FROM THE DESK OF DEBORAH WEINSWIG

Do It Yourself Is Losing Out to Do It for Me

The housing market in the US looks set for a strong run. Annual household formation is forecast to be well above 1 million, and comfortably above the long-term average, in both 2016 and 2017. We recently noted the opportunities in the US home improvement market in our 16 Global Retail Trends for 2016 report.

In theory, do-it-yourself (DIY) stores should be enjoying boom times, not just in the US, but also in robust European property markets. In reality, however, structural changes mean consumer-focused DIY retailers are likely to underperform versus the housing markets over the medium term. Shoppers in mature markets are shifting more toward “do it for me” (DIFM), where they pay tradespeople to do home maintenance for them instead of doing it themselves.

A key driver of DIFM is the aging of populations in Western Europe and North America, where affluent older consumers are looking more to professionals to do work for them. At the same time, many younger shoppers appear to be less familiar with DIY techniques than previous generations were, and so are likely to need professional help with home projects.

And specific markets are facing particular changes. In the UK, home ownership is becoming much more skewed toward older generations, with millennials—“generation rent”—less likely than previous generations to own their own home. In the US, growth in multifamily households is helping drive demand for home improvement services.

WHAT DIFM MEANS FOR RETAIL

Demand for Convincing Trade-Focused Propositions

The most obvious result of the DIFM trend for DIY retailers is a falloff in trade: professionals tend to turn to specialist business-to-business suppliers rather than to consumer-positioned DIY stores for their needs. In this context, how are major DIY retailers responding?

When we attended Home Depot’s analyst day in December, the pursuit of the pro customer was a recurring theme. The company noted a number of initiatives it had undertaken in pursuit of the business: it had reorganized in order to have one team dedicated to the needs of professionals; it had acquired Interline, a seller of products to trade customers, which should bolster its penetration among professionals; and it had worked on developing delivery and credit options, sales reps, and a loyalty program focused on trade customers.

But it is not always so easy to woo professional customers by tweaking a long-standing consumer fascia. In recent years, European DIY giant Kingfisher attempted to specifically target professionals in its core UK chain, B&Q, by rolling out TradePoint zones in its stores. Despite these investments, B&Q continued to turn in underwhelming top-line performance, even in a strong property market. The chain is now closing 60 of its 360 stores and downsizing six others. A more successful plank of Kingfisher’s UK strategy has been growing its Screwfix chain of stores, which are much more strongly, and convincingly, targeted to trade customers.

B&Q’s major UK rival, softer-positioned Homebase, was recently sold by Home Retail Group to Australia’s Wesfarmers. The new owner plans to bring the chain under its Bunnings fascia, which has a harder-end, lower-price positioning. To capture growth in the UK market, we think it needs to target the trade customer with conviction. The chain’s new name is unfamiliar to UK shoppers, which gives the company the advantage of starting with a clean slate.

Opportunity for Services

Big consumer-focused DIY chains are not limited to serving pro customers; they can compete with them, too. For example, trusted names in DIY could attempt to grab share of home maintenance services markets, which offer the prospect of fatter margins and which tend to be dominated by small traders.

In its recent presentation for analysts, Home Depot noted that US aggregate spending on consumer home improvement, professional maintenance, repair and operations, and DIFM services totals $550 billion. That dwarfs Home Depot, with its $89 billion in annual sales. The scale of the market means that even mature DIY retailers can find opportunities to tap, if their product offerings are convincing enough to win professional customers and their services appeal sufficiently to consumers.

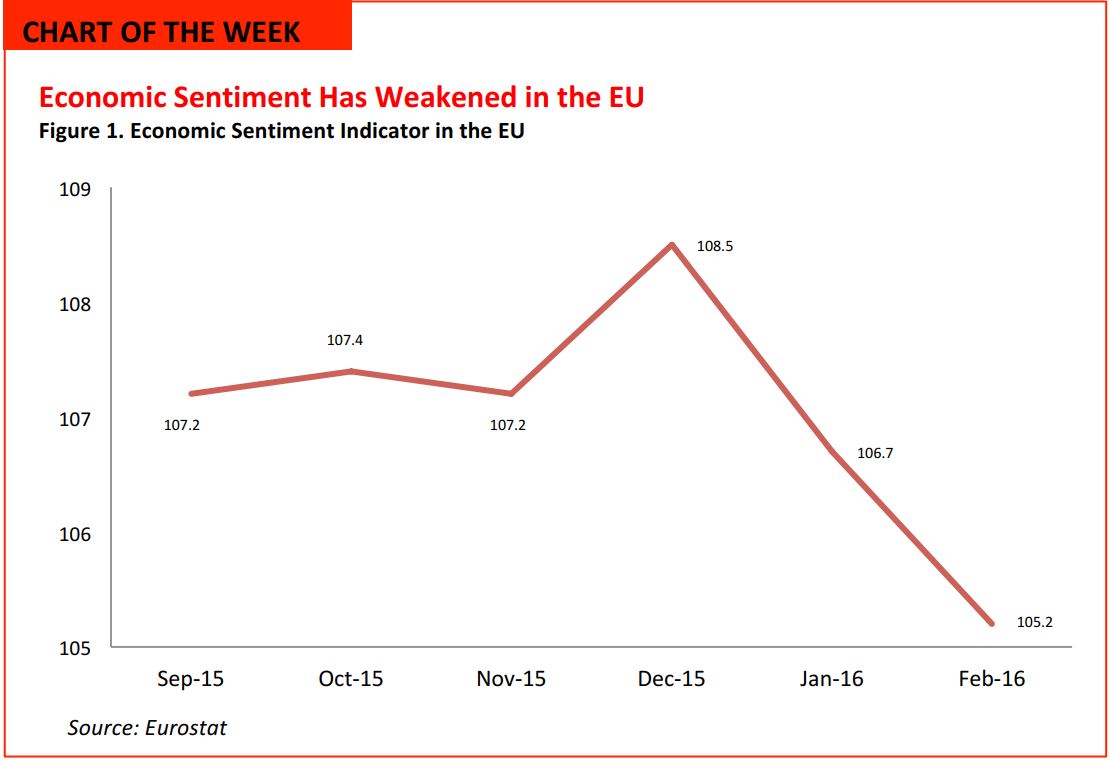

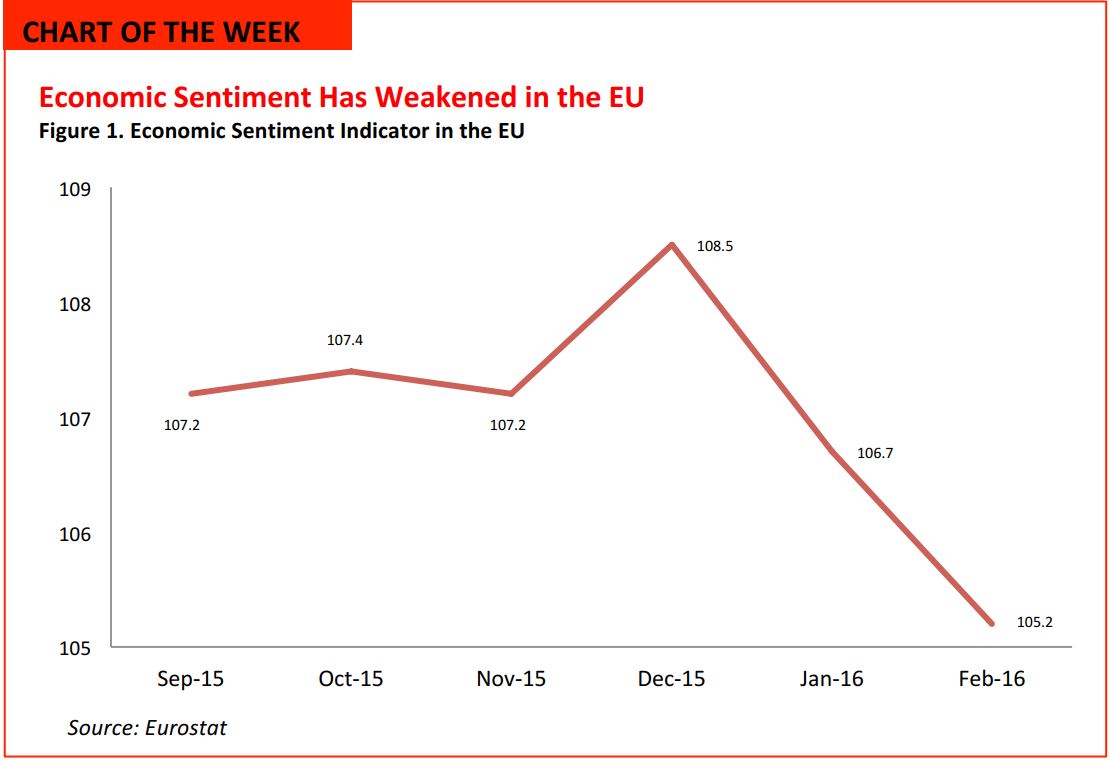

- The Economic Sentiment Indicator is a composite index made up of five separate indicators (with different weights) that gauge confidence in the industrial, services, consumer, construction and retail trade sectors.

- Economic sentiment in the EU weakened considerably in the first two months of 2016. After showing slight optimism toward the end of 2015, the index dropped from 108.5 in December 2015 to 105.2 in February 2016.

- The ongoing “Brexit” debate, the tightening of financial conditions in the region and the general slowdown in emerging markets could all have fueled fears of a shrinking economy.

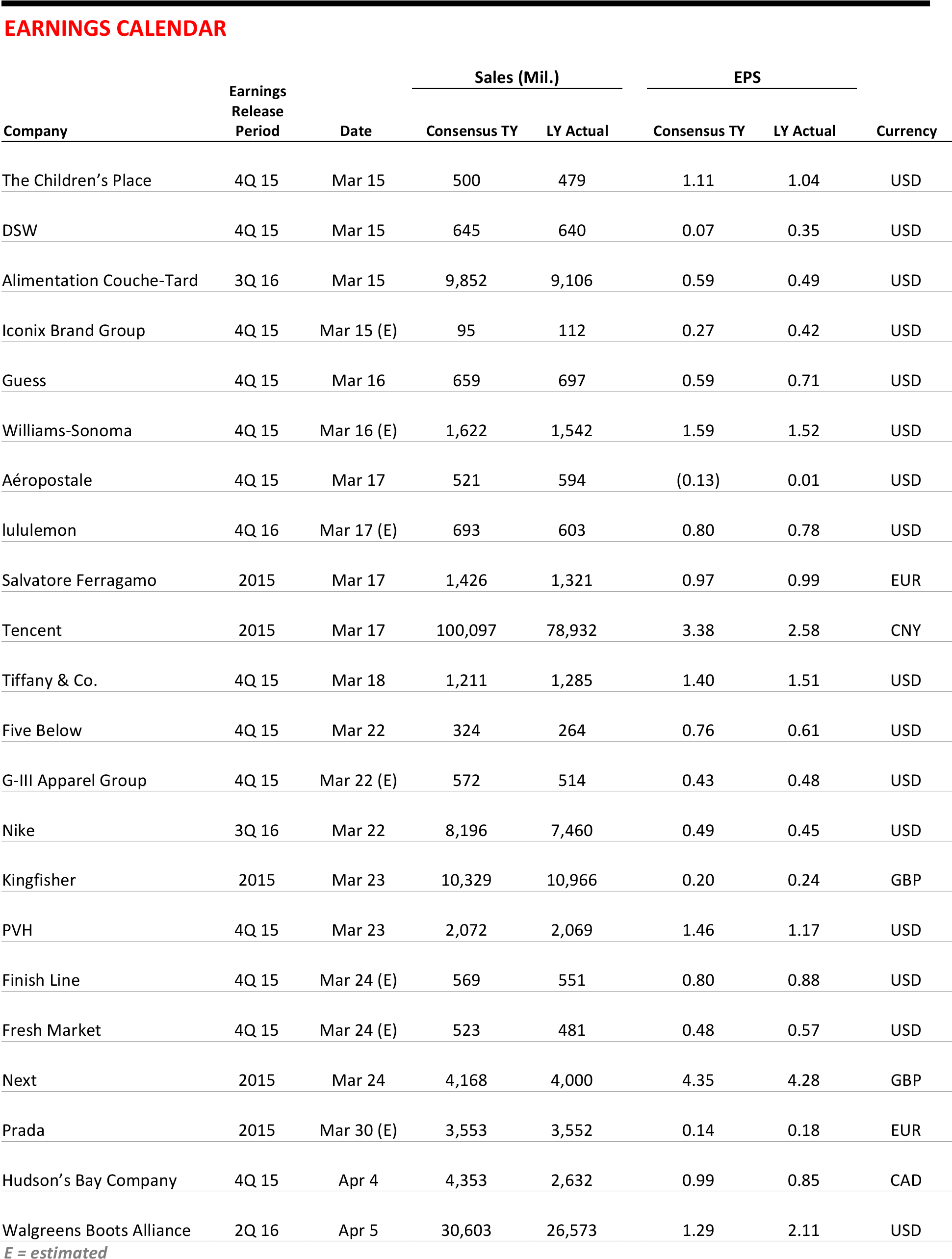

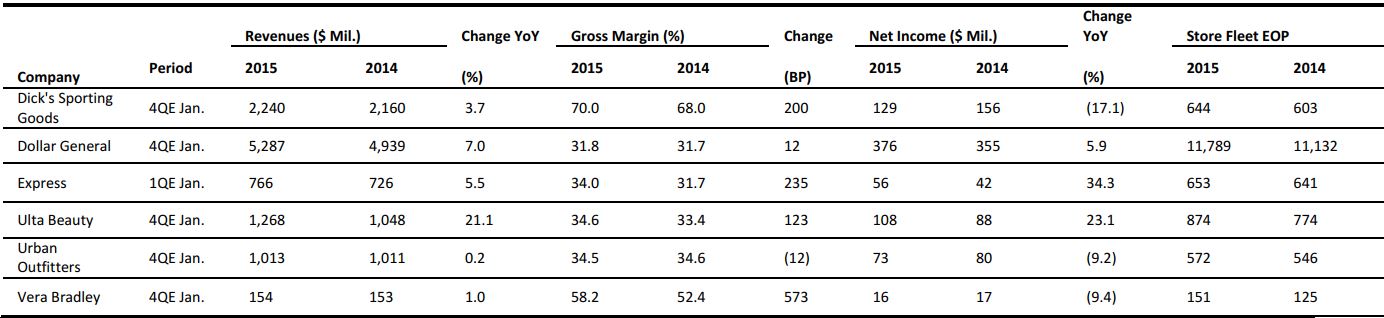

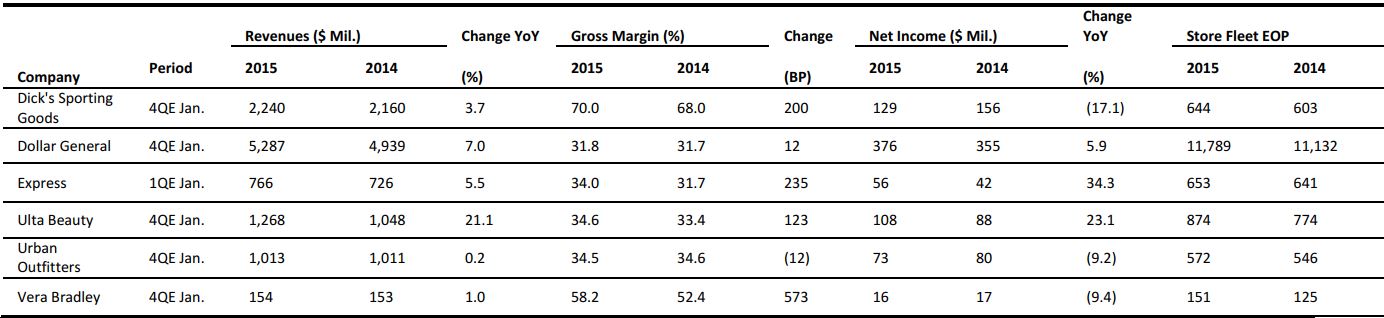

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Valley VCs Sit on Cash, Forcing Startups to Dial Back Ambition

(March 9) Bloomberg

Valley VCs Sit on Cash, Forcing Startups to Dial Back Ambition

(March 9) Bloomberg

- Once driven by fear of missing out on the next Uber or Airbnb, venture investors have turned circumspect, waiting to see how far the tech market will fall.

- Dropping valuations often kick-start a fresh round of deal making, but anemic IPOs and billion-dollar markdowns for the likes of Snapchat and Dropbox are causing venture capitalists to sit on their hands—leaving some startups to starve.

Now Your Jacket Charges Your Mobile Devices

(March 8) Inc.

Now Your Jacket Charges Your Mobile Devices

(March 8) Inc.

- Evolution Wear has created a way to charge mobile devices using solar panels integrated into a jacket. The idea is that the device gets charged as the wearer walks around outside during the day.

- Solar power is the most immediate and efficient green technology option, and the company’s solar charger jacket is yet another example of how clothing is becoming “smart.”

Find the Missing Cash Register

(March 8) The Wall Street Journal

Find the Missing Cash Register

(March 8) The Wall Street Journal

- More high-end boutiques and department stores are moving cash registers out of sight or eliminating them entirely. In these stores, sales associates walk the floor with mobile checkout devices or handle transactions in discreet nooks.

- Stores are aiming to make the experience of paying more elegant and to eliminate a pain point that keeps some shoppers from completing a purchase—having to wait in a long line. Hiding cash registers also forces shoppers to interact with salespeople and might even encourage them to buy more.

Big US Banks to Take on Tech Rivals with Instant Payments

(March 9) Reuters

Big US Banks to Take on Tech Rivals with Instant Payments

(March 9) Reuters

- Depositors at some of the largest US banks are finally going to be able to send money to another person’s account instantaneously by mobile phone. JPMorgan Chase, Bank of America, Wells Fargo and U.S. Bancorp jointly own a system called clearXchange that will allow their customers to transfer money to others’ accounts at member banks.

- While PayPal and Facebook already offer payment apps that appeal to young consumers, the banking industry has a crucial advantage because it controls how quickly money actually moves between bank accounts. Individuals transferred some $200 billion to one another using mobile phones and computers last year, according to Javelin Strategy & Research.

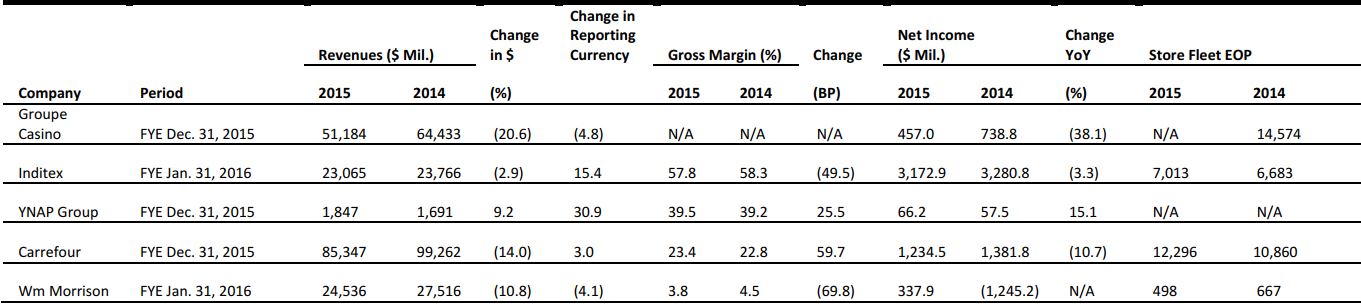

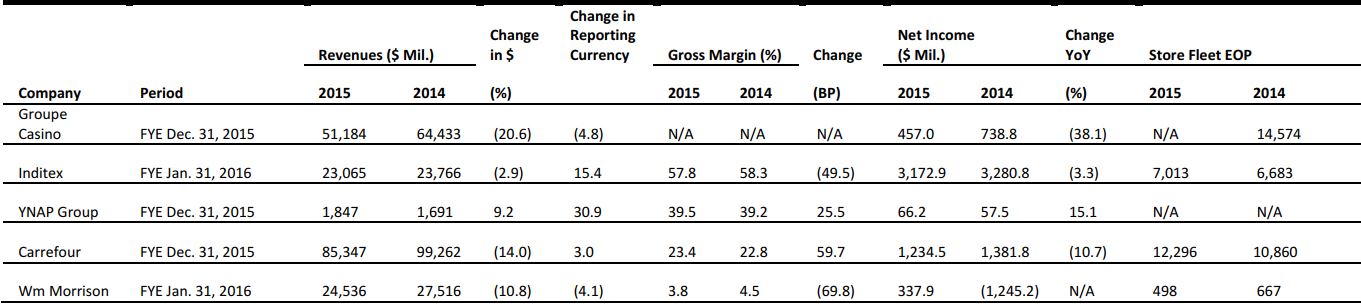

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

BHS Threatens to Shut Stores

(March 3) Retail-week.com

BHS Threatens to Shut Stores

(March 3) Retail-week.com

- UK clothing and homewares retailer BHS filed a proposed Company Voluntary Agreement (CVA) seeking rent reductions from the landlords of half of its stores. The retailer is reported to be asking for rent reductions of up to 75% at some stores.

- BHS said it could close 40 of its stores if rents are not reduced, and that its creditors could lose up to £1.3 billion if it is forced into liquidation. Sir Philip Green sold BHS for £1 a year ago to Retail Acquisitions, a company formed to acquire the chain. UK department store chain Beales followed BHS in applying on March 7 for a CVA to reduce rents.

Germany’s Rewe Group Grows Its Convenience Presence

(March 8) Retailanalysis.igd.com

Germany’s Rewe Group Grows Its Convenience Presence

(March 8) Retailanalysis.igd.com

- Germany’s Rewe Group announced it will roll out its Rewe To Go convenience stores at Aral gas stations. The plan is to install Rewe To Go stores at 1,000 of Aral’s 2,500 German gas stations.

- The stores will include a substantial range of food to go, as well as regular groceries. Convenience retailing has traditionally been niche in Germany, due to competition from small-store discounters and restrictions on Sunday operating hours.

Aldi UK Launches Nonfood Specialbuys Online

(March 8) Retailanalysis.igd.com

Aldi UK Launches Nonfood Specialbuys Online

(March 8) Retailanalysis.igd.com

- Aldi UK began selling its nonfood Specialbuys online, marking a further move into e-commerce in the UK, following the launch of an online wine store in January. The new online offering features the short-term special deals that Aldi offers in its UK stores twice a week in categories such as apparel, DIY and electronics.

- Aldi has announced no plans to sell groceries online, as the no-frills format of discount grocery retailing fits poorly with the added cost of e-commerce services. In Germany, meanwhile, Aldi Süd has added more major brands, including Head & Shoulders and Pampers, to its range.

Burberry Shares Jump amid Takeover Rumor

(March 8) WSJ.com and FT.com

Burberry Shares Jump amid Takeover Rumor

(March 8) WSJ.com and FT.com

- Shares in British luxury brand Burberry jumped on Tuesday following speculation that the company could be the target of an activist investor or a takeover bid.

- A mystery investor has built a 5% stake in the firm, according to the Financial Times, prompting the company to seek help from its financial advisors to defend it against any potential takeover bid. The firm had previously seen its market value fall by more than a quarter amid a slowdown in Chinese demand.

Tesco Slows Sales Declines, Says Kantar Worldpanel

(March 8) Press release

Tesco Slows Sales Declines, Says Kantar Worldpanel

(March 8) Press release

- Tesco’s sales decline slowed in the 12 weeks ending February 28, according to new grocery market share data from Kantar Worldpanel. The British retailer’s sales fell by 0.8% during the period, compared to 1.6% during the 12 weeks ending January 31.

- Sainsbury’s was the top performer among the big British grocers, with sales growing by 0.5% during the period. Morrisons and Asda were the worst performers among the large British grocers, posting declines of 3.2% and 4.0%, respectively. German discounters Aldi and Lidl were the top performers, posting a surge in sales of 15.1% and 18.9%, respectively, for the 12 weeks ending February 28.

ASIA TECH HEADLINES

Alibaba’s Finance Arm Valued at $50 Billion in New Funding Round

(March 7) TechinAsia

Alibaba’s Finance Arm Valued at $50 Billion in New Funding Round

(March 7) TechinAsia

- Ant Financial, Alibaba’s finance arm, has been valued at $50 billion in its latest round of fundraising. According to a new report in The Wall Street Journal, the company is in the midst of raising a new, US$3.1 billion funding round, which is expected to close in mid-April.

- Ant Financial controls and operates Alipay, Alibaba’s massively popular e-payment system. Ant Financial also runs Alibaba’s Yuebao online money market fund, and has a stake in virtually all of Alibaba’s online finance ventures. It is rumored the company is planning an IPO of its own—possibly in China—as early as next year.

Samsung Pay Expands to eBay Korea

(March 7) ZDNet

Samsung Pay Expands to eBay Korea

(March 7) ZDNet

- Samsung Electronics and eBay Korea have signed a memorandum of understanding to start running a joint marketing campaign sometime this year and to develop new services.

- Consumers will be able to use Samsung Pay on all online shopping sites managed by eBay Korea, including Gmarket, Auction and G9, which offer goods from books to clothes to electronics. Gmarket is consistently ranked as one of South Korea’s top online shopping malls.

Toyota Is Developing a Wearable Mobility Device for the Blind

(March 7) ZDNet

Toyota Is Developing a Wearable Mobility Device for the Blind

(March 7) ZDNet

- Toyota is working on a device to help give blind and visually impaired people greater mobility. The device, designed to be worn around the shoulders, uses cameras, speakers and vibration motors to communicate information to the user. The user interacts with the device through voice recognition and buttons.

- The Japanese automaker has been working on the development of robotic helpers for the aging population for several years now. It has developed the Human Support Robot to help the disabled and elderly live independently, and has built a range of prototype bots with the same goal.

Apple Is Selling More Phones in India’s Biggest Cities than You Might Think

(March 4) TechCrunch

Apple Is Selling More Phones in India’s Biggest Cities than You Might Think

(March 4) TechCrunch

- In India, Apple smartphones accounted for less than 1% of all smartphone sales in the third quarter of 2015. However, a new report from IDC found that Apple phones accounted for 4.6% of sales in India’s top 30 cities in the fourth quarter. These cities account for 51% of the country’s smartphone sales, the firm estimates.

- IDC estimates that two-thirds of the smartphones sold in India’s tier-two and tier-three cities (which account for just over 20% of the market) are priced below $100. Apple phones are priced higher, which explains why the company is not among the top sellers based on nationwide market share.

Line Plots US$3 Billion IPO, but May Have a Tough Road Ahead

(March 4) TechinAsia

Line Plots US$3 Billion IPO, but May Have a Tough Road Ahead

(March 4) TechinAsia

- According to a report from Reuters affiliate IFR that cites people close to the deal, Line Corp., the Japanese company behind the Line messaging app, is planning an IPO of up to US$3 billion in New York and Tokyo that is to happen before the end of the summer.

- Despite facing serious stagnation in terms of MAU growth, Line pulled in more than US$1 billion in revenue in 2015 and remains—for the third year in a row—the world’s top-earning app publisher, thanks to cash from social gaming and an array of other services.

LATAM RETAIL HEADLINES

Tapping Brazil’s Olympic Opportunity

(March 4) The Business of Fashion

Tapping Brazil’s Olympic Opportunity

(March 4) The Business of Fashion

- Brazilians are notorious for their body-conscious attitudes, and nearly 80 million Brazilians claim to be actively engaged in one or more sports. Thus, the Rio 2016 Summer Olympics present a particular opportunity to market sportswear brands. Olympic years can have a significant impact on a brand’s financial performance, as has been seen with Adidas’ sponsorship of previous games.

- Official Rio 2016 products are expected to generate approximately $260 million in sales within Brazil. Companies should look for opportunities to sponsor individuals, teams and specialized products to capitalize on the event.

Motorola Seeks to Win over LatAm with Innovation

(March 3) BNamericas

Motorola Seeks to Win over LatAm with Innovation

(March 3) BNamericas

- The Moto X Force phone debuted this week in Chile, and will be available in Brazil, Peru, Mexico and Colombia. The phone has a ShatterShield shatterproof screen and a battery that holds a charge for two days, and it can get eight hours’ worth of charge in only 15 minutes.

- Following its acquisition by Lenovo last year, Motorola is able to provide a broader range of products for retailers, including location services that do not require GPS or other external signals and so use less data and save battery life.

Coppel Seen as Leading Bidder for Walmart Mexico Subsidiary Suburbia

(March 8) WWD.com

Coppel Seen as Leading Bidder for Walmart Mexico Subsidiary Suburbia

(March 8) WWD.com

- Mexican Walmart subsidiary Suburbia has been put on the market for as much as $1.7 billion, and analysts believe Coppel is likely to be the buyer. Coppel has a similar store format and consumer demographic as Suburbia.

- Analysts say there may be a chance that Liverpool will bid for the company, but because the two brands are not similar, the acquisition would be for the locations and properties only. Liverpool is also currently looking to purchase a 50% stake in Chilean peer Ripley in 2016.

Mexico Consumer Prices Increased by Less than Forecast in February

(March 9) Bloomberg

Mexico Consumer Prices Increased by Less than Forecast in February

(March 9) Bloomberg

- Mexico’s consumer prices did not rise as much in February as had been expected; thus, the annual inflation rate stayed below the Mexican central bank’s goal. Mexico surprised investors when its central bank raised borrowing costs by .5%, to 3.75%.

- Inflation rates in Mexico slowed to their lowest levels since the late 1960s last year, though the peso slid 14% at the same time—its biggest drop since 2008.

Alibaba’s Finance Arm Valued at $50 Billion in New Funding Round

(March 7) TechinAsia

Alibaba’s Finance Arm Valued at $50 Billion in New Funding Round

(March 7) TechinAsia

Samsung Pay Expands to eBay Korea

(March 7) ZDNet

Samsung Pay Expands to eBay Korea

(March 7) ZDNet

Tapping Brazil’s Olympic Opportunity

(March 4) The Business of Fashion

Tapping Brazil’s Olympic Opportunity

(March 4) The Business of Fashion