From the Desk of Deborah Weinswig

Walmart Rapidly Evolves Its E-Commerce Offering

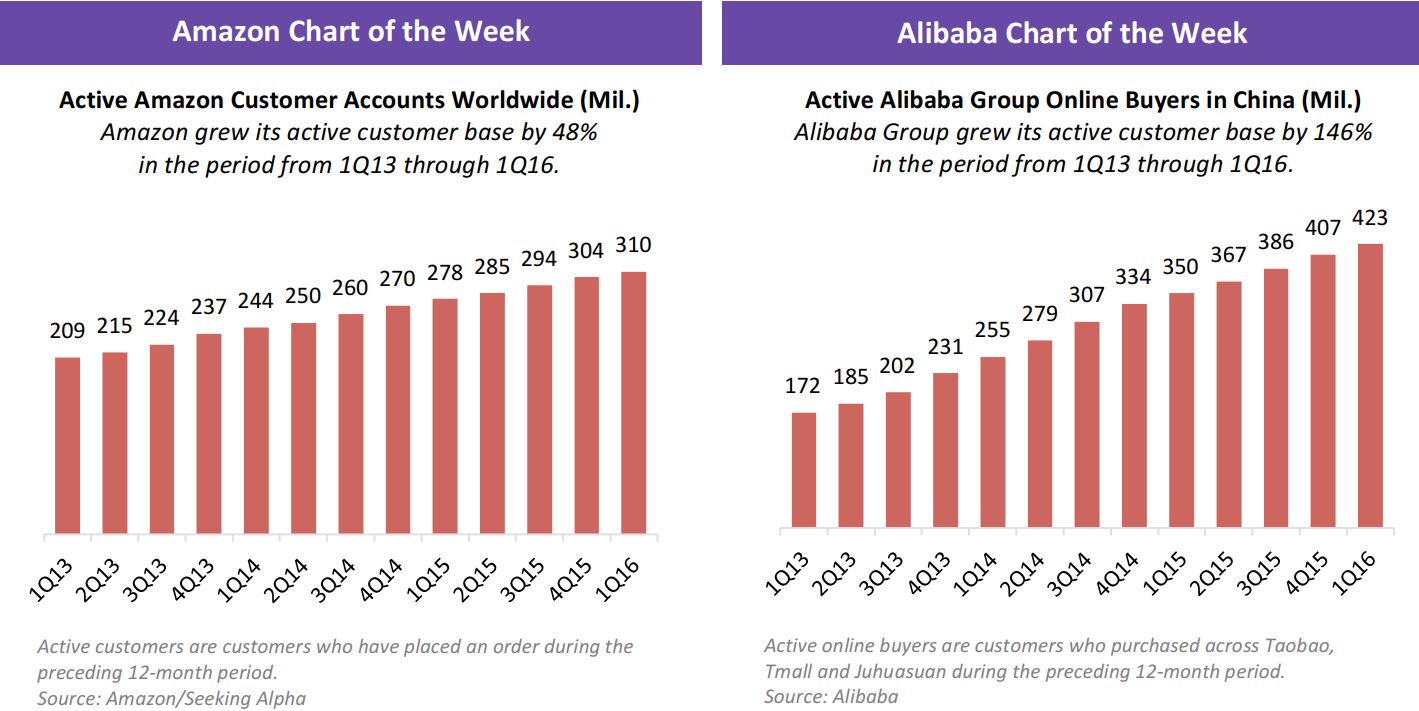

In recent months, Walmart has undertaken a flurry of innovations and acquisitions as it seeks to strengthen its multichannel offering and ultimately compete more strongly against Amazon. Walmart acquired Internet pure-play retailer Jet.com in September 2016, online outdoor retailer Moosejaw in February 2017 and online womenswear retailer ModCloth in March 2017. In this week’s note, we consider three of the company’s recent initiatives in its online offering: deliveries by store associates, lower prices for customers who choose in-store collection and expanded choice in its online marketplace.

1. Deliveries by Store Associates

Walmart’s latest push to improve its omnichannel offering is to ask its store associates to deliver online orders to nearby residents. It is running a trial in three test stores whereby store workers can choose to make paid deliveries on their own time, such as on their way home from work. Marc Lore, President and CEO of Walmart eCommerce, said in a June 1 blog post that this could “cut shipping costs and get packages to their final destinations faster and more efficiently.” Lore said the trial leverages Walmart’s physical network, as 90% of the US population lives within 10 miles of a Walmart store.

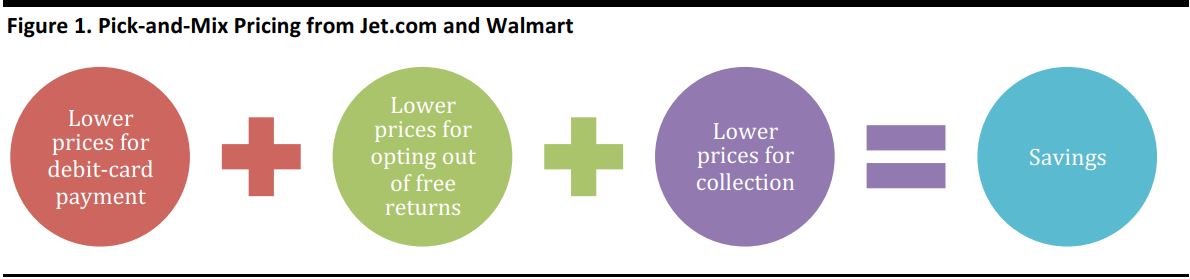

2. Pick-and-Mix Pricing

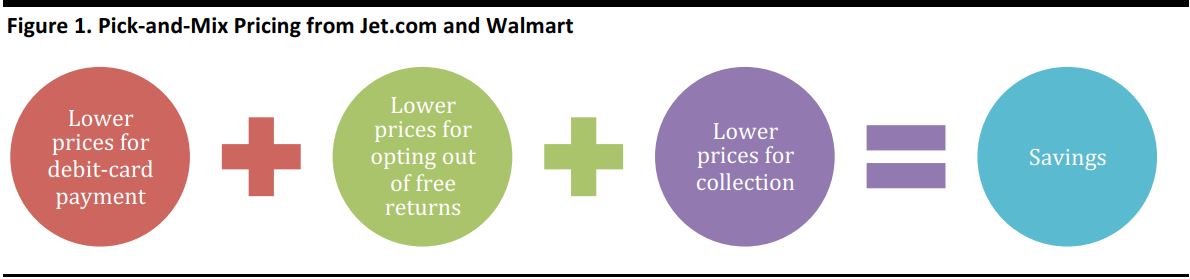

Since April 19, Walmart has offered lower prices on online purchases to those customers who opt for in-store collection instead of having their orders shipped to them. We call this “pick-and-mix pricing,” because shoppers can opt for different prices by making certain choices. Jet.com already offers lower prices to shoppers who opt out of free returns or choose to pay with a debit card. This flexible pricing could help Walmart compete with marketplace sites such as Amazon Marketplace, where offerings from third-party sellers mean shoppers enjoy a range of price points.

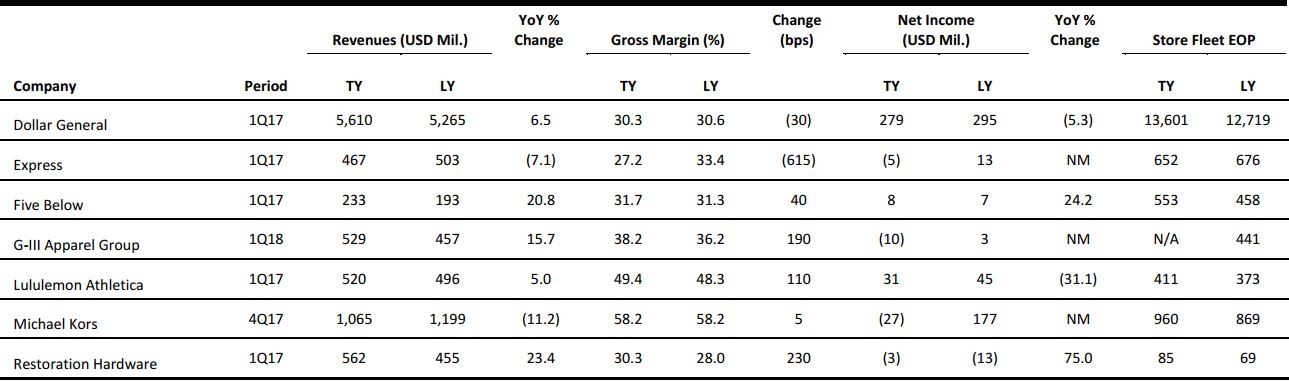

Source: Company reports/Fung Global Retail & Technology

3. Bolstering the Marketplace Offering

Walmart has also been ramping up its online assortment by bringing new third-party sellers onto its marketplace. In the company’s recent first-quarter earnings call, management noted that Walmart’s total online offering had soared from about 10 million products a year ago to more than 50 million today.

The Reward? Surging Online Sales

It is too soon to see the impact of some of these recently added services on Walmart’s performance results. However, in its first-quarter earnings report, Walmart noted a 63% surge in e-commerce sales and a 69% jump in e-commerce gross merchandise volume (which includes sales by third-party sellers). The company also noted that most of this growth was organic through Walmart.com, which suggests that investments, rather than acquisitions, are driving its e-commerce growth.

Even apart from these topline rewards, we think these kinds of investments and initiatives from Walmart should be welcomed, as they reflect a highly innovative and flexible approach to adapting to a new era of retailing.

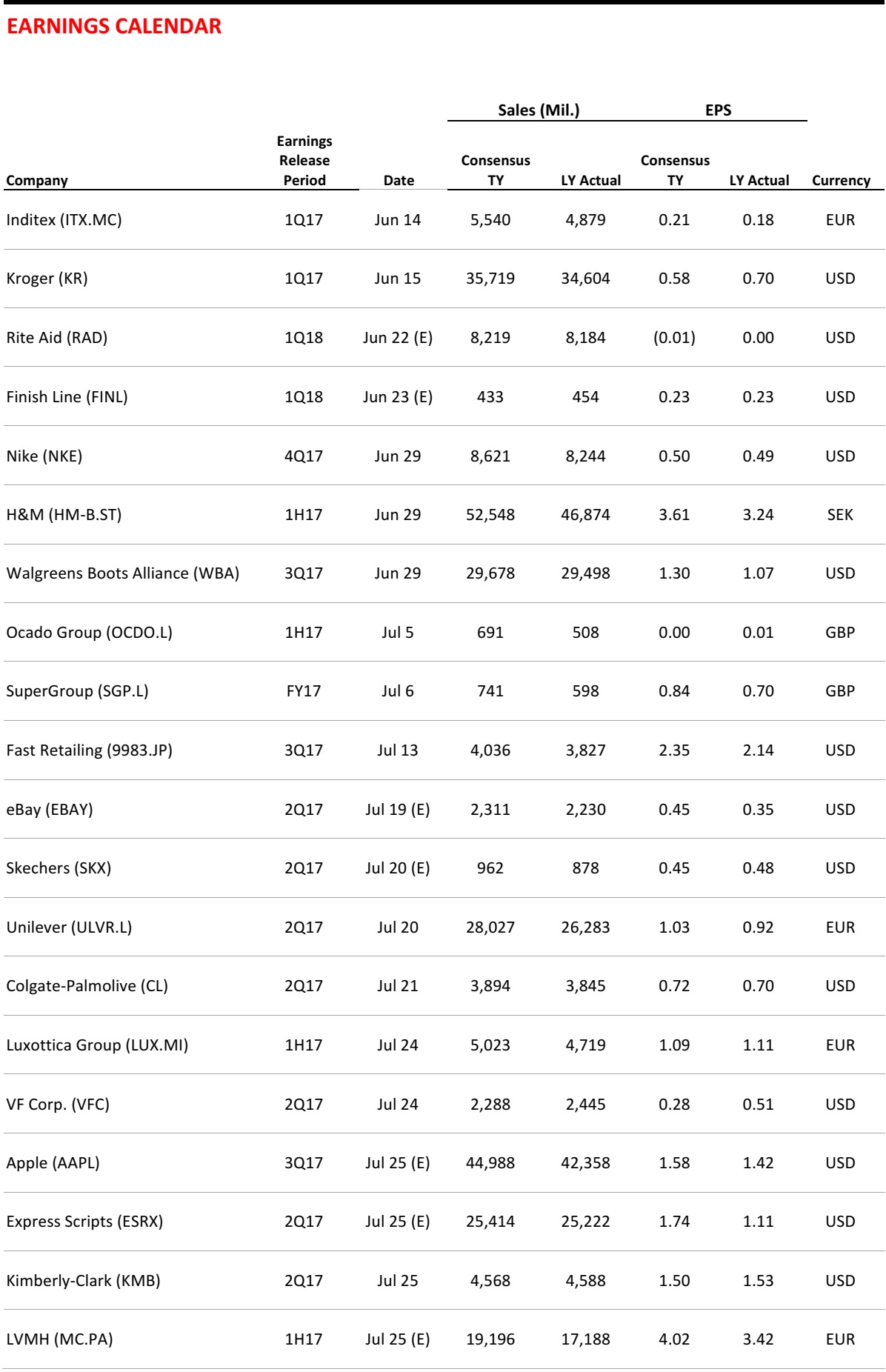

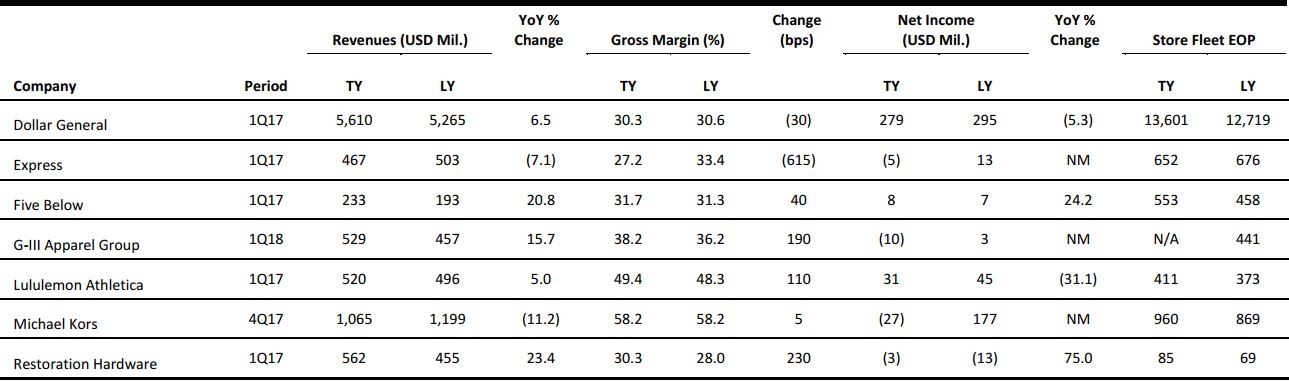

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

Amazon Offers Prime Discount to Those on Government Benefits

(June 6) CNBC.com

Amazon Offers Prime Discount to Those on Government Benefits

(June 6) CNBC.com

- Amazon is making a play for low-income shoppers by offering a discount on its pay-by-month Prime membership for people who receive government assistance. The move is seen by some analysts as an attempt to go after rival Walmart’s lower-income shoppers.

- People who have a valid Electronic Benefits Transfer card, used for programs such as the Supplemental Nutrition Assistance Program, or food stamps, will pay $5.99 per month for Amazon Prime benefits, which include free shipping and unlimited streaming of movies and TV shows.

Famed Retailer Mickey Drexler Leaving CEO Job at J.Crew

(June 5) CNBC.com

Famed Retailer Mickey Drexler Leaving CEO Job at J.Crew

(June 5) CNBC.com

- Mickey Drexler is stepping down from his role as CEO of clothing brand J.Crew, the company said Monday. Drexler, who is 72 years old, will remain chairman of the company’s board, and will be replaced by James Brett in July. Brett, a 25-year retail veteran, most recently served as president of Williams-Sonoma’s specialty home-furnishing company, West Elm.

- Drexler was famed for his turnaround of Gap in the 1990s. When he arrived at J.Crew in 2003, he worked hard to do the same by introducing the idea of providing designer-quality clothing for the masses.

Retail Keeps Bleeding Jobs

(June 2) BusinessInsider.com

Retail Keeps Bleeding Jobs

(June 2) BusinessInsider.com

- The most recent jobs report showed that employment in the retail industry continued to shrink. Retail lost 6,100 jobs overall, according to data from the US Bureau of Labor Statistics. The majority of those jobs came from department stores and “other general merchandise” stores, but food and beverage stores also saw a large drop-off.

- However, nonstore retailers (i.e., online retailers) saw employment rise by 2,900. The US administration has focused its rhetoric on coal and manufacturing jobs. However, it is notable that the number of workers in general merchandise stores who have lost their jobs since October is greater than the entire number of people employed in the US coal industry.

Walmart Tries Using Store Workers to Deliver Online Orders

(June 1) The Wall Street Journal

Walmart Tries Using Store Workers to Deliver Online Orders

(June 1) The Wall Street Journal

- Walmart is testing a program in which store workers deliver some orders placed on Walmart.com or Jet.com, a sign of how the retailer hopes to use its 4,700 US stores to its advantage in its battle against Amazon.com. The test is small, and has been active for just a few weeks in an Arkansas store near Walmart’s corporate headquarters and in two New Jersey stores near the offices of Jet.com, the discount retailer Walmart bought for $3.3 billion last September.

- Walmart store workers who have a car and pass a background check can choose to deliver up to 10 packages a day using a mobile application that suggests orders that would be convenient for them to deliver on their route home. They are paid for the time spent making deliveries, though Walmart declined to say how much they earn or if they remain on the clock during those times.

EUROPE RETAIL HEADLINES

Food Prices Rise Further in May

(May 31 and June 6) BRC press releases

Food Prices Rise Further in May

(May 31 and June 6) BRC press releases

- Food prices increased at their fastest rate in three years in May, rising by 1.4% compared with 0.9% in April, according to the British Retail Consortium (BRC). Nonfood deflation deepened from 1.4% in April to 1.5% in May, and total shop price deflation stood at 0.4% in May.

- Separately, the BRC reported that UK retail sales fell by 0.4% year over year on a comparable basis in May. On a total basis, retail sales rose by 0.2% year over year in May.

Ocado to Expand into Europe

(June 4) FT.com

Ocado to Expand into Europe

(June 4) FT.com

- Online grocery retailer Ocado has signed a technology licensing deal with a European retailer that will remain anonymous until the online business is launched.

- The unidentified partner will be able to access website software and other technology, with the option to install Ocado’s automated mechanical handling equipment in the future. Ocado said the deal will have no impact on profits or cash flow for another 18 months.

House of Fraser Named Best Multichannel Retailer

(June 5) RetailGazette.co.uk

House of Fraser Named Best Multichannel Retailer

(June 5) RetailGazette.co.uk

- British department store House of Fraser has been named the highest-ranking multichannel retailer in the 2017 Multichannel Retail Report from digital agency Ampersand.

- The report scores and ranks 187 high street retailers that sell online, identifying the top 10 that the industry should benchmark against. House of Fraser beat competition from Schuh, Argos, B&Q and Marks & Spencer, which were also in the top 10.

Marks & Spencer Partners with Dropit

(June 1) Retail-Week.com

Marks & Spencer Partners with Dropit

(June 1) Retail-Week.com

- British retailer Marks & Spencer has partnered with West End shopping platform Dropit, which enables customers to have their purchases picked up and delivered by a courier.

- The service is being trialed in two London stores and will cost £10 (US$13). It allows customers to leave their purchases behind once they have paid for them, and subsequently have them delivered to an address they choose.

Tesco Completes First Grocery Delivery Using a Robot

(June 1) Retail-Week.com

Tesco Completes First Grocery Delivery Using a Robot

(June 1) Retail-Week.com

- British grocery retailer Tesco has successfully used a six-wheeled robot to deliver a basket of goods as part of a one-off test in its Tesco Now one-hour delivery trial.

- Tesco has partnered with tech firm Starship Technologies for this trial, which offers robots that are fitted with antitheft protocols and trackable via smartphone that can carry items within a three-mile radius.

AmazonFresh Adds 42 Postcodes to Its UK Delivery Map

(June 5) TheTimes.co.uk

AmazonFresh Adds 42 Postcodes to Its UK Delivery Map

(June 5) TheTimes.co.uk

- AmazonFresh has expanded its grocery delivery service to another 42 postcodes in Southeast England, bringing its total UK coverage up to 302 postcodes.

- AmazonFresh VP Ajay Kavan said, “We said we would take our time and be methodical, but a year since we launched, we are really pleased with the take-up and the response.”

ASIA TECH HEADLINES

Toyota’s Flying Car Project Takes a Tentative Test Flight

(June 4) TechCrunch.com

Toyota’s Flying Car Project Takes a Tentative Test Flight

(June 4) TechCrunch.com

- Toyota is working on developing flying cars, with the aim of having a single-driver vehicle ready to fly in time for the 2020 Olympic Games in Tokyo. The idea is that a small flying car will be able to smoothly transition from road to sky in order to deliver the Olympic torch for its last leg to officially open the Games.

- Toyota has been exploring a range of new tech and transportation options, including luxury yachts under its Lexus brand. The company is also reimagining itself as an energy concern, though last week it ended a partnership with Tesla to codevelop electric vehicle technologies.

Alibaba Takes Another Step into India, Acquires Movie-Ticketing Company

(June 5) TechinAsia.com

Alibaba Takes Another Step into India, Acquires Movie-Ticketing Company

(June 5) TechinAsia.com

- Chinese giant Alibaba has taken another step into India with the acquisition of a majority stake in online movie-ticketing site TicketNew. The Chennai-based company enables the booking of movie theater tickets in more than 300 cities across India.

- The Indian film industry churns out the highest number of films in the world. These films, in multiple languages, are the staple entertainment for hundreds of millions. Two recent hits have grossed over $125 million each. One of them is a big hit in China, too, and the other will be released there next month.

VC Backing for Asia Tech Sector Seen Doubling in 2017

(June 3) ChinaDaily.com.cn

VC Backing for Asia Tech Sector Seen Doubling in 2017

(June 3) ChinaDaily.com.cn

- Venture capital investments in Asia’s tech sector this year are expected to be double those in 2016, with China accounting for the majority, according to a report by CB Insights, a venture capital research and data firm.

- China’s venture capital tech investment in the first quarter of the year reached $6 billion, accounting for 66% of the total invested in Asia. With 101 projects, China has the largest number of venture capital deals in the Asian market.

Plug and Play Partners with Japan’s Biggest Bank to Launch Tokyo Accelerator

(June 6) TechinAsia.com

Plug and Play Partners with Japan’s Biggest Bank to Launch Tokyo Accelerator

(June 6) TechinAsia.com

- Silicon Valley–based Plug and Play has partnered with Mitsubishi UFJ Financial, the financial services group that includes Japan’s biggest bank, to bring its combined startup accelerator and corporate innovation platform to Japan.

- Located in Tokyo, Plug and Play Japan is looking to work with domestic and foreign startups from all industry sectors. Their technologies will be piloted with some of Plug and Play’s 33 Japanese corporate partners, which include Hitachi, Nissan and Panasonic.

LATAM RETAIL AND TECH HEADLINES

Nestlé Investing in Latin America

(May 31) TheStreet.com

Nestlé Investing in Latin America

(May 31) TheStreet.com

- Swiss chocolate maker Nestlé is investing in Latin America, creating thousands of jobs and looking to boost its position in the region’s strongest markets. The company is integrating young people to shape itself at a time of digital revolution.

- The maker of Kit Kat candy bars and Toll House cookie dough is working with the governments of Chile, Mexico, Peru and Colombia to create 2,900 jobs for young people over a three-year period. The company will also teach job-hunting skills.

Yogome, a Mexican Startup that Makes Educational Games for Kids, Raises $6.6 Million

(May 31) TechCrunch.com

Yogome, a Mexican Startup that Makes Educational Games for Kids, Raises $6.6 Million

(May 31) TechCrunch.com

- Yogome, a Mexican edtech startup that makes kids’ games for the iPad, has raised $6.6 million in series A funding. Spanish venture capital firm Seaya Ventures led the round, with participation from Variv Capital and Endeavor Catalyst. Yogome had previously raised $3.2 million in seed funding and is also backed by 500 Startups.

- Founded by Manolo Diaz and Alberto Colin in 2011, Yogome provides a subscription-based educational-gaming service for iOS and Android tablets that targets kids ages 6–11. It claims that its mini games are pedagogically sound and developed in conjunction with educational experts. The company has worked with Yale University to measure the efficacy of its math games for first-grade students.

Triad Retail Media Launches Mexican Unit

(June 1) Portada-Online.com

Triad Retail Media Launches Mexican Unit

(June 1) Portada-Online.com

- North American company Triad Retail Media is launching operations in Mexico in response to the country’s retail e-commerce growth, which presents major opportunities in digital advertising.

- Triad develops, manages and operates digital media programs that enable the world’s leading brands to engage consumers on the largest digital retail platforms.

Colombian Grocery Delivery App Mercadoni Raises $6.2 Million

(June 6) TechCrunch.com

Colombian Grocery Delivery App Mercadoni Raises $6.2 Million

(June 6) TechCrunch.com

- Mercadoni, a grocery delivery app and service operating in Colombia, Argentina and Mexico, has raised $6.2 million in series A funding, one of the largest series A rounds in the region. The Colombian grocery market alone is said to be worth $40 billion, most of which is concentrated in a few densely populated cities.

- The startup lets customers order groceries for delivery, and promises delivery in under an hour. It already claims 250,000 users and says that it is operationally profitable in the markets in which it operates.

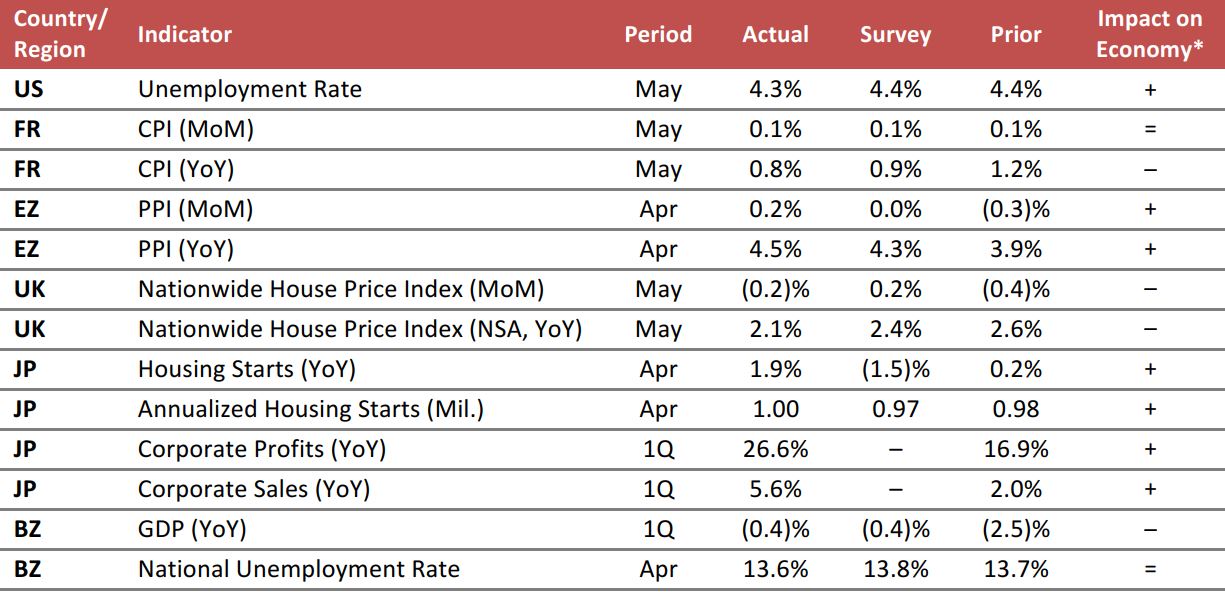

MACRO UPDATE

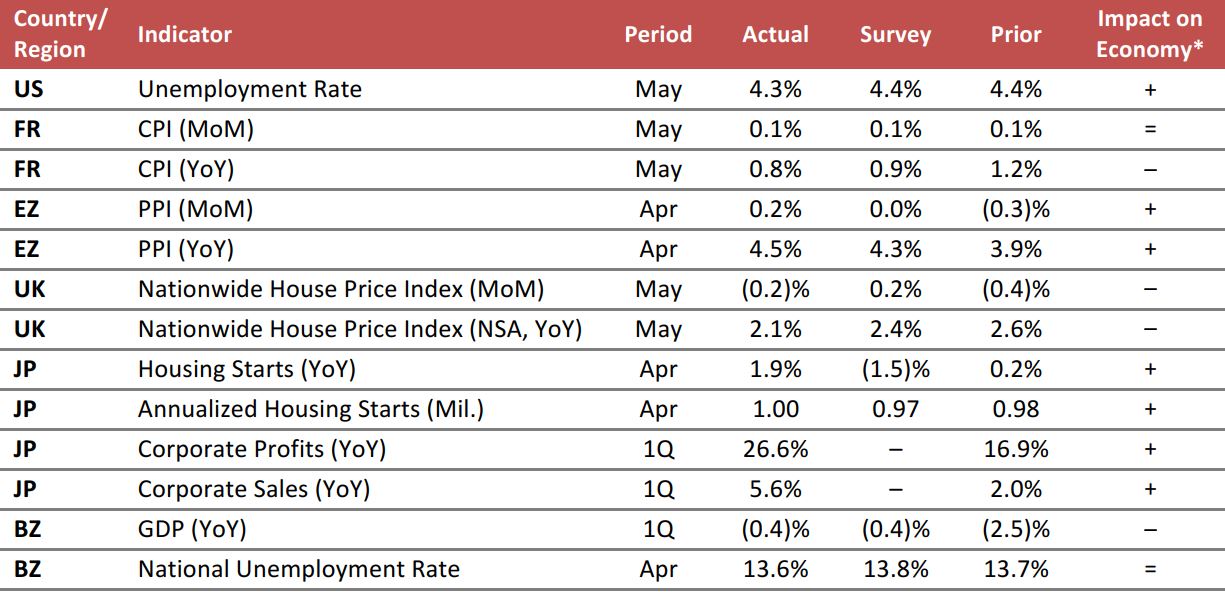

Key points from global macro indicators released May 31–June 7, 2017:

- US: The US unemployment rate declined further in May, to 4.3%, signaling that the US economy’s recovery is strong and stable.

- Europe: In France, the Consumer Price Index (CPI) grew by 0.8% year over year in May, slightly missing expectations. The eurozone Producer Price Index (PPI) saw 4.5% year-over-year growth in April. In the UK, nationwide house prices grew by 2.1% year over year; the rate was slightly lower than in the previous period and was lower than economists had estimated.

- Asia-Pacific: In Japan, housing starts in April increased by 1.9% year over year. In the first quarter, corporate profits in Japan rose by 26.6%, a significant improvement from 16.9% in the fourth quarter of 2016.

- Latin America: In Brazil, first quarter GDP declined by 0.4% year over year, and the national unemployment rate in April was 13.6%, down only slightly from March.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/INSEE/Eurostat/UK Nationwide Building Society/Ministry of Finance Japan/Instituto Brasileiro de Geografia e Estatística (IBGE)/Fung Global Retail & Technology