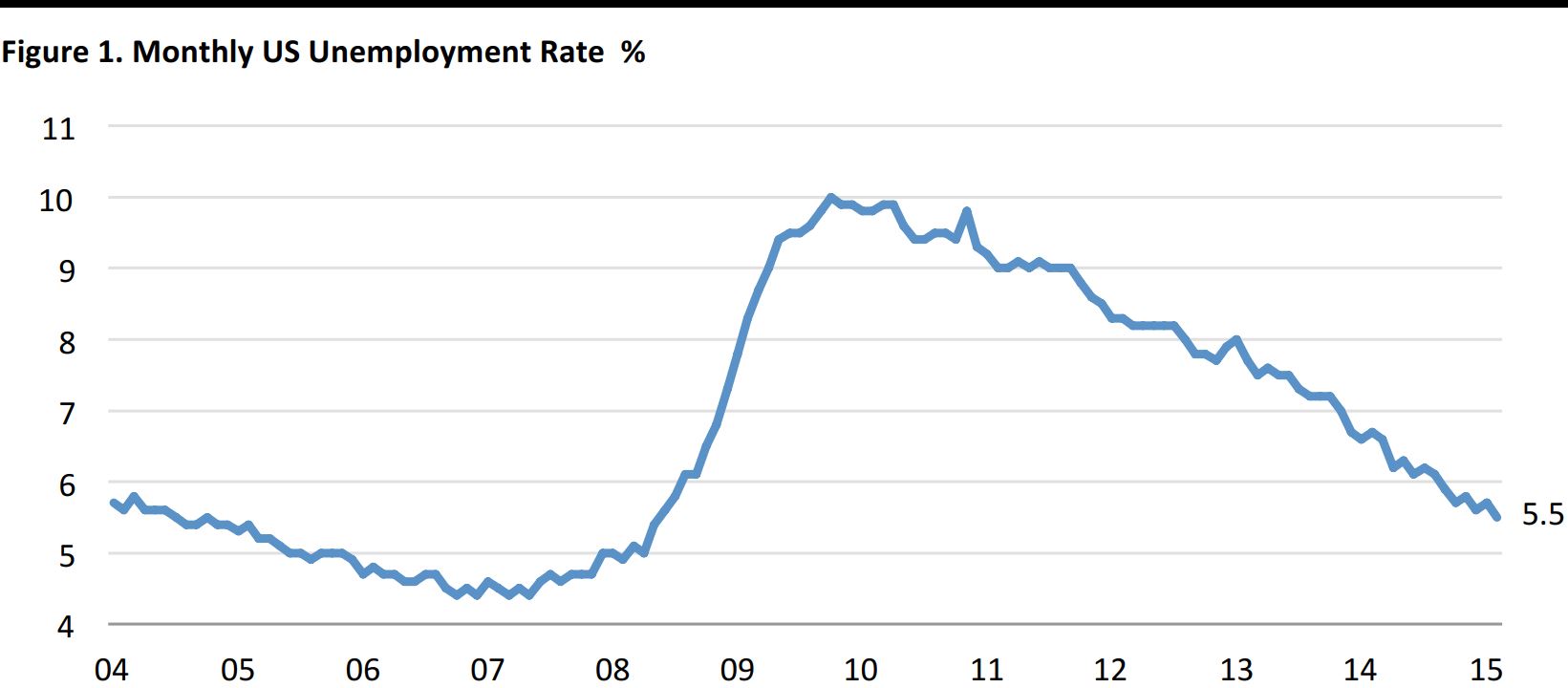

US MACROECONOMIC UPDATE

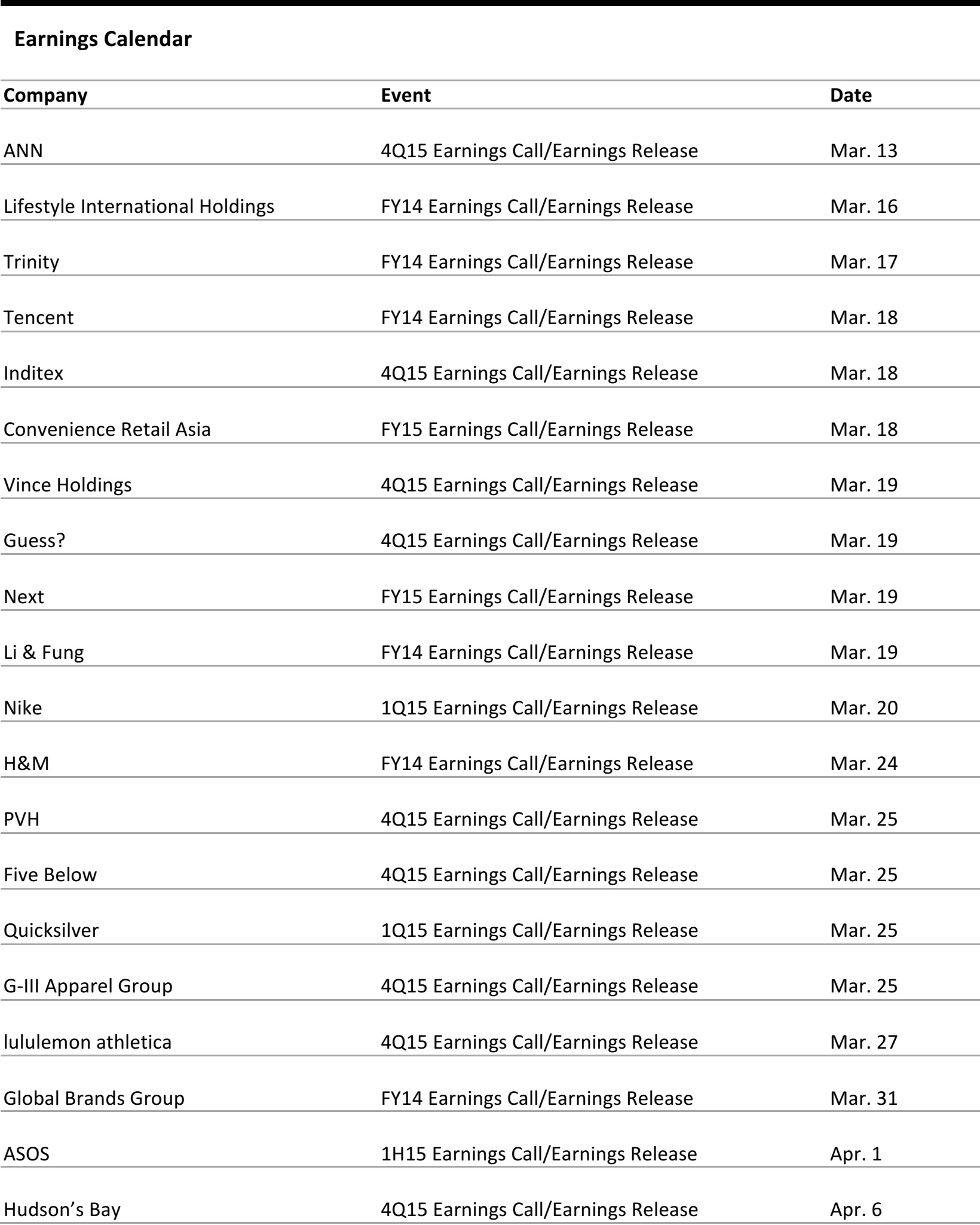

Unemployment Rate Resumes Downward Path

Through February 28, 2015 Seasonally adjusted Source: Bureau of Economic Analysis

- The unemployment rate resumed its downward path in February 2015, after a brief upward blip in January.

- The US economy added 295,000 jobs in February, representing the twelfth consecutive month that more than 200,000 jobs were created.

- The latest 5.5% represents the lowest unemployment rate since May 2008.

- One year ago, in February 2014, the rate stood at 6.7%.

US RETAIL SALES

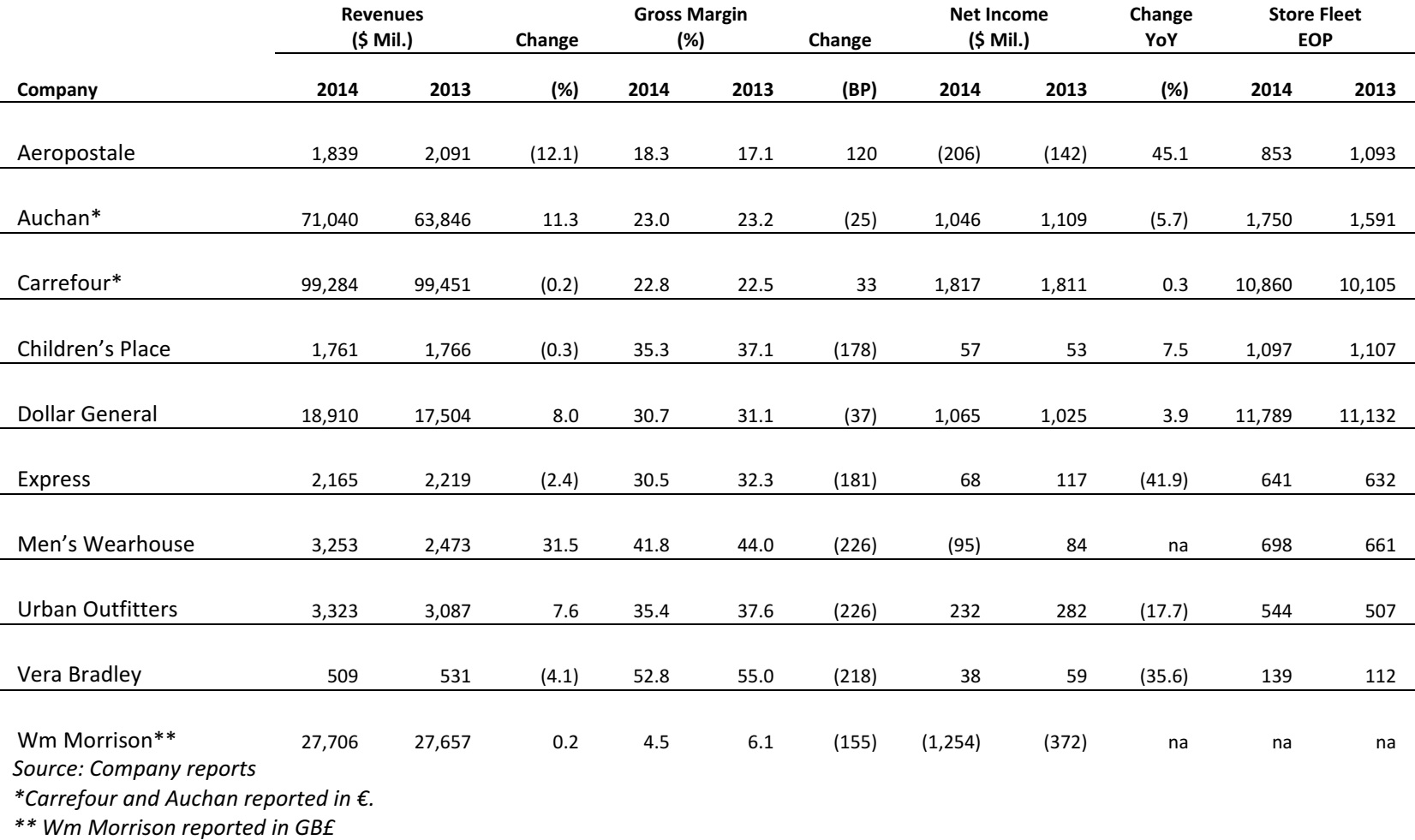

Retail Sales Lose Momentum in February

Through February 28, 2015 Seasonally adjusted Source: US Census Bureau

- February retail sales ex-auto rose 0.8% YoY, down from the 1.7% YoY pace set in January. Inclement weather throughout the US likely tempered sales activity.

- Most retail categories exhibited attenuated growth in February versus January’s YoY increase: most notably restaurants, which reported a 7.7% YoY gain (down from a 11.3% YoY gain set in January).

- Apparel retailers enjoyed a February lift, up 3.3% YoY gaining momentum from 2.7% last month.

- Sales at furniture & home goods retailers rose 5.8% YoY, up modestly from January.

US RETAIL TRAFFIC

Severe Weather Impacts Store Traffic Across the US

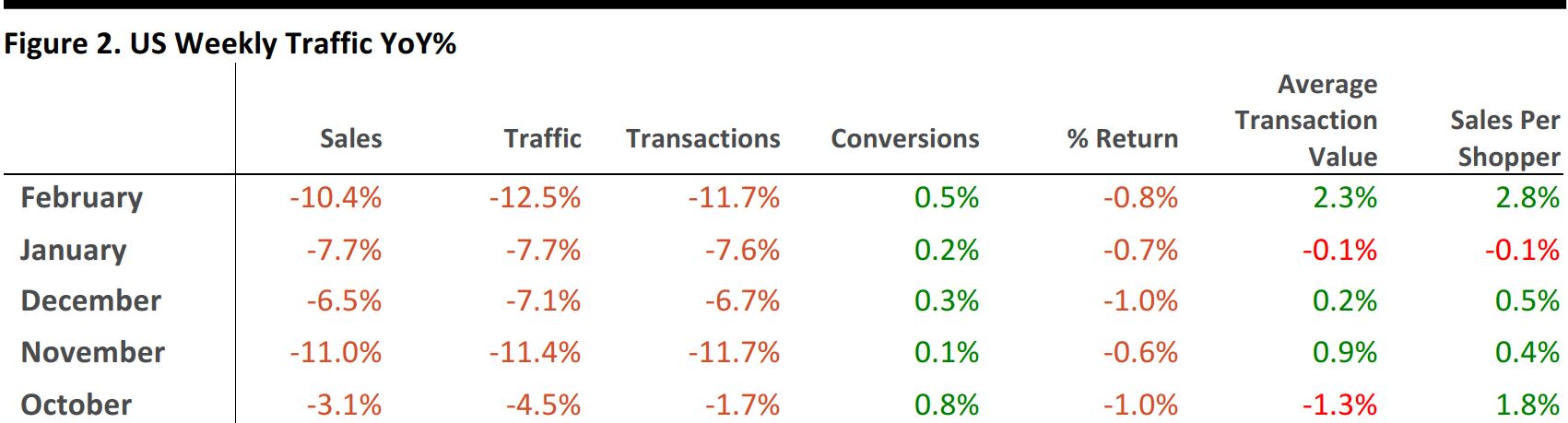

Through February 28 Source: RetailNext

- Retail sales and traffic YoY comparisons declined 10.4% and 12.5% respectively this February.

- February temperatures were the lowest since 1989 and snowfall was the greatest in more than 55 years, which hindered shopper traffic into stores. All regions experienced double-digit declines in traffic and sales.

- The best regional sales performance was in the West, down 10.6%, and the worst performance was in the Midwest, down 13.5%.

- Valentine’s Day (February 14) showed the highest sales, traffic and transactions of the month. Conversion and sales per shopper were highest the day before Valentine ’s Day, which is typical from a historical perspective.

- The lowest sales, traffic and transactions occurred during the first week of the month, when Super Bowl Sunday turned into Super Storm Monday and impacted the Northeast.

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

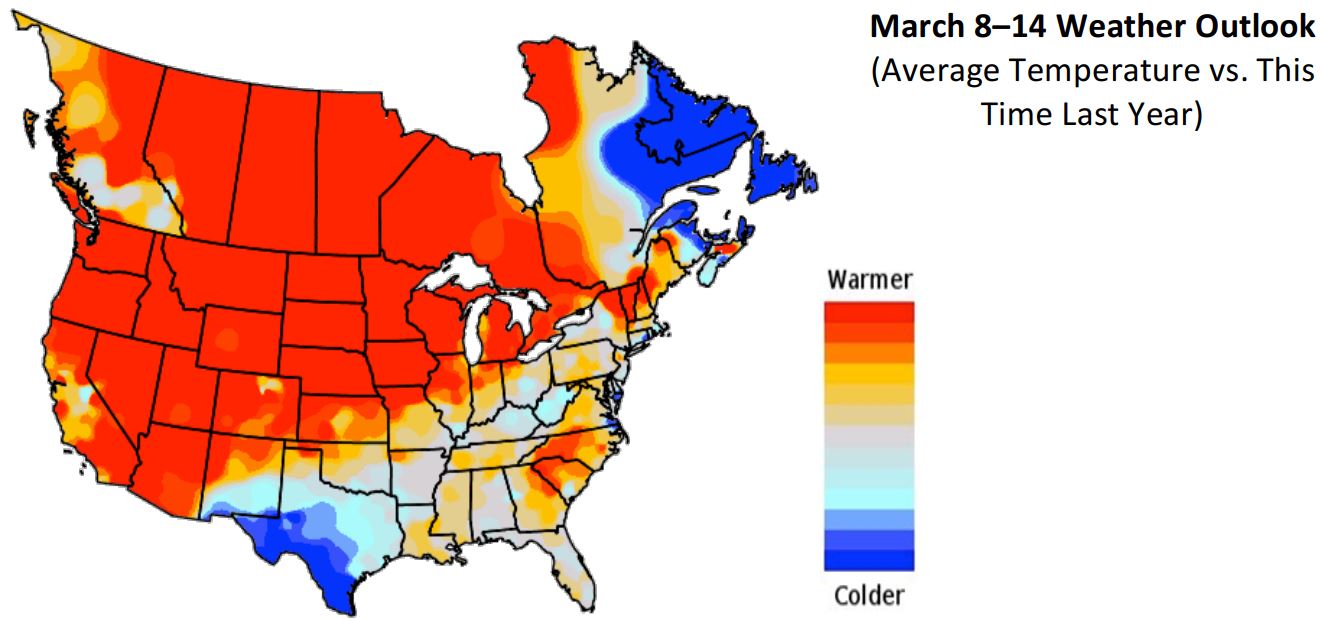

US WEATHER ANALYTICS: Week of March 15–21

Spring Officially Arrives, With the Warmest Temperatures Compared to Last Year at This Time Focused in the West

- Warmth, With Showers to Come. The greatest warmth versus normal and a year ago this week is across central areas of the Canadian Prairies and down through the Central Plains. Showers and storms will break out across the Plains during the second half of the week.

- Warm, but Wetter Across the West. Temperatures in the Western US will climb back to above normal, although they will remain similar to a year ago this week. More rain and mountain snow are on the way. The rain and milder temperatures will spread out into the Plains by the middle of the week, driving demand for rain gear.

- No Spring for the East Next Week. The latest surge of cold air will drop into the eastern US and stick around a bit, pushing the trend back to colder than a year ago this week. The good news is that most of the East will be relatively dry, giving consumers a much needed break from wintry precipitation and supporting foot traffic to most shopping destinations.

Source: Planalytics

US PROMO HIGHLIGHTS

- Dollar stores such as Family Dollar featured “spring cleaning essentials” starting at $3.

- Department stores continued their spring campaigns: Nordstrom offered new spring arrivals starting at $58; Macy’s started a 3-day sale offering 25% off on spring picks.

- Big box retailer Costco focused on outdoor furniture sales in its spring sales campaign.

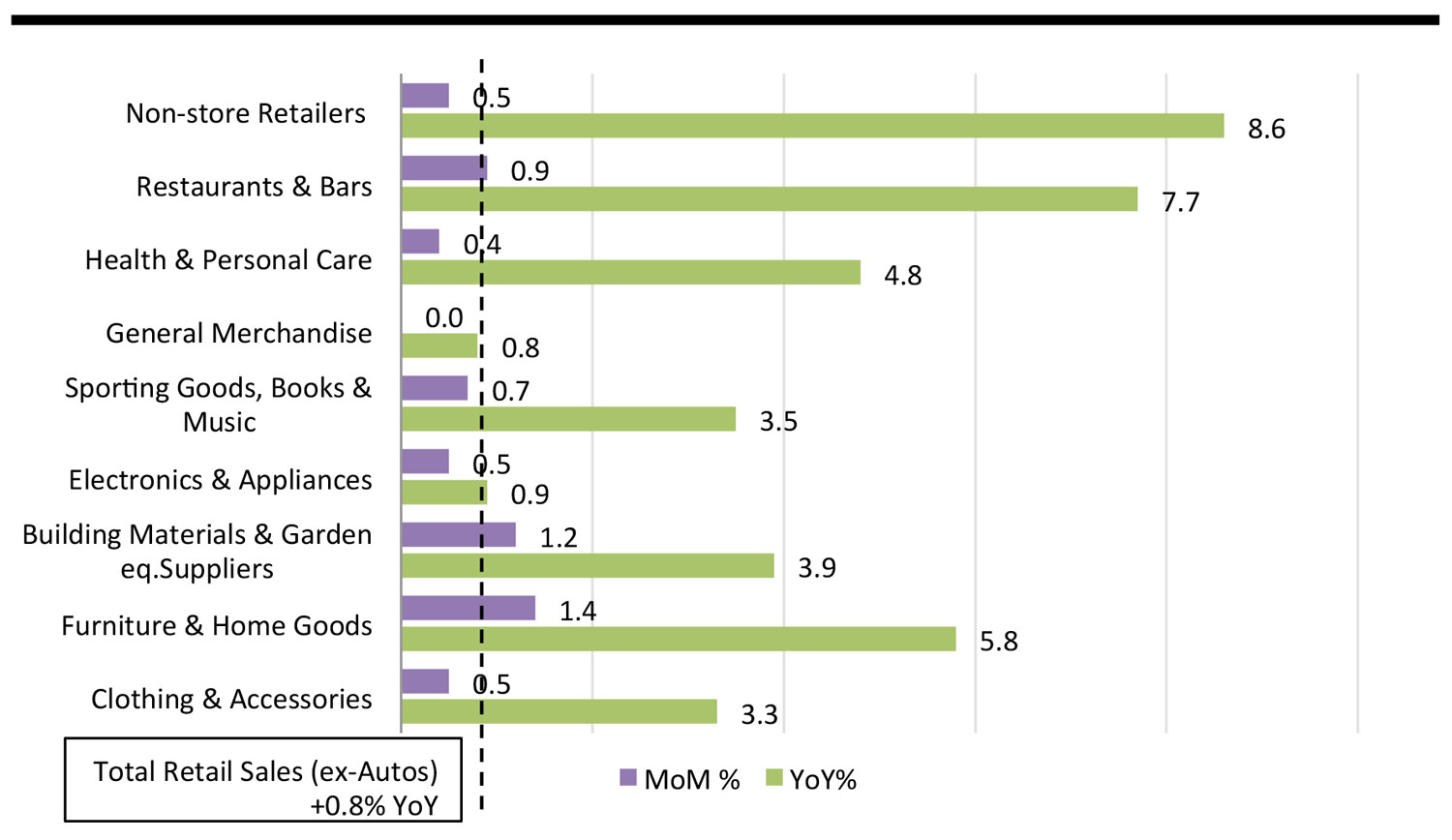

RETAIL EARNINGS

US RETAIL HEADLINES

- Ecommerce sales trends in February have some channels exceeding the ~15% comScore ecommerce growth rate baseline: specifically, Amazon, Google Shopping, and eBay Motors P+A category, while eBay fixed price/auction, search, and comparison shopping engines (CSE) grew slower than the baseline.

- Amazon’s February SSS was 7%, down from January’s 27%; eBay exhibited a 5.1% comp, a sequential drop from the 6.8% in January, driven by a 26.2% comp decline at eBay auction. Overall, Google Shopping for February came in up 20.7% YoY, a strong increase from January’s 10.1%. The conversion rate was up 12.1% YoY from 2.48% to 2.78%. Average order value (AOV) rose 10.3% YoY to $102.86.

- 2Q sales of $1.5 billion reflected a comp increase of 5.6% and 15% growth at Neiman Marcus online. Company sales per square foot for the trailing 12 months were $592, up 4.4%. Fine apparel, designer and couture exhibited the strongest selling trends.

- Technological advancements include Memory Mirrors at two stores that allow customers to configure different outfits in real-time and envision how they would look when worn via a quick video or series of photos. The photos can instantly be shared with friends over social media, transforming the shopping trip into a group interactive experience. Mobile payment options now include just-launched NM Mobile Wallet, which accepts the company’s private label cards as well as other general purpose cards. NM Mobile Wallet was developed in partnership with Capital One and is the first deployment of a mobile wallet capability created specifically for a retail card partner.

- Simon announced that it has sent a letter to Macerich confirming its prior discussions regarding Simon's proposal to acquire all of the outstanding stock of Macerich for $91 per share in cash and Simon shares. The total value of the proposed transaction is approximately $22.4 billion, including the assumption of Macerich's approximately $6.4 billion of outstanding debt. Macerich shareholders would receive 50% cash and 50% Simon common stock.

- Macerich issued a statement that its board of directors will review the proposal with their financial and legal advisors and that Macerich stockholders are advised to take no action at this time. Macerich owns 59 shopping centers to Simon’s 190 properties.

ASIA TECH HEADLINES

- News Corp will buy VCCircle for an undisclosed sum, the deal to be completed by end of this month. VCCircle tracks private equity, venture capital and merger & acquisitions- related information and analysis of the Indian investment ecosystem.

- Last November, News Corp acquired a 25% stake in Indian real estate portal PropTiger.com; in December, News Corp took over personal finance management platform BigDecisions.com.

Hong Kong’s Tofupay Wants to Make Online Payments Easy

(Mar 7) e27.co

Hong Kong’s Tofupay Wants to Make Online Payments Easy

(Mar 7) e27.co

- The startup aims to make transactions simpler by offering easy multicurrency management, providing the possibility of keeping the user’s preferred currency without doing any conversion.

- Tofupay offers services to relieve common issues in the online transaction process such as customer service, ease when setting up merchant accounts, handling of recurring payments and an affordable, transparent fee structure.

- Mandarin Oriental said in a statement (March 5) that the company has removed malware which allowed remote attackers to access credit card systems present in hotels across the US and Europe. No hotels owned by the company in Asia suffered the same security breach.

- A cause for concern: Mandarin Oriental states that the malware is “undetectable by all antiviral systems.”

- Hong Kong-based startup Insight Robotics has proven that there is a smarter way to detect wildfires, no matter how small. The company created an automated system that combines a high-precision, pan-tilt robot with thermal imaging sensors and advanced artificial intelligence vision technology.

- The Insight Robotics system can detect and locate wood- or vegetation-based fires as small as two meters by one meter in size within a 5km radius, covering up to nearly 80 sq km of forest and living area. The robot then sends real-time images and the location of the fire to control centers for manual or computer analysis.

- The Robot Revolution Realization Committee, an advisory panel appointed by ABE, or Autonomous Benthic Explorer, an underwater robotic vehicle, will review existing radio and civil aeronautics laws and set up industry-run best practices for drones, giving its drone sector an edge over that of the United States.

- Yamaha is now looking to adapt its drone technology for patrolling Japan’s borders or for checking oil and gas pipelines; Secom will launch a service for small businesses that includes having a surveillance drone that can be scrambled to take photos of an intruder when an alarm sounds.

- UberX’s closure in Seoul marks the second of its kind in Asia. In December, Uber entirely ceased operations in Delhi following a tragic rape incident that made waves in international media.

- “After consulting with Seoul City Transport Division and taking their advice, we determined it was in the best interests of Korean riders, drivers and the community as a whole to further define our business offerings within the current confines of the regulatory framework, without ambiguity,” offered an official statement from Uber.

- Fujitsu explained that, unlike fingers and thumbs, irises are less prone to injury and almost impossible to forge. There’s also the added bonus of being able to unlock Fujitsu’s phone with gloves on. The technology can additionally be used to log into web services.

- Fujitsu has already passed International Electrotechnical Commission (IEC)-regulated photobiological safety tests. The typical false acceptance rate for iris authentication is one out of 1.25 million, proving the high security level of this technology.

- A controversial documentary about pollution in China, Under the Dome, was scrubbed from the It accrued more than 200 million views in the country in the past five days through March 6. The 104-minute film, created by former state TV news anchor Chai Jing, vanished from the nation’s biggest video site.

- China’s censors allowed the film—which mixed interviews with government officials and ordinary people with a presentation by Chai that resembles a TED talk—to be shown around the Web and discussed for a whole week before circulating a censorship order to WeChat and Weibo.

Xiaomi Plans to Sell 100 Million Smartphones in 2015

(Mar 9) Tech in Asia

Xiaomi Plans to Sell 100 Million Smartphones in 2015

(Mar 9) Tech in Asia

- At a press event related to China’s National People’s Congress (of which he is a member), Xiaomi CEO Lei Jun told reporters that in 2015 Xiaomi plans to sell between 80 and 100 million smartphones.

- The company expects to generate between RMB 100 and 200 billion (US$16 billion–$32 billion) in total revenue, doubling its 2014 revenue of RMB 74.3 billion (almost US$12 billion).

- China’s market regulator said today that the government will regulate ecommerce more strictly in an upcoming clampdown on counterfeit products and poor customer service. The comments came from Zhang Mao, minister of the State Administration for Industry and Commerce (SAIC).

- A controversial report on fake products, produced by the SAIC late January, claimed that about 63% of the stuff for sale on Alibaba’s marketplace, Taobao, is counterfeit. However, that was extrapolated from a survey of 51 products that SAIC’s secret shoppers bought from Taobao.

China Will Start Punishing Taobao Shops Caught With Fake Product Reviews

(Mar 10) Tech in Asia

China Will Start Punishing Taobao Shops Caught With Fake Product Reviews

(Mar 10) Tech in Asia

- The world of C2C ecommerce on sites like Taobao revolves around user-written product reviews. The system has led to widespread fraudulence: merchants posting positive-but-fake user reviews of their own products.

- Alibaba has never condoned faking comments on Taobao, but the way most reviews are faked is difficult to detect. Chinese authorities will have the same problem when they begin attempting to enforce the new law that forbids this kind of fakery from March 15 onwards.

- CNN’s technology editor commented in February that Apple Watch is simply too expensive for “the slight bit of convenience” it offers. Tech in Asia’s David Corbin agrees that the price tag will also be a bridge too far for Asian consumers.

- Forbes reported: “...The feeling with the analysts is that China has passed the US in terms of iPhone shipments, with UBS estimating 36% of the iPhone market is in China, with the US now in second place on 24%.”

EUROPE/UK RETAIL HEADLINES

- The UK grocery sector reached deflation of -1.6% in the 12 weeks to March 1, according to new data from Kantar Worldpanel, a market share monitoring service.

- Kantar said Tesco had been the standout retailer among the biggest grocers, with sales up 1.1% in the 12 weeks. Asda’s sales fell 2.1%, while Morrisons and Sainsbury’s both grew sales slightly during the period.

- Retail sales volumes in the eurozone currency bloc grew 3.7% YoY in January 2015, reported Eurostat this week. Across the broader European Union, sales volumes were up 4.0%.

- Eurostat said Eurozone retail sales volumes were bolstered by growth in automotive fuel (+6.1% YoY in real terms) and non-food retailers (+5.0%). Luxembourg (+10.7%), Hungary (+8.2%) and Poland (+7.5%) saw the biggest volume growth.

- French grocery giant Carrefour reported group organic sales growth of 3.9% for full-year 2014 (excluding petrol and calendar effects), with operating income up 10.6% (at constant exchange rates) and net income from continuing operations up 24.6%.

- In its home market of France, Carrefour saw organic sales growth of 1.2% for the year, with operating income up 6.1%. Operating income rose 9.6% for the rest of Europe and 23.2% in its emerging markets segment.

- German discounter Lidl will make a €100 million investment in revamping or rebuilding around 30 of its Austrian stores, it was reported this week. The plans form part of its project to overhaul all of its 203 Austrian supermarkets.

- It was also revealed that Lidl will be spending €200 million to open around 40 new stores in Spain this year. This would be double the number of Spanish stores opened by Lidl in 2014.

- Luxury goods companies have been hit hard by Russia’s lurch into recession, forcing them to cut prices. The rapid devaluation of the ruble has badly hurt Russian shoppers’ spending power.

- Spending on international travel by Russian consumers dropped 6% in 2014, the UN World Tourism Organization said, hitting sales of luxury goods outside of the country: Russian tourists are major consumers of luxury goods, especially in Europe.

- British online grocery retailer Ocado continued its run of strong growth, posting 15.2% growth in its gross retail sales in the 12 weeks to February 22, 2015. Total revenues, including revenues from its agreement to service Morrisons.com, rose 19.2% in the period.

- The average order size was down 2.4% and average orders per week rose 18.1%. Tim Steiner, Ocado CEO, said “Notwithstanding the uncertainty that remains in the marketplace, we expect to continue growing slightly ahead of the online grocery market.”

- French supermarket retailer Auchan this week posted a 25.2% fall in full-year net profits, with operating profit down 11.6%. At constant exchange rates and for continuing activities, operating profit was up 2%.

- Group sales were up 14.7%, helped by the integration of Sun Art Retail Group in China. At “constant scope and exchange rates” sales were up 0.8% for the year. The company was hit by its exposure to Russia and Ukraine.

- British grocer Sainsbury’s announced the rollout of a new collection service for online grocery orders. The company said 100 stores are in the pipeline to offer click-and-collect by the end of 2015.

- Sainsbury’s will become the latest big grocer to offer click-and-collect. Asda, Tesco and Waitrose already offer the service, and Sainsbury’s already offers click-and-collect for online non-grocery orders.

LATAM Retail Headlines

- A joint statement released by the Department for Business Innovation and Skills and UK Trade & Investment reveals that trade between the UK and Mexico is enjoying double-digit growth, with bilateral trade in 2013 at £3.3 billion, up 15% compared to 2012.

- Mexico is the UK’s fourth largest market for goods exports, and the UK is Mexico’s fifth largest inward investor. This makes Mexico the UK’s second largest trading partner in Latin America, only behind Brazil.

- Falabella announced a 13% increase in consolidated revenues for 4Q 2014. Consolidation of the Maestro DIY business and new store openings over the year were key contributors to this increase.

- The group opened nine new supermarkets during 4Q, in Peru and Chile, and a distribution center is now under construction in Peru, indicating preparations for the next phase of growth. In Chile, Tottus grew revenue in 4Q, opening five new stores and reporting positive same store sales.

- comScore a leader in measuring the digital world, and UPS, a global leader in logistics and transportation services, released the second UPS Pulse of the Online Shopper™ Global Study revealing emerging trends from the leading ecommerce markets in Asia, Brazil, Europe, Mexico and the US.

- Brazilian consumers are the most advanced and social in their online shopping habits. More than half (56%) of their purchases are made online, the highest proportion of any market, and 64% said they are influenced by reviews or posts on social media to help decide which products to purchase. However, they experience barriers to shopping on a mobile device: 39% said they can't get a clear or large product image, 31% said they cannot easily view product information, and 34% said it is hard to compare Over a third (38%) of online shoppers in Brazil are willing to wait 11 days or more for their international orders in order to qualify for free shipping.

- Latin American ecommerce platform MercadoLibre has reported consolidated net revenue gain of 17.8% for 2014.

- MercadoLibre sold 101.3 million items in 2014, an increase of 22% year on year. Items sold in the fourth quarter alone were up 27.2%, driven primarily by operations in Brazil. Full year net income, excluding the effects of Venezuelan devaluation, would have been up 8.4%.

- Retail sales in Chile increased 1.8% in January 2015 over January 2014. Retail sales YoY growth in Chile averaged 7.8% from 2006 until 2015, reaching an all-time high of 23.8% in April of 2010 and a record low of -5.1% in April of 2009.

- At today's presentation of the 2014 full year results, Carrefour said its action plans were bearing fruit as it confirmed acceleration in its organic sales growth for the year, up 3.9%. Recurring operating income increased by 7.0% in Europe and 14.9% in emerging markets.

- Exchange rates had an unfavorable effect in Latin America for the second consecutive year; however, the region still posted what Carrefour called a “remarkable performance.” All formats contributed to growth, particularly new openings of Atacadão.